Tradeska 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive tradeska review reveals concerning findings about this forex broker. Traders should carefully consider these issues before investing their money. Tradeska started in 2022 and has its headquarters in the UK. The company operates as an STP trading broker offering forex services only through the MT5 platform. Our analysis of available information and user feedback presents a troubling picture of this broker's operations.

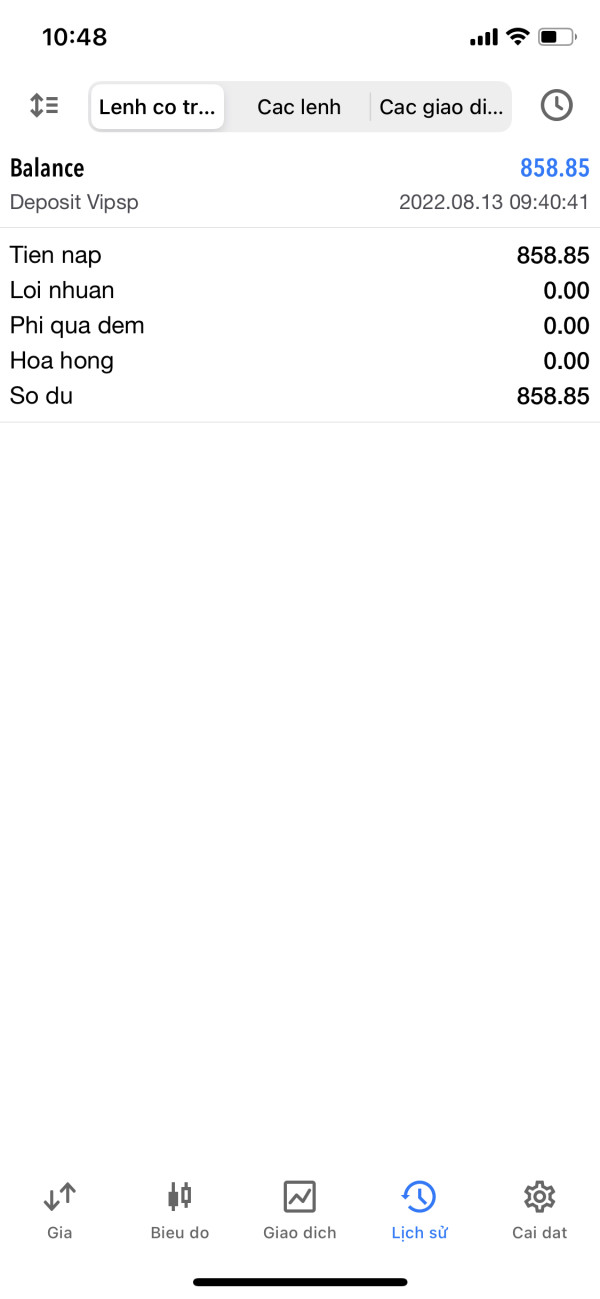

Tradeska has a WikiFX rating of just 1 out of 10. The broker has received overwhelmingly negative reviews from users who consistently warn about potential fraudulent activities. Tradeska offers only a single account type and lacks transparency about crucial operational details. These details include regulatory compliance, minimum deposits, and fee structures. The platform supports MT5 trading, which is generally reliable. However, user experiences suggest significant issues with execution quality and customer service.

The primary target audience appears to be novice traders attracted to simplified platform offerings. The extensive negative feedback and safety concerns make this broker unsuitable for any serious trading activity. Multiple sources indicate that users should exercise extreme caution when considering Tradeska for their trading needs.

Important Notice

Regional Entity Differences: Information regarding specific regulatory entities across different jurisdictions is not available in current documentation. Traders should independently verify regulatory status in their respective regions before engaging with this broker.

Review Methodology: This evaluation is based on publicly available information, user feedback from various sources, and third-party ratings. No direct testing or account verification was conducted as part of this assessment due to safety concerns highlighted in user reports.

Rating Framework

Broker Overview

Tradeska entered the forex market in 2022. The company positions itself as an STP trading broker based in the United Kingdom. The company's business model focuses on providing direct market access through its single trading platform. Tradeska attempts to serve retail forex traders seeking straightforward trading solutions. Despite its relatively recent establishment, the broker has quickly gained attention in the trading community for predominantly negative reasons.

The broker's operational framework centers around offering forex trading services through the popular MetaTrader 5 platform. According to available information, Tradeska operates exclusively in the foreign exchange market. The company does not diversify into other asset classes such as commodities, indices, or cryptocurrencies. This narrow focus might appeal to traders specifically interested in forex trading. However, the limited scope raises questions about the broker's long-term viability and commitment to comprehensive trading services.

What makes this tradeska review particularly concerning is the absence of clear regulatory information. The mounting evidence of problematic practices reported by users across multiple review platforms and forums also raises red flags.

Regulatory Status: Current available information does not specify any regulatory oversight from recognized financial authorities. This represents a significant red flag for potential traders.

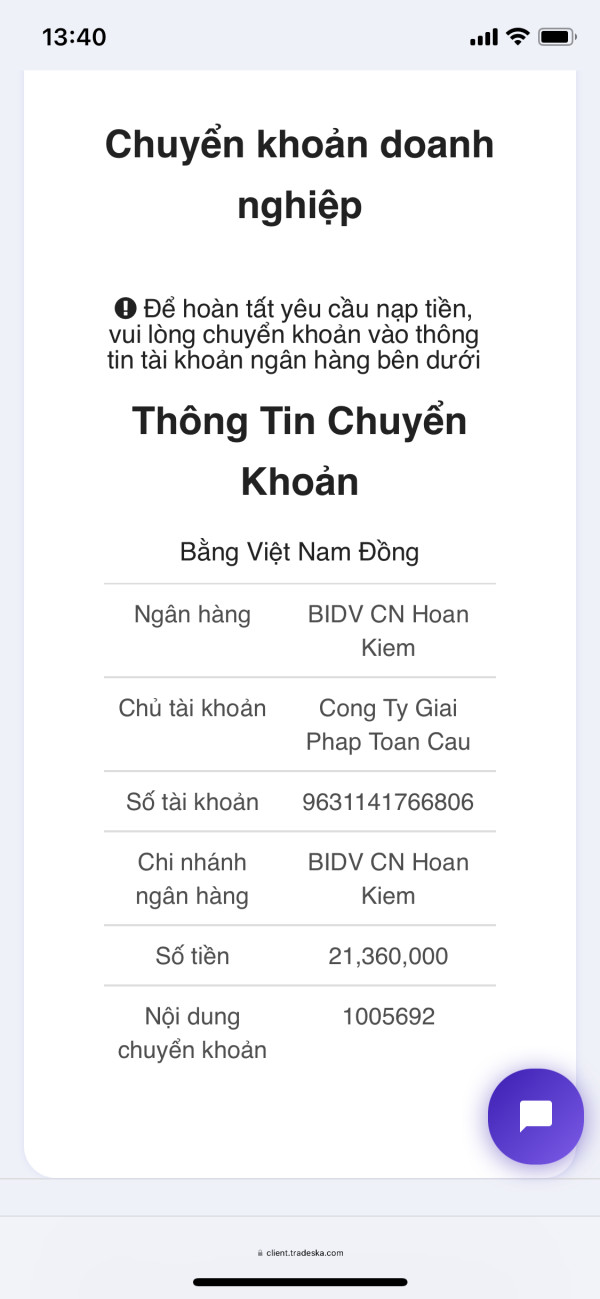

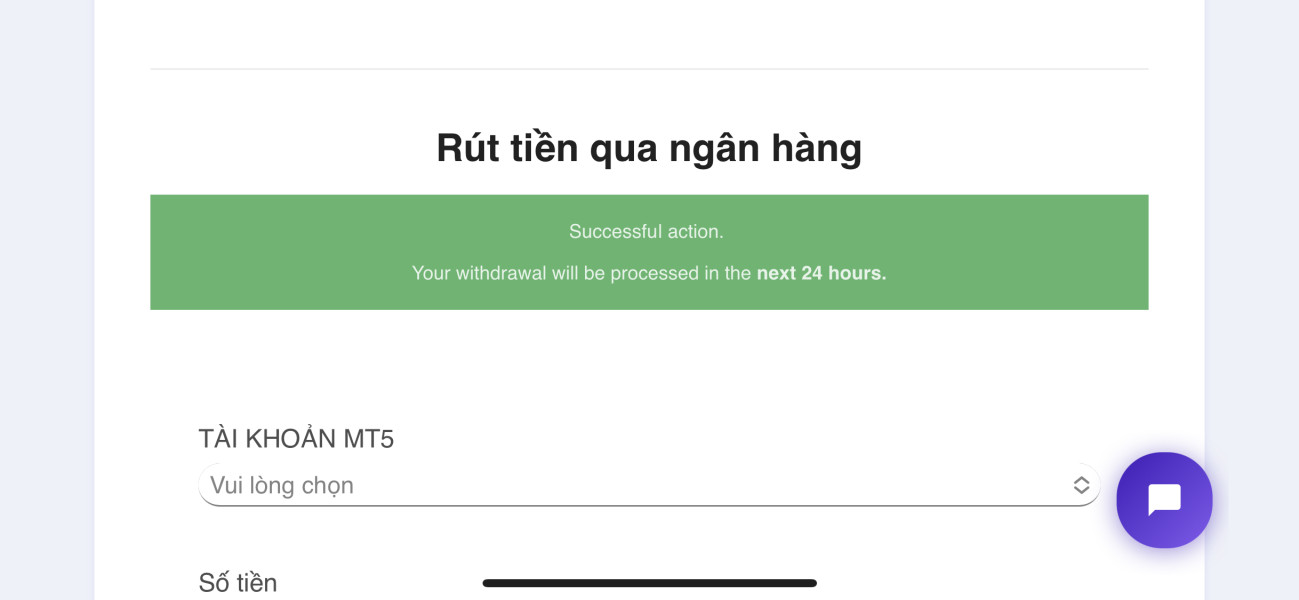

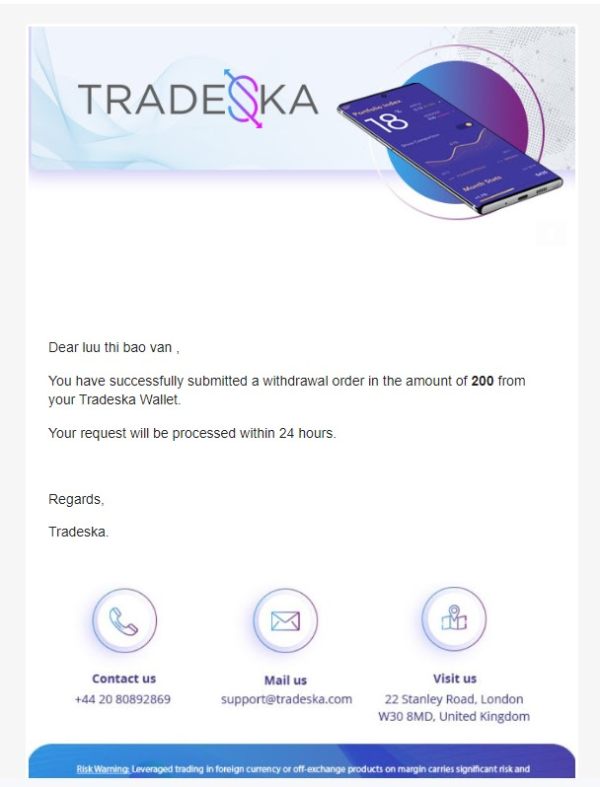

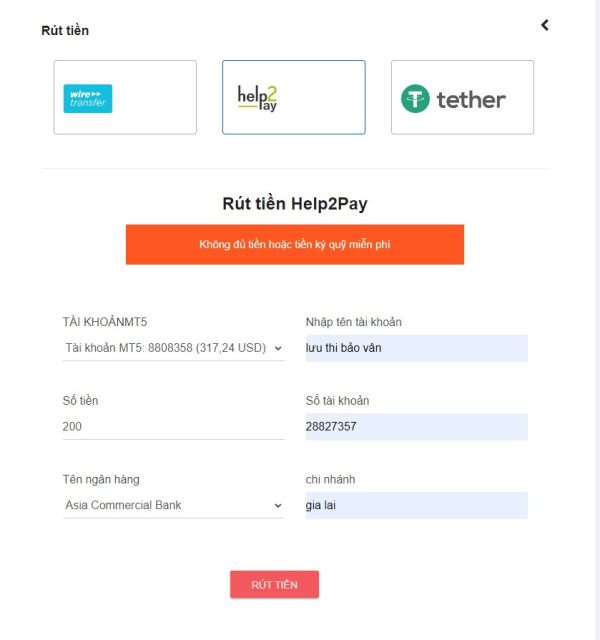

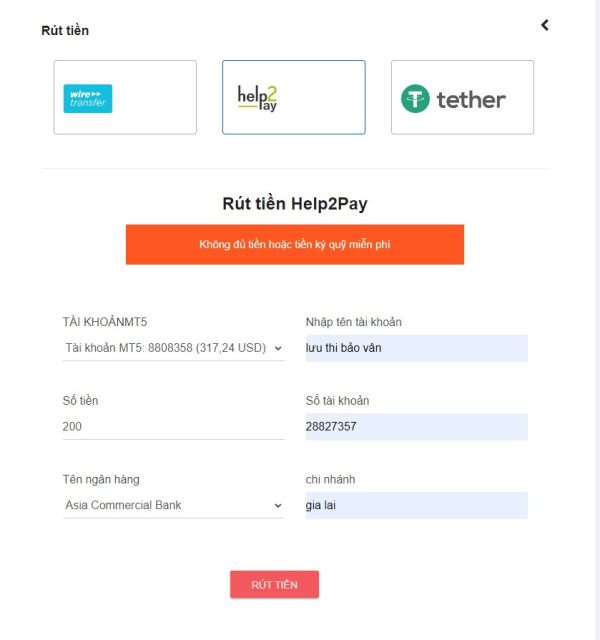

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees is not detailed in available documentation.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit thresholds in publicly available materials.

Bonuses and Promotions: No information regarding welcome bonuses, trading incentives, or promotional offers is currently available.

Tradeable Assets: The platform focuses exclusively on forex trading pairs. There is no mention of other financial instruments such as commodities, stocks, or indices.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed in available sources.

Leverage Options: Specific leverage ratios offered by the broker are not mentioned in current documentation.

Platform Selection: Tradeska exclusively supports the MetaTrader 5 platform. No alternative trading interfaces or proprietary platforms are available.

Geographic Restrictions: Information about restricted countries or regions is not specified in available materials.

Customer Support Languages: The range of supported languages for customer service is not detailed in current documentation.

The lack of transparency regarding these fundamental aspects of broker operations contributes significantly to user concerns. This tradeska review highlights these transparency issues as major red flags.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

Tradeska's account structure represents one of its most significant weaknesses. The broker offers traders extremely limited options with only a single account type available. This lack of variety fails to accommodate different trading styles, experience levels, or capital requirements. Most reputable brokers provide multiple account tiers to serve everyone from beginners to institutional clients. Tradeska's singular offering is particularly concerning when compared to industry standards.

The absence of detailed information about minimum deposit requirements, account features, or special conditions further compounds these issues. Users report difficulty obtaining clear information about what exactly their account includes or excludes. This creates an environment of uncertainty that professional traders typically avoid. The lack of specialized accounts such as Islamic accounts for Muslim traders also indicates a limited understanding of diverse client needs.

User feedback consistently highlights dissatisfaction with account conditions. Many users report unexpected limitations or restrictions that were not clearly communicated during the account opening process. The simplified account structure, while potentially appealing to complete beginners, ultimately lacks the sophistication and transparency that serious traders require. Professional traders need comprehensive information for effective portfolio management.

This tradeska review finds that the broker's account conditions fall well below industry standards. The platform lacks both variety and transparency that characterize reputable trading platforms.

The trading tools and resources offered by Tradeska are severely limited. The platform consists primarily of basic MetaTrader 5 functionality without significant enhancements or additional analytical resources. While MT5 is generally considered a robust trading platform with comprehensive charting tools and technical indicators, Tradeska appears to offer only the standard package. The broker does not provide value-added features or customizations that might differentiate their service.

Educational resources, which are crucial for trader development and retention, appear to be entirely absent from Tradeska's offerings. Most legitimate brokers provide extensive educational materials including webinars, trading guides, market analysis, and educational videos. These resources help traders improve their skills and understanding of market dynamics. The absence of such resources suggests either a lack of commitment to client success or insufficient resources to provide comprehensive support.

Research and analysis tools beyond basic MT5 functionality are not mentioned in available information. This leaves traders without access to professional-grade market research, economic calendars, or expert analysis that typically inform trading decisions. This limitation forces traders to seek third-party resources, adding complexity and cost to their trading operations.

The lack of automated trading support information, API access, or advanced order types further constrains the platform's appeal. More sophisticated traders require comprehensive trading infrastructure that Tradeska fails to provide.

Customer Service and Support Analysis (Score: 2/10)

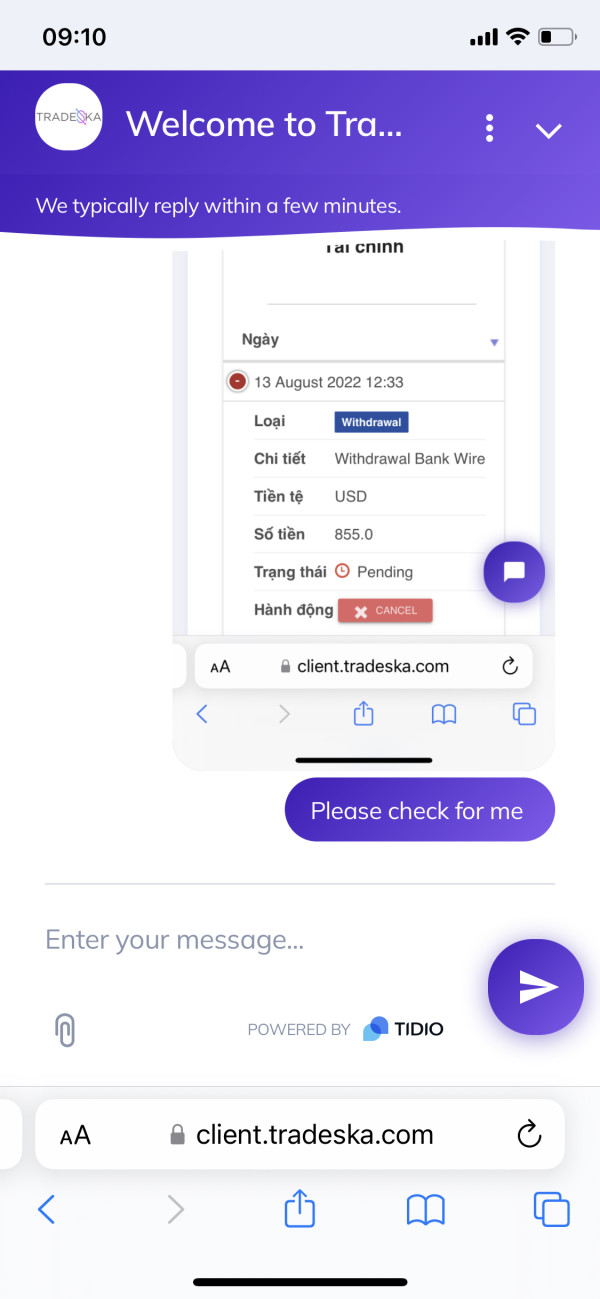

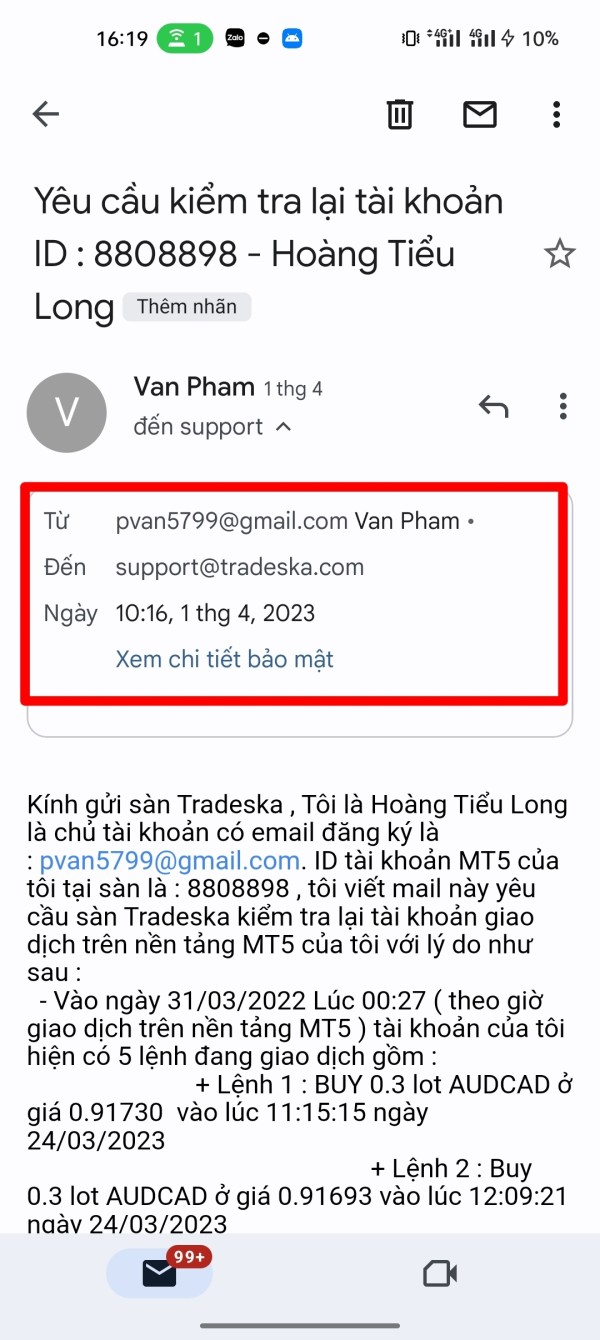

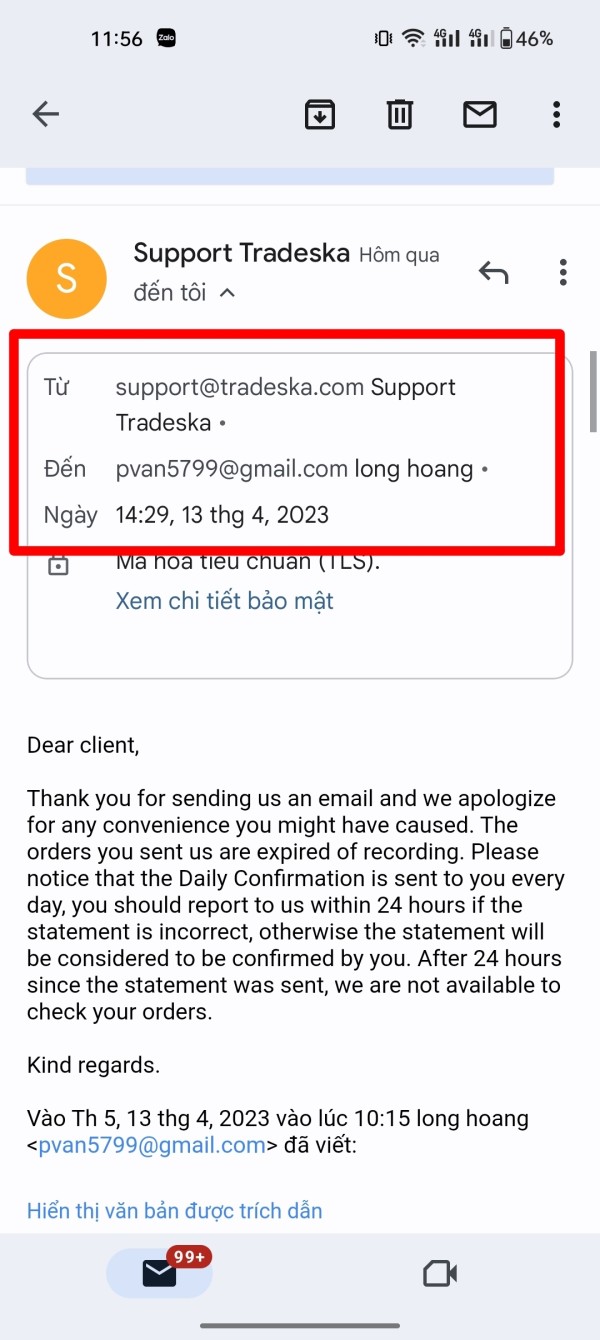

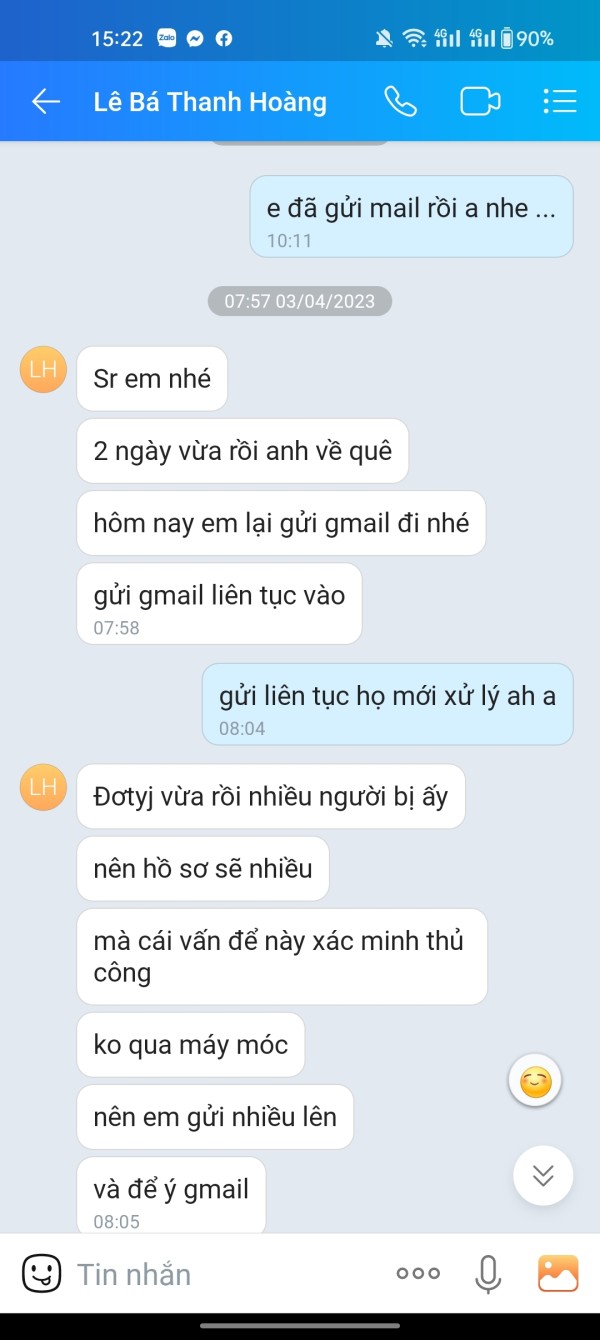

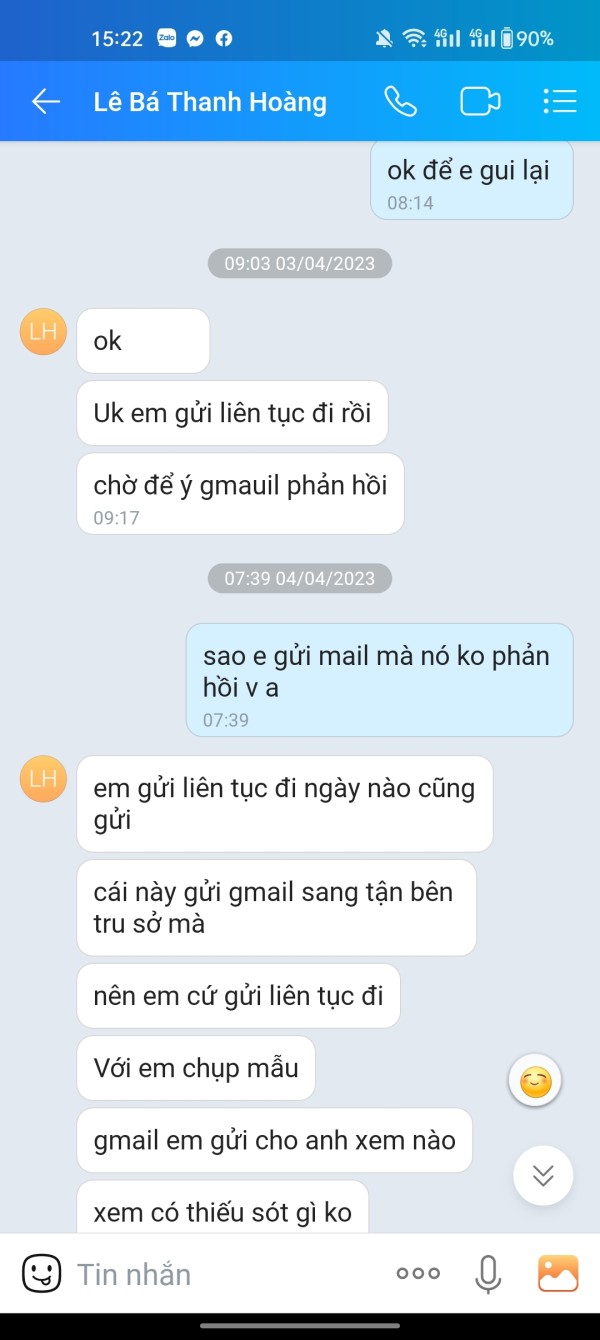

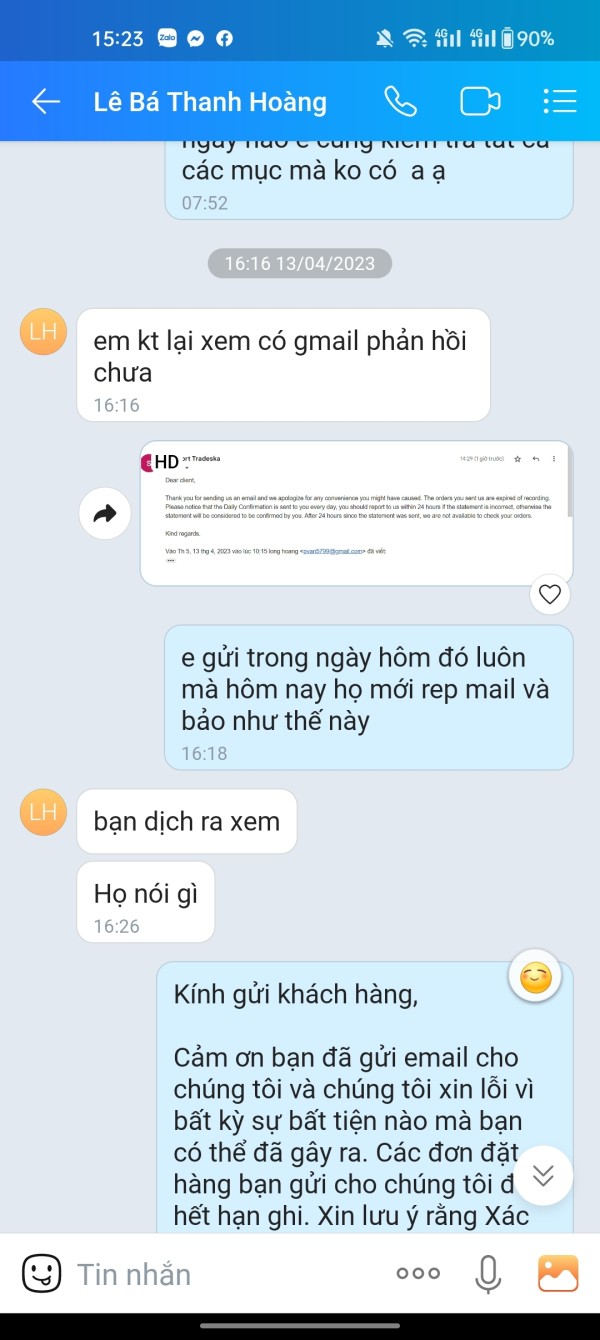

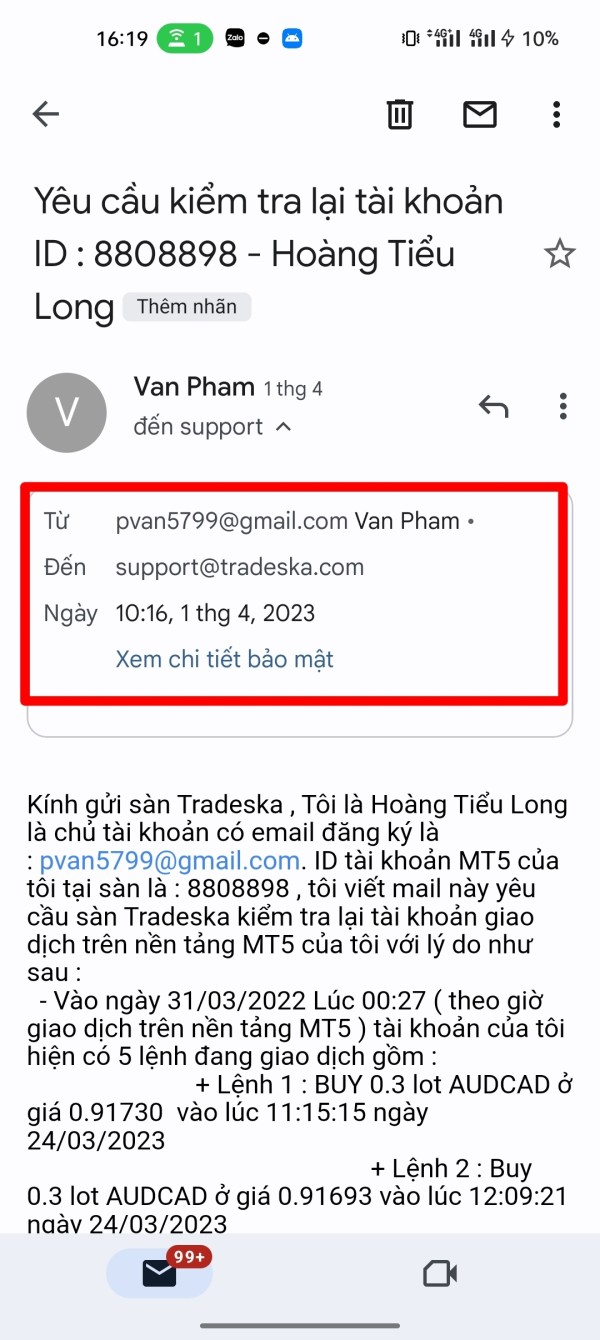

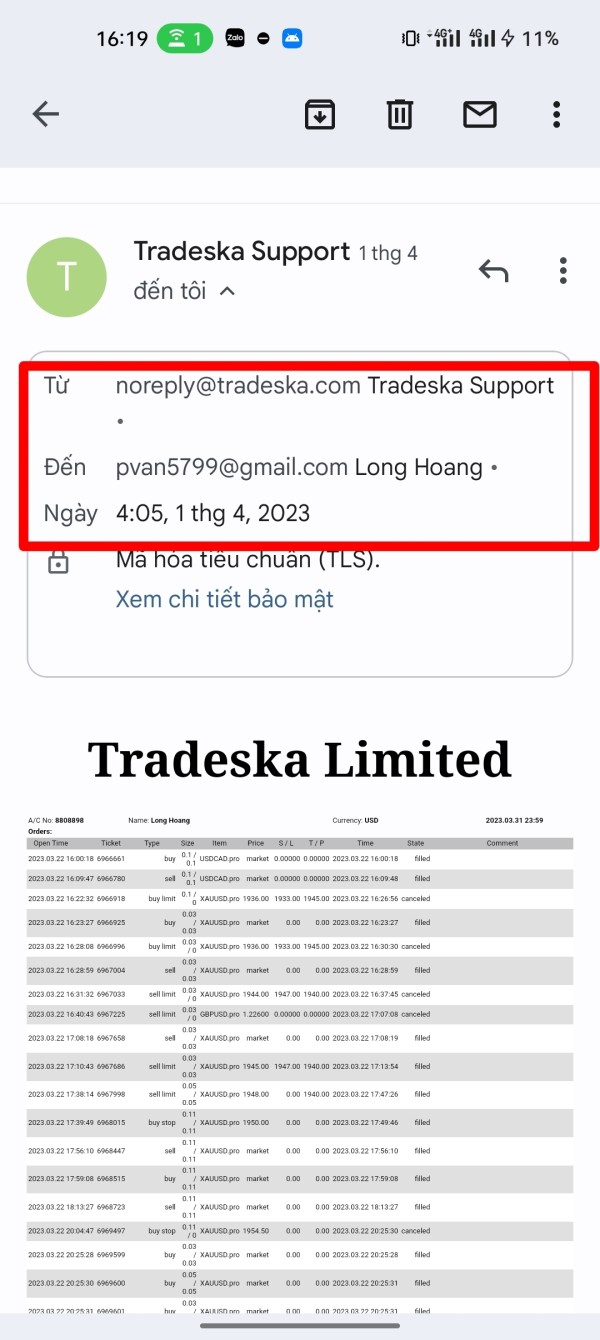

Customer service represents perhaps the most consistently criticized aspect of Tradeska's operations. User feedback indicates widespread dissatisfaction with support quality, responsiveness, and problem-resolution capabilities. Multiple reports suggest that users experience significant delays in receiving responses to inquiries. Some users indicate that support requests go entirely unanswered for extended periods.

The quality of support interactions, when they do occur, appears to be substandard according to user reports. Many users describe interactions with support staff who seem inadequately trained or unable to resolve basic account or trading issues. This pattern suggests either insufficient investment in customer service infrastructure or inadequate staff training programs.

Communication channels and availability hours are not clearly specified in available documentation. This creates additional barriers for users who need assistance. Professional brokers typically provide multiple contact methods including live chat, email, phone support, and comprehensive FAQ sections. They also provide clear information about service hours and expected response times.

The absence of multilingual support information also raises concerns about the broker's ability to serve international clients effectively. Given the global nature of forex trading, limited language support can significantly impact user experience and problem resolution for non-English speaking traders.

Trading Experience Analysis (Score: 3/10)

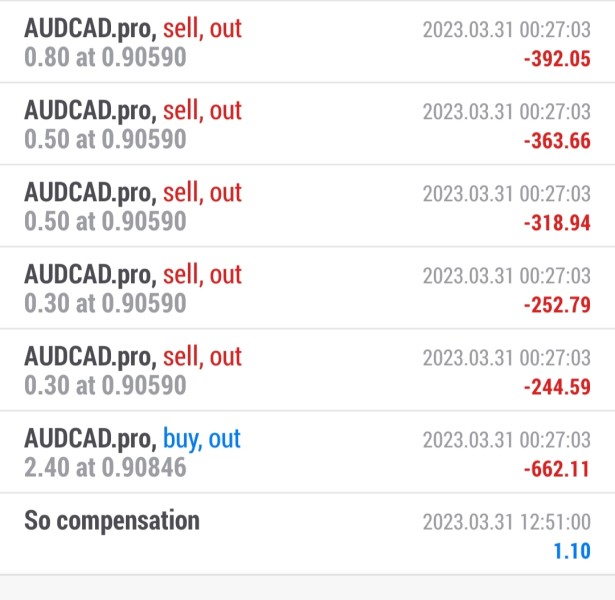

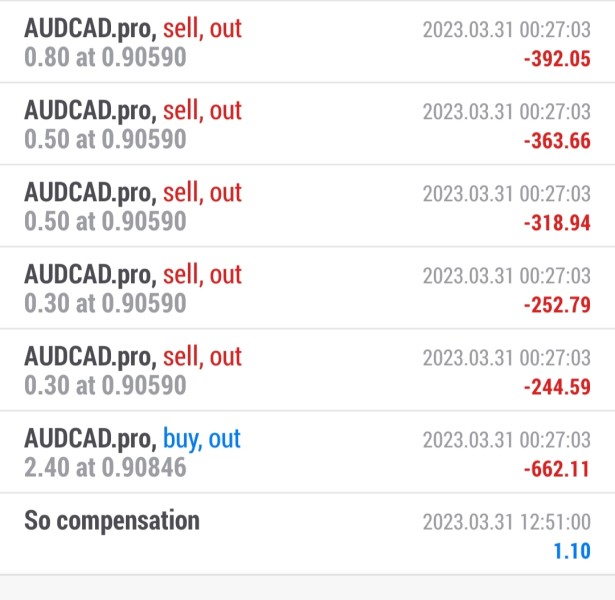

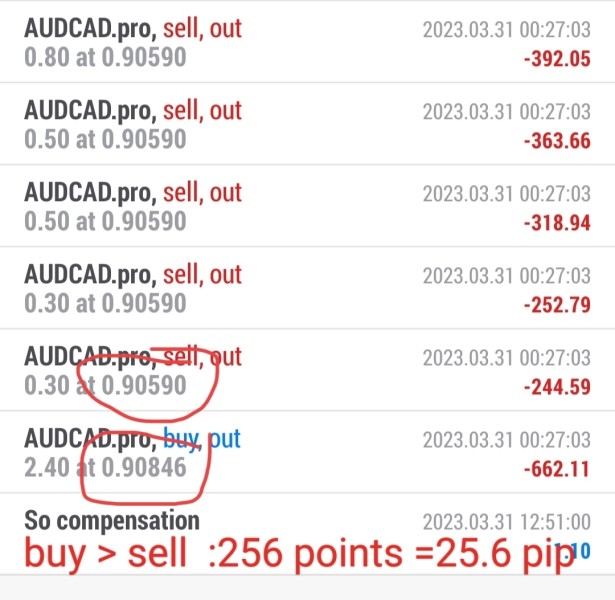

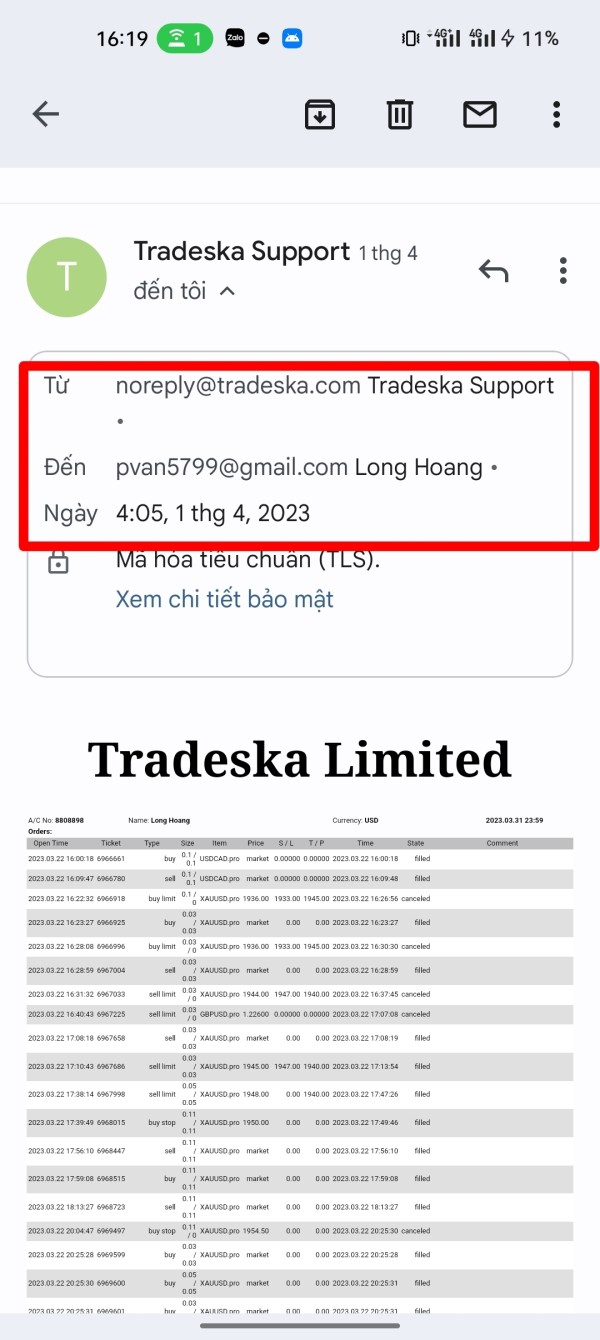

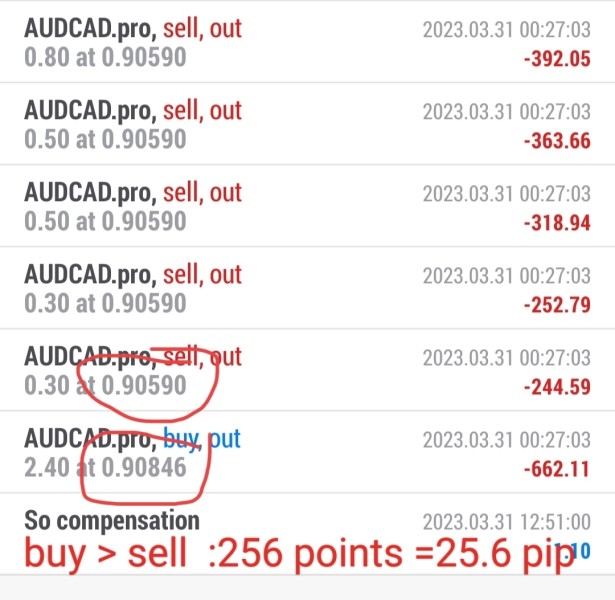

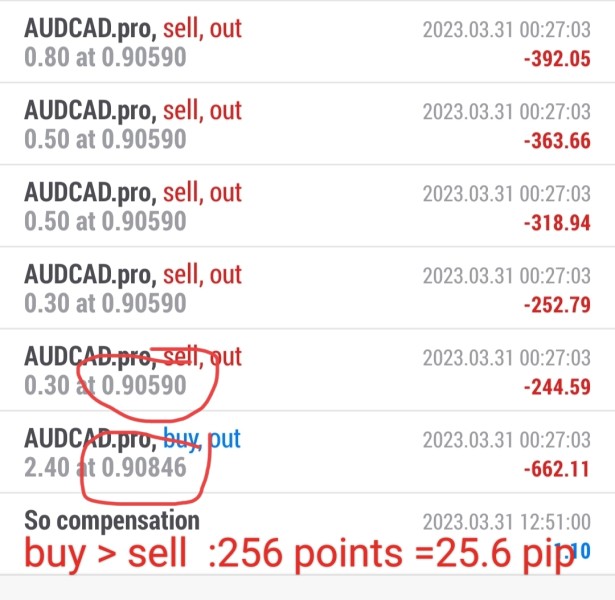

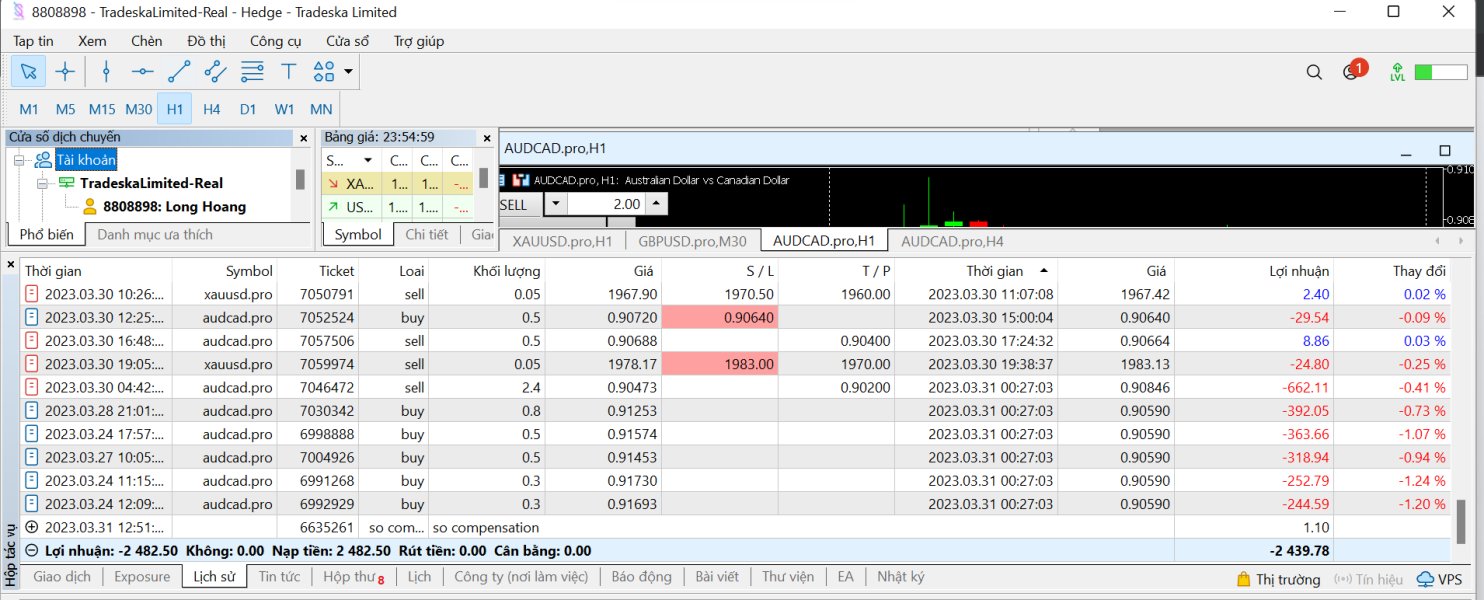

The trading experience at Tradeska suffers from significant execution and reliability issues according to user feedback. The platform is built on the generally reliable MT5 foundation, but users report problems with order execution quality. These problems include instances of slippage and requoting that can significantly impact trading profitability. Such issues are particularly problematic for scalping or short-term trading strategies.

Platform stability appears to be a recurring concern. Users report connection issues and platform freezes during critical trading periods. Such technical problems can result in missed opportunities or unexpected losses. These issues make the platform unsuitable for serious trading activities that require consistent and reliable execution.

The absence of detailed information about trading conditions makes it difficult for traders to assess whether the platform meets their specific requirements. Professional traders require transparent information about typical spreads, execution speeds, and liquidity sources. This information is essential for making informed decisions about broker selection.

Mobile trading capabilities, which are essential for modern traders, are not adequately documented. Modern traders need to monitor and manage positions while away from their computers. This tradeska review finds that the overall trading experience falls significantly short of industry standards due to execution issues and lack of transparency about trading conditions.

Trust and Safety Analysis (Score: 1/10)

Trust and safety concerns represent the most serious issues identified in this evaluation. Multiple indicators suggest that Tradeska poses significant risks to trader funds and personal information. The WikiFX rating of 1 out of 10 represents an extremely low trust score. This score typically indicates serious regulatory or operational problems.

Regulatory compliance information is notably absent from available documentation. This represents a critical red flag in an industry where regulatory oversight is essential for client protection. Legitimate brokers prominently display their regulatory licenses and compliance information. This information provides crucial assurance to traders about fund safety and operational standards.

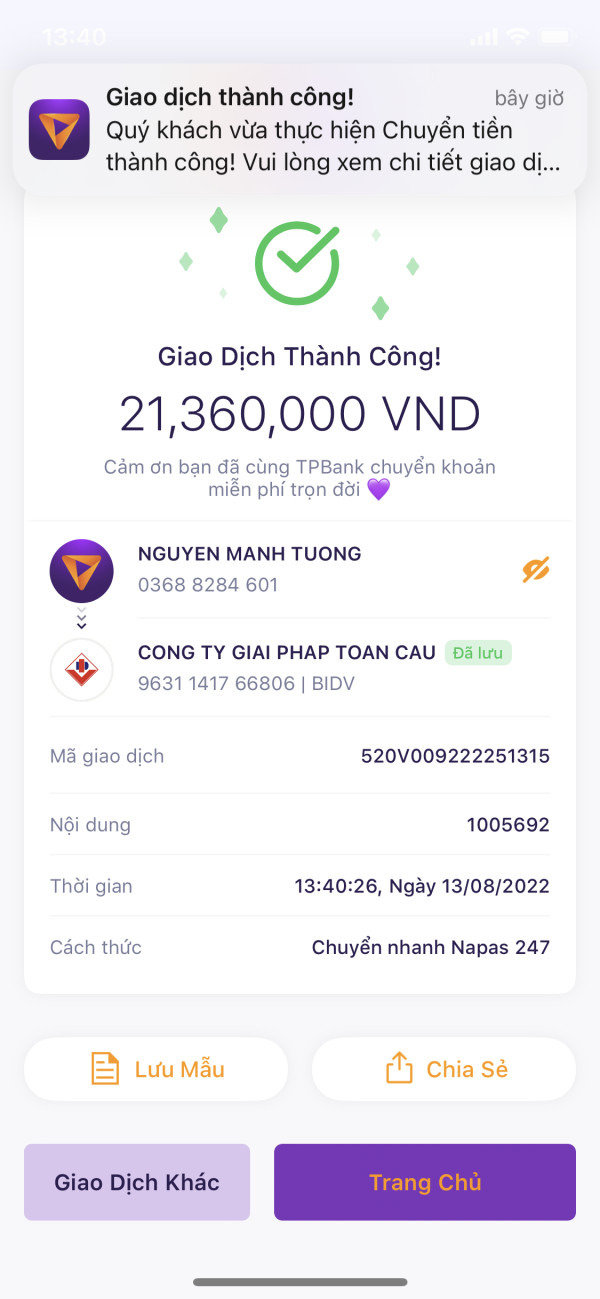

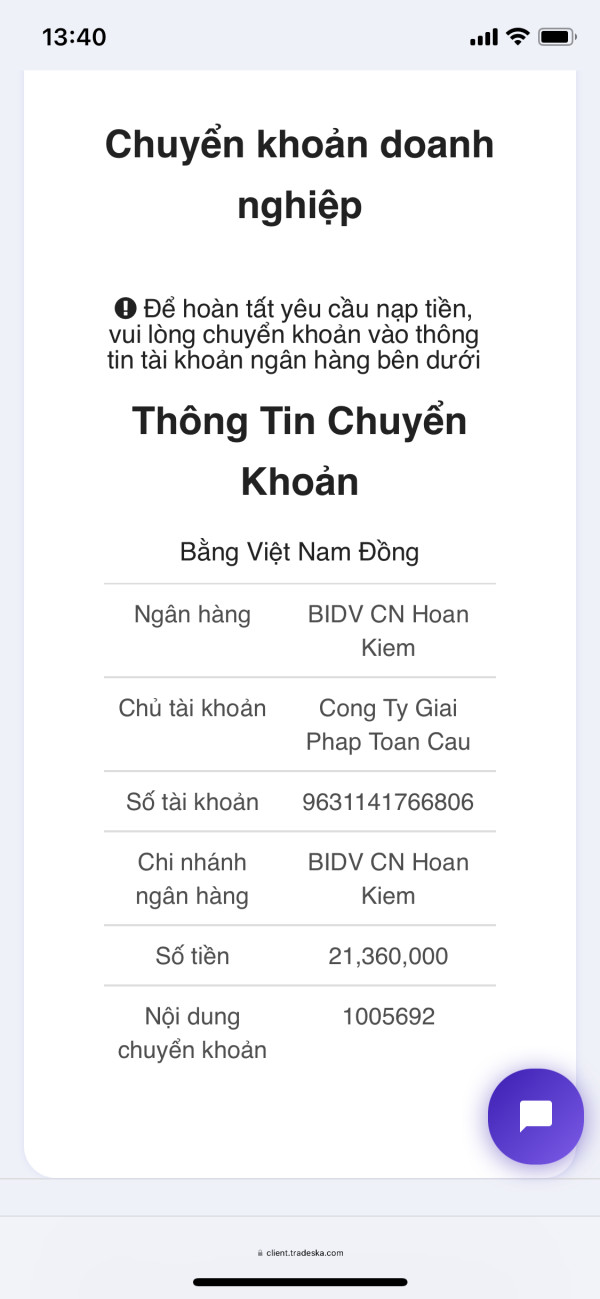

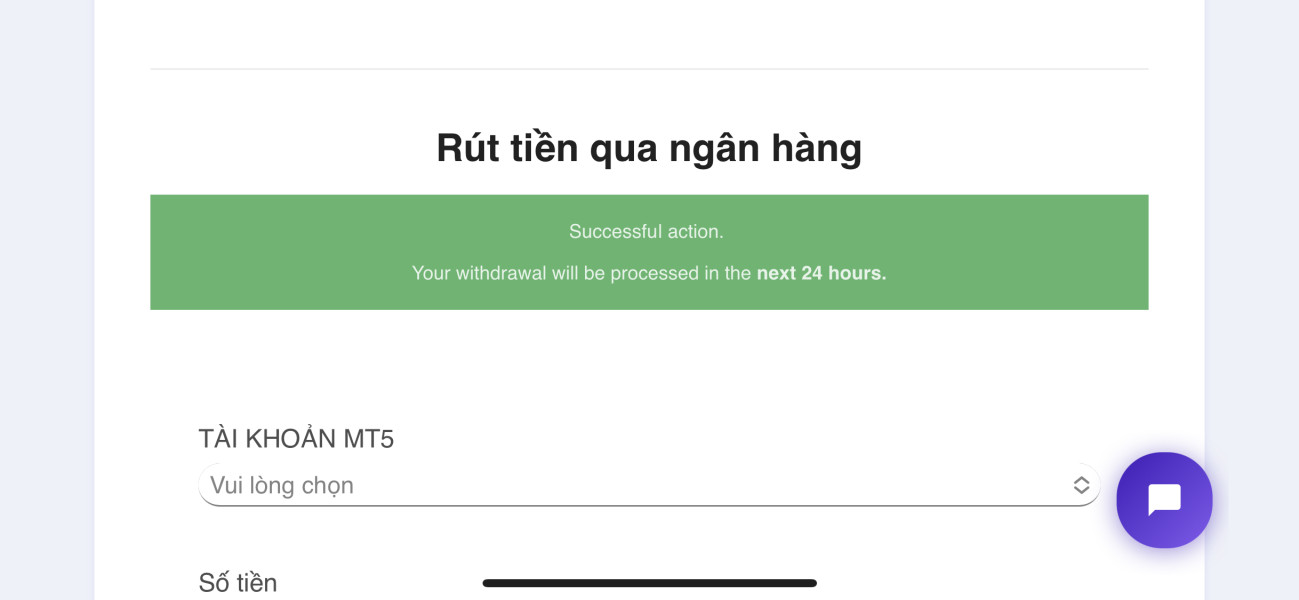

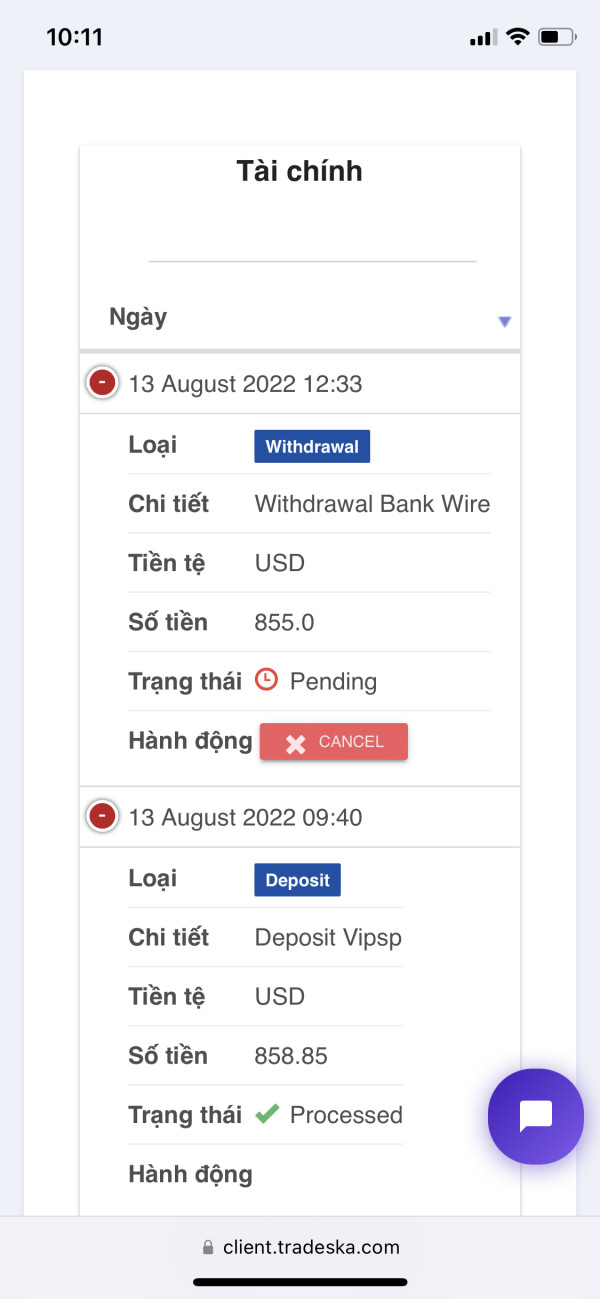

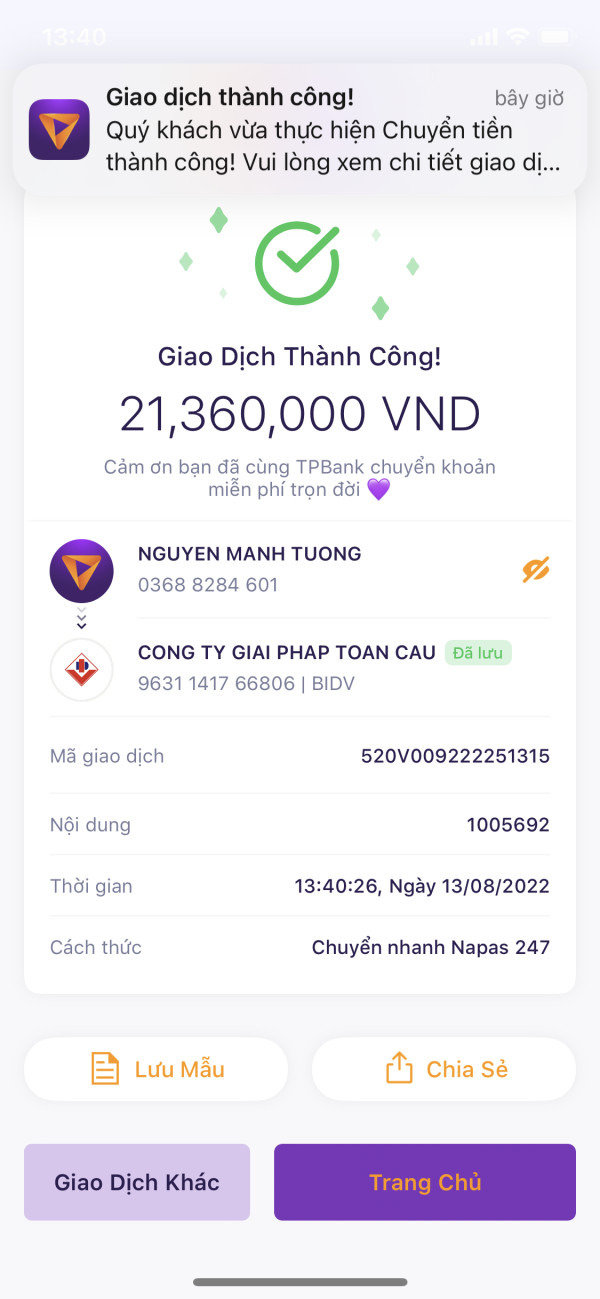

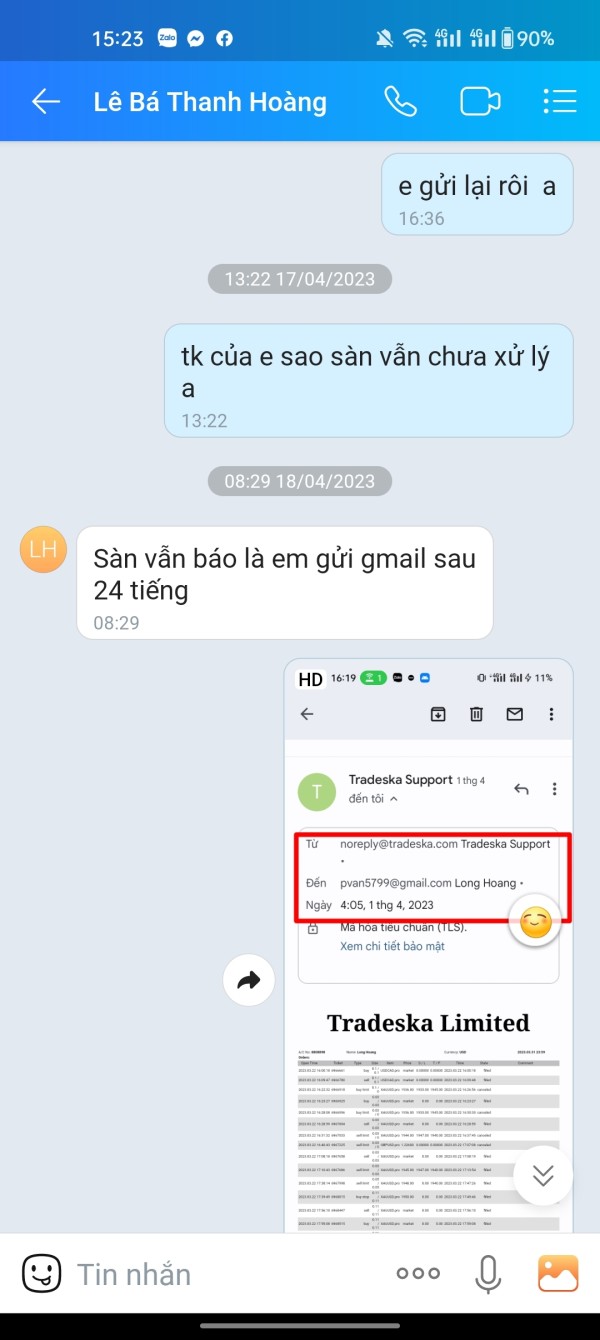

User reports consistently warn about potential fraudulent activities. Multiple sources indicate that traders should exercise extreme caution when considering this broker. Such widespread negative feedback from actual users provides compelling evidence of serious operational problems. These problems extend beyond typical service issues.

The absence of information about client fund segregation, deposit insurance, or other safety measures further compounds these concerns. Reputable brokers implement these measures to protect client assets. Without proper regulatory oversight and transparent safety measures, traders face significant risks. These risks extend far beyond normal market risks associated with forex trading.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with Tradeska appears to be extremely low. Negative feedback dominates available reviews and user reports across multiple platforms. The consistent pattern of user complaints suggests systematic problems rather than isolated incidents. This indicates fundamental issues with the broker's operations and service delivery.

Interface design and usability benefit from MT5's generally intuitive layout. However, broader operational problems undermine the overall user experience. Users report frustration with account management processes, unclear terms and conditions, and difficulty obtaining basic information. These problems affect their accounts and trading conditions.

The registration and verification processes appear to lack the transparency and efficiency that users expect from professional brokers. Many users report confusion about account setup requirements. They also experience ongoing difficulties with account verification procedures that seem unnecessarily complicated or poorly explained.

Common user complaints center around the fundamental trustworthiness of the platform. Many users express concerns about the safety of their funds and the legitimacy of the broker's operations. This pattern of feedback suggests that user experience problems extend far beyond typical service issues. The problems raise fundamental questions about the broker's integrity and reliability.

Conclusion

This comprehensive tradeska review reveals a broker that fails to meet basic industry standards. The broker lacks adequate safety, transparency, and service quality. With a WikiFX rating of 1/10 and consistently negative user feedback warning about potential fraudulent activities, Tradeska cannot be recommended for any serious trading activities.

The broker offers MT5 platform access and claims to provide STP trading services. However, these limited advantages are completely overshadowed by serious concerns about regulatory compliance, fund safety, and operational integrity. The lack of transparency regarding fundamental aspects represents unacceptable risks for traders. These aspects include regulatory status, trading costs, and safety measures.

We strongly advise traders to avoid Tradeska and instead consider well-regulated, transparent brokers with proven track records. These brokers should demonstrate client protection and service quality. The forex market offers numerous legitimate alternatives that provide comprehensive trading services with proper regulatory oversight and transparent operations.