POIPEX 2025 Review: Everything You Need to Know

Summary

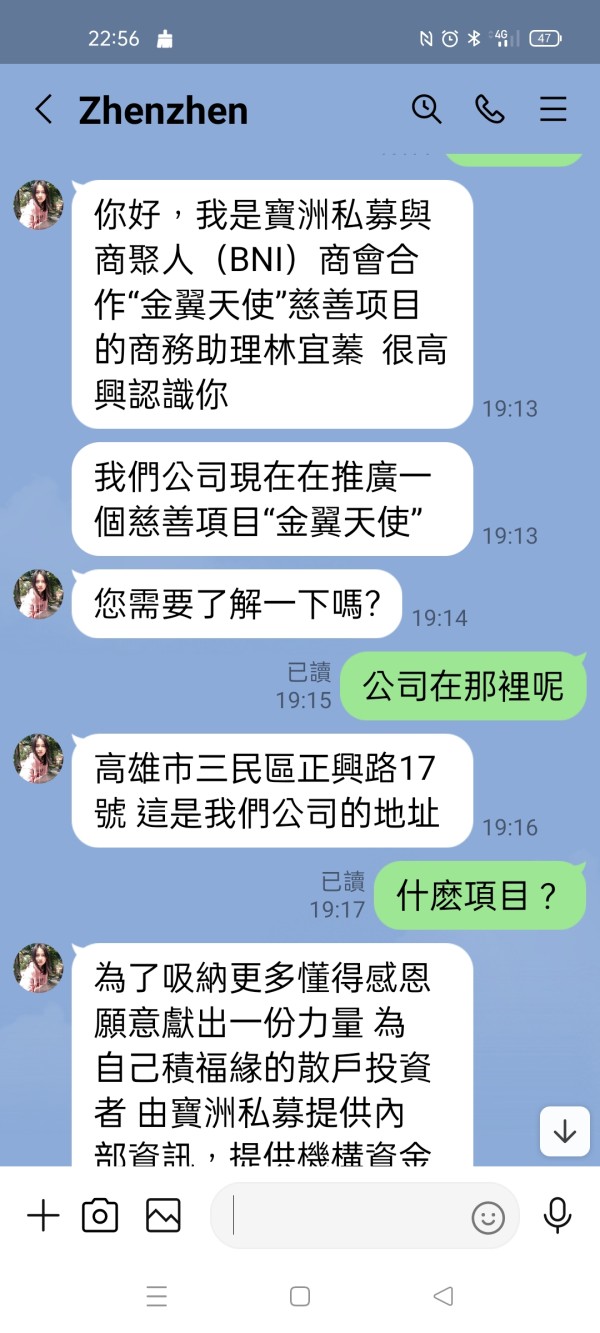

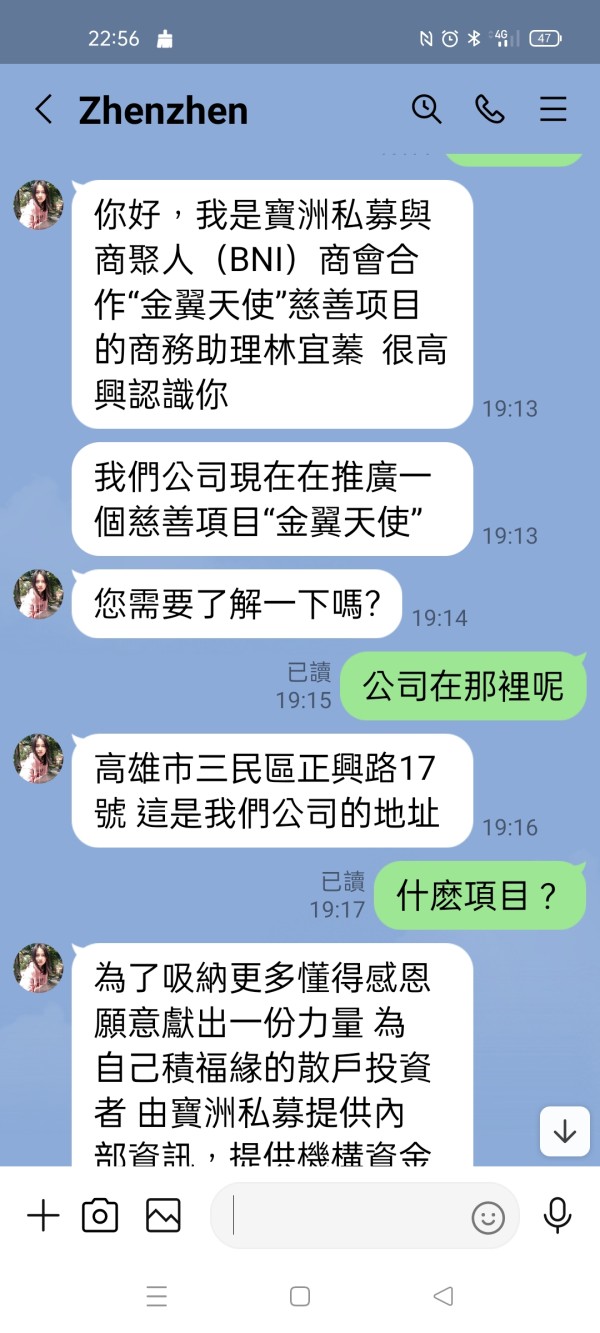

POIPEX has emerged in the forex trading landscape as a relatively new broker. The company was established in 2022. However, this poipex review reveals concerning information that potential investors should carefully consider. Multiple industry sources and user feedback have flagged POIPEX as a potentially fraudulent broker, with widespread recommendations advising traders to avoid investing with this platform.

The broker offers trading services across various financial instruments including forex, precious metals, energy commodities, and indices. However, the broker's legitimacy remains highly questionable. The company positions itself to attract investors seeking diversified trading products, but the mounting evidence of trust issues raises serious red flags. Industry analysts and user testimonials consistently point toward significant concerns regarding the broker's operational practices and reliability.

Given the current market conditions and regulatory scrutiny in 2025, traders are strongly advised to exercise extreme caution when considering POIPEX as their trading platform. The lack of transparent information, combined with negative user experiences, suggests that this broker may not provide the secure and reliable trading environment that serious investors require.

Important Notice

This evaluation of POIPEX is based on comprehensive research from multiple industry sources, user feedback reports, and available public information. Due to the limited transparency provided by POIPEX regarding their regulatory status and operational procedures, specific cross-regional regulatory differences cannot be definitively established. Our assessment methodology incorporates data from industry monitoring platforms, user testimonials, and professional trading community feedback to provide the most accurate picture possible of this broker's services and reliability.

Rating Framework

Broker Overview

POIPEX entered the competitive forex brokerage market in 2022. The company positioned itself as a provider of diversified trading services. Despite its relatively recent establishment, the company has attempted to build a presence in the online trading sector by offering access to multiple financial markets. However, the broker's short operational history has been marked by concerning developments that have attracted negative attention from industry watchdogs and trading communities.

The company's business model centers around providing trading services across four main asset categories: foreign exchange currencies, precious metals, energy commodities, and stock indices. This diversified approach initially appears attractive to traders seeking exposure to multiple markets through a single platform. However, the implementation and execution of these services have raised significant questions about the broker's operational capabilities and commitment to client welfare.

According to available information, POIPEX operates without clear regulatory oversight from recognized financial authorities. This represents a major red flag for potential clients. The absence of proper licensing and regulatory compliance creates an environment where trader protections are minimal or non-existent. This poipex review emphasizes that the lack of regulatory backing significantly undermines the broker's credibility in an industry where trust and security are paramount concerns for traders managing their capital.

Regulatory Status

Available information indicates that POIPEX does not hold licenses from major financial regulatory bodies. This absence of regulatory oversight represents a critical concern for potential clients, as regulated brokers typically provide essential protections including segregated client funds and dispute resolution mechanisms.

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal options is not clearly detailed in available sources. This lack of transparency about financial transactions raises additional concerns about the broker's operational procedures.

Minimum Deposit Requirements

The minimum deposit amount required to open an account with POIPEX is not specified in available documentation. This further contributes to the overall lack of transparency.

Current promotional offerings and bonus structures are not detailed in accessible sources. This makes it impossible to evaluate the competitiveness of any incentive programs.

Tradeable Assets

POIPEX claims to offer trading opportunities across four main categories: forex currency pairs, precious metals including gold and silver, energy commodities such as oil, and major stock indices. However, the specific number of instruments and detailed specifications are not clearly outlined.

Cost Structure

Critical information regarding spreads, commissions, overnight financing charges, and other trading costs remains undisclosed in available materials. This poipex review notes that transparent cost structures are essential for traders to make informed decisions.

Leverage Ratios

Maximum leverage ratios offered by POIPEX are not specified in available documentation. This prevents potential clients from understanding the risk parameters of their trading environment.

The specific trading platforms supported by POIPEX, such as MetaTrader 4, MetaTrader 5, or proprietary solutions, are not clearly identified in accessible sources.

Geographic Restrictions

Information about countries or regions where POIPEX services are restricted or unavailable is not provided in available materials.

Customer Support Languages

The languages supported by POIPEX customer service are not specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by POIPEX receive a concerning score of 4/10. This low rating is primarily due to the significant lack of transparency regarding account specifications and user requirements. Available information fails to provide details about different account types, their respective features, or the specific benefits offered to traders at various levels. This absence of clear account information creates uncertainty for potential clients who need to understand exactly what services they would receive.

The minimum deposit requirements remain undisclosed. This makes it impossible for traders to plan their initial investment or compare POIPEX's accessibility with other brokers in the market. Additionally, the account opening process lacks clear documentation, with no detailed explanation of required verification procedures, documentation needs, or timeline expectations. This opacity in fundamental account information suggests either poor operational organization or deliberate concealment of important terms.

User feedback regarding account experiences has been predominantly negative. Multiple reports indicate difficulties in account management and unclear terms of service. The absence of specialized account features, such as Islamic accounts for Muslim traders or demo accounts for practice trading, further limits the broker's appeal to diverse trading communities. This poipex review emphasizes that reputable brokers typically provide comprehensive account information upfront, and POIPEX's failure to do so raises serious questions about their commitment to transparency and client service.

POIPEX receives a moderate score of 6/10 for tools and resources. This rating is primarily based on their claimed offering of multiple asset classes including forex, precious metals, energy, and indices. While the diversity of tradeable instruments appears adequate on paper, the actual quality and accessibility of these tools remain questionable due to limited detailed information about their implementation and functionality.

The broker's research and analysis resources are not clearly documented. This leaves traders without access to essential market insights, technical analysis tools, or fundamental research that serious traders require for informed decision-making. Educational resources, which are crucial for trader development and success, appear to be either non-existent or inadequately promoted, suggesting a lack of commitment to client education and long-term trading success.

Automated trading support, including expert advisors and algorithmic trading capabilities, is not clearly outlined in available information. This absence of advanced trading tools limits the platform's appeal to sophisticated traders who rely on automated strategies for their trading operations. The overall impression suggests that while POIPEX may offer basic trading access to various markets, the depth and quality of tools and resources fall short of industry standards expected by serious traders.

Customer Service and Support Analysis

Customer service and support receive a poor rating of 3/10. This reflects significant concerns raised by user feedback and the general lack of transparent support infrastructure. Available information does not clearly outline the specific customer service channels offered by POIPEX, such as live chat, telephone support, or email assistance, which creates uncertainty about how clients can seek help when needed.

Response times for customer inquiries are not documented. User feedback suggests that when support is available, the quality and effectiveness of assistance provided falls below acceptable standards. Multiple sources indicate that users have experienced difficulties in obtaining timely and helpful responses to their questions and concerns, particularly regarding account issues and technical problems.

The availability of multilingual support is not clearly established. This could create barriers for international clients who require assistance in their native languages. Additionally, the operating hours for customer support are not specified, leaving clients uncertain about when they can expect to receive help. User testimonials consistently point to poor customer service experiences, with many reporting unresolved issues and inadequate communication from the broker's support team.

Trading Experience Analysis

The trading experience with POIPEX receives a below-average score of 5/10. This rating is primarily due to insufficient information about platform stability and execution quality. User feedback regarding platform performance is limited, but available reports suggest that the trading environment may not meet the reliability standards expected by active traders who require consistent platform availability and fast execution speeds.

Order execution quality remains unclear. There is no specific information available about slippage rates, requote frequency, or execution speeds during different market conditions. This lack of transparency about execution performance makes it difficult for traders to assess whether POIPEX can provide the reliable trade execution necessary for successful trading strategies, particularly for scalping or high-frequency trading approaches.

The completeness of platform functionality is not well-documented. There is unclear information about charting capabilities, technical indicators, and advanced order types. Mobile trading experience, which is crucial for modern traders who need to monitor and manage positions on the go, lacks detailed documentation about app functionality and performance. The overall trading environment appears to lack the comprehensive features and reliability that experienced traders require for effective market participation. This poipex review notes that successful trading requires robust platform infrastructure, which POIPEX appears unable to adequately demonstrate.

Trustworthiness Analysis

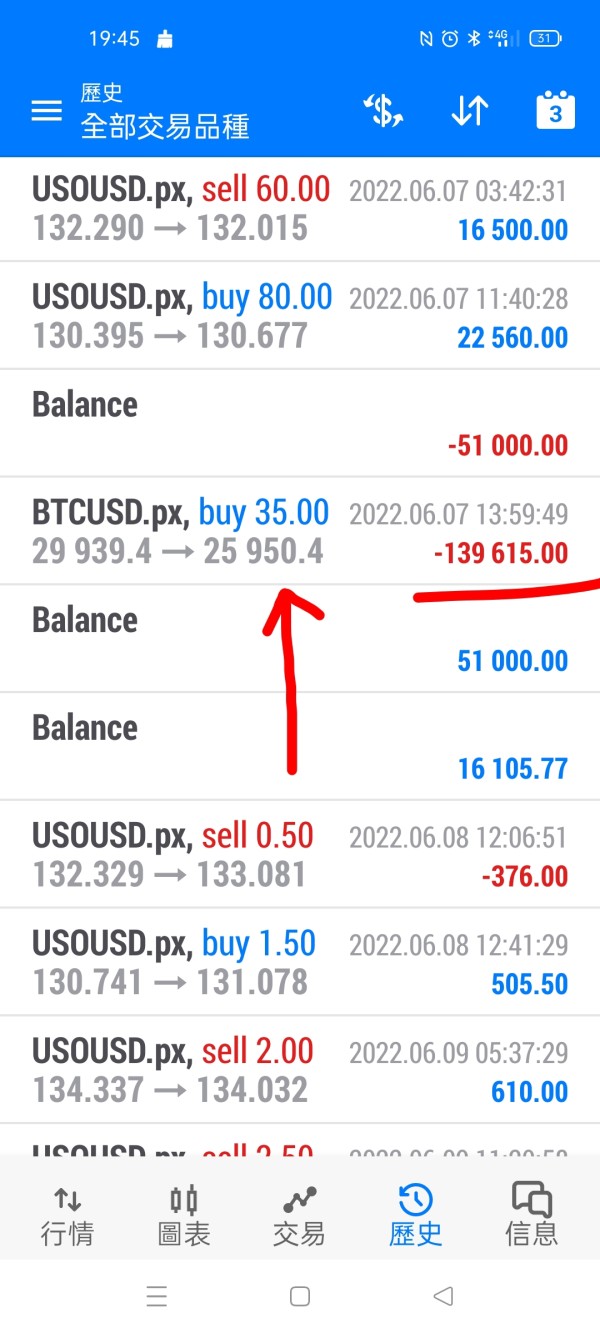

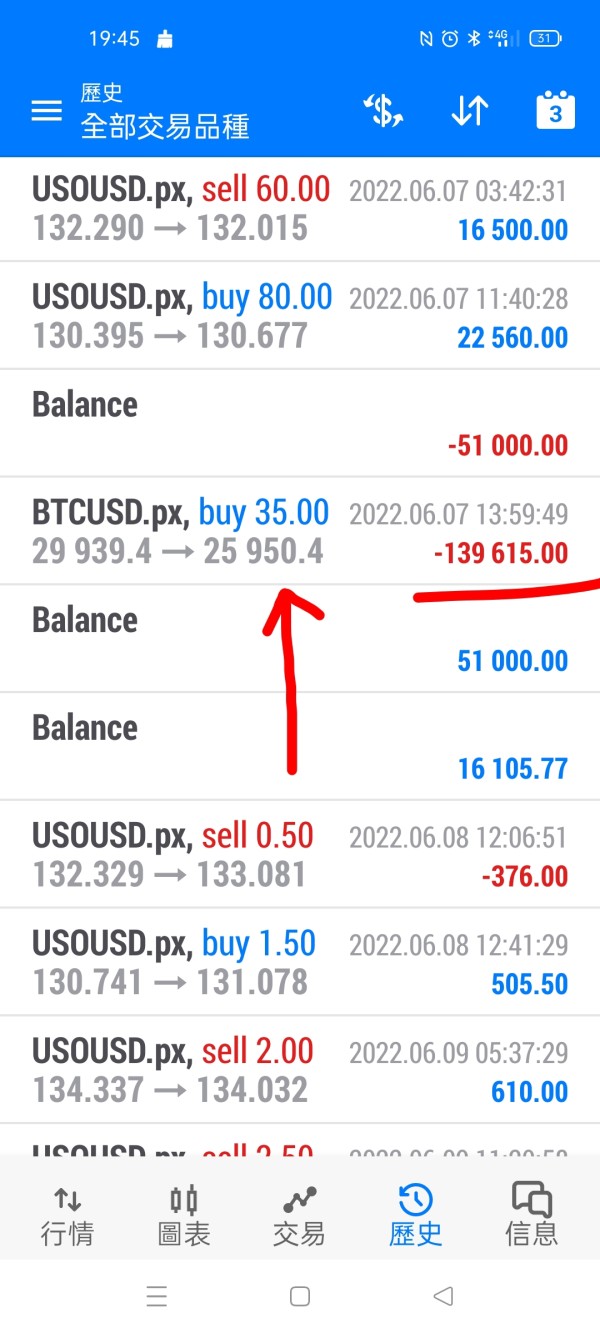

Trustworthiness receives the lowest possible rating of 2/10. This reflects the most serious concerns about POIPEX's legitimacy and operational integrity. The broker's regulatory status remains highly problematic, with no evidence of licensing or oversight from recognized financial regulatory authorities. This absence of regulatory compliance eliminates essential protections that traders rely on, including fund segregation, compensation schemes, and formal dispute resolution procedures.

Multiple industry sources have flagged POIPEX as a potentially fraudulent operation. There are widespread warnings advising traders to avoid investing with this broker. These warnings come from various trading communities, review platforms, and industry monitoring services that track broker reliability and safety. The consistency of these negative assessments across multiple independent sources strongly suggests legitimate concerns about the broker's operations.

Fund safety measures are not clearly documented. This raises serious questions about how client deposits are protected and whether traders would be able to recover their funds if needed. The company's transparency regarding its ownership, management, and operational procedures is severely lacking, making it impossible for potential clients to verify the legitimacy of the organization. The absence of verifiable company information, combined with the multiple fraud warnings, creates a highly risky environment for any trader considering this broker.

User Experience Analysis

User experience receives a poor rating of 4/10. This reflects predominantly negative feedback from traders who have interacted with POIPEX services. Overall user satisfaction appears to be significantly below industry standards, with multiple reports indicating various operational and service-related problems that impact the trading experience.

The user interface design and platform usability are not well-documented. Available feedback suggests that the trading environment may not provide the intuitive and efficient experience that modern traders expect. Registration and verification processes appear to be problematic based on user reports, with unclear procedures and potential delays in account activation creating frustration for new clients.

Fund operation experiences, including deposits and withdrawals, have generated negative feedback from users who report difficulties in processing financial transactions. These operational issues are particularly concerning as they directly impact traders' ability to manage their capital effectively. The most common user complaint centers around the recommendation from experienced traders and industry observers to avoid investing with POIPEX entirely, which represents a severe indictment of the overall user experience and broker reliability.

Conclusion

This comprehensive poipex review reveals significant concerns that strongly suggest traders should avoid this broker entirely. POIPEX's overall evaluation is severely compromised by its potential fraud designation, lack of regulatory oversight, and consistently poor user feedback across multiple evaluation criteria. The absence of transparency in critical areas such as regulatory compliance, cost structures, and operational procedures creates an unacceptable risk environment for traders.

The broker is not recommended for any category of traders, particularly newcomers to forex trading who may be more vulnerable to fraudulent operations. While POIPEX claims to offer diversified trading products across forex, precious metals, energy, and indices, these potential advantages are completely overshadowed by fundamental trust and safety issues. The combination of regulatory non-compliance, industry fraud warnings, and negative user experiences creates a clear picture of a broker that fails to meet basic standards of legitimacy and reliability in the financial services industry.