Ofmg 2025 Review: Everything You Need to Know

Summary

The Ofmg review reveals a concerning picture of this forex broker, highlighting significant risks associated with its unregulated status and poor customer service. Users have reported difficulties with withdrawals and a lack of transparency, raising red flags about the broker's legitimacy.

Note: It is crucial to recognize that Ofmg operates in a complex regulatory environment, which varies across regions. This review aims to provide an accurate and fair analysis based on available data.

Rating Overview

We rate brokers based on user feedback, regulatory status, and overall market reputation.

Broker Overview

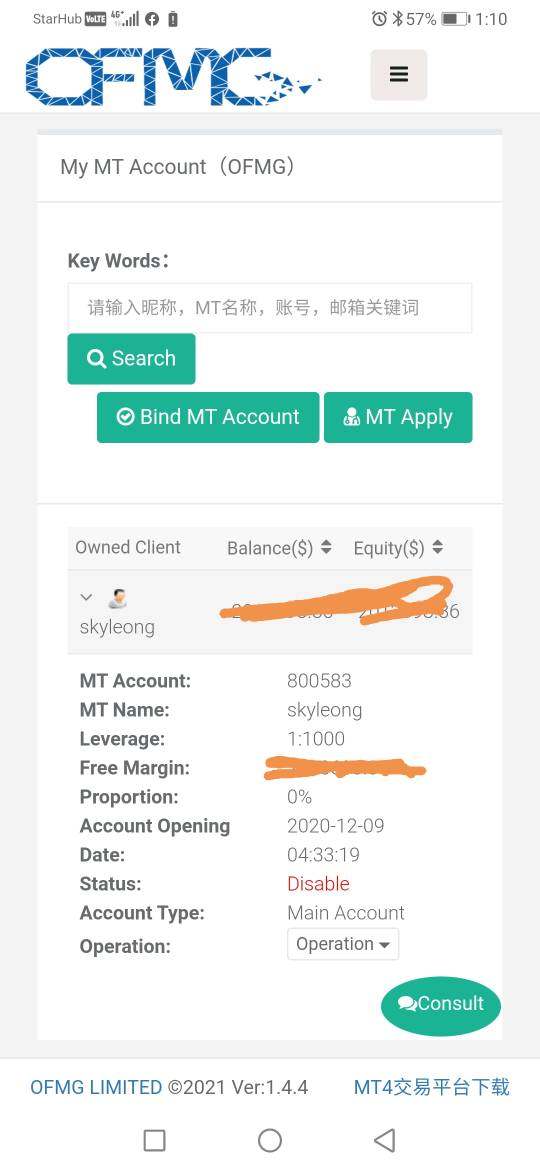

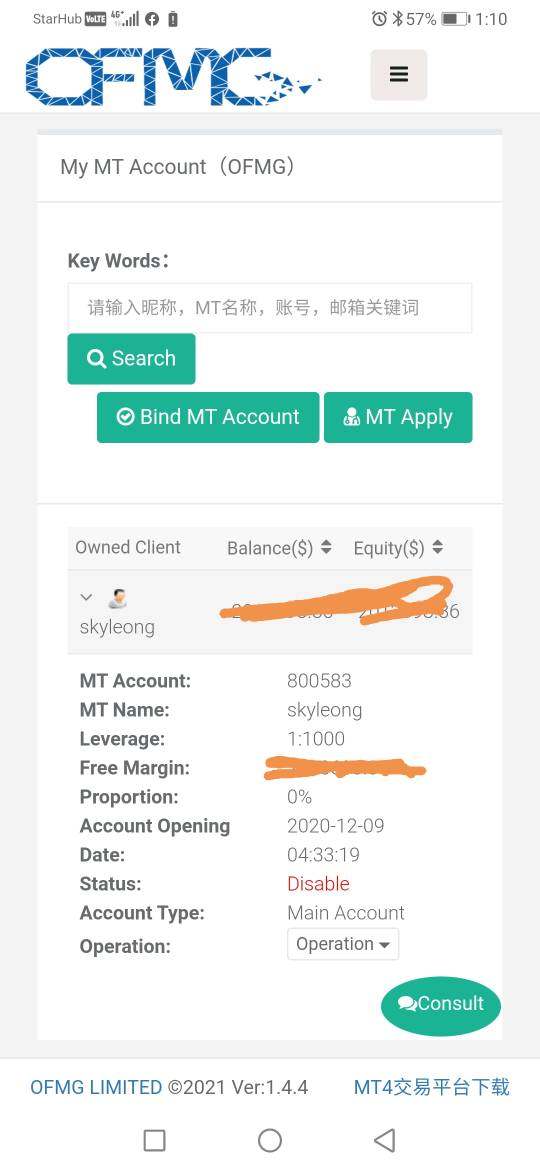

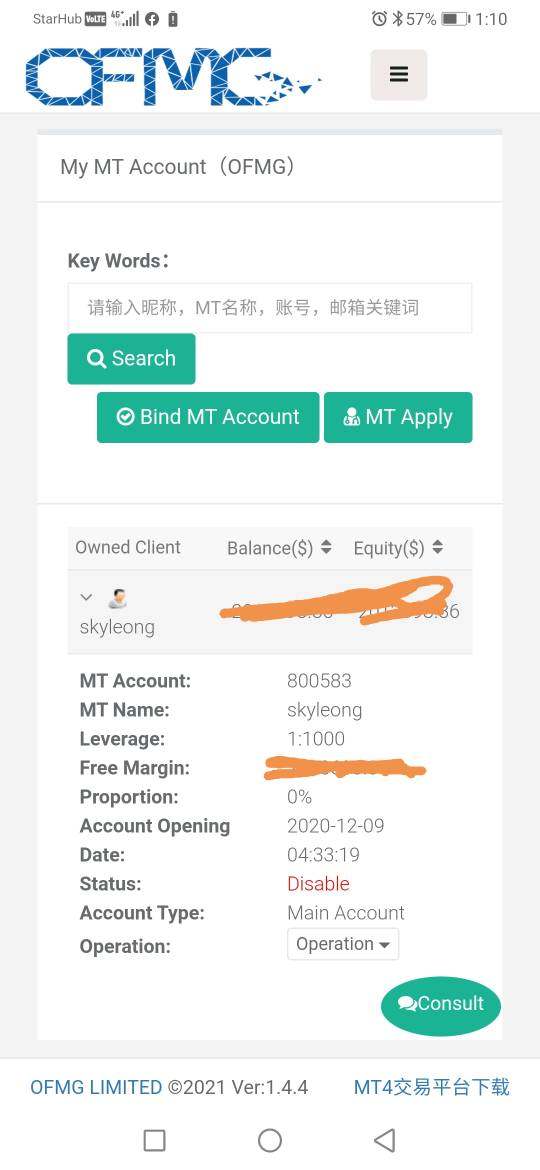

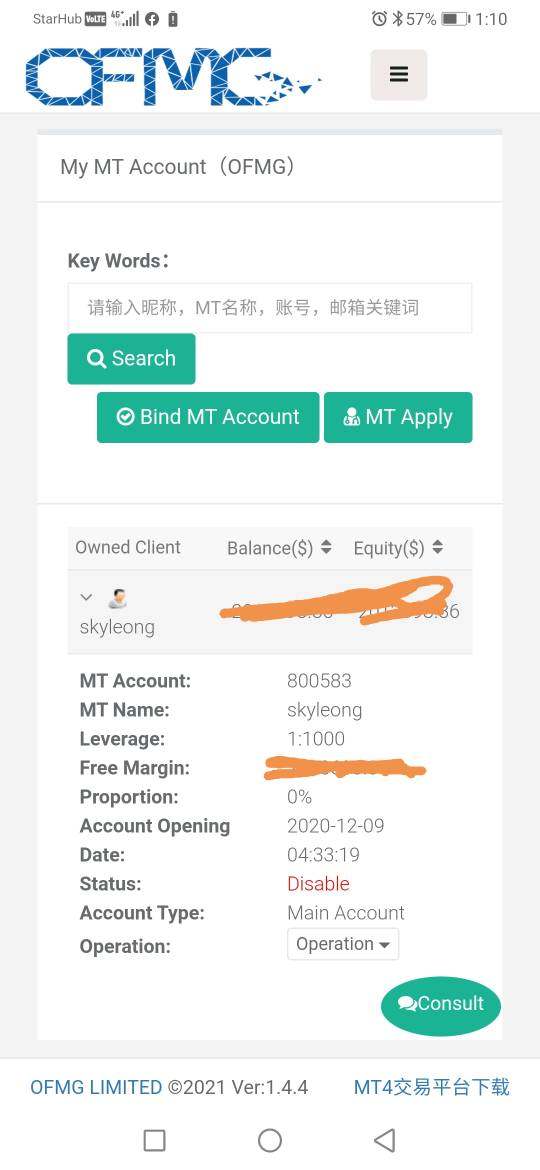

Established in 2020, Ofmg is a forex broker based in the United Kingdom. The broker operates without any valid regulatory oversight, which poses a significant risk to traders. Ofmg primarily utilizes the popular MetaTrader 4 (MT4) trading platform, offering various assets for trading, including forex, commodities, indices, stocks, bonds, and cryptocurrencies. However, it lacks a robust regulatory framework, which is a critical factor for potential investors.

Detailed Review

Regulatory Environment

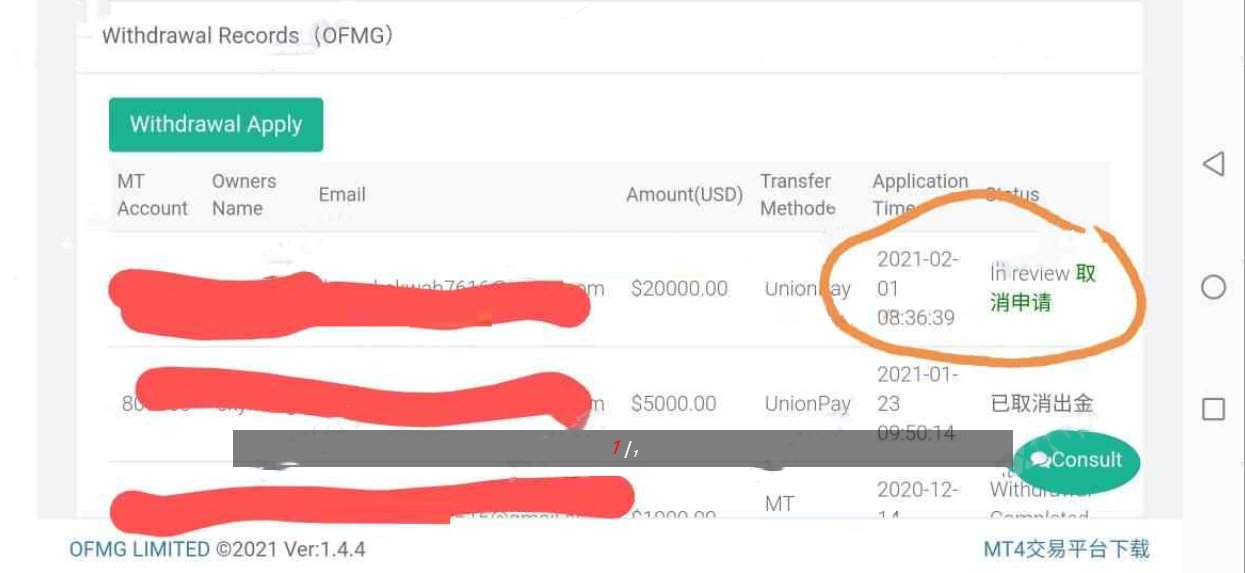

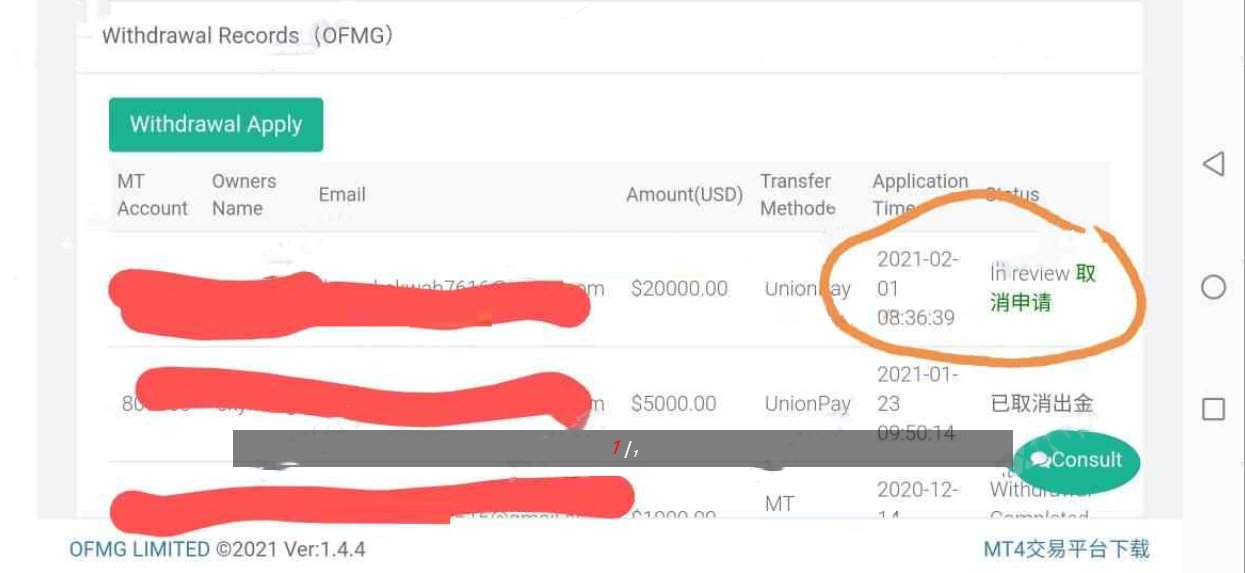

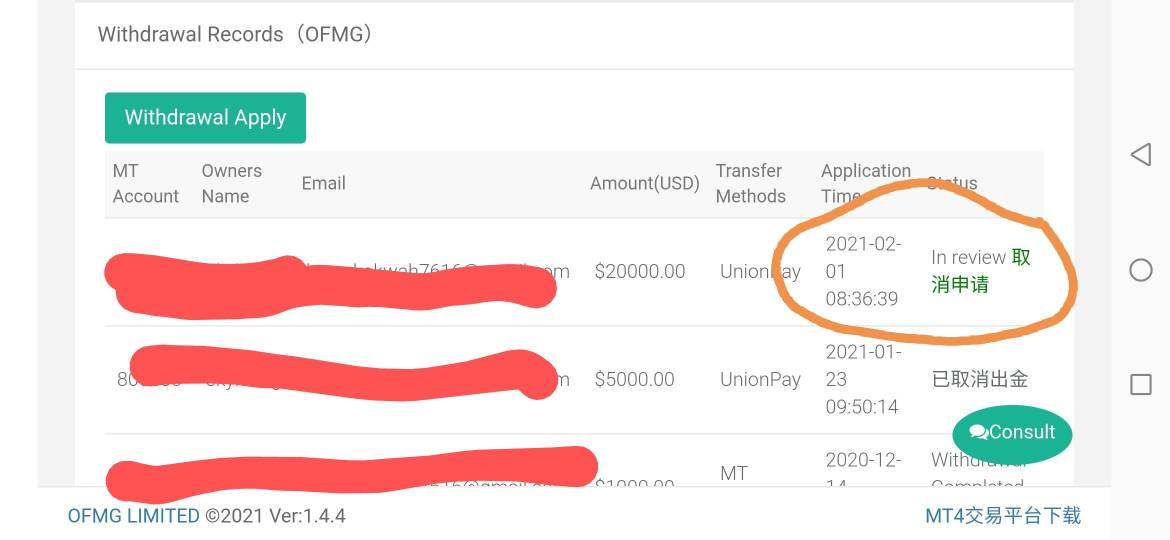

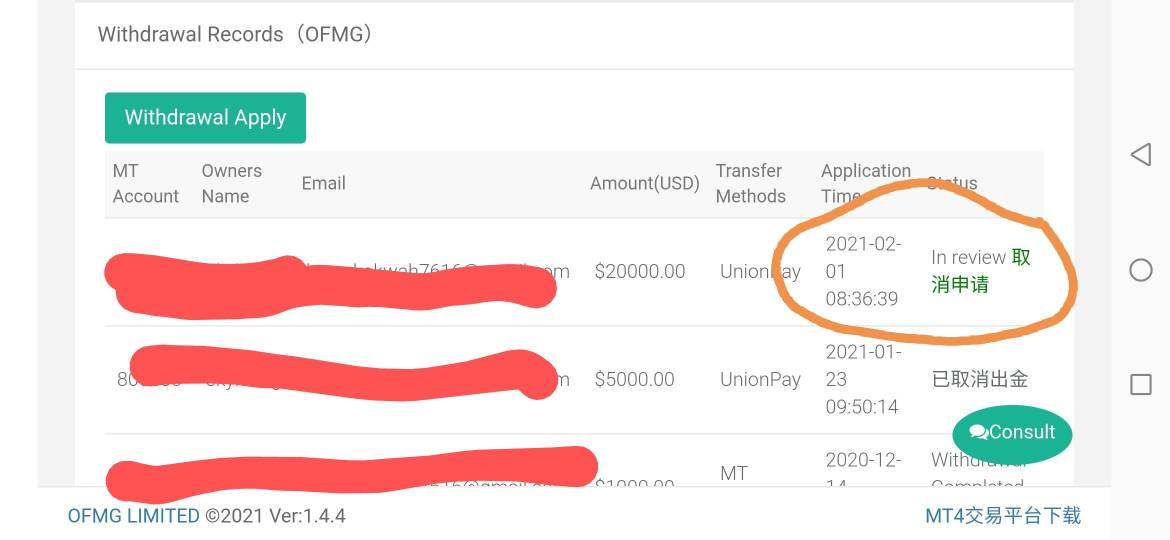

Ofmg is not regulated by any recognized financial authority, which is a major concern for traders. The absence of regulation means that there is no oversight to ensure fair practices or protect investors in case of disputes. According to the WikiFX, Ofmg has received multiple complaints related to withdrawal issues, further emphasizing the need for caution when dealing with this broker.

Deposit/Withdrawal Currencies and Cryptocurrencies

Ofmg accepts deposits and withdrawals through various methods, including bank wire transfers and credit/debit cards. However, the specifics regarding supported currencies are not clearly outlined in the available reviews. The lack of transparency in this area raises concerns about the broker's reliability. Additionally, there is no mention of cryptocurrency payment options, which is increasingly becoming a standard feature among forex brokers.

Minimum Deposit

The minimum initial deposit required to open an account with Ofmg is reported to be around $1,000. This amount may deter novice traders who wish to start with a smaller capital. The high entry barrier is a potential drawback for those looking to test the waters before committing significant funds.

The Ofmg review does not highlight any ongoing bonuses or promotional offers, which is a common strategy among brokers to attract new clients. The lack of promotional incentives may indicate a less competitive approach compared to other brokers in the market.

Tradable Asset Classes

Ofmg provides access to a diverse range of trading instruments, including forex pairs, commodities, indices, and CFDs on stocks and cryptocurrencies. While this variety may appeal to traders looking for multiple trading opportunities, it is essential to consider the associated risks, especially given the broker's unregulated status.

Costs (Spreads, Fees, Commissions)

According to the reviews, Ofmg offers variable spreads starting from around 2 pips for major currency pairs, along with a commission of $10 per lot traded. While these costs may seem competitive at first glance, traders should be cautious and consider the overall trading environment, especially in light of the broker's lack of regulation.

Leverage

Ofmg offers a maximum leverage of up to 1:400, which can amplify both potential profits and losses. While high leverage can attract experienced traders looking for greater returns, it also significantly increases the risk of substantial losses, particularly in volatile markets.

Ofmg exclusively uses the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and comprehensive trading tools. However, the broker does not support mobile or web-based trading platforms, limiting accessibility for traders who prefer to trade on-the-go.

Restricted Regions

The reviews do not specify any restricted regions, but the unregulated nature of Ofmg may pose challenges for traders in certain jurisdictions. It is advisable for potential clients to verify the broker's acceptability within their region.

Available Customer Service Languages

Ofmg's customer support is reportedly available only in English, which may limit accessibility for non-English speaking traders. Furthermore, the lack of multiple contact methods, such as phone support, raises concerns about the broker's commitment to customer service.

Repeated Rating Overview

Detailed Breakdown

Account Conditions

The minimum deposit requirement of $1,000 is relatively high, which may not be suitable for all traders. Additionally, the lack of regulatory oversight raises concerns about the security of funds.

Ofmg utilizes the well-regarded MT4 platform, providing traders with essential tools for technical analysis and automated trading. However, the absence of educational resources and other trading tools limits its appeal.

Customer Service and Support

Customer support has been a significant pain point for many users, with reports of slow response times and difficulties in obtaining assistance. The lack of a dedicated support line further exacerbates this issue.

Trading Setup (Experience)

While MT4 is a robust platform, the overall trading experience is marred by the broker's unregulated status and limited accessibility options, such as mobile trading.

Trustworthiness

Ofmg's lack of regulation and numerous complaints regarding withdrawal issues contribute to a very low trust rating. Potential investors are strongly advised to proceed with caution.

User Experience

Overall user experience has been reported as subpar, with many users expressing frustration over the broker's customer service and withdrawal processes.

In conclusion, the Ofmg review paints a troubling picture of a broker that poses significant risks to potential investors. The combination of unregulated status, poor customer service, and high minimum deposit requirements suggests that traders should consider alternative options that offer better protection and support.