Is POIPEX safe?

Business

License

Is Poipex Safe or Scam?

Introduction

Poipex is an online trading platform that positions itself as a forex broker, claiming to offer a wide range of trading services across various asset classes, including currencies, commodities, and indices. However, the rapid growth of online trading has also led to the emergence of numerous unregulated and potentially fraudulent brokers, making it crucial for traders to carefully evaluate the legitimacy of any trading platform before committing their funds. This article investigates whether Poipex is a safe trading option or a potential scam. Our investigation is based on a thorough analysis of available information, including regulatory status, company background, trading conditions, customer feedback, and security measures.

Regulatory Status and Legitimacy

The regulatory environment is a critical factor in determining the safety of a trading platform. A broker's regulatory status can provide insight into its legitimacy and operational standards. In the case of Poipex, it has been flagged by multiple review sites as an unregulated broker, which poses significant risks for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight from recognized bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) raises red flags. Unregulated brokers are not required to adhere to strict operational guidelines, which can lead to unethical practices and a higher risk of fraud. Furthermore, the lack of a regulatory history indicates that traders may have little recourse in the event of disputes or financial losses. Overall, the lack of regulation is a significant concern when assessing whether Poipex is safe.

Company Background Investigation

Poipex Market Limited, the company behind the trading platform, claims to operate from the United Kingdom. However, the information available about its history, ownership structure, and management team is limited. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their corporate structure and key personnel.

The management team‘s expertise and experience in the financial markets are crucial indicators of a broker's reliability. Unfortunately, Poipex does not disclose any information regarding its management or their qualifications, which further complicates the assessment of its legitimacy. The absence of clear information about the company’s history and ownership structure may suggest an attempt to obscure the true nature of its operations, making it vital for potential investors to approach this broker with caution.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and commissions, is essential. Poipex advertises competitive spreads and various trading options. However, many user reviews indicate potential issues related to hidden fees and unclear withdrawal policies.

| Fee Type | Poipex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0-2.0 pips |

| Commission Structure | None stated | Varies (typically $5 per lot) |

| Overnight Interest Range | Not disclosed | 0.5% - 2% |

The claim of spreads starting from 0.0 pips is appealing, but the lack of transparency regarding commission structures and overnight interest rates raises questions. Furthermore, several complaints from users suggest that withdrawal processes are often delayed or denied, which is a significant warning sign. These factors collectively contribute to the overall assessment of whether Poipex is safe for trading.

Client Fund Safety

The safety of client funds is paramount when considering a forex broker. Poipex's lack of regulation raises concerns about its fund safety measures. Regulated brokers are typically required to implement strict safeguards, such as segregating client funds from operational funds, providing investor protection schemes, and ensuring negative balance protection.

Unfortunately, Poipex does not provide any information regarding its fund safety measures. The absence of these critical protections increases the risk for traders, as their funds may not be secure in the event of financial distress or operational failure. Additionally, there have been reports of users experiencing difficulties in withdrawing their funds, which is a common issue with unregulated brokers. This lack of transparency and the potential for fund mismanagement further contribute to the conclusion that Poipex is not a safe option.

Client Experience and Complaints

Customer feedback is a vital aspect of evaluating a trading platform. In the case of Poipex, numerous complaints have surfaced regarding withdrawal issues, unresponsive customer service, and overall dissatisfaction with the trading experience.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Poor |

Many users report that they faced significant delays when attempting to withdraw their funds, with some claiming that their requests were outright ignored. This pattern of complaints is concerning and indicates a lack of accountability on the part of the broker. The quality of customer service is also reported to be subpar, with users often receiving no response to their inquiries. These issues highlight the risks associated with trading through Poipex and reinforce the notion that Poipex may not be a safe choice for traders.

Platform and Execution

The performance and reliability of a trading platform are crucial for a smooth trading experience. Poipex claims to offer a robust trading platform, but user reviews suggest otherwise. Many traders report experiencing technical glitches, slow execution speeds, and issues with order fulfillment.

The presence of slippage and rejected orders can significantly impact trading profitability. Users have expressed frustration over the platform's performance, particularly during high-volatility market conditions. These concerns raise questions about the overall integrity of the trading environment provided by Poipex, further suggesting that Poipex is not a safe option for serious traders.

Risk Assessment

Trading with an unregulated broker like Poipex carries inherent risks. The lack of regulatory oversight, combined with poor customer feedback and potential issues regarding fund safety, creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing fraud risk. |

| Fund Safety Risk | High | Lack of client fund protection measures. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

To mitigate these risks, potential traders should conduct thorough research and consider using regulated brokers that offer better security and transparency. Additionally, it is advisable to start with a demo account or a small investment to gauge the platform's reliability before committing significant funds.

Conclusion and Recommendations

In conclusion, the investigation into Poipex reveals several alarming indicators that suggest it may not be a safe trading option. The absence of regulatory oversight, combined with a lack of transparency regarding company operations, fund safety measures, and customer service issues, raises significant concerns about the platform's legitimacy.

For traders seeking a reliable and secure trading experience, it is advisable to avoid Poipex and consider alternative options that are well-regulated and have positive user feedback. Reputable brokers often provide comprehensive information about their operations, regulatory status, and customer support, which can help ensure a safer trading environment. If you are considering trading in forex, look for brokers regulated by authorities such as the FCA, ASIC, or CySEC, which offer the necessary protections for your investments.

Is POIPEX a scam, or is it legit?

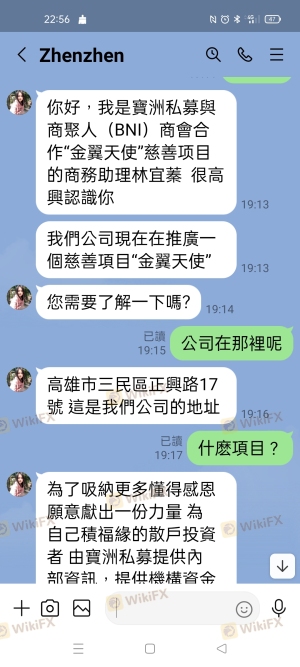

The latest exposure and evaluation content of POIPEX brokers.

POIPEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

POIPEX latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.