Paradtrade 2025 Review: Everything You Need to Know

Executive Summary

Paradtrade is a forex broker that started in 2019. This paradtrade review shows a platform that offers good conditions for new traders but has serious concerns about regulation and oversight. The broker works from Prague and gives access to many types of assets including forex, stocks, cryptocurrencies, commodities, and indices.

Two main features make Paradtrade stand out in the competitive brokerage world: a very low minimum deposit of just $5 and trading leverage up to 1:1000. This makes it easy for traders with different experience levels and money amounts to start trading. The platform works on multiple devices including web browsers, mobile phones, desktop computers, and tablets, which gives traders flexibility for their different trading needs.

Paradtrade targets many different types of traders. It appeals to beginners who want low-barrier entry and experienced traders who want high-leverage opportunities across forex, stock, and cryptocurrency markets. However, the lack of clear regulatory information raises important questions about trader protection and fund security that potential clients must think about carefully before using this broker.

Important Notice

Regional Entity Differences: Paradtrade's regulatory status is unclear based on available information. This may create different legal problems across different countries and regions. Potential traders should check local regulatory compliance before opening accounts, as the broker's operations may not meet regulatory standards in all regions.

Review Methodology: This evaluation uses publicly available information, user feedback, and market data. The assessment has not been checked through direct platform testing or official regulatory database confirmation, so traders should do their own research before making investment decisions.

Rating Framework

Overall Rating: 6.7/10 - Above Average with Reservations

Broker Overview

Paradtrade started in the forex brokerage scene in 2019. The company built a business model focused on attracting different types of traders through competitive entry conditions and broad asset coverage. As an unregulated broker, Paradtrade operates outside traditional regulatory frameworks, which allows for flexible trading conditions but also brings risks for client fund protection and dispute resolution.

The broker's approach focuses on low barriers to entry combined with high-leverage opportunities. This creates an environment that appeals to both new traders testing the waters with small amounts of money and experienced traders seeking maximum leverage potential. This dual-target strategy shows Paradtrade's attempt to capture market share across different trader groups while operating in the competitive unregulated brokerage space.

Paradtrade offers access to multiple asset classes through various platform versions. The broker supports web-based trading, mobile applications, and desktop installations. The broker provides access to forex pairs, individual stocks, major cryptocurrencies, commodity futures, and stock indices. However, detailed information about regulatory oversight is notably missing from available sources, which represents a significant consideration for potential clients checking platform safety and compliance standards.

Regulatory Jurisdictions: Available information does not specify particular regulatory authorities watching over Paradtrade's operations. This suggests the broker operates without traditional financial services regulation.

Deposit and Withdrawal Methods: Specific payment processing methods and withdrawal procedures are not detailed in accessible sources, so traders need to contact the broker directly for complete information.

Minimum Deposit Requirements: Paradtrade sets a very low minimum deposit threshold at $5. This makes it one of the most accessible brokers for entry-level traders.

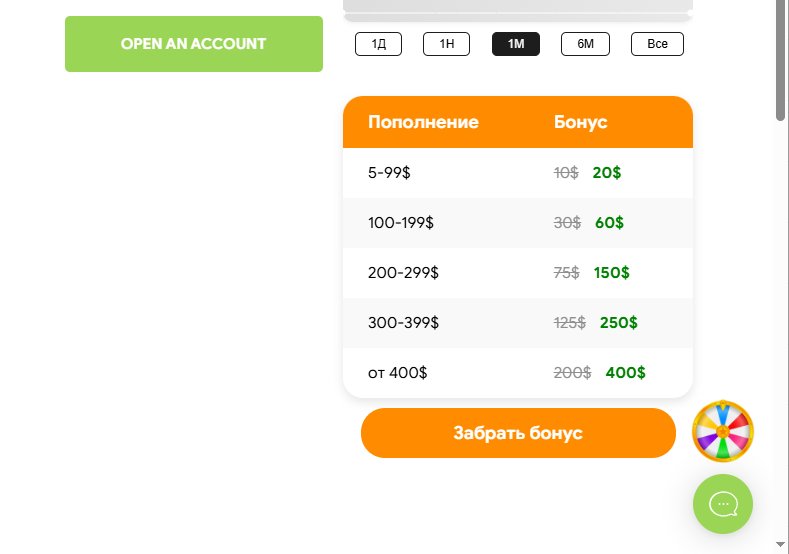

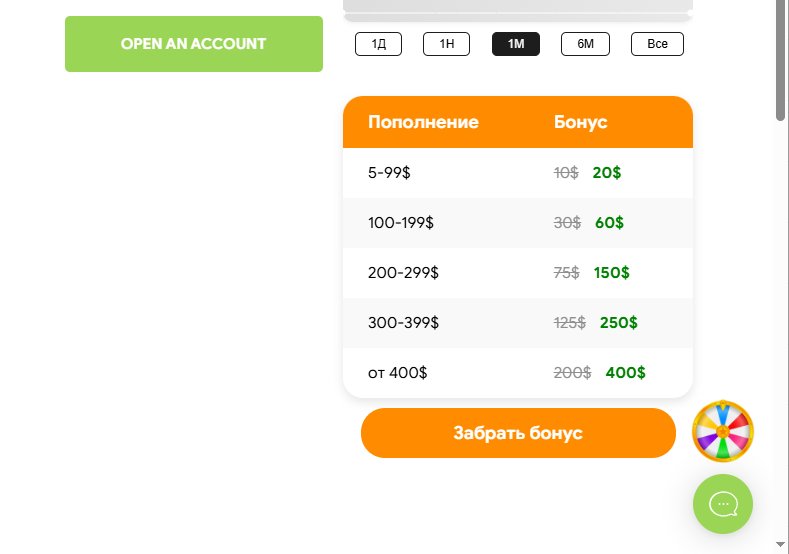

Bonus and Promotional Offers: Current promotional structures and bonus programs are not specified in available documentation. Traders should ask about potential incentives directly.

Available Trading Assets: The platform provides access to forex currency pairs, individual stocks, major cryptocurrencies, commodity contracts, and various market indices across global markets.

Cost Structure: Spreads begin from 0 pips according to available information. However, complete commission structures and additional fees require further clarification through direct broker communication.

Leverage Ratios: Maximum leverage reaches 1:1000, providing significant amplification potential for experienced traders while requiring careful risk management.

Platform Options: Trading infrastructure includes web browser access, mobile applications, desktop software, and tablet-compatible versions for complete market access.

Geographic Restrictions: Specific country limitations and regional access restrictions are not detailed in current paradtrade review materials.

Customer Support Languages: Available language support for customer service communications is not specified in accessible sources.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Paradtrade's account structure shows strong accessibility through its $5 minimum deposit requirement. This ranks among the lowest in the industry and removes big barriers for new traders entering forex markets. This approach lets users experience real trading conditions without big financial commitment, making it particularly attractive for educational purposes and strategy testing.

The leverage offering up to 1:1000 provides flexibility for different trading approaches, from conservative position sizing to aggressive capital amplification strategies. This range works for both risk-averse traders preferring lower leverage and experienced traders seeking maximum market exposure potential.

However, specific account type variations and their features are not clearly outlined in available sources. The absence of detailed information about Islamic account availability, VIP account structures, or professional trader designations limits complete evaluation of the account ecosystem.

User feedback about account opening procedures suggests a streamlined process, though verification requirements and documentation standards remain unspecified. The combination of low entry barriers and high leverage potential creates an attractive proposition for many traders, though the lack of regulatory oversight raises questions about account protection measures and client fund segregation practices that typically come with regulated brokerage operations.

The platform's multi-version accessibility across web, mobile, desktop, and tablet environments shows technological adaptability and user convenience. This complete platform coverage ensures traders can maintain market access regardless of their preferred device or location, which is essential for modern trading flexibility.

Asset diversity spanning forex, stocks, cryptocurrencies, commodities, and indices provides substantial trading opportunities within a single platform environment. This breadth reduces the need for multiple brokerage relationships and enables diversified portfolio strategies across different market sectors.

However, specific details about analytical tools, charting capabilities, technical indicators, and market research resources are not extensively documented in available sources. The absence of information about automated trading support, expert advisor compatibility, and advanced order types limits assessment of the platform's sophistication level.

Educational resources, market analysis publications, and trader development materials are not detailed in current documentation. This represents a significant gap for traders seeking complete learning support. The platform's effectiveness ultimately depends on these undocumented features that require direct investigation to evaluate fully.

Customer Service and Support Analysis (8/10)

User feedback consistently highlights responsive customer service as a notable Paradtrade strength. Multiple reviews emphasize quick response times and effective problem resolution. This positive service reputation suggests the broker prioritizes client communication and support quality despite operating without regulatory oversight requirements.

The quality of service interactions appears to meet or exceed user expectations based on available feedback. This indicates trained support staff capable of addressing common trading issues and account management questions. This service standard contributes significantly to overall user satisfaction and platform credibility.

However, specific support channels, availability hours, and multilingual capabilities are not detailed in accessible information. The absence of complete support structure documentation makes it difficult to assess coverage consistency and specialized support for complex trading issues or technical problems.

Response time consistency during high-volume periods and crisis situations remains unverified through available sources. While current user feedback suggests positive experiences, the long-term sustainability of service quality without regulatory service standards requirements presents potential concerns for future support reliability.

Trading Experience Analysis (6/10)

Platform stability and execution quality receive mixed feedback from users. Some report satisfactory trading speeds while others mention occasional technical issues. This variability suggests inconsistent performance that may depend on market conditions, server loads, or individual connection quality factors.

The spread structure starting from 0 pips indicates competitive pricing potential, though actual execution conditions during volatile market periods and news events are not thoroughly documented. Real-world trading costs often exceed advertised minimums due to market conditions and liquidity variations.

Order execution quality, including slippage rates and requote frequency, lacks complete documentation in available sources. These execution characteristics significantly impact trading profitability and overall platform effectiveness, particularly for scalping strategies and high-frequency trading approaches.

Mobile platform functionality and synchronization with desktop versions require further evaluation, as user experiences with cross-platform consistency are not extensively documented. The effectiveness of mobile trading capabilities becomes crucial for traders requiring constant market access and position management flexibility.

This paradtrade review indicates that while basic trading functionality appears adequate, the platform may not meet advanced trader requirements for professional-grade execution and sophisticated trading tools.

Trust and Reliability Analysis (4/10)

The absence of specified regulatory oversight represents the most significant concern regarding Paradtrade's trustworthiness and operational reliability. Regulated brokers must comply with capital adequacy requirements, client fund segregation rules, and dispute resolution procedures that provide essential trader protections.

Fund security measures and client money protection protocols are not detailed in available information. This creates uncertainty about asset safety and recovery procedures in potential business difficulties. This transparency gap significantly impacts trader confidence and risk assessment capabilities.

Some user feedback includes concerns about potential fraudulent activities, though these claims require careful evaluation against the broader user experience spectrum. The presence of such concerns, regardless of their validity, indicates reputational challenges that may affect trader confidence and platform credibility.

Company transparency regarding ownership structure, financial statements, and business operations remains limited in accessible sources. This opacity contrasts with regulated brokers who must provide complete corporate disclosure and maintain public accountability standards.

The combination of regulatory absence and limited transparency creates substantial trust challenges that potential traders must carefully weigh against the platform's attractive trading conditions and competitive features.

User Experience Analysis (7/10)

Overall user satisfaction appears mostly positive based on available feedback. Many traders express satisfaction with platform accessibility and service quality. The low entry barrier and competitive trading conditions contribute to positive initial experiences for new users.

Interface design and navigation ease are not extensively detailed in current sources, though multi-platform availability suggests attention to user accessibility across different devices. The effectiveness of platform design ultimately impacts trading efficiency and user retention rates.

Account registration and verification processes appear streamlined based on user reports, though specific requirements and timeframes are not completely documented. Efficient onboarding procedures contribute significantly to positive first impressions and user adoption rates.

Common user complaints center on concerns about regulatory status and fund security rather than platform functionality or service quality issues. This pattern suggests that operational aspects generally meet user expectations while structural concerns about broker legitimacy create ongoing anxiety.

The user demographic appears to include both novice traders attracted by low barriers and experienced traders seeking high-leverage opportunities. This indicates successful appeal across different experience levels despite underlying trust concerns.

Conclusion

Paradtrade presents a complex proposition for forex traders. It offers attractive entry conditions and competitive features while raising significant concerns about regulatory oversight and long-term reliability. The broker's $5 minimum deposit and 1:1000 leverage create compelling opportunities for diverse trader types, particularly those seeking accessible entry points or maximum capital amplification potential.

The platform appears most suitable for experienced traders who understand unregulated broker risks and can implement appropriate risk management strategies. It also works for novice traders willing to limit exposure while gaining market experience. However, traders prioritizing regulatory protection and fund security may find better alternatives among established regulated brokers.

Key advantages include exceptional accessibility, competitive leverage ratios, and reportedly strong customer service, while primary disadvantages center on regulatory absence, limited transparency, and associated fund security concerns that characterize unregulated brokerage operations.