Is Oxtrade safe?

Pros

Cons

Is Oxtrade Safe or a Scam?

Introduction

Oxtrade is a forex and CFD broker that claims to offer a user-friendly trading platform for a range of financial instruments, including forex, indices, and cryptocurrencies. Based in Saint Vincent and the Grenadines, Oxtrade positions itself as a competitive player in the online trading market. However, the lack of robust regulatory oversight raises concerns for potential traders. It is essential for traders to carefully evaluate forex brokers before committing their funds, as the industry is rife with unregulated entities that can pose significant risks. This article aims to assess whether Oxtrade is safe for trading or if it falls under the category of a scam. Our investigation is based on a thorough review of available information, including regulatory status, company background, trading conditions, customer feedback, and risk assessments.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for ensuring the safety of traders' funds and maintaining market integrity. Oxtrade is registered with the Financial Services Authority of Saint Vincent and the Grenadines (SVG FSA), but it lacks a license from any major regulatory authority. This absence of oversight raises serious questions about the broker's legitimacy.

Here is a summary of Oxtrade's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 775 | Saint Vincent and the Grenadines | Active but unregulated |

The SVG FSA is known for its lenient regulatory framework, which often leads to concerns about the quality of oversight. Moreover, Oxtrade does not have any licenses from top-tier regulatory bodies such as the FCA (UK), ASIC (Australia), or SEC (USA). This lack of stringent regulation could expose traders to higher risks, including potential fraud and mismanagement of funds. The absence of a regulatory safety net means that traders have limited recourse in the event of disputes or financial losses. Thus, when considering whether Oxtrade is safe, it is essential to recognize the potential implications of trading with an unregulated broker.

Company Background Investigation

Oxtrade claims to have been operational for several years, but specific details about its ownership and management team remain elusive. The company is headquartered at the Beachmont Business Centre in Kingstown, Saint Vincent and the Grenadines. However, there is a notable lack of transparency regarding the individuals behind the brokerage. This lack of information raises red flags, as reputable brokers often provide clear details about their management teams and operational history.

Moreover, the absence of verified certifications or industry accolades further diminishes Oxtrade's credibility. A transparent company typically shares information about its operational history, management experience, and regulatory compliance. In contrast, Oxtrade's limited disclosure could indicate a lack of accountability and oversight. Therefore, potential investors should approach this broker with caution and consider the implications of dealing with a company that lacks transparency.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is crucial to analyze the fee structure and any unusual charges that may apply. Oxtrade presents itself as a competitive option with a variety of trading tools and features. However, the overall cost structure is not fully transparent, which can be a cause for concern. Traders need to understand the costs associated with trading before opening an account.

Here is a comparison of Oxtrade's core trading costs:

| Cost Type | Oxtrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $3 - $7 per lot |

| Overnight Interest Range | High | 0.5% - 2.0% |

While Oxtrade claims to have competitive spreads, the lack of clarity surrounding commissions and overnight fees may indicate potential hidden costs. Traders should be wary of any broker that does not provide straightforward information about its fee structure. This can lead to unexpected expenses that could significantly impact trading profitability. Therefore, it is essential for traders to ask the question: Is Oxtrade safe in terms of its trading conditions?

Customer Funds Security

The security of client funds is a paramount concern for any trader considering a broker. Oxtrade claims to implement various security measures to protect customer funds, but the details are vague. It is unclear whether Oxtrade segregates client funds from its operating capital, which is a standard practice among reputable brokers.

Moreover, the absence of investor protection schemes further exacerbates the risks associated with trading on this platform. Without proper safeguards in place, traders could potentially lose their investments in the event of the broker's insolvency. Historically, there have been no reports of significant security breaches or fund mismanagement associated with Oxtrade, but the lack of regulatory oversight means that traders must remain vigilant.

Overall, the question of whether Oxtrade is safe in terms of customer fund security remains unanswered, as the broker does not provide sufficient information to reassure potential clients.

Customer Experience and Complaints

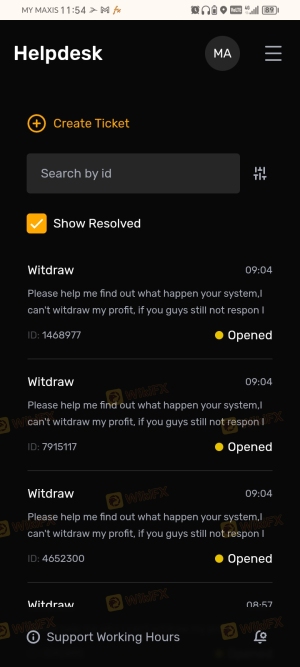

Customer feedback is a critical component in assessing the reliability of a broker. Reviews and testimonials from existing users can provide valuable insights into the broker's strengths and weaknesses. However, Oxtrade has received mixed reviews, with several users reporting issues related to withdrawals and customer service responsiveness.

Here are some common complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Promotions | High | No resolution |

One notable case involved a trader who reported significant delays in processing withdrawal requests, leading to frustration and loss of trust in the platform. Another user expressed dissatisfaction with the quality of customer support, claiming that their inquiries went unanswered for extended periods. Such complaints highlight potential operational deficiencies that could affect the trading experience.

Given the mixed feedback and the potential for unresolved issues, traders should carefully consider whether Oxtrade is safe based on the experiences of others.

Platform and Trade Execution

The performance of a trading platform is crucial for traders to execute their strategies effectively. Oxtrade claims to offer a user-friendly interface and advanced trading tools, but user experiences vary. Some traders report satisfactory execution speeds and minimal slippage, while others have encountered issues with order rejections during volatile market conditions.

It is vital for traders to assess the quality of trade execution, as delays or errors can lead to significant financial losses. Signs of platform manipulation, such as frequent slippage or unexplained order rejections, could indicate deeper issues within the broker's operational integrity.

Overall, while some users find the platform functional, the inconsistency in experiences raises concerns about the reliability of Oxtrade's trading environment. This uncertainty leads to the question of whether Oxtrade is safe for traders who rely on timely and accurate trade executions.

Risk Assessment

Trading with any broker carries inherent risks, and Oxtrade is no exception. The following risk assessment summarizes key risk areas associated with trading on this platform:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from major regulators. |

| Financial Risk | Medium | Potential for hidden fees and poor execution. |

| Operational Risk | High | Limited transparency and customer support issues. |

To mitigate these risks, traders should conduct thorough research and consider using alternative brokers with better regulatory oversight and customer feedback. It is advisable to start with smaller investments until more is known about the broker's reliability.

Conclusion and Recommendations

In conclusion, while Oxtrade presents itself as a viable trading option, significant concerns regarding its regulatory status, company transparency, customer feedback, and trading conditions prompt caution. The lack of oversight from reputable regulatory bodies, combined with mixed customer experiences, raises serious questions about whether Oxtrade is safe for traders.

For those considering trading with Oxtrade, it is crucial to weigh the risks carefully. We recommend exploring alternative brokers with established reputations and robust regulatory frameworks. Options such as brokers regulated by the FCA or ASIC provide a safer trading environment, ensuring that traders' funds are better protected and that they have recourse in case of disputes. Ultimately, due diligence is essential for any trader looking to navigate the complexities of the forex market safely.

Is Oxtrade a scam, or is it legit?

The latest exposure and evaluation content of Oxtrade brokers.

Oxtrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Oxtrade latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.