Finowiz 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive finowiz review looks at one of the new players in the forex brokerage world. Finowiz presents itself as a trading platform designed mainly for beginners and intermediate traders who want easy market access. The broker offers several attractive features including leverage up to 1:500 and zero fees on all deposits and withdrawals. This positions itself as a cost-effective solution for traders looking to maximize their trading capital.

The platform mainly attracts investors interested in using high ratios for forex and other asset trading. According to available information, Finowiz maintains a minimum deposit requirement of just $100. This makes it particularly appealing to new traders. The broker claims to offer spreads starting from 0 pips, though specific details about trading conditions need further investigation.

Finowiz is registered in Saint Lucia. It operates under a regulatory framework that may present certain considerations for international traders. The company provides market analysis, real-time currency rates, and educational resources to support trader development. User feedback suggests generally positive trading experiences. However, comprehensive service details remain limited in publicly available information.

Important Disclaimers

Cross-Regional Entity Differences: Given Finowiz's registration in Saint Lucia, international investors should understand the potential risks associated with cross-border regulatory frameworks. Saint Lucia's financial regulatory environment may differ significantly from major financial centers. Traders should carefully consider the implications for investor protection and dispute resolution.

Review Methodology: This evaluation is based on comprehensive analysis of publicly available information, user feedback from various platforms, and industry standard assessment criteria. Due to limited detailed information in some areas, certain aspects of this review rely on available data points. These may require updates as more information becomes accessible.

Rating Framework

Broker Overview

Company Background and Establishment

Finowiz was established in 2020. This positions it as a relatively new entrant in the competitive forex brokerage market. The company has focused on building a platform that caters to both novice and experienced traders, emphasizing accessibility and competitive trading conditions. Since its inception, Finowiz has worked to establish itself as a reliable trading partner. However, its short operational history means long-term performance data remains limited.

The broker's business model centers on providing comprehensive trading services across multiple asset classes while maintaining competitive fee structures. According to available information, Finowiz aims to differentiate itself through zero-fee deposit and withdrawal policies. This potentially offers significant cost savings for active traders. The company's approach suggests a focus on volume-based revenue generation rather than fee-based income streams.

Trading Infrastructure and Asset Coverage

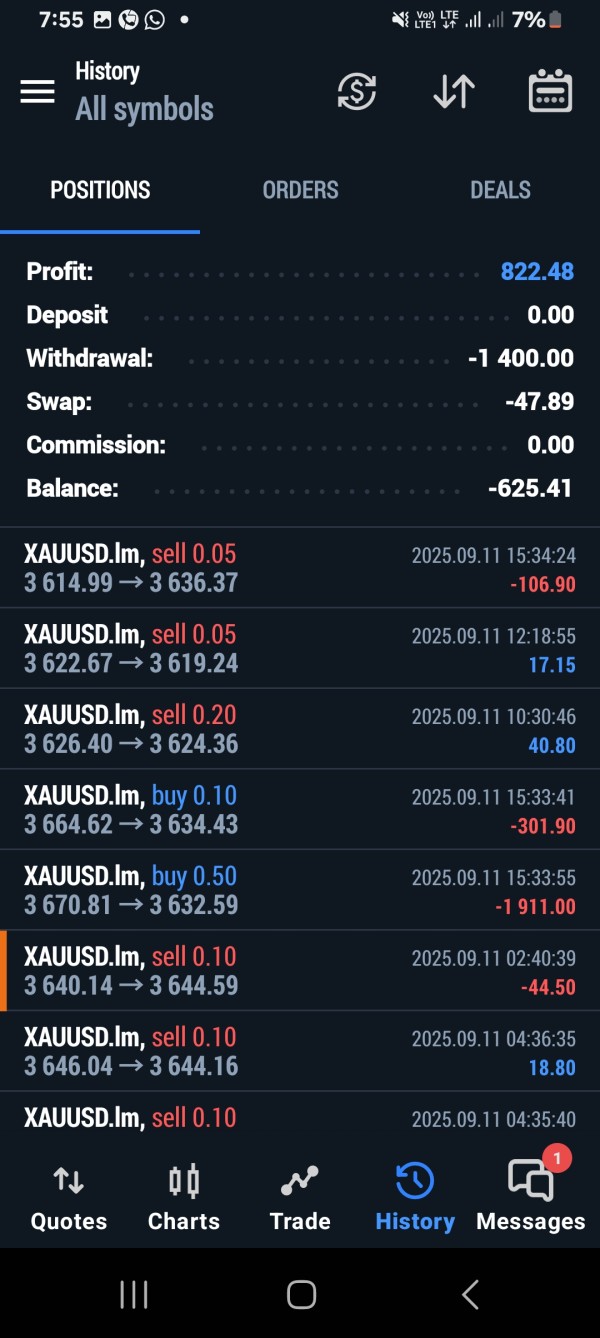

Finowiz offers trading across multiple asset categories including forex, indices, precious metals, energy commodities, and cryptocurrencies. This diversified approach allows traders to build varied portfolios and capitalize on different market conditions. The broker's asset selection appears designed to meet the needs of traders seeking exposure to both traditional and emerging markets.

The platform operates under Saint Lucia registration. However, specific details about the trading platform technology and infrastructure are not extensively detailed in available materials. The regulatory framework in Saint Lucia provides the operational foundation for the broker's services. Though traders should understand the implications of this jurisdiction for their specific trading needs.

Regulatory Environment and Jurisdiction

Finowiz operates under Saint Lucia registration. This places it outside the regulatory oversight of major financial centers like the UK's FCA or Australia's ASIC. This regulatory positioning may offer certain operational flexibilities but also means traders should carefully consider the level of investor protection available compared to more established regulatory jurisdictions.

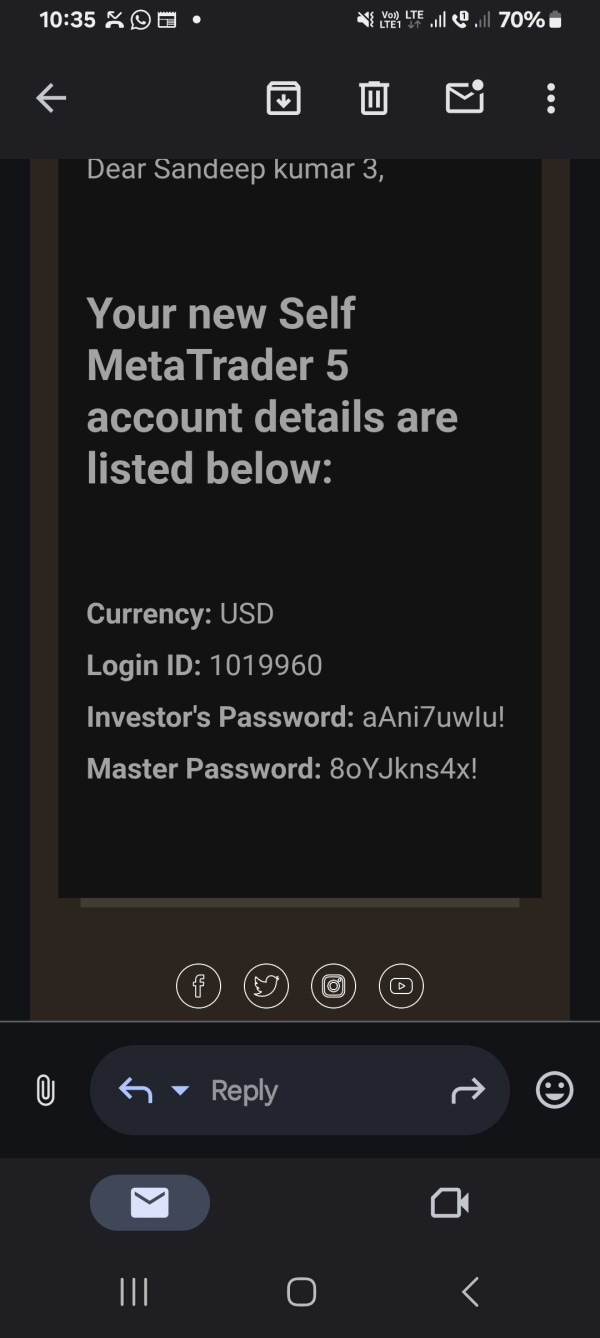

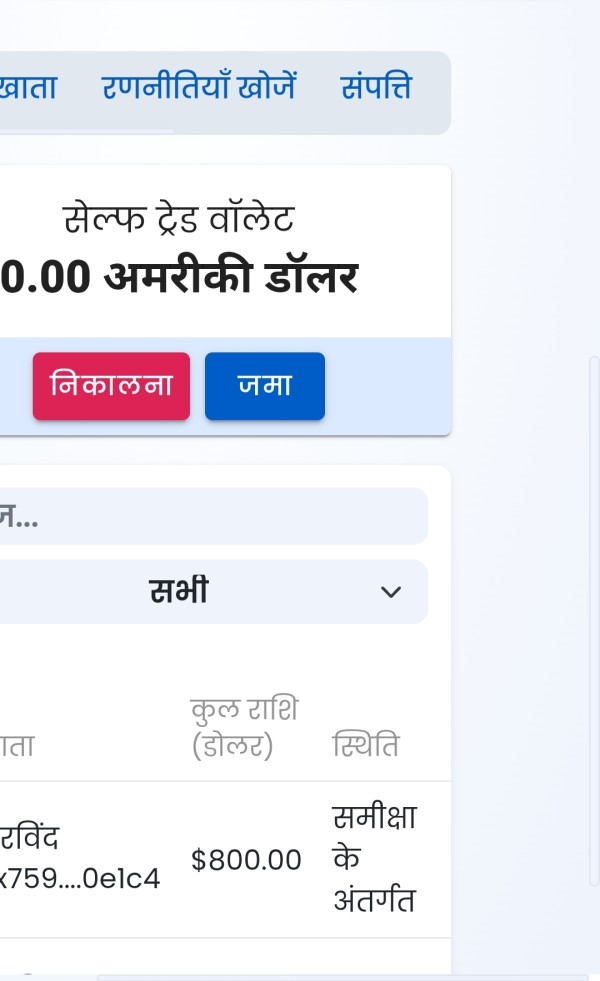

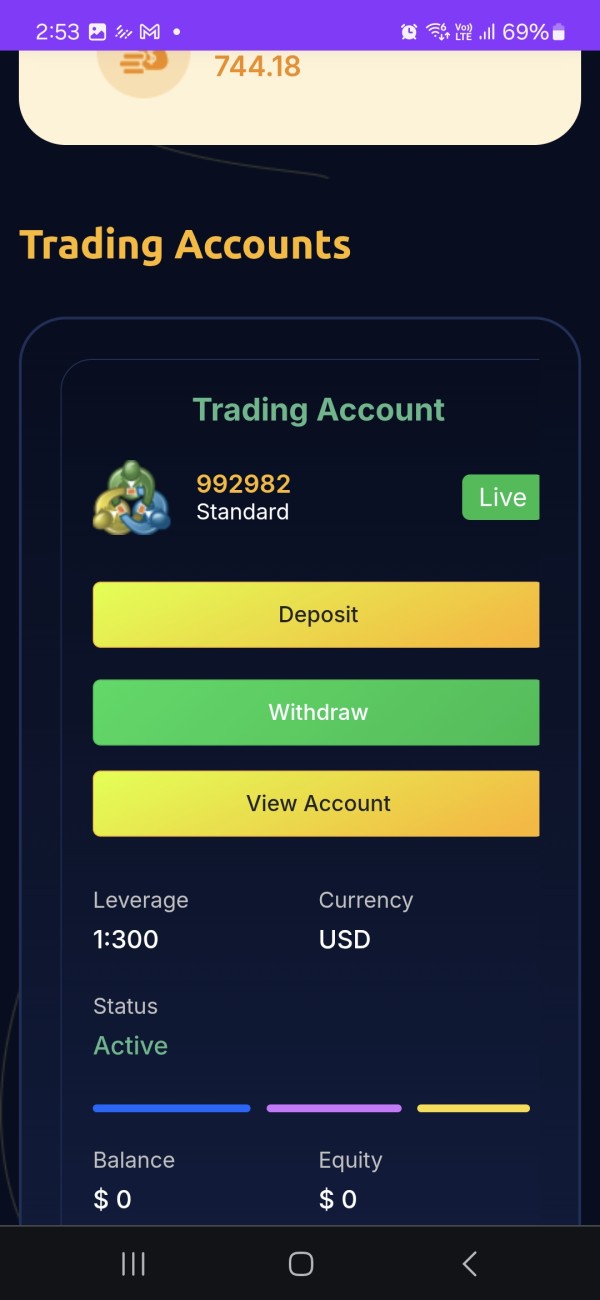

Deposit and Withdrawal Framework

One of Finowiz's key selling points is its zero-fee policy on all deposits and withdrawals. This approach can provide significant cost savings for traders, particularly those who frequently move funds. However, specific information about supported payment methods, processing times, and any potential third-party fees is not extensively detailed in available sources.

Minimum Investment Requirements

The $100 minimum deposit requirement positions Finowiz as accessible to beginning traders and those testing new strategies with limited capital. This low barrier to entry aligns with the broker's apparent focus on attracting new market participants and building trading volume through accessibility.

Cost Structure and Spreads

Finowiz advertises spreads starting from 0 pips. This would be highly competitive if consistently available across major currency pairs. However, detailed information about average spreads, commission structures, and trading costs across different account types is not comprehensively available in current sources.

Leverage and Risk Management

The broker offers leverage up to 1:500. This provides significant trading power but also substantially increases risk exposure. This high leverage ratio may appeal to experienced traders seeking maximum capital efficiency but requires careful risk management, particularly for newer traders.

Asset Diversity and Trading Options

Available trading assets include forex pairs, stock indices, precious metals, energy commodities, and cryptocurrencies. This broad selection allows for portfolio diversification and provides opportunities across different market sectors and economic conditions.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 8/10)

Finowiz's account conditions receive a strong rating primarily due to the accessible $100 minimum deposit requirement. This low entry threshold removes significant barriers for beginning traders. It also allows experienced traders to test the platform with minimal capital commitment. The zero-fee deposit and withdrawal policy further enhances the account value proposition by reducing operational costs.

However, specific information about different account types, their respective features, and any premium account benefits is not extensively detailed in available sources. The lack of detailed account tier information prevents a higher rating. This is because traders cannot fully assess which account structure best suits their trading style and volume requirements.

User feedback suggests general satisfaction with account opening processes and initial trading conditions. However, specific details about verification requirements, account approval timeframes, and any special account features remain limited. The finowiz review data indicates that most users find the basic account structure sufficient for their trading needs, particularly those focused on forex trading with moderate volumes.

Finowiz provides market analysis and educational resources designed to support trader development and decision-making. The platform offers real-time currency rates and market analysis, which are essential tools for effective trading. These resources appear particularly valuable for beginning traders who need guidance in understanding market movements and developing trading strategies.

The educational component seems designed to help users improve their trading skills. However, specific details about the depth and quality of educational materials are not extensively documented. Available information suggests that the platform provides fundamental analysis tools, but advanced technical analysis capabilities and automated trading support are not clearly detailed in current sources.

User feedback indicates general appreciation for the market analysis provided. However, specific comments about the quality and accuracy of research materials are limited. The platform's analytical resources appear adequate for basic trading needs, but traders requiring advanced research tools or sophisticated analytical capabilities may need to supplement with third-party resources.

Customer Service and Support Analysis (Score: 6/10)

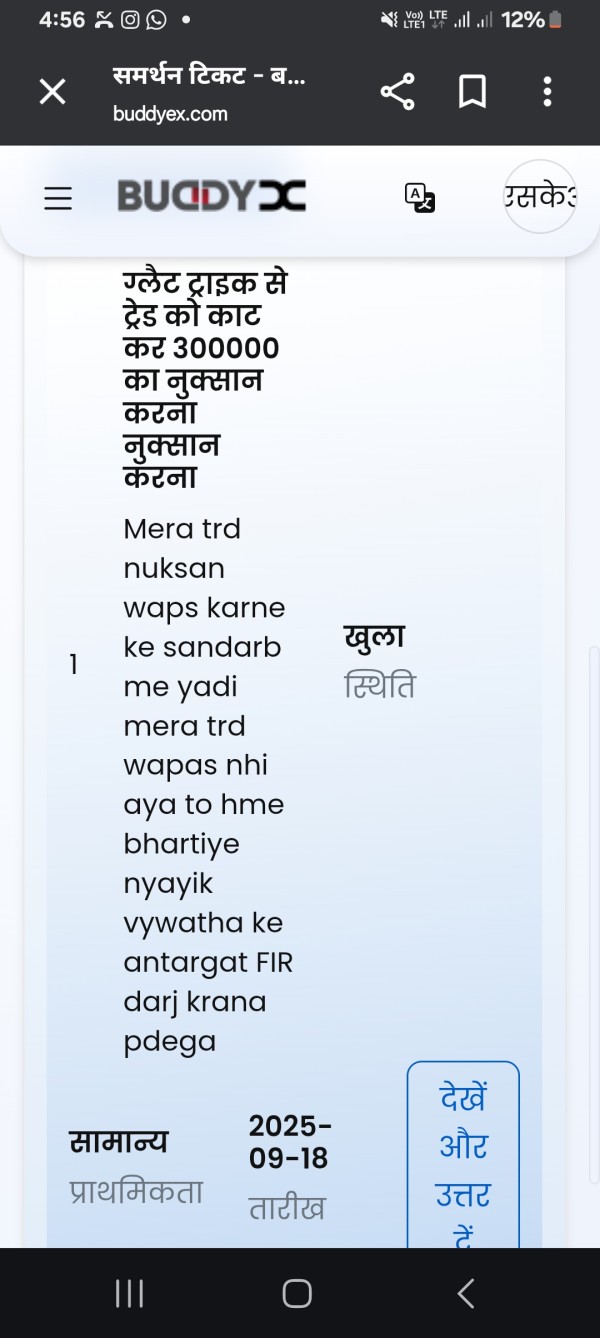

Customer service information for Finowiz is notably limited in available sources. This impacts the overall service assessment. While some users report that "trading has no problems," specific details about customer support channels, response times, and service quality are not comprehensively documented.

The lack of detailed customer service information raises questions about support availability. This is particularly concerning for traders who may need assistance during volatile market conditions or when experiencing technical difficulties. Available information does not specify supported languages, operating hours, or preferred contact methods for customer support.

User feedback suggests that basic trading operations proceed smoothly. This indirectly indicates that major technical issues may be infrequent. However, the absence of detailed customer service testimonials or specific problem resolution examples makes it difficult to assess the quality and effectiveness of support when issues do arise.

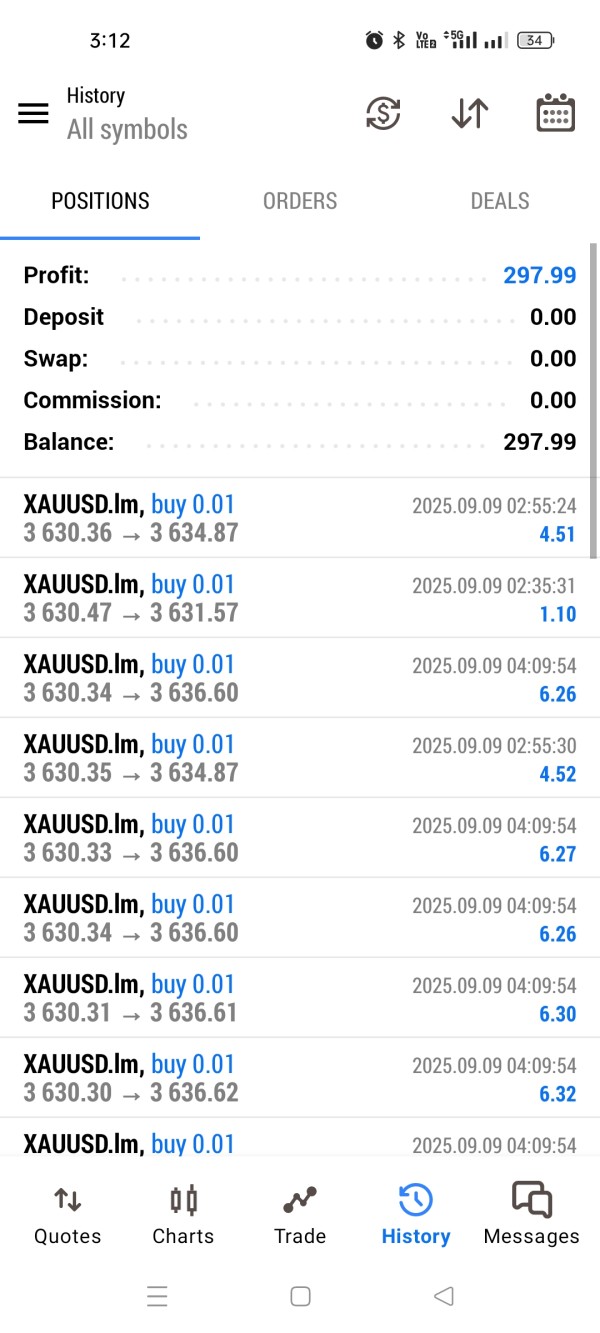

Trading Experience Analysis (Score: 8/10)

User feedback regarding the trading experience with Finowiz is generally positive. Reports indicate that "trading has no problems" and overall satisfaction with platform performance. The advertised 0 pip spreads, if consistently available, would provide an excellent trading environment, particularly for scalping strategies and high-frequency trading approaches.

However, specific technical performance data such as execution speeds, slippage rates, and platform stability during volatile market conditions is not detailed in available sources. The lack of comprehensive platform information makes it difficult to assess advanced trading features, mobile platform capabilities, and overall technical infrastructure quality.

The finowiz review feedback suggests that basic trading functions operate smoothly. This is essential for trader confidence and strategy execution. The high leverage availability (up to 1:500) provides significant trading flexibility, though this also requires careful risk management and may not be suitable for all trader experience levels.

Trust and Reliability Analysis (Score: 5/10)

Finowiz's trust rating reflects concerns about regulatory transparency and detailed operational information. While the broker is registered in Saint Lucia, specific license numbers and detailed regulatory compliance information are not readily available in current sources. This lack of detailed regulatory information may concern traders who prioritize comprehensive regulatory oversight.

The absence of detailed financial reporting, management team information, or third-party auditing details further impacts the trust assessment. Established brokers typically provide extensive transparency about their operations, financial backing, and regulatory compliance. This helps build trader confidence.

User feedback suggests that basic trading operations function as expected. This provides some confidence in day-to-day operations. However, the limited operational history (since 2020) and lack of detailed public information about company backing and financial stability prevent a higher trust rating.

User Experience Analysis (Score: 7/10)

The overall user experience with Finowiz appears positive based on available feedback. Users report satisfaction with basic trading operations. The low minimum deposit requirement and zero-fee deposit/withdrawal policy contribute positively to the user experience by reducing barriers and operational costs.

However, detailed information about platform interface design, ease of use, and comprehensive user journey experiences is not extensively documented. The registration and verification process details, along with specific user interface feedback, are not comprehensively available in current sources.

The platform appears to attract primarily beginning and intermediate traders. This suggests that the user experience is designed for accessibility rather than advanced functionality. While this approach serves the target market well, more experienced traders may find the platform lacking in sophisticated features and advanced trading tools.

Conclusion

This finowiz review reveals a broker that shows promise for beginning and intermediate traders seeking accessible market entry with competitive basic conditions. The combination of low minimum deposits, zero-fee deposit and withdrawal policies, and high leverage availability creates an attractive proposition for traders prioritizing cost-effectiveness and capital efficiency.

However, the limited regulatory transparency and lack of detailed operational information present considerations that traders must carefully evaluate. While user feedback suggests satisfactory basic trading experiences, the absence of comprehensive service details and limited operational history require careful consideration.

Finowiz appears most suitable for traders who prioritize low-cost access to forex and other markets. This is particularly true for those beginning their trading journey or testing new strategies with limited capital. More experienced traders or those requiring advanced trading tools and comprehensive regulatory protection may want to consider additional factors before committing significant trading capital.