Vault Markets 2025 Review: Everything You Need to Know

Executive Summary

Vault Markets is a forex broker that started operating in 2021. This Vault Markets review shows major concerns about the company's regulatory compliance and trustworthiness that traders should know about before investing their money. Vault Markets has failed to meet the requirements of the Financial Sector Conduct Authority in South Africa, which means it operates as an unregulated forex broker. This regulatory problem raises serious questions about the platform's credibility and how well it protects traders.

The broker's reputation in the market is concerning. User feedback shows potential reliability issues that could affect trading success and account security. The lack of proper regulatory oversight means that traders who choose Vault Markets face higher risks compared to properly regulated alternatives. The platform targets forex trading enthusiasts, but the absence of regulatory safeguards makes it particularly dangerous for new traders or those seeking secure trading environments.

Given the regulatory compliance issues and negative user sentiment, potential clients should be extremely careful when considering Vault Markets. The combination of regulatory non-compliance and poor user feedback creates a risk profile that most professional traders would find unacceptable for their trading activities.

Important Notice

This review focuses on a broker that operates without recognized regulatory authorization. Cross-border traders should be particularly careful when considering this platform because it lacks the regulatory protections that legitimate financial service providers typically offer to their clients. The absence of proper licensing from respected financial authorities means that standard investor protections may not apply to your trading account.

Our evaluation relies primarily on available user feedback, industry data, and publicly accessible information about the company's regulatory status. Given the limited transparency from Vault Markets itself, this assessment is based on external sources and user experiences rather than comprehensive broker-provided documentation that would normally be available.

Rating Framework

Broker Overview

Company Background and Establishment

Vault Markets entered the financial services sector in 2021. The company positioned itself as a forex trading platform for retail traders looking to access currency markets. Despite being relatively new to the market, the company has attempted to establish a presence in the competitive forex brokerage space where many established players already dominate. However, the available information about the company's corporate structure, leadership team, and business development strategy remains very limited and raises transparency concerns.

The broker's short operational history means it lacks the proven track record that many traders seek. Without detailed information about the company's financial backing, operational infrastructure, or strategic partnerships, it becomes challenging for potential clients to assess the platform's long-term viability. The lack of comprehensive corporate disclosure raises transparency concerns that potential clients should carefully consider before opening accounts.

Regulatory Status and Business Model

The most significant concern regarding Vault Markets relates to its regulatory compliance status. The broker has failed to meet the requirements established by the Financial Sector Conduct Authority in South Africa, which means it operates without proper regulatory oversight that protects traders. This Vault Markets review emphasizes that the absence of legitimate regulatory authorization creates substantial risks for traders who might consider using the platform for their forex trading activities.

The specific business model employed by Vault Markets remains unclear from available information. Details about whether the company operates as a market maker, uses an Electronic Communication Network model, or employs other execution methods are not readily available to potential clients. This lack of transparency regarding operational structure further compounds the concerns about the platform's overall legitimacy and trader protection measures that should be standard in the industry.

Regulatory Jurisdiction and Compliance

Vault Markets operates without proper regulatory authorization from recognized financial authorities. The broker's failure to comply with FSCA requirements in South Africa indicates significant regulatory deficiencies that potential traders must consider seriously before investing.

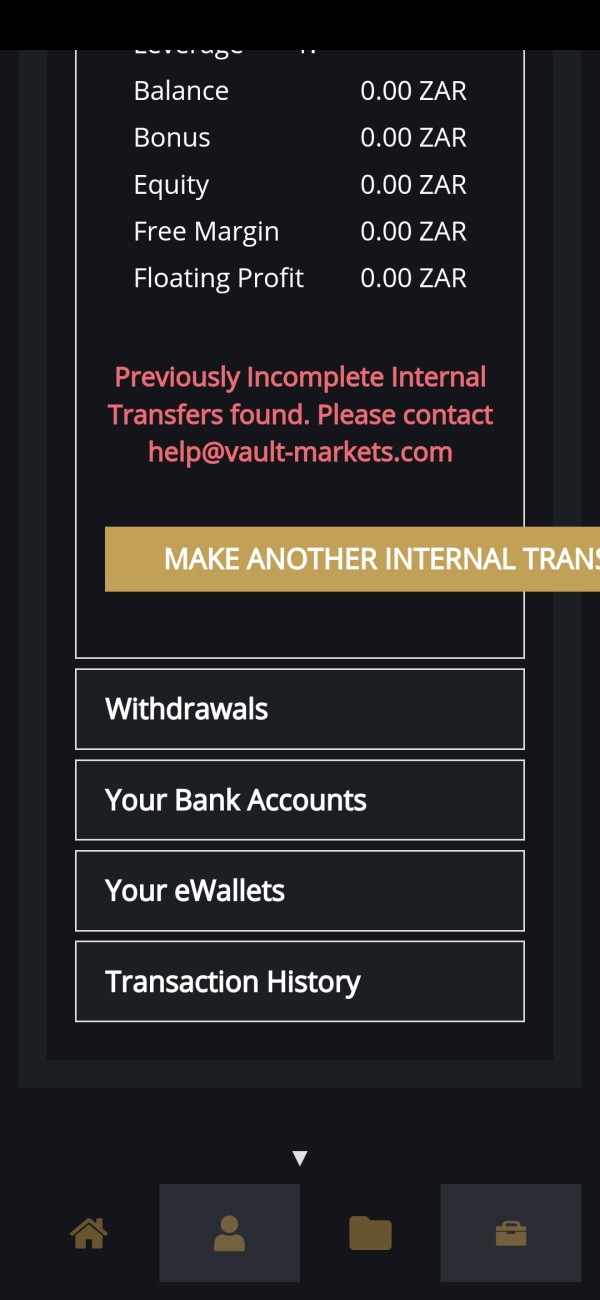

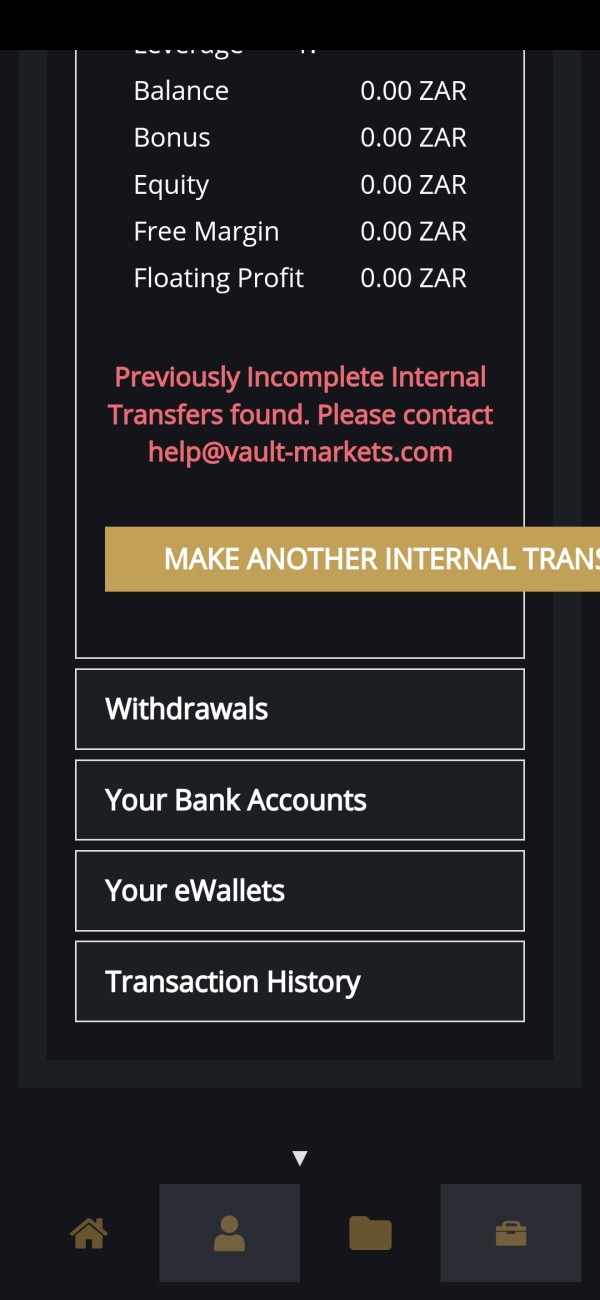

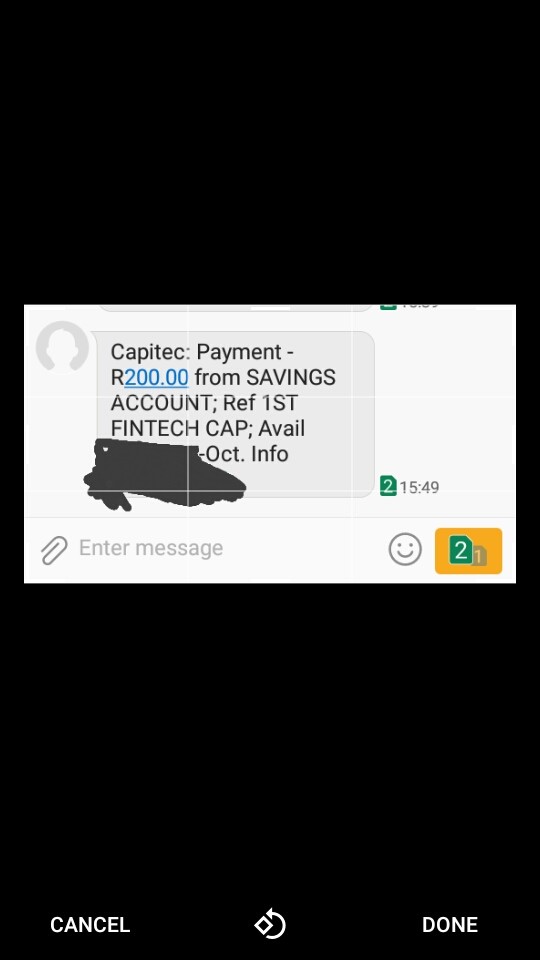

Deposit and Withdrawal Methods

Specific information about available deposit and withdrawal methods is not detailed in available sources. This makes it difficult for potential clients to understand funding options and associated processing times or fees that could affect their trading operations.

Minimum Deposit Requirements

The minimum deposit requirements for opening accounts with Vault Markets are not specified in available documentation. This creates uncertainty for potential traders regarding initial investment thresholds and account accessibility for different budget levels.

Bonus and Promotional Offerings

Available sources do not provide information about bonus structures, promotional campaigns, or incentive programs. These details would normally be available to help potential clients understand additional value propositions that might be offered to new or existing clients.

Tradeable Assets and Instruments

Details about the range of tradeable assets are not comprehensively outlined in accessible materials. This includes information about forex pairs, commodities, indices, or other financial instruments that traders might want to access through the platform.

Cost Structure and Fee Schedule

Specific information about spreads, commissions, overnight fees, or other trading costs is not available from current sources. This makes cost comparison with other brokers impossible and prevents traders from understanding the true cost of trading with Vault Markets.

Leverage Ratios and Risk Management

The maximum leverage ratios offered by Vault Markets and associated risk management tools are not detailed. This information is crucial for traders to understand their potential exposure and risk management options available through the platform.

Platform Options and Technology

Information about available trading platforms is not provided in accessible sources. This includes whether the broker offers proprietary solutions or third-party platforms like MetaTrader that many traders prefer for their functionality and reliability.

Geographic Restrictions

Specific countries or regions where Vault Markets services are restricted or unavailable are not clearly outlined. This information would help international traders understand whether they can legally access the platform from their location.

Customer Support Languages

The languages supported by Vault Markets customer service teams are not specified in current information sources. This detail is important for international clients who may need support in their native language for effective communication.

This Vault Markets review highlights the concerning lack of detailed operational information that legitimate brokers typically provide transparently to potential clients.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Vault Markets' account conditions reveals significant information gaps. These gaps raise concerns about the platform's transparency and professionalism that potential traders should consider carefully. Legitimate forex brokers typically provide comprehensive details about their account structures, including various account types designed for different trader experience levels and investment capacities that help clients choose appropriate options. However, available information about Vault Markets fails to specify the types of accounts offered, whether standard, premium, or VIP tiers exist, or what distinguishing features might differentiate these offerings from competitors.

The absence of clear minimum deposit requirements represents another red flag in this Vault Markets review. Established brokers routinely publish their minimum funding thresholds to help potential clients understand entry requirements and plan their initial investments accordingly. Without this basic information, traders cannot properly assess whether the platform aligns with their investment capacity or risk tolerance levels.

Account opening procedures and verification requirements also remain unclear from available sources. Legitimate brokers typically outline their Know Your Customer processes, document requirements, and account approval timelines to help clients prepare for the registration process. The lack of such information suggests either poor communication practices or potentially inadequate compliance procedures that could affect account security.

Special account features are not mentioned in available materials. This includes Islamic or swap-free accounts for traders requiring Sharia-compliant trading conditions that comply with religious requirements. The absence of information about specialized account options further limits the platform's appeal to diverse trading communities with specific needs.

The assessment of trading tools and resources available through Vault Markets reveals a concerning absence of information. This absence affects the evaluation of platform capabilities and trader support systems that are essential for successful trading operations. Professional forex brokers typically offer comprehensive suites of trading tools, including advanced charting packages, technical analysis indicators, economic calendars, and market research resources that help traders make informed decisions. However, available information about Vault Markets provides no details about such essential trading infrastructure that modern traders expect.

Market analysis and research resources represent critical components of legitimate brokerage services. Established platforms routinely provide daily market commentary, technical analysis reports, fundamental analysis insights, and economic event previews that help traders understand market conditions. The lack of information about such resources suggests that Vault Markets may not offer the analytical support that serious traders require for informed decision-making and strategy development.

Educational resources and training materials are standard offerings from reputable brokers. These resources are particularly important for supporting novice traders in developing their skills and knowledge through structured learning programs. These typically include webinars, video tutorials, trading guides, and educational articles covering various aspects of forex trading from basic concepts to advanced strategies. The absence of information about educational support raises questions about Vault Markets' commitment to trader development and long-term success.

Automated trading support remains unspecified in available documentation. This includes Expert Advisor compatibility and algorithmic trading capabilities that many modern traders rely on for strategy implementation. Modern traders often rely on automated systems for strategy implementation, making this information gap particularly significant for technically-oriented trading approaches that require sophisticated platform integration.

Customer Service and Support Analysis

The evaluation of customer service capabilities at Vault Markets reveals substantial information deficiencies. These deficiencies impact the assessment of support quality and accessibility that traders need when encountering problems or requiring assistance. Professional forex brokers typically maintain multiple communication channels, including phone support, live chat, email assistance, and sometimes social media engagement that provides flexible contact options for different client preferences. However, available information does not specify which contact methods Vault Markets offers or their operational hours for client support.

Response time expectations represent crucial factors in customer service evaluation. This is particularly important in the fast-moving forex market where trading issues require prompt resolution to prevent financial losses. Legitimate brokers often publish service level agreements or expected response times for different communication channels to set clear expectations for their clients. The absence of such information makes it impossible to assess whether Vault Markets can provide timely support when traders encounter problems that require immediate attention.

Service quality indicators are not available from current sources. These indicators include staff expertise, problem resolution capabilities, and customer satisfaction metrics that demonstrate the effectiveness of support operations. Professional brokers typically invest in comprehensive staff training to ensure support representatives can address technical, account-related, and platform-specific inquiries effectively and professionally.

Multilingual support capabilities remain unspecified. This is particularly important for international brokers serving diverse client bases with different language preferences and communication needs. The ability to communicate in clients' native languages often significantly impacts support effectiveness and overall customer satisfaction levels.

Operating hours and timezone coverage are not detailed in available information. This makes it unclear whether Vault Markets provides support during major trading sessions or offers 24/7 assistance as many established brokers do to serve their global client base effectively.

Trading Experience Analysis

The assessment of trading experience quality at Vault Markets is severely hampered by the lack of specific information. This lack of information affects platform performance, execution standards, and overall trading environment quality that directly impact trader success. Professional forex brokers typically provide detailed specifications about their trading infrastructure, including server locations, execution speeds, and uptime statistics that demonstrate their commitment to reliable service delivery. However, such technical performance data is not available for Vault Markets, making it impossible to assess platform reliability.

Order execution quality represents a fundamental aspect of trading experience. This quality directly impacts trader profitability through factors such as slippage rates, requote frequency, and execution speed during high-volatility periods that can significantly affect trading results. Factors such as slippage rates, requote frequency, and execution speed during high-volatility periods are critical considerations for serious traders who need consistent execution. The absence of information about these execution characteristics makes it impossible to assess whether Vault Markets can deliver professional-grade trading conditions that meet industry standards.

Platform stability and reliability are essential for maintaining consistent trading operations. This is particularly important during important market events or high-volume trading periods when system performance is most critical for trader success. Legitimate brokers often publish uptime statistics and infrastructure redundancy information to demonstrate their commitment to service reliability and operational excellence. The lack of such transparency from Vault Markets raises concerns about platform dependability during crucial trading moments.

Mobile trading capabilities have become increasingly important as traders seek flexibility. Modern traders want the ability to manage their positions and monitor markets from anywhere using their mobile devices for maximum trading flexibility. Modern brokers typically offer sophisticated mobile applications with full trading functionality, real-time charts, and account management features that match desktop platform capabilities. Without information about mobile platform availability or capabilities, potential clients cannot assess whether Vault Markets supports contemporary trading preferences and lifestyle requirements.

This Vault Markets review emphasizes that the absence of detailed trading environment information creates uncertainty. This uncertainty affects the platform's ability to support serious forex trading activities effectively and meet the expectations of professional traders.

Trust and Reliability Analysis

The trust and reliability assessment of Vault Markets reveals the most concerning aspects of this broker evaluation. The fundamental issue centers on the platform's regulatory status, specifically its failure to comply with Financial Sector Conduct Authority requirements in South Africa that are designed to protect traders and ensure fair market practices. This regulatory non-compliance immediately places Vault Markets in the category of unregulated brokers, significantly elevating the risk profile for potential clients who value security and legal protection.

Regulatory authorization serves as the foundation of trust in financial services. It provides legal frameworks for dispute resolution, compensation schemes, and operational oversight that protect client interests and ensure fair treatment. The absence of proper licensing means that traders using Vault Markets lack the standard protections typically available through regulated brokers that operate under strict oversight. This includes access to financial compensation schemes, regulatory complaint procedures, and standardized operational requirements that protect client interests and provide recourse in case of disputes.

Fund security measures and segregation practices are not detailed in available information about Vault Markets. Legitimate brokers typically maintain client funds in segregated accounts with tier-one banks, providing clear documentation about fund protection protocols that ensure client money remains separate from company operational funds. The lack of transparency regarding client money handling raises serious concerns about asset security and the safety of deposited funds.

Company transparency and corporate disclosure represent additional areas of concern. Professional brokers routinely publish detailed company information, including corporate structure, management team backgrounds, financial statements, and operational policies that allow clients to assess company stability and credibility. The limited availability of such information about Vault Markets suggests inadequate transparency standards that further undermine trust and make it difficult for potential clients to assess company legitimacy.

Industry reputation and peer recognition are notably absent from available information about Vault Markets. Established brokers typically receive industry awards, regulatory commendations, or professional recognition that validates their service quality and operational standards within the financial services community.

User Experience Analysis

The user experience evaluation for Vault Markets is significantly constrained by limited availability of comprehensive user feedback. This limitation affects the assessment of platform usability information that would normally provide insights into actual user satisfaction and platform performance. Professional brokers typically generate substantial user communities that provide detailed feedback about platform functionality, service quality, and overall satisfaction levels through reviews and testimonials. However, available user sentiment regarding Vault Markets appears limited and concerning where it exists, suggesting potential issues with user satisfaction.

Interface design and platform usability are critical factors. These factors determine whether traders can effectively implement their strategies and manage their accounts efficiently without technical obstacles or confusing navigation. Modern trading platforms typically feature intuitive navigation, customizable layouts, advanced charting capabilities, and streamlined order management systems that enhance trading efficiency. Without detailed information about Vault Markets' platform design and functionality, potential clients cannot assess whether the interface meets contemporary usability standards that traders expect from professional platforms.

Registration and account verification processes significantly impact initial user experience. This impact is particularly important regarding time requirements and documentation complexity that can affect how quickly new clients can start trading. Legitimate brokers typically provide clear guidance about account opening procedures, required documentation, and expected processing times to help new clients prepare for the registration process. The lack of detailed information about these processes creates uncertainty for potential clients and may indicate poor onboarding procedures.

Fund management experience represents crucial aspects of overall user satisfaction. This includes deposit and withdrawal procedures, processing times, and associated fees that directly affect the cost and convenience of account management. Professional brokers typically offer multiple funding methods, transparent fee structures, and efficient processing systems that make account funding convenient and cost-effective. Without specific information about Vault Markets' fund management capabilities, traders cannot assess the convenience and cost-effectiveness of account funding operations that are essential for active trading.

Common user concerns and complaint patterns are not well-documented in available sources. This makes it difficult to identify recurring issues or assess the broker's responsiveness to client feedback and continuous improvement efforts.

Conclusion

This comprehensive Vault Markets review reveals significant concerns that lead to an overall negative assessment of the broker. The most critical issue remains the platform's regulatory non-compliance, specifically its failure to meet FSCA requirements in South Africa that are designed to protect traders and ensure fair market practices. This regulatory deficiency creates substantial risks for traders and eliminates standard investor protections typically available through legitimate, regulated brokers that operate under proper oversight.

The lack of transparency regarding essential operational details creates additional concerns. This includes missing information about account conditions, trading costs, platform specifications, and customer support capabilities that traders need to make informed decisions. Legitimate brokers typically provide comprehensive information about their services to help potential clients make informed decisions and understand exactly what they can expect from the trading relationship.

Based on the available evidence, Vault Markets is not recommended for traders of any experience level. It is particularly unsuitable for novice traders who require regulatory protection and professional support to develop their trading skills safely. The combination of regulatory non-compliance, limited transparency, and concerning user feedback creates a risk profile that professional traders should avoid at all costs. Potential clients would be better served by selecting established, properly regulated brokers that demonstrate clear compliance with international financial standards and provide transparent operational information that builds trust and confidence.