1000x 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive 1000x review reveals major concerns about this broker's operations and regulatory standing. 1000x has been flagged by the Thailand Securities and Exchange Commission and appears on regulatory warning lists, which raises serious questions about trader safety. Despite offering an attractive minimum deposit of just $10 and leverage up to 1:1000, the platform has received poor user ratings. 283 reviews average only 2 out of 5 stars.

The broker targets traders who want high leverage and low entry barriers. It particularly focuses on those interested in cryptocurrency and forex trading. However, the combination of regulatory warnings, poor user feedback, and questionable operational transparency makes this platform unsuitable for most retail traders. While the low minimum deposit might appeal to beginners, the associated risks far outweigh any potential benefits.

Key Warning: 1000x operates without proper regulatory oversight and has been specifically warned against by financial authorities. This makes it a high-risk choice for traders.

Important Notice

This review is based on available regulatory information and user feedback as of 2025. Traders should note that 1000x is registered in Saint Vincent but operates from Hong Kong. This creates potential jurisdictional complications and regulatory gaps. The platform's unregulated status means traders have limited recourse in case of disputes or fund recovery issues.

Our assessment methodology relies on official regulatory warnings, verified user testimonials, and publicly available company information. Given the serious regulatory concerns surrounding this broker, we strongly advise traders to exercise extreme caution.

Rating Framework

Broker Overview

1000x positions itself as a broker operating primarily in the decentralized finance (DeFi) sector. Specific details about its founding date remain unclear from available sources. The company maintains registration in Saint Vincent and the Grenadines while conducting actual operations from Hong Kong. This creates a complex regulatory structure that has drawn scrutiny from financial authorities.

The broker's business model focuses on providing high-leverage trading opportunities with minimal entry requirements. It targets traders who seek aggressive position sizing capabilities. However, this approach has led to regulatory concerns, particularly regarding trader protection and operational transparency.

According to available information, 1000x primarily supports cryptocurrency and major currency pair trading. The specific range of available assets lacks detailed documentation. The platform's emphasis on high leverage trading, reaching up to 1:1000, appeals to experienced traders but poses significant risks for newcomers to forex markets. This 1000x review highlights the importance of understanding these risk factors before considering this broker.

The Thailand Securities and Exchange Commission has specifically included 1000x on its warning list. They cite concerns about unauthorized operations and potential fraud risks. This regulatory action represents a significant red flag for potential users and underscores the importance of thorough due diligence.

Regulatory Status: 1000x faces significant regulatory challenges. It has been listed on the Thailand Securities and Exchange Commission's warning list. The broker operates without proper regulatory oversight, creating substantial risks for trader fund security and dispute resolution.

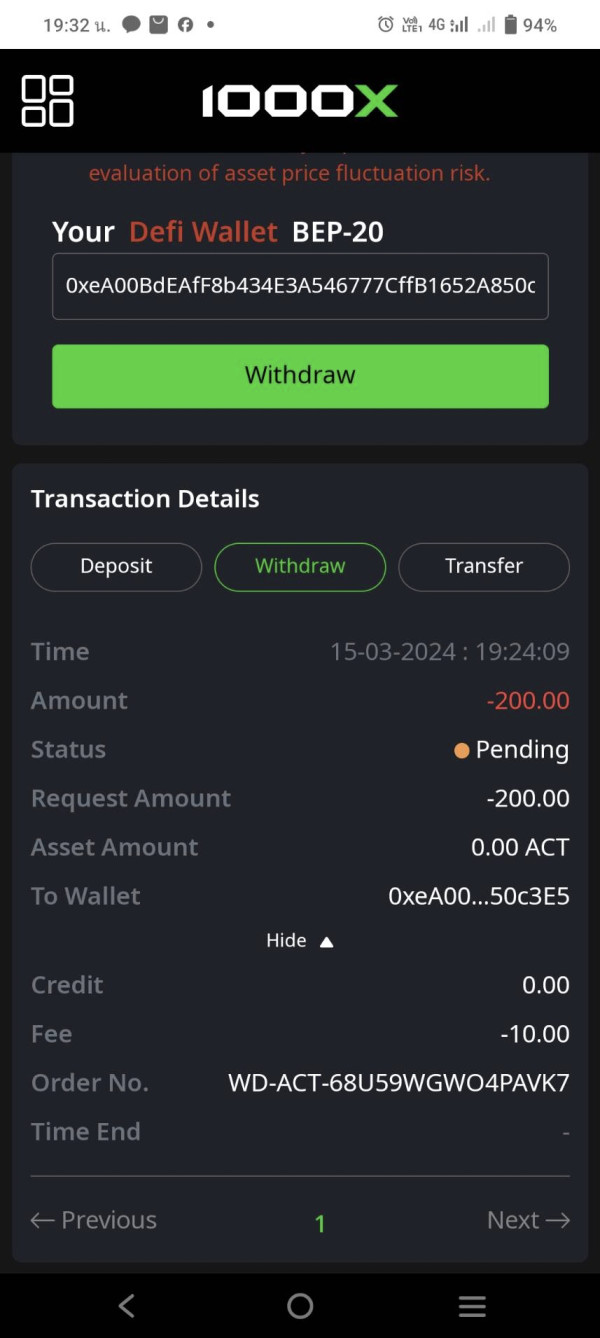

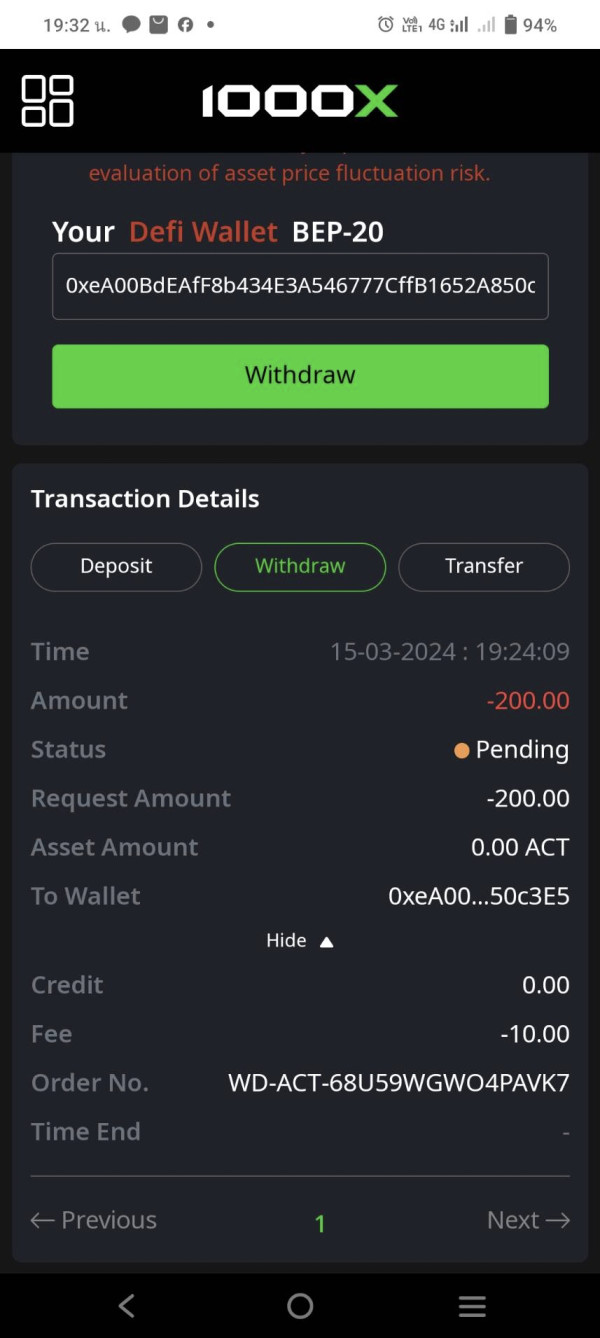

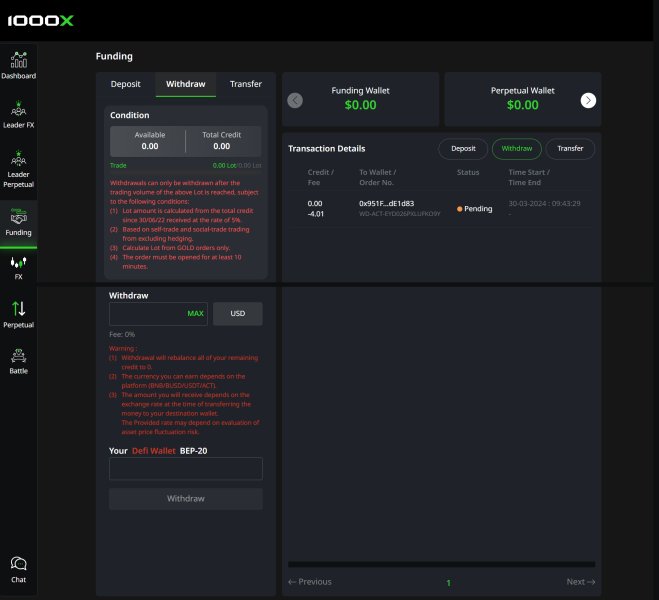

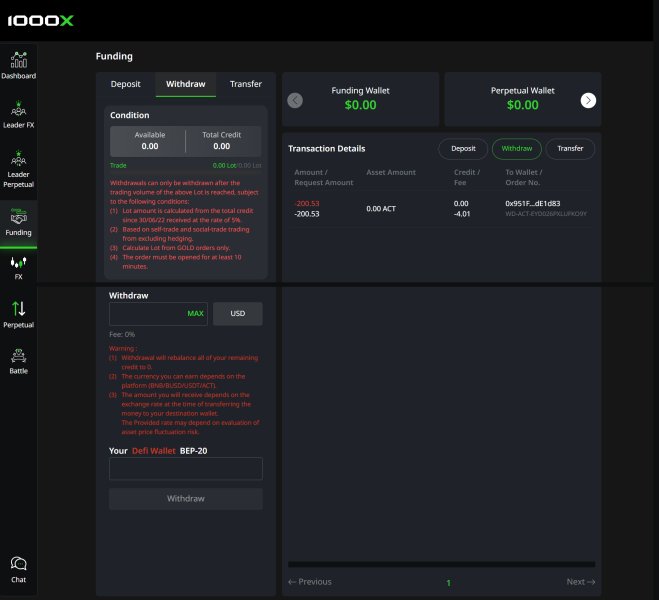

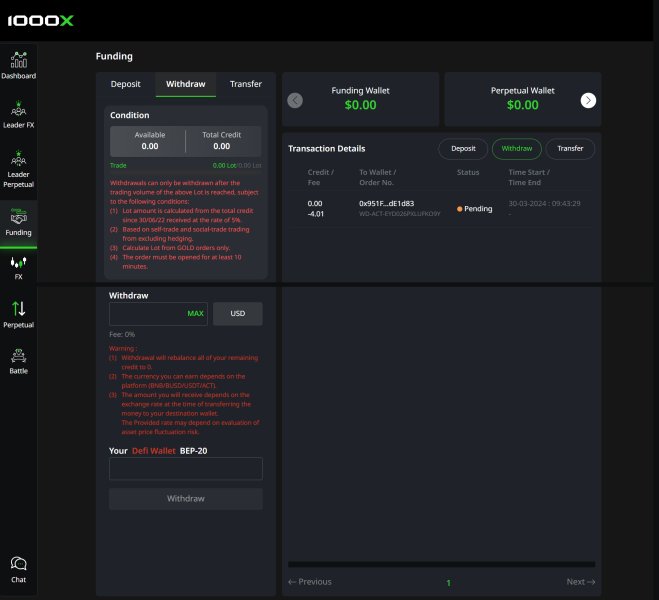

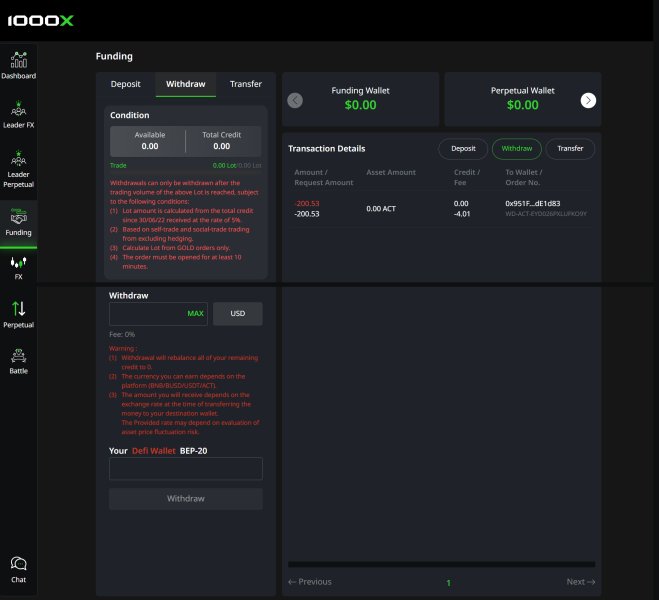

Deposit and Withdrawal Methods: Specific information about supported payment methods remains limited in available documentation. This raises concerns about operational transparency and fund accessibility.

Minimum Deposit Requirement: The platform offers a notably low minimum deposit of $10. This may attract new traders but could also indicate targeting of inexperienced investors who may not fully understand the associated risks.

Promotional Offers: Available sources do not provide detailed information about current bonus structures or promotional campaigns. This limits traders' ability to evaluate potential incentives.

Available Trading Assets: The broker primarily focuses on cryptocurrency and major forex pairs. The complete asset catalog lacks comprehensive documentation in publicly available materials.

Cost Structure: 1000x advertises commission-free trading. Specific spread information and hidden fees remain unclear from available sources, making it difficult for traders to calculate true trading costs.

Leverage Options: Maximum leverage reaches 1:1000. This is significantly higher than regulated brokers typically offer, which increases both potential profits and catastrophic loss risks.

Trading Platform Options: Specific details about supported trading platforms are not clearly documented in available materials. This creates uncertainty about technological capabilities.

Geographic Restrictions: Information about regional limitations and service availability remains unspecified in current documentation.

Customer Service Languages: Available support languages are not detailed in accessible broker information. This potentially limits communication for international traders.

This 1000x review emphasizes the concerning lack of transparency surrounding many operational details that legitimate brokers typically disclose prominently.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account structure at 1000x presents a mixed picture for potential traders. The $10 minimum deposit requirement stands out as exceptionally accessible. However, this low barrier to entry raises questions about the broker's target demographic and business sustainability model. Legitimate regulated brokers typically require higher minimums to ensure operational stability and trader seriousness.

Available documentation does not provide clear information about different account tiers or specialized features. This might differentiate various user levels. The lack of account variety limits traders' ability to find suitable options matching their experience levels and trading objectives. The absence of detailed account specifications also makes it difficult to understand what services and protections different deposit levels might provide.

User feedback consistently indicates dissatisfaction with account-related services. This suggests that despite the low entry requirement, the overall account experience fails to meet trader expectations. The combination of regulatory concerns and poor user satisfaction significantly undermines any advantage the low minimum deposit might otherwise provide.

This 1000x review finds that while the low deposit requirement may initially appear attractive, the lack of account variety and poor user feedback substantially limit the value proposition for serious traders.

The trading tools and educational resources offered by 1000x remain poorly documented. This creates significant transparency concerns for potential users. Professional traders typically require access to comprehensive analytical tools, real-time market data, and educational materials to make informed trading decisions.

Available information suggests limited provision of research and analysis resources. This puts traders at a significant disadvantage compared to properly regulated brokers that offer extensive market research, economic calendars, and professional analysis. The absence of clearly documented educational materials also raises concerns about the broker's commitment to trader development and success.

User feedback indicates widespread disappointment with the quality and availability of trading tools. This suggests that even basic analytical capabilities may be insufficient for serious trading activities. The lack of information about automated trading support further limits the platform's appeal to sophisticated traders who rely on algorithmic strategies.

Industry professionals consistently rate 1000x poorly for tool quality and resource availability. This reinforces concerns about the platform's ability to support serious trading activities. The combination of limited documentation and negative user feedback suggests that traders seeking comprehensive analytical capabilities should consider alternative brokers.

Customer Service and Support Analysis (3/10)

Customer service quality represents a critical weakness in 1000x's operational structure. User feedback consistently highlights poor response times and inadequate problem resolution capabilities. Effective customer support becomes particularly crucial when dealing with unregulated brokers, as traders have limited alternative recourse options.

Available information does not specify supported communication channels, operating hours, or multilingual capabilities. This creates uncertainty about accessibility for international traders. The lack of transparency regarding support infrastructure raises additional concerns about the broker's commitment to customer service excellence.

User reviews frequently cite slow response times and unprofessional interactions with support staff. This suggests systemic issues with customer service training and resource allocation. The absence of documented escalation procedures or dispute resolution mechanisms further compounds these concerns, particularly given the broker's unregulated status.

The combination of poor user feedback and limited transparency regarding support infrastructure makes customer service a significant liability for 1000x. Traders considering this platform should carefully evaluate their comfort level with potentially inadequate support, especially when dealing with account or technical issues.

Trading Experience Analysis (4/10)

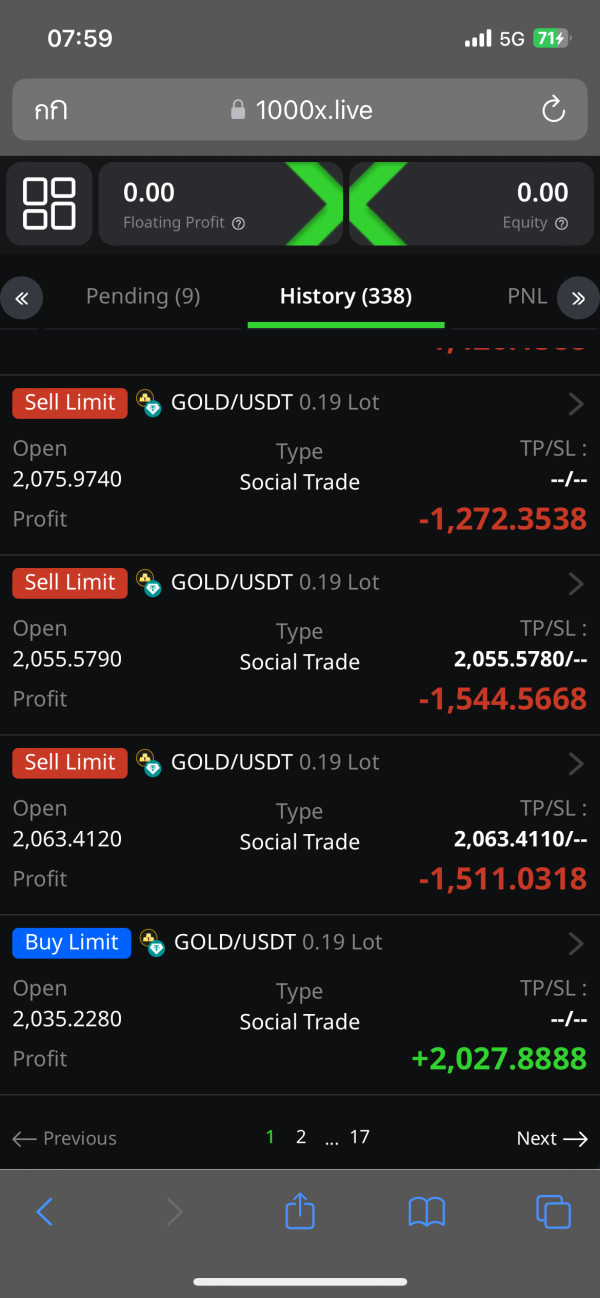

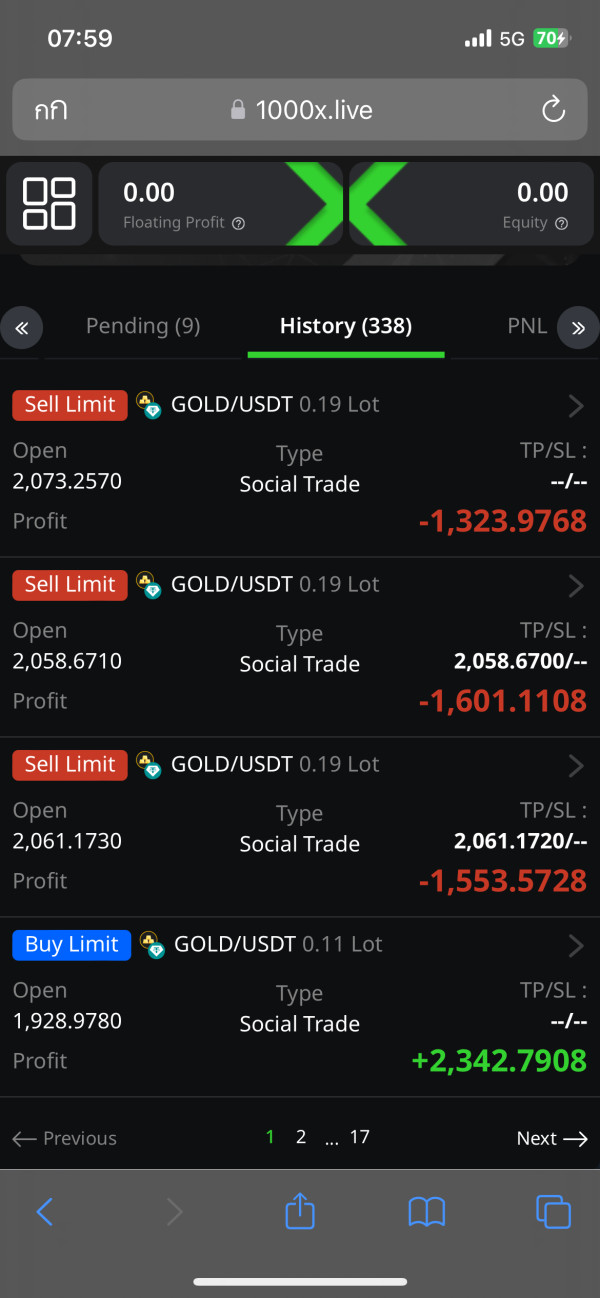

The overall trading experience at 1000x receives poor marks from users. There are consistent reports of platform instability and execution quality issues. Reliable order execution represents a fundamental requirement for any trading platform, making these concerns particularly significant for potential users.

User feedback indicates problems with platform stability. This suggests that traders may experience unexpected disconnections or system failures during critical trading moments. Poor execution quality, including excessive slippage and requoting, can significantly impact trading profitability and strategy implementation effectiveness.

The lack of detailed information about platform capabilities, mobile trading options, and advanced order types creates additional uncertainty about the trading environment's sophistication. Professional traders typically require access to complex order types and reliable execution to implement their strategies effectively.

Liquidity concerns mentioned in user feedback suggest that the broker may struggle to provide competitive pricing and smooth execution. This is particularly true during volatile market conditions. This 1000x review finds that the combination of technical issues and execution problems makes the platform unsuitable for serious trading activities.

Trustworthiness Analysis (2/10)

Trustworthiness represents 1000x's most significant weakness. The broker's inclusion on regulatory warning lists creates serious concerns about operational legitimacy and trader safety. The Thailand Securities and Exchange Commission's specific warning against this broker indicates substantial regulatory violations or unauthorized operations.

The broker's unregulated status means traders lack access to investor protection schemes, deposit insurance, or regulatory oversight that legitimate brokers provide. This absence of regulatory protection creates significant risks for fund security and dispute resolution, particularly if operational issues arise.

The lack of transparent financial reporting and operational disclosure further undermines confidence in the broker's legitimacy and operational stability. Legitimate brokers typically provide detailed information about their financial backing, operational procedures, and regulatory compliance measures.

Industry reputation remains consistently negative. Multiple sources identify fraud risks and operational concerns. The combination of regulatory warnings, unregulated status, and poor industry reputation makes 1000x unsuitable for traders who prioritize fund security and operational legitimacy.

User Experience Analysis (3/10)

User satisfaction metrics paint a concerning picture of the overall experience at 1000x. 283 reviews average only 2 out of 5 stars, indicating widespread dissatisfaction across multiple aspects of the service. This low rating suggests systemic issues rather than isolated problems.

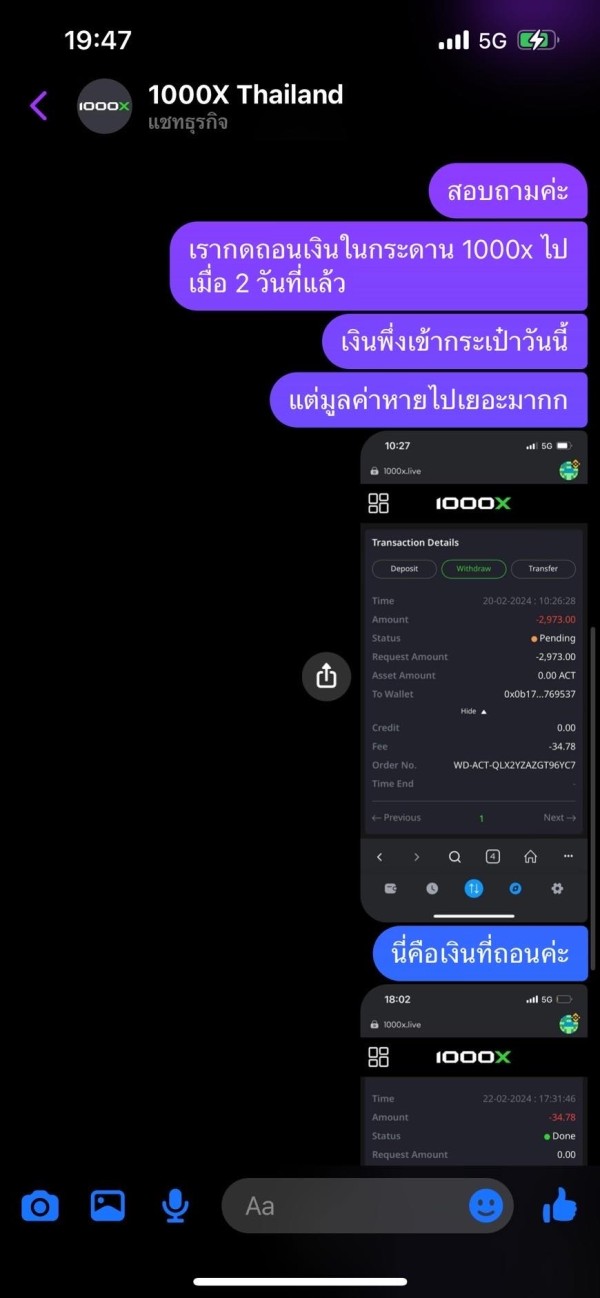

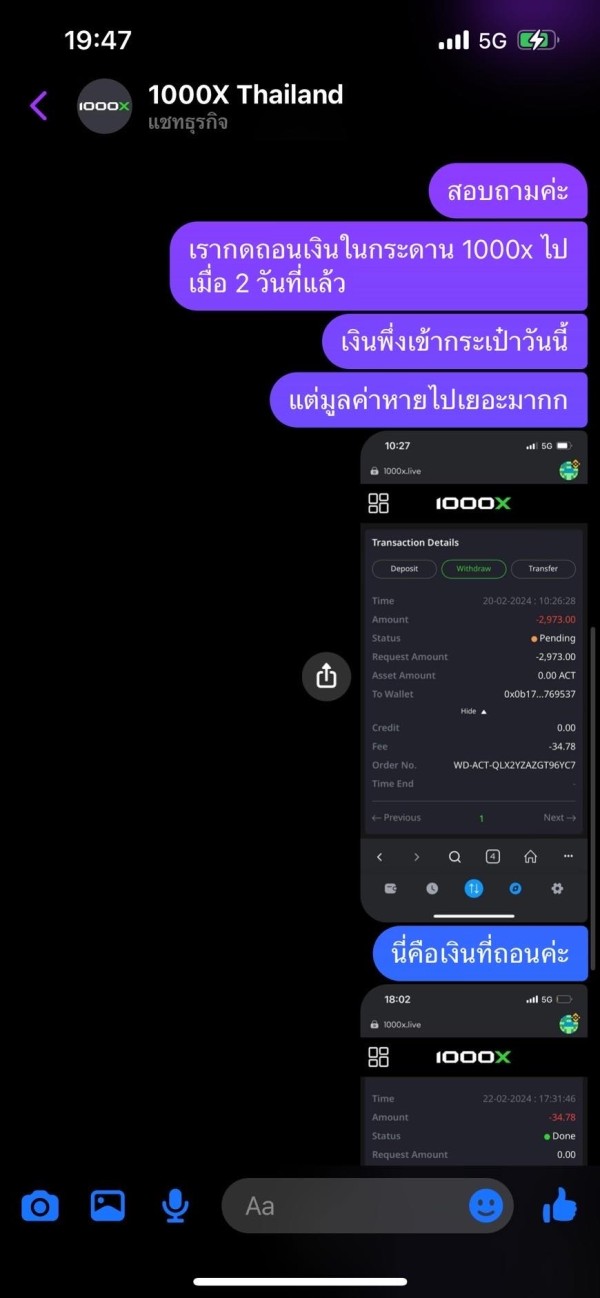

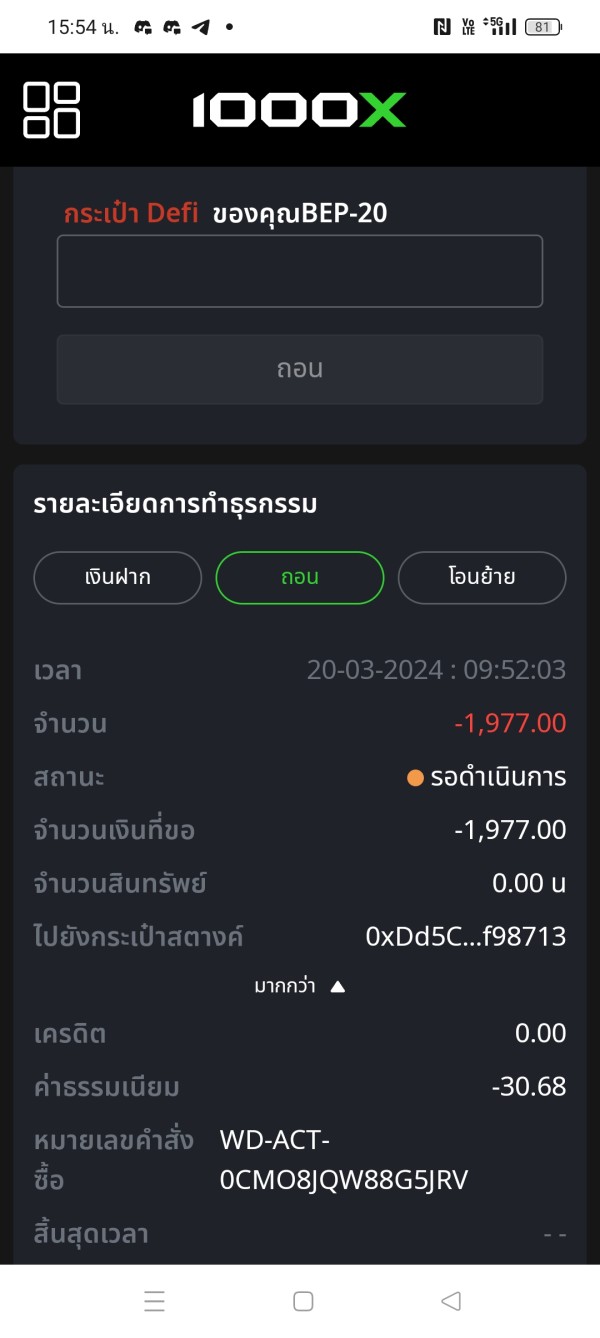

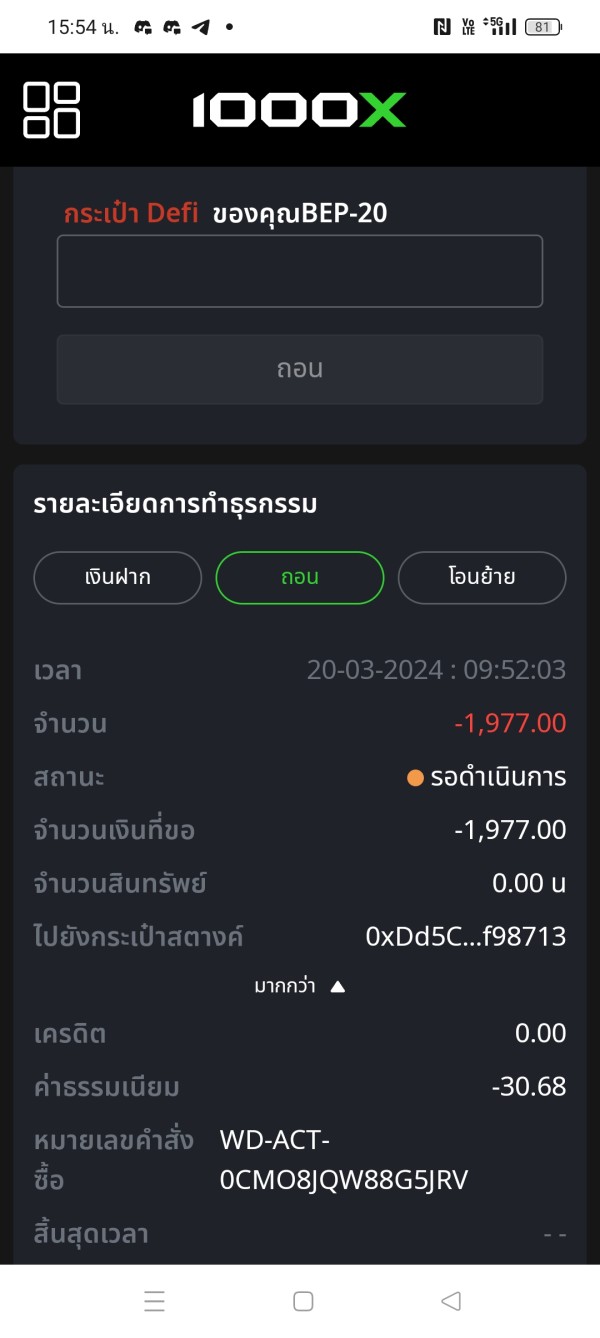

The consistent negative feedback spans multiple areas including customer service, platform functionality, and overall operational reliability. Users frequently express concerns about fund security, withdrawal processes, and general business practices. This reflects broader trust issues with the platform.

The target demographic appears to focus on high-risk traders seeking maximum leverage opportunities. However, even this specialized audience reports significant dissatisfaction with service quality. The lack of positive user testimonials or success stories further reinforces concerns about the platform's ability to serve its intended market effectively.

Common user complaints center on poor customer service response, technical platform issues, and concerns about fund security and withdrawal processing. The overwhelming negative feedback suggests that improvements in multiple operational areas would be necessary to achieve acceptable user satisfaction levels.

Conclusion

This comprehensive 1000x review reveals a broker with significant operational and regulatory concerns that make it unsuitable for most retail traders. The platform offers attractive features like a $10 minimum deposit and 1:1000 leverage. However, these benefits are overshadowed by serious regulatory warnings, poor user feedback, and questionable operational transparency.

The broker may only be appropriate for extremely high-risk traders who fully understand the implications of trading with an unregulated entity. They must be comfortable with the associated fund security risks. However, we strongly recommend that most traders consider regulated alternatives that offer better protection and operational reliability.

Key advantages include low entry barriers and high leverage options. Major disadvantages encompass regulatory warnings, poor user satisfaction, and limited operational transparency. The overwhelming negative feedback and regulatory concerns make 1000x a high-risk choice that most traders should avoid.