CLMFX Review 12

I couldn’t withdraw fund. The platform has absconded, which is a rip-off. Stay away.

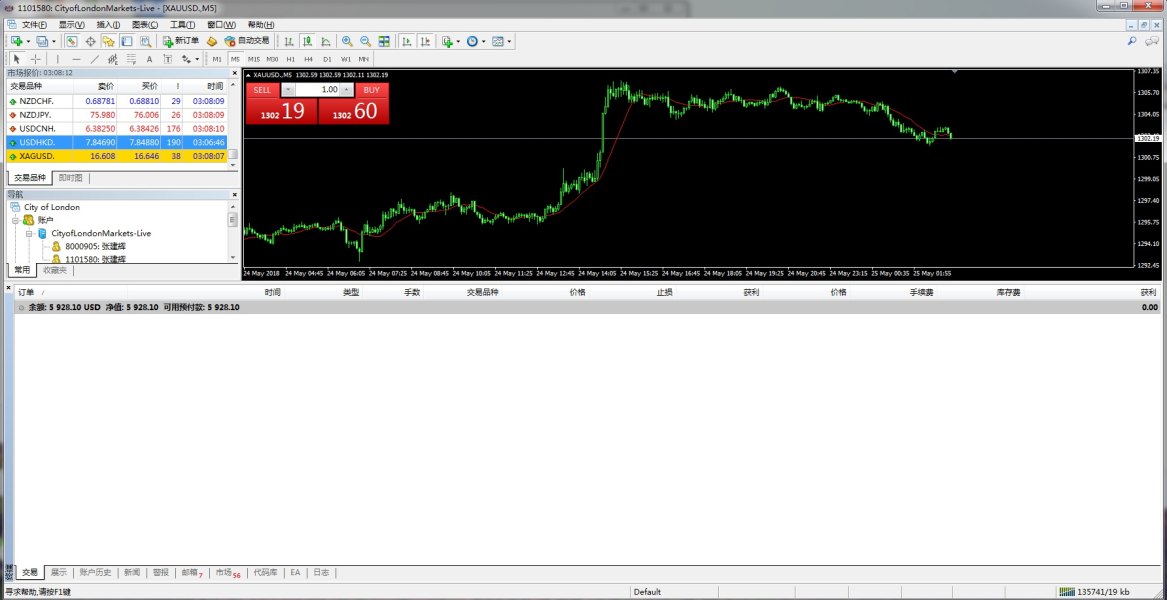

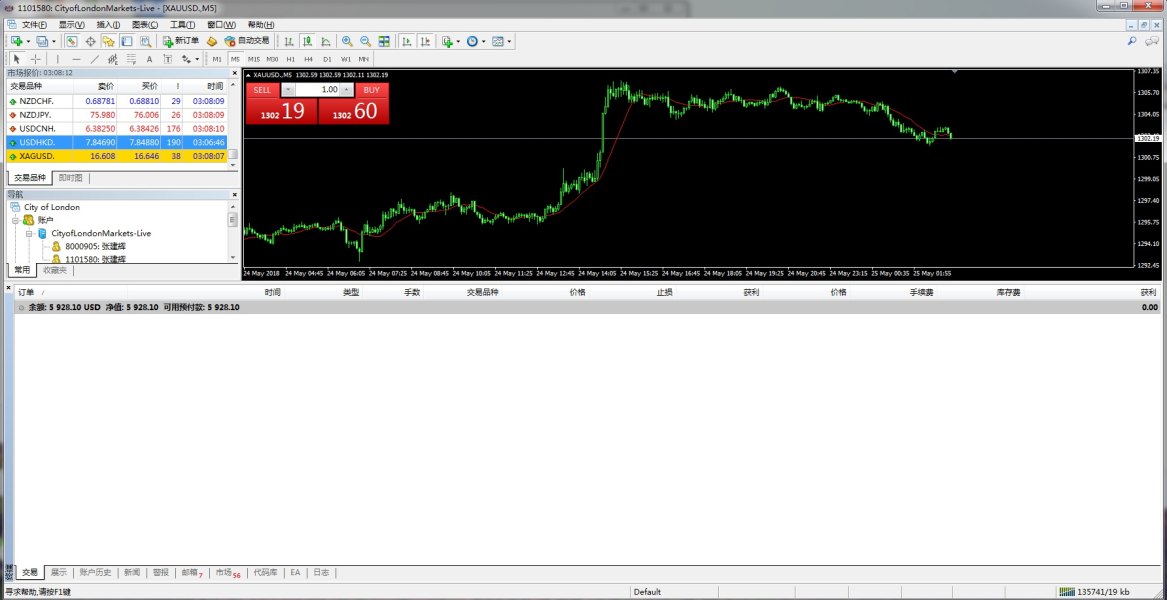

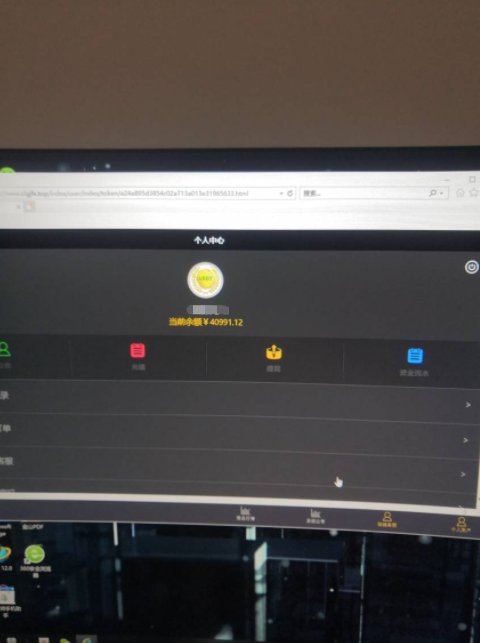

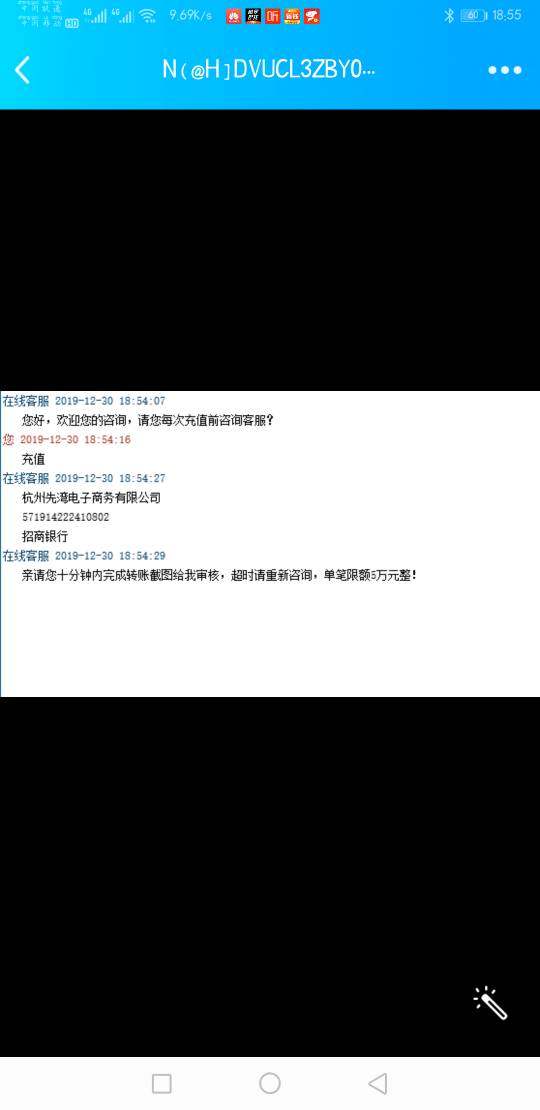

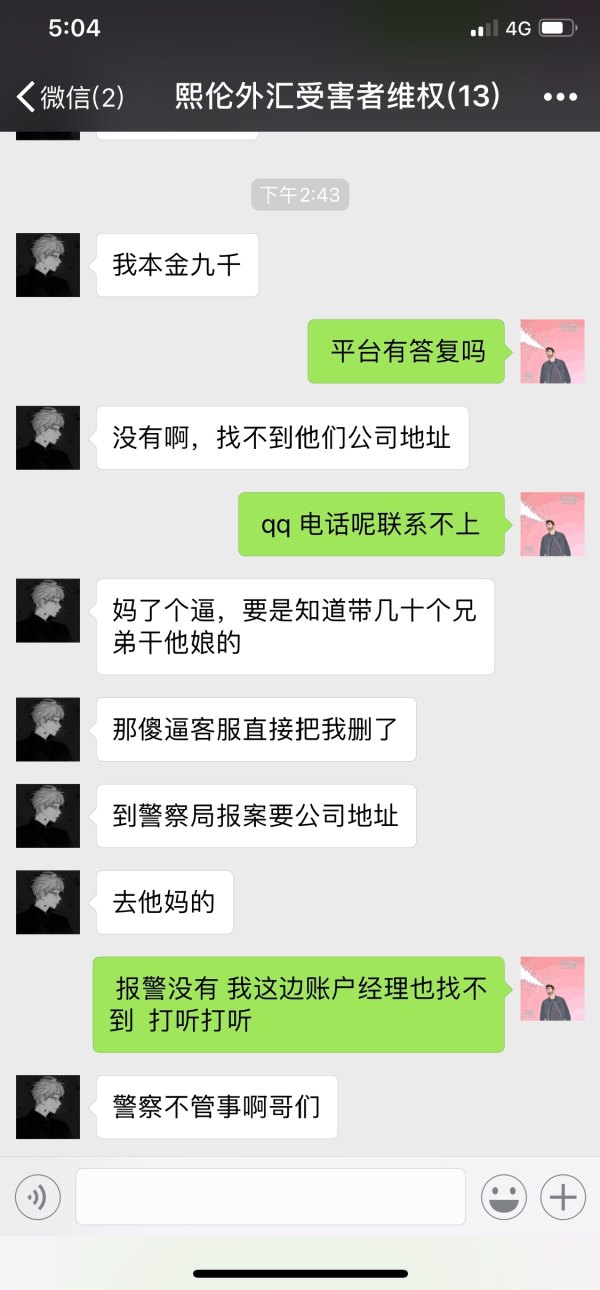

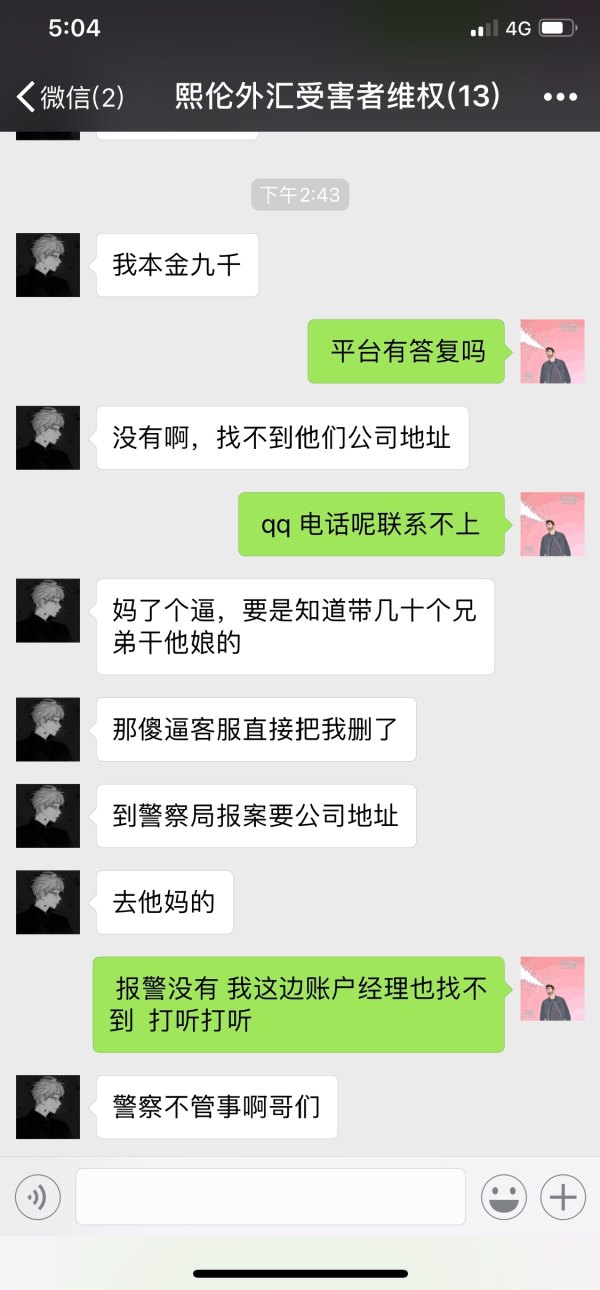

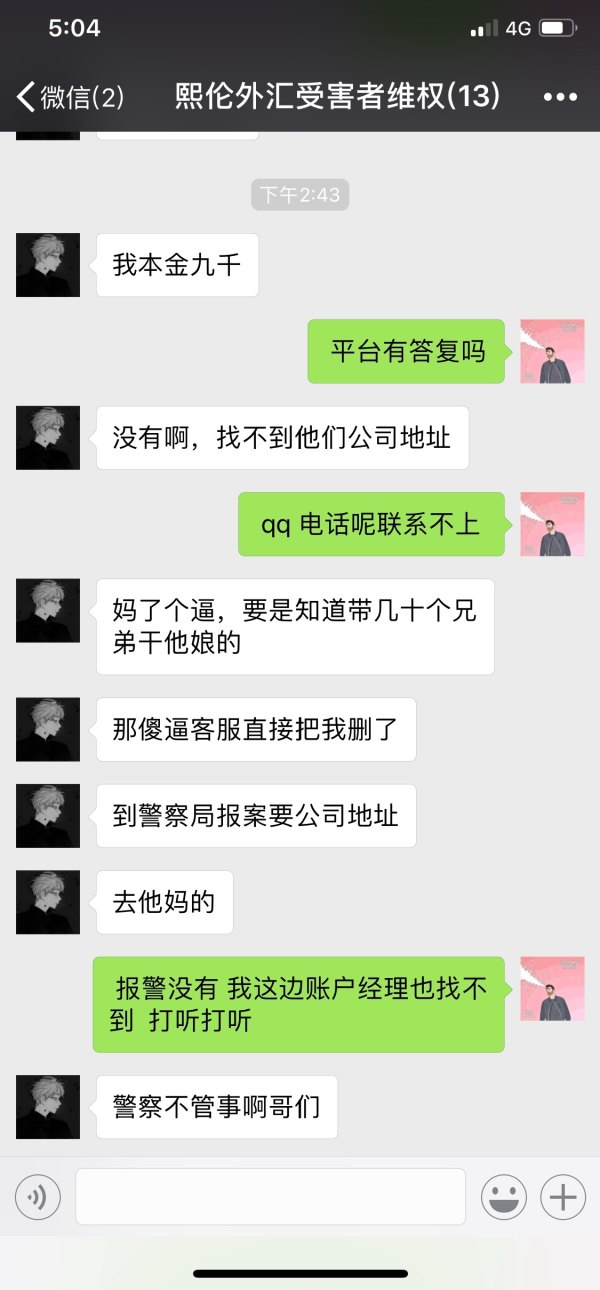

I deposited $15000 or so on May 8th or 9th and traded on 10th.I traded a lot,with losses and profits.There was $14000 profit in my account after I closed position.Within 5 minutes,my all profit were deleted,remaining $9000.I regarded it as a system bug and logged in again.It is the same.I called CLMFX’s client manager.He said that there was no profit in my account.What???Mt profit was gone!!!!After I made a complaint,they just compensate me the fund.I was speechless.How dare you to modify my profit?Are all forex platform like this?

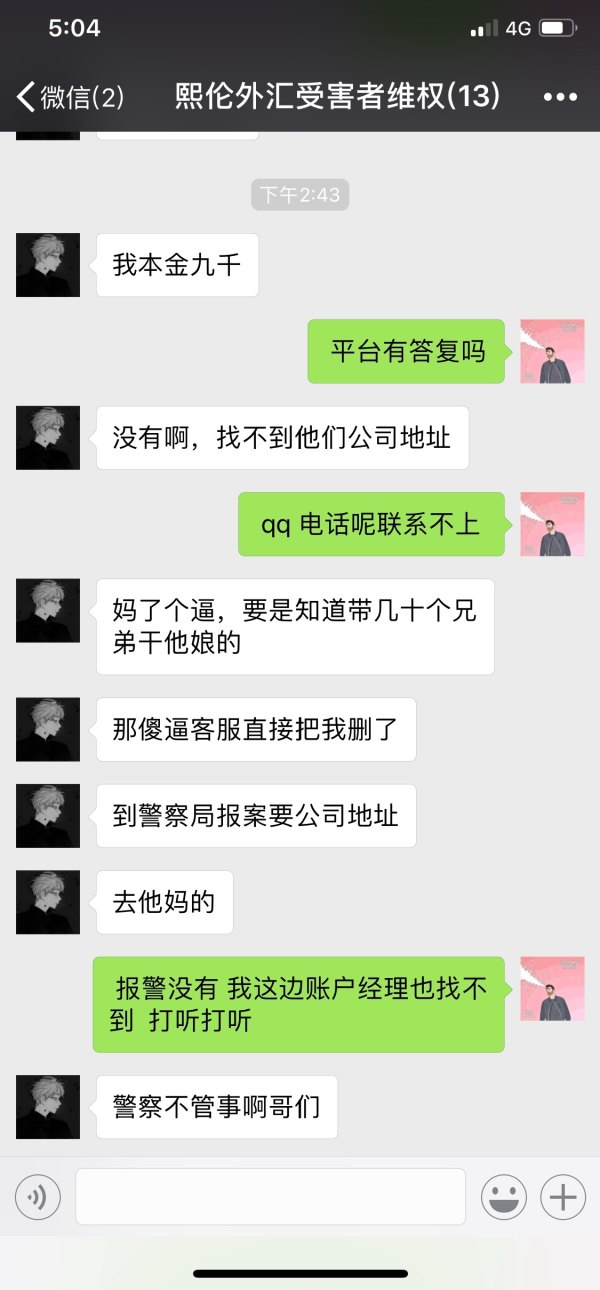

Neither the withdrawal nor the commission is available.They even dare not to hang the company logo.They said they had no money,but they often throw party at weekends.It also changed its address. Is this the performance of no money?Let us get united nad safeguard our rights.

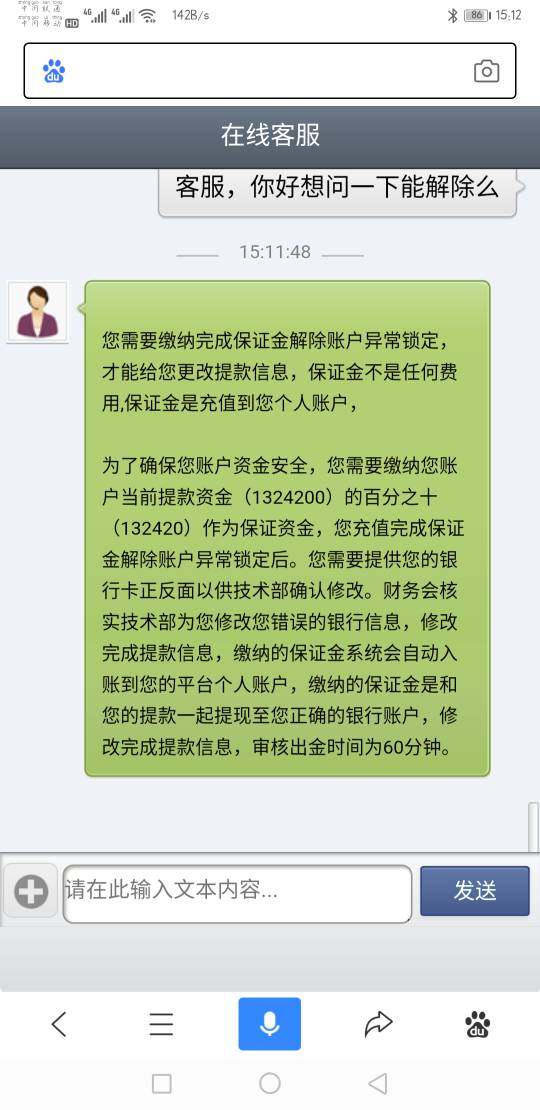

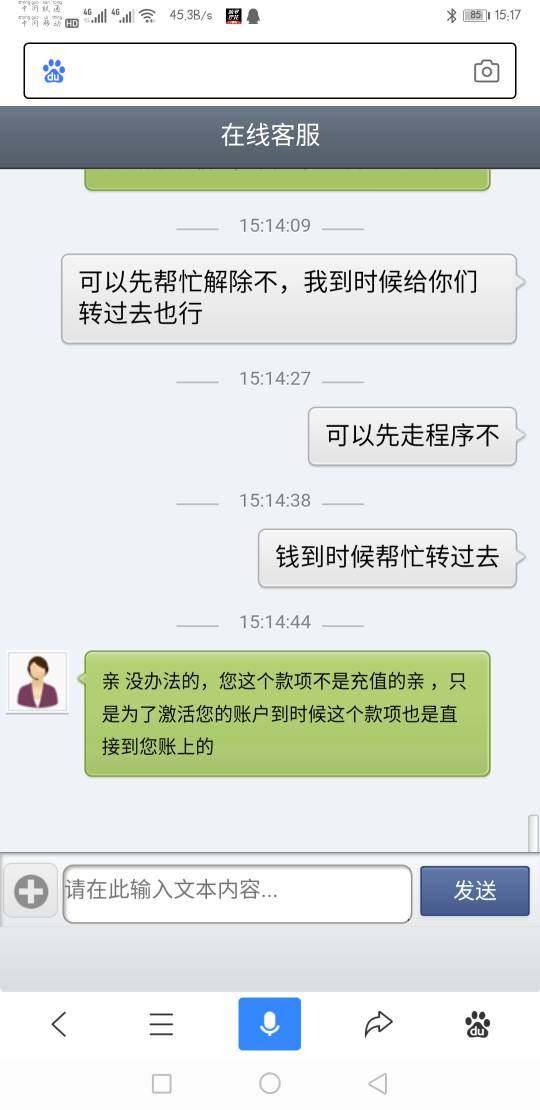

On April 24th,2019.I deposited $10000 in CLMFX,trading for 0.03 lot in all.On the afternoon of 25th,my account was disable suddenly.The platform sent me an email,notifying me that my account was under illegal trading.How could be! I just traded for 0.03 lot to test the leverage and check the margin.Then a woman,self-proclaimed as the staff of ATFX to address problem,called me and asked me to sign a contract to admit the illegal trading in my account.Only by pressing the handprint and taking photos by holding ID card,can I withdraw my fund.How could be? I just traded for 0.03 lot.Did you give me the agreement to sign when I deposit money? You made my account disabled,giving no access to withdrawal,and even imposing a crime of illegal trading! At least you should deceive us reasonably! Hope WikiFX punish these rotten apples in China!

The platform induced me to deposit and banned my account after I made a profit.The withdraw was unavailable.Only by signing the indecent agreement,can I get back the fund.

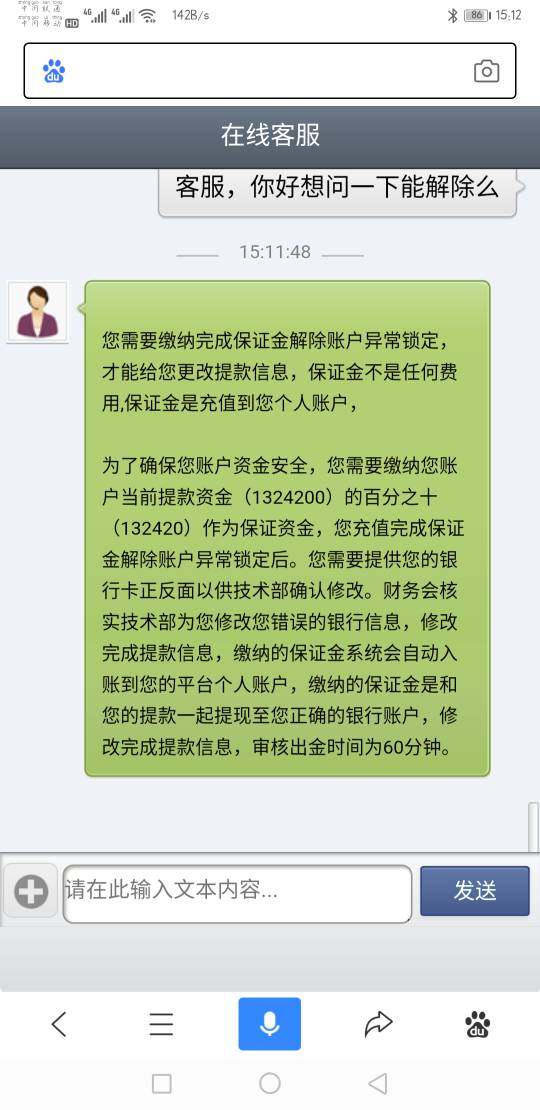

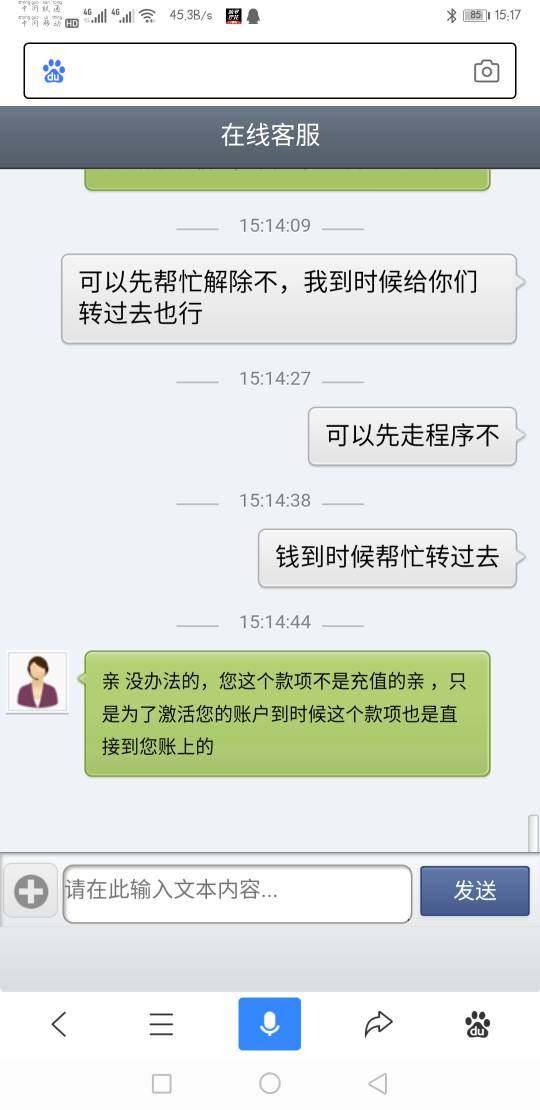

In May, CLMFX's account manager contacted me, introducing the platform and saying that the platform under UK's regulation platform promises that the funds were absolutely safe. I then opened a trading account and deposited the funds. After I gained profits, the account could not be logged in. And the money could not be withdrawn from the background. The platform customer service personnel were gone after accusing me of irregular trading. Now investors everywhere have the same problem.

They wiped all my balance after I made a profit. Such a scam platform! They said they are big and legit on FX110 website. Trash!

I deposited $15000 in my account 8000905 and traded. My account was banned the next day and I can’t withdraw. I contacted the manager, but he didn’t response. I found their office in Shanghai. After a three-month negotiation, they promised to give me some of my principal after signing all kinds of contracts. I heard there are many people being scammed.