LFS Broking 2025 Review: Everything You Need to Know

Executive Summary

LFS Broking operates as a full-service brokerage firm in the highly competitive Indian stockbroker market. This lfs broking review reveals a company that positions itself as a comprehensive trading solution provider. However, market reception appears mixed based on available feedback. The brokerage offers access to multiple asset classes including stocks, commodities, currencies, mutual funds, and IPO investments, catering to diverse investor needs across the board.

The firm's business model focuses on providing integrated trading services across various financial instruments. They target both retail and institutional clients with their comprehensive approach. However, detailed information about specific account features, regulatory compliance, and operational metrics remains limited in public domain sources. The competitive landscape in India's brokerage sector demands careful evaluation of any broker's offerings, particularly regarding cost structures, platform reliability, and customer service quality that clients expect.

For potential clients, LFS Broking presents itself as an option for multi-asset trading. Though investors should conduct thorough due diligence given the limited transparency in available information about the firm's regulatory status and operational track record.

Important Notice

This review is based on available public information and industry sources. Potential investors should note that specific details about LFS Broking's regulatory compliance, fee structures, and operational policies may vary and should be verified directly with the broker. The brokerage landscape in India is subject to regulatory oversight by SEBI. Investors should ensure any chosen broker maintains proper licensing and compliance.

Our evaluation methodology incorporates analysis of available broker information, industry standards comparison, and assessment of publicly available user feedback where accessible. Given the limited detailed information available about LFS Broking's specific operations, this review focuses on general industry practices and available data points that we could gather.

Rating Framework

Broker Overview

LFS Broking operates within India's dynamic financial services sector. The company positions itself as a full-service brokerage solution for various types of investors. The Indian stockbroker market has experienced significant growth and consolidation in recent years, with numerous players competing for market share through technology innovation and service differentiation. According to available information, LFS Broking attempts to capture market share by offering diversified trading options across multiple asset classes.

The firm's business approach appears to focus on providing comprehensive trading access to stocks, commodities, currencies, mutual funds, and IPO investments. This multi-asset strategy aligns with industry trends where brokers seek to become one-stop financial service providers rather than specialized single-asset platforms. However, specific details about the company's founding date, management structure, and operational scale remain limited in publicly available sources.

The brokerage operates in an environment where established players like Zerodha, Angel Broking, and ICICI Direct dominate market share. These major players achieve success through competitive pricing and robust technology platforms. New entrants and smaller brokers face challenges in differentiating their services while maintaining cost competitiveness. LFS Broking's position within this competitive landscape requires careful evaluation by potential clients seeking reliable trading partners.

Regulatory Status: Specific information about LFS Broking's regulatory compliance and SEBI registration details are not clearly available in accessible sources. Indian brokers are required to maintain SEBI registration and comply with regulatory guidelines for client protection and operational standards.

Account Types: Details about different account categories, minimum balance requirements, and account-specific features are not specified in available information. Most Indian brokers typically offer regular trading accounts and demat accounts for securities holding.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees for fund transfers is not detailed in available sources. Standard Indian brokers typically support bank transfers, UPI, and net banking options.

Trading Assets: LFS Broking reportedly provides access to stocks, commodities, currencies, mutual funds, and IPO investments. This multi-asset approach allows investors to diversify their portfolios across different market segments from a single platform.

Cost Structure: Detailed brokerage charges, transaction fees, and additional costs are not clearly specified in available information. This lfs broking review cannot provide specific fee comparisons without access to current pricing schedules.

Trading Platforms: Information about proprietary platforms, mobile applications, or third-party platform integration is not available in accessible sources. Platform quality and features remain unclear for evaluation purposes.

Leverage Options: Specific margin trading facilities and leverage ratios are not detailed in available information. Indian regulations typically govern margin requirements and leverage limits for retail investors.

Customer Support: Details about customer service channels, operating hours, and support quality are not specified in available sources. Effective customer support is crucial for trading operations and issue resolution.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of LFS Broking's account conditions faces significant limitations due to lack of detailed information. We cannot assess account types, minimum deposit requirements, and specific features offered to different client categories. In the Indian brokerage market, account conditions typically vary based on client profiles, with different offerings for retail investors, high-net-worth individuals, and institutional clients.

Most established Indian brokers provide clear information about their account opening procedures, documentation requirements, and ongoing account maintenance terms. The absence of such detailed information for LFS Broking creates uncertainty for potential clients who need to understand costs and requirements before committing to a trading relationship.

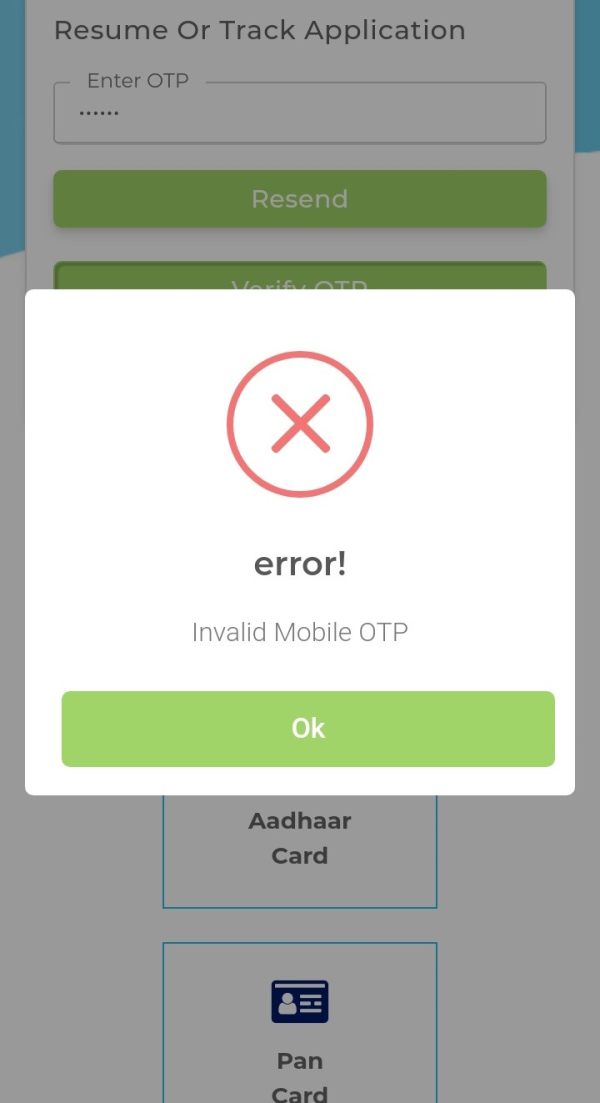

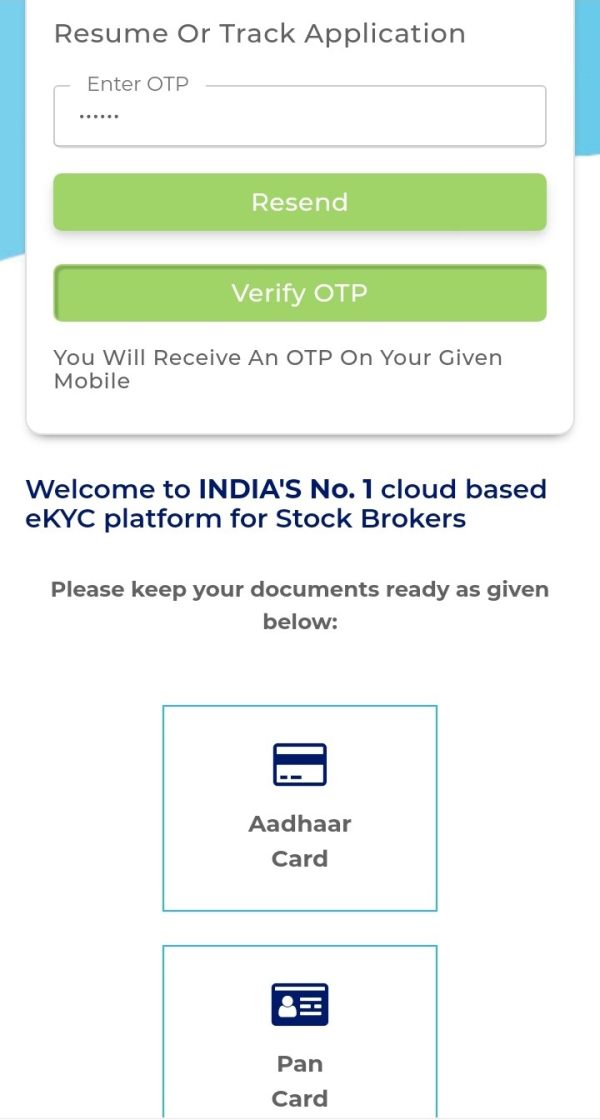

Account opening processes in India generally require KYC compliance, PAN card verification, and bank account linking. Without specific details about LFS Broking's procedures, clients cannot adequately prepare for the onboarding process or compare requirements with other brokers.

The competitive Indian market has seen brokers eliminate or minimize account opening fees and maintenance charges to attract clients. Without transparent information about LFS Broking's fee structure, this lfs broking review cannot assess the competitiveness of their account conditions against market standards.

LFS Broking's tools and resources evaluation is constrained by limited information about specific trading tools, research capabilities, and analytical resources provided to clients. The multi-asset trading capability suggests some level of platform sophistication, but detailed features remain unclear.

Modern brokerage success often depends on providing comprehensive research reports, market analysis, technical analysis tools, and educational resources. Established Indian brokers typically offer real-time market data, charting tools, fundamental analysis reports, and expert recommendations to support client decision-making.

The absence of detailed information about LFS Broking's research team, market analysis capabilities, or proprietary tools makes it difficult to assess the value proposition. Clients seeking comprehensive trading support need these resources for effective decision-making. Advanced traders particularly require sophisticated analytical tools and real-time data feeds for effective strategy implementation.

Educational resources have become increasingly important as brokers compete for new investors entering the market. Without information about LFS Broking's educational initiatives, webinars, or training programs, potential clients cannot evaluate the learning support available for skill development.

Customer Service and Support Analysis

Customer service evaluation for LFS Broking is limited by the lack of specific information about support channels, response times, and service quality metrics. Effective customer support is crucial in the brokerage industry where clients may need immediate assistance with trading issues, technical problems, or account queries.

Industry standards in India typically include multiple support channels such as phone support, email assistance, live chat, and sometimes dedicated relationship managers. The availability and quality of these services significantly impact client satisfaction and retention. Response time expectations have evolved with digital transformation, where clients expect quick resolution of queries and technical issues.

Without specific information about LFS Broking's support infrastructure and performance metrics, clients cannot assess whether service levels meet their requirements. The complexity of multi-asset trading often requires specialized support staff who understand different market segments and can provide relevant assistance. The absence of information about LFS Broking's support team expertise and training creates uncertainty about service quality.

Trading Experience Analysis

The trading experience evaluation for LFS Broking faces limitations due to insufficient information about platform features, execution quality, and user interface design. Trading experience encompasses platform stability, order execution speed, mobile accessibility, and overall user satisfaction with the trading environment.

Platform reliability is crucial for active traders who cannot afford system downtime during critical market moments. Without specific information about LFS Broking's technology infrastructure, uptime statistics, or platform performance metrics, clients cannot assess operational reliability.

Order execution quality, including fill rates and slippage control, directly impacts trading profitability. The absence of detailed information about LFS Broking's execution capabilities and market connectivity makes it difficult to evaluate trading efficiency compared to established competitors.

Mobile trading has become essential as investors increasingly manage portfolios on-the-go. This lfs broking review cannot assess mobile platform quality or features without access to specific application information and user feedback about mobile trading experience.

Trust Factor Analysis

Trust factor evaluation for LFS Broking reveals significant concerns due to limited transparency about regulatory compliance, company background, and operational credentials. Trust represents a fundamental requirement in financial services where clients entrust brokers with their capital and sensitive financial information.

Regulatory compliance forms the foundation of broker trustworthiness, with SEBI registration and compliance being mandatory for Indian brokers. The lack of clear regulatory information about LFS Broking creates uncertainty about legal protections and regulatory oversight applicable to client relationships.

Company transparency, including management information, financial stability indicators, and operational history, helps clients assess broker reliability. The limited availability of such information for LFS Broking reduces confidence in the firm's credibility and long-term viability.

Industry reputation and third-party endorsements typically support broker credibility. Without access to independent reviews, industry recognition, or peer evaluations, potential clients have limited basis for assessing LFS Broking's market standing and reputation.

User Experience Analysis

User experience assessment for LFS Broking is constrained by the absence of detailed user feedback, platform usability information, and client satisfaction metrics. User experience encompasses the entire client journey from account opening through ongoing trading activities and support interactions.

The onboarding process significantly impacts first impressions, with efficient account opening and verification procedures setting positive expectations. Without specific information about LFS Broking's onboarding experience, new clients cannot anticipate the setup process complexity or duration.

Platform usability, including interface design, navigation efficiency, and feature accessibility, directly affects daily trading activities. The lack of detailed platform information prevents assessment of user-friendliness and learning curve requirements for new users.

Overall client satisfaction typically reflects the cumulative experience across all touchpoints including platform performance, customer service, cost competitiveness, and problem resolution effectiveness. The limited feedback available about LFS Broking makes comprehensive user experience evaluation challenging.

Conclusion

This lfs broking review reveals a brokerage firm operating in India's competitive financial services market with limited publicly available information. The lack of details about specific operations, regulatory status, and service quality creates significant uncertainty for potential clients. While LFS Broking positions itself as a multi-asset trading provider, the absence of detailed information about fees, platforms, and customer support raises important questions.

The Indian brokerage market offers numerous well-established alternatives with transparent pricing, robust platforms, and clear regulatory compliance. Potential investors should carefully evaluate LFS Broking against these established competitors, ensuring adequate due diligence regarding regulatory status, cost structures, and service quality before making commitments.

Given the limited information available and the importance of trust and transparency in financial services, investors may benefit from considering more established brokers. These alternatives typically offer clear track records and comprehensive public information about their operations and regulatory compliance.