Promax Trading 2025 Review: Everything You Need to Know

Executive Summary

This promax trading review looks at a forex broker that has gotten lots of bad attention from traders. Promax Trading Limited works as an unregulated company registered in Saint Vincent and the Grenadines, which makes many users worry about whether it's safe and real. The broker says it offers ECN trading services with good spreads starting from 0.0 pips on their Premium and Ultimate accounts, but these accounts charge commissions.

The platform gives you access to the MetaTrader 5 (MT5) trading platform with leverage up to 1:100. It targets traders who want low spreads and high leverage options. But lots of user feedback shows that people are very unhappy with the broker's services, including claims of data tricks, bad customer service, and trouble getting money out. The fact that no government authority watches over them really hurts trader confidence and safety.

Based on detailed market analysis and what users say, Promax Trading doesn't seem right for most everyday traders because of its questionable legal status and mostly bad user experiences. While the broker might interest traders looking for specific trading conditions, the risks are much bigger than any possible benefits.

Important Disclaimers

Regional Entity Variations: Promax Trading works under registration in Saint Vincent and the Grenadines, a place known for easy rules. Traders should know that this registration doesn't give the same protection as brokers watched by major financial authorities like the FCA, ASIC, or CySEC.

Review Methodology: This review uses information anyone can find from the broker's platform, user feedback from different review sites, and market analysis. We didn't do direct testing or visit their offices. Information accuracy might change, and traders should do their own research before making any money decisions.

Overall Rating Framework

Broker Overview

Promax Trading Limited says it's a global ECN forex broker that has been working in financial markets for about 2-5 years. The company is registered in Saint Vincent and the Grenadines, a popular offshore place for financial services companies that want minimal rules watching them. Even though it claims to give professional trading services, the broker has gotten lots of controversy and bad feedback from the trading community.

The company's business plan focuses on giving forex trading services through the MetaTrader 5 platform. It targets everyday traders with promises of good spreads and professional execution. But many user reports show big differences between what the broker says in marketing and what they actually deliver, with lots of claims of tricky practices and poor customer treatment.

Based on available information, Promax Trading works mainly as a Market Maker, though they claim to offer ECN-style execution. The broker's main trading tool appears to be forex pairs, though specific details about their complete asset offering stay limited. The lack of proper rules watching has led to widespread doubt about the broker's realness within the trading community.

This promax trading review shows that while the company keeps a professional-looking website and marketing materials, the basic service quality and business practices have gotten lots of criticism from users and industry watchers.

Regulatory Status: Promax Trading works without rules from any recognized government financial authority. The company is registered in Saint Vincent and the Grenadines, which doesn't give meaningful watching or trader protection systems.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods isn't detailed in available public materials. This lack of openness about payment processing is worrying for potential clients.

Minimum Deposit Requirements: The exact minimum deposit amount needed to open an account with Promax Trading isn't clearly specified in available documentation. This may create uncertainty for future traders.

Bonus and Promotions: No information about bonus programs or promotional offers is available in the current material. This suggests either no such programs exist or poor marketing openness.

Tradable Assets: The broker mainly focuses on forex trading, though complete details about the full range of available trading tools, including the number of currency pairs and other asset classes, aren't provided in available sources. The specific commission rates and complete fee structure details aren't openly shared in available materials.

Cost Structure: Promax Trading offers spreads starting from 0.0 pips on their Premium and Ultimate account types, but these accounts require commission payments. The specific commission rates and complete fee structure details aren't openly shared in available materials.

Leverage Ratios: The broker offers maximum leverage of up to 1:100. This is relatively careful compared to many offshore brokers but may still pose big risk for new traders.

Platform Options: Trading is done only through the MetaTrader 5 (MT5) platform. This is a well-known and feature-rich trading environment that many professional traders prefer.

Geographic Restrictions: Information about specific geographic restrictions or country limits isn't detailed in available materials. Available customer support languages aren't specified in current documentation, though English support is implied given their target market.

Customer Support Languages: Available customer support languages aren't specified in current documentation. English support is implied given their target market.

This promax trading review highlights the worrying lack of openness in many basic aspects of the broker's operations.

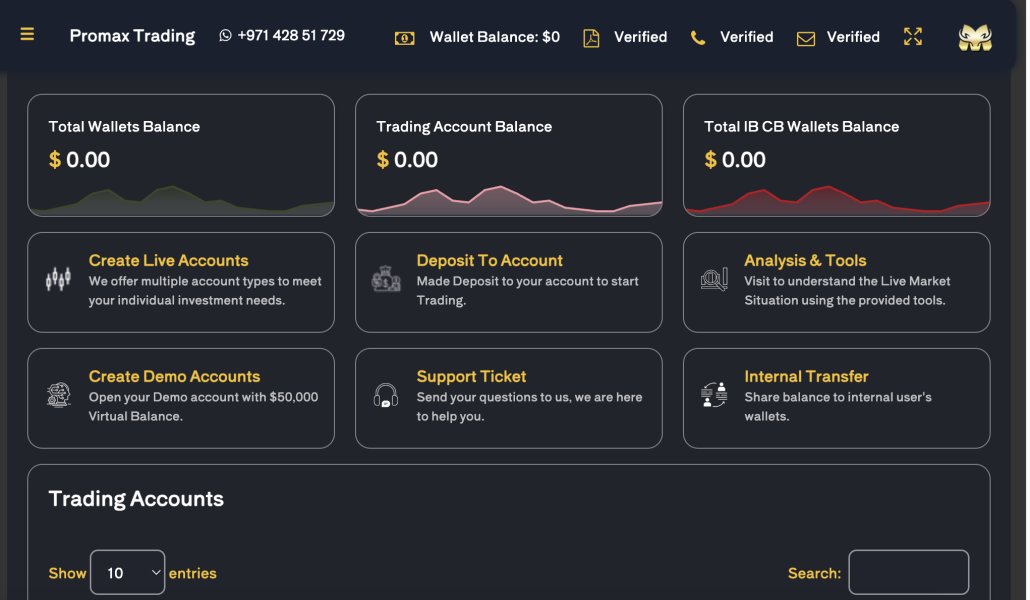

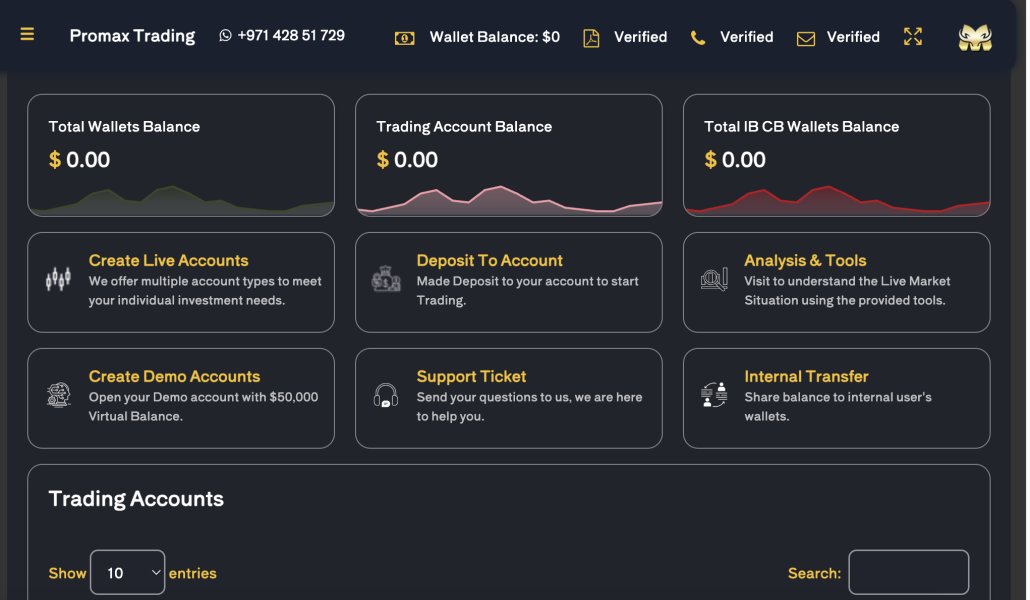

Account Conditions Analysis (Score: 4/10)

Promax Trading's account conditions show a mixed picture that ultimately helps the broker rather than the trader. The company offers Premium and Ultimate account types that have spreads starting from 0.0 pips, which looks competitive on the surface. But these low spreads come with commission charges that aren't openly shared upfront, making it hard for traders to calculate their true trading costs.

The lack of clear information about minimum deposit requirements creates uncertainty for potential clients. It suggests poor openness in the broker's operational standards. User feedback shows that the account opening process lacks the professional standards expected from real brokers, with reports of poor documentation requirements and verification procedures.

Account holders have reported problems with account management features and limited flexibility in account customization options. The absence of specialized account types, such as Islamic accounts for Muslim traders, shows a limited service offering compared to established brokers in the industry.

The terms and conditions governing account operations appear to heavily help the broker. User reports suggest unfavorable clauses about dispute resolution and fund protection. The lack of rules watching means that standard account protection measures required by major financial authorities aren't in place.

Overall, while the advertised spreads may appear attractive, the complete account conditions package lacks the openness, flexibility, and protection that traders should expect from a good broker. The combination of hidden costs, unclear terms, and user dissatisfaction significantly hurts the value of Promax Trading's account offerings.

This promax trading review assessment of account conditions reflects the broader concerns about the broker's commitment to fair and open trading environments.

Promax Trading's trading tools and resources offering is notably limited, focusing mainly around the MetaTrader 5 platform. While MT5 is a strong and professional trading platform with complete charting capabilities and technical analysis tools, the broker's failure to add additional proprietary tools or resources represents a big limitation.

The platform lacks complete market research and analysis resources that traders typically expect from professional brokers. There's no evidence of dedicated research teams providing market commentary, economic analysis, or trading insights that could help traders make informed decisions. This absence of value-added content puts Promax Trading at a disadvantage compared to established brokers who invest heavily in research capabilities.

Educational resources appear to be virtually non-existent. There's no indication of trading courses, webinars, or educational materials designed to help traders improve their skills. This lack of educational support is particularly worrying for new traders who require guidance and learning resources to develop their trading capabilities effectively.

Automated trading support through Expert Advisors (EAs) is available via the MT5 platform. But there's no indication of broker-specific tools or enhanced automation features. The absence of proprietary trading tools, advanced analytics, or custom indicators further limits the platform's appeal to serious traders.

Risk management tools beyond the standard MT5 offerings aren't evident. There's no mention of advanced order types or sophisticated risk management features that professional traders often require. The lack of integration with third-party analysis tools or data providers also restricts traders' ability to conduct complete market analysis.

The overall tools and resources package represents a bare-minimum offering that relies entirely on the MT5 platform's built-in capabilities. It doesn't have any broker-specific enhancements or additional value-added services.

Customer Service Analysis (Score: 3/10)

Customer service represents one of Promax Trading's most significant weaknesses, according to extensive user feedback and available information. Multiple user reports consistently highlight poor response times, unprofessional communication, and poor problem resolution as major concerns with the broker's support operations.

The broker's customer service channels aren't clearly defined in available materials. This creates uncertainty about how traders can reach support when needed. This lack of openness about support accessibility is worrying, particularly given the unregulated nature of the broker's operations where reliable customer service becomes even more critical.

Response times appear to be consistently slow based on user testimonials. Many traders report delays of several days or even weeks before receiving meaningful responses to their inquiries. When responses are provided, users frequently describe them as unhelpful, generic, or failing to address the specific issues raised.

The quality of customer service interactions has been heavily criticized by users. There are reports of unprofessional communication, lack of technical expertise among support staff, and apparent unwillingness to resolve legitimate trader concerns. These service quality issues are particularly problematic when dealing with account access problems, withdrawal requests, or technical trading issues.

Multi-language support capabilities aren't clearly specified. This potentially limits accessibility for non-English speaking traders. The absence of 24/7 support availability, which is standard among good forex brokers, further adds to the service limitations.

Problem resolution effectiveness appears to be poor. Numerous user reports indicate that legitimate complaints and issues remain unresolved for extended periods. This pattern of poor problem resolution, combined with the broker's unregulated status, leaves traders with limited options when disputes arise.

The overall customer service experience reflects broader concerns about the broker's commitment to professional standards and client satisfaction.

Trading Experience Analysis (Score: 4/10)

The trading experience with Promax Trading has been consistently criticized by users, with multiple reports highlighting significant issues that impact trade execution quality and overall platform performance. Platform stability appears to be a recurring problem, with users reporting frequent disconnections, system crashes, and delayed order processing during active trading sessions.

Order execution quality has been heavily questioned by traders. There are numerous allegations of slippage manipulation, requotes during volatile market conditions, and suspicious price movements that consistently favor the broker. These execution issues are particularly worrying during high-impact news events when accurate and fair execution becomes crucial for trader success.

The MT5 platform itself provides complete functionality and technical analysis capabilities. But users report that the broker's implementation lacks optimization and reliability. Trading delays and platform freezing during critical market moments have been frequently cited as major frustrations among active traders.

Price feed quality has been questioned, with some users alleging that the broker manipulates quotes to trigger stop losses or prevent profitable trades from closing at favorable prices. While these claims are difficult to verify independently, the consistency of such reports raises serious concerns about execution integrity.

The trading environment appears to suffer from poor liquidity provision. This results in wider spreads during market volatility and difficulty executing larger position sizes without significant market impact. This liquidity limitation particularly affects traders employing scalping or high-frequency trading strategies.

Mobile trading experience through the MT5 mobile application isn't specifically detailed in available feedback. But desktop platform issues suggest that mobile functionality may also be compromised. The lack of proprietary mobile solutions or enhanced mobile features further limits trading flexibility.

Overall, the trading experience falls significantly short of professional standards expected from legitimate forex brokers. Execution quality and platform reliability represent major concerns for active traders.

This promax trading review of trading experience highlights the substantial risks associated with choosing this broker for serious trading activities.

Trust and Safety Analysis (Score: 2/10)

Trust and safety represent the most critical weaknesses in Promax Trading's offering, with the broker's unregulated status creating fundamental concerns about trader protection and fund security. The absence of oversight from any recognized financial regulatory authority means that traders have no institutional protection or recourse mechanisms in case of disputes or broker misconduct.

The company's registration in Saint Vincent and the Grenadines, while legal, provides minimal regulatory oversight. It doesn't include the investor protection schemes that are standard with brokers regulated by major authorities such as the FCA, ASIC, or CySEC. This regulatory gap leaves traders vulnerable to potential fund misappropriation or business closure without warning.

Fund safety measures aren't openly shared, with no clear information about segregated client accounts, deposit insurance, or third-party fund custody arrangements. This lack of openness about fund protection is particularly worrying given the broker's unregulated status and the numerous user complaints about withdrawal difficulties.

Company openness is notably poor, with limited information available about the broker's management team, financial backing, or operational history. The absence of audited financial statements or regulatory filings makes it impossible for traders to assess the company's financial stability and long-term viability.

Industry reputation has been severely damaged by widespread negative user feedback and allegations of fraudulent practices. Multiple review platforms and trading forums contain warnings about the broker, with many users advising others to avoid the platform entirely due to safety concerns.

Negative incident handling appears to be poor, with numerous reports of unresolved complaints, ignored withdrawal requests, and poor communication during dispute resolution attempts. The broker's apparent inability or unwillingness to address legitimate user concerns effectively further undermines confidence in their operations.

The overall trust and safety profile presents significant risks that make Promax Trading unsuitable for traders who prioritize fund security and regulatory protection.

User Experience Analysis (Score: 3/10)

User experience with Promax Trading has been predominantly negative, based on extensive feedback from multiple review platforms and trading communities. Overall user satisfaction appears to be very low, with the majority of reviews expressing dissatisfaction with various aspects of the broker's services and warning other traders to avoid the platform.

Interface design and usability, while benefiting from the MT5 platform's professional layout, suffer from implementation issues and lack of customization options. Users report that the trading environment feels generic and lacks the polish and optimization found with established brokers who invest in platform enhancement and user experience improvements.

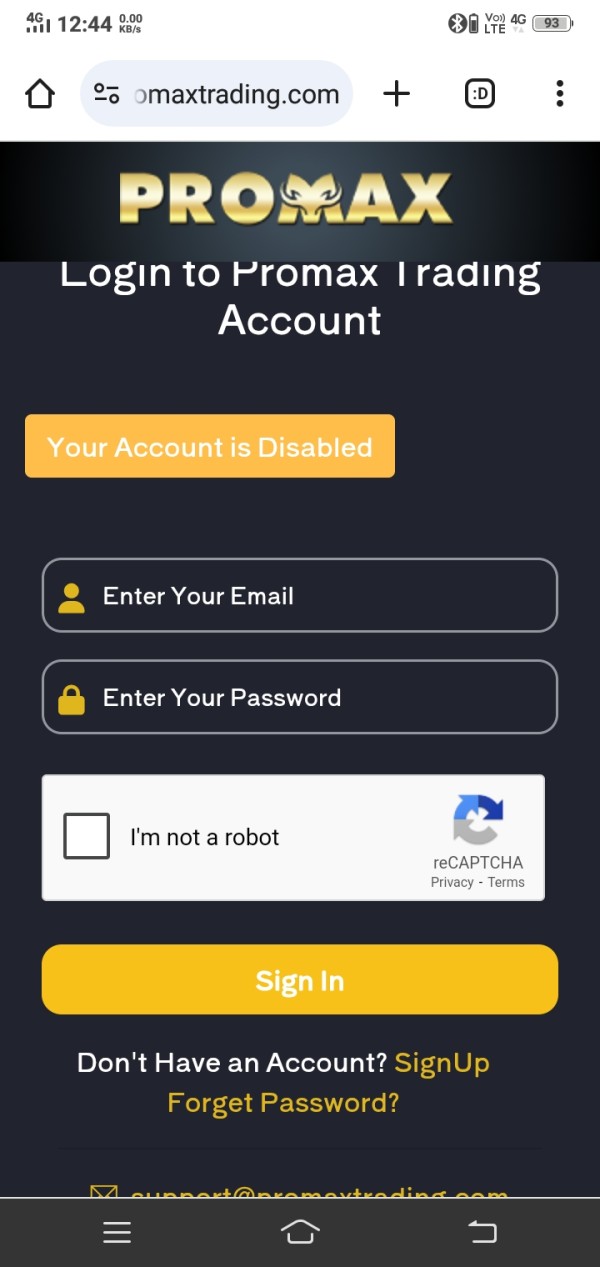

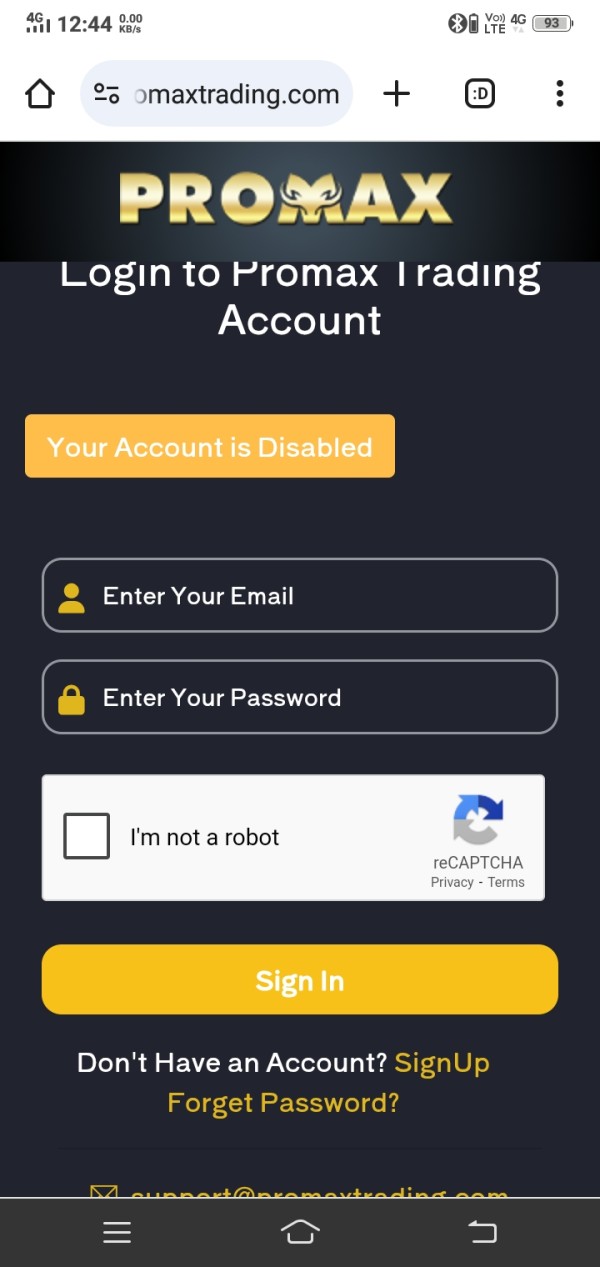

The registration and account verification process hasn't been specifically detailed in available feedback. But general user dissatisfaction suggests that onboarding procedures may lack the professionalism and efficiency expected from legitimate brokers. The absence of clear documentation about verification requirements creates uncertainty for prospective clients.

Fund management experience represents a major pain point for users, with numerous reports of withdrawal difficulties, delayed processing times, and questionable practices regarding deposit and withdrawal procedures. These financial transaction issues are among the most serious concerns raised by users and contribute significantly to the broker's poor reputation.

Common user complaints consistently focus on platform unreliability, poor customer service, withdrawal problems, and suspicions about trade execution manipulation. The frequency and consistency of these complaints across multiple review platforms suggest systemic issues rather than isolated incidents.

User demographics appear to include primarily retail traders seeking low-cost trading options. But the high risk tolerance required to trade with an unregulated broker makes this platform unsuitable for most conservative or risk-averse traders. The broker may only be appropriate for highly experienced traders willing to accept significant counterparty risk.

Improvement recommendations would require fundamental changes to the broker's regulatory status, operational openness, and customer service standards. However, the scope of required improvements suggests that traders would be better served by choosing regulated alternatives with established track records.

Conclusion

This comprehensive promax trading review reveals a broker that presents significant risks and limitations that outweigh any potential benefits for most traders. While Promax Trading offers some attractive features such as low spreads starting from 0.0 pips and access to the professional MT5 platform, these advantages are overshadowed by fundamental concerns about safety, reliability, and regulatory protection.

The broker's unregulated status represents the most critical weakness, leaving traders without institutional protection or recourse mechanisms. Combined with consistently negative user feedback, allegations of manipulative practices, and poor customer service, Promax Trading fails to meet the standards expected from professional forex brokers.

The platform may only be suitable for highly experienced traders with significant risk tolerance who fully understand the implications of trading with an unregulated entity. However, even experienced traders would likely find better value and security with established, regulated alternatives that provide similar trading conditions with proper oversight and protection.

For the vast majority of retail traders, particularly those new to forex trading or seeking reliable, long-term trading relationships, Promax Trading presents risks that far exceed any potential benefits. The combination of regulatory concerns, user dissatisfaction, and operational issues makes this broker unsuitable for serious trading activities.