Is PROMAX safe?

Pros

Cons

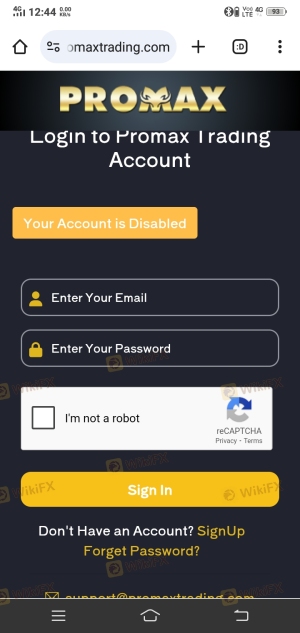

Is Promax Trading A Scam?

Introduction

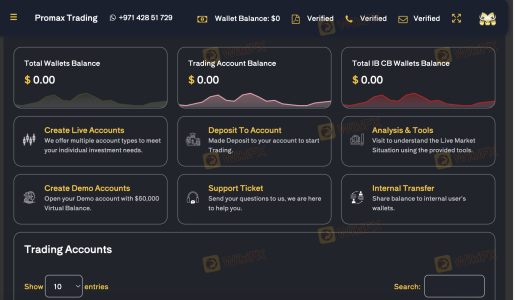

Promax Trading is an online forex broker that has gained attention in the trading community for its diverse range of trading instruments and attractive trading conditions. Operating in a highly competitive market, the broker aims to cater to both novice and experienced traders by offering various account types and trading platforms. However, with the proliferation of online trading scams, it is crucial for traders to conduct thorough due diligence before engaging with any broker. This article aims to investigate the credibility of Promax Trading by evaluating its regulatory status, company background, trading conditions, customer fund safety, user experiences, and potential risks. The analysis is based on a comprehensive review of recent online resources and user feedback.

Regulation and Legality

The regulatory environment in which a broker operates is paramount to its credibility and trustworthiness. A well-regulated broker is generally viewed as safer, as it is subject to stringent oversight and compliance requirements. Promax Trading claims to operate under the jurisdiction of Saint Vincent and the Grenadines, but it lacks regulation from any top-tier financial authority.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and the Grenadines | Not Regulated |

The absence of regulation from reputable entities like the FCA (UK), ASIC (Australia), or SEC (USA) raises significant concerns. Regulatory bodies enforce strict standards to ensure brokers operate fairly and transparently. Without such oversight, traders are left vulnerable to potential malpractices and financial losses, as there are limited avenues for recourse in cases of disputes or mismanagement of funds. This lack of regulatory framework is a critical red flag for potential investors, and it is advisable to approach Promax Trading with caution.

Company Background Investigation

Promax Trading was established in recent years, with its operational base in Saint Vincent and the Grenadines. The company claims to offer a wide range of trading services, including forex, commodities, and indices. However, details about its ownership structure and management team remain vague, which can be a cause for concern regarding transparency.

The management teams background is crucial in assessing a broker's reliability. Unfortunately, Promax Trading does not provide detailed information about its executives or their professional experience. Such opacity can lead to skepticism about the broker's operational integrity and commitment to ethical trading practices. Transparency in ownership and management typically signals a broker's accountability and willingness to adhere to industry standards.

Moreover, the company's website lacks comprehensive disclosures regarding its financial health or operational history, further obscuring its credibility. Given these factors, potential investors should weigh the risks of engaging with a broker that does not provide adequate transparency.

Trading Conditions Analysis

Promax Trading offers a variety of trading conditions that may appeal to different types of traders. However, the absence of transparency regarding its fee structure raises concerns. The broker claims to provide competitive spreads and commissions, but without proper regulatory oversight, traders may encounter hidden fees or unfavorable trading conditions.

| Fee Type | Promax Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (from 0.0 pips) | 1.0 - 2.0 pips |

| Commission Model | Varies by account type | $5 - $10 per lot |

| Overnight Interest Range | Not disclosed | Varies widely |

The variability in spreads is common in the industry; however, the lack of a clear commission structure can lead to unexpected costs for traders. Additionally, the absence of information regarding overnight interest rates may indicate a lack of transparency that could affect trading profitability. Traders should be wary of any costs that may not be immediately apparent, as these can significantly impact overall returns.

Client Fund Safety

The safety of client funds is a top priority for any trading broker. Promax Trading claims to implement various measures to secure client funds, including segregated accounts and negative balance protection. However, without robust regulatory oversight, the effectiveness of these measures remains uncertain.

The broker's website does not provide specific details on how client funds are protected or whether they are insured against potential losses. This lack of information is concerning, especially given the high-risk nature of forex trading. Historical incidents involving unregulated brokers often reveal that clients are left without recourse in the event of mismanagement or fraud.

Traders must ensure that their funds are held securely and that they are protected from potential losses. The absence of a clear fund protection policy at Promax Trading poses a risk that investors should carefully consider before committing their capital.

Customer Experience and Complaints

User feedback is an essential component of evaluating a broker's credibility. Reviews of Promax Trading reveal mixed experiences among clients, with several users reporting issues related to withdrawal delays and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Unresolved issues |

| Account Management Issues | High | Limited support |

One common complaint involves difficulties in withdrawing funds, which is a significant concern for traders. Users have reported long waiting times for withdrawal requests to be processed, leading to frustration and distrust. Additionally, the quality of customer support has been criticized, with many users stating that their inquiries went unanswered or were met with inadequate responses.

These patterns of complaints suggest that Promax Trading may struggle with customer service and operational efficiency. Potential investors should be cautious and consider these factors when deciding whether to engage with this broker.

Platform and Trade Execution

The trading platform offered by Promax Trading is based on the popular MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the overall performance and reliability of the platform are critical factors for traders.

Users have reported varying experiences regarding order execution quality, with some experiencing slippage and delays during high volatility periods. A high rate of rejected orders or poor execution can lead to significant losses, especially for active traders and scalpers.

Traders should assess the platform's performance and reliability through demo accounts or user reviews before committing real funds. Any signs of manipulation or poor execution could indicate deeper issues within the broker's operational framework.

Risk Assessment

Engaging with Promax Trading involves several inherent risks that potential investors should consider. The lack of regulatory oversight, combined with reported customer complaints and transparency issues, raises the overall risk profile of this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation from top-tier authorities |

| Client Fund Safety | High | Lack of clear fund protection measures |

| Customer Service Reliability | Medium | Mixed reviews on support responsiveness |

| Trading Conditions | Medium | Potential hidden fees and unfavorable conditions |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts, and only invest what they can afford to lose. It is also advisable to explore alternative brokers that offer better regulatory protection and customer service.

Conclusion and Recommendations

In conclusion, while Promax Trading presents itself as a viable option for forex trading, the lack of regulatory oversight, transparency issues, and customer complaints raise significant red flags. The absence of a robust regulatory framework means that traders may be vulnerable to fraud and mismanagement of funds.

Considering these factors, potential investors are advised to exercise caution. It may be prudent to seek alternative brokers that are well-regulated and have a proven track record of reliability and customer satisfaction. Some recommended alternatives include brokers regulated by the FCA, ASIC, or SEC, which provide a higher level of investor protection and transparency.

Is PROMAX a scam, or is it legit?

The latest exposure and evaluation content of PROMAX brokers.

PROMAX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PROMAX latest industry rating score is 2.11, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.11 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.