Lcfx 2025 Review: Everything You Need to Know

In the ever-evolving landscape of forex trading, Lcfx, a broker established in 2017, has garnered attention for both its offerings and the mixed reviews from its users. While some traders appreciate its low entry barriers and the use of the familiar MetaTrader 4 platform, concerns about its regulatory status and customer service persist. This review will delve into the key aspects of Lcfx, highlighting its strengths and weaknesses based on user experiences and expert analysis.

Note: Its essential to recognize that Lcfx operates under various entities in different jurisdictions, which can impact regulatory oversight. This review aims to provide a fair and accurate assessment based on the available data.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user reviews, expert opinions, and factual data derived from multiple sources.

Broker Overview

Lcfx, founded in 2017, is a forex broker that primarily offers trading on the MetaTrader 4 platform. It provides access to a range of forex pairs and commodities, but its regulatory status raises concerns. The broker is registered in the United States and operates under the National Futures Association (NFA), but its low WikiFX score of 1.55 indicates potential issues with trustworthiness and user satisfaction.

Detailed Analysis

Regulatory Status and Geographic Coverage

Lcfx is based in the United States and is associated with the NFA. However, its low regulatory score suggests that it may not be adequately monitored, leading to questions about the safety of funds. According to WikiFX, the broker is classified as unauthorized, which heightens the risk for potential investors.

Deposit/Withdrawal Currencies and Cryptocurrency

The broker allows deposits and withdrawals in major currencies like USD, EUR, and GBP. However, it does not support cryptocurrency transactions, which may be a drawback for traders looking to diversify their investment options.

Minimum Deposit

The minimum deposit required to open an account with Lcfx is relatively low at $100, making it accessible for new traders. This aspect is often highlighted positively in user reviews, as it allows individuals to start trading without significant financial commitment.

Currently, Lcfx does not appear to offer any promotional bonuses or incentives, which is a point of contention among users who often expect such benefits from brokers to enhance their trading experience.

Tradeable Asset Classes

Lcfx primarily offers trading in forex pairs and a limited selection of commodities. The number of available trading instruments is not as extensive as some of its competitors, which may deter traders looking for a broader range of options.

Costs (Spreads, Fees, Commissions)

The broker's spreads are reported to start from 0.9 pips, which can be competitive in certain market conditions. However, user feedback indicates that trading costs may not be the lowest available, and additional fees could apply depending on the account type.

Leverage

Lcfx offers leverage up to 1:500, which can be appealing for traders looking to maximize their potential returns. However, high leverage also comes with increased risk, and users are advised to exercise caution when utilizing such options.

The primary trading platform provided by Lcfx is MetaTrader 4, a widely used platform known for its robust trading tools and user-friendly interface. This platform is a significant draw for many traders, as it allows for automated trading and access to various technical analysis tools.

Restricted Regions

While Lcfx operates in multiple regions, it is crucial to verify whether specific countries have restrictions on trading with this broker. The lack of clear information about restricted regions can be a red flag for potential users.

Available Customer Service Languages

Customer service at Lcfx is reportedly limited, with support primarily available in English. Users have expressed dissatisfaction with the responsiveness and effectiveness of customer service, often citing long wait times and inadequate support as significant drawbacks.

Final Ratings Overview

Detailed Breakdown

- Account Conditions: The low minimum deposit is a plus, but the lack of diverse account types limits options for more experienced traders.

- Tools and Resources: While the MT4 platform is robust, Lcfx lacks additional educational resources that could benefit novice traders.

- Customer Service and Support: User reviews highlight significant issues with customer service, including long response times and unhelpful support.

- Trading Setup: The trading experience is generally positive due to the MT4 platform, but limited asset options may not meet all traders' needs.

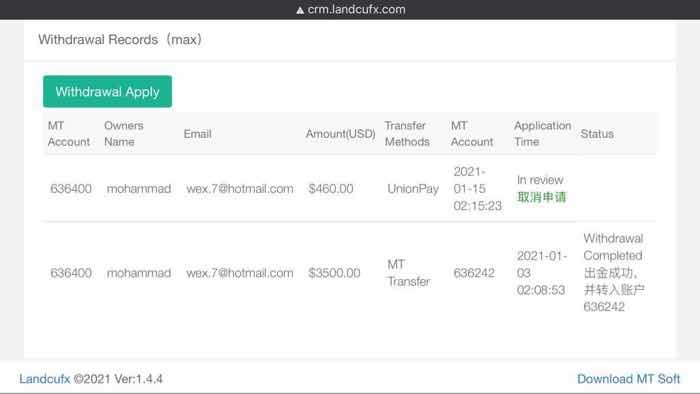

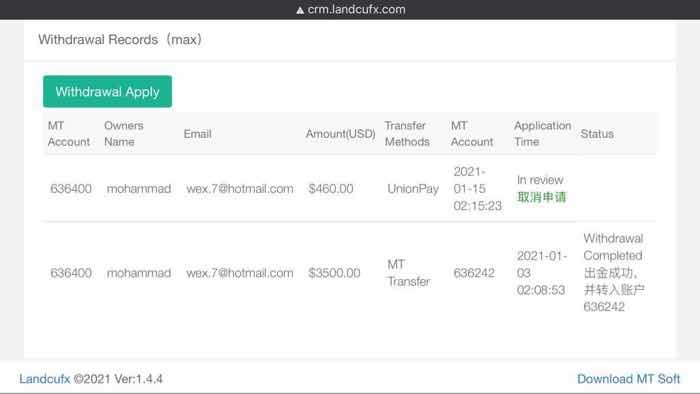

- Trustworthiness: The low regulatory score and user complaints about withdrawal issues raise concerns about the broker's reliability.

- User Experience: Overall user experience is mixed, with some traders appreciating the low entry barriers while others express frustration with service quality.

In conclusion, while Lcfx offers some appealing features for new traders, its regulatory concerns and customer service issues warrant caution. Prospective investors should conduct thorough research and consider these factors before committing funds to this broker.