Is LCFX safe?

Business

License

Is Lcfx Safe or a Scam?

Introduction

Lcfx is a relatively new player in the forex market, having been established in 2017. Positioned as a broker that offers trading services for various financial instruments, Lcfx aims to attract both novice and experienced traders with its diverse offerings and competitive conditions. However, the forex market is notorious for its potential pitfalls, and traders must exercise caution when selecting a broker. The landscape is dotted with scams and unregulated entities that can lead to significant financial losses. Therefore, it is crucial for traders to conduct thorough research and evaluation of any broker before committing their funds. This article will investigate Lcfx's regulatory standing, company background, trading conditions, customer experiences, and overall safety to determine whether Lcfx is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its legitimacy. Lcfx claims to operate under the oversight of the National Futures Association (NFA), a regulatory body in the United States. However, its low score of 1.55 on WikiFX raises questions about its compliance and reliability. Below is a summary of Lcfx's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0509260 | United States | Unauthorized |

The NFA is known for its stringent regulations, but Lcfx's unauthorized status indicates that it may not be operating within the necessary legal frameworks. This lack of proper regulation can expose traders to higher risks, as unregulated brokers do not provide the same level of investor protection. In the absence of a reputable regulatory body, traders should be wary of engaging with Lcfx, as they may not have recourse in the event of disputes or financial issues.

Company Background Investigation

Lcfx was founded in 2017, and while it has established a presence in the forex market, there is limited information available regarding its ownership structure and management team. A thorough background check reveals that the company's transparency is questionable, as it does not disclose key information about its executives or their professional experience. This lack of transparency can be a significant red flag for potential investors.

Moreover, the absence of a robust track record raises concerns about the company's operational stability and reliability. Investors typically prefer brokers with a long history of compliance and a strong reputation in the industry. Given Lcfx's relatively short existence and the absence of detailed information about its management team, traders may find it challenging to assess the company's credibility.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. Lcfx's fee structure appears competitive at first glance; however, a deeper analysis reveals some potential pitfalls. The broker's spreads on major currency pairs start from 0.9 pips, which is slightly above the industry average. Below is a comparison of Lcfx's trading costs:

| Fee Type | Lcfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.9 pips | 0.6 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The higher spreads and variable commission structure can lead to increased trading costs, which may not be immediately apparent to new traders. Additionally, Lcfx's overnight interest rates are reported to be on the higher side, which could further erode profits, especially for traders who hold positions overnight. Understanding these costs is crucial for traders to make informed decisions and avoid unexpected losses.

Customer Funds Security

The safety of customer funds is paramount when evaluating a broker's reliability. Lcfx claims to implement measures to protect client funds, such as segregated accounts. However, the lack of regulation raises concerns about the effectiveness of these measures. Without a regulatory authority overseeing the broker's operations, there is no guarantee that customer funds are safeguarded against potential mismanagement or fraud.

Furthermore, Lcfx does not offer negative balance protection, which means that traders could potentially lose more than their initial investment. This is particularly concerning for inexperienced traders who may not fully understand the risks involved in leveraged trading. Historical issues related to fund security have been reported by other users, suggesting that Lcfx may not have a solid track record in safeguarding client assets.

Customer Experience and Complaints

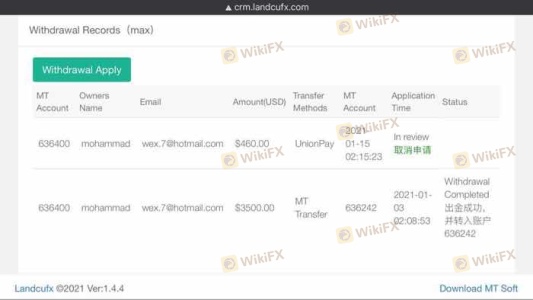

Customer feedback is a vital component in assessing the overall reliability of a broker. Reviews of Lcfx indicate a mixed bag of experiences, with several users expressing dissatisfaction with the broker's services. Common complaints include difficulties in withdrawing funds and slow response times from customer support. Below is a summary of the primary complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Unresolved queries |

| High Fees | Medium | No adjustment |

Typical case studies reveal that some traders have reported being unable to withdraw their funds after multiple attempts, leading to frustration and distrust. The quality of customer support has also been criticized, with many users noting long wait times and inadequate resolutions to their inquiries. Such issues can significantly impact a trader's experience and raise concerns about the broker's reliability.

Platform and Trade Execution

The performance of the trading platform is another critical factor when evaluating a broker. Lcfx utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and comprehensive trading tools. However, reports of execution issues, including slippage and order rejections, have surfaced among users. These problems can hinder trading performance and lead to unexpected losses.

Additionally, there are concerns about potential platform manipulation, as some users have reported discrepancies between the prices displayed on the platform and actual market rates. Such issues can erode trust and raise doubts about the broker's integrity in executing trades fairly.

Risk Assessment

Using Lcfx comes with inherent risks that traders should carefully consider. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk exposure. |

| Financial Risk | Medium | High fees and spreads can erode profits. |

| Operational Risk | Medium | Customer support issues and withdrawal problems. |

To mitigate these risks, traders are advised to start with a small investment, thoroughly read the terms and conditions, and consider using demo accounts to test the platform before committing significant funds.

Conclusion and Recommendations

In conclusion, while Lcfx presents itself as a viable option for forex trading, the evidence suggests that traders should approach with caution. The broker's lack of proper regulation, coupled with mixed customer feedback and potential issues with fund security, raises significant red flags. For traders seeking a reliable and safe trading environment, it may be prudent to consider alternative brokers that are well-regulated and have established a positive reputation in the industry.

For those who are still considering Lcfx, it is essential to conduct further research, weigh the risks, and remain vigilant about the potential for issues related to fund withdrawals and customer support. Ultimately, the question of "Is Lcfx safe?" leans towards skepticism, and potential traders should carefully evaluate their options before proceeding.

Is LCFX a scam, or is it legit?

The latest exposure and evaluation content of LCFX brokers.

LCFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LCFX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.