Seventy Brokers 2025 Review: Everything You Need to Know

Executive Summary

This seventy brokers review shows serious problems with an unregulated broker that creates big risks for traders. Seventy Brokers works without proper rules and has unclear business practices that make it hard to trust, leading to a very negative review overall. Reports from brokers-exchange.com say this broker is "quite a confusing broker" with unclear legal status and possible fake characteristics.

The platform gives traders access to forex, commodities, stock CFDs, and index CFDs, plus they have a digital way to open accounts. But these few good points are much smaller than the big problems with rules and honesty. This seventy brokers review is for traders who want high leverage and many trading options, but you should be very careful because it's not regulated and users give bad reviews.

Looking at public information and what users say, the broker's trustworthiness is very questionable. Users worry about service quality and whether the company is honest.

Important Notice

Seventy Brokers operates from multiple places around the world. They say they're registered in Vanuatu but claim their main office is in Singapore. This setup across different countries may create rule gaps and legal uncertainties for people who trade with them.

The difference between where they're registered and where they say they operate raises more concerns about honesty. This review looks at user feedback and public information that anyone can see. Since the broker doesn't share much information, some details are missing from what the public can find.

Rating Framework

Broker Overview

Seventy Brokers started in online trading around 2018. Some sources say they registered in Vanuatu in 2016, which makes their history confusing. The company says it provides investment trading services, but their business structure is unclear with different information about where they're registered and where they operate.

The broker works mainly through the internet and focuses on regular traders who want leveraged trading across many types of assets. Available information shows that Seventy Brokers targets traders who want access to forex, commodities, and CFD markets, but users have criticized their actual service. The platform focuses on digital access with a completely digital account opening process, but they don't share details about their trading platform.

The broker's business seems to focus on CFD trading across forex, commodities, stock indices, and individual stock CFDs. However, they don't clearly explain how they execute trades or set prices. This seventy brokers review finds that the company is registered in Vanuatu but claims to operate from Singapore, creating a complex legal structure that may affect oversight and trader protection.

Regulatory Jurisdiction: Seventy Brokers operates without proper oversight and is registered in Vanuatu where financial rules are much less strict. This unregulated status creates big transparency problems and reliability concerns for potential traders.

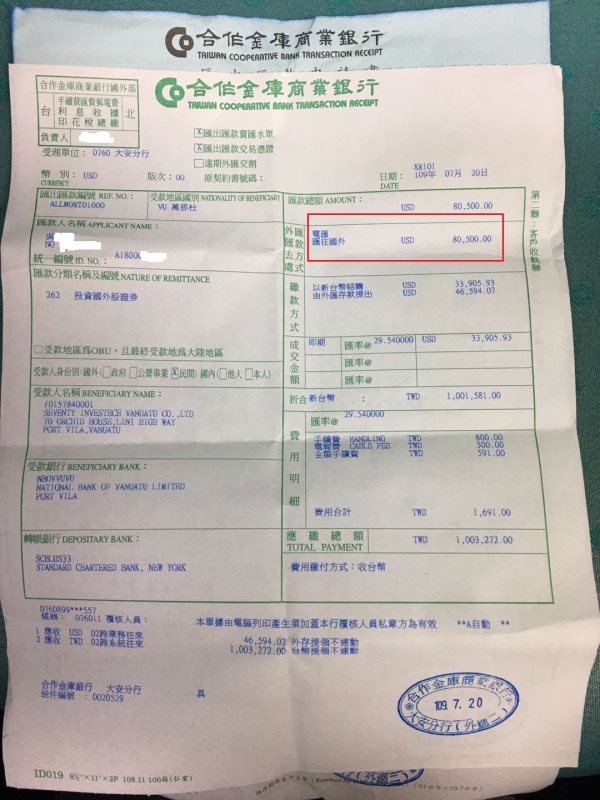

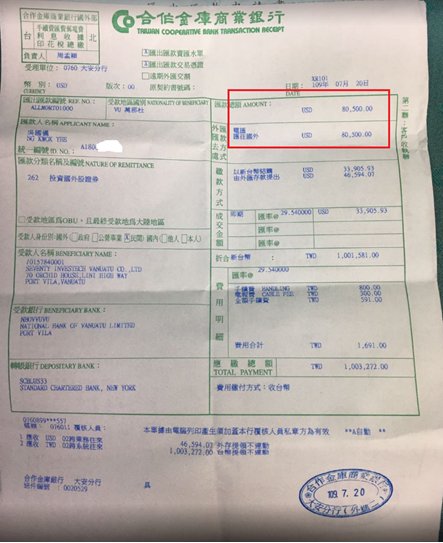

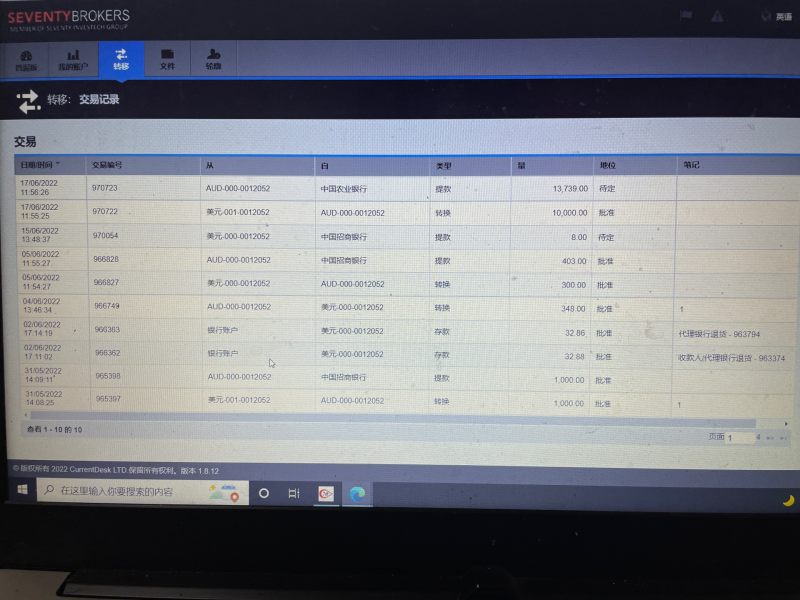

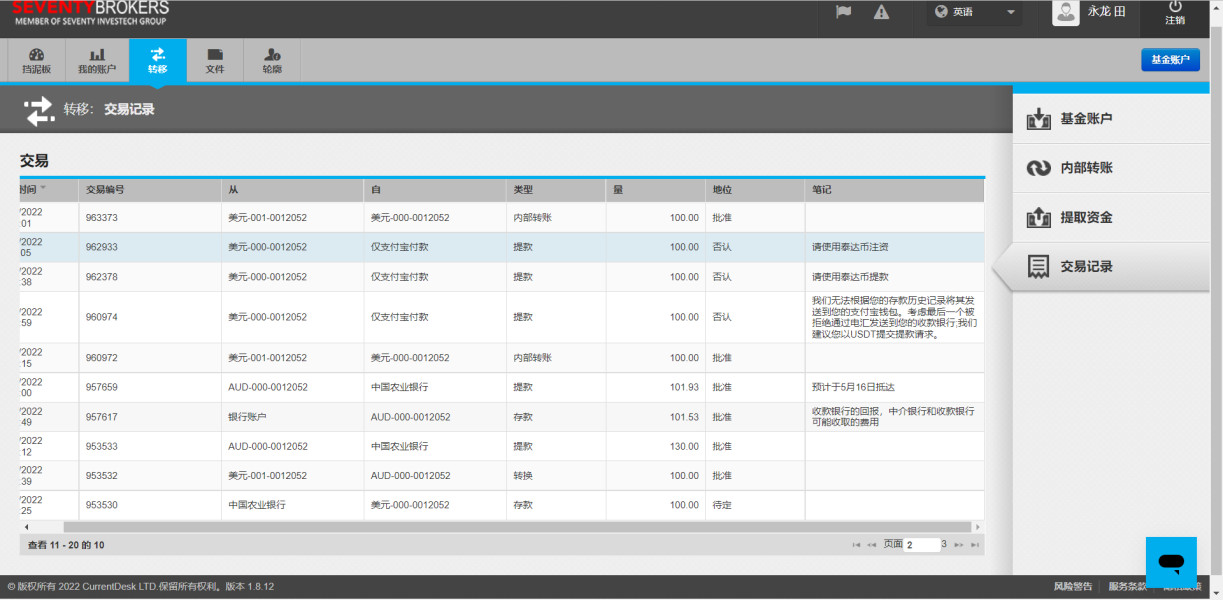

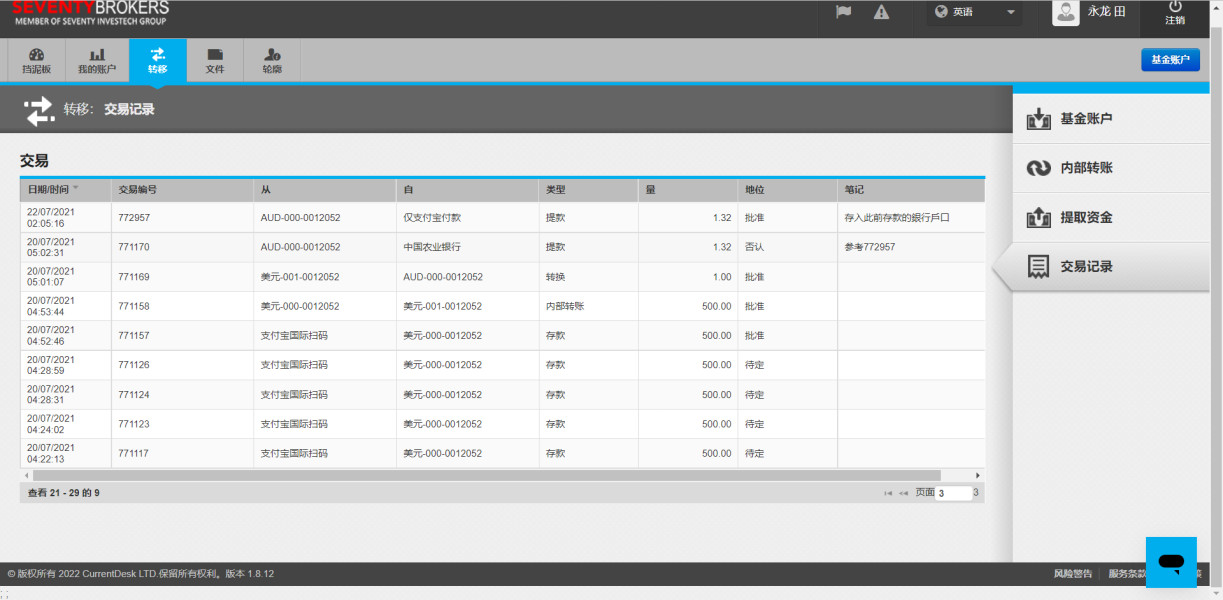

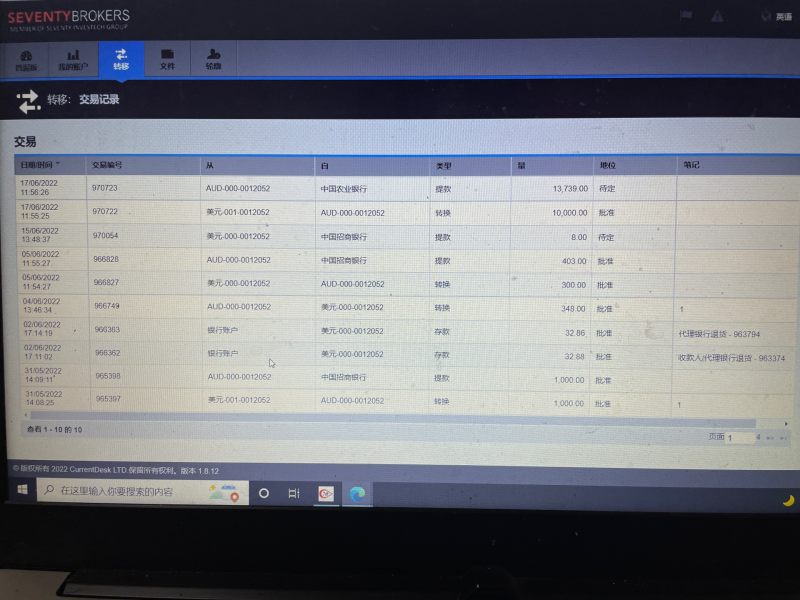

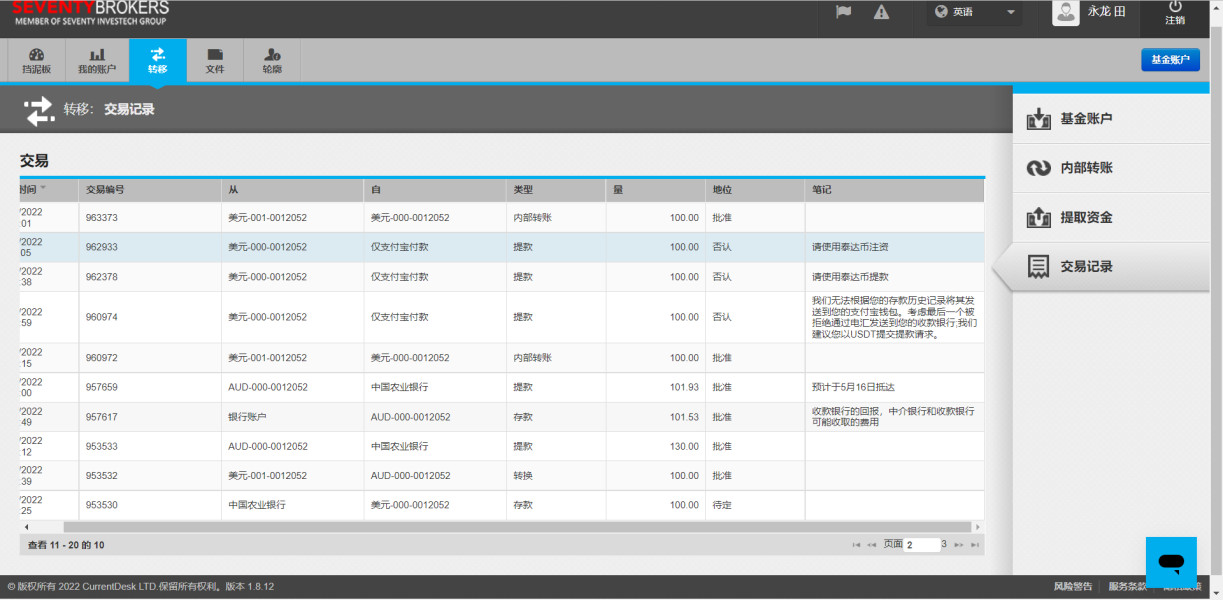

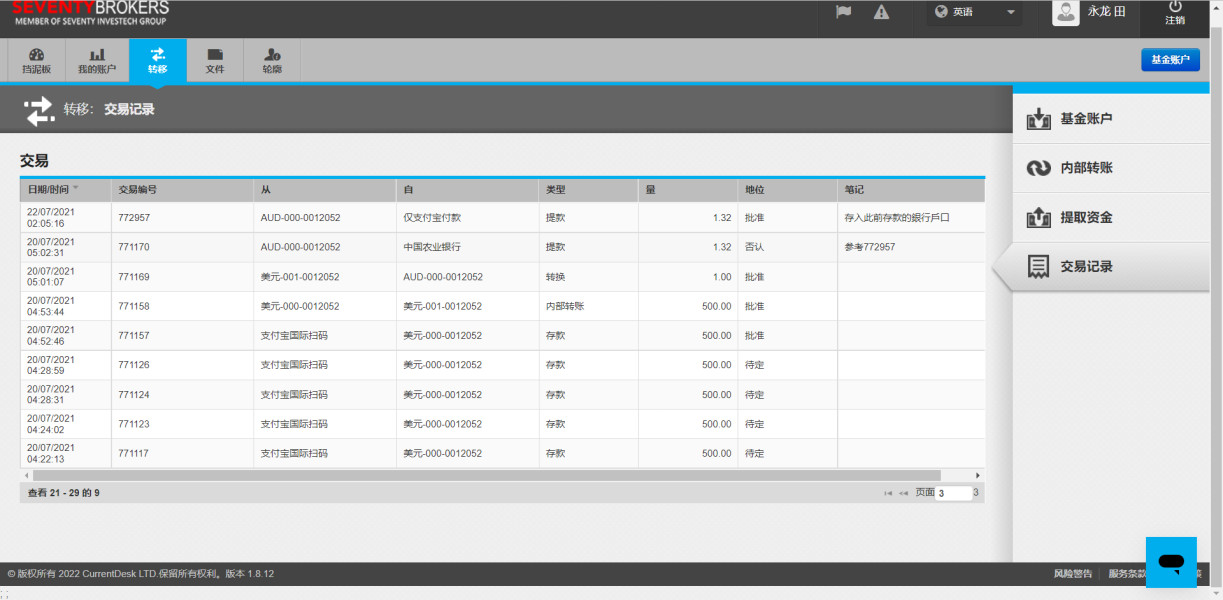

Deposit and Withdrawal Methods: The broker doesn't give specific information about how to deposit and withdraw money in public materials. This represents a significant transparency gap.

Minimum Deposit Requirements: The broker hasn't shared minimum deposit requirements in accessible documents. This makes it hard for traders to know entry barriers.

Bonus and Promotions: No information about promotional offers or bonus structures is available in current public materials.

Tradeable Assets: The platform gives access to forex pairs, commodity CFDs, stock CFDs, and index CFDs. This offers reasonable asset variety despite other operational concerns.

Cost Structure: Specific spread and commission information is not publicly available. Users express concerns about hidden costs and unclear fee structures.

Leverage Ratios: The broker mentions offering high leverage options but doesn't share specific leverage multiples in available materials.

Platform Options: They don't provide detailed information about specific trading platforms like MT4 or MT5 in accessible documents.

Regional Restrictions: Geographic trading restrictions are not specified in available public information.

Customer Service Languages: They don't detail supported customer service languages in current accessible materials.

This seventy brokers review highlights significant information gaps that raise concerns about operational transparency and trader protection.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Account conditions at Seventy Brokers get a poor rating because of serious transparency issues and lack of detailed information. Available materials don't specify account types, their features, or differences between various account levels. This absence of clear account structure information makes it impossible for traders to make informed decisions about which account might suit their trading needs.

The minimum deposit requirements remain undisclosed. This creates uncertainty about entry barriers for new traders. The broker offers a completely digital account opening process, but user feedback suggests concerns about the overall account management experience.

The lack of information about special account features, such as Islamic accounts for Muslim traders, further limits accessibility. User reviews show dissatisfaction with account conditions, though specific details about spreads, commissions, or account maintenance fees are not publicly available. This seventy brokers review finds that the broker's failure to provide transparent account information significantly undermines trader confidence and decision-making capabilities.

The absence of clear account documentation and terms represents a major red flag for potential traders seeking transparent and professional brokerage services.

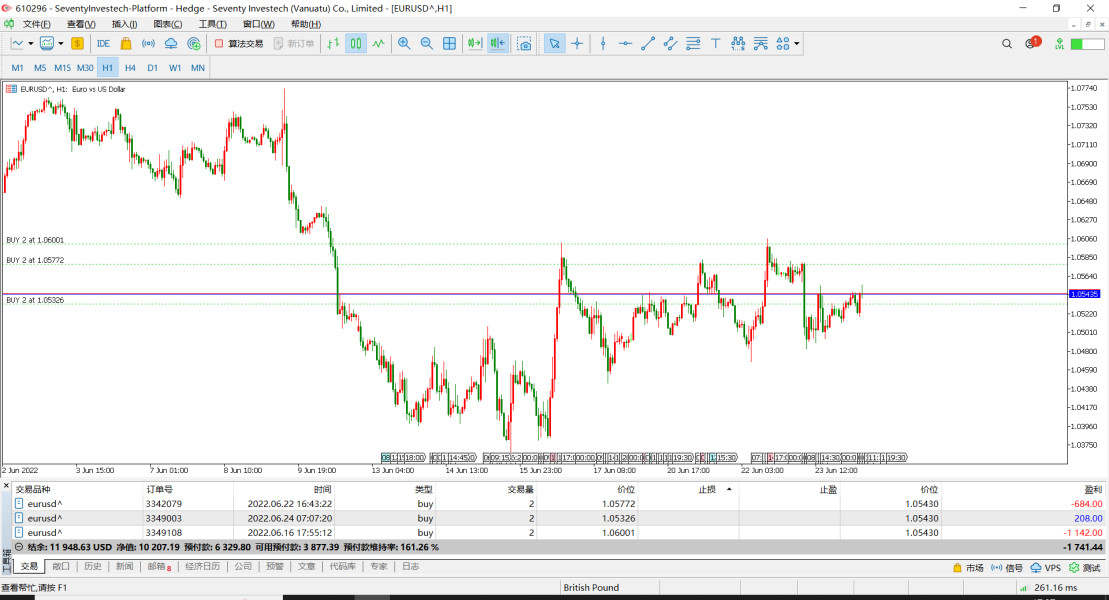

Seventy Brokers offers a moderate selection of trading instruments including forex, commodities, stock CFDs, and index CFDs. This provides reasonable asset diversity for traders. This variety allows traders to diversify their portfolios across different market sectors, which represents one of the broker's few positive aspects.

However, the quality and depth of trading tools remain unclear due to limited public information. The broker hasn't disclosed details about analytical resources, market research capabilities, or educational materials that might support trader development.

Advanced trading features such as automated trading support, expert advisors, or algorithmic trading capabilities are not mentioned in available documentation. The absence of detailed information about research and analysis resources limits traders' ability to make informed decisions. Professional traders often require comprehensive market analysis, economic calendars, and technical analysis tools, none of which are clearly documented as available through this broker.

While the asset class diversity provides some value, the overall tools and resources package appears limited compared to regulated brokers who typically provide extensive educational materials, market analysis, and trading support tools.

Customer Service and Support Analysis (Score: 2/10)

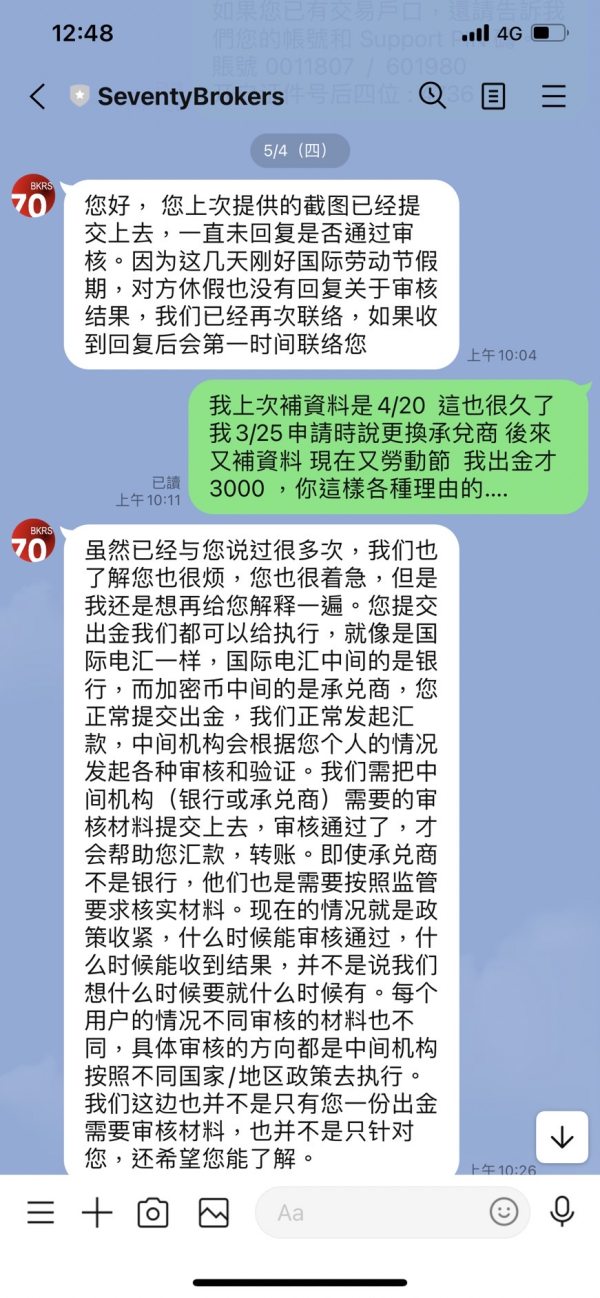

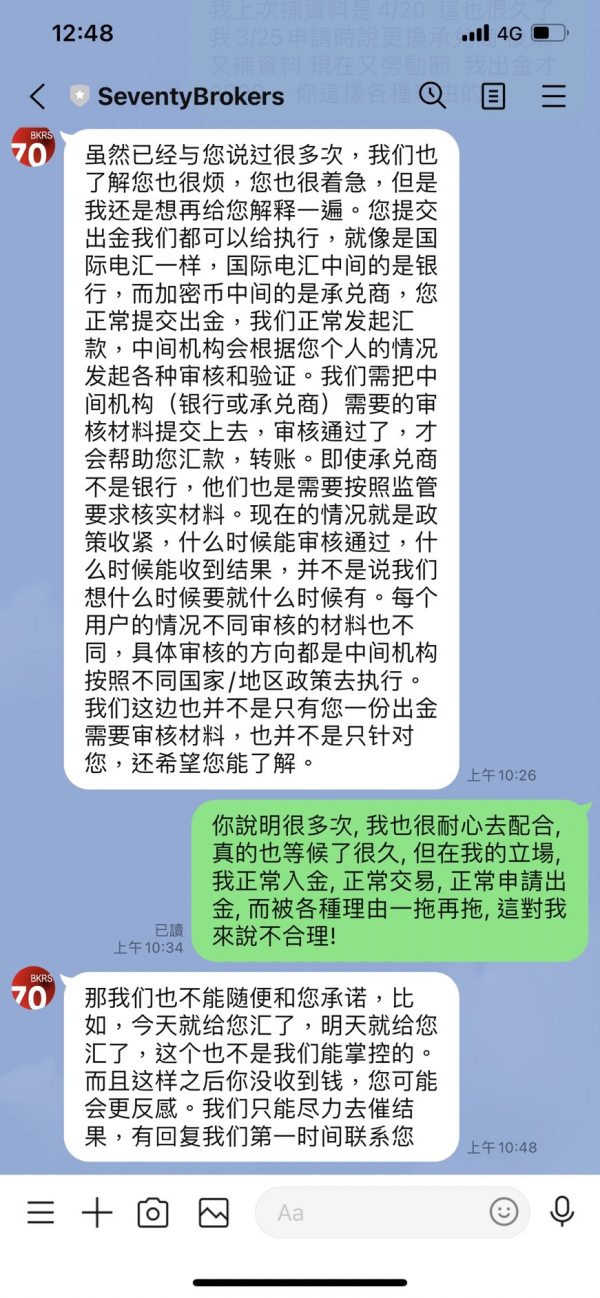

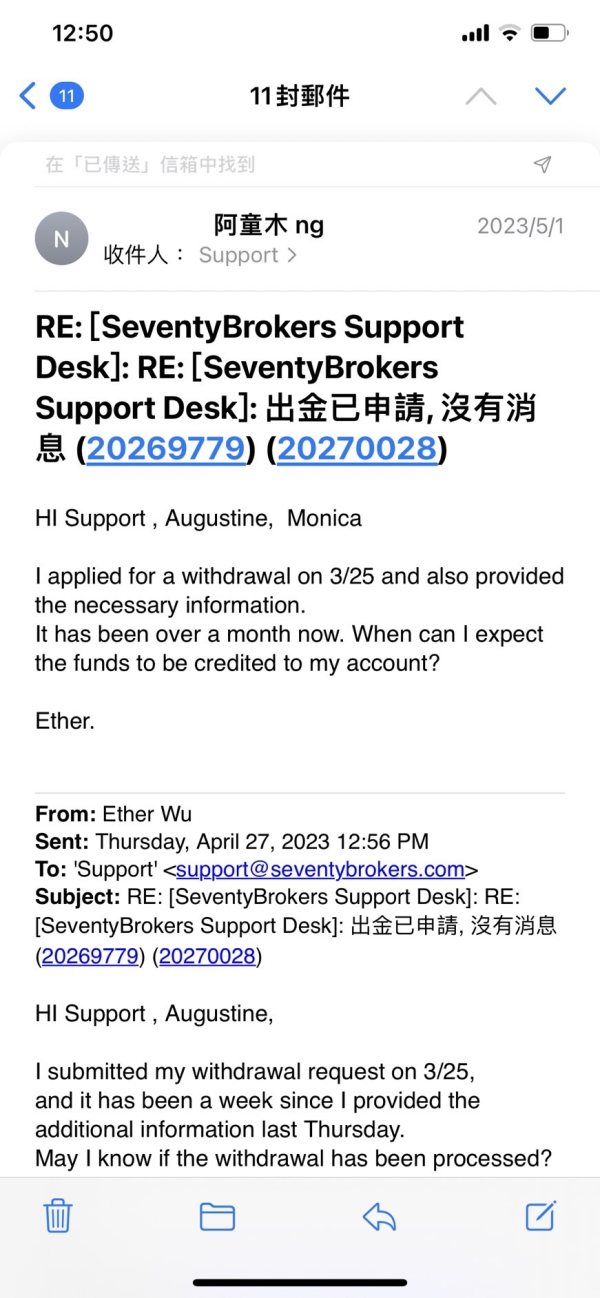

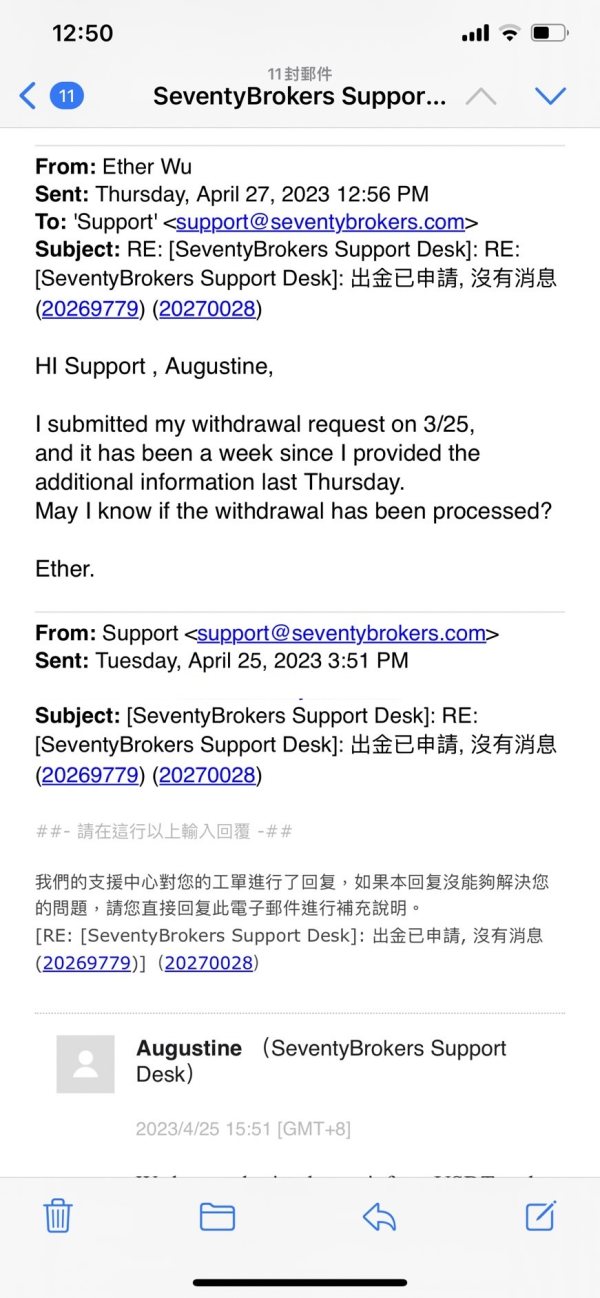

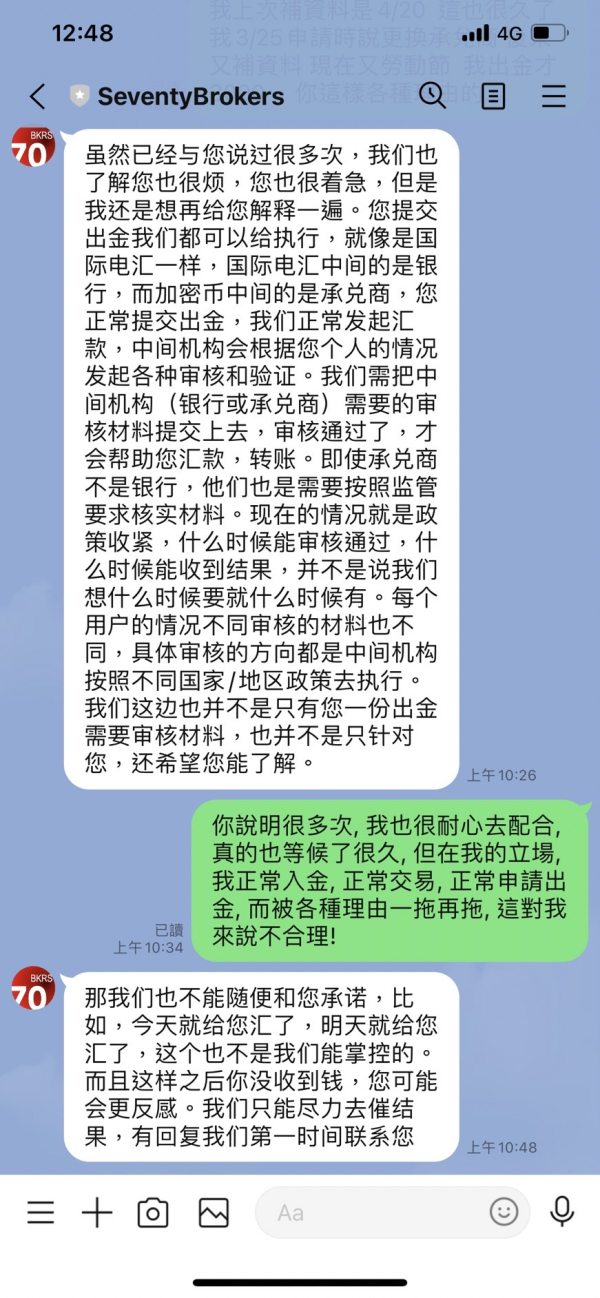

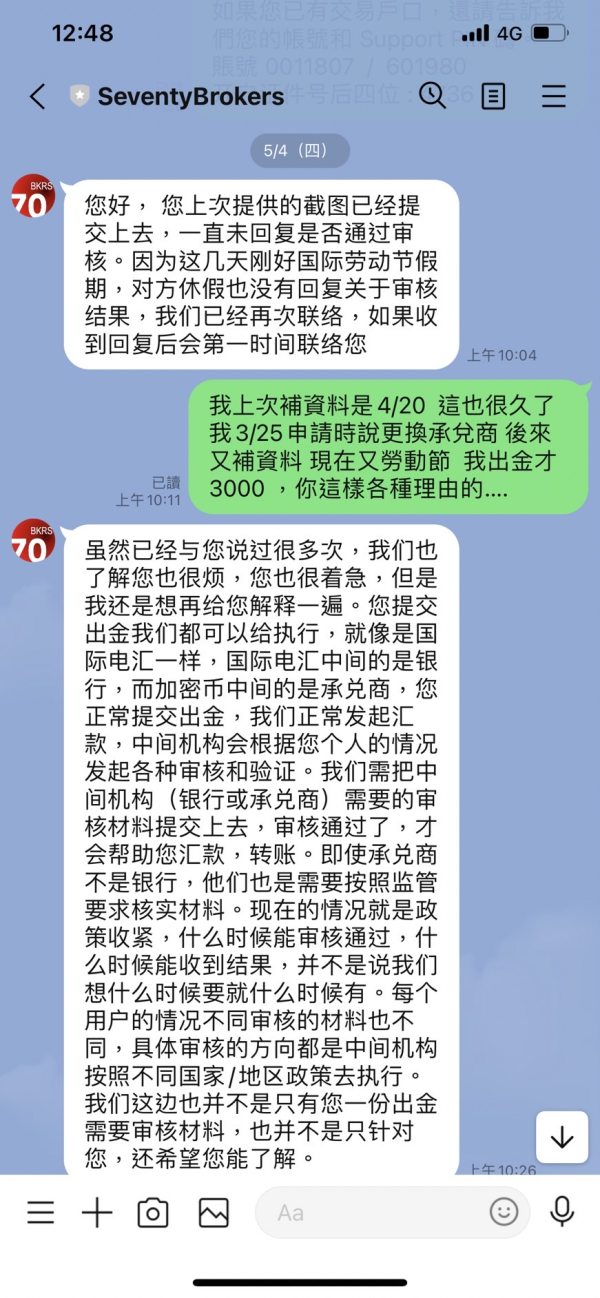

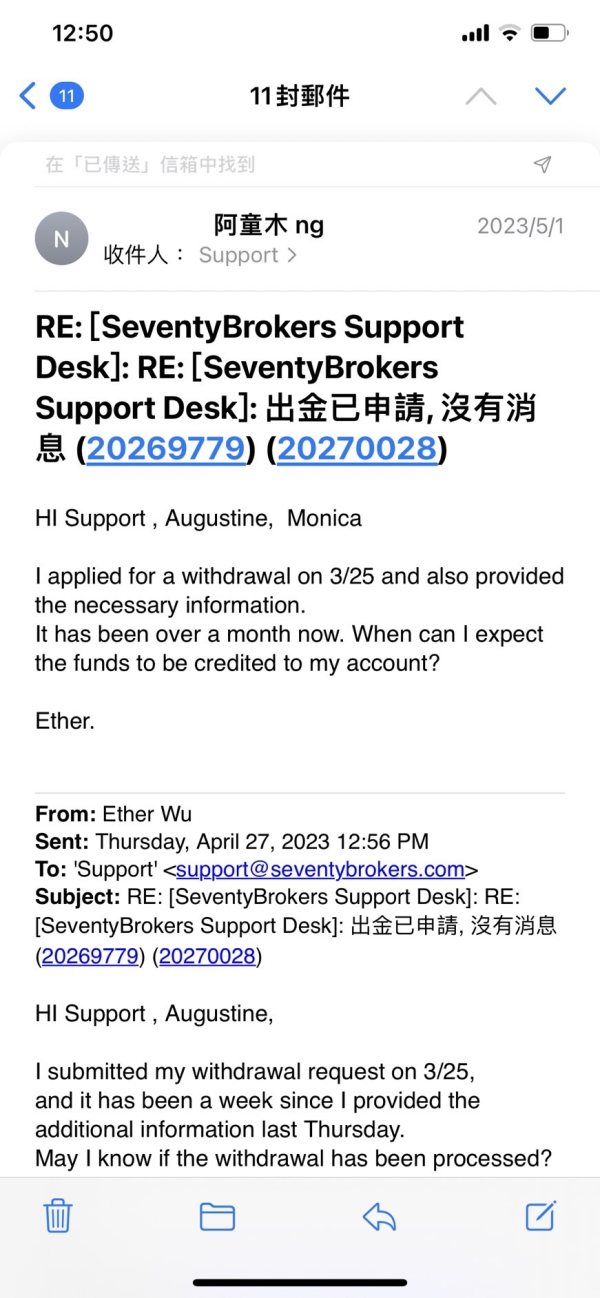

Customer service represents one of Seventy Brokers' weakest areas. Users consistently report poor experiences and reliability concerns. Available user feedback indicates widespread dissatisfaction with support quality, response times, and problem resolution capabilities.

The broker hasn't disclosed specific customer service channels, operating hours, or response time guarantees. This creates uncertainty about support accessibility. Multi-language support options are not specified, potentially limiting service accessibility for international traders.

User testimonials suggest significant problems with customer service responsiveness and effectiveness. Traders report difficulties in getting timely responses to inquiries and concerns about the quality of support provided when issues arise.

The lack of transparent communication channels and support procedures adds to user frustration. This poor customer service performance is particularly concerning for an unregulated broker, as traders have limited recourse options when service problems occur. The absence of regulatory oversight means traders cannot escalate complaints to financial authorities, making reliable customer service even more critical.

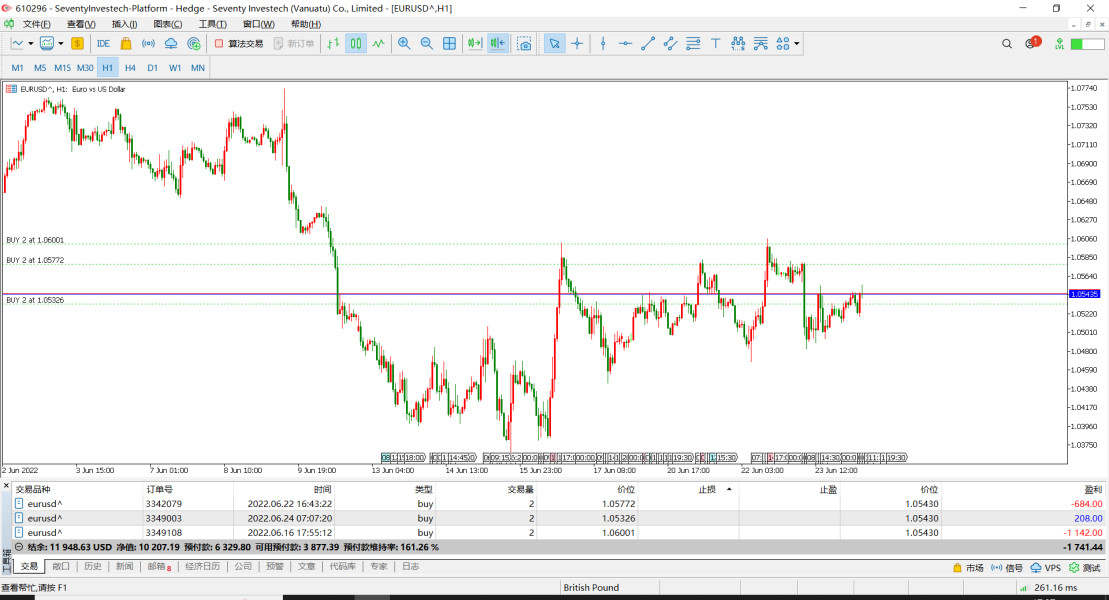

Trading Experience Analysis (Score: 5/10)

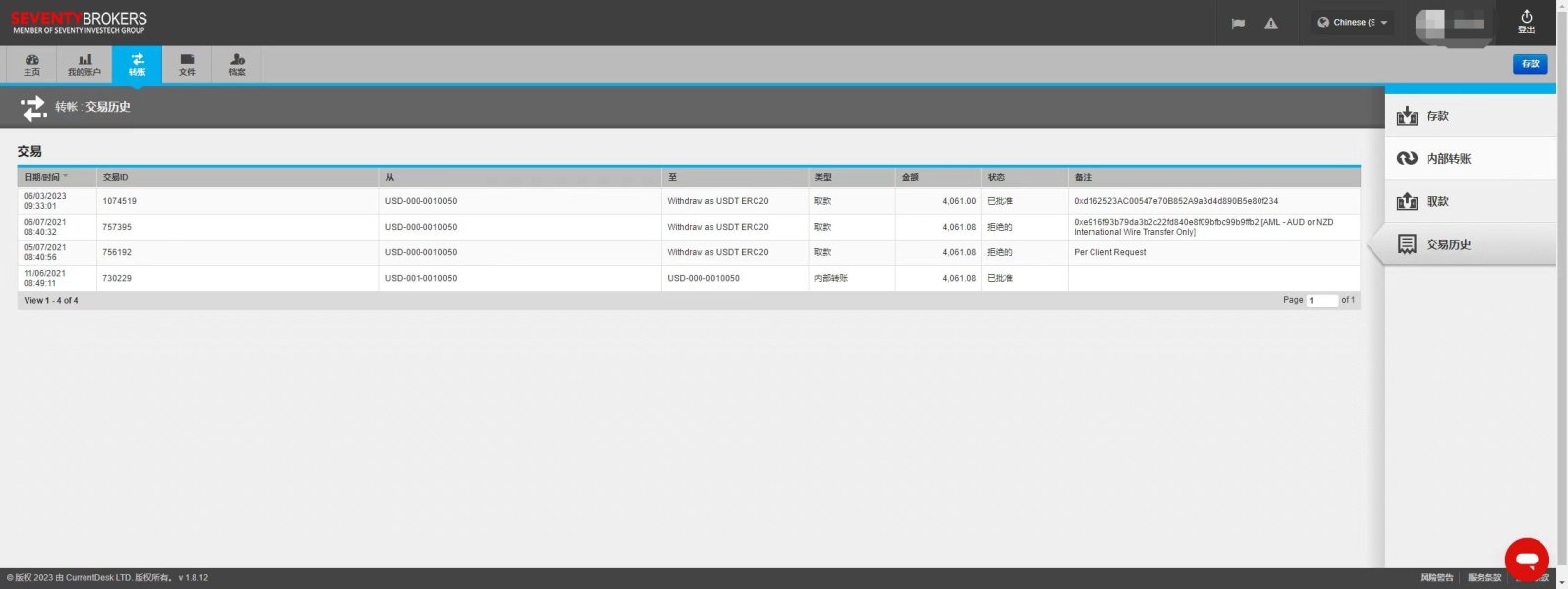

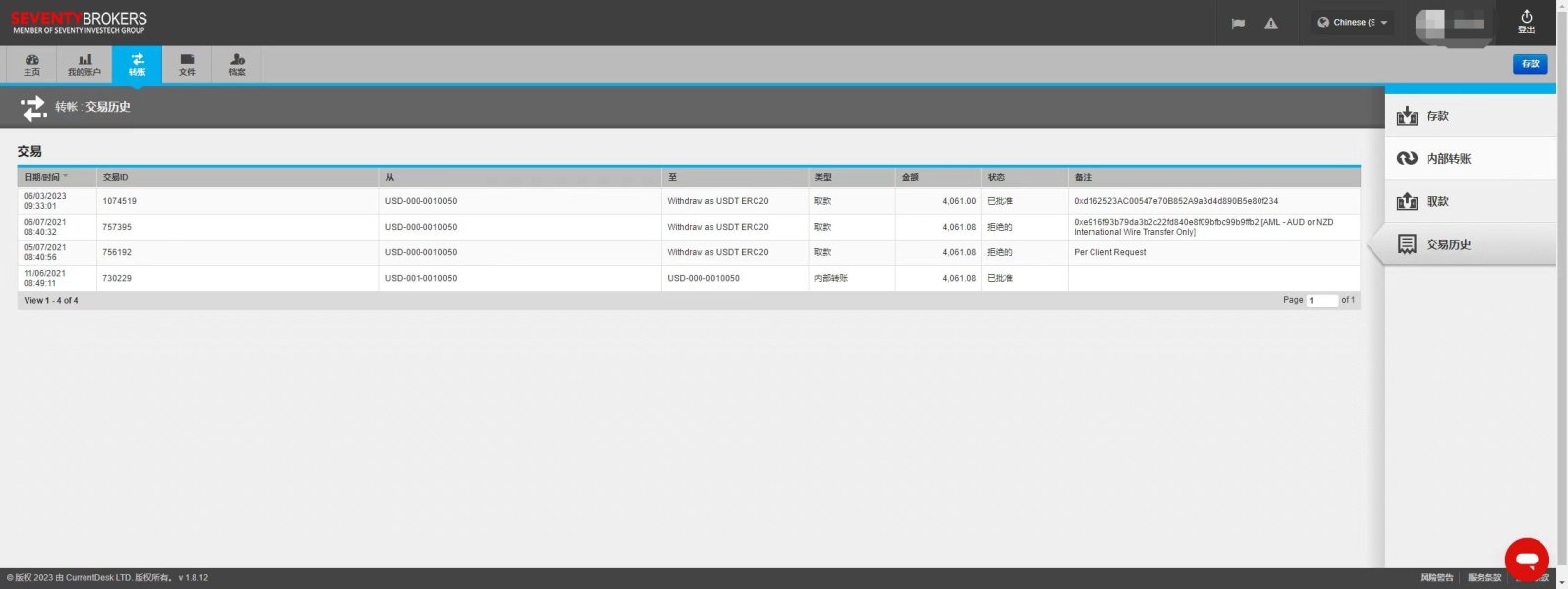

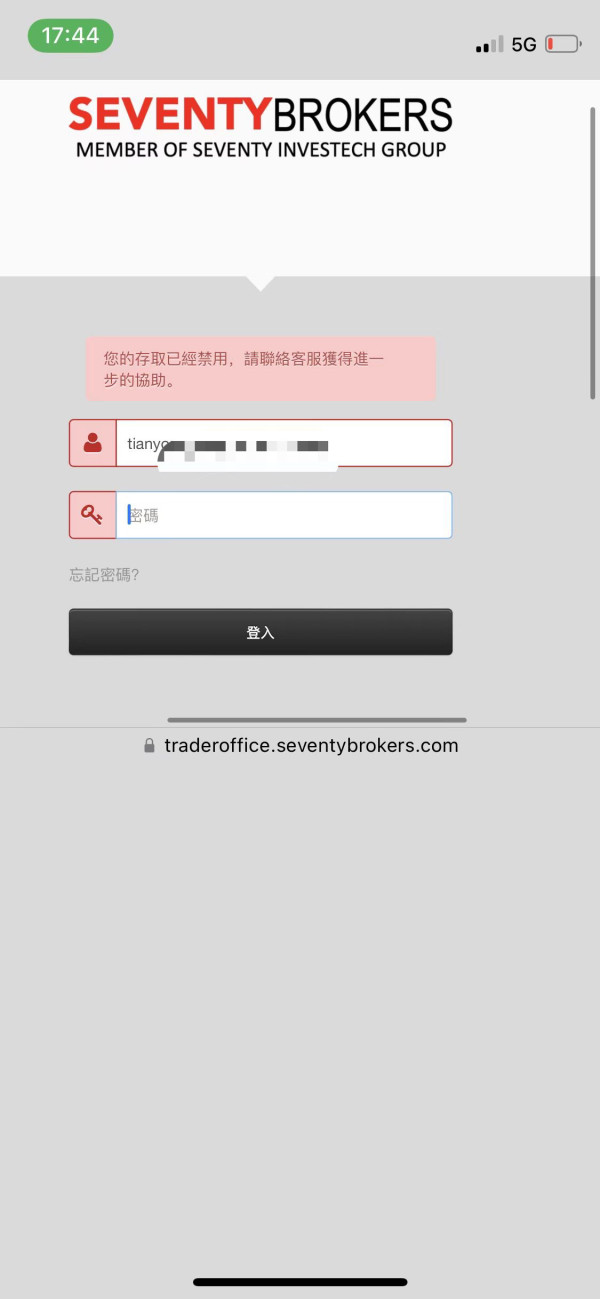

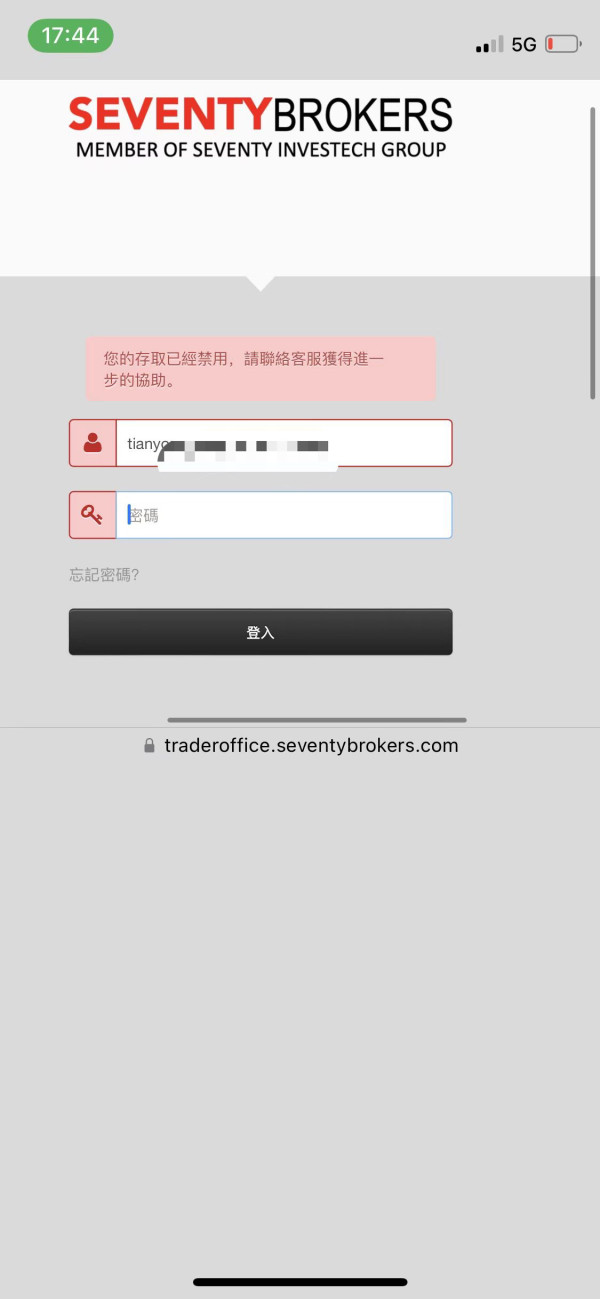

The trading experience at Seventy Brokers receives a below-average rating due to limited transparency about platform functionality and mixed user feedback. The broker offers digitized account opening, but specific details about trading platform stability, execution speed, and order processing quality are not publicly available. Information about slippage rates, requote frequency, and execution quality is not disclosed, making it difficult to assess the actual trading environment.

Platform functionality completeness, including charting capabilities, order types, and analytical tools, remains unclear from available documentation. Mobile trading experience details are not specified, though mobile accessibility is increasingly important for modern traders.

The absence of information about mobile app features, performance, and reliability represents a significant information gap. Users haven't provided detailed feedback about trading experience specifics, though overall user satisfaction appears limited based on general negative reviews. The lack of transparent information about trading conditions, combined with the unregulated status, creates uncertainty about execution quality and trading environment stability.

This seventy brokers review notes that trading experience assessment is hampered by limited transparency from the broker regarding platform capabilities and performance metrics.

Trust and Reliability Analysis (Score: 2/10)

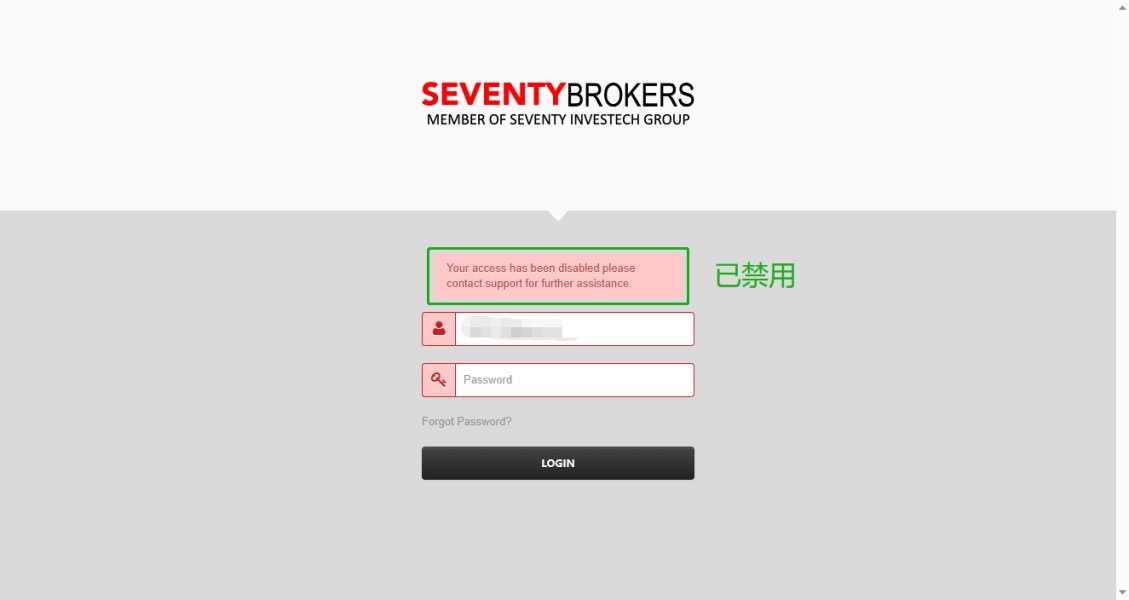

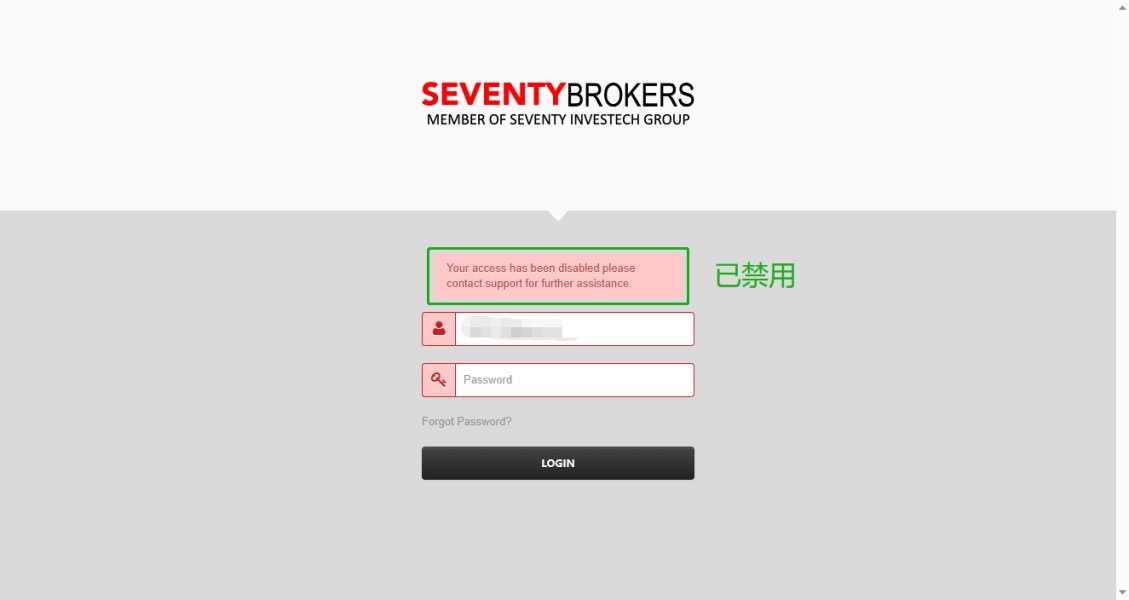

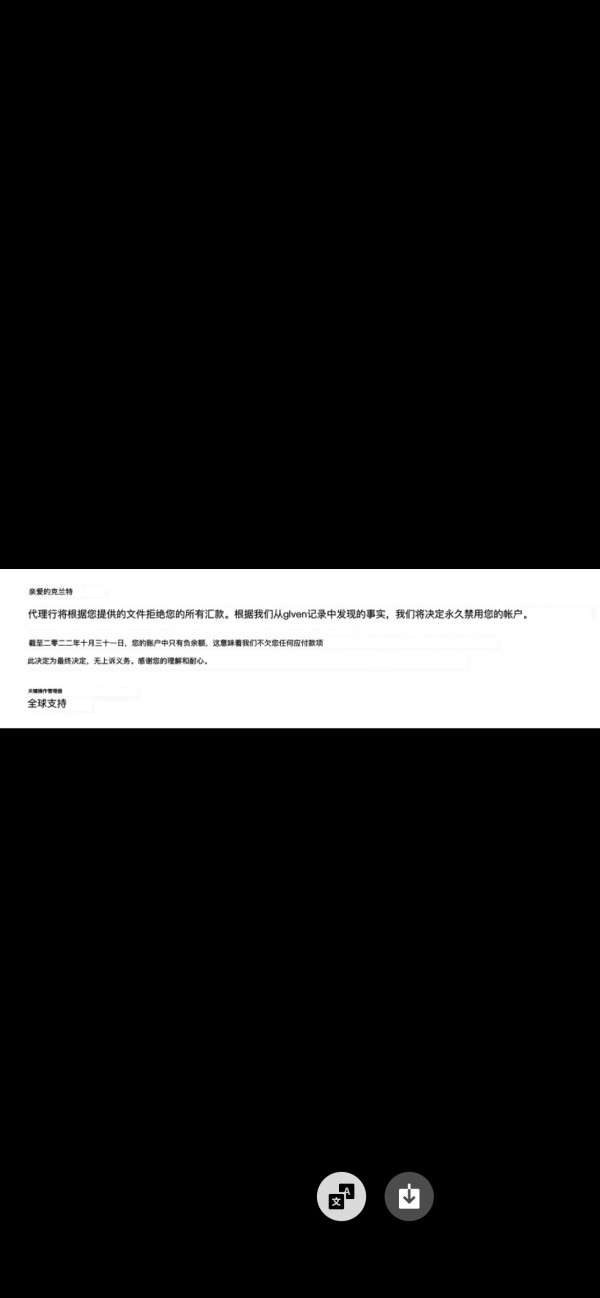

Trust and reliability represent Seventy Brokers' most significant weaknesses. They earn the lowest possible rating due to fundamental regulatory and transparency concerns. The broker operates without proper regulatory oversight, creating substantial risks for trader fund safety and dispute resolution.

The unregulated status means no external authority monitors the broker's operations, fund handling, or business practices. This absence of regulatory supervision eliminates important trader protections such as compensation schemes, segregated client accounts, and independent oversight of business operations.

Reports suggest potential clone broker characteristics. This raises serious concerns about the company's legitimacy and operational integrity. The confusion surrounding registration locations and operational headquarters further undermines credibility and transparency.

Fund safety measures such as segregated client accounts or insurance protection are not documented in available materials. The lack of clear information about how client funds are protected represents a major risk factor for potential traders.

Company transparency is notably poor, with limited disclosure about management, operational procedures, or financial standing. This opacity, combined with the unregulated status, creates an environment where trader interests may not be adequately protected.

User Experience Analysis (Score: 3/10)

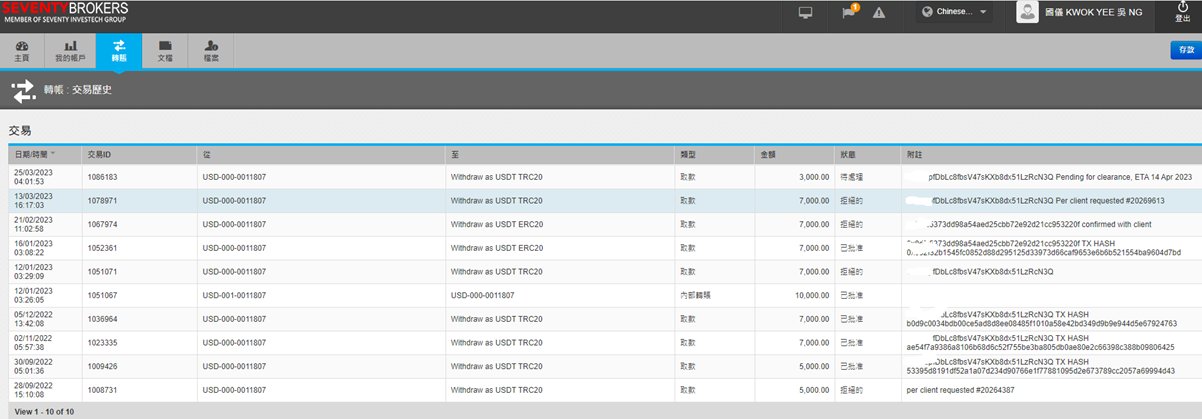

Overall user satisfaction with Seventy Brokers is notably poor. Users give widespread negative feedback about service reliability and operational transparency. Users consistently express concerns about the broker's trustworthiness and service quality, creating a pattern of dissatisfaction.

The digitized account opening process represents one of the few positive user experience elements. Even this advantage is overshadowed by subsequent service issues. User interface design and platform usability information is not available in public materials, limiting assessment of day-to-day user experience quality.

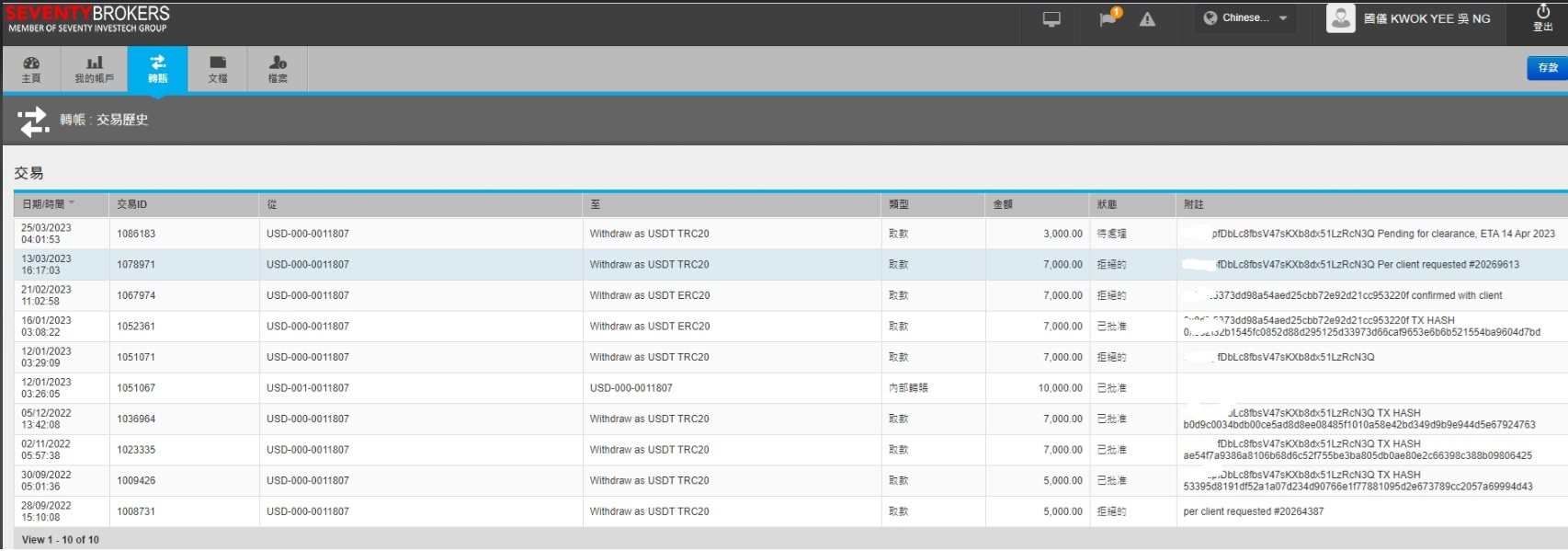

Registration and verification processes may be streamlined through digital channels, but user feedback suggests concerns about subsequent account management and service delivery. The absence of detailed information about fund operation experiences, including deposit and withdrawal convenience and processing times, creates uncertainty about practical usability.

Common user complaints focus on service reliability concerns and transparency issues. The pattern of negative feedback suggests systemic problems with service delivery and customer satisfaction. Users seeking high leverage and diverse trading instruments might initially be attracted to the broker's offerings, but should carefully consider the reliability risks highlighted in user testimonials.

The combination of poor customer service, limited transparency, and regulatory concerns creates a challenging user experience that falls well below industry standards for professional brokerage services.

Conclusion

This comprehensive seventy brokers review concludes with a negative overall assessment due to fundamental regulatory and transparency concerns. Seventy Brokers is an unregulated broker with poor user service feedback and limited operational transparency that presents significant risks outweighing any potential benefits. The broker offers diverse asset classes including forex, commodities, and CFDs along with a digitized account opening process, but these limited advantages cannot compensate for the absence of regulatory oversight and poor user satisfaction patterns.

The broker might appeal to traders seeking high leverage and multiple trading instruments. However, the unregulated nature and reliability concerns make it an unsuitable choice for serious traders. The main advantages include asset class diversity and digital accessibility, while significant disadvantages include regulatory absence, poor customer service, limited transparency, and negative user feedback patterns.

Traders are strongly advised to consider regulated alternatives that provide proper oversight, transparent operations, and reliable customer protection mechanisms.