Is ADO Trading safe?

Business

License

Is ADO Trading A Scam?

Introduction

ADO Trading is a forex broker that has recently garnered attention in the trading community. With claims of offering a wide range of financial instruments, including over 75 currency pairs, stocks, commodities, and precious metals, ADO Trading positions itself as a viable option for traders looking to enter the forex market. However, the importance of thoroughly evaluating forex brokers cannot be overstated, especially in an industry rife with scams and unregulated entities. Traders must ensure that they choose brokers with a solid regulatory framework, transparent operations, and a good reputation among users. This article aims to provide a comprehensive analysis of ADO Trading, assessing its safety, legitimacy, and overall reliability based on various sources and evaluation criteria.

Regulation and Legitimacy

Regulation is a cornerstone of a broker's legitimacy and safety. ADO Trading claims to be licensed in the Marshall Islands; however, the validity of this claim is questionable. Many sources indicate that ADO Trading operates without proper regulatory oversight, which raises significant red flags. The absence of a reputable regulatory body can expose traders to higher risks, including potential fraud and mismanagement of funds.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Marshall Islands | 107756 | Marshall Islands | Suspicious |

The lack of a credible regulatory framework raises concerns about the quality of services provided by ADO Trading. A broker regulated by a top-tier authority ensures that clients' funds are protected and that the broker adheres to strict operational standards. Unfortunately, ADO Trading's claims of regulation appear dubious, which is a significant factor for traders to consider when evaluating whether ADO Trading is safe.

Company Background Investigation

ADO Trading Investment Limited was incorporated in the Marshall Islands and has been operating for approximately 2 to 5 years. However, the company's history is sparse, and there is limited information available regarding its ownership structure or the backgrounds of its management team. This lack of transparency weakens the trustworthiness of the broker.

The management teams qualifications and experience play a crucial role in the overall credibility of a brokerage. ADO Trading does not provide sufficient information about its leadership, which is concerning. Companies that are transparent about their team often foster greater trust among clients. The absence of clear information regarding ADO Trading's operations and management further fuels skepticism about whether ADO Trading is safe for potential clients.

Trading Conditions Analysis

When assessing a broker, understanding the trading conditions is essential. ADO Trading claims to offer competitive spreads and a low minimum deposit of $100, which may seem appealing to new traders. However, the lack of clarity regarding specific spreads and commissions is troubling.

| Fee Type | ADO Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | Typically 0.1 - 1.5 pips |

| Commission Model | Not Specified | Varies by broker |

| Overnight Interest Range | Not Specified | Varies by broker |

The absence of detailed information about fees and commissions can lead to unexpected costs for traders. Moreover, high leverage ratios of up to 1:1000 can amplify both gains and losses, increasing the risk profile significantly. Traders should approach ADO Trading with caution, as unclear fee structures may indicate potential hidden costs, leading to the question: Is ADO Trading a scam?

Client Fund Security

Client fund security is paramount in determining a broker's reliability. ADO Trading's website does not provide clear information about its fund security measures, such as whether client funds are held in segregated accounts or if there are any investor protection schemes in place.

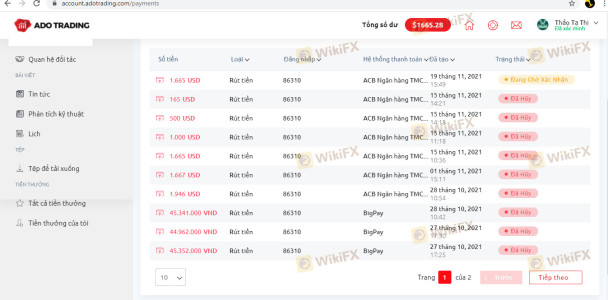

Without robust security measures, traders run the risk of losing their investments. Historical issues related to fund security, such as withdrawal problems or mismanagement of client funds, can severely damage a broker's reputation. Unfortunately, ADO Trading has not demonstrated a strong commitment to fund security, which raises further concerns about whether ADO Trading is safe for potential investors.

Customer Experience and Complaints

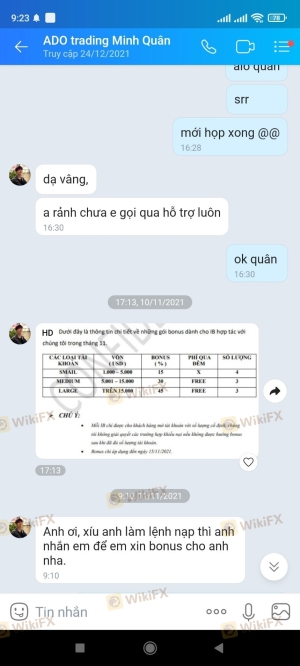

Customer feedback is an invaluable resource when assessing a broker's reputation. ADO Trading has received mixed reviews, with some users reporting positive experiences, while others have voiced significant complaints. Common issues include difficulties with withdrawals and inadequate customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or no response |

| Customer Support | Medium | Limited contact options |

Two notable cases highlight these concerns: one trader reported being unable to withdraw funds for several weeks, while another faced challenges in receiving timely responses from customer support. These complaints suggest that ADO Trading may not prioritize customer service, leading to a negative overall experience. This further fuels the skepticism surrounding the question of whether ADO Trading is safe.

Platform and Execution

The trading platform offered by ADO Trading is reportedly based on the widely used MetaTrader 5 (MT5). While MT5 is known for its advanced features and user-friendly interface, the performance of ADO Trading's platform remains uncertain. Users have expressed concerns regarding order execution quality, including instances of slippage and rejected orders.

A broker's ability to execute trades efficiently is crucial for traders, especially in a volatile market. If ADO Trading's platform is prone to issues, it could hinder traders' ability to execute their strategies effectively. The potential for platform manipulation or poor execution raises further doubts about whether ADO Trading is safe for traders.

Risk Assessment

Using ADO Trading presents various risks that traders should be aware of. The lack of regulatory oversight, unclear fee structures, and customer complaints contribute to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No credible regulation |

| Financial Risk | Medium | Unclear fees and potential hidden costs |

| Operational Risk | High | Complaints about execution and withdrawals |

To mitigate these risks, traders should conduct thorough research, consider starting with a small deposit, and remain vigilant regarding their trading activities. It is crucial to stay informed about any developments related to ADO Trading to ensure that they do not become victims of fraud or mismanagement.

Conclusion and Recommendations

In conclusion, the evidence suggests that ADO Trading raises several red flags that warrant caution. The lack of credible regulation, transparency issues, and a history of customer complaints lead to serious concerns about whether ADO Trading is safe. Traders should be wary of engaging with ADO Trading and consider alternative options that have proven regulatory oversight and a solid reputation.

For those seeking reliable forex trading opportunities, brokers regulated by top-tier authorities such as the FCA, ASIC, or NFA are recommended. These brokers typically offer better protection for client funds, more transparent fee structures, and a commitment to customer service. Ultimately, ensuring the safety of your investments should always be a priority when selecting a forex broker.

Is ADO Trading a scam, or is it legit?

The latest exposure and evaluation content of ADO Trading brokers.

ADO Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ADO Trading latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.