Is FXZANK safe?

Business

License

Is FXZANK Safe or a Scam?

Introduction

FXZANK is a forex broker that positions itself within the competitive landscape of online trading, offering various financial instruments to traders. As the forex market continues to grow, with daily trading volumes exceeding $7 trillion, the importance of selecting a trustworthy broker cannot be overstated. Traders must exercise caution, as the landscape is rife with unregulated entities and potential scams that can lead to significant financial losses. This article aims to provide an objective analysis of FXZANK, evaluating its safety and legitimacy through regulatory scrutiny, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining the safety of any forex broker. Regulation serves as a safeguard for traders, ensuring that the broker adheres to strict operational guidelines and provides a level of investor protection. Upon investigation, it was found that FXZANK operates without any valid regulatory oversight, which raises significant concerns.

| Regulatory Authority | License Number | Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that FXZANK does not fall under the jurisdiction of any recognized financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This lack of oversight can lead to practices that are detrimental to traders, including the potential for fraud and the mishandling of funds. Historical compliance issues, if any, cannot be assessed due to the absence of a regulatory framework. Therefore, it is imperative for traders to consider this lack of regulation when asking, "Is FXZANK safe?"

Company Background Investigation

FXZANK, operating under the name Zank International Ltd., has a somewhat obscure history and ownership structure. Information regarding the company's establishment and operational history is limited, which raises red flags about its transparency. The management team behind FXZANK lacks publicly available information that would typically provide insights into their qualifications and experience in the financial services sector.

The companys transparency is further compromised by the use of a private registration service to conceal ownership details. This practice is often associated with less reputable entities, as it prevents potential clients from conducting thorough due diligence. In the absence of clear information regarding the management team and ownership, traders may find themselves questioning the legitimacy of FXZANK. Thus, the question "Is FXZANK safe?" becomes increasingly pertinent.

Trading Conditions Analysis

FXZANK claims to offer competitive trading conditions, including various account types with different minimum deposit requirements. However, the overall cost structure and fee policies warrant closer examination.

| Fee Type | FXZANK | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.4 pips (Classic) | 1.0 pips |

| Commission Model | Zero commissions on Classic and Pro accounts | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by FXZANK are higher than the industry average, particularly for the Classic account. Additionally, the lack of transparency surrounding commission structures raises concerns. Traders have reported instances of unexpected fees, which can significantly impact profitability. These unusual fee policies, combined with the absence of regulation, suggest that traders should approach FXZANK with caution when considering the question: "Is FXZANK safe?"

Customer Fund Safety

The security of customer funds is paramount in the forex trading environment. FXZANK's lack of regulatory oversight raises serious concerns about the safety of client deposits. The absence of measures like fund segregation and negative balance protection can expose traders to significant risks.

Without a regulatory framework, there is no guarantee that FXZANK will adhere to best practices in fund management. Historical instances of financial misconduct, such as withdrawal restrictions and the imposition of unexpected fees, have been reported by users, further highlighting the precarious nature of trading with this broker. In light of these factors, the question "Is FXZANK safe?" remains unanswered, leaning towards a negative assessment.

Customer Experience and Complaints

Customer feedback regarding FXZANK has been predominantly negative, with numerous complaints surfacing on various platforms. Common issues include difficulties in fund withdrawals, lack of responsive customer service, and unexpected fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Unexpected Fees | High | Poor |

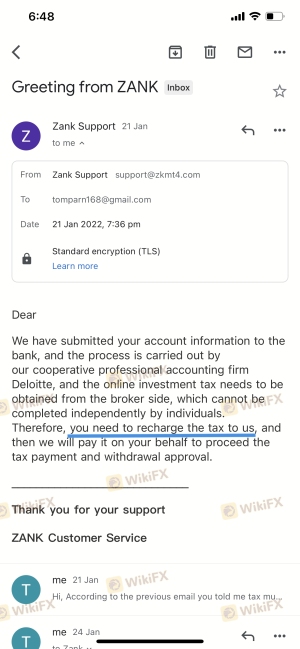

Several users have reported that upon attempting to withdraw their funds, they were met with requests for additional payments, often framed as "taxes" or "fees." Such tactics are indicative of potential scam operations, where brokers create barriers to accessing funds. These patterns of complaints further underscore the need for caution when considering FXZANK, leading us to question: "Is FXZANK safe?"

Platform and Trade Execution

The trading platform offered by FXZANK is the widely recognized MetaTrader 4 (MT4), known for its user-friendly interface and advanced trading features. However, concerns have been raised regarding the execution quality, including instances of slippage and order rejections.

Traders have reported that during high volatility, FXZANK's platform has not performed optimally, leading to execution delays and unfavorable pricing. Such issues can significantly impact a trader's strategy and profitability. The potential for platform manipulation, alongside the lack of regulation, raises further alarms about the safety of trading with FXZANK. Thus, the question "Is FXZANK safe?" becomes increasingly relevant.

Risk Assessment

Trading with FXZANK involves several inherent risks, primarily due to its lack of regulatory oversight and the numerous complaints from users.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Platform reliability concerns |

To mitigate these risks, traders are advised to conduct thorough research before engaging with FXZANK. Utilizing demo accounts, starting with minimal investments, and diversifying trading portfolios can help manage exposure to potential losses.

Conclusion and Recommendations

In conclusion, the investigation into FXZANK reveals significant concerns regarding its safety and legitimacy. The absence of regulatory oversight, coupled with negative customer experiences and ambiguous fee structures, strongly suggests that FXZANK may not be a safe trading option.

Traders should exercise extreme caution and consider alternative, well-regulated brokers that offer robust investor protections. Reliable options include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide a higher level of security and transparency. Ultimately, the question "Is FXZANK safe?" leans towards a resounding "no," and traders are recommended to seek more reputable alternatives for their forex trading needs.

Is FXZANK a scam, or is it legit?

The latest exposure and evaluation content of FXZANK brokers.

FXZANK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXZANK latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.