FNory 2025 Review: Everything You Need to Know

Executive Summary

This FNory review shows major concerns about this forex and CFD broker. Traders should think carefully before investing their money with this company. FNory started in 2022 and registered in Saint Vincent and the Grenadines, presenting itself as an easy-to-use trading platform with just $100 minimum deposit and leverage up to 1:500. Our detailed analysis uses multiple industry sources and user feedback to reveal serious red flags that need attention.

The broker targets small to medium-sized traders and high-risk investors. They use low entry barriers and aggressive leverage offerings to attract these customers. FNory advertises zero spreads and zero commission on standard accounts, but the lack of proper regulation and mostly negative user reviews create serious questions about reliability. Multiple review platforms have flagged FNory as a potentially fraudulent broker, with users reporting various issues from poor customer service to concerns about fund security.

Reports from TheForexReview and ForexBrokerz show that FNory operates under minimal regulatory supervision. This significantly impacts trader protection and safety. The broker's registration in Saint Vincent and the Grenadines, a place known for lighter regulatory requirements, makes these concerns even worse.

Important Disclaimers

Regional Entity Differences: FNory operates mainly through its Saint Vincent and the Grenadines registration. This may not comply with regulatory requirements in many places including the United States, European Union, and other major financial centers. Traders should check whether FNory is authorized to provide services in their specific country before using the platform.

Review Methodology: This analysis uses publicly available information from multiple sources including TheForexReview, ForexBrokerz, PlanetOfReviews, and ChainBits. We also used user feedback compiled from various review platforms to create this assessment. Our goal is to provide objective analysis while knowing that individual trading experiences may vary. All information was current as of the publication dates of the source materials (2021-2023).

Overall Rating Framework

Broker Overview

FNory entered the forex and CFD trading market in 2022. The company positions itself as a broker for retail traders seeking easy entry points into financial markets. FNory operates from Saint Vincent and the Grenadines, a Caribbean place that has become popular among forex brokers because of its relaxed regulatory environment. According to PlanetOfReviews, FNory markets itself as offering competitive trading conditions with zero spreads and commission-free trading on standard accounts.

The broker's business model focuses on providing forex and contract for difference (CFD) trading services to individual investors. FNory's marketing emphasizes low barrier-to-entry features, including the modest $100 minimum deposit requirement and access to significant leverage ratios. However, multiple review sources including TheForexReview and ForexBrokerz note that the broker's operational transparency and regulatory compliance have been subjects of considerable concern within the trading community.

The company's asset offerings center on foreign exchange pairs and CFDs. Specific details about the range of available instruments remain limited in available documentation though. FNory operates under the regulatory framework of Saint Vincent and the Grenadines, though sources indicate that no specific license number has been prominently displayed or verified. This FNory review emphasizes the importance of understanding these fundamental aspects of the broker's structure before making any investment decisions.

Regulatory Jurisdiction: FNory operates under Saint Vincent and the Grenadines registration. This jurisdiction provides limited regulatory oversight compared to major financial centers. According to ForexBrokerz, the broker has not displayed valid licensing credentials, which raises significant concerns about legal compliance and trader protection.

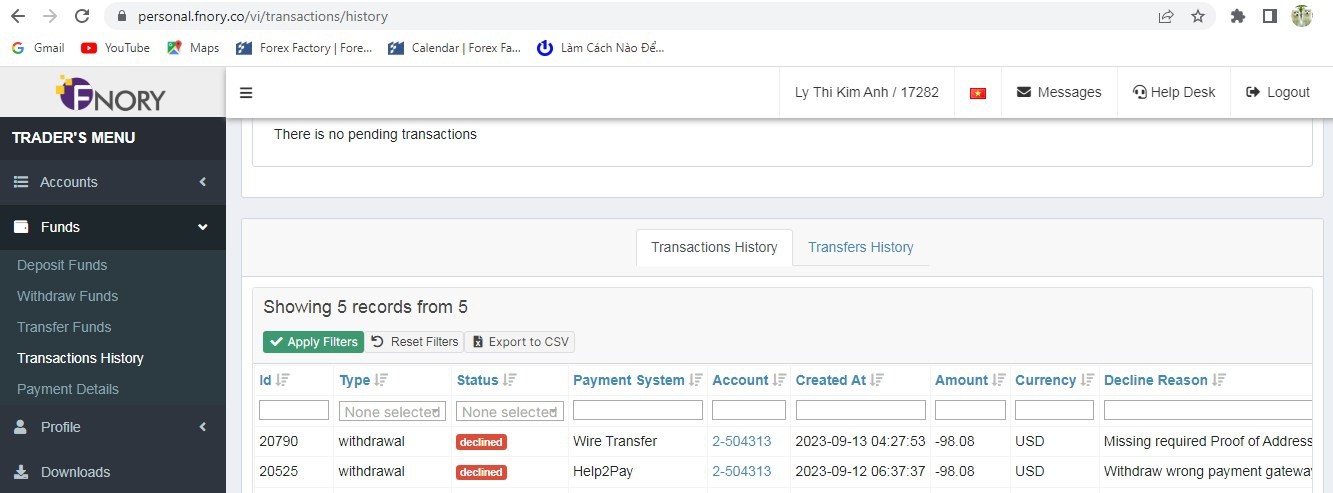

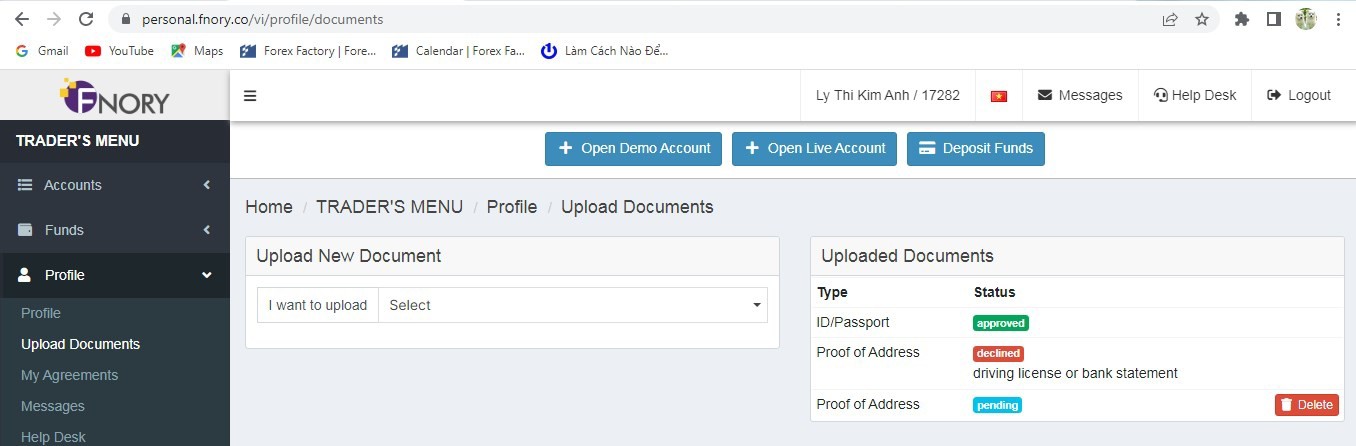

Deposit and Withdrawal Methods: Available source materials did not detail specific information about deposit and withdrawal methods. This represents a significant transparency gap that potential traders should investigate directly with the broker.

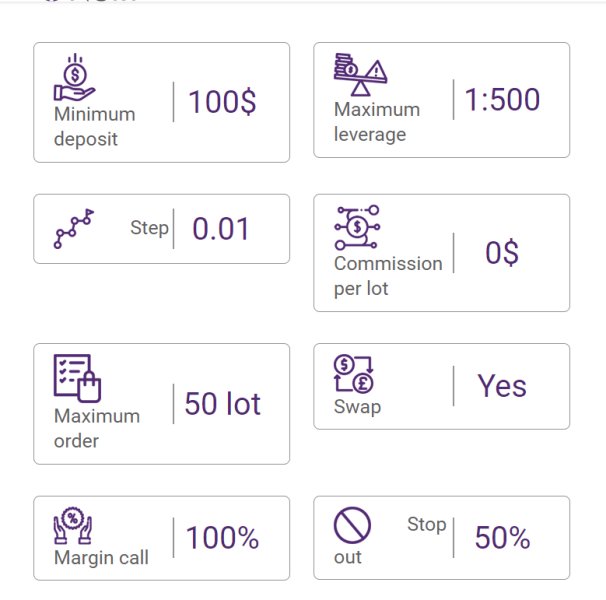

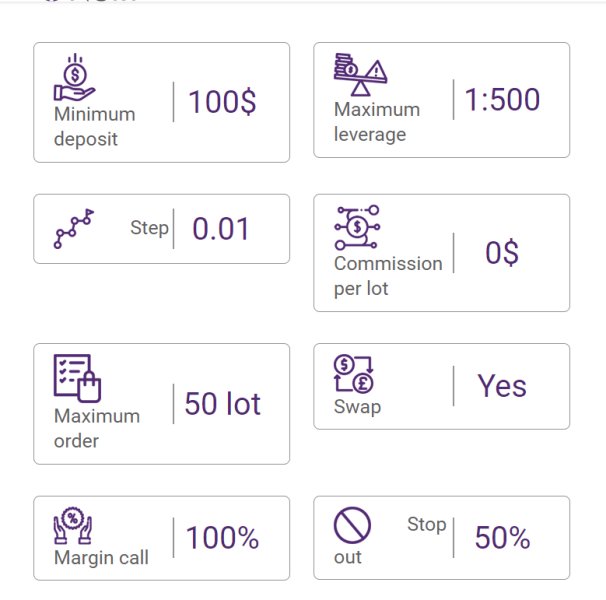

Minimum Deposit Requirements: FNory sets its minimum deposit at $100. This makes it accessible to new traders with limited capital. The low threshold aligns with the broker's apparent strategy of attracting smaller retail investors.

Promotional Offers: Available source materials did not provide specific information about bonus programs or promotional offers. This suggests either limited promotional activities or insufficient transparency in marketing materials.

Available Trading Assets: The broker focuses on forex currency pairs and contracts for difference (CFDs). The exact number of available instruments and specific asset categories remain unspecified in reviewed materials though.

Cost Structure: FNory advertises zero spreads and zero commission for standard accounts. This appears attractive but should be evaluated alongside other potential costs and the broker's overall reliability concerns highlighted in multiple reviews.

Leverage Options: The broker offers leverage up to 1:500. This is significantly high and suitable only for experienced traders with substantial risk tolerance. Such leverage levels can amplify both profits and losses dramatically.

Trading Platforms: Available source materials did not provide specific information about trading platform options. This represents another area where the broker lacks transparency.

Geographic Restrictions: Available materials did not provide details about specific country restrictions. The Saint Vincent and the Grenadines registration likely limits services in major regulated jurisdictions though.

Customer Support Languages: Available materials did not specify supported languages for customer service. This FNory review notes this as an important consideration for international traders.

Account Conditions Analysis

FNory's account structure appears straightforward but limited in scope based on available information. The broker offers standard accounts with a $100 minimum deposit, which positions it competitively for new traders seeking low-cost entry into forex markets. According to TheForexReview, this low threshold makes FNory accessible to traders who might be excluded from brokers with higher minimum requirements.

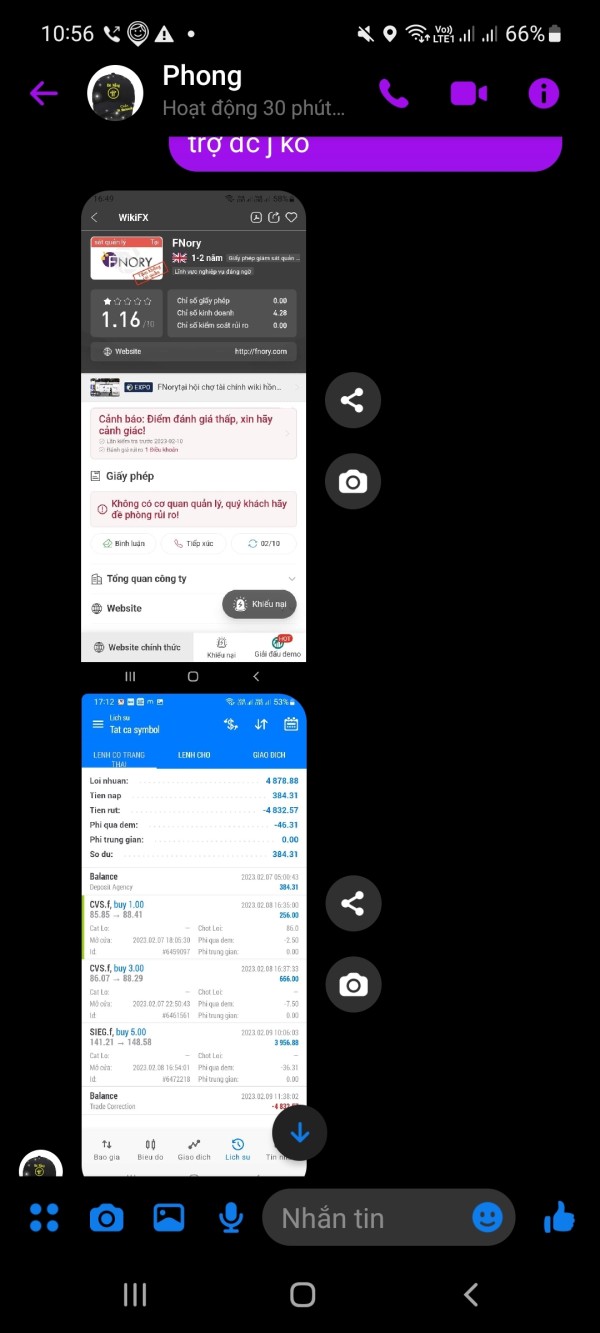

The advertised zero spreads and zero commission structure represents the most attractive aspect of FNory's account conditions. However, traders should approach these claims with caution, as multiple review sources have questioned the sustainability and authenticity of such favorable terms. The lack of detailed information about account types suggests limited options for traders seeking specialized features like Islamic accounts or professional trading conditions.

User feedback regarding account conditions has been mixed. Some traders appreciate the low entry barrier while expressing concerns about the overall reliability of the platform. The absence of detailed account specifications, including information about account currencies, maintenance fees, or inactivity charges, represents a significant transparency issue that potential clients should investigate thoroughly.

FNory's account conditions appear designed to attract new traders with aggressive pricing when compared to established brokers. The lack of regulatory backing and negative user reviews suggest that these attractive terms may come with substantial hidden risks that outweigh the apparent benefits though.

The availability of trading tools and educational resources represents a significant weakness in FNory's offering. This is based on the limited information available in reviewed materials. Unlike established brokers that typically provide comprehensive suites of analytical tools, market research, and educational content, FNory appears to offer minimal support in these crucial areas.

Available source materials did not mention advanced trading tools such as economic calendars, technical analysis indicators, automated trading systems, and market research reports. This absence is particularly concerning for traders who rely on sophisticated analytical tools to make informed trading decisions. The lack of educational resources also suggests that FNory may not be suitable for new traders who need guidance and learning materials.

User feedback consistently highlights the inadequacy of available tools and resources as a major drawback. Traders have expressed frustration with the limited analytical capabilities and absence of market insights that are standard offerings with reputable brokers. This deficiency significantly impacts the overall trading experience and limits traders' ability to conduct thorough market analysis.

Industry experts generally view the absence of comprehensive trading tools as a red flag. This is particularly true when combined with other concerns about regulatory oversight and transparency. For this FNory review, the limited tools and resources contribute significantly to the broker's low overall rating in this category.

Customer Service and Support Analysis

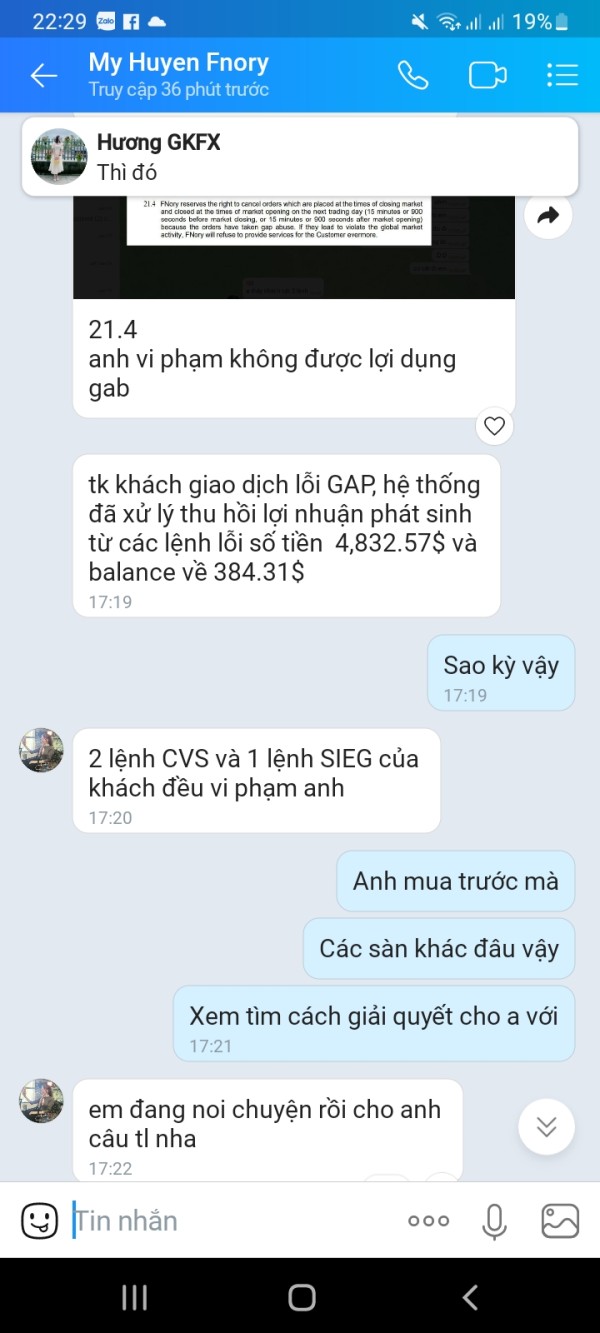

Customer service quality emerges as a major concern in user feedback about FNory. Multiple sources report inadequate support responsiveness and professionalism. According to reviews compiled by PlanetOfReviews and other platforms, users frequently experience delayed responses to inquiries and unsatisfactory resolution of trading-related issues.

The broker's customer support infrastructure appears limited. Available materials provide no specific information about support channels, operating hours, or multilingual capabilities. This lack of transparency regarding customer service operations is concerning, particularly for international traders who may require support in different time zones and languages.

Response time issues represent a consistent theme in user complaints. Traders report delays of several days for simple inquiries. The quality of support interactions has also been criticized, with users describing unhelpful responses and apparent lack of expertise among support staff. These service deficiencies can be particularly problematic in fast-moving forex markets where timely support is crucial.

Problem resolution capabilities appear inadequate based on user feedback. Many traders report that their concerns were not addressed satisfactorily. The absence of clear escalation procedures or dedicated account management further compounds these customer service challenges, contributing to the overall negative user experience reported across multiple review platforms.

Trading Experience Analysis

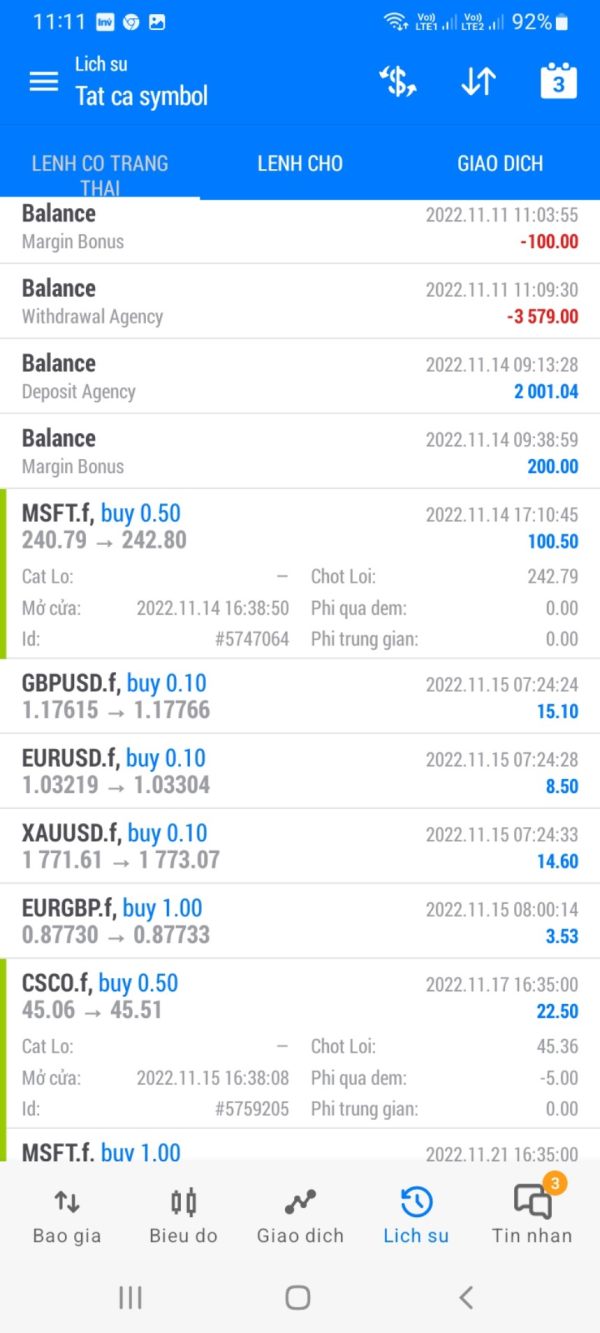

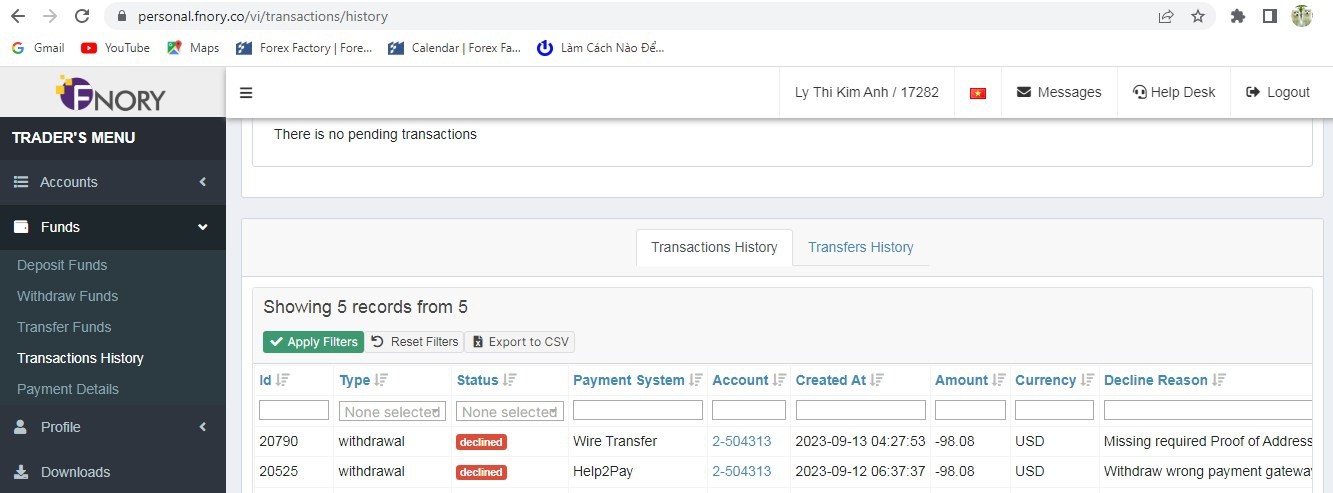

The trading experience with FNory appears problematic based on available user feedback and the lack of detailed platform information. Users have reported concerns about platform stability and execution quality, though specific technical performance data was not available in the reviewed materials. The absence of comprehensive platform specifications makes it difficult for potential traders to assess whether FNory's technology infrastructure meets modern trading standards.

Order execution quality represents a critical concern. Some user reports suggest delays and potential issues with trade processing. However, specific data about execution speeds, slippage rates, or fill quality was not available in the source materials, making it difficult to provide a comprehensive assessment of execution performance.

Platform functionality appears limited based on the lack of detailed feature descriptions in available materials. Modern traders typically expect sophisticated charting tools, multiple order types, risk management features, and mobile trading capabilities, but FNory's offerings in these areas remain unclear. This uncertainty about platform capabilities represents a significant concern for serious traders.

Available materials did not address the mobile trading experience, which is crucial for modern forex trading. Given the importance of mobile platforms for contemporary trading strategies, this information gap represents another area where FNory falls short of transparency standards expected from reputable brokers. User feedback suggests that the overall trading environment does not meet the expectations of experienced traders, contributing to the negative reviews found across multiple platforms.

Trust and Safety Analysis

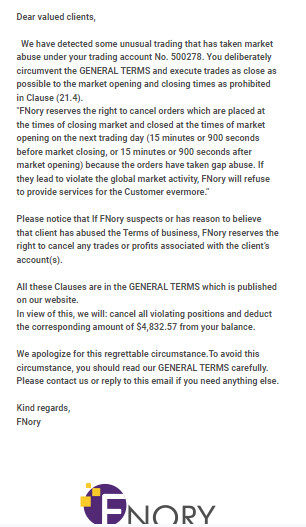

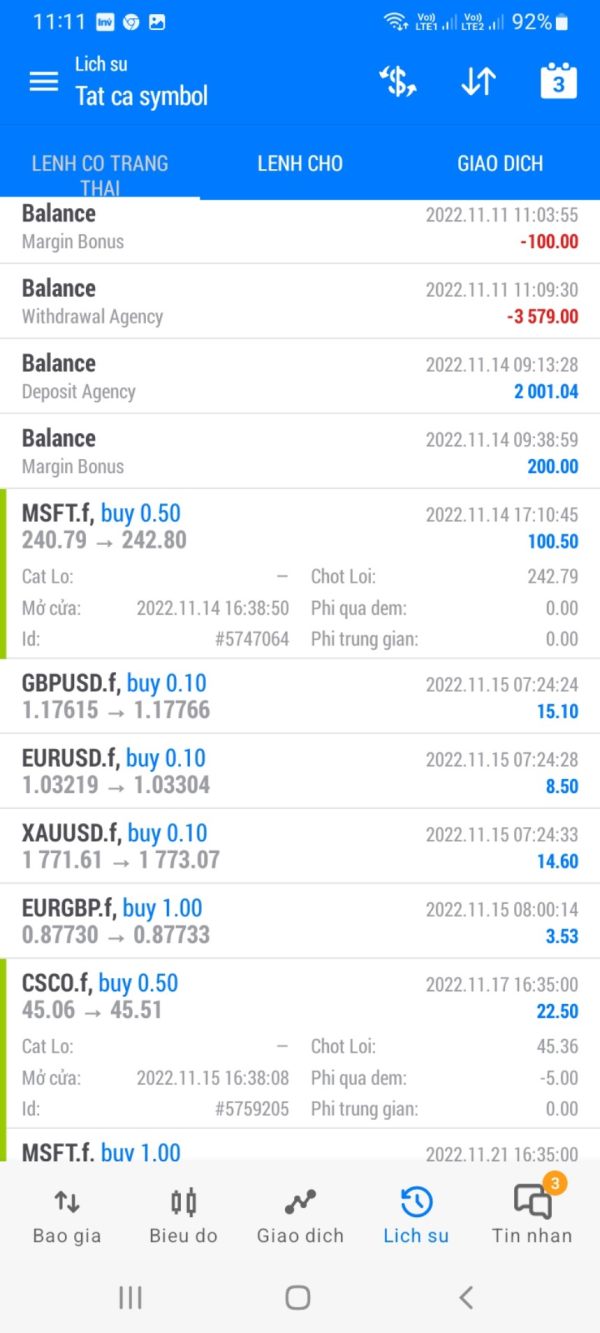

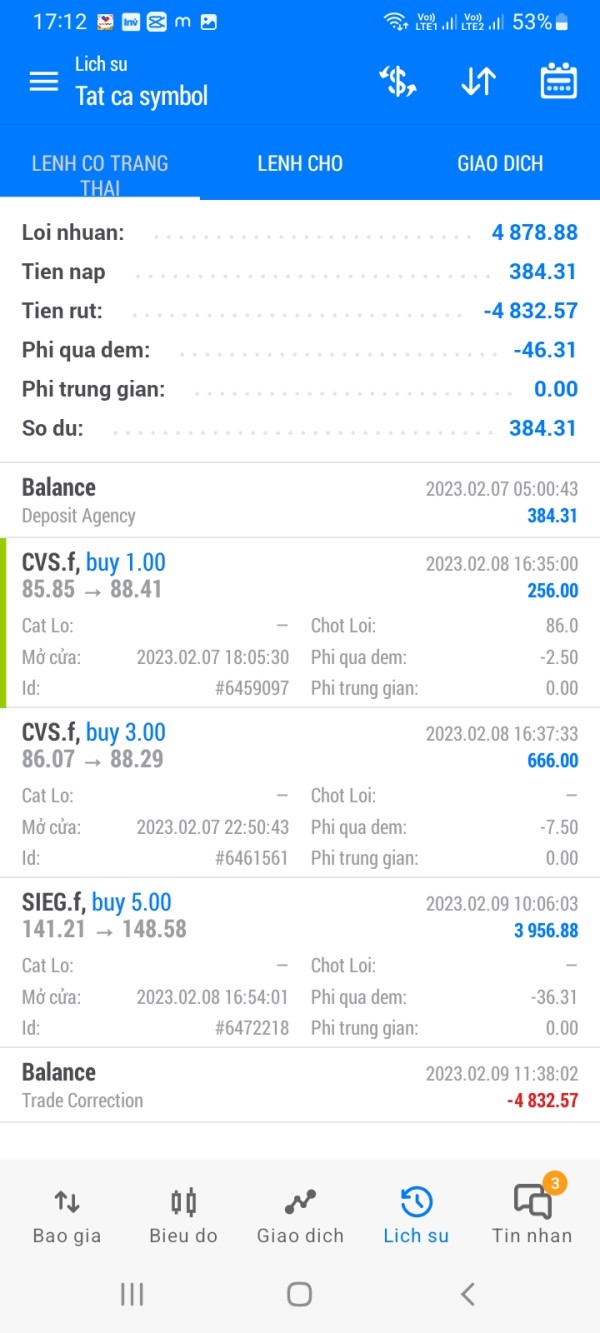

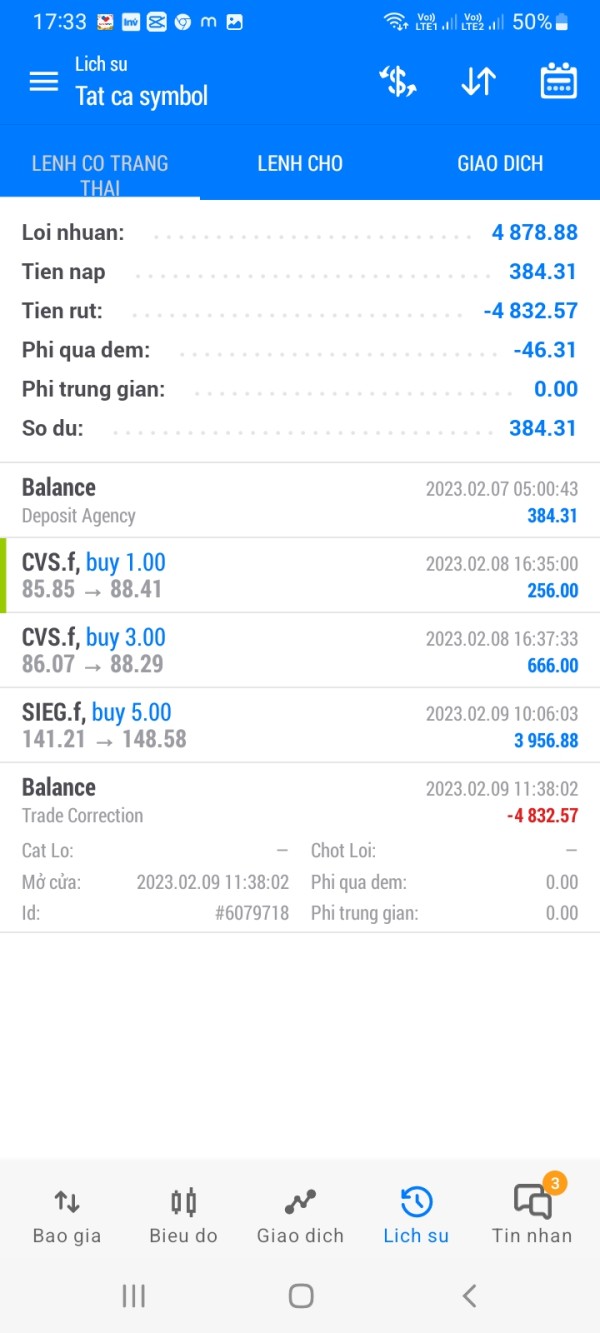

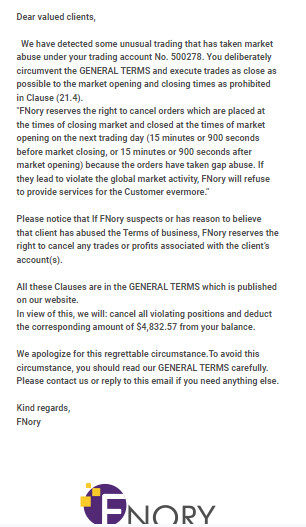

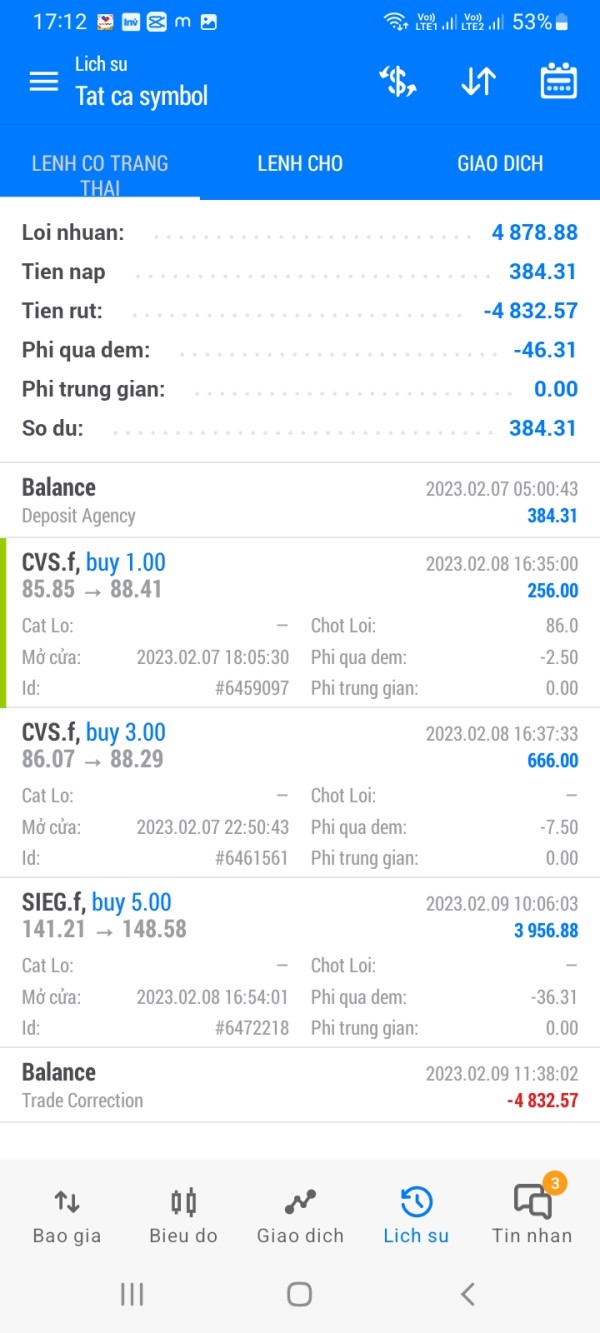

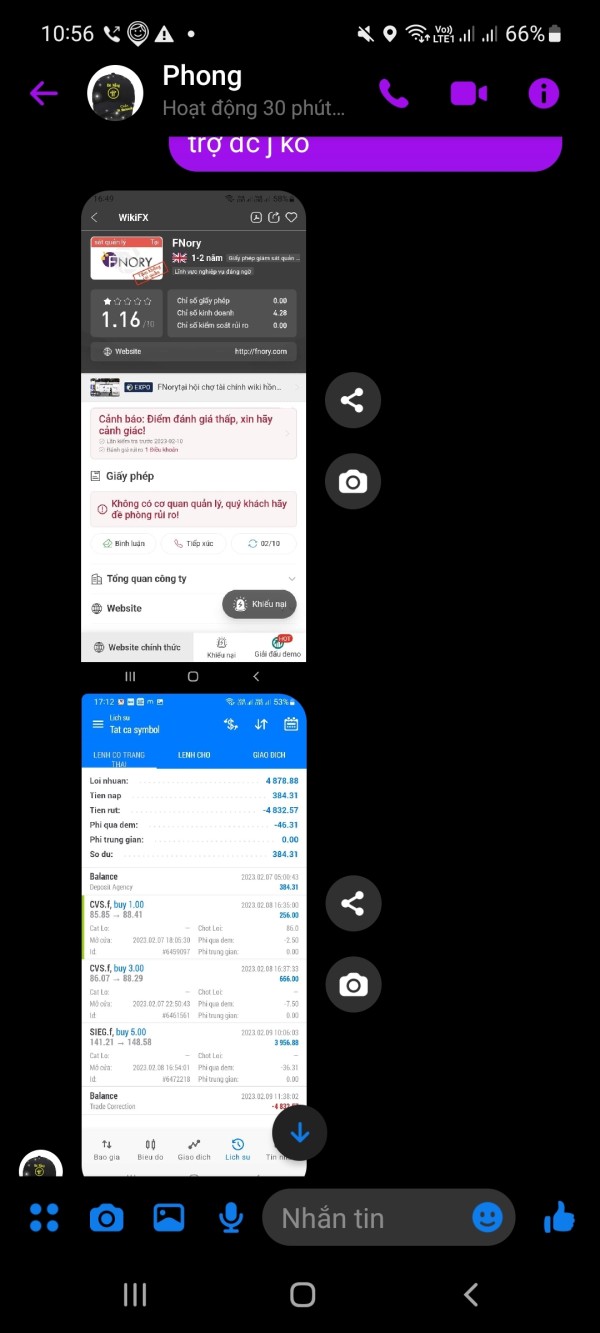

Trust and safety concerns represent the most significant issues with FNory. Multiple independent sources have flagged the broker as potentially fraudulent. According to ForexBrokerz and PlanetOfReviews, FNory has been identified as a "scam broker" with insufficient regulatory oversight and questionable business practices. These allegations severely undermine the broker's credibility and suggest substantial risks for potential traders.

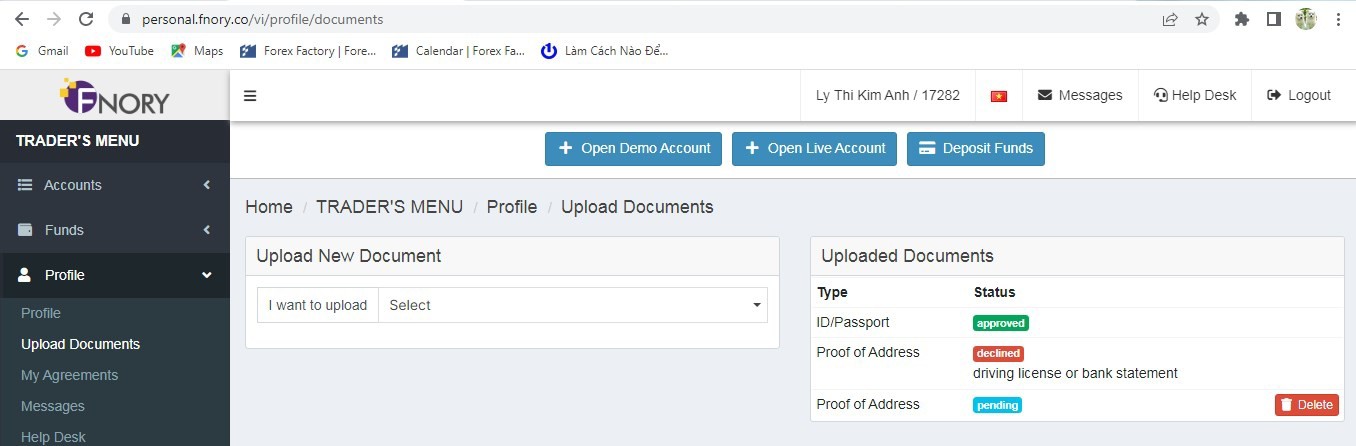

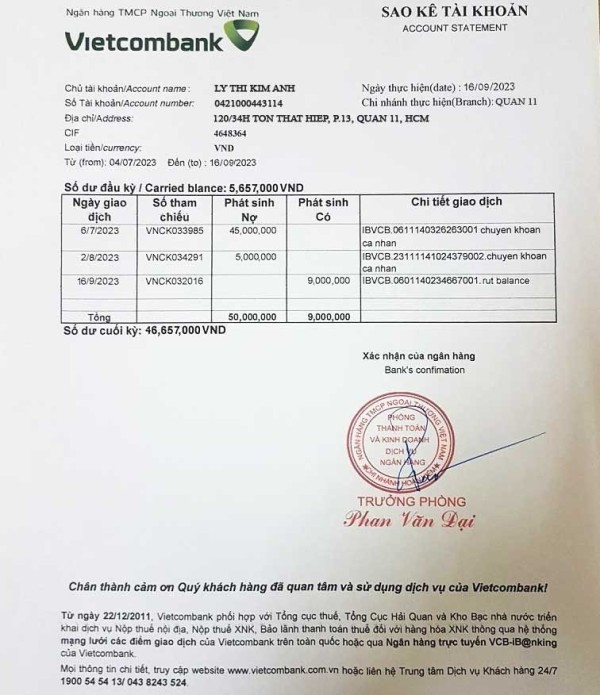

The regulatory situation presents major red flags. FNory's Saint Vincent and the Grenadines registration provides minimal trader protection compared to major financial jurisdictions. The absence of valid licensing credentials, as noted by multiple review sources, raises serious questions about the broker's legal authority to provide financial services and the security of client funds.

Fund safety measures appear inadequate or non-existent based on available information. Reputable brokers typically provide detailed information about client fund segregation, insurance coverage, and regulatory protections, but FNory has not demonstrated compliance with these standard safety practices. This lack of transparency regarding fund security represents a critical concern for potential investors.

Multiple negative reviews and scam allegations have severely damaged industry reputation. Third-party evaluation platforms consistently rate FNory poorly, with warnings about the broker's reliability and legitimacy. The handling of negative events and user complaints appears inadequate, with many traders reporting unsatisfactory responses to their concerns. These trust and safety issues form the foundation for this FNory review's strong cautionary stance regarding the broker.

User Experience Analysis

Overall user satisfaction with FNory appears significantly below industry standards. This is based on feedback compiled from multiple review platforms. The predominance of negative reviews and scam allegations suggests that most traders who have engaged with FNory have experienced unsatisfactory outcomes. User testimonials consistently highlight issues with platform reliability, customer service, and overall trustworthiness.

Reviewed materials did not provide interface design and usability information. This represents another transparency gap that affects user experience assessment. Modern traders expect intuitive, responsive platforms with comprehensive functionality, but FNory's offerings in this area remain unclear. The absence of detailed platform descriptions suggests either limited functionality or insufficient transparency about available features.

Available source materials did not detail registration and verification processes. User feedback suggests potential issues with account setup and documentation requirements though. Smooth onboarding processes are crucial for positive user experiences, and any complications in these areas can significantly impact trader satisfaction.

The user profile for FNory appears to target high-risk tolerance traders seeking low-cost entry into forex markets. Feedback suggests that even risk-tolerant traders have found the platform unsatisfactory though. Common user complaints center on trust issues, poor customer service, and concerns about fund security rather than trading costs or platform features.

User feedback suggests improvement recommendations would include enhanced regulatory compliance, improved customer service infrastructure, greater transparency about platform features and business practices, and implementation of standard industry safety measures. However, the severity of trust and safety concerns suggests that fundamental changes would be necessary to address user satisfaction issues.

Conclusion

This comprehensive FNory review reveals a broker with significant risks that outweigh any potential benefits from its low-cost trading conditions. FNory offers attractive features such as a $100 minimum deposit, zero spreads, and high leverage up to 1:500, but these advantages are overshadowed by serious concerns about regulatory compliance, user safety, and overall reliability.

The broker appears most suitable for high-risk tolerance traders who prioritize low entry costs over regulatory protection and platform reliability. However, even risk-seeking investors should carefully consider the substantial warnings from multiple independent review sources and the predominantly negative user feedback before engaging with FNory.

The main advantages include low minimum deposits and advertised zero-cost trading conditions. The primary disadvantages encompass inadequate regulatory oversight, poor user reviews, limited transparency, insufficient customer support, and multiple scam allegations from industry sources. Based on this analysis, traders are strongly advised to consider well-regulated alternatives that offer better protection and more comprehensive services, even if they require higher minimum deposits or less aggressive trading terms.