TradeEU Global 2025 Review: Everything You Need to Know

Executive Summary

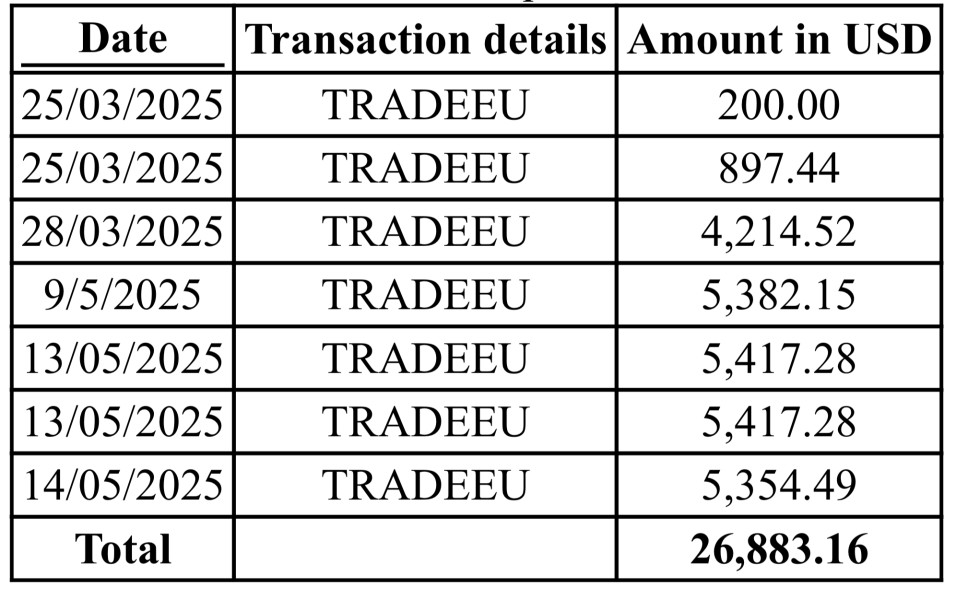

This detailed tradeeu global review looks at one of the new players in forex and CFD trading. TradeEU Global shows itself as a broker that offers many different assets, with over 250 trading tools across various types including forex, metals, commodities, indices, cryptocurrencies, and stocks through CFDs. The broker works under the rules of the Financial Services Commission (FSC) of Mauritius. It markets itself with good spreads starting from 0 pips.

User feedback shows TradeEU Global keeps a good rating. About 80% of users give good reviews, praising the platform's trading setup and cost structure. The broker seems to help traders who want different investment choices across many asset types. But some parts of the platform's work and service quality need careful thought by possible clients.

Key points include the broker's good pricing with zero starting spreads and maximum leverage of 1:200. It also offers many assets spanning old and new financial tools.

Important Notice

Regional Entity Differences: TradeEU Global is registered in Mauritius under FSC rules. Traders should know that rules and investor protections may be very different from brokers regulated in major financial centers such as the UK, EU, or Australia. The rules in Mauritius may not give the same level of investor protection or compensation plans available in other places.

Review Methodology: This review uses public information, user feedback, and market analysis. Our assessment aims to give a fair evaluation of the broker's services, though traders should do their own research before making investment decisions.

Rating Framework

Broker Overview

TradeEU Global works as a forex and CFD broker registered in Mauritius. It positions itself in the competitive online trading world. The company focuses on giving multi-asset trading chances, emphasizing its role as a complete trading solution for retail and institutional clients. While specific start dates are not clearly shown in available materials, the broker has built a presence in the online trading community.

The company's business model centers on offering CFD trading across various asset classes. This allows clients to guess on price movements without owning underlying assets. This approach lets traders access diverse markets through a single platform, from traditional forex pairs to modern cryptocurrency markets.

TradeEU Global operates under the rules of the Financial Services Commission (FSC) of Mauritius, which gives the legal framework for its operations. The broker offers trading with maximum leverage of 1:200 and promotes competitive spread conditions starting from zero pips. The platform supports trading across forex, precious metals, commodities, stock indices, cryptocurrencies, and individual stocks through CFD instruments. This caters to traders seeking portfolio diversification opportunities.

Regulatory Jurisdiction: TradeEU Global operates under the regulation of the Financial Services Commission (FSC) of Mauritius. This regulatory body oversees financial services within the Mauritius jurisdiction. Specific license numbers are not clearly shown in available materials.

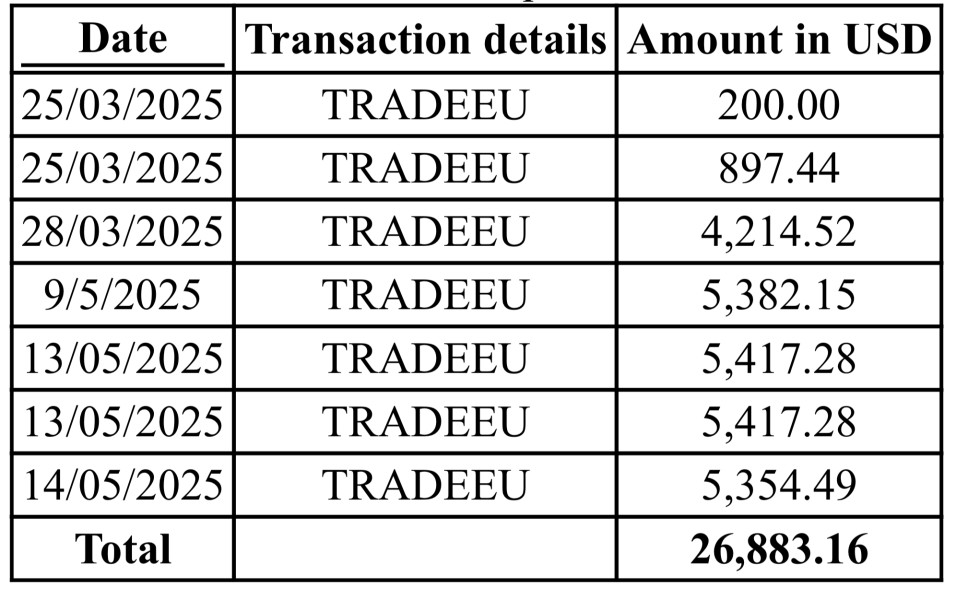

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available documentation. This requires potential clients to contact the broker directly for complete banking information.

Minimum Deposit Requirements: The minimum deposit requirement is not specified in available materials. This may impact transparency for potential clients evaluating account opening procedures.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in accessible documentation. This suggests traders should ask directly with the broker about any available incentives.

Available Trading Assets: The broker provides access to over 250 trading instruments spanning multiple asset categories. These include major, minor, and exotic forex pairs, precious metals such as gold and silver, commodity CFDs, major stock indices, cryptocurrency CFDs, and individual stock CFDs from various global markets.

Cost Structure: TradeEU Global advertises spreads starting from 0 pips, positioning itself competitively in terms of trading costs. However, detailed commission structures and additional fees are not fully outlined in available materials. This potentially affects cost transparency for traders.

Leverage Options: Maximum leverage is offered at 1:200, providing significant capital amplification opportunities. This requires appropriate risk management considerations from traders.

Trading Platform Options: Specific trading platform information is not detailed in available documentation. This requires clarification from the broker regarding MT4, MT5, or proprietary platform availability.

Geographic Restrictions: Regional trading restrictions and service availability are not clearly specified in accessible materials.

Customer Support Languages: Available customer service languages are not documented in current materials. This tradeeu global review notes this as an area requiring clarification for international clients.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

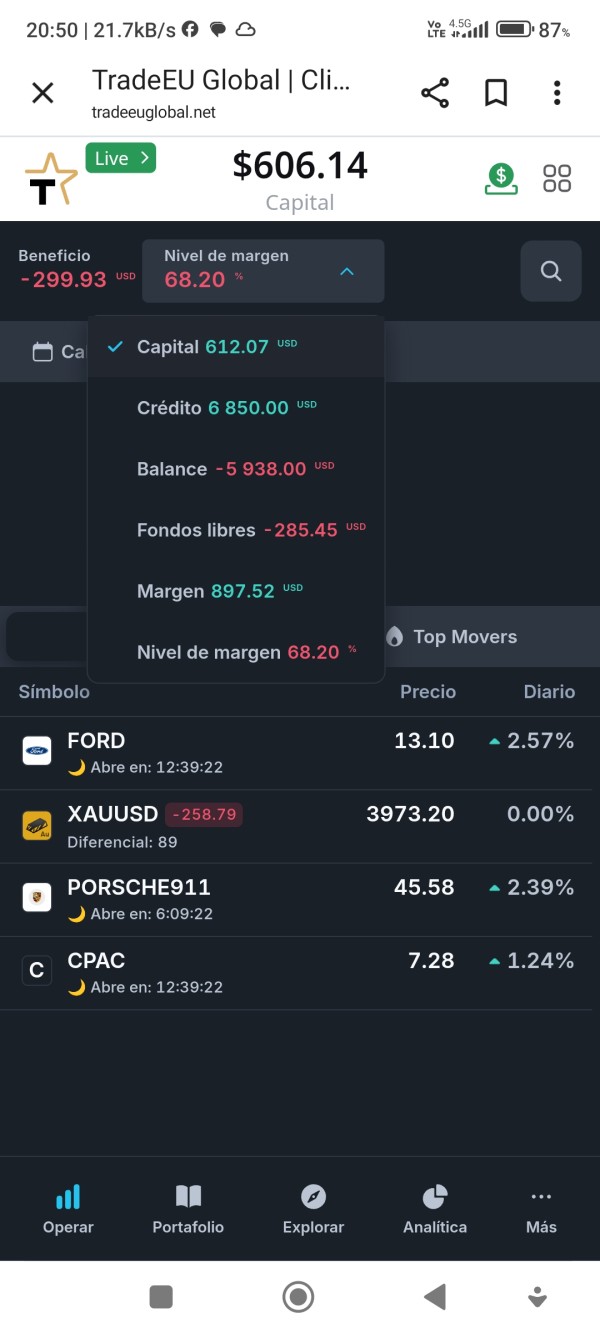

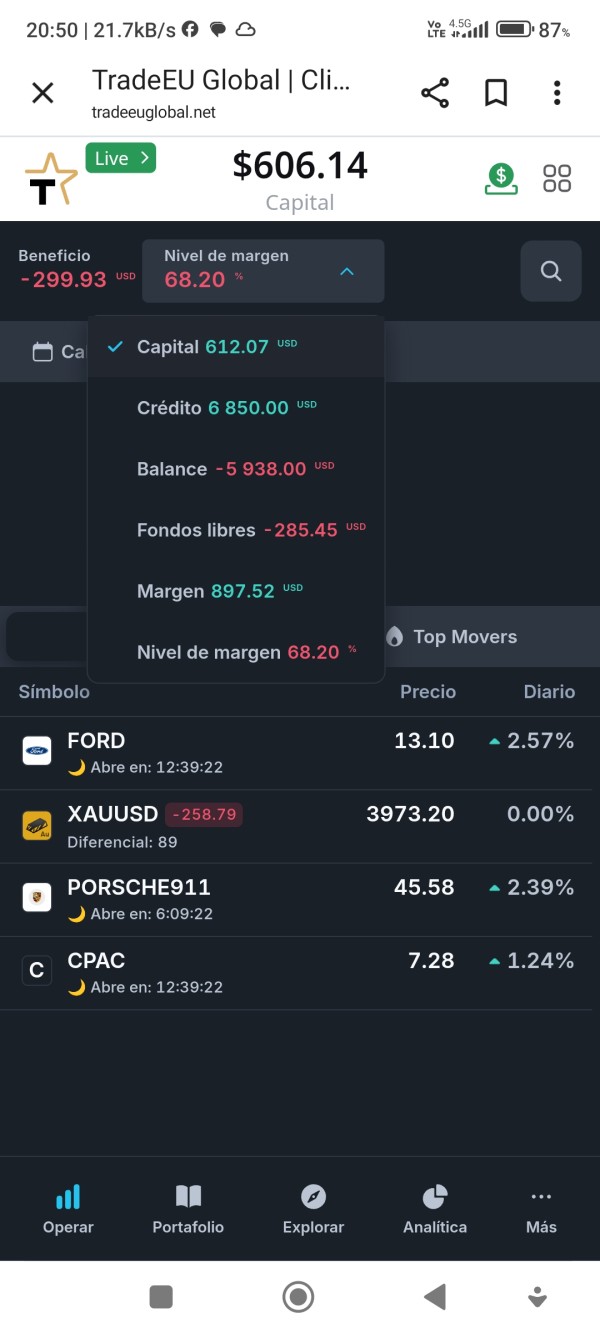

TradeEU Global's account conditions present a mixed picture for potential traders. The broker's competitive spread structure, starting from 0 pips, represents a significant advantage for cost-conscious traders. This is particularly true for those engaging in high-frequency trading strategies or dealing with major currency pairs where tight spreads can substantially impact profitability.

However, the lack of transparency regarding specific account types, minimum deposit requirements, and comprehensive fee structures creates uncertainty for potential clients. This information gap makes it difficult for traders to fully evaluate the true cost of trading and compare offerings with other brokers in the market. The absence of detailed account tier information also prevents traders from understanding what additional benefits or reduced costs might be available with higher deposit levels.

The broker's leverage offering of 1:200 provides reasonable capital amplification without reaching the extreme levels that might indicate irresponsible risk practices. This leverage level strikes a balance between providing trading opportunities and maintaining some level of risk management consideration.

Account opening procedures and verification requirements are not clearly documented. This could impact the user experience for new clients. In this tradeeu global review, we note that clearer communication of account conditions would significantly improve the broker's transparency rating.

TradeEU Global demonstrates strong performance in its tools and resources offering. Over 250 trading instruments provide comprehensive market access across multiple asset classes. This extensive range allows traders to implement diversified strategies and access both traditional and emerging markets through a single broker relationship.

The inclusion of forex pairs across major, minor, and exotic categories ensures that currency traders can access both high-liquidity mainstream markets and potentially more profitable niche opportunities. The precious metals offering provides traditional safe-haven asset access. Commodity CFDs enable exposure to global commodity price movements without the complexities of futures markets.

The broker's cryptocurrency CFD offering addresses the growing demand for digital asset exposure. This allows traders to speculate on cryptocurrency price movements with traditional trading tools and leverage. Stock CFDs provide access to individual equity movements across global markets, expanding beyond simple index tracking.

However, specific information about research tools, market analysis resources, educational materials, and automated trading support is not detailed in available documentation. These analytical and educational resources are increasingly important for trader success and broker differentiation in competitive markets.

Customer Service and Support Analysis (6/10)

Customer service evaluation for TradeEU Global presents challenges due to limited available user feedback and documented service information. The available user reviews, while generally positive, raise some concerns about authenticity and representativeness of actual client experiences.

Available customer service channels, response times, and service quality metrics are not clearly documented in accessible materials. This lack of transparency makes it difficult for potential clients to assess the level of support they can expect when encountering trading issues or requiring assistance with platform operations.

The concern about suspicious review activity mentioned in available sources suggests potential issues with authentic customer feedback representation. This raises questions about the reliability of positive reviews and the actual quality of customer service experiences.

Multi-language support availability and customer service hours are not specified. This could impact international clients requiring support in their native languages or outside standard business hours. Professional trading often requires 24/7 support availability, particularly for markets operating across different time zones.

Trading Experience Analysis (8/10)

User feedback indicates generally positive trading experiences with TradeEU Global. Users particularly praise execution speed and commission transparency. Traders report satisfaction with the platform's ability to execute orders promptly, which is crucial for successful trading, especially in volatile market conditions.

The transparent commission structure receives positive mentions from users. This suggests that the broker provides clear information about trading costs once clients are engaged with the platform. This transparency helps traders calculate their true trading costs and develop appropriate risk management strategies.

Platform stability appears to meet user expectations based on available feedback. However, specific technical performance data such as uptime statistics, average execution speeds, and slippage measurements are not documented in accessible materials. The spread stability receives favorable user comments, indicating consistent pricing conditions that allow for reliable trading strategy implementation.

However, detailed information about platform functionality, advanced trading features, mobile trading capabilities, and specialized trading tools is not comprehensively documented. These features are increasingly important for modern traders who require sophisticated analysis tools and flexible trading access. This tradeeu global review notes that more detailed platform information would enhance trader evaluation capabilities.

Trust and Security Analysis (7/10)

TradeEU Global's trust profile is anchored by its FSC regulation from Mauritius. This provides a basic regulatory framework for operations. However, the regulatory environment in Mauritius may not offer the same level of investor protection or oversight intensity found in major financial centers such as the UK's FCA or Cyprus's CySEC.

The absence of specific license numbers or detailed regulatory compliance information in available materials reduces transparency regarding the broker's regulatory standing. Traders typically expect easy access to regulatory verification information to confirm a broker's legitimate status.

User feedback presents mixed signals regarding trust. Positive ratings comprise 80% of reviews but concerns about review authenticity affect overall credibility assessment. The presence of negative feedback, while representing a minority of reviews, requires attention as these often highlight genuine operational issues.

Specific information about client fund segregation, investor compensation schemes, and additional security measures is not detailed in available documentation. These security features are fundamental for trader protection and are typically highlighted by reputable brokers as key safety measures.

User Experience Analysis (7/10)

The overall user experience with TradeEU Global shows positive trends. 80% of users provide favorable ratings for their trading experience. This high satisfaction rate suggests that the majority of traders find the platform meets their basic trading requirements and expectations.

However, the 12% negative rating component requires consideration. Negative experiences often highlight operational deficiencies or service gaps that could affect new clients. The 8% neutral ratings suggest some users have mixed experiences that neither strongly favor nor criticize the broker's services.

Interface design, ease of use, and navigation efficiency are not specifically documented in available materials. This makes it difficult to assess the platform's user-friendliness for traders with varying experience levels. Modern trading platforms require intuitive design to support both novice and experienced traders effectively.

Registration and account verification processes are not detailed. These procedures significantly impact initial user experience and onboarding satisfaction. Efficient, transparent verification processes are essential for positive first impressions and regulatory compliance.

The suitability for traders seeking diversified investment opportunities appears well-supported by the broker's extensive asset range. However, specific user interface features supporting portfolio management and multi-asset trading are not documented in available materials.

Conclusion

This tradeeu global review reveals a broker with notable strengths in trading costs and asset diversity. These are balanced against areas requiring improved transparency and documentation. TradeEU Global demonstrates competitive advantages through its zero starting spreads and comprehensive asset offering spanning over 250 instruments across multiple markets.

The broker appears most suitable for traders prioritizing low-cost trading conditions and seeking diversified market access through a single platform. The positive user feedback regarding execution speed and commission transparency suggests operational competency in core trading functions.

However, potential clients should carefully consider the limited transparency regarding account conditions, customer service capabilities, and comprehensive platform features. The regulatory framework, while legitimate, may not provide the same level of investor protection available through major financial center regulations.