Is JKG safe?

Pros

Cons

Is JKG Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, JKG Capital LLC has emerged as a player, offering a range of trading services to investors. However, with the rise of online trading platforms, the need for traders to exercise caution has never been more critical. The forex market, while lucrative, is also rife with potential pitfalls, including unregulated brokers and scams. This article aims to provide a comprehensive evaluation of JKG Capital by examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on an analysis of multiple sources, including user reviews, regulatory filings, and expert opinions, to determine whether JKG is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in assessing its legitimacy. JKG Capital claims to be regulated by the National Futures Association (NFA) in the United States. However, recent investigations have raised concerns about the validity of this claim, suggesting that it may be operating under a clone license. A clone license refers to a fraudulent imitation of a legitimate regulatory license, often used by unscrupulous brokers to mislead potential clients.

Here is a summary of the regulatory information for JKG Capital:

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0443132 | United States | Suspected Clone |

The importance of regulation cannot be overstated, as it serves as a safeguard for traders against fraud and malpractice. A broker regulated by a reputable authority is subject to strict compliance standards, ensuring transparency and accountability. In contrast, JKG's alleged clone license raises significant red flags, indicating that traders may be exposed to higher risks. The lack of verified regulation suggests a potential for unscrupulous practices, making it crucial for traders to approach JKG with caution.

Company Background Investigation

JKG Capital LLC was established with the intent of providing trading services in the forex market. However, the company's history and ownership structure remain somewhat opaque. Despite being registered in the United States, the specifics of its founding and operational milestones are not readily available. The management team, led by individuals with varying degrees of experience in finance, has not been extensively documented, leading to questions about their qualifications and commitment to ethical trading practices.

Transparency is a vital aspect of any financial institution, and JKG's lack of clear information regarding its history and ownership structure is concerning. Potential clients should be wary of firms that do not openly disclose their background and operational details, as this can be indicative of deeper issues. The absence of comprehensive information about the company's management and operations further complicates the assessment of its credibility and trustworthiness.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. JKG Capital has a notably high minimum deposit requirement of $15,000 for all account types, which is significantly above the industry average. This high entry barrier may deter many potential traders and raises questions about the broker's accessibility and intent.

The following table summarizes JKG's trading costs compared to industry averages:

| Cost Type | JKG Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.7 - 2.5 pips | 1.0 - 2.0 pips |

| Commission Model | $6 per lot | $4 - $8 per lot |

| Overnight Interest Range | Not disclosed | Varies widely |

JKG's spreads are relatively competitive for major currency pairs, but the overall cost structure, combined with the high minimum deposit, may not provide sufficient value for traders. Additionally, the lack of transparency regarding overnight interest and other fees is concerning. Traders should be cautious of brokers that do not clearly outline their fee structures, as hidden costs can significantly impact profitability.

Customer Funds Security

The safety of customer funds is a critical consideration when selecting a forex broker. JKG Capital claims to implement various security measures to protect clients' investments. However, there is little publicly available information detailing these measures, including whether client funds are held in segregated accounts or if there are any investor protection schemes in place.

The absence of clear policies regarding fund security raises concerns about the potential risks associated with trading with JKG. Traders should prioritize brokers that provide explicit details about their fund protection measures, including the use of segregated accounts and negative balance protection. Historical incidents involving fund security issues can also serve as a warning sign, and it is crucial for traders to conduct thorough research before entrusting their capital to any broker.

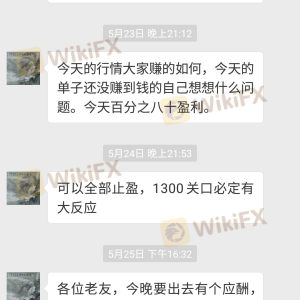

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability and service quality. Reviews of JKG Capital reveal a pattern of complaints, particularly regarding withdrawal issues and customer service responsiveness. Many users have reported difficulties in accessing their funds and a lack of timely support from the company.

The following table summarizes the main types of complaints received about JKG Capital:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Misleading Information | High | Inconsistent |

One notable case involved a trader who was unable to withdraw their funds after multiple attempts, leading to significant financial distress. The company's slow response and lack of transparency in addressing these concerns have further exacerbated the situation. Such complaints highlight the importance of choosing a broker with a solid reputation for customer service and reliability.

Platform and Trade Execution

The trading platform provided by JKG Capital is a critical aspect of the trading experience. While the company claims to offer the popular MetaTrader 4 (MT4) platform, there are concerns regarding the authenticity and reliability of this software. Reports of counterfeit versions of MT4 being offered raise significant doubts about the platform's integrity and the quality of trade execution.

Traders have expressed dissatisfaction with the order execution quality, citing issues such as slippage and rejected orders. These factors can severely impact trading performance, making it essential for traders to have confidence in their broker's platform capabilities. A reliable trading platform should provide stable performance, quick execution times, and minimal slippage to ensure that traders can effectively manage their positions.

Risk Assessment

Engaging with JKG Capital presents several risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Suspected clone license raises red flags. |

| Fund Security | High | Lack of transparency regarding fund protection measures. |

| Customer Service | Medium | Numerous complaints about withdrawal issues and support responsiveness. |

| Platform Reliability | High | Concerns about counterfeit MT4 and execution quality. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with JKG Capital. This includes seeking alternative brokers with verified regulatory status, transparent fee structures, and positive customer feedback.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that JKG Capital may not be a safe option for forex trading. The combination of a suspected clone license, high minimum deposit requirements, customer complaints, and concerns about platform reliability raises significant red flags. Traders should exercise extreme caution and consider alternative options that offer verified regulation, transparent practices, and a strong track record of customer satisfaction.

For traders seeking reliable alternatives, consider brokers that are regulated by top-tier authorities such as the FCA or ASIC, which provide robust investor protection and transparent trading conditions. Ultimately, making an informed decision is crucial to safeguarding your investments in the forex market.

Is JKG a scam, or is it legit?

The latest exposure and evaluation content of JKG brokers.

JKG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JKG latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.