Ivision Market 2025 Review: Everything You Need to Know

Executive Summary

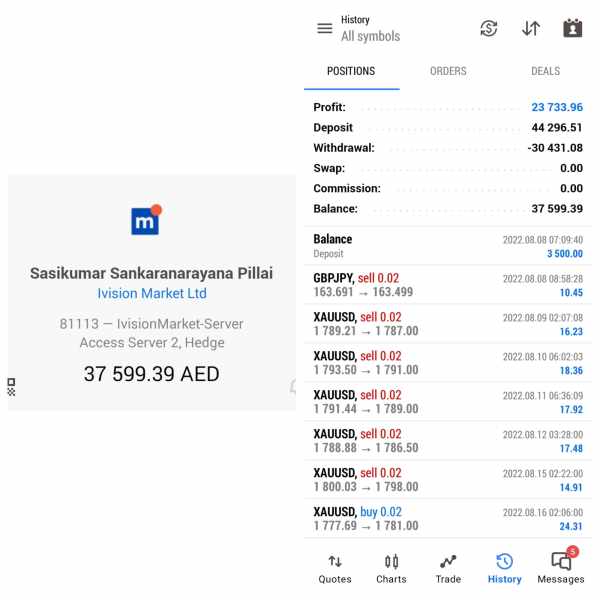

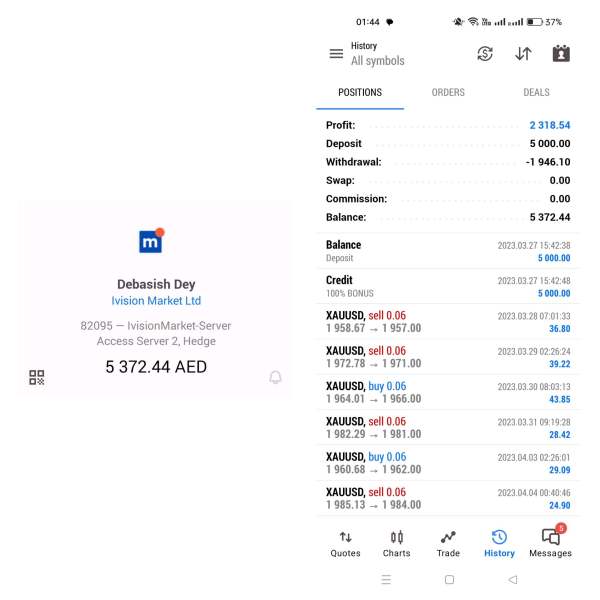

This comprehensive ivision market review examines a broker whose legitimacy and safety remain subjects of considerable debate within the trading community. Ivision Market Limited presents itself as a registered broker under NFA ID: 0553552. The company offers access to over 1,100 financial instruments across multiple asset classes through the Meta Trader 5 platform and proprietary trading solutions.

The broker's key highlights include its diverse range of trading instruments spanning forex, cryptocurrencies, precious metals, energy commodities, stocks, and indices. Ivision Market positions itself as bringing "the future of online trading" to clients seeking diversified investment opportunities. However, user evaluations reveal a polarized landscape. Some traders question the broker's legitimacy and safety protocols.

Our analysis indicates that Ivision Market primarily targets small to medium-sized traders interested in portfolio diversification across multiple asset classes. The broker's registration in Saint Lucia and NFA oversight provide some regulatory framework. However, concerns about transparency and operational practices persist among certain user segments.

Based on available public information and user feedback, this ivision market review aims to provide traders with essential insights for making informed decisions about this broker's services.

Important Disclaimers

This evaluation is based on publicly available information and user feedback collected from various sources as of early 2025. Readers should note that Ivision Market Limited does not provide services to citizens or residents of the United States, Cuba, Iraq, Myanmar, North Korea, or Sudan due to regulatory restrictions.

The assessment methodology employed in this review relies on company-provided information, regulatory filings, and user testimonials available through public channels. As with any broker evaluation, subjective elements may influence certain aspects of this analysis. Potential clients are strongly advised to conduct their own due diligence and verify all information independently before making any trading decisions.

Scoring Framework

Broker Overview

Ivision Market Limited operates as an online trading platform provider. The company is registered in Saint Lucia at Rodney Bay, Rodney Village, The Sotheby Building. The company focuses primarily on CFD trading services, positioning itself as a technology-forward broker bringing innovative solutions to the retail trading market. While specific founding dates remain unclear from available documentation, the broker has established its presence in the competitive online trading landscape.

The company's business model centers on providing access to global financial markets through sophisticated trading platforms. Ivision Market emphasizes its commitment to offering comprehensive trading solutions that cater to diverse investment strategies and risk appetites. The broker's operational structure appears designed to serve international clients while maintaining compliance with applicable regulatory frameworks in its jurisdiction of registration.

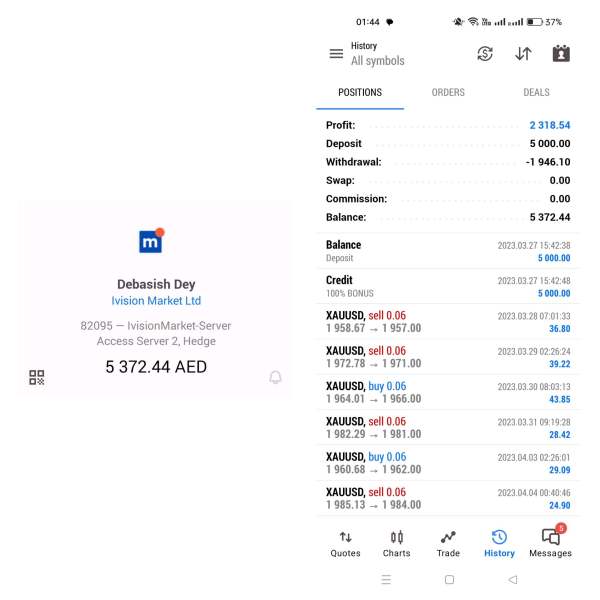

Regarding platform offerings, Ivision Market provides access to the industry-standard Meta Trader 5 (MT5) platform alongside proprietary trading solutions. This ivision market review found that the broker supports trading across six major asset categories: foreign exchange, cryptocurrencies, precious metals, energy commodities, individual stocks, and market indices. The company claims to offer over 1,100 distinct financial instruments. This provides traders with extensive market exposure opportunities. Regulatory oversight comes through the National Futures Association (NFA) under license number 0553552, though the effectiveness and scope of this supervision continue to generate discussion among users and industry observers.

Regulatory Jurisdiction: Ivision Market Limited operates under NFA supervision with license number 0553552. The broker's registration in Saint Lucia provides the legal framework for its international operations. However, specific regulatory protections may vary by client location.

Deposit and Withdrawal Methods: Specific information regarding payment processing methods, supported currencies, and transaction procedures was not detailed in available documentation.

Minimum Deposit Requirements: Concrete minimum deposit thresholds for different account types were not specified in accessible materials.

Bonus and Promotional Programs: Details about welcome bonuses, trading incentives, or promotional campaigns were not mentioned in available sources.

Available Trading Assets: The broker offers access to over 1,100 financial instruments across multiple asset classes. These include major and minor currency pairs, popular cryptocurrencies, precious metals like gold and silver, energy commodities including oil and gas, individual company stocks, and major market indices.

Cost Structure and Pricing: Specific information about spreads, commission rates, overnight financing charges, and other trading costs was not comprehensively detailed in available materials.

Leverage Options: Maximum leverage ratios and margin requirements for different asset classes were not specified in accessible documentation.

Platform Selection: Traders can access markets through Meta Trader 5, one of the industry's most recognized platforms. They can also use proprietary trading solutions developed by the broker.

Geographic Restrictions: Services are not available to residents or citizens of the United States, Cuba, Iraq, Myanmar, North Korea, and Sudan due to regulatory limitations.

Customer Support Languages: Specific information about multilingual support options and available languages was not detailed in this ivision market review.

Detailed Scoring Analysis

Account Conditions Analysis (Score: N/A)

The evaluation of account conditions for Ivision Market proves challenging due to limited publicly available information. Standard broker assessment criteria including account type varieties, minimum deposit requirements, account opening procedures, and specialized account features such as Islamic accounts remain unspecified in accessible documentation.

Without concrete details about starter, standard, premium, or VIP account tiers, it becomes impossible to assess the competitiveness of the broker's account structure. Similarly, the absence of information regarding minimum funding requirements prevents evaluation of accessibility for different trader demographics.

Account opening procedures, verification requirements, and documentation standards are not detailed in available sources. This lack of transparency regarding fundamental account conditions raises questions about operational clarity. It may concern potential clients seeking comprehensive information before committing to a broker relationship.

The availability of specialized account types, such as Islamic accounts compliant with Shariah principles, could not be determined from available sources. This ivision market review cannot provide a meaningful score for account conditions without access to essential details that would typically inform such an assessment.

Ivision Market demonstrates strong performance in tools and resources, primarily through its support for Meta Trader 5, one of the industry's most sophisticated trading platforms. MT5 provides advanced charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and comprehensive market analysis features that meet professional trading requirements.

The broker's offering of over 1,100 financial instruments across six major asset categories represents significant strength in market access diversity. This extensive instrument selection allows traders to implement sophisticated portfolio strategies. It also helps them hedge positions across different markets and capitalize on various global economic trends.

However, specific details about proprietary research resources, market analysis publications, educational materials, and advanced trading tools beyond the standard MT5 offering were not detailed in available documentation. The absence of information about economic calendars, market sentiment indicators, or exclusive research content limits the complete assessment of the broker's analytical resources.

Automated trading support through MT5's Expert Advisor functionality provides algorithmic trading capabilities. However, broker-specific automation tools or signal services were not mentioned in accessible materials. Despite some information gaps, the combination of MT5 platform access and extensive instrument selection justifies a strong rating in this category.

Customer Service and Support Analysis (Score: N/A)

Customer service evaluation for Ivision Market cannot be completed due to insufficient information about support infrastructure and service quality. Essential elements including available communication channels, response time standards, service quality metrics, and multilingual support capabilities remain unspecified in accessible documentation.

Critical support features such as 24/7 availability, live chat functionality, phone support, email responsiveness, and dedicated account management services could not be verified from available sources. Without concrete information about support hours, regional coverage, or service level agreements, it becomes impossible to assess the broker's commitment to client assistance.

User feedback specifically addressing customer service experiences was not detailed in available materials. This prevents analysis of real-world support quality and problem resolution effectiveness. The absence of documented support policies, escalation procedures, or service guarantees further complicates meaningful evaluation.

Professional trading environments require reliable, knowledgeable, and responsive customer support, particularly during market volatility or technical difficulties. Without access to comprehensive support information, this ivision market review cannot provide a meaningful assessment of customer service capabilities.

Trading Experience Analysis (Score: N/A)

Evaluating the trading experience at Ivision Market proves challenging due to limited information about platform performance, execution quality, and user interface design. While MT5 platform availability suggests access to professional-grade trading tools, specific performance metrics, execution speeds, and platform stability data were not available in accessible sources.

Order execution quality, including fill rates, slippage statistics, and rejection rates, represents crucial elements of trading experience that could not be assessed from available documentation. Similarly, information about server locations, latency optimization, and infrastructure reliability remains unspecified.

Mobile trading capabilities, while likely available through standard MT5 mobile applications, were not specifically detailed regarding broker-specific features or optimizations. The user interface design of proprietary platforms and any custom trading tools could not be evaluated without access to platform demonstrations or detailed specifications.

Trading environment factors such as market depth, liquidity provision, and execution model (market maker vs. ECN) were not clearly specified in available materials. Without comprehensive information about these fundamental trading experience elements, a meaningful score cannot be assigned to this critical evaluation category.

This ivision market review emphasizes the importance of platform testing and demo account evaluation for traders considering this broker.

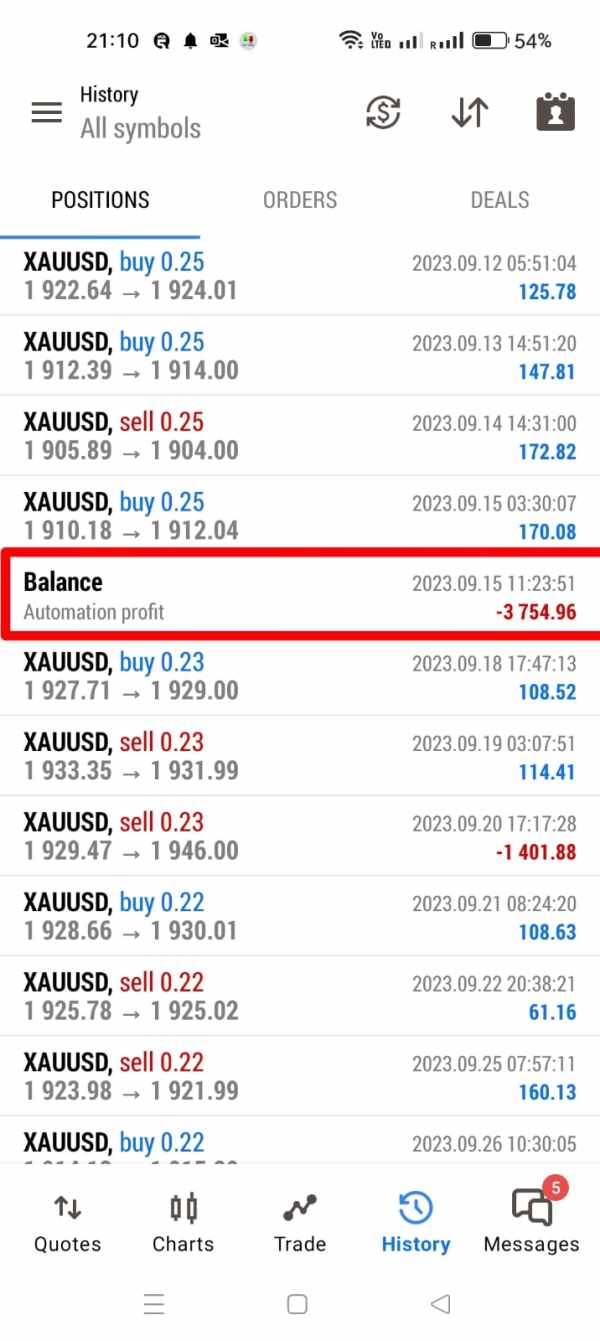

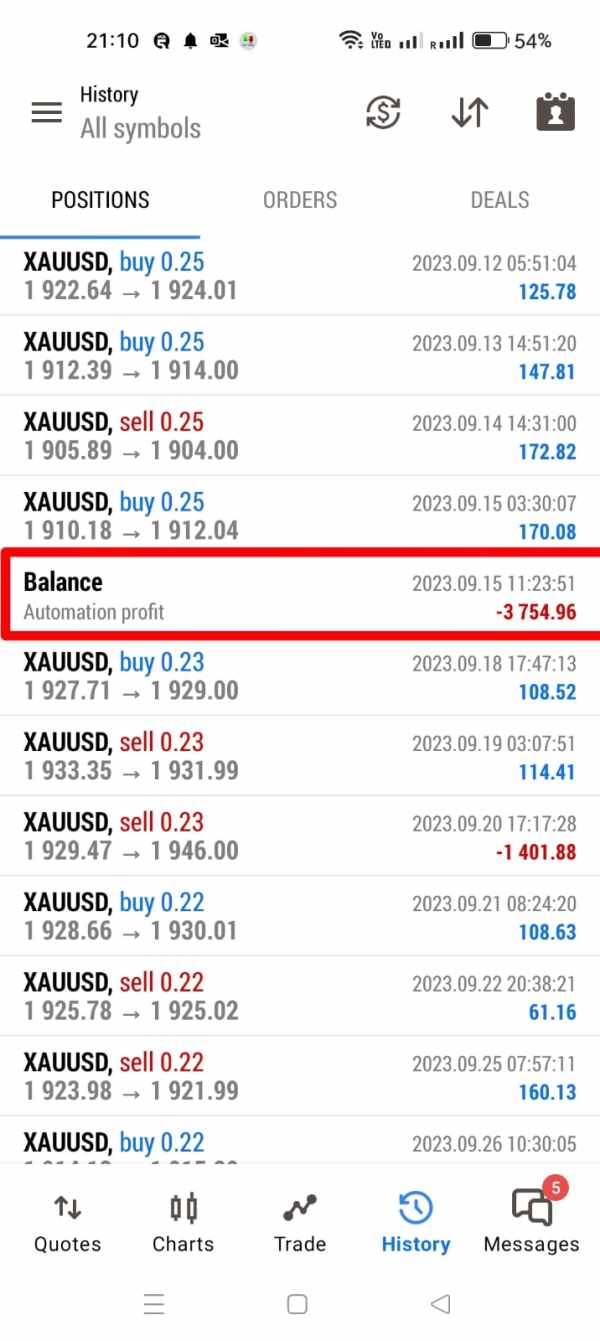

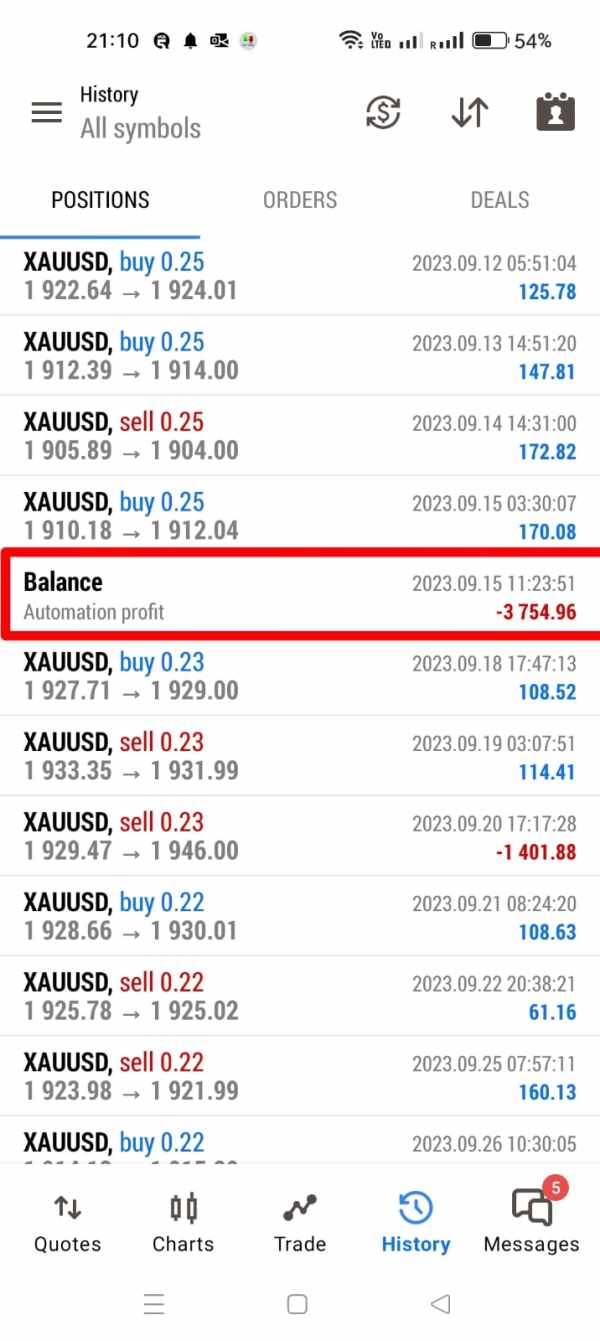

Trust and Safety Analysis (Score: 4/10)

Trust and safety concerns represent significant considerations for Ivision Market, with mixed signals emerging from available information. While the broker maintains NFA registration under ID 0553552, questions about legitimacy and safety have been raised by some users and industry observers.

The regulatory framework provided by NFA registration offers some oversight, though the effectiveness and scope of protection for international clients may vary. Saint Lucia registration provides legal structure. However, the jurisdiction's regulatory robustness compared to major financial centers like the UK or Australia remains a consideration for risk-conscious traders.

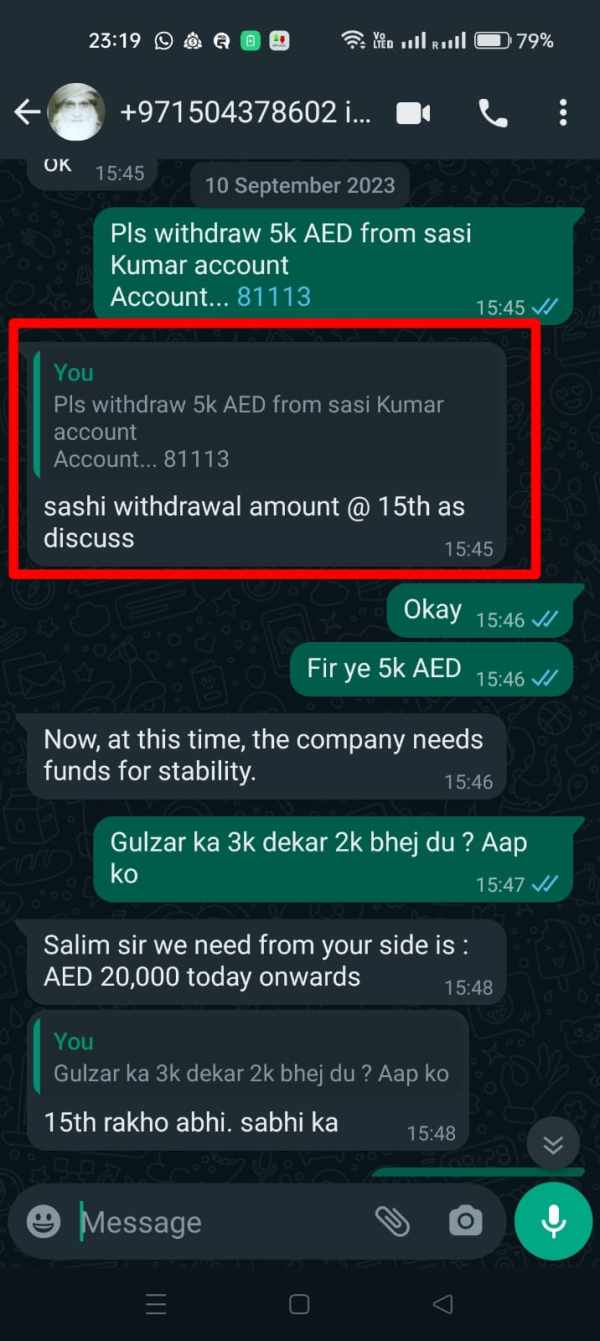

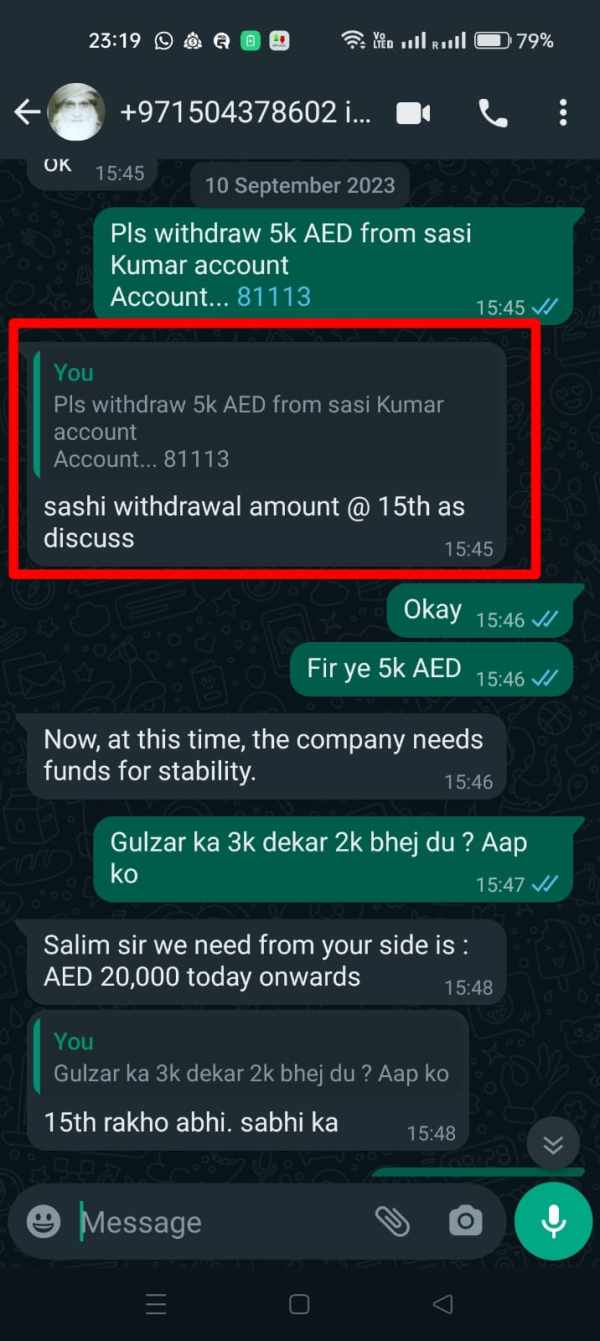

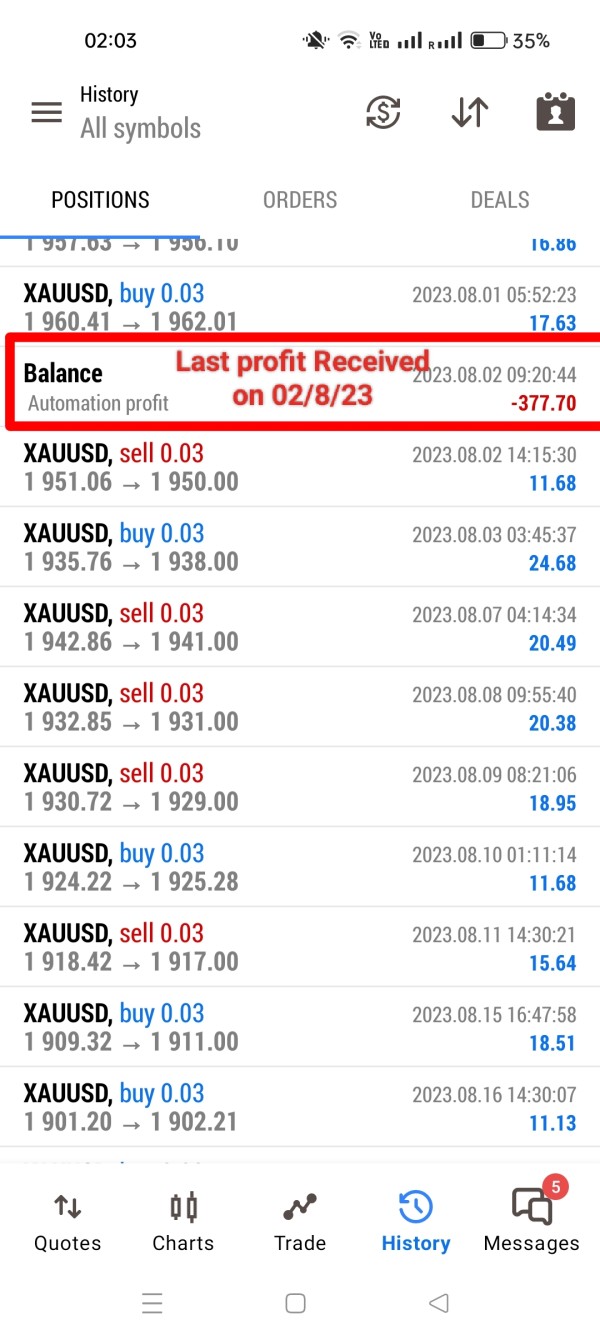

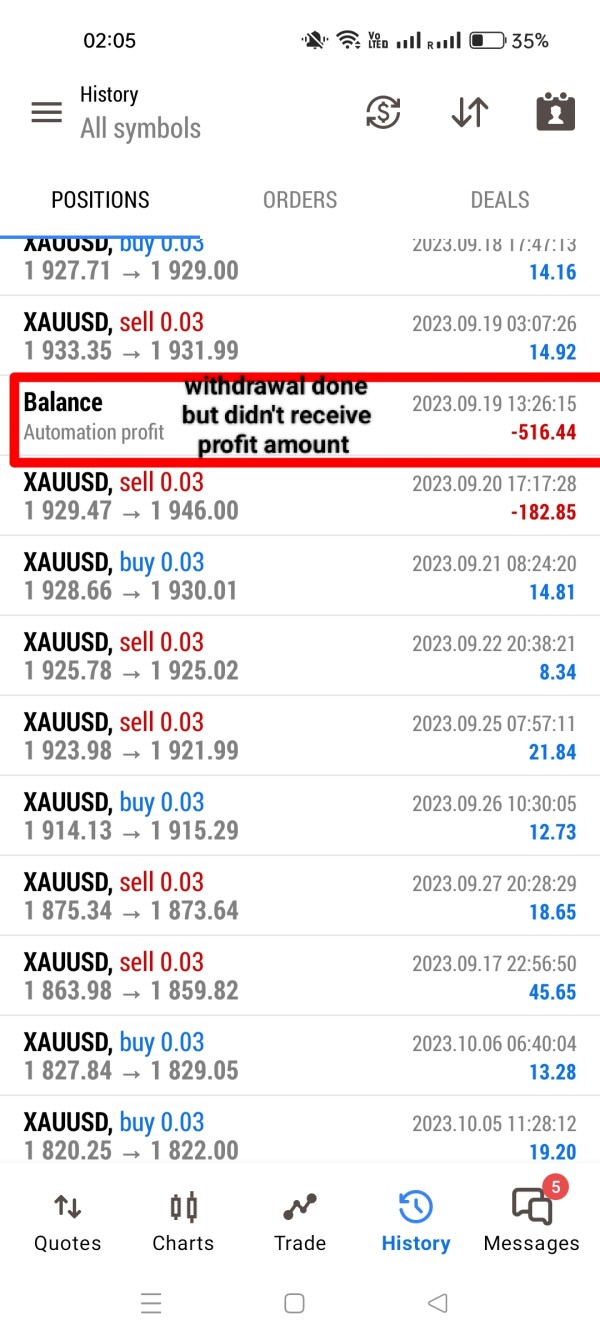

User feedback indicates polarized opinions about the broker's legitimacy, with some traders expressing concerns about safety and operational transparency. These concerns, while not conclusively proven, suggest the need for enhanced due diligence by potential clients considering this broker.

Information about client fund segregation, insurance protection, negative balance protection, and other safety measures was not detailed in available documentation. The absence of clear safety protocols and risk management disclosures contributes to uncertainty about client protection standards.

Given the mixed signals regarding safety and legitimacy concerns raised by some users, this aspect of the broker's operations requires careful consideration by potential clients.

User Experience Analysis (Score: N/A)

Comprehensive user experience evaluation for Ivision Market cannot be completed due to limited feedback data and interface information. While the broker targets small to medium-sized traders interested in diversified investing, specific user satisfaction metrics and experience testimonials were not extensively documented in available sources.

Interface design quality, navigation efficiency, and platform usability could not be assessed without access to detailed platform reviews or user interface demonstrations. Registration and verification processes, which significantly impact initial user experience, were not described in available materials.

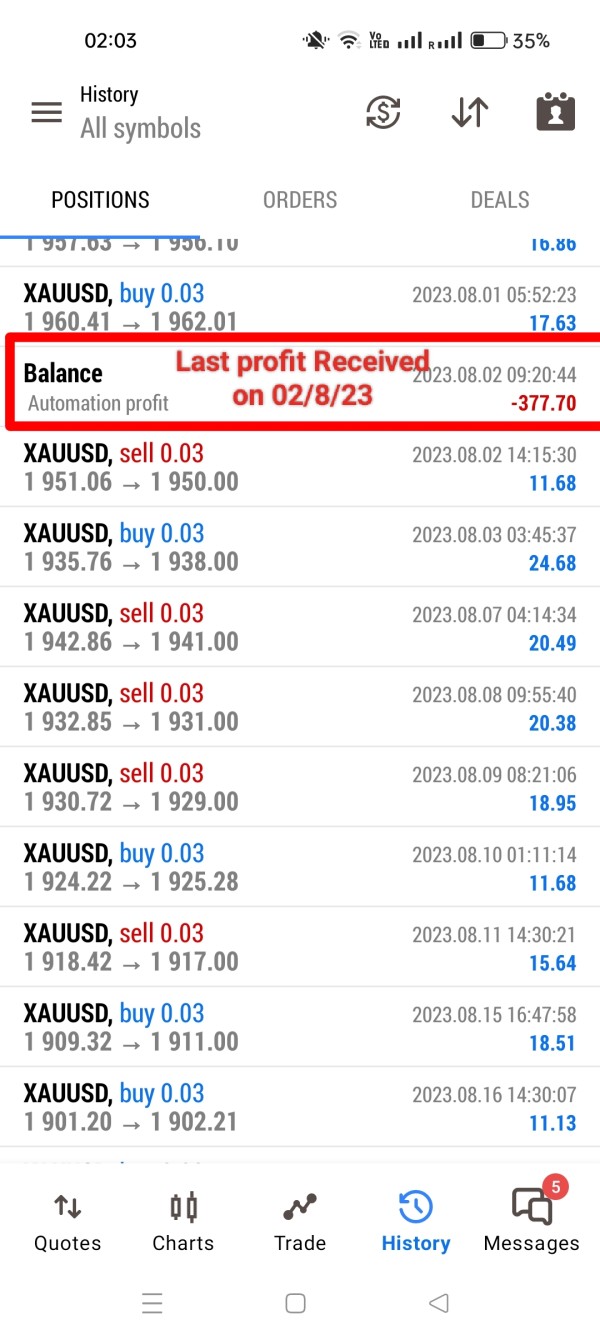

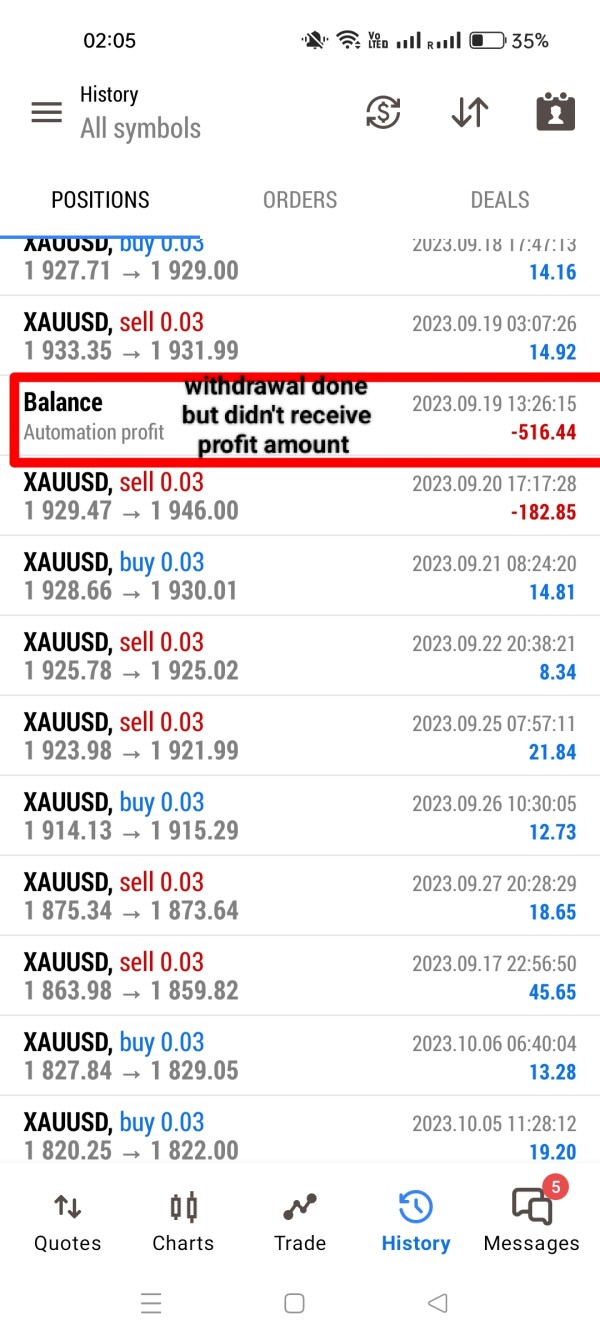

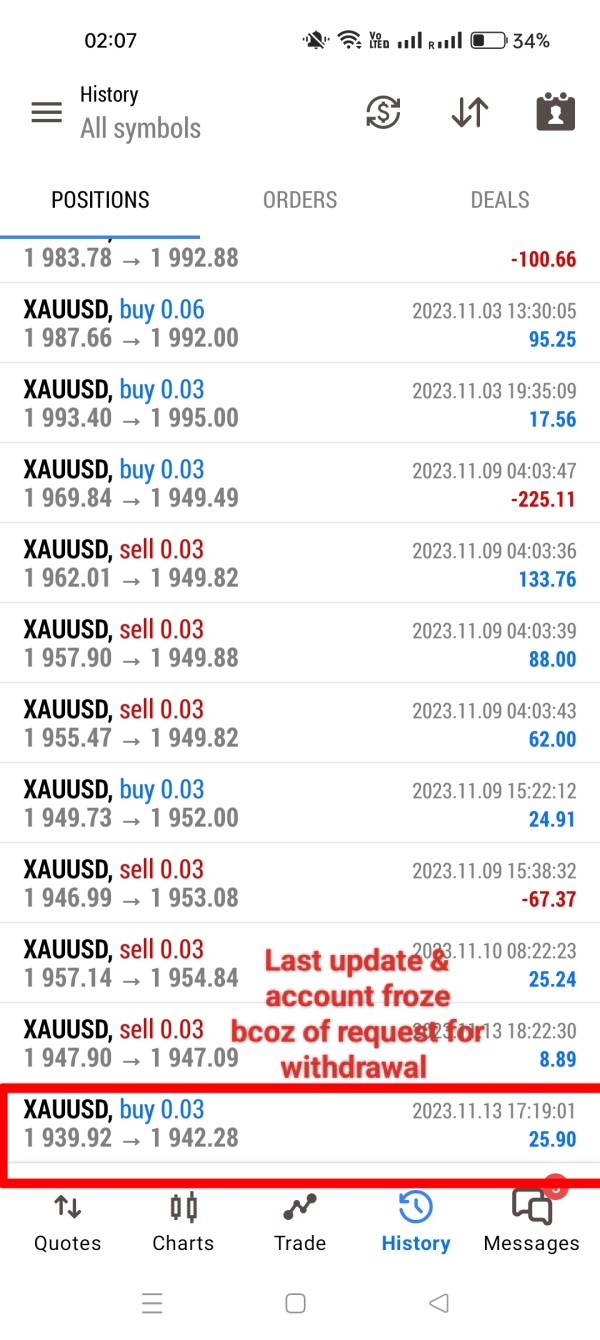

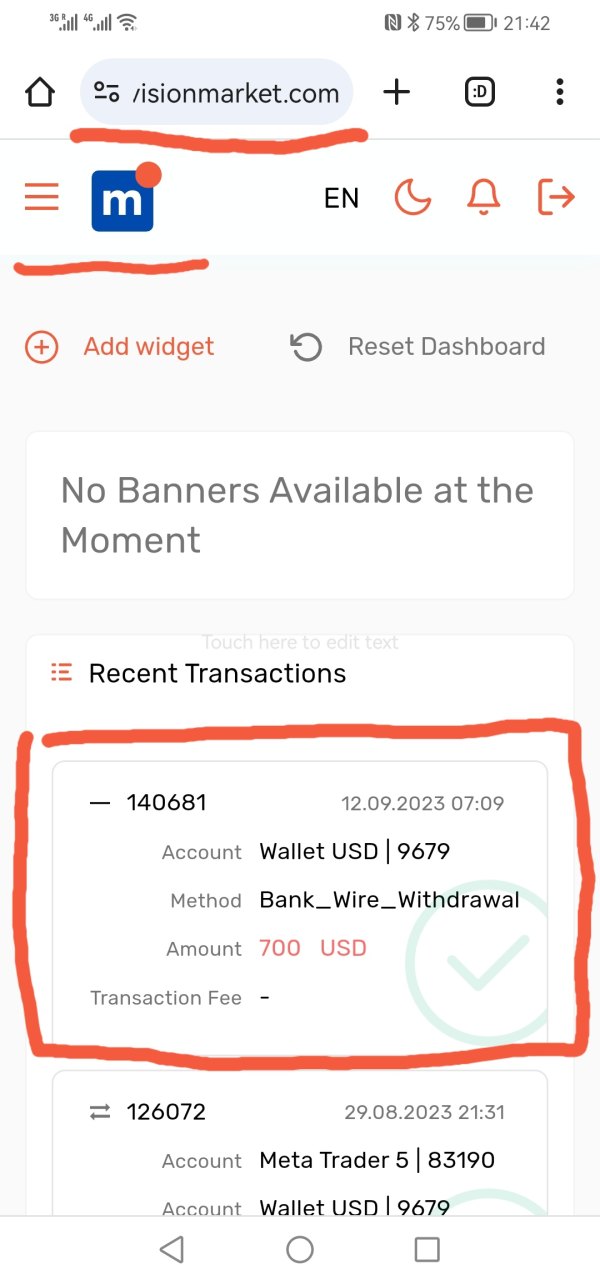

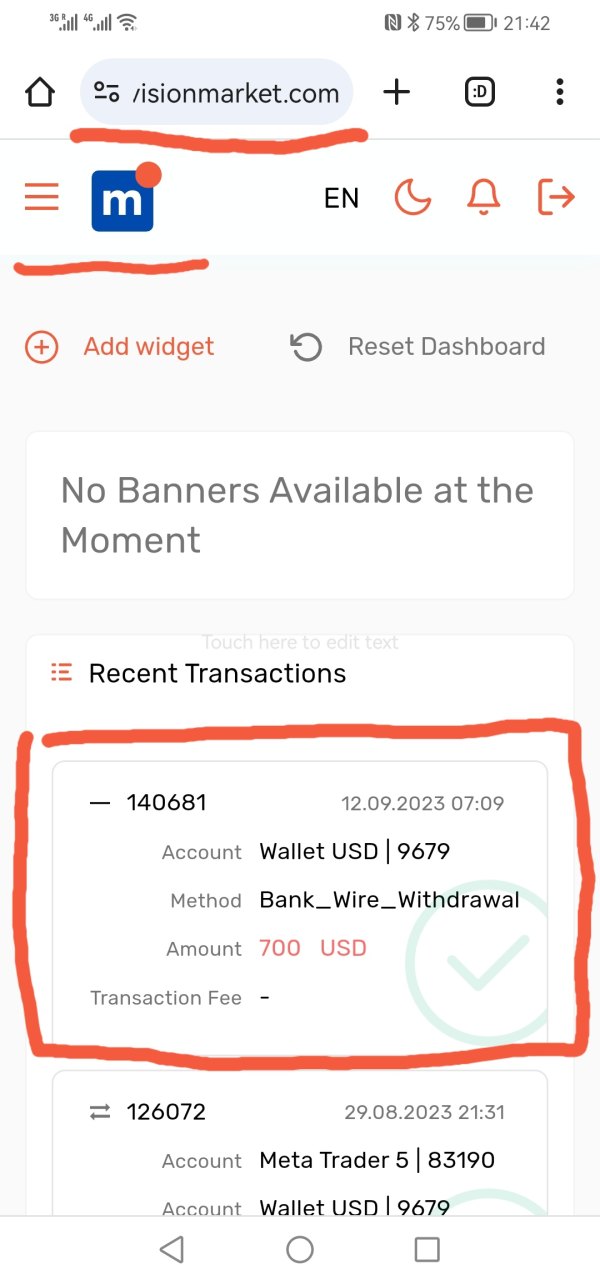

Fund management experience, including deposit and withdrawal procedures, processing times, and user satisfaction with financial operations, remains unspecified in accessible documentation. These elements critically influence overall user satisfaction and retention.

Some users have raised concerns about legitimacy and safety, which negatively impacts overall user confidence and experience. However, without comprehensive user feedback covering the full range of broker services, a complete user experience assessment cannot be provided.

The broker's positioning toward traders seeking diversified investment opportunities suggests a focus on user needs. However, specific user experience optimization measures and satisfaction initiatives were not detailed in this analysis.

Conclusion

This ivision market review reveals a broker with both potential strengths and significant areas of concern. Ivision Market's primary advantages include access to over 1,100 financial instruments across diverse asset classes and support for the professional-grade Meta Trader 5 platform. These features provide substantial trading opportunities for investors seeking portfolio diversification.

However, the legitimacy and safety concerns raised by some users, combined with limited transparency about essential operational details, present considerable caution flags. The absence of comprehensive information about account conditions, customer service, and safety protocols makes thorough evaluation challenging.

Ivision Market may suit small to medium-sized traders interested in diversified investing, but only those willing to accept higher uncertainty levels and conduct extensive independent due diligence. The mixed user feedback and questions about operational transparency suggest that potential clients should proceed with exceptional caution. They should consider alternative brokers with more established track records and clearer operational frameworks.

Traders considering this broker should prioritize thorough research, demo account testing, and careful risk assessment before committing funds to live trading accounts.