PPI Forex Review 1

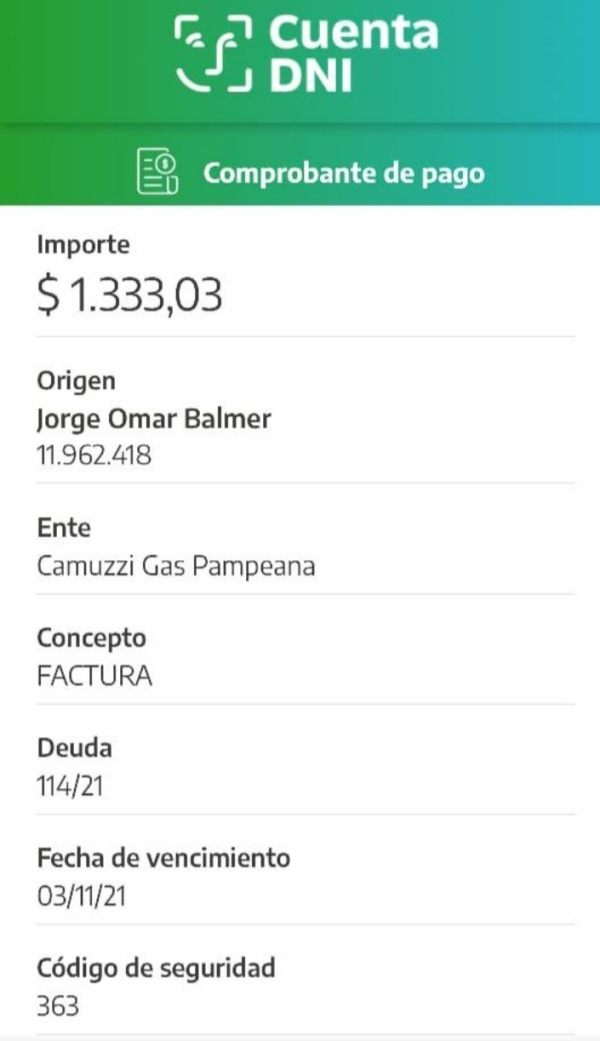

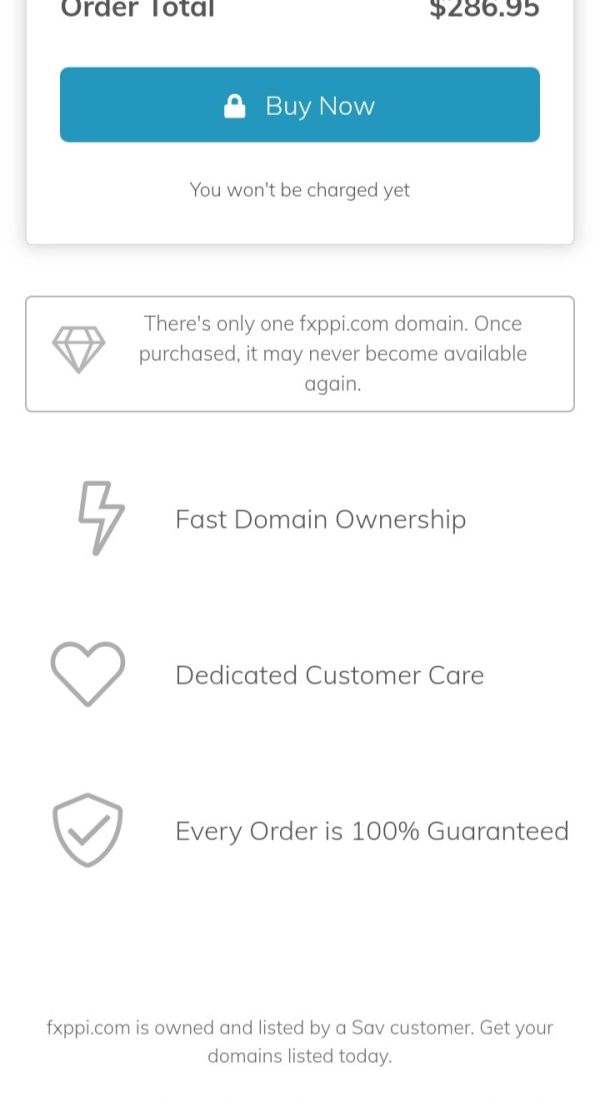

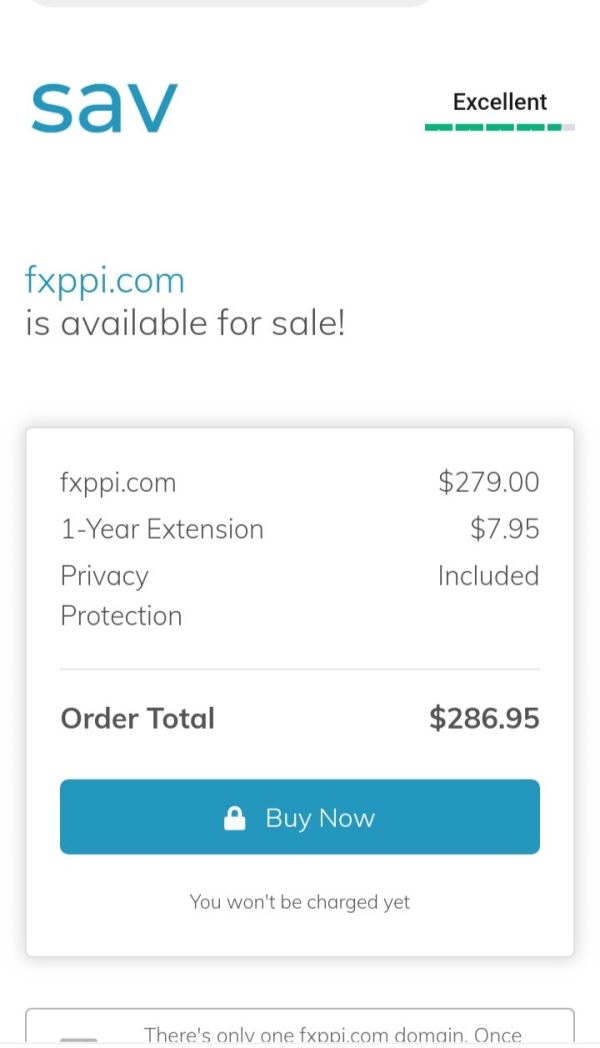

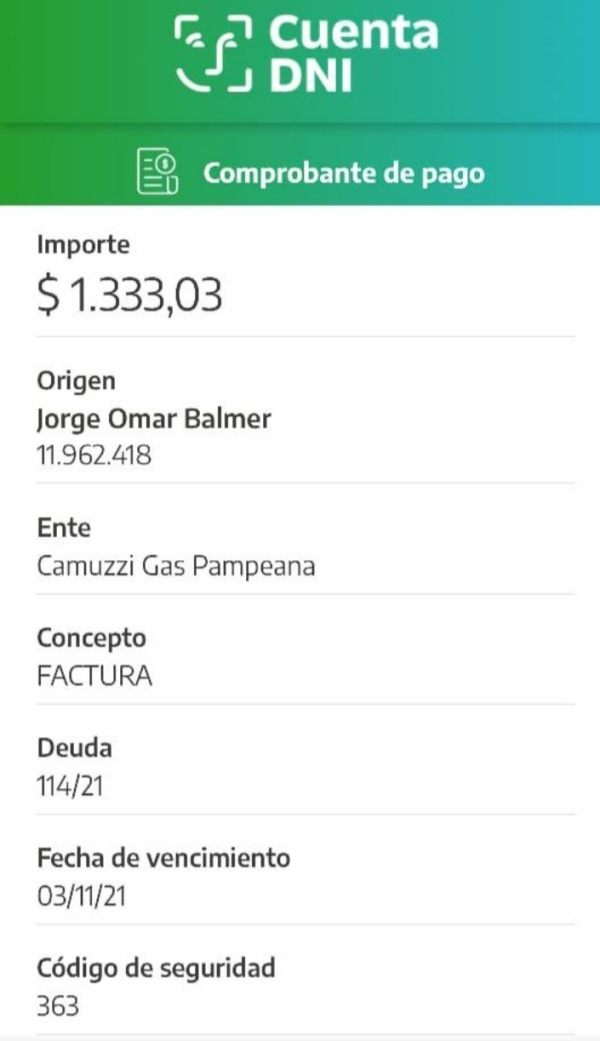

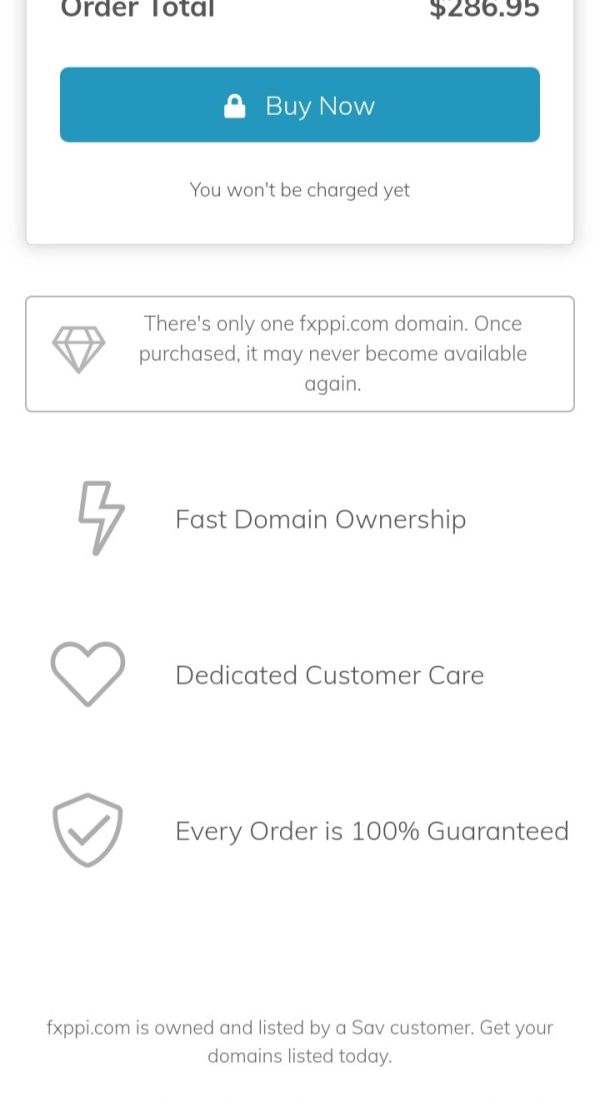

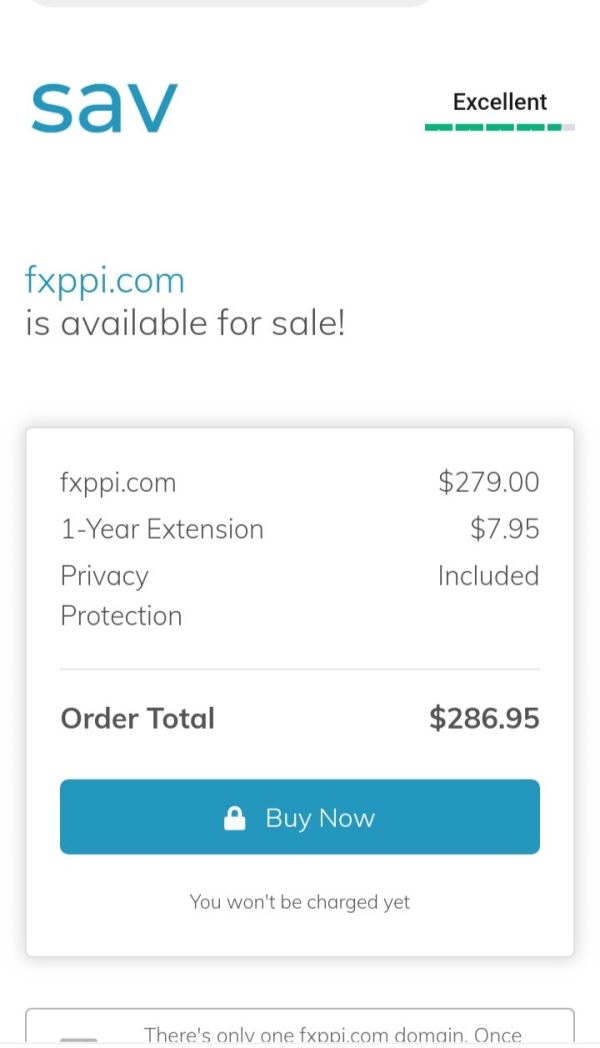

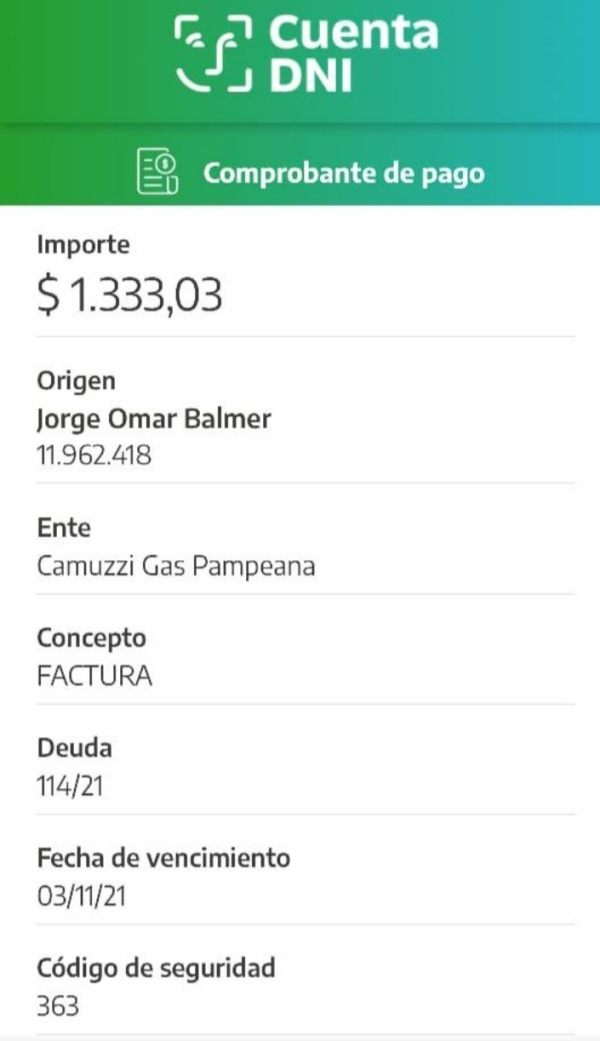

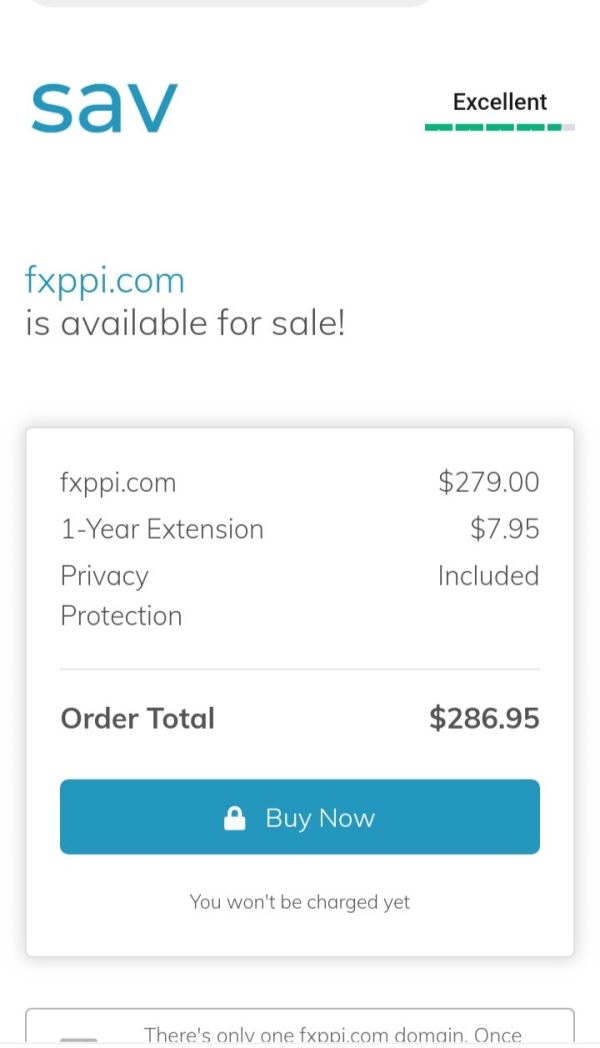

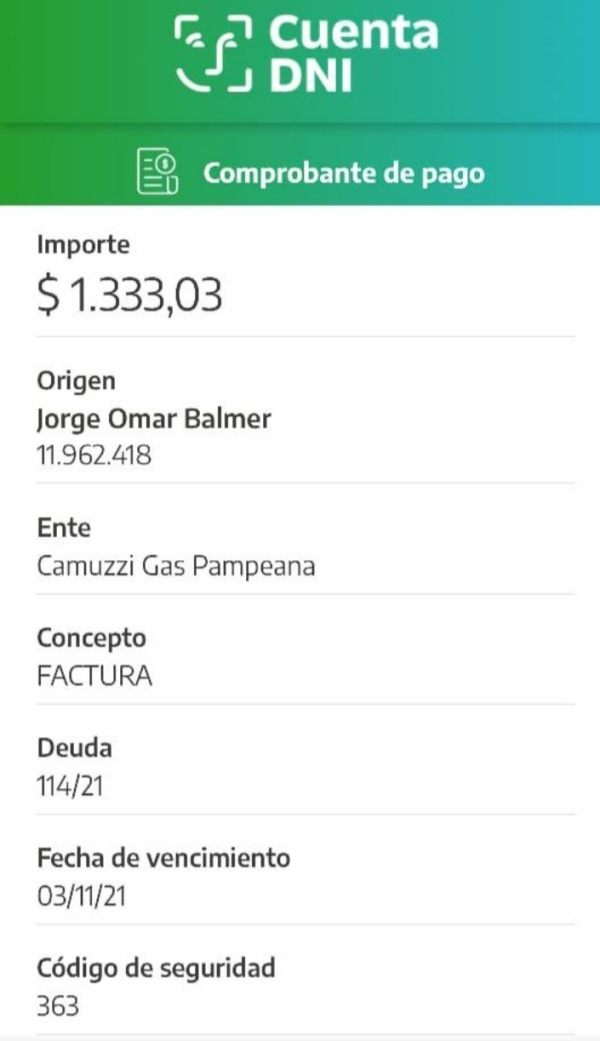

My money ($ 1,333), has gone to the trash can after the deposit to the broker PPI Broker since I see that the company closed and change of domain, and it is for sale now.

PPI Forex Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

My money ($ 1,333), has gone to the trash can after the deposit to the broker PPI Broker since I see that the company closed and change of domain, and it is for sale now.

PPI Forex presents itself as a specialized trading platform geared towards seasoned investors who are ready to embrace considerable risk for potentially high rewards. Established in 1999 and based in Argentina, PPI Forex operates without regulatory oversight, making it an inherently precarious choice for investors. The firm demands a robust minimum deposit of $5,000, which serves to filter out novice traders and those with limited capital. While the broker offers tailored services aimed at meeting the unique needs of individual investors, the lack of regulation, coupled with numerous complaints about withdrawal issues and hidden fees, raises significant concerns. For experienced traders with sufficient capital and market know-how, PPI Forex may appear as an enticing opportunity; however, the jeopardy associated with unregulated trading platforms cannot be overstated.

Caution is crucial when considering PPI Forex:

Self-Verification Steps:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 1 | Unregulated status raises significant safety concerns. |

| Trading Costs | 3 | Competitive commissions but hidden high fees detract. |

| Platforms & Tools | 3 | Good platform options available but user feedback mixed. |

| User Experience | 2 | Numerous complaints regarding customer service and withdrawals. |

| Customer Support | 2 | Limited responses from support indicate potential service issues. |

| Account Conditions | 1 | High minimum deposit and lack of demo accounts deter new users. |

Founded in 1999, PPI Forex operates under the formal name of Portfolio Personal de Inversiones S.A., and is headquartered in Argentina. Despite establishing a foothold in the financial landscape over the past two decades, PPI Forex has remained unregulated, leading to concerns about its operational integrity and investor protection. The firms unregulated status is a significant detriment, as it means clients are not shielded from the risks typically mitigated by regulatory oversight, such as the safeguarding of funds and adherence to industry best practices.

PPI Forex primarily functions as a broker for various financial instruments, including equities, sovereign bonds, futures, options, and mutual funds. The platform offers tailored investment services aimed at experienced traders, but lacks regulatory accreditation. With a minimum deposit requirement set at $5,000, the firm caters to high-net-worth individuals and seasoned investors. However, the absence of a demo account further alienates potential newcomers, as they cannot familiarize themselves with the platform or develop strategies without committing real capital upfront.

| Key Details | Information |

|---|---|

| Regulation | Unregulated |

| Minimum Deposit | $5,000 |

| Leverage | Not specified in sourced materials |

| Major Fees | High withdrawal fees (up to $30), various commissions |

| Trading Platforms | Custom platform (not MT4/MT5) |

| Customer Support | Email and phone contact available |

Regulatory Information Conflicts

PPI Forex operates without any legitimate regulatory credentials, as noted by multiple sources. No valid regulatory information exists, which poses significant risks to investors. Without regulatory oversight, there is no assurance that the company complies with standard industry practices or that client funds are protected.

User Self-Verification Guide

To manage uncertainty, follow these steps to verify the broker's reliability:

Industry Reputation and Summary

User feedback about PPI Forex indicates a concerning trend regarding fund safety. As one user lamented:

"Withdrawing my funds has been an uphill battle; it feels like they intentionally delay the process."

This sentiment underscores the crucial need for potential investors to conduct rigorous self-verification before engaging with the broker.

Advantages in Commissions

PPI Forex offers a relatively competitive commission structure, particularly on transactions such as stocks and government bonds, which charge around 0.6% plus VAT for internet trades.

The "Traps" of Non-Trading Fees

While the commissions can be appealing, the broker imposes high withdrawal fees and various hidden costs. For instance, users have reported withdrawal fees reaching up to $30, excluding VAT, which significantly reduces overall investment returns.

Cost Structure Summary

The firm's pricing may appear favorable to high traders given the low commissions; however, the hidden fees can dramatically affect profitability. Thus, traders must weigh these costs against potential benefits.

Platform Diversity

PPI Forex supports several trading instruments, yet it does not offer the widely recognized platforms like MetaTrader 4 or 5. Instead, it promotes a self-developed platform that may not meet industry standards for usability.

Quality of Tools and Resources

The tools available on their platform lack depth and sophistication when compared to other leading brokers. Users express frustrations regarding the absence of comprehensive analytics or educational resources that are essential for traders at all experience levels.

Platform Experience Summary

User experiences with PPI Forex's platform are variable. A common complaint reflects on its usability, as relayed by a trader who stated:

“The lack of a demo account coupled with a confusing interface makes it difficult for newcomers to grasp.”

Navigational Challenges and Features

Users often find PPI Forex's interface cumbersome, which can deter effective trading strategies. The failure to provide a demo account further hinders those who wish to acclimatize themselves to the trading environment without financial risk.

Feedback on Services Offered

Feedback highlights concerns regarding customer service responsiveness. Potential users have pointed out that their queries often go unanswered for extended periods, indicating a lack of adequate customer support infrastructure.

Accessibility and Responsiveness

Customer support is primarily available via email and phone, but anecdotal evidence suggests delays in response times leave consumers frustrated. Many clients express dissatisfaction with the quality and speed of assistance.

Comprehensive Customer Support Summary

Several traders have voiced their concerns, with one stating:

“When issues arise, it takes forever to get a response from them; it seems like they're not equipped to handle higher volumes of inquiries.”

Initial Financial Commitment

The threshold for investing in PPI Forex is steep, with a minimum deposit of $5,000. This requirement, coupled with the absence of a demo account, potentially alienates smaller investors who seek a safer entry point into the trading world.

Account Types and Restrictions

The lack of diverse account types or conditions limits growth opportunities for novice traders. This presents an obstacle in a landscape where flexibility and accessibility are highly valued.

PPI Forex presents itself as a platform designed for experienced traders willing to navigate high-risk waters for personalized services. While the appeal of tailored investment opportunities exists, the dangers accompanying an unregulated broker cannot be understated. Investors should approach with caution, ensuring thorough self-verification and an awareness of the inherent risks involved. The absence of regulation, high initial deposit requirements, and notable withdrawal issues constitute significant red flags.

For seasoned investors with substantial capital and risk tolerance, PPI Forex may provide an opportunity; however, the proposition of securing your investment should be vigorously scrutinized.

Disclaimer: Trading in Forex and CFD remains a high-risk endeavor. Always conduct thorough research and ensure that you understand the risks tied to trading with an unregulated broker like PPI Forex.

FX Broker Capital Trading Markets Review