iForex 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

iForex, established in 1996, has built a reputation for offering a wide array of trading instruments, ranging from over 80 currency pairs and cryptocurrencies to various commodities and CFDs. Its platforms cater primarily to beginner and intermediate traders who appreciate a user-friendly interface and a wealth of educational resources.

However, despite its long-standing presence in the financial services industry, iForex faces scrutiny on multiple fronts, particularly concerning regulatory compliance and customer experiences. Mixed reviews highlight significant issues regarding fund withdrawals and the overall reliability of its customer service. Therefore, while iForex may seem appealing for those willing to engage with a diverse trading environment, traders need to weigh the potential risks, including negative customer experiences and regulatory concerns.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement:

Trading with iForex involves significant risks, including regulatory scrutiny and issues related to fund withdrawals. Potential traders are urged to conduct thorough due diligence before investing.

Potential Harms:

- Difficulty in accessing funds, as numerous customers have reported challenges with withdrawals.

- Aggressive sales tactics from account managers that may mislead novice traders.

- Mixed regulatory oversight raises concerns about the safety of funds.

How To Self-Verify:

- Check Regulatory Status: Visit the CySEC and BVI FSC websites to confirm iForex's compliance.

- Search for Reviews: Utilize platforms like Trustpilot to read about real experiences from users.

- Contact Support: Try reaching out to customer service to evaluate their responsiveness.

- Beware of Promises: Stay cautious of brokers promising guaranteed returns or overly high leverage without adequate risk warnings.

Rating Framework

Broker Overview

Company Background and Positioning

iForex was founded in 1996 and is headquartered in the British Virgin Islands, with additional operational oversight through its subsidiary governed by the Cyprus Securities and Exchange Commission (CySEC). Over the years, it has expanded its offerings to include a diverse range of financial instruments. However, iForex's reliance on multiple regulatory environments complicates its positioning, particularly as it caters to a global audience that includes regions with varying regulatory standards.

Core Business Overview

iForex provides access to numerous markets, allowing traders to engage in forex, CFDs, commodities, stocks, and more through its proprietary platforms—WebTrader and a mobile application. While geared toward beginners and intermediates, its educational resources and personal trading sessions further enhance its attractiveness. However, concerns about withdrawal processes and the efficacy of its customer service remain significant red flags.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

The regulatory landscape surrounding iForex raises questions about the broker's overall trustworthiness. While it operates under the oversight of CySEC and the BVI FSC, both entities have limitations in their regulatory power compared to Tier-1 regulators like the FCA in the UK. Mixed reviews indicate that many users have faced considerable challenges regarding fund withdrawals and adherence to promised services.

Analysis of Regulatory Information Conflicts:

The lack of alignment with Tier-1 regulatory standards indicates potential vulnerabilities, making traders question fund safety. Concerns have been raised about instances where withdrawals are delayed or denied without sufficient explanation.

User Self-Verification Guide:

- Visit the CySEC website and search for iForex to confirm active regulation.

- Use the BVI FSC database to check registration status.

- Read reviews on platforms like TrustPilot to assess user experiences.

- Industry Reputation Summary:

User feedback often reveals a concerning pattern regarding fund access and customer support.

"I have been cheated by the company, iforex... I tried to withdrawal... but I have not received my money."

Trading Costs Analysis

The double-edged sword effect.

iForex offers a competitive trading environment, particularly with its commission structure; however, its fee structure isn't without pitfalls.

Advantages in Commissions:

iForex does not charge commission on trades, which may attract many traders. Spreads can start as low as 1 pip on major currency pairs, making it appealing for those who prioritize low trading costs.

The "Traps" of Non-Trading Fees:

However, concerns exist regarding non-trading fees. For instance, some users have reported withdrawal fees of up to $20, and inactivity fees could apply after extended periods of non-use.

"I was charged a $20 fee for my withdrawal that wasnt initially disclosed."

- Cost Structure Summary:

The absence of trading commissions is an advantage, but the existence of withdrawal fees complicates the overall trading cost evaluation as it can reduce the effective profit margin for traders.

Professional depth vs. beginner friendliness.

iForexs proprietary trading platform is a focal point of its service offering, providing traders with a decent balance of functionality and usability.

Platform Diversity:

The WebTrader platform and dedicated mobile application are designed to facilitate ease of access. While they have a user-friendly layout, experienced traders may find the absence of customizable tools or support for MT4 limiting.

Quality of Tools and Resources:

iForex provides various charting tools, trading signals, and educational resources, yet these tools receive mixed reviews for depth. The educational resources are more tailored for beginners.

Platform Experience Summary:

Overall user feedback is mixed:

"I made my first step into the world of trading with iforex... the broker comes up with a user-friendly product."

User Experience Analysis

The balance of convenience and reliability.

User experiences with iForex vary significantly, especially concerning customer support and trading execution.

User Experience Insights:

While many new traders appreciate the ease of registering and the educational resources offered, challenges arise when attempting to access support or withdraw funds. Reports indicate delays and difficulties that can deter potential or current clients.

General Sentiments:

Many users express frustration at the lack of proactive support once they become clients, which contrasts with the help constituents are promised during onboarding.

Feedback Example:

"I signed up thinking Id receive a lot of support, but once I deposited, the communication ceased."

Customer Support Analysis

Evaluating performance under pressure.

iForexs customer support has garnered mixed reviews, with many notes on responsiveness and resolution time.

Support Accessibility:

Users often find it challenging to communicate with support, especially during critical times when they want to withdraw funds. While some find initial contact satisfactory, follow-ups usually lead to frustration.

Overall Satisfaction:

Complaints abound over unresponsive support channels:

"My account manager doesn‘t respond anymore, and I can’t get any help processing my withdrawal."

- Expectation Management:

Understanding that customer support dynamics can significantly impact user experience is critical, especially considering the financial stakes involved.

Account Conditions Analysis

Assessing the entry barriers and ongoing maintenance costs.

iForex has comparative structure for accounts that caters to a variety of traders, yet holds notable conditions.

Account Types Available:

With a minimum deposit set at $100 and the option for various platforms, iForex makes it accessible for beginners. However, the singular focus on basic accounts can lead to dissatisfaction among seasoned traders looking for tailored solutions.

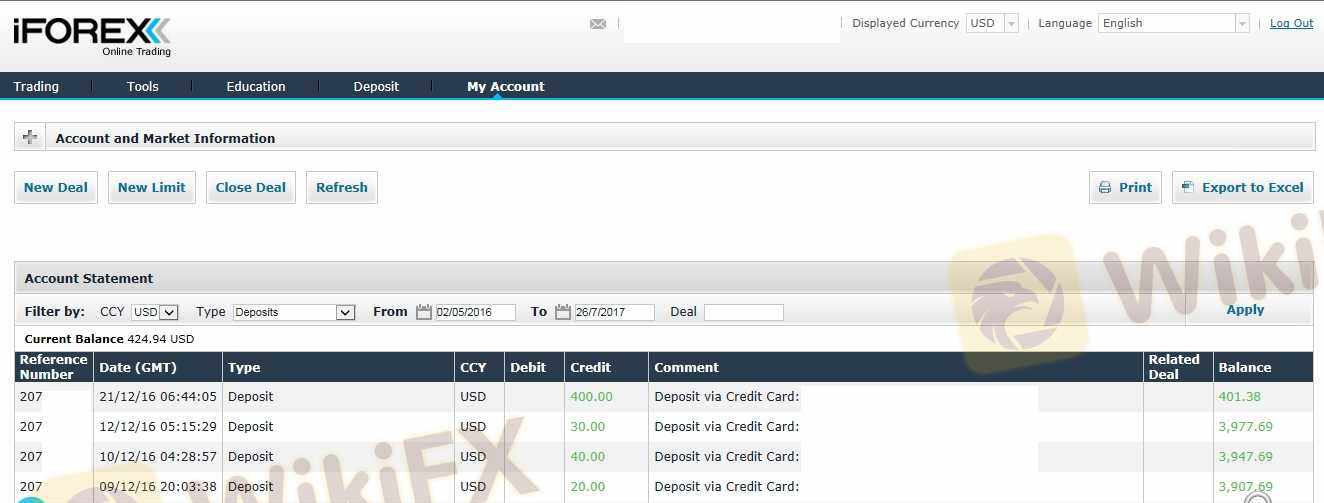

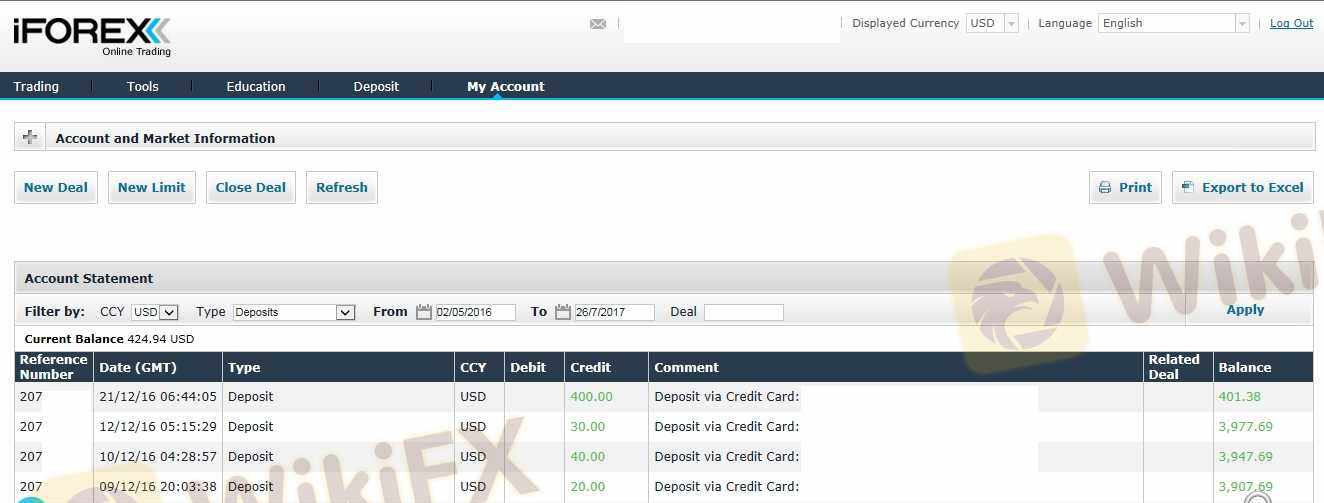

Withdrawal Policies:

The requirement that clients fill out specific forms for withdrawals adds a layer of complexity and may lead to perceived inefficiencies or frustrations that should be duly addressed to enhance user trust.

Additional Fees Insight:

The quarterly inactivity fee comes into play after a year, which could accumulate if users do not continuously engage.

Conclusion

In conclusion, while iForex offers attractive options for beginner and intermediate traders through its user-friendly platforms, a wide array of instruments, and educational resources, the shortcomings related to customer support, regulatory compliance, and withdrawal processes raise several red flags.

Prospective users must weigh the potential benefits of iForex against the risks highlighted throughout this review, particularly focusing on regulatory scrutiny and mixed user experiences. As a trading partner, being well-equipped with knowledge about potential pitfalls will serve to better prepare any trader considering engaging with iForex in the dynamic world of forex trading.