HiFX Review 1

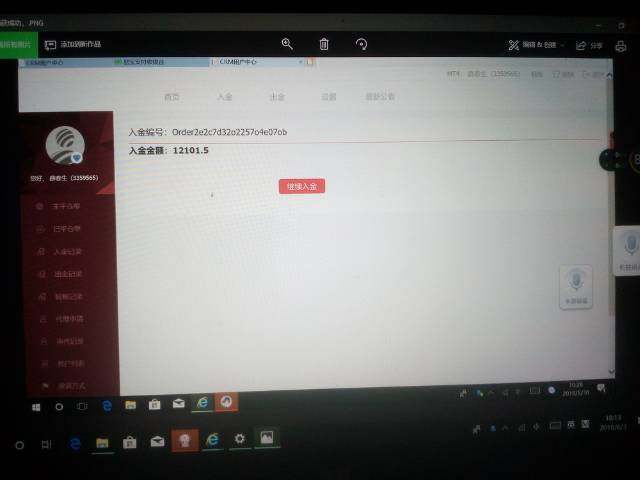

It induced me to activate the account.Then I couldn’t log in my account for 2-3 days.How rampant it is?Who can take back the money for me?

HiFX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

It induced me to activate the account.Then I couldn’t log in my account for 2-3 days.How rampant it is?Who can take back the money for me?

This comprehensive hifx review examines a foreign exchange service provider that has undergone significant changes in recent years. HiFX was originally established in 1998. The company merged with XE Money Transfer in 2019 and now operates under the XE Money Transfer brand as a subsidiary of Euronet Worldwide. It primarily serves mid-sized businesses and high-net-worth individuals with foreign exchange consulting and trading services.

HiFX offers competitive exchange rates and fees according to available reports. User evaluations suggest there may be better alternatives in the current market. The overall assessment remains neutral, reflecting the limited transparency of information and mixed user feedback. The merger with XE Money Transfer has expanded the service range, but questions remain about the consistency of service quality and customer satisfaction across different regions.

The broker's target demographic focuses on corporate clients and affluent individuals seeking specialized foreign exchange solutions rather than retail traders. However, the lack of comprehensive public information about current operations makes it challenging to provide a definitive recommendation for potential users.

Following the 2019 merger, HiFX now operates under the XE Money Transfer brand. This may result in variations in regulatory oversight and service delivery across different jurisdictions. Potential clients should verify current operational status and regulatory compliance in their specific region before engaging services.

This review is based on publicly available information and user feedback compiled from various sources. Due to limited recent data availability, some assessments reflect general industry standards rather than specific HiFX metrics. Readers should conduct independent verification of current terms and conditions.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account terms not detailed in available sources |

| Tools and Resources | N/A | Trading tools and educational resources not specified |

| Customer Service | N/A | Customer support information not available in source materials |

| Trading Experience | N/A | Platform performance data not provided in available information |

| Trust and Security | N/A | Current regulatory status not clearly outlined |

| User Experience | N/A | User satisfaction metrics not available in source materials |

HiFX emerged in the foreign exchange market in 1998. The company was originally headquartered in the United Kingdom. It built its reputation as a specialized foreign exchange service provider, focusing on corporate and high-net-worth individual clients rather than retail trading markets. The 2019 merger with XE Money Transfer marked a significant transformation, integrating HiFX operations into the broader Euronet Worldwide ecosystem.

As a subsidiary of Euronet Worldwide, the combined entity leverages expanded infrastructure and global reach. The primary business model centers on providing foreign exchange consulting and trading services to mid-sized enterprises and affluent individuals who require sophisticated currency management solutions. This hifx review notes that the target market differs significantly from typical retail forex brokers.

The company's evolution reflects broader industry consolidation trends. Smaller specialized providers merge with larger financial technology companies to enhance service capabilities and market reach. However, specific details about current trading platforms, available asset classes, and regulatory frameworks remain limited in publicly available documentation, making comprehensive evaluation challenging for potential clients.

Regulatory Jurisdiction: Current regulatory information is not clearly specified in available source materials following the XE Money Transfer integration.

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not detailed in accessible documentation.

Minimum Deposit Requirements: Minimum account funding thresholds are not specified in available information sources.

Bonuses and Promotions: No promotional offers or bonus structures are mentioned in current source materials.

Tradeable Assets: The range of available currency pairs and other financial instruments is not comprehensively outlined in accessible information.

Cost Structure: While sources indicate competitive rates and fees, specific pricing details including spreads, commissions, and additional charges are not provided in available documentation. This hifx review cannot provide definitive cost comparisons without more detailed fee schedules.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in source materials.

Platform Selection: Trading platform options and technical specifications are not detailed in available information.

Geographic Restrictions: Service availability limitations by country or region are not clearly outlined.

Customer Service Languages: Supported languages for customer support are not specified in accessible documentation.

The evaluation of HiFX account conditions is limited by insufficient publicly available information. Traditional account features such as account types, minimum deposit requirements, and special account options are not comprehensively detailed in accessible sources. This information gap significantly impacts the ability to assess account condition competitiveness compared to industry standards.

The lack of transparent account structure documentation raises questions about service accessibility for different client segments. While the company reportedly targets mid-sized businesses and high-net-worth individuals, specific account tiers and their corresponding benefits remain unclear. The absence of detailed account opening procedures and verification requirements in public documentation suggests potential clients may need direct contact for comprehensive information.

Without access to current account terms and conditions, this hifx review cannot provide definitive guidance on account suitability for different user profiles. The integration with XE Money Transfer may have altered original HiFX account structures, but these changes are not clearly documented in available sources.

Assessment of HiFX trading tools and educational resources is constrained by limited information availability. The source materials do not specify the range of analytical tools, research capabilities, or educational content provided to clients. This information deficiency prevents meaningful evaluation of the platform's utility for different trading strategies and experience levels.

Modern forex service providers typically offer comprehensive analytical suites, market research, and educational programs. However, without specific details about HiFX offerings, potential clients cannot assess whether the platform meets contemporary standards for trading support tools. The merger with XE Money Transfer may have enhanced resource availability, but these improvements are not documented in accessible sources.

Automated trading support, algorithmic trading capabilities, and third-party integration options remain unspecified in available documentation. This lack of technical specification information makes it difficult for sophisticated users to evaluate platform suitability for advanced trading strategies.

Customer service evaluation is hindered by the absence of detailed support information in available sources. Critical factors including support channel availability, response timeframes, service quality metrics, and multilingual capabilities are not specified in accessible documentation. This information gap prevents assessment of customer support adequacy for international clients.

The transition from independent HiFX operations to XE Money Transfer integration may have altered customer service structures and availability. However, these changes and their impact on service quality are not clearly documented in public sources. Without user feedback data or service level agreements, this hifx review cannot provide definitive customer support quality assessments.

Professional forex services require responsive, knowledgeable customer support, particularly for corporate clients managing significant currency exposures. The lack of transparent customer service information raises questions about support adequacy for time-sensitive trading requirements.

Platform performance evaluation is limited by insufficient technical specification data in available sources. Key performance indicators including platform stability, execution speed, order processing quality, and mobile application functionality are not detailed in accessible documentation. This prevents comprehensive assessment of trading environment quality.

The absence of platform performance metrics and user experience data makes it challenging to evaluate HiFX competitiveness against established forex service providers. Modern trading environments require reliable, fast execution and comprehensive functionality across desktop and mobile platforms. Without specific performance data, potential users cannot assess platform adequacy for their trading requirements.

Technical infrastructure quality, server reliability, and execution consistency remain unspecified in available information. These factors are critical for professional trading operations, particularly for corporate clients requiring dependable currency management solutions.

Trust evaluation is complicated by limited regulatory and security information in available sources. Current regulatory compliance status, client fund protection measures, company transparency levels, and industry reputation details are not comprehensively outlined in accessible documentation. This information deficiency impacts the ability to assess overall trustworthiness and security standards.

The integration with Euronet Worldwide, a publicly traded financial technology company, may enhance security and regulatory compliance. However, specific security measures, regulatory oversight details, and client protection protocols are not clearly documented in available sources. Without regulatory verification and third-party security assessments, comprehensive trust evaluation remains challenging.

Client fund segregation, insurance coverage, and regulatory complaint mechanisms are not specified in accessible information. These factors are fundamental for assessing broker reliability and client asset protection standards.

User experience assessment is constrained by limited user feedback and satisfaction data in available sources. Overall user satisfaction levels, interface design quality, registration processes, and common user concerns are not detailed in accessible documentation. This prevents comprehensive evaluation of service delivery quality from the client perspective.

The lack of user testimonials, satisfaction surveys, and experience reviews makes it difficult to assess real-world service performance. User experience factors including ease of use, process efficiency, and problem resolution effectiveness remain unspecified in available information. Without user feedback data, this hifx review cannot provide definitive user experience assessments.

Interface design, navigation efficiency, and overall usability standards are not documented in accessible sources. These factors significantly impact user satisfaction and service adoption rates, particularly for less experienced users requiring intuitive platform design.

This hifx review reveals a foreign exchange service provider with a long operational history but limited current transparency. While HiFX's 1998 establishment and subsequent integration with XE Money Transfer suggest institutional stability, the lack of comprehensive public information about current operations, pricing, and service standards makes definitive evaluation challenging.

The company appears most suitable for mid-sized businesses and high-net-worth individuals seeking specialized foreign exchange services. However, potential clients should exercise caution due to information transparency limitations. The main advantages include historical longevity and expanded service capabilities following the XE Money Transfer merger, while the primary disadvantage is insufficient public information for informed decision-making.

Prospective users should conduct thorough independent research and direct consultation before committing to HiFX services. This is especially important given the limited publicly available information about current operational standards and client satisfaction levels.

FX Broker Capital Trading Markets Review