XLNTrade 2025 Review: Everything You Need to Know

Summary:

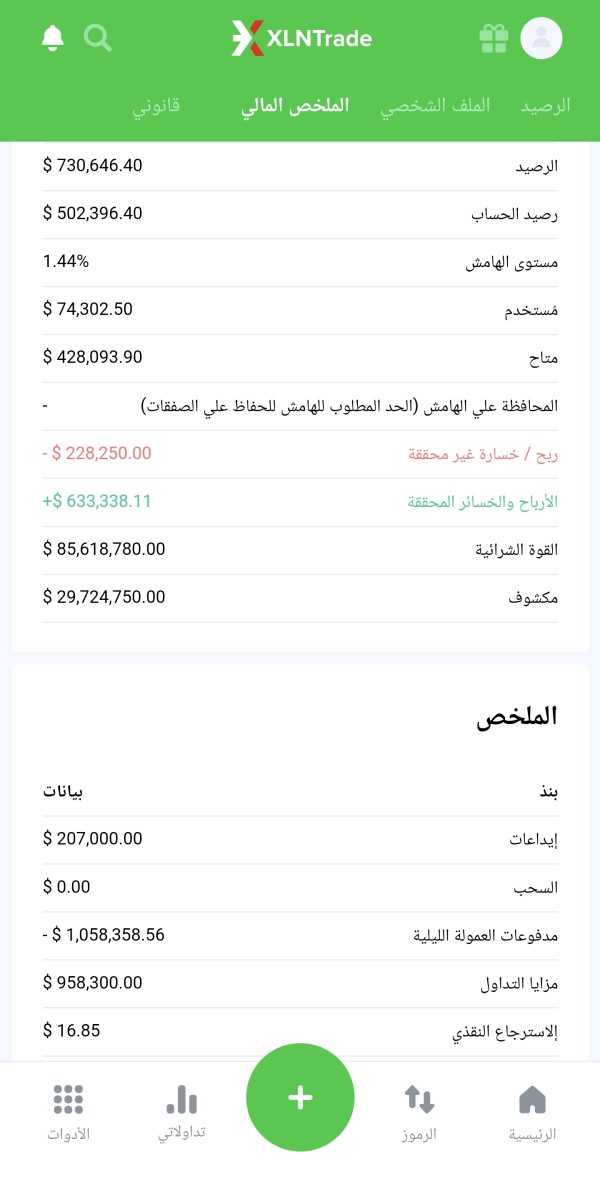

XLNTrade has garnered mixed reviews, with some users expressing dissatisfaction regarding withdrawal issues and high spreads, while others appreciate its user-friendly platform and range of trading instruments. The broker operates under a regulatory framework that raises concerns about its legitimacy, particularly given its offshore status.

Note:

Its important to recognize that XLNTrade operates under different entities across regions, which can impact user experiences. This review synthesizes various sources to provide a balanced perspective on the broker's offerings and reputation.

Ratings Overview

We evaluate brokers based on user feedback, expert opinions, and factual data regarding their services and operations.

Broker Overview

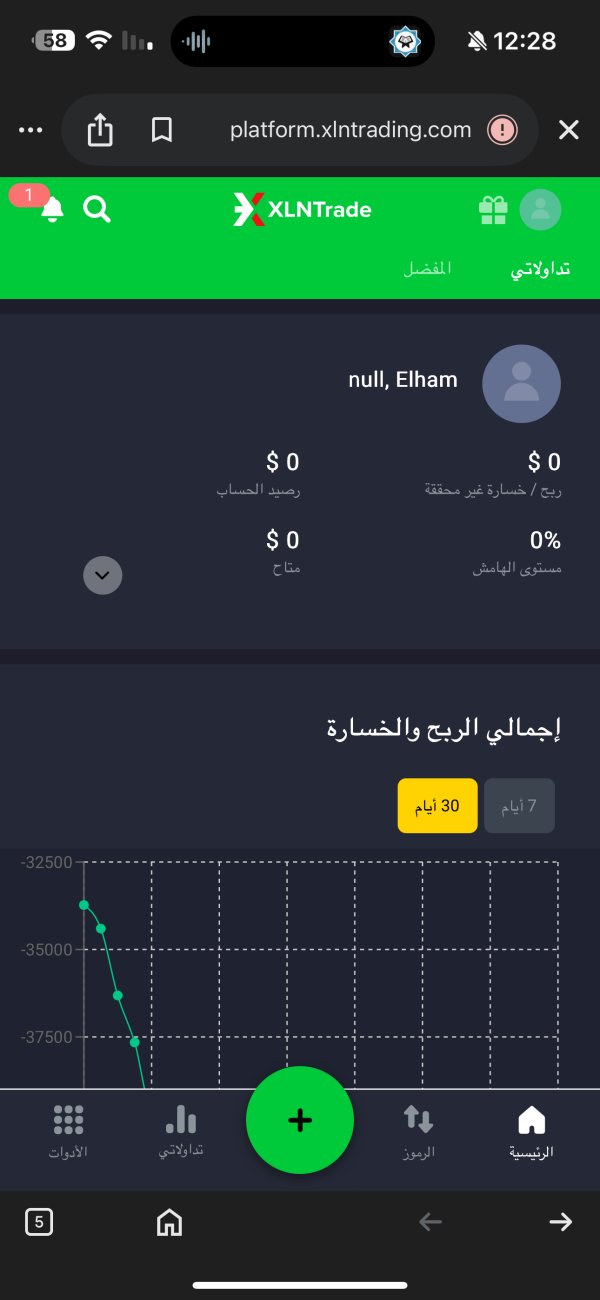

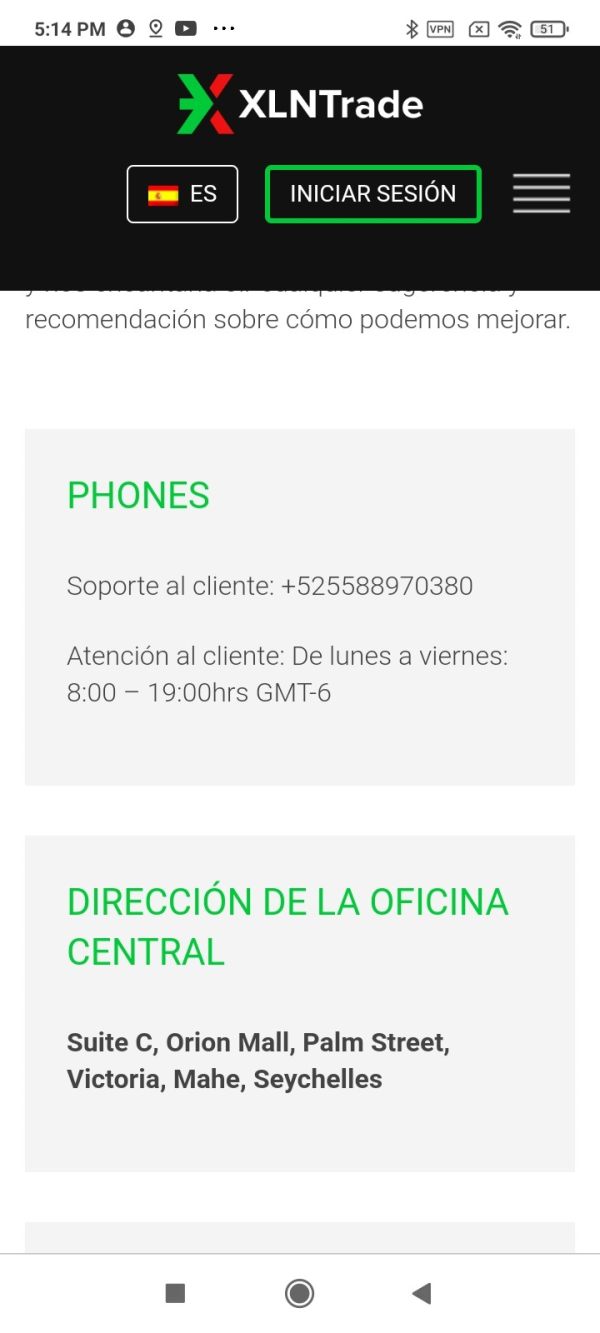

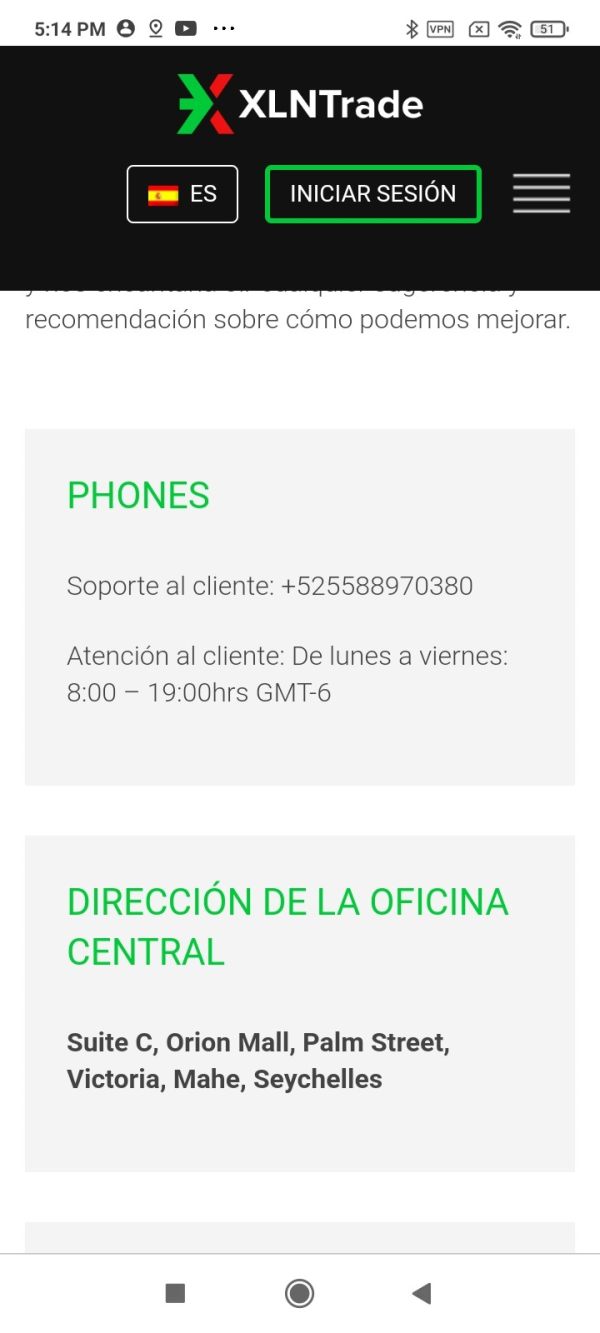

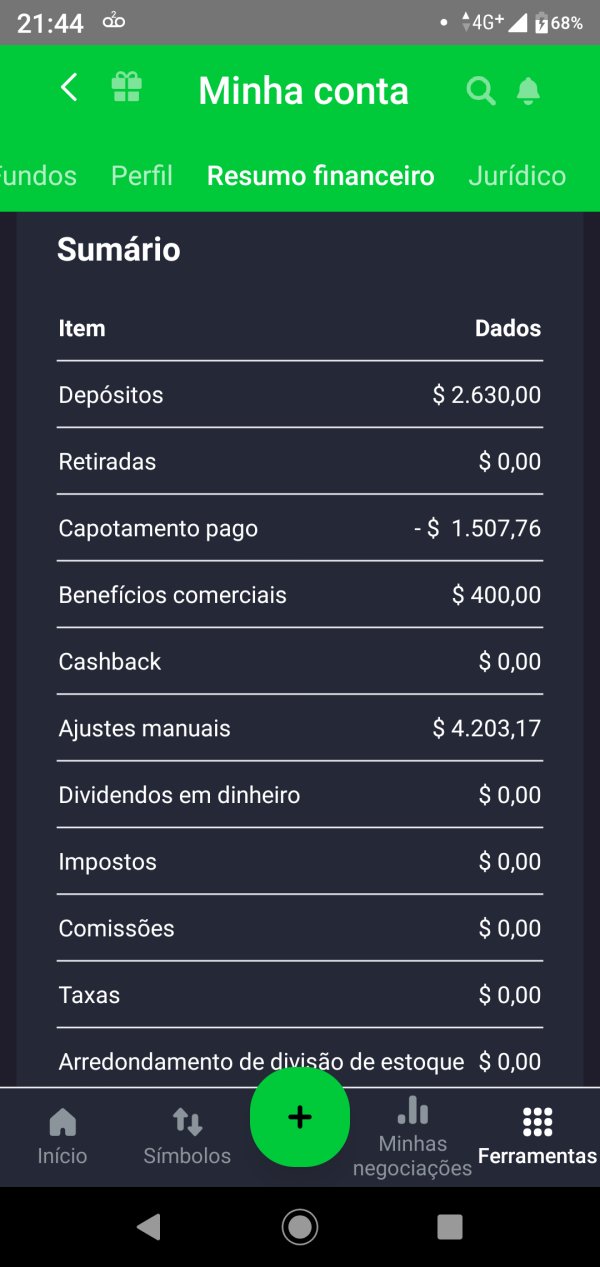

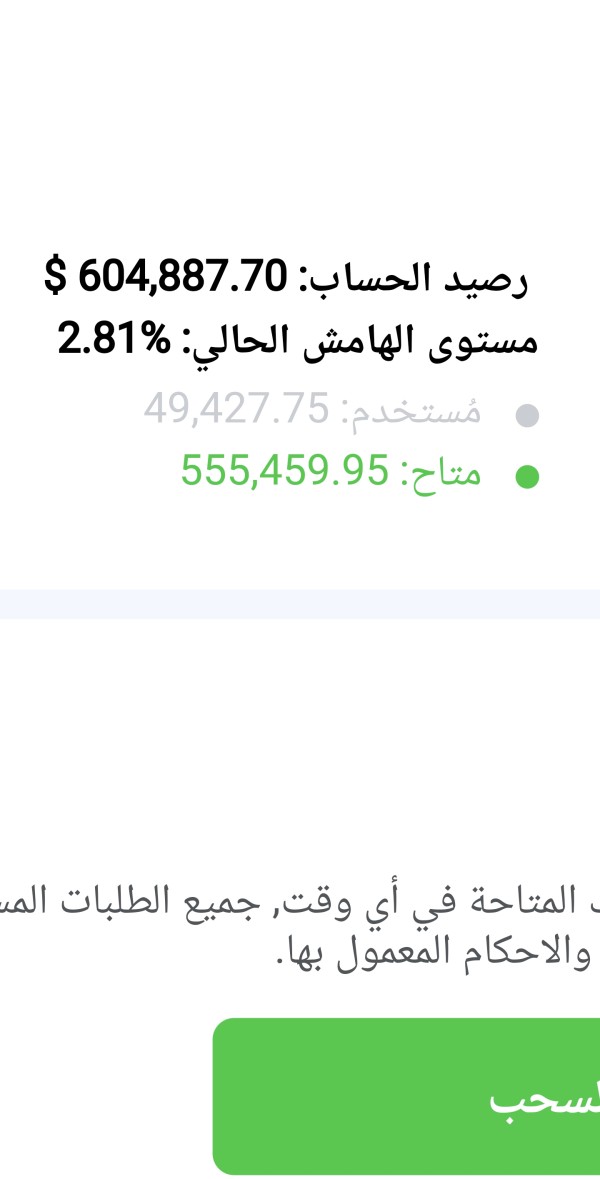

Established in 2018, XLNTrade is operated by Securcap Securities Ltd and claims to be regulated by the Seychelles Financial Services Authority (FSA). The broker offers a proprietary trading platform called Xcite, which is accessible via web and mobile applications. Traders can access a variety of asset classes, including over 45 forex pairs, commodities, indices, cryptocurrencies, and stocks. However, the regulatory oversight from the Seychelles FSA is often viewed as less stringent compared to tier-1 regulatory bodies, raising concerns about the broker's reliability.

Detailed Sections

Regulatory Areas

XLNTrade is regulated by the Seychelles FSA, which is considered a tier-3 regulator. This means that while the broker is registered, the oversight is minimal, and traders may not have the same protections as they would with brokers regulated by more reputable authorities like the FCA (UK) or ASIC (Australia).

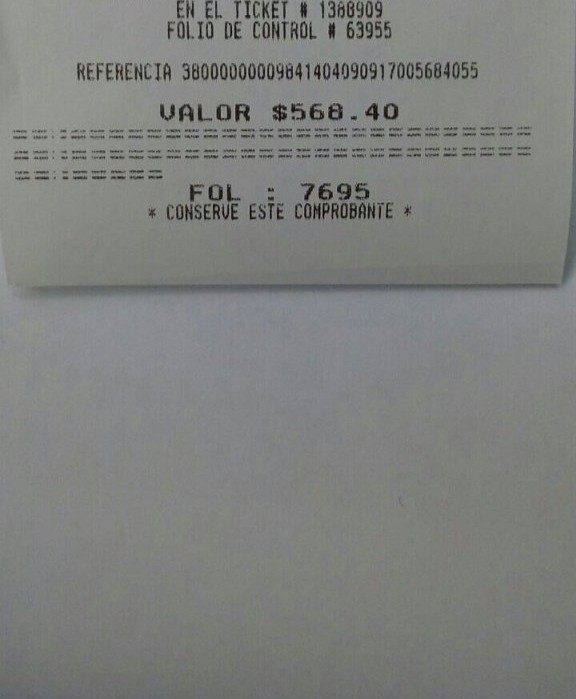

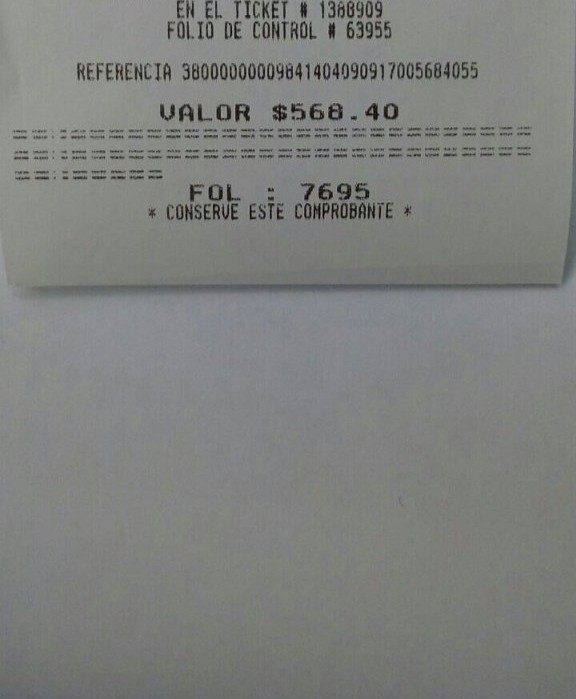

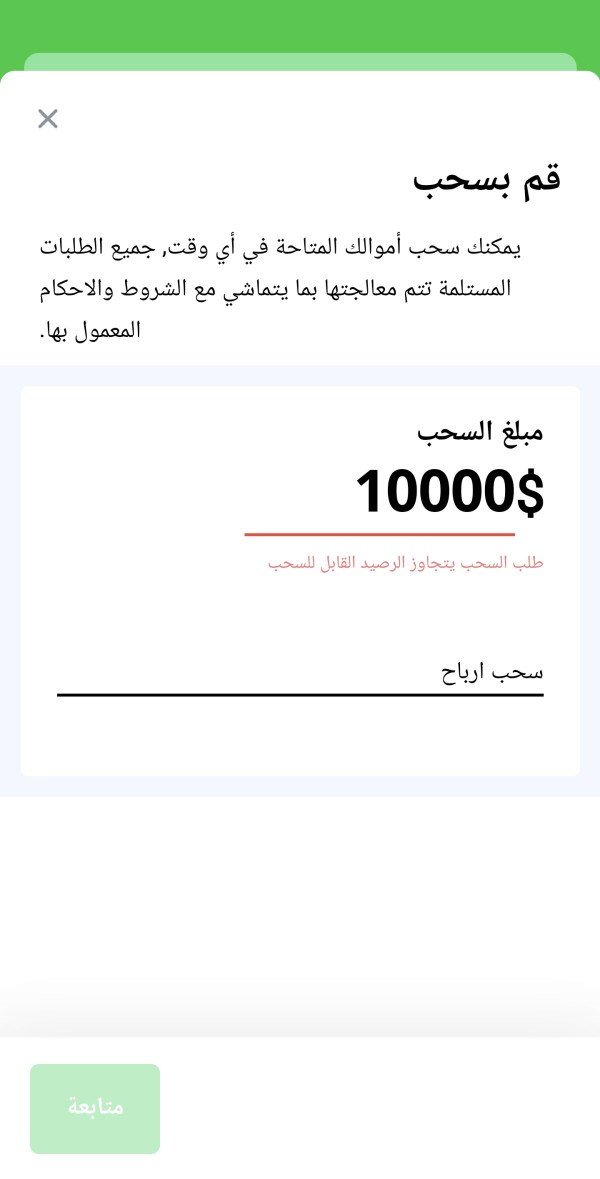

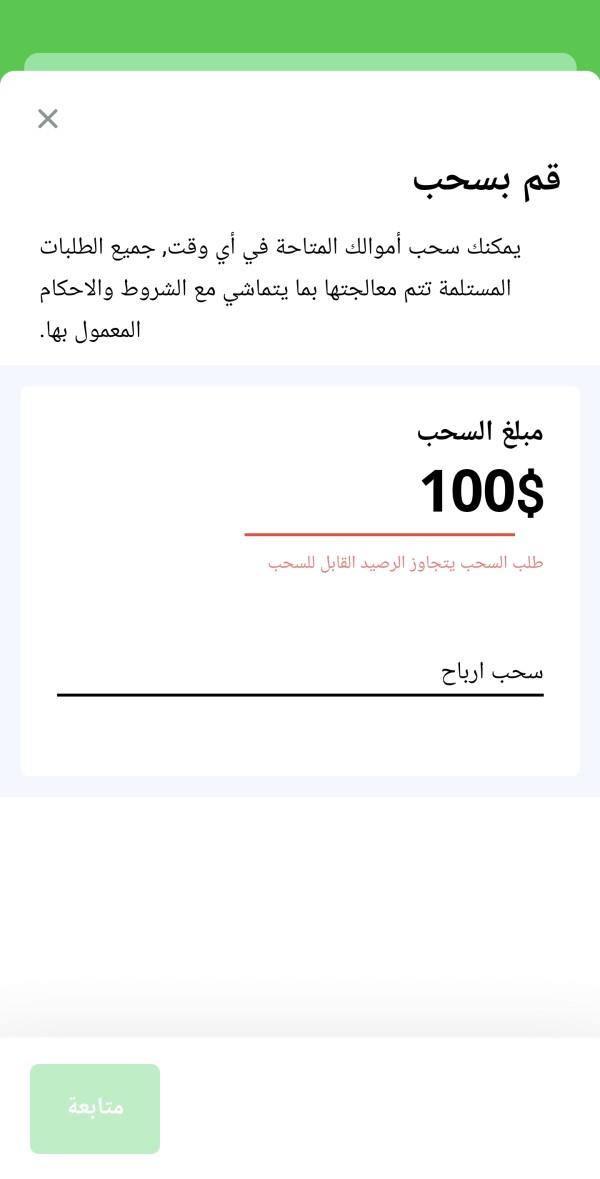

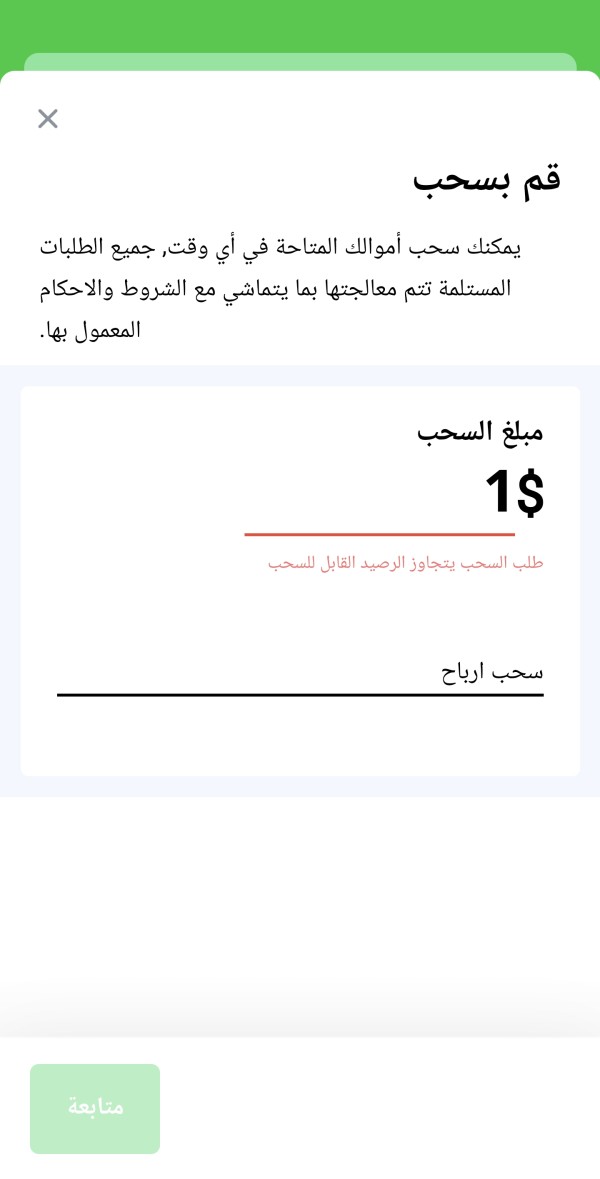

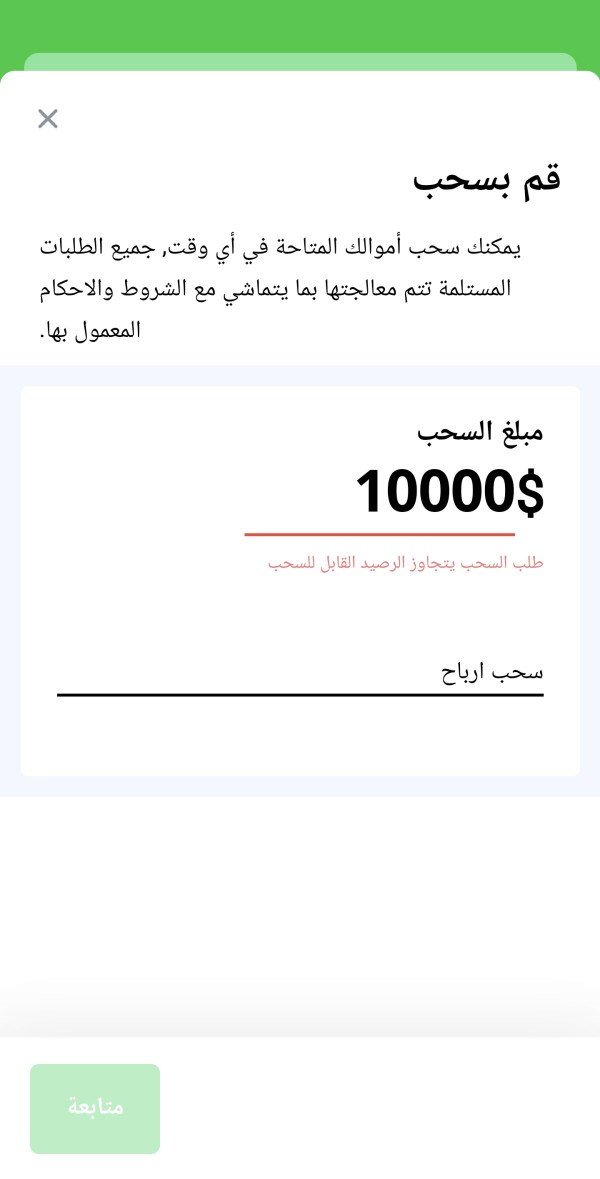

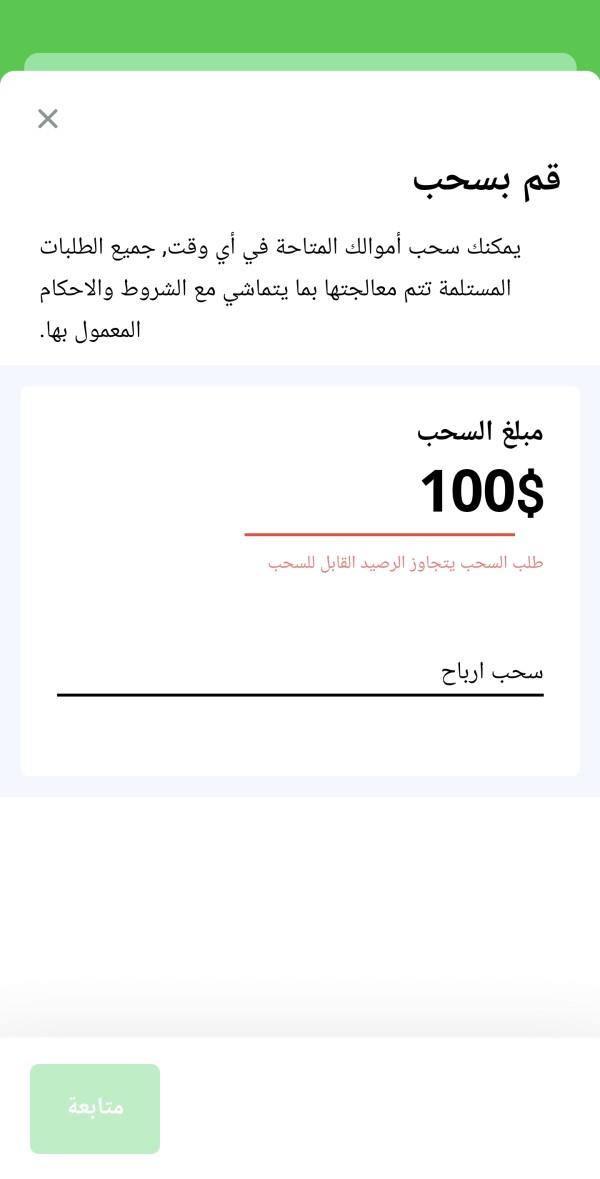

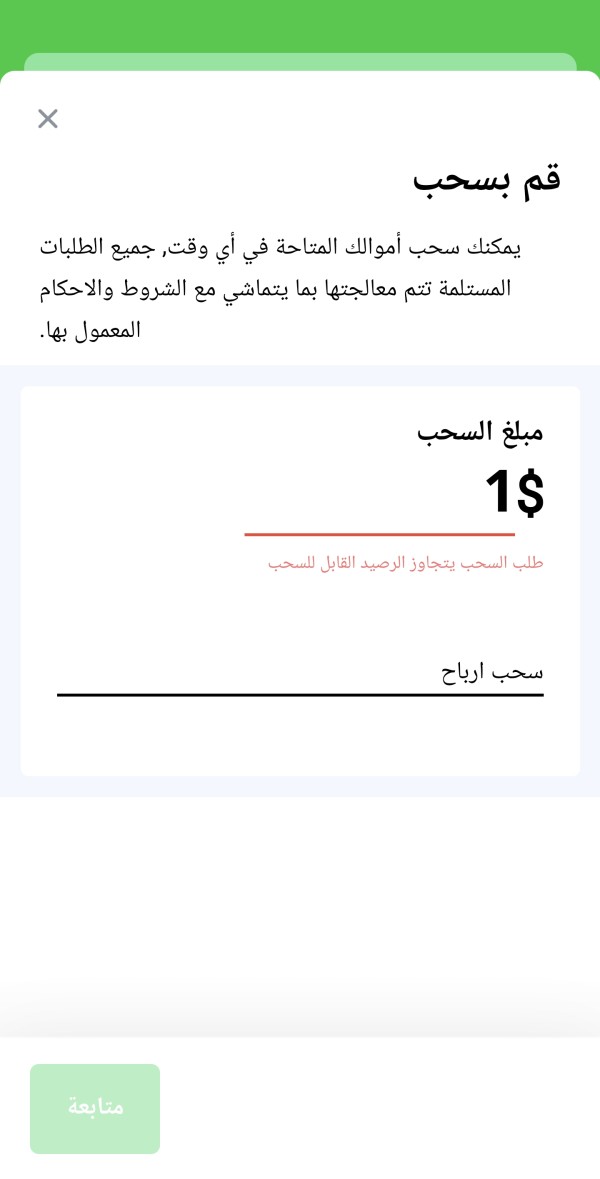

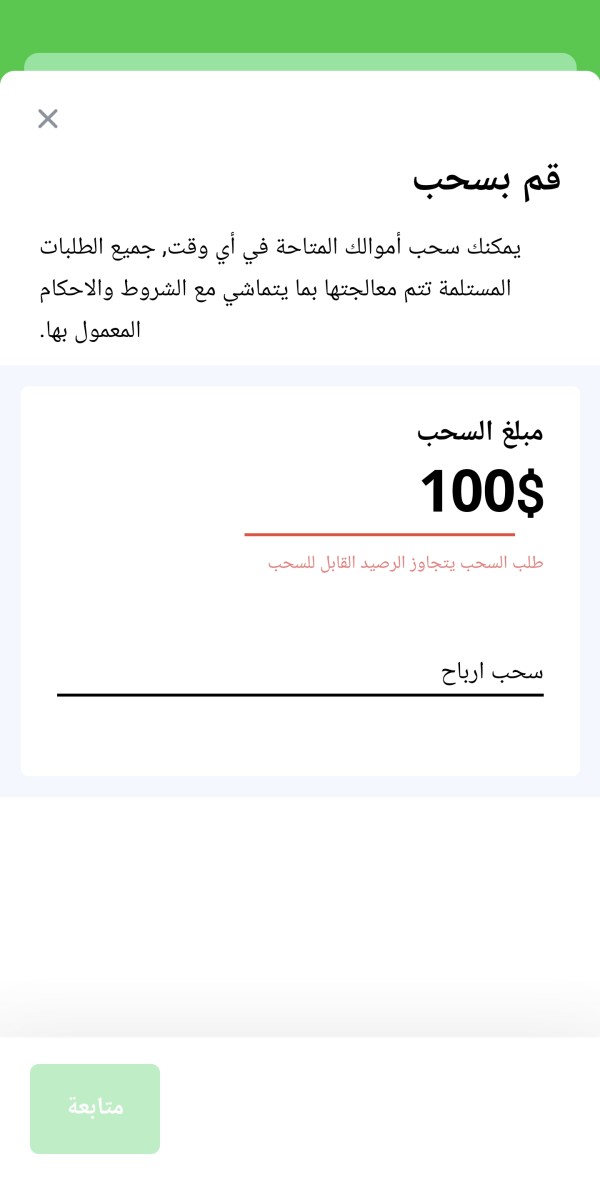

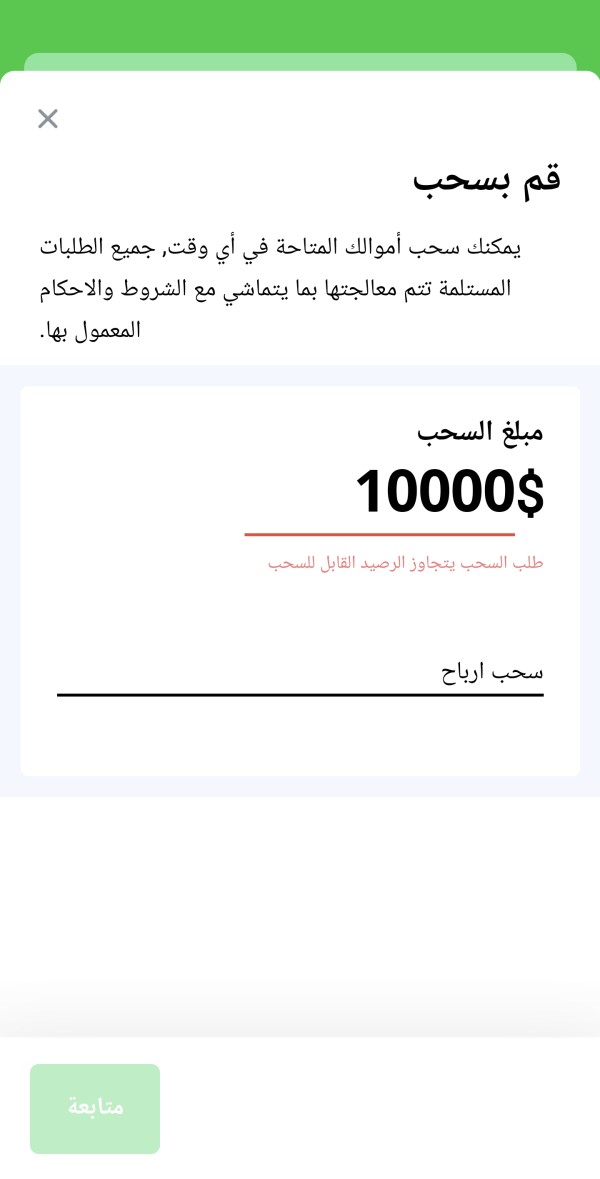

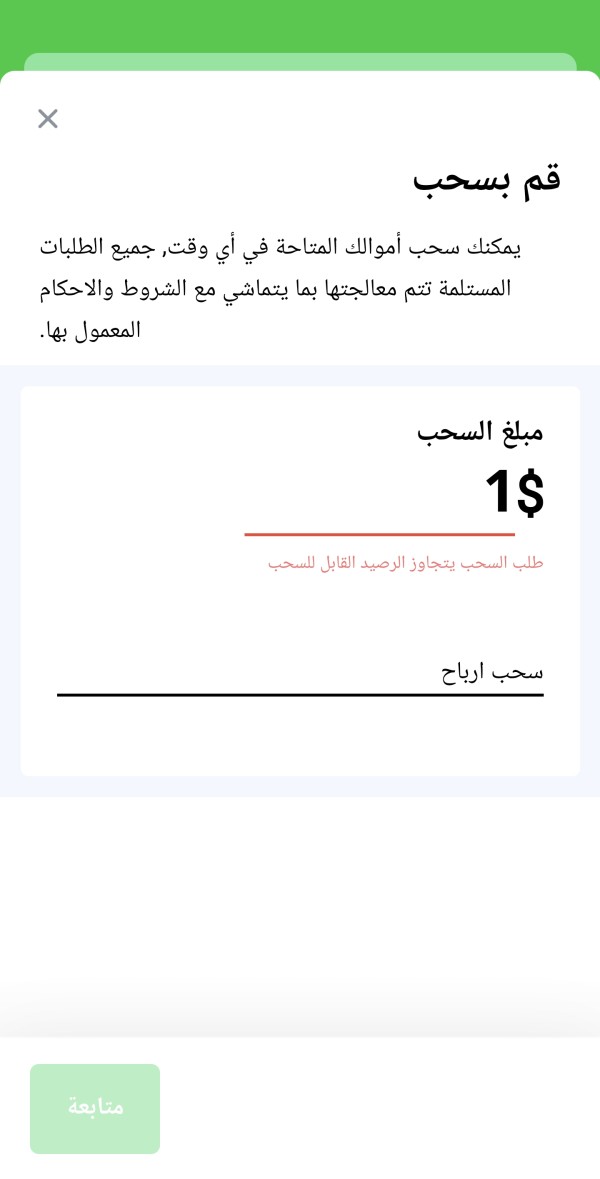

Deposit/Withdrawal Currencies and Cryptocurrencies

XLNTrade accepts deposits and withdrawals in USD primarily, along with a range of payment methods including credit/debit cards, bank transfers, and e-wallets like Neteller and Skrill. However, some sources indicate that the broker does not support certain popular e-wallets, which could limit flexibility for some traders.

Minimum Deposit

The minimum deposit required to open an account with XLNTrade is $200, which is relatively standard for the industry but higher than some competitors that allow deposits as low as $10.

Currently, XLNTrade does not offer any bonuses or promotional offers, which is a common practice among many regulated brokers to avoid complications related to withdrawal conditions.

Tradeable Asset Classes

XLNTrade provides access to a diverse range of trading instruments, including forex, cryptocurrencies, commodities, indices, and stocks. The availability of over 150 financial instruments is a positive aspect for traders looking for variety.

Costs (Spreads, Fees, Commissions)

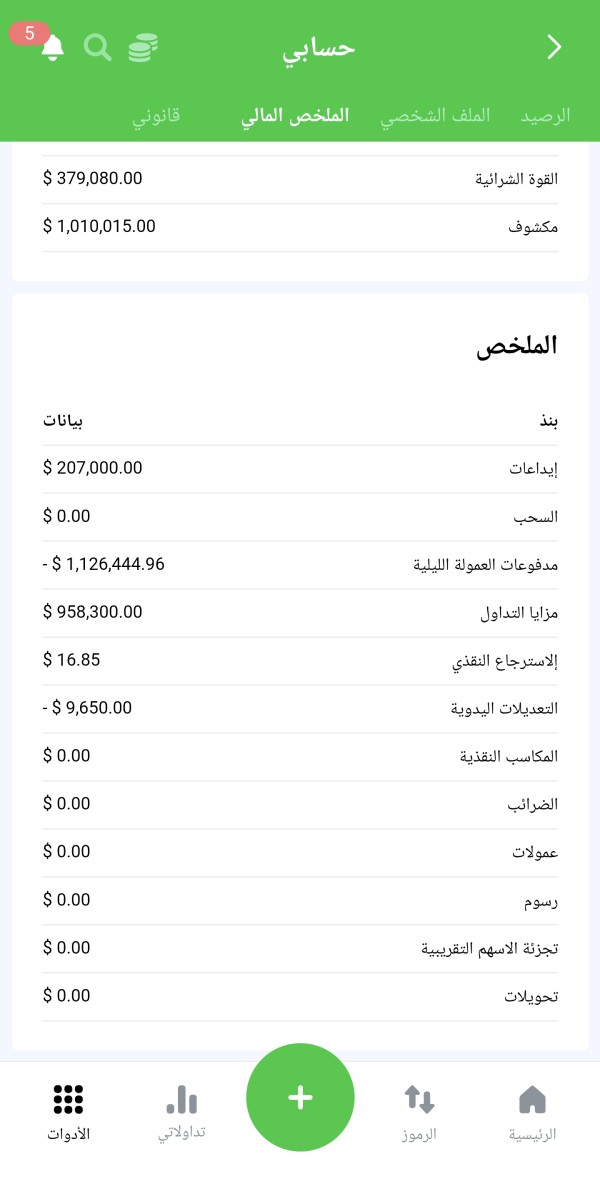

The spreads at XLNTrade start from 4 pips on major pairs like EUR/USD, which is considered high compared to industry standards. Additionally, there is a quarterly inactivity fee of $500 for accounts that remain inactive for more than three months, which is quite steep.

Leverage

The broker offers leverage of up to 1:200, which can be appealing to traders looking to maximize their positions. However, high leverage also increases the risk of significant losses, particularly for inexperienced traders.

XLNTrade uses its proprietary platform, Xcite, which lacks some of the advanced features found in popular platforms like MetaTrader 4 or 5. This could deter experienced traders who prefer more robust trading tools.

Restricted Regions

XLNTrade does not accept clients from several regions, including the United States, Europe, and the UK, which may limit its accessibility for some traders.

Available Customer Service Languages

Customer support is available in multiple languages, including English, Spanish, French, and Italian. However, the quality of support has been reported as lacking, with many users citing difficulties in reaching customer service for withdrawal issues.

Repeat Ratings Overview

Detailed Breakdown

-

Account Conditions (4.5/10): While the minimum deposit is competitive, the absence of multiple account types and high inactivity fees can deter potential clients.

Tools and Resources (5.0/10): The Xcite platform offers basic trading tools, but the lack of advanced features compared to other platforms may limit traders' capabilities.

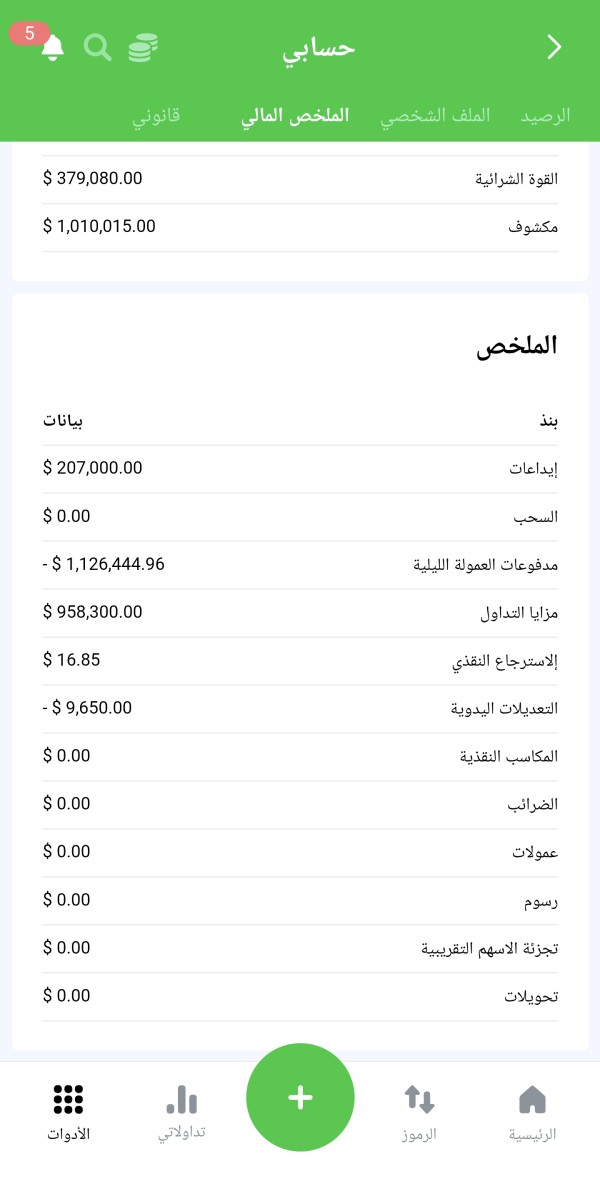

Customer Service and Support (3.0/10): Despite offering multilingual support, user reviews indicate significant issues with responsiveness and effectiveness, particularly regarding withdrawal requests.

Trading Settings (Experience) (4.0/10): The trading experience is hindered by high spreads and a lack of advanced trading platforms, which may not meet the needs of more experienced traders.

Trustworthiness (3.5/10): The regulatory status under the Seychelles FSA raises concerns about the safety of funds, particularly in light of negative user feedback regarding withdrawal issues.

User Experience (4.0/10): Mixed reviews highlight both positive aspects, such as a user-friendly platform, and significant drawbacks, particularly regarding customer service and withdrawal difficulties.

In conclusion, while XLNTrade offers a range of trading instruments and a user-friendly platform, potential clients should exercise caution due to its offshore regulation and reported issues with customer service and withdrawals. It is advisable to consider these factors carefully before engaging with this broker.