CFDM Review 1

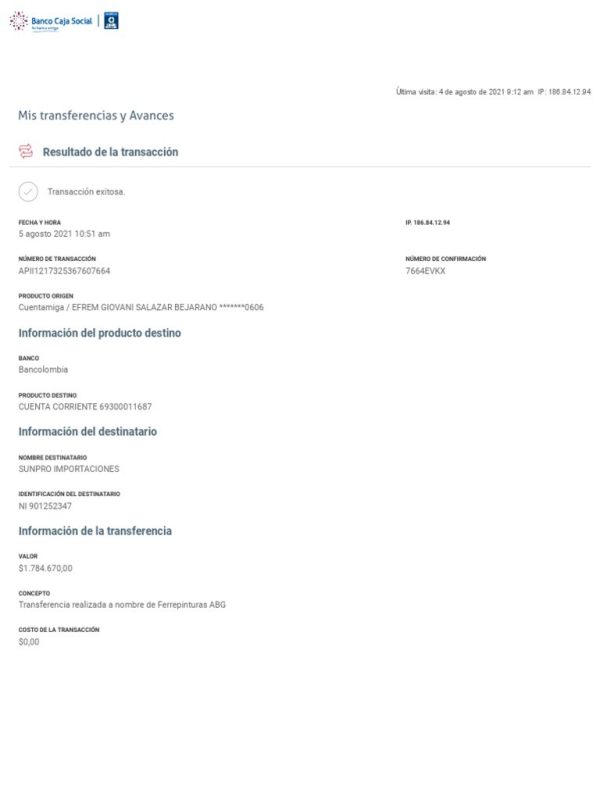

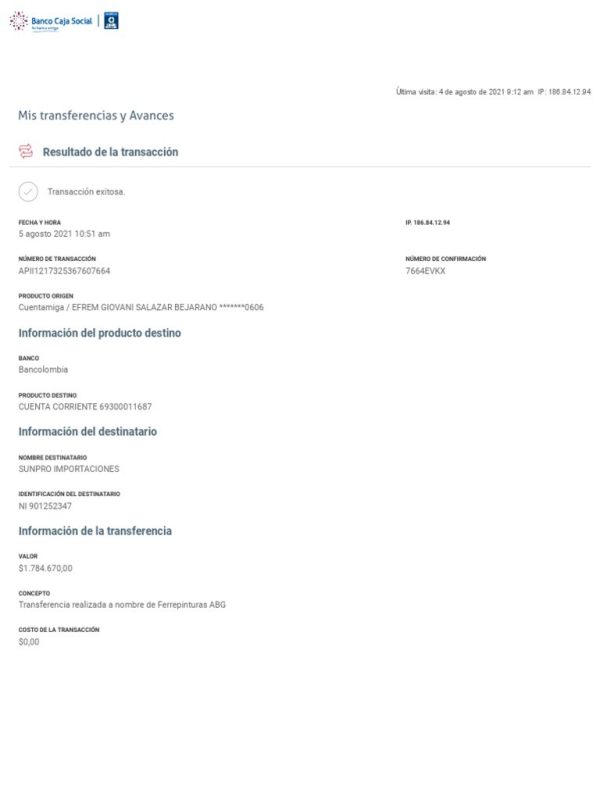

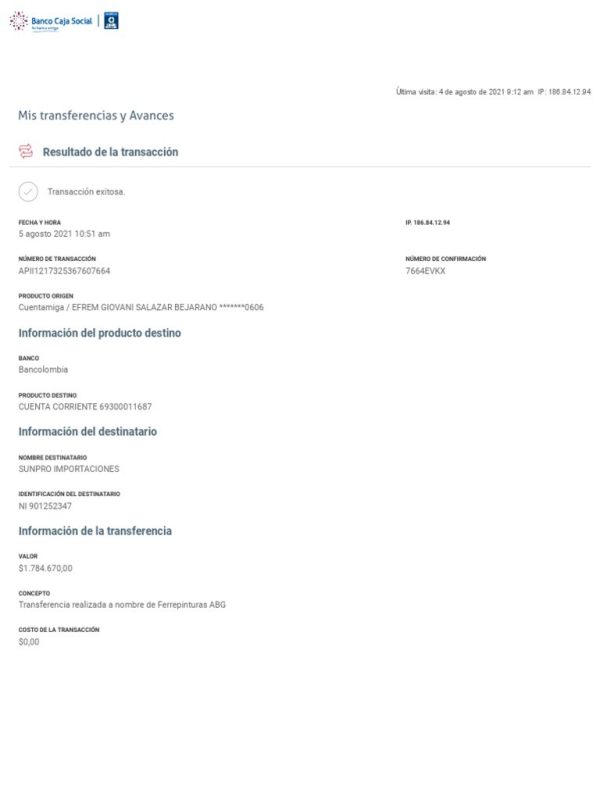

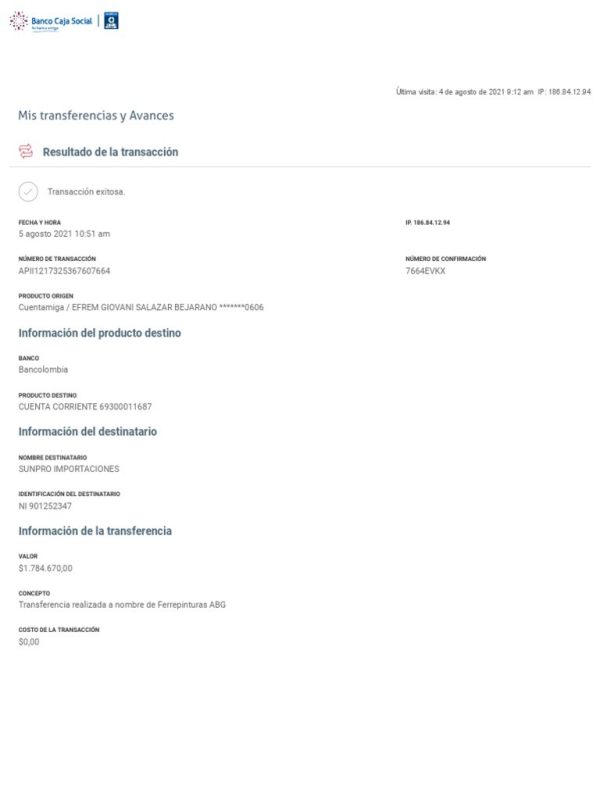

The promised $30,000 profit but it was a scam.

CFDM Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The promised $30,000 profit but it was a scam.

The Cfdm review reveals a broker that operates in a highly competitive and risky environment. While it offers a range of trading instruments and platforms, concerns about its regulatory status and user experiences raise red flags for potential traders. Key features include its lack of robust regulation and a multitude of customer complaints regarding withdrawal issues.

Note: It is essential to consider the different entities operating under the Cfdm name, as this can significantly impact user experience and regulatory oversight. This review aims to provide a fair and accurate assessment based on available data.

| Category | Rating (Out of 10) |

|---|---|

| Account Conditions | 4 |

| Tools and Resources | 5 |

| Customer Service and Support | 3 |

| Trading Experience | 4 |

| Trustworthiness | 2 |

| User Experience | 3 |

We rate brokers based on comprehensive analysis of user feedback, expert opinions, and factual data from reputable sources.

Founded in an unspecified year, Cfdm is a trading platform that allows users to engage in various financial markets through Contracts for Difference (CFDs). The broker offers trading on popular platforms like MT4, enabling users to access a diverse range of asset classes, including forex, commodities, and indices. However, it operates without significant regulation, primarily under the oversight of the Vanuatu Financial Services Commission (VFSC), which has raised concerns among traders regarding its credibility.

Regulated Geographic Areas:

Cfdm operates primarily in regions with limited regulatory oversight, including Vanuatu. This raises significant concerns about the safety of client funds and the reliability of the trading environment.

Deposit/Withdrawal Currencies/Cryptocurrencies:

While the specific currencies supported for deposits and withdrawals are not detailed, users generally report difficulties in processing withdrawals, which is a common issue among unregulated brokers.

Minimum Deposit:

The minimum deposit requirement for opening an account with Cfdm is not explicitly stated in the sources reviewed, but it is typically around $250, which aligns with industry standards.

Bonuses/Promotions:

Cfdm does not appear to offer substantial bonuses or promotions, which is often a tactic used by less reputable brokers to attract new clients.

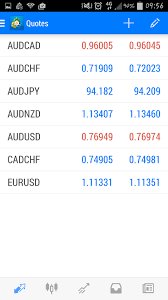

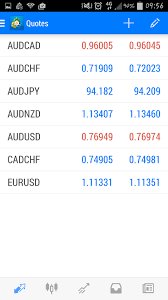

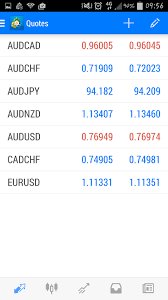

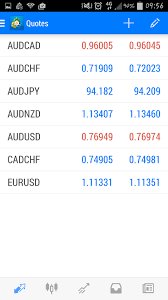

Tradable Asset Classes:

The broker provides access to various asset classes, including forex, commodities, and indices. However, the absence of direct forex trading options is a notable limitation.

Costs (Spreads, Fees, Commissions):

Cfdm's cost structure is not transparent, with some reviews mentioning spreads that can be higher than industry averages. Users have reported unexpected fees, which can significantly impact profitability.

Leverage:

Cfdm offers leverage options, but the exact ratios are not specified in the reviewed sources. Traders should be cautious, as high leverage can amplify both gains and losses.

Allowed Trading Platforms:

Cfdm supports MT4, a widely used trading platform that offers various tools for technical analysis. However, the lack of advanced platforms may limit trading capabilities for more experienced traders.

Restricted Regions:

Cfdm's services may not be available in regions with stricter regulatory requirements, such as the United States, where CFD trading is prohibited.

Available Customer Service Languages:

Customer service is reportedly lacking, with many users expressing frustration over slow response times and inadequate support. This is a critical area for improvement, especially for a broker operating in a high-risk environment.

| Category | Rating (Out of 10) |

|---|---|

| Account Conditions | 4 |

| Tools and Resources | 5 |

| Customer Service and Support | 3 |

| Trading Experience | 4 |

| Trustworthiness | 2 |

| User Experience | 3 |

Account Conditions (4/10):

Cfdm offers standard account types, but the lack of transparency regarding fees and conditions is concerning. Many users report difficulties with withdrawals, which is a significant drawback.

Tools and Resources (5/10):

While the availability of MT4 is a plus, the overall lack of advanced tools and educational resources limits the trading experience for users seeking to enhance their skills.

Customer Service and Support (3/10):

User feedback highlights a significant gap in customer service, with many reporting slow response times and unhelpful support. This is critical for traders who may need assistance in a volatile market.

Trading Experience (4/10):

Although Cfdm allows trading on various instruments, the overall experience is marred by issues such as high spreads and withdrawal difficulties.

Trustworthiness (2/10):

The lack of robust regulation and numerous user complaints about withdrawal issues significantly undermine Cfdm's trustworthiness. Many users express concerns about the broker's reliability.

User Experience (3/10):

Overall user experience is negatively affected by the broker's customer service and withdrawal issues, leading to dissatisfaction among traders.

In conclusion, while Cfdm offers a platform for trading various financial instruments, potential users should proceed with caution. The broker's regulatory status, customer service issues, and user feedback suggest that it may not be the best choice for traders seeking a secure and reliable trading environment. Always conduct thorough research and consider alternative brokers with stronger regulatory oversight and better user experiences.

FX Broker Capital Trading Markets Review