HF Market 2025 Review: Everything You Need to Know

Executive Summary

HF Markets used to be called HotForex. It stands as a reliable and trustworthy broker that has established itself as a credible player in the global online trading industry. This comprehensive hf market review reveals that the broker offers an impressive selection of six different account types designed to accommodate traders with varying experience levels and capital requirements. With nearly 1,000 CFD trading products available, including over 100 forex pairs, HF Markets provides extensive market access. This appeals to both novice and experienced traders.

The broker's commitment to delivering quality research alongside its MetaTrader platform offering sets it apart in a competitive marketplace. HF Markets also features a proprietary copy trading platform. This platform enables less experienced traders to benefit from the strategies of successful market participants. The combination of diverse account options, comprehensive asset selection, and innovative trading tools makes HF Markets suitable for a broad spectrum of trading styles and preferences. It works for conservative long-term investors and active day traders seeking maximum market exposure.

Important Notice

This review is based on publicly available information and user feedback collected from various sources across the internet. While HF Markets operates in multiple jurisdictions, specific regulatory information varies by region. It may not be comprehensively detailed in all available sources. Potential traders should verify current regulatory status and compliance requirements in their specific jurisdiction before opening an account.

The evaluation presented here represents an independent analysis based on available data. It should not be considered as investment advice. Trading CFDs and forex involves significant risk. Traders should carefully consider their financial situation and risk tolerance before engaging with any broker.

Overall Rating Framework

Broker Overview

HF Markets represents a significant presence in the global forex and CFD trading landscape. It has evolved from its previous identity as HotForex to become a comprehensive trading services provider. The company operates under a market maker business model, which allows it to provide competitive pricing while maintaining control over order execution and liquidity provision. This approach enables HF Markets to offer tight spreads and reliable execution across its extensive product range.

The broker's transformation and rebranding efforts reflect its commitment to modernizing its services. It also shows their goal to expand global reach. According to available information, HF Markets has positioned itself as a technology-forward broker that combines traditional trading excellence with innovative features such as copy trading capabilities. The company's focus on providing multiple account types demonstrates its understanding that different traders have varying needs regarding minimum deposits, leverage requirements, and trading conditions.

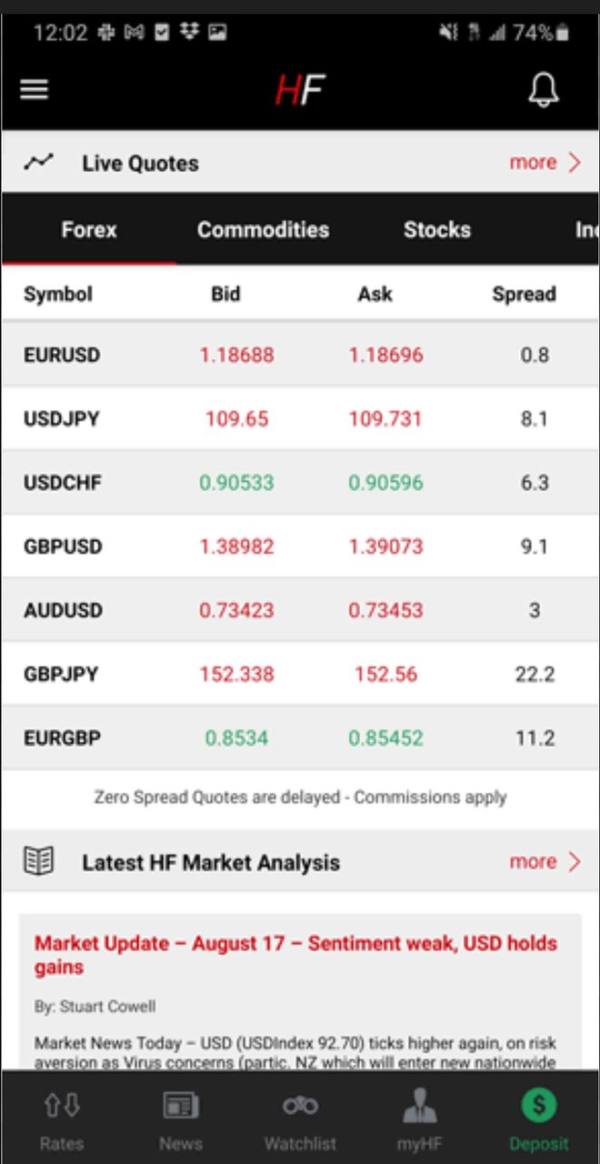

HF Markets exclusively offers the MetaTrader platform suite, which includes both MT4 and MT5 versions. This provides traders with access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features. The broker's asset universe spans nearly 1,000 different CFD instruments, covering major asset classes including forex, commodities, indices, and individual stocks. This extensive selection ensures that traders can diversify their portfolios and access global markets through a single trading account.

Regulatory Jurisdictions: Specific regulatory information for HF Markets was not detailed in available sources. The broker operates across multiple international jurisdictions with varying compliance requirements.

Deposit and Withdrawal Methods: Information regarding specific payment methods, processing times, and associated fees was not comprehensively detailed in the available research materials.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types were not specified in the source materials. The broker offers six distinct account categories.

Promotional Offers: Details about current bonus programs, welcome offers, or ongoing promotional campaigns were not available in the reviewed sources.

Tradeable Assets: HF Markets provides access to nearly 1,000 CFD instruments. This includes over 100 forex pairs, major global indices, commodities, and individual equity CFDs across multiple international markets.

Cost Structure: Specific information about spreads, commission rates, overnight financing charges, and other trading costs was not detailed in the available research materials.

Leverage Options: Maximum leverage ratios and margin requirements for different asset classes and account types were not specified in the source documentation.

Platform Selection: The broker exclusively offers MetaTrader platforms. These include MT4 and MT5, along with proprietary copy trading tools and mobile applications.

Geographic Restrictions: Specific information about prohibited jurisdictions or regional limitations was not available in the reviewed sources.

Customer Support Languages: Details about multilingual support options and available communication languages were not specified in the available materials.

This hf market review continues with detailed analysis of each evaluation criterion to provide comprehensive insights into the broker's offerings and performance.

Account Conditions Analysis

HF Markets demonstrates its commitment to serving diverse trading needs through its offering of six distinct account types. Each is designed to accommodate different trader profiles and capital levels. This variety suggests that the broker recognizes the importance of providing tailored solutions rather than adopting a one-size-fits-all approach. However, the specific details regarding minimum deposit requirements, spread structures, and leverage options for each account tier were not comprehensively detailed in available sources.

The account opening process appears to be streamlined. Specific information about required documentation, verification timeframes, and approval procedures was not available in the reviewed materials. The absence of detailed cost structures makes it challenging to evaluate the competitiveness of different account types, particularly for traders who prioritize low-cost execution or specific fee arrangements.

While the broker's commitment to offering multiple account categories is commendable, the lack of transparent information about Islamic account availability, VIP account benefits, or professional trader classifications limits the ability to fully assess the suitability for specialized trading requirements. The hf market review suggests that potential clients should directly contact the broker to obtain detailed specifications for each account type before making a commitment.

HF Markets excels in providing robust trading infrastructure through its exclusive focus on the MetaTrader platform ecosystem. The availability of both MT4 and MT5 ensures that traders can access comprehensive charting capabilities, advanced technical analysis tools, and automated trading functionality through Expert Advisors. The platform's reputation for stability and feature completeness makes it an excellent choice for both manual and algorithmic trading strategies.

The broker's proprietary copy trading platform represents a significant value-add. This is particularly true for novice traders who wish to learn from experienced market participants. This social trading functionality allows users to automatically replicate the trades of successful traders, potentially reducing the learning curve associated with independent trading. The integration of copy trading with the broader platform ecosystem suggests thoughtful development of complementary trading tools.

However, specific information about additional research resources, market analysis tools, educational materials, or third-party integrations was not detailed in available sources. The absence of information about economic calendars, news feeds, sentiment indicators, or proprietary research limits the ability to fully evaluate the broker's analytical capabilities. Advanced traders who rely heavily on fundamental analysis or specialized research tools may need to seek additional information about these offerings.

Customer Service and Support Analysis

The evaluation of HF Markets' customer service capabilities is limited by the absence of specific information about support channels, response times, and service quality metrics in available sources. Professional forex brokers typically offer multiple communication channels including live chat, email support, and telephone assistance. The specific availability and quality of these services at HF Markets requires further investigation.

Response time benchmarks, which are crucial for active traders who may encounter urgent technical or account-related issues, were not documented in the reviewed materials. The absence of information about 24/5 support availability, weekend assistance, or emergency contact procedures makes it difficult to assess the broker's commitment to comprehensive customer care.

Multilingual support capabilities, which are essential for a global broker serving international clients, were not specified in available documentation. The quality of support staff training, their ability to handle complex trading inquiries, and their authority to resolve account issues promptly are all factors that significantly impact the overall trading experience. These remain unaddressed in current source materials.

Trading Experience Analysis

User feedback suggests that HF Markets generally provides a satisfactory trading experience. Specific performance metrics regarding execution speed, slippage rates, and requote frequency were not available in the reviewed sources. The exclusive use of MetaTrader platforms typically ensures reliable order execution and comprehensive trading functionality, which likely contributes to positive user experiences.

The platform's stability and feature set enable traders to implement various trading strategies, from scalping to long-term position holding. The availability of automated trading through Expert Advisors expands the possibilities for systematic trading approaches. However, specific data about server uptime, execution latency, or platform performance during high-volatility periods was not documented in available sources.

Mobile trading capabilities, which are increasingly important for modern traders who require market access while away from desktop computers, were mentioned but not detailed in terms of functionality or user experience. The quality of mobile execution, chart analysis capabilities, and account management features through mobile applications represents a crucial component of the overall hf market review that requires additional investigation.

Trust and Reliability Analysis

The assessment of HF Markets' trustworthiness is significantly hampered by the absence of specific regulatory information in available sources. Regulatory oversight represents one of the most critical factors in evaluating broker reliability. It provides legal protections for client funds and ensures adherence to professional standards. Without clear information about regulatory licenses, governing bodies, and compliance requirements, it becomes challenging to provide a comprehensive trust evaluation.

Client fund protection measures, such as segregated account arrangements, deposit insurance schemes, or compensation fund participation, were not detailed in the reviewed materials. These protections are fundamental to broker safety and represent primary concerns for traders when selecting a trading partner. The absence of transparency regarding financial safeguards raises questions about the broker's commitment to client protection.

Company transparency, including information about ownership structure, financial reporting, and management team, was not available in the source materials. Industry awards, third-party certifications, or independent audits that could support credibility claims were also not documented. This lack of verifiable trust indicators necessitates additional due diligence from potential clients.

User Experience Analysis

Overall user satisfaction with HF Markets appears to be positive based on available feedback. Comprehensive satisfaction surveys or detailed user testimonials were not included in the reviewed sources. The broker's focus on providing multiple account types and extensive asset selection suggests an understanding of diverse user needs and preferences.

Interface design and navigation convenience, particularly regarding the MetaTrader platform implementation and any proprietary tools, were not specifically addressed in available materials. The ease of account registration, verification procedures, and initial platform setup represents important factors in the overall user journey that require additional documentation.

Fund management convenience, including deposit and withdrawal processes, processing times, and associated fees, significantly impacts user satisfaction but was not detailed in the source materials. Common user complaints, areas for improvement, and the broker's responsiveness to client feedback are all factors that would contribute to a complete user experience evaluation. These remain undocumented in current sources.

Conclusion

This comprehensive hf market review reveals that HF Markets operates as a legitimate broker with several appealing features. These include diverse account options and an extensive selection of nearly 1,000 tradeable CFD instruments. The broker's exclusive focus on MetaTrader platforms, combined with proprietary copy trading capabilities, creates a solid foundation for both novice and experienced traders.

However, significant information gaps regarding regulatory oversight, specific cost structures, and detailed service specifications limit the ability to provide a complete evaluation. The absence of transparent regulatory information particularly impacts the trust assessment. Missing details about customer service quality and specific account conditions make it challenging for potential clients to make fully informed decisions.

HF Markets appears most suitable for traders who value platform stability, diverse asset selection, and copy trading functionality. Those prioritizing regulatory transparency and detailed cost disclosure may need to conduct additional research before committing to this broker.