Regarding the legitimacy of HF Market forex brokers, it provides CYSEC and WikiBit, .

Is HF Market safe?

Pros

Cons

Is HF Market markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

HF Markets (Europe) Ltd

Effective Date:

2012-11-20Email Address of Licensed Institution:

reg@hfmarkets.euSharing Status:

No SharingWebsite of Licensed Institution:

https://www.hfaffiliates.com/eu/en/index.html, www.hfeu.comExpiration Time:

--Address of Licensed Institution:

Spyrou Kyprianou & Papanikoli 84, NIC. SHOPPING CITY ANG. COURT, 6th floor, Flat/Office 601, 6052, Larnaca, CyprusPhone Number of Licensed Institution:

+357 24 400 165Licensed Institution Certified Documents:

Is HF Markets A Scam?

Introduction

HF Markets, previously known as HotForex, has established itself as a prominent player in the forex and CFD trading landscape since its inception in 2010. With a diverse range of trading instruments and a commitment to customer service, HF Markets aims to cater to both novice and experienced traders. However, as the forex market continues to expand, so does the need for traders to exercise caution when selecting a broker. The potential for scams and fraudulent activities is a constant concern in this volatile environment, making it imperative for traders to thoroughly evaluate brokers before committing their funds. This article employs a comprehensive framework to assess HF Markets, focusing on its regulatory status, company background, trading conditions, and client experiences to determine whether HF Markets is safe or a potential scam.

Regulation and Legitimacy

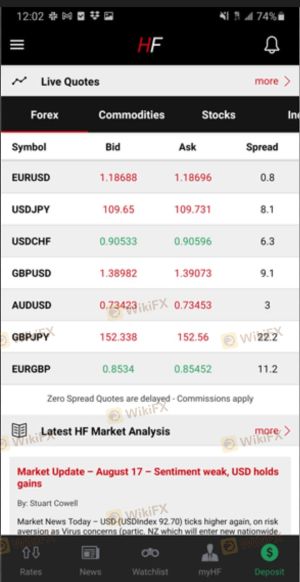

The regulatory landscape is a crucial factor in evaluating the legitimacy of any forex broker. HF Markets operates under the oversight of several respected regulatory bodies, which is a positive indicator of its credibility. The following table summarizes HF Markets' regulatory information:

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 801701 | United Kingdom | Verified |

| CySEC | 183/12 | Cyprus | Verified |

| DFSA | F004885 | Dubai | Verified |

| FSCA | 46632 | South Africa | Verified |

| FSA | SD 015 | Seychelles | Verified |

| CMA | 155 | Kenya | Verified |

HF Markets is regulated by tier-1 authorities such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulators impose strict standards on brokers, ensuring that they adhere to best practices in terms of client fund protection, transparency, and operational integrity. The presence of multiple regulatory licenses is a strong indicator that HF Markets is committed to maintaining a safe trading environment for its clients. Furthermore, HF Markets has not faced any major compliance issues or sanctions in its operational history, reinforcing its standing as a reputable broker.

Company Background Investigation

HF Markets has a rich history that dates back to 2010, when it was founded as HotForex. The company has since evolved into a multi-entity global broker, operating under various legal entities across different jurisdictions. This expansion has allowed HF Markets to serve over 4 million clients worldwide, showcasing its popularity and trust within the trading community.

The management team at HF Markets possesses extensive experience in the financial services industry, with backgrounds in trading, finance, and technology. This expertise is crucial for navigating the complexities of the forex market and ensuring that the broker remains competitive. Additionally, HF Markets is transparent about its operations, providing detailed information about its services, trading conditions, and regulatory compliance on its website.

In terms of ownership structure, HF Markets is part of the HF Markets Group, which includes several regulated entities. This diversified structure allows the broker to operate in various regions while adhering to local regulations. Overall, the company's strong foundation and commitment to transparency contribute to its reputation as a reliable trading platform.

Trading Conditions Analysis

When assessing whether HF Markets is safe, it's essential to examine its trading conditions, including fees and commissions. HF Markets offers a variety of account types, each designed to meet the needs of different traders. The overall fee structure is competitive, with no commissions on most accounts, making it appealing for retail traders. However, some fees may be associated with specific account types or trading conditions. The following table outlines the core trading costs at HF Markets:

| Fee Type | HF Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.2 pips |

| Commission Model | Variable | Variable |

| Overnight Interest Range | -3.00 to -3.10 USD | Varies |

HF Markets provides spreads starting from 1.3 pips on major currency pairs, which is competitive compared to the industry average. However, traders should be aware that spreads may widen during periods of high volatility. The commission structure is straightforward, with no hidden fees, but it's crucial to review the specific terms associated with each account type. Additionally, HF Markets does charge a monthly inactivity fee after six months of no trading activity, which is a standard practice among brokers.

Overall, the trading conditions at HF Markets are designed to be favorable for traders, with no hidden fees and a transparent fee structure. This contributes to the broker's reputation as a safe and reliable trading platform.

Client Fund Security

The safety of client funds is a top priority for any reputable broker. HF Markets employs several measures to ensure the security of its clients' deposits. One of the key features is the segregation of client funds, which ensures that traders' money is held in separate accounts from the broker's operational funds. This practice protects client deposits in the event of the broker facing financial difficulties.

Moreover, HF Markets offers negative balance protection, which means that traders cannot lose more than their deposited funds. This is particularly important in the highly leveraged environment of forex trading, where market fluctuations can lead to significant losses.

Additionally, HF Markets has implemented a civil liability insurance policy with a coverage limit of €5 million, which provides further protection against potential fraud or negligence. This level of security is a strong indicator that HF Markets prioritizes the safety of its clients' funds.

Customer Experience and Complaints

Analyzing customer feedback is essential in determining the overall satisfaction level of HF Markets' clients. Many traders have reported positive experiences with the broker, highlighting its efficient customer service and user-friendly trading platforms. However, there are some recurring complaints that warrant attention. The following table categorizes the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Account Verification Issues | High | Slow response time |

| Spread Fluctuations | Moderate | Addressed in FAQs |

One common complaint involves delays in the withdrawal process, which can be frustrating for traders wanting to access their funds quickly. While HF Markets typically processes withdrawal requests within 24 hours, some users have experienced longer wait times.

Another issue raised by clients is related to the account verification process, which some users found to be slow and cumbersome. This can lead to delays in trading, which may affect overall trading performance.

Despite these complaints, HF Markets has generally been responsive to client inquiries and concerns, indicating a commitment to improving customer satisfaction.

Platform and Trade Execution

The performance of a trading platform plays a crucial role in the overall trading experience. HF Markets offers the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both of which are known for their reliability and advanced features. Users have reported a smooth trading experience with minimal downtime, which is essential for executing trades effectively.

In terms of order execution quality, HF Markets maintains a strong reputation, with low slippage rates and a high order fill rate. However, some traders have noted occasional instances of slippage during high volatility periods, which is common across many trading platforms. Overall, the execution quality at HF Markets is considered satisfactory, contributing to its standing as a safe broker.

Risk Assessment

While HF Markets presents several positive attributes, it's essential to consider the risks associated with trading through this broker. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight |

| Market Risk | High | Potential for significant losses due to leverage |

| Withdrawal Risk | Medium | Occasional delays in fund access |

| Platform Reliability Risk | Medium | Minor issues reported during high volatility |

Traders should be aware of the inherent risks associated with forex trading, particularly the potential for significant losses when using leverage. To mitigate these risks, it is advisable for traders to implement sound risk management strategies, such as setting stop-loss orders and only trading with funds they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that HF Markets is a legitimate broker with a solid reputation in the forex trading community. Its regulatory compliance, commitment to client fund safety, and positive customer experiences indicate that HF Markets is generally safe for traders. However, potential clients should remain vigilant regarding withdrawal processes and the occasional delays associated with account verification.

For traders seeking a reliable broker, HF Markets can be a suitable choice, particularly for those interested in a wide range of trading instruments and competitive trading conditions. However, for individuals who prioritize faster withdrawal times or a more extensive range of cryptocurrencies, it may be worth exploring alternative brokers such as IG or Avatrade.

Ultimately, as with any trading decision, it is essential for traders to conduct thorough research and consider their individual trading needs before selecting a broker.

Is HF Market a scam, or is it legit?

The latest exposure and evaluation content of HF Market brokers.

HF Market Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HF Market latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.