TradingWeb 2025 Review: Everything You Need to Know

Executive Summary

This detailed tradingweb review shows troubling facts about a trading platform that works without proper rules. TradingWeb says it offers forex trading, but many sources point to serious warning signs that possible investors should think about carefully. Reports say the platform works as a "completely anonymous broker without premises," which brings up big questions about whether it's real and if it protects traders.

The platform gets mixed reviews from users, with a strange mix of high ratings and warnings from industry experts. Many review sites have marked TradingWeb as possibly fake, pointing to its lack of proper licenses and rule-following. The company hides its identity and has no real business location, which makes these worries even worse.

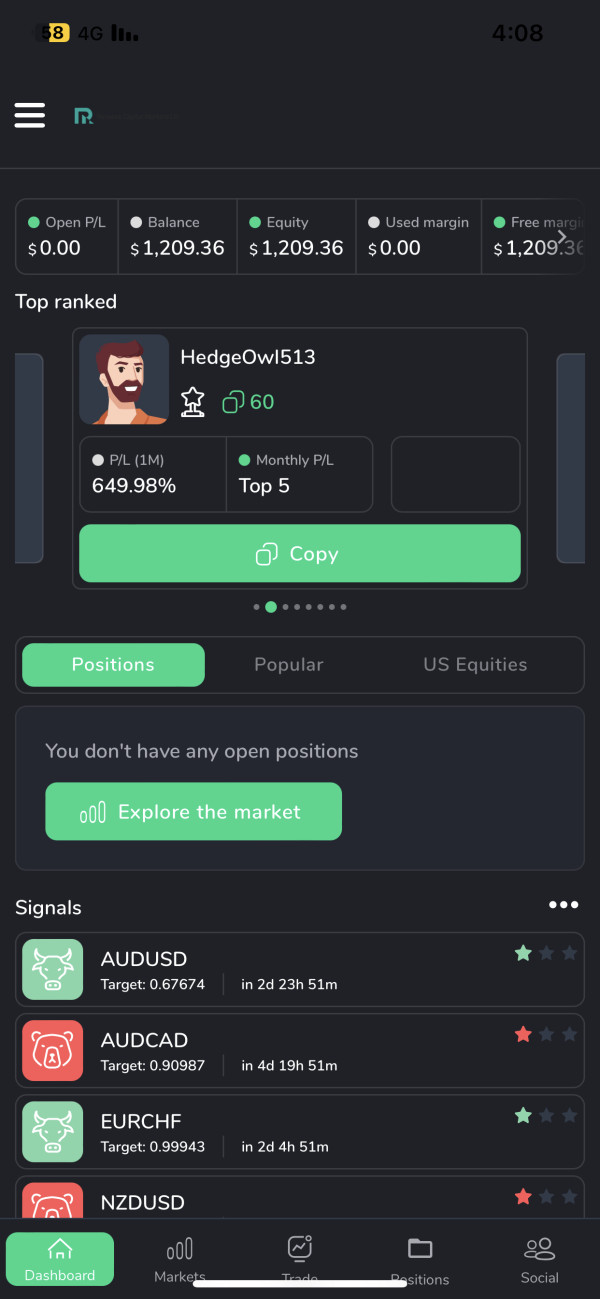

Our study of available facts shows TradingWeb seems to target forex trading fans but lacks the basic rule protections that real brokers give. The platform's safety score of 65 out of 100 points shows these hidden problems, while user reviews create a mixed picture that needs careful study. Traders who want reliable forex trading services should think about regulated options with clear operations and proper licenses.

Important Notice

This review uses public information and user feedback from different sources. Since TradingWeb hides its identity and lacks openness, we could not check all claims and features completely. Possible users should know that trading rules change a lot across different areas, and what works in one place might be banned in another.

The review method used here relies mainly on outside reports, user stories, and industry studies rather than direct platform testing. Given the worries about TradingWeb's realness, we strongly suggest that readers do their own research and talk with financial advisors before making any investment choices.

Rating Framework

Broker Overview

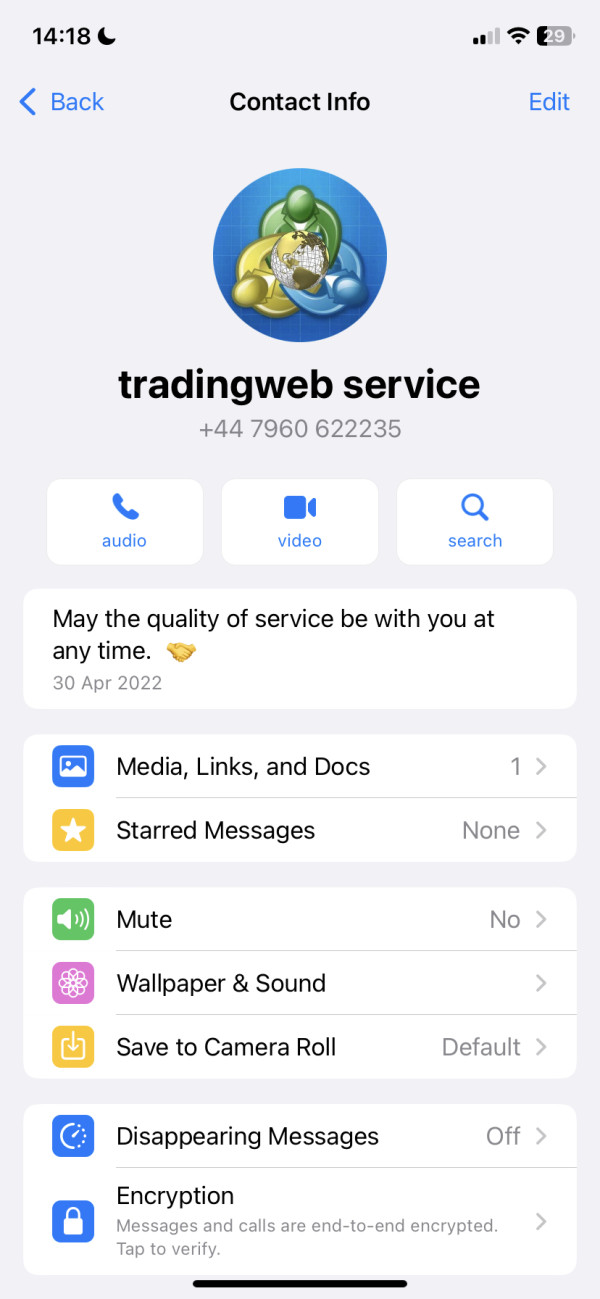

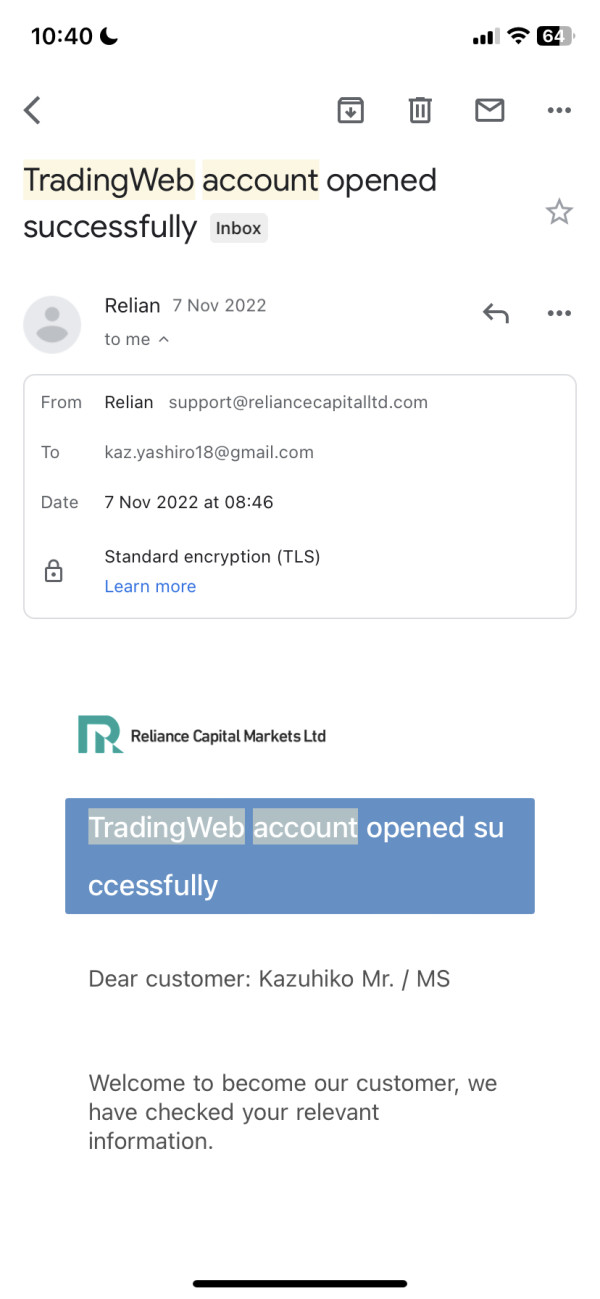

TradingWeb works in the online trading space, though exact details about when it started and its company background stay unclear based on available information. The platform hides its identity, which makes it hard to check standard company information that real brokers usually give, such as company registration details, physical address, or founding team facts.

The broker seems to focus on forex trading services, though the exact range of trading tools and platform details are not clearly shown in the source materials reviewed. This lack of openness extends to basic business information that traders usually rely on when checking possible brokers.

This tradingweb review finds that the platform works without clear rule oversight from major financial authorities. Unlike established brokers who clearly show their licensing information and rule compliance details, TradingWeb's regulatory status stays unclear. The lack of checkable licensing from recognized authorities such as the FCA, CySEC, ASIC, or other top-level regulators represents a big concern for potential users seeking protected trading environments.

Regulatory Status

The regulatory position of TradingWeb stays unclear, with no proof of licensing from major financial authorities. Industry reports suggest the platform works without proper regulatory oversight, which usually means traders lack standard protections such as compensation schemes or regulatory dispute resolution methods.

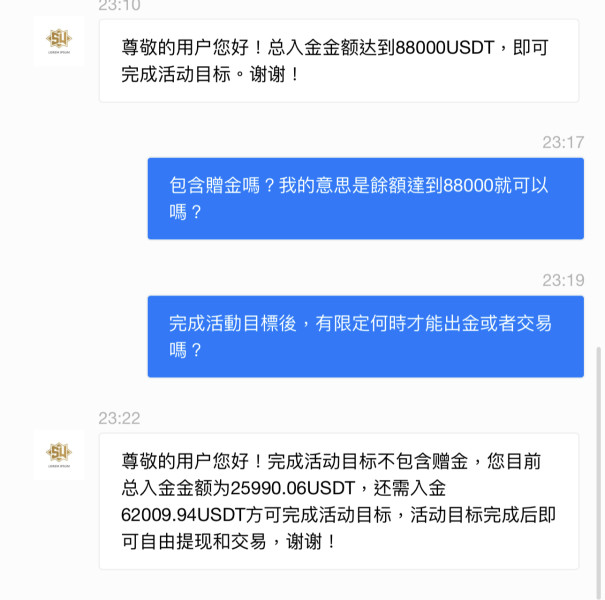

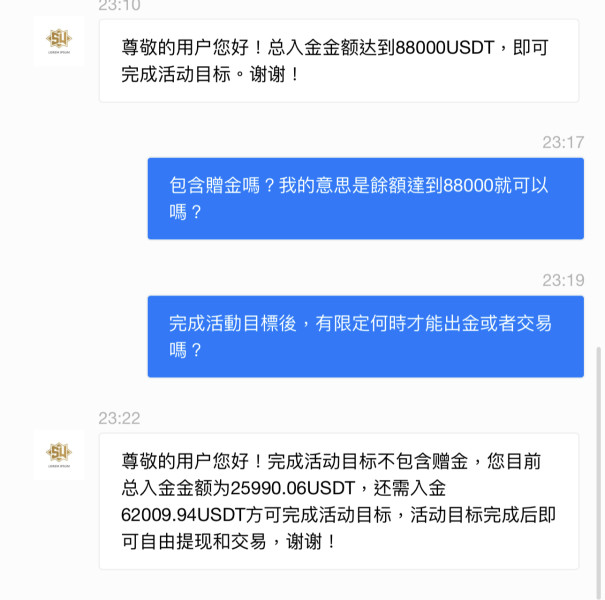

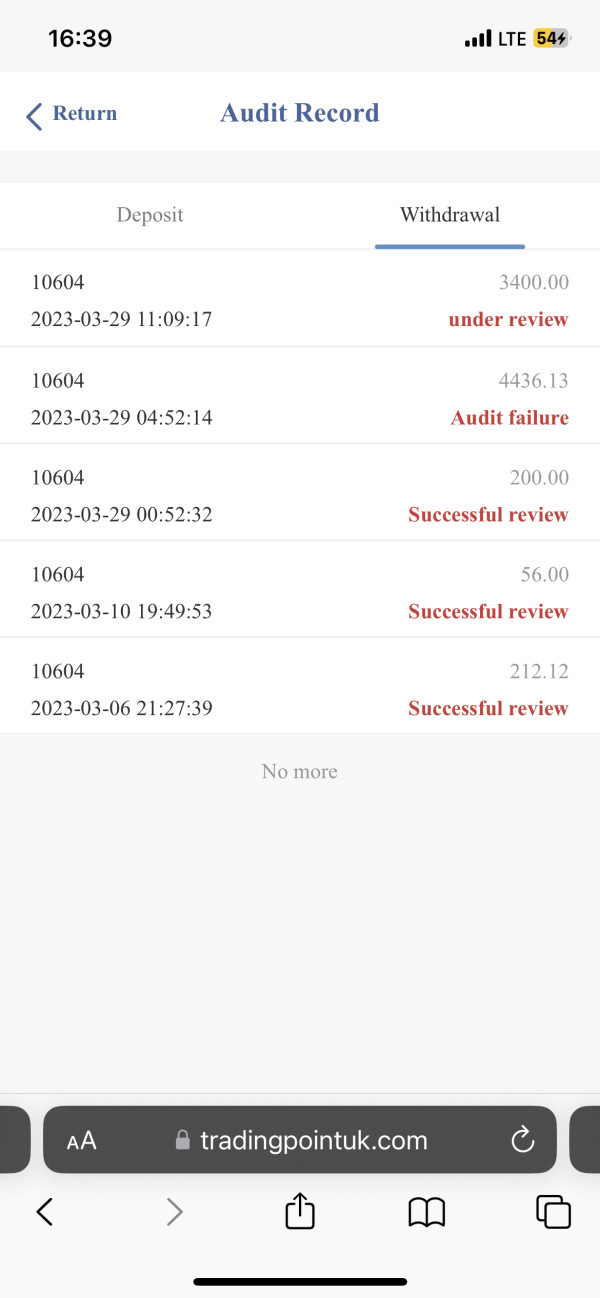

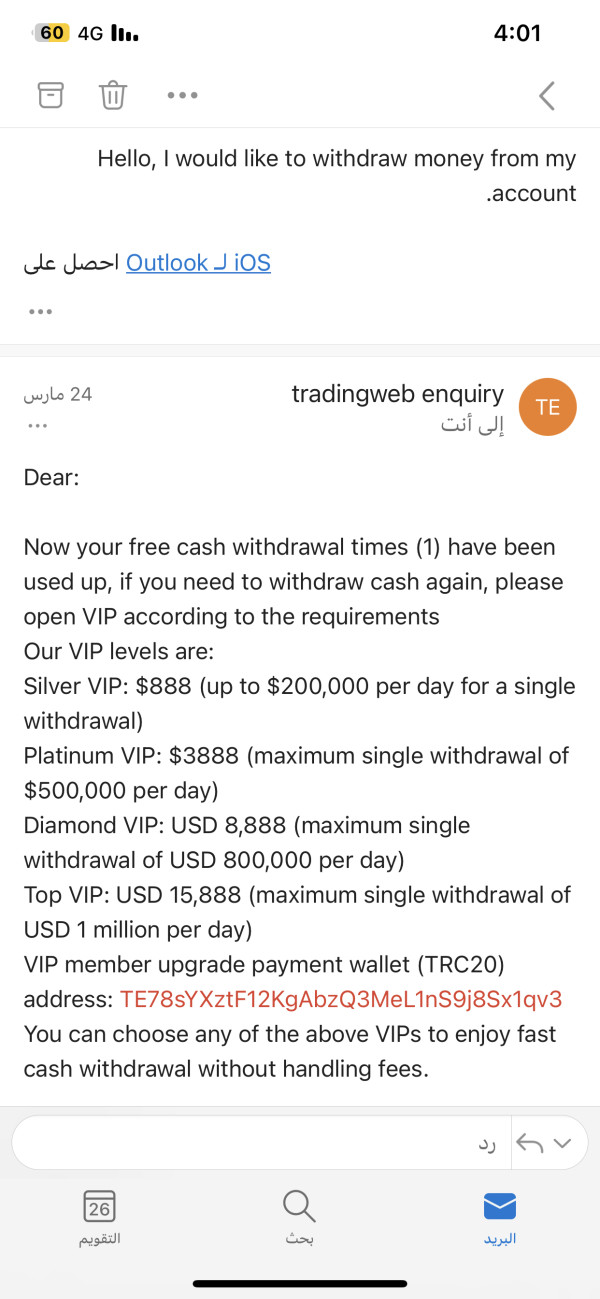

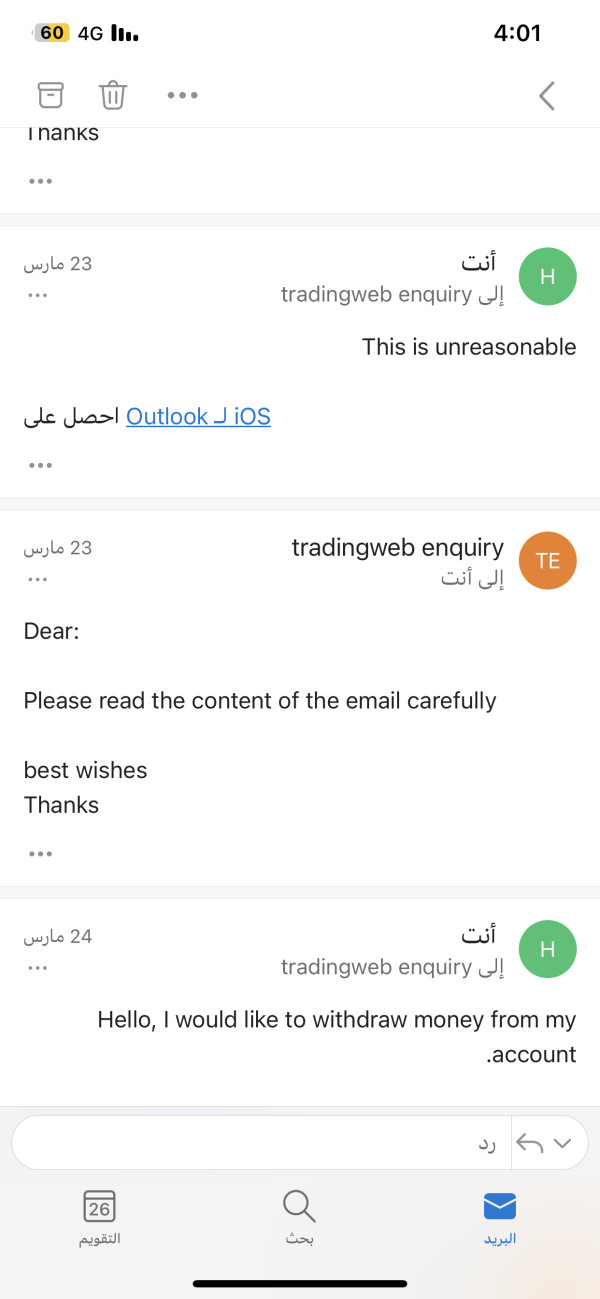

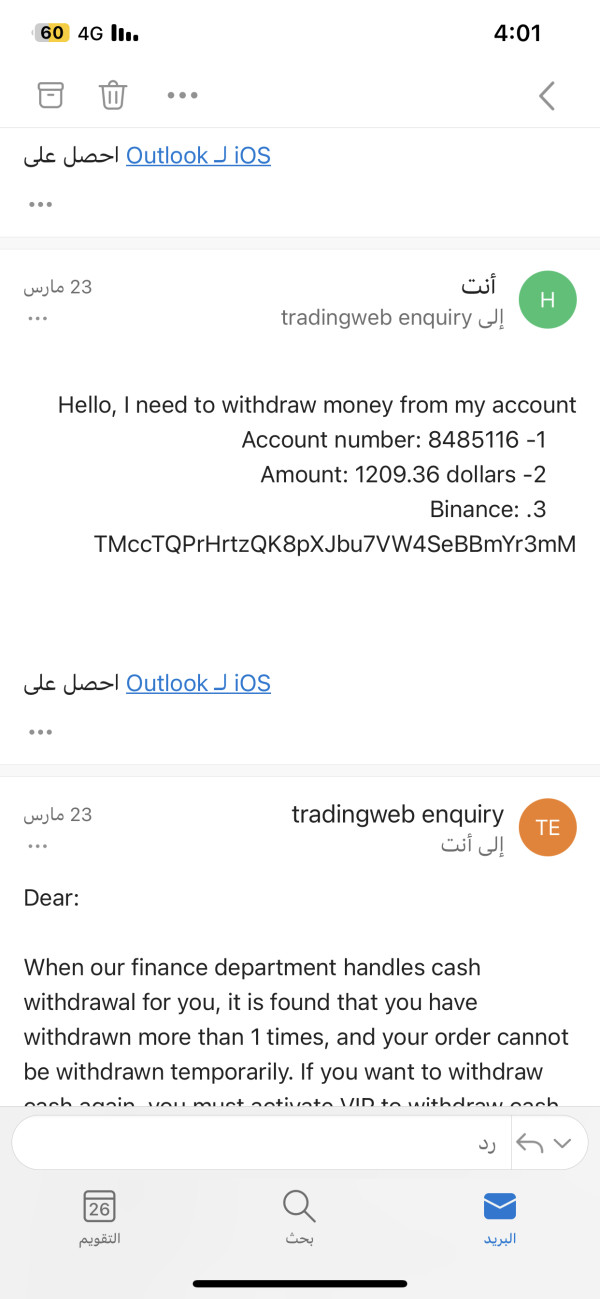

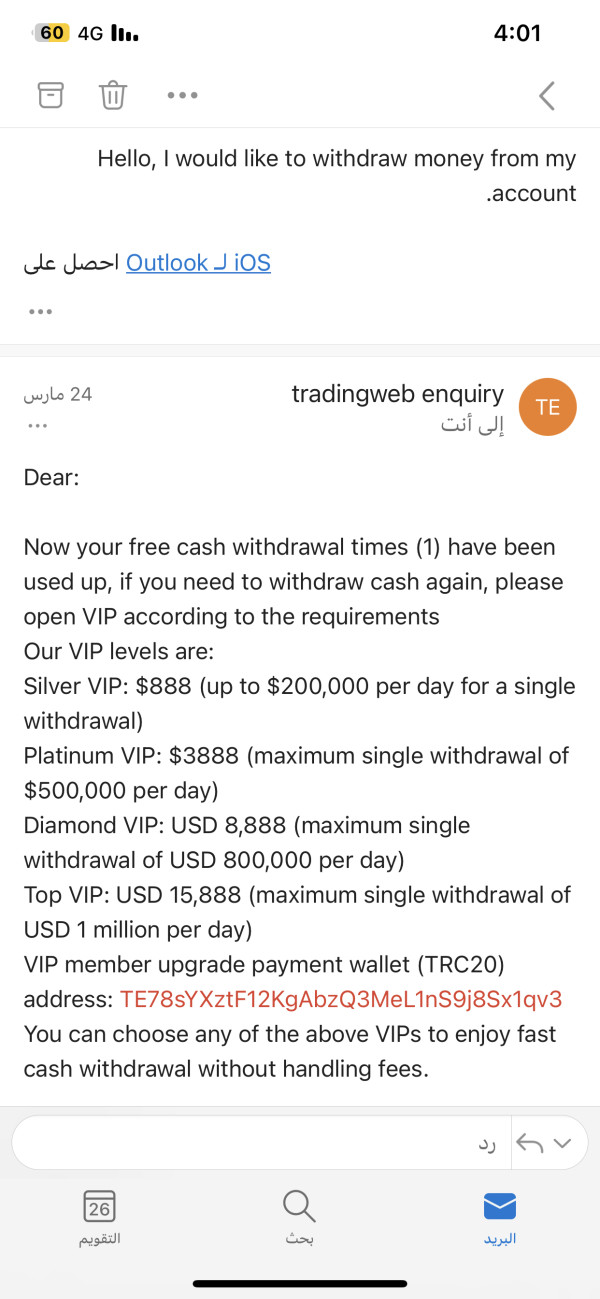

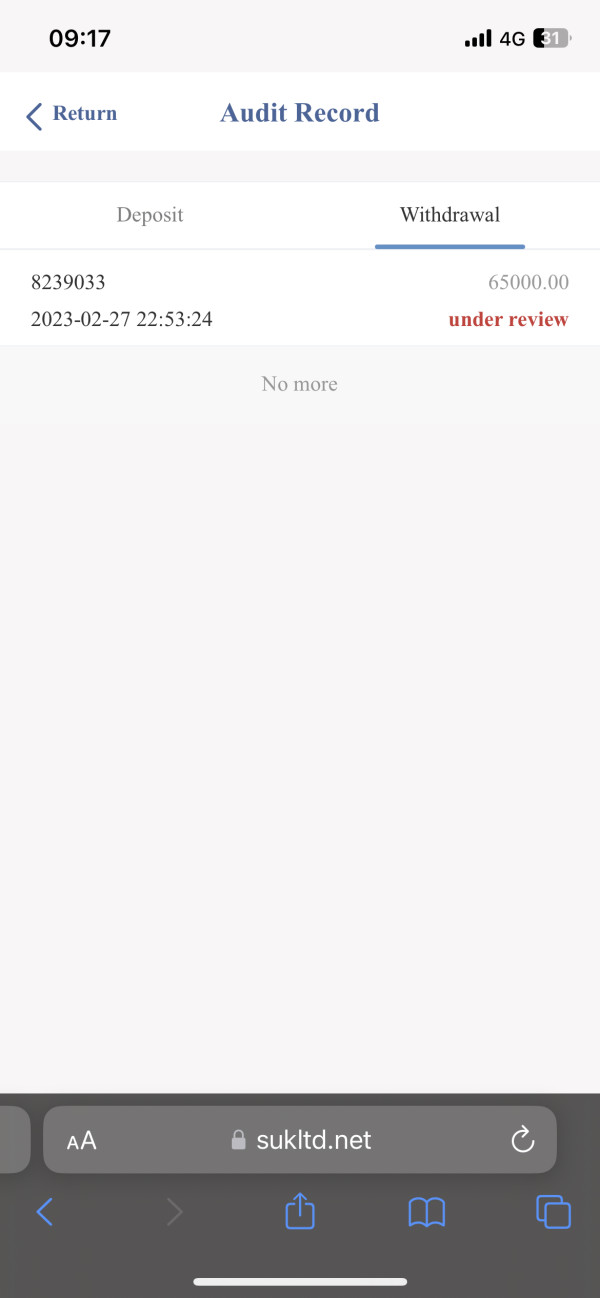

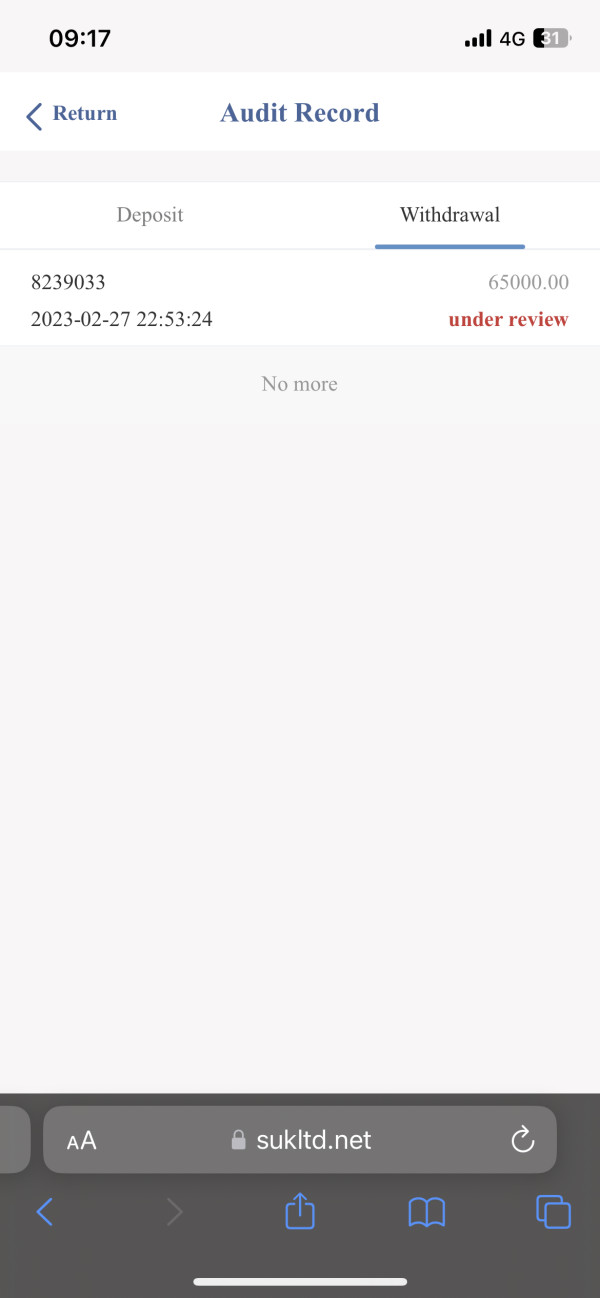

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal options is not detailed in available source materials. The lack of clear payment processing information adds to concerns about the platform's operational realness.

Minimum Deposit Requirements

Minimum deposit limits are not specified in the available documentation, making it hard for potential users to understand the financial commitment required to begin trading.

Details about bonus structures or promotional campaigns are not provided in the source materials reviewed for this tradingweb review.

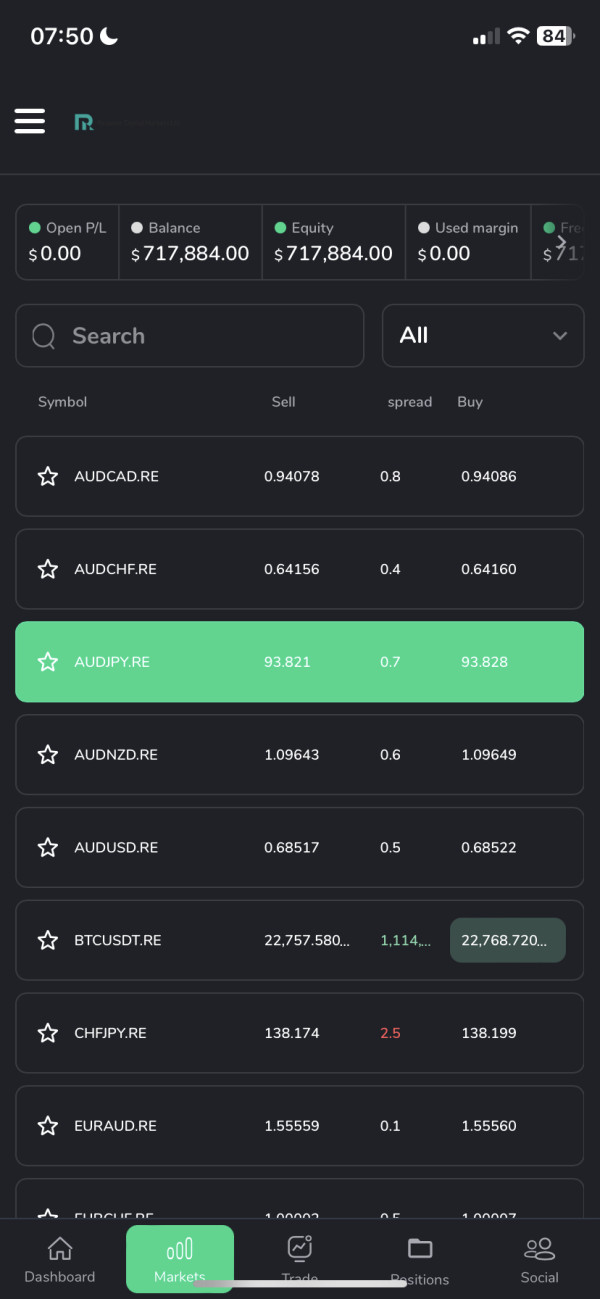

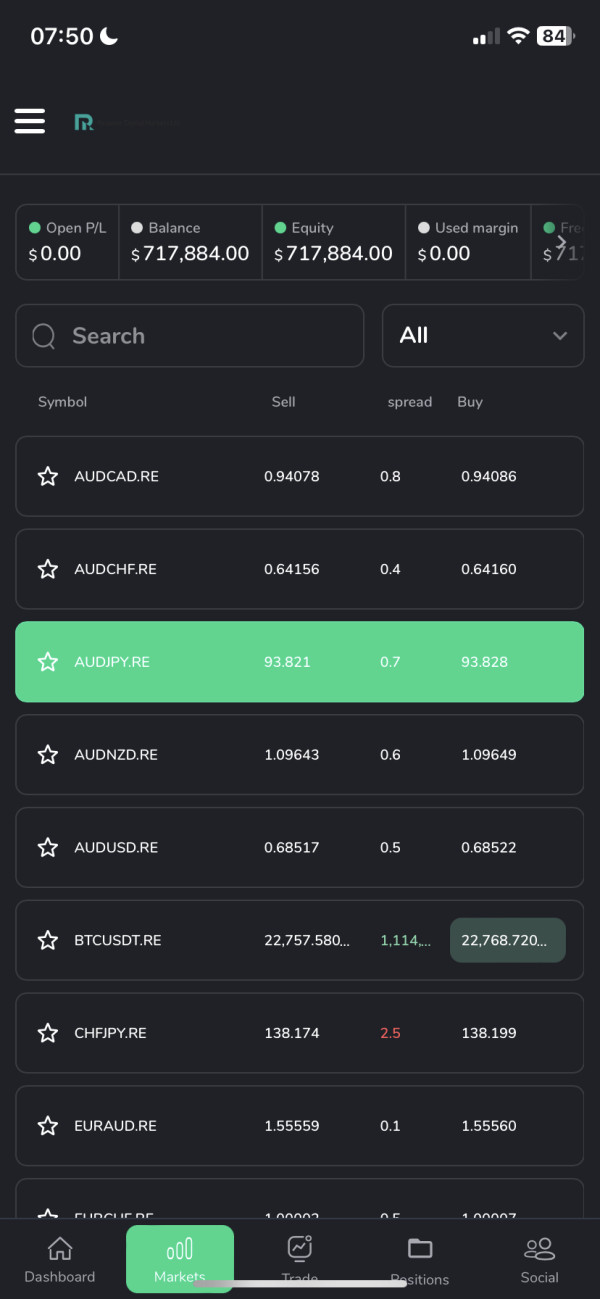

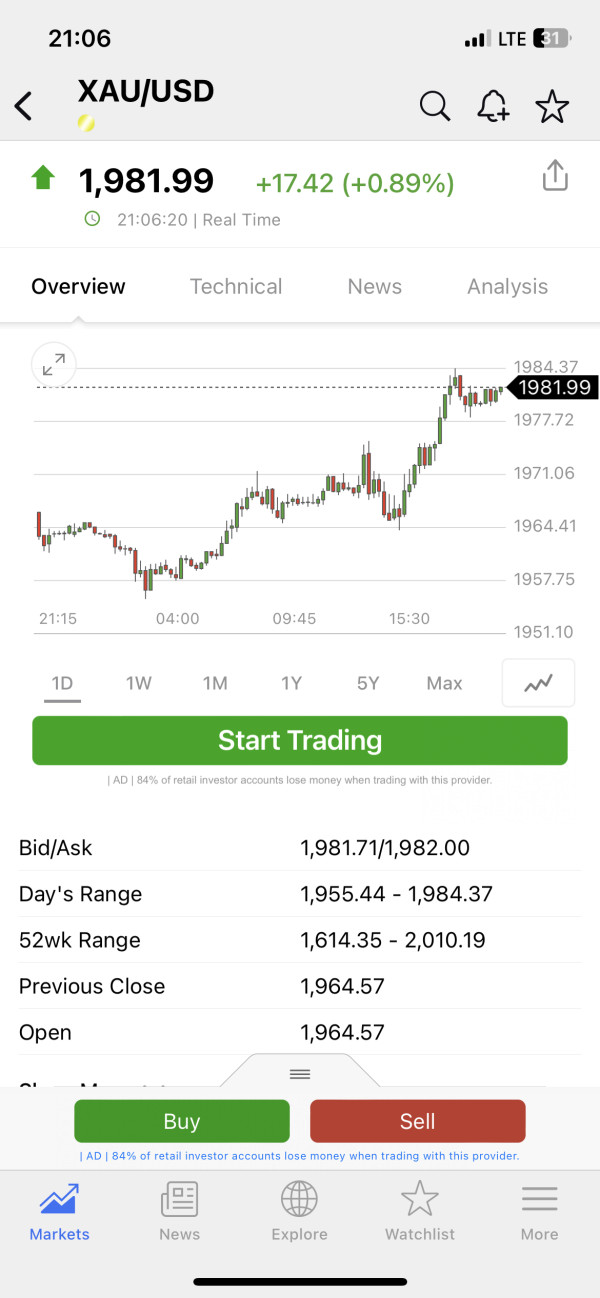

Available Trading Assets

The specific range of tradeable tools offered by TradingWeb is not clearly outlined in available reports, though the platform appears to focus mainly on forex trading opportunities.

Cost Structure

Complete fee schedules, spread information, and commission structures are not detailed in the source materials, preventing accurate cost comparisons with established brokers.

Leverage Options

Leverage ratios and margin requirements are not specified in available documentation.

Technical specifications and platform features are not detailed in the reviewed source materials.

Geographic Restrictions

Information about regional availability and trading restrictions is not provided in available reports.

Customer Support Languages

Multi-language support capabilities are not specified in the source documentation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of TradingWeb's account conditions proves challenging due to limited transparency in available documentation. Unlike established brokers who provide detailed account specifications, TradingWeb's account structure remains largely hidden. This lack of clarity extends to basic aspects such as account types, minimum balance requirements, and special features that traders usually expect from real platforms.

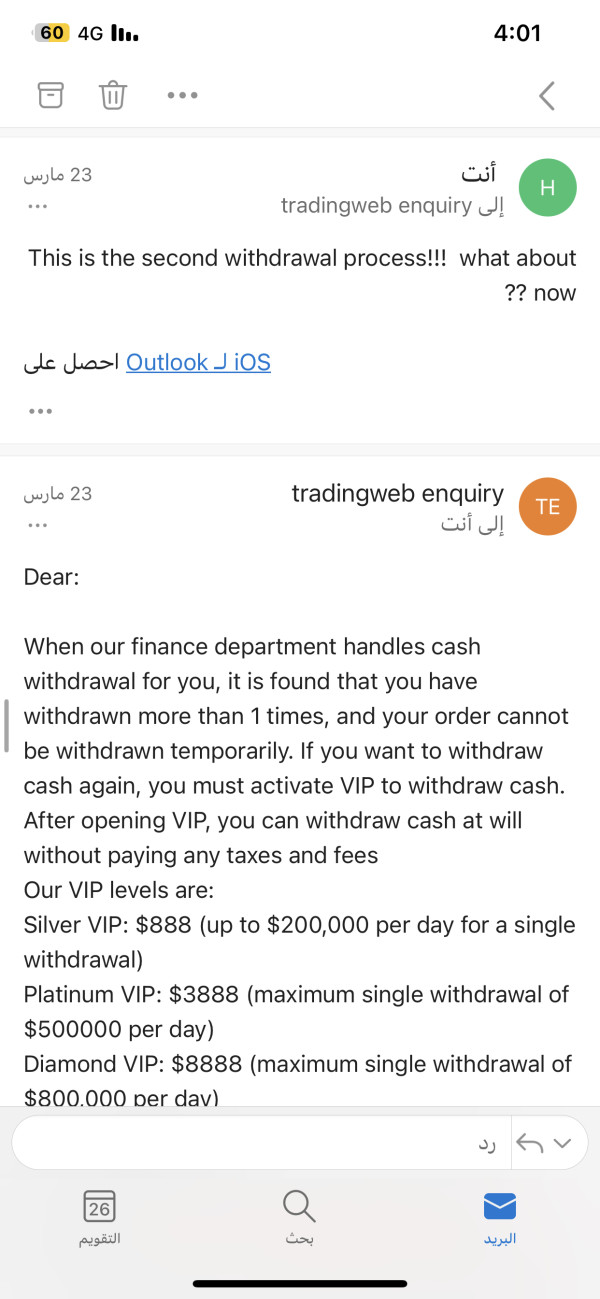

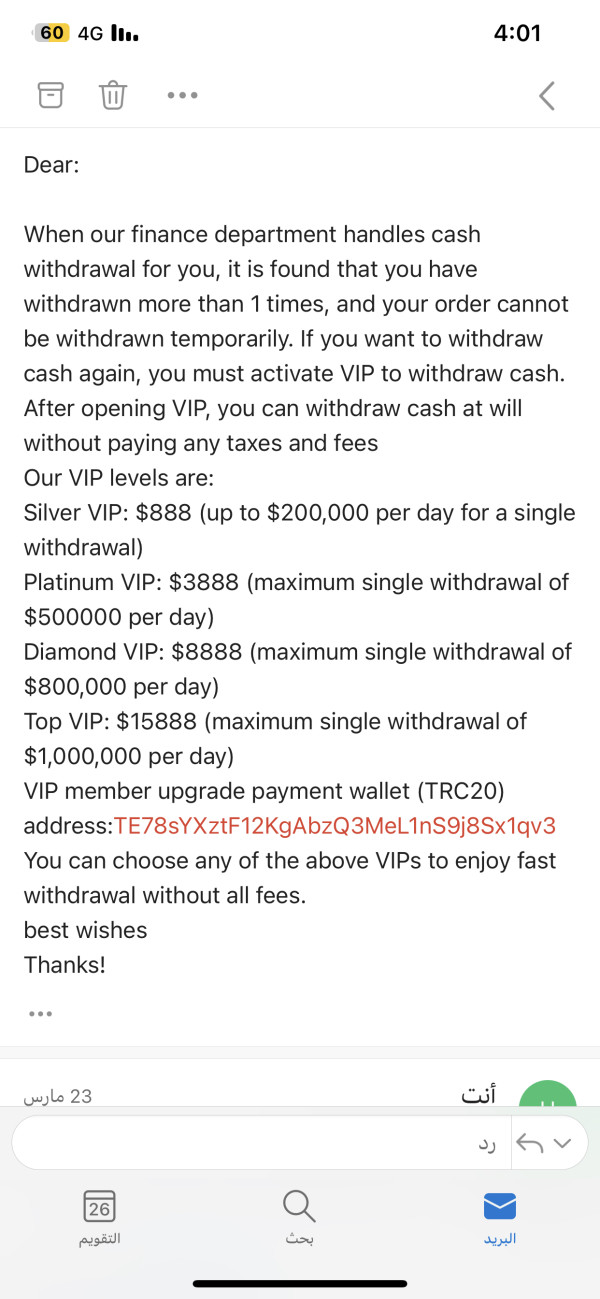

Standard industry practice involves offering multiple account levels to accommodate different trader profiles, from beginners to institutional clients. However, TradingWeb's account offerings are not clearly explained in available materials. The absence of detailed account information, including Islamic account options, VIP services, or educational account features, raises questions about the platform's commitment to serving diverse trader needs.

This tradingweb review cannot provide specific account condition ratings due to insufficient information in source materials. The lack of transparency regarding account structures represents a significant departure from industry standards, where reputable brokers typically provide comprehensive account documentation to help traders make informed decisions.

Assessment of TradingWeb's trading tools and educational resources faces significant limitations due to sparse information in available source materials. Professional trading platforms usually offer complete analytical tools, market research capabilities, and educational content to support trader development. However, TradingWeb's resource offerings remain largely undocumented.

Industry-standard trading tools usually include advanced charting capabilities, technical indicators, economic calendars, and market analysis features. Educational resources commonly include webinars, tutorials, market commentary, and trading guides. The absence of detailed information about such resources in TradingWeb's case prevents meaningful evaluation of the platform's value proposition for trader development.

Automated trading support, copy trading features, and third-party tool integration are increasingly important in modern trading environments. Without clear documentation of these capabilities, potential users cannot assess whether TradingWeb meets contemporary trading technology expectations.

Customer Service and Support Analysis

Evaluating TradingWeb's customer service capabilities proves difficult due to limited information in available source materials. Professional brokers usually maintain multiple contact channels, including live chat, phone support, email assistance, and complete FAQ sections. However, TradingWeb's support infrastructure is not clearly documented in reviewed materials.

Response time metrics, service quality assessments, and multi-language support capabilities are standard benchmarks for measuring broker customer service effectiveness. The absence of such information in TradingWeb's case prevents complete service evaluation. Professional trading environments require reliable support systems to address technical issues, account inquiries, and trading assistance promptly.

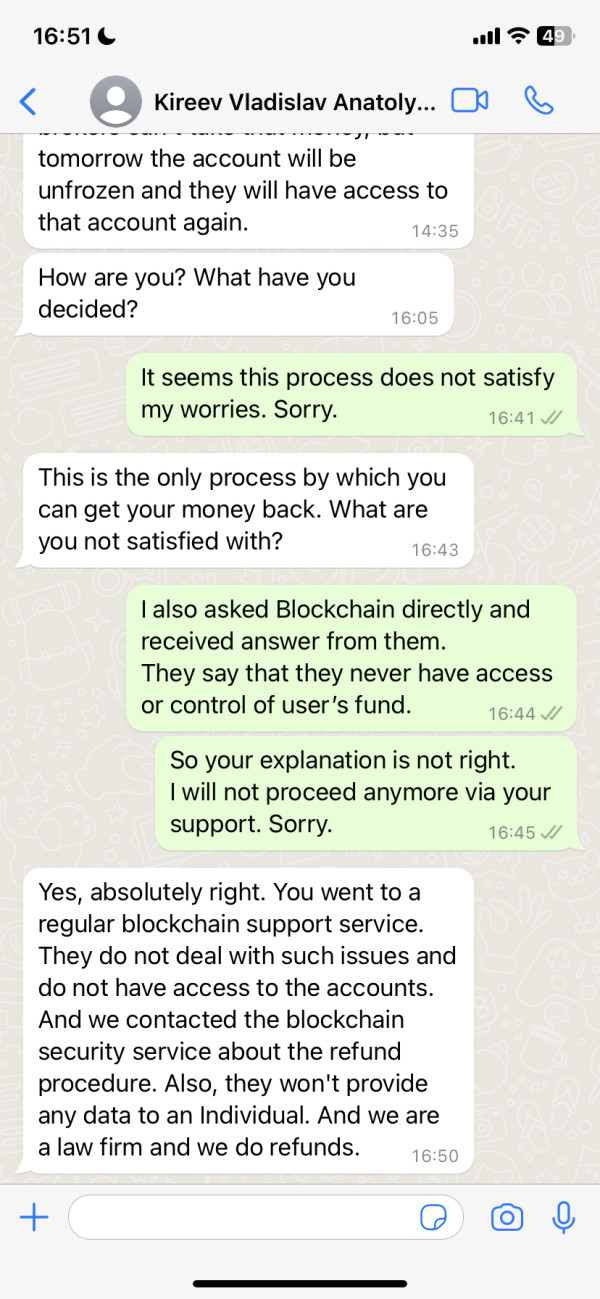

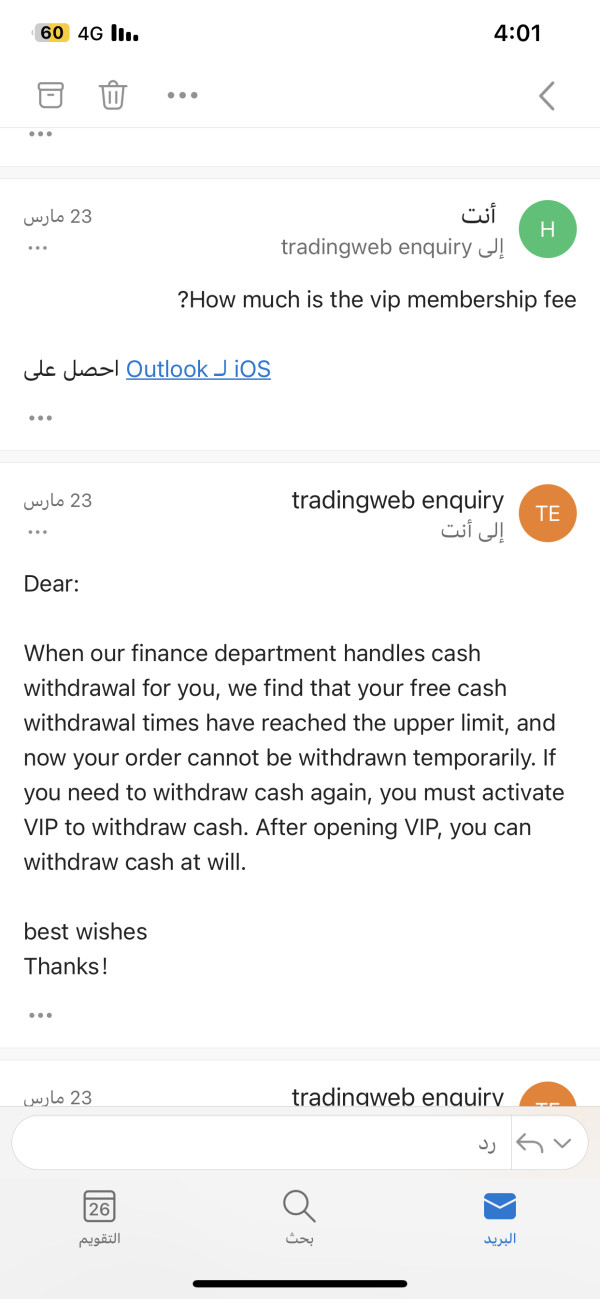

Industry reports suggest that TradingWeb's anonymous nature may complicate customer service delivery, as legitimate support typically requires verified business operations and clear escalation procedures. The lack of transparent customer service information aligns with broader concerns about the platform's operational legitimacy.

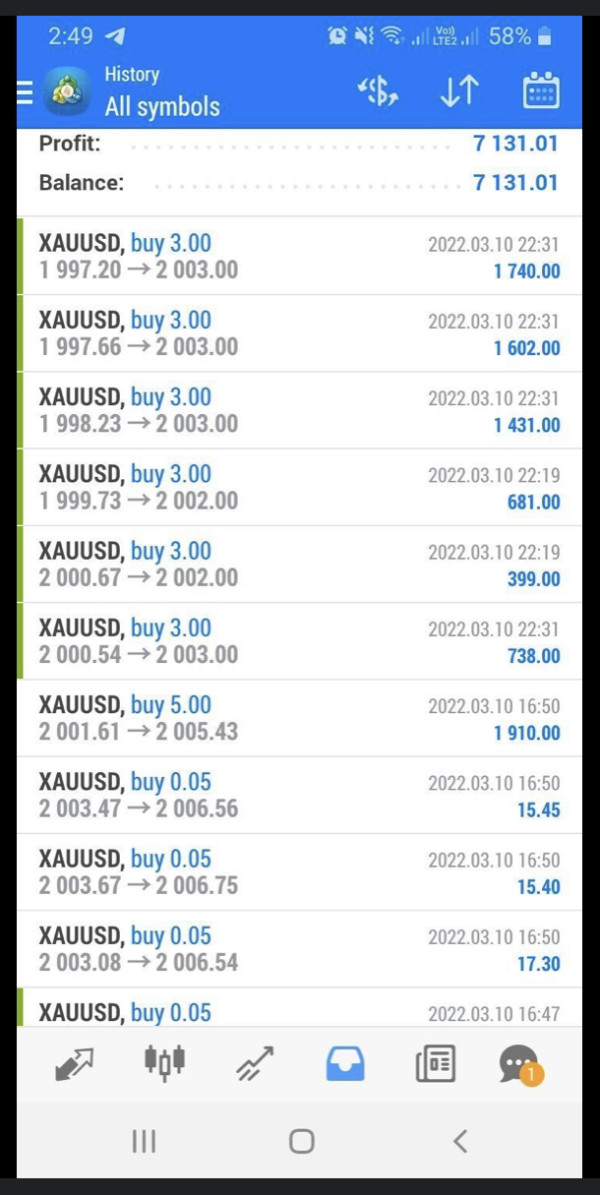

Trading Experience Analysis

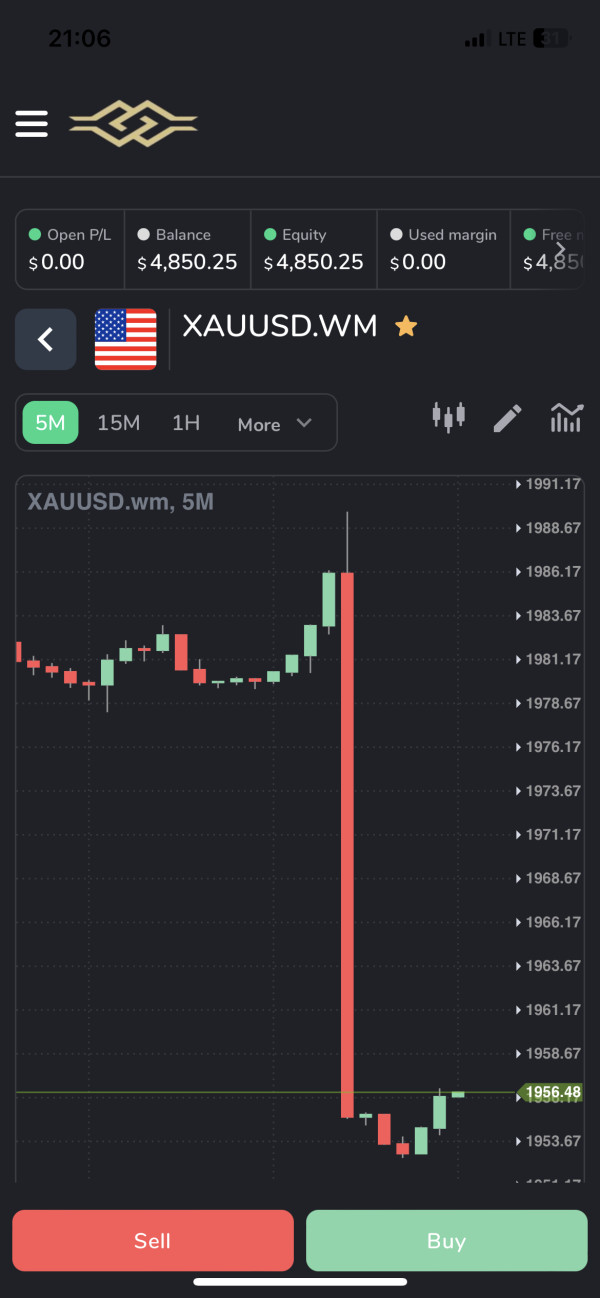

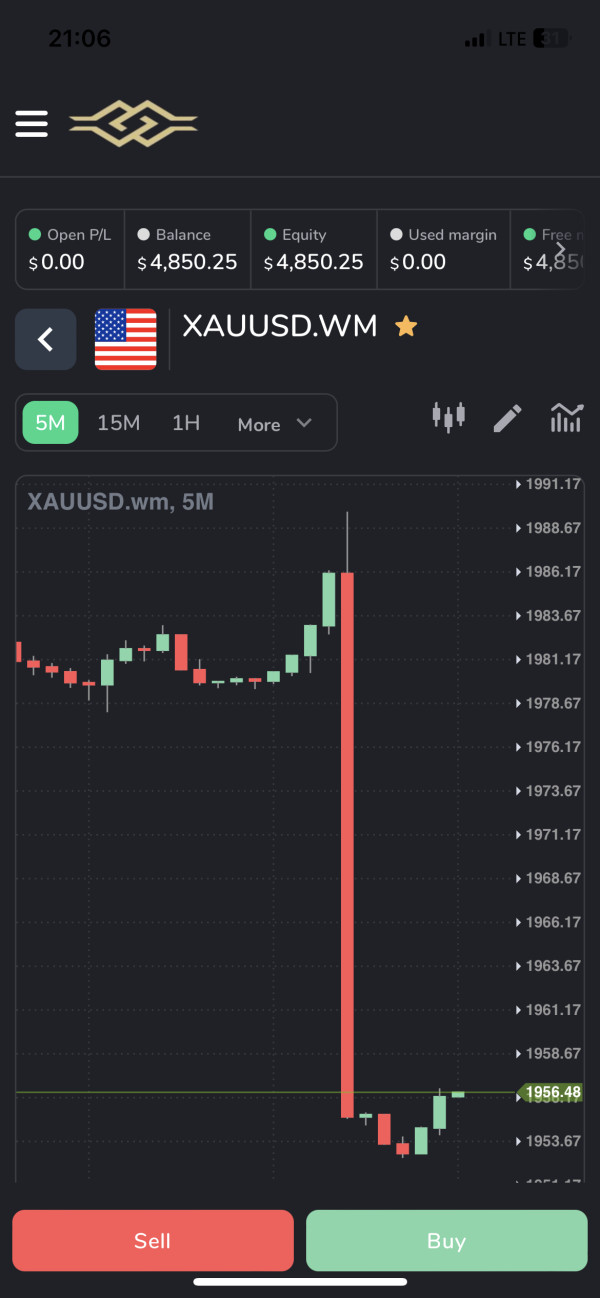

The trading experience evaluation for TradingWeb encounters significant limitations due to insufficient technical information in available source materials. Modern trading platforms are usually assessed based on execution speed, platform stability, order types, and mobile accessibility. However, specific performance metrics for TradingWeb are not documented in reviewed sources.

Professional trading environments require reliable order execution, minimal slippage, and complete order management capabilities. Platform stability during market volatility and peak trading hours represents a critical factor for serious traders. The absence of checkable performance data makes it impossible to assess TradingWeb's capabilities in these crucial areas.

This tradingweb review cannot provide specific trading experience ratings due to limited technical information. The lack of transparent performance documentation, combined with concerns about the platform's regulatory status, suggests potential risks for traders seeking reliable execution environments.

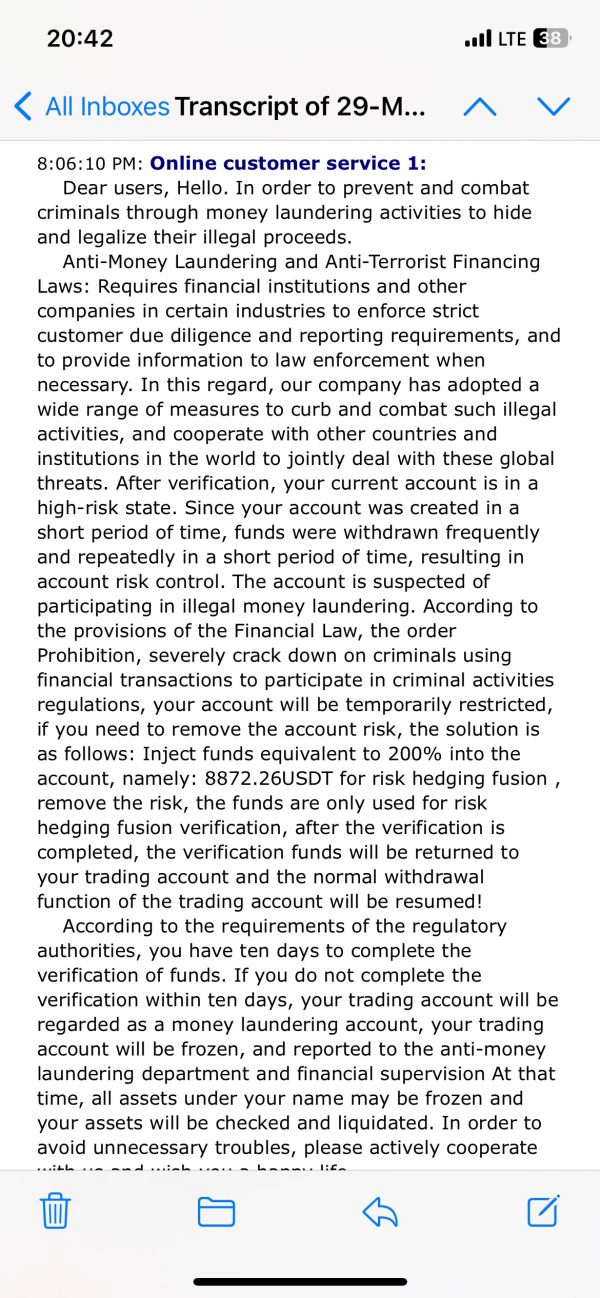

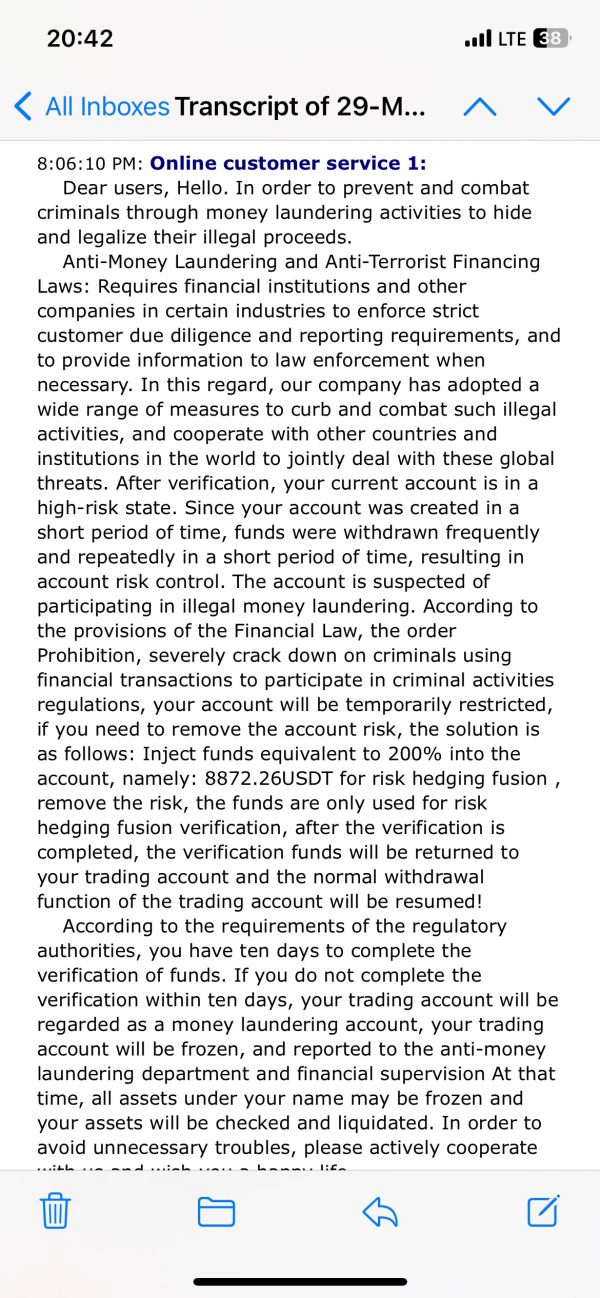

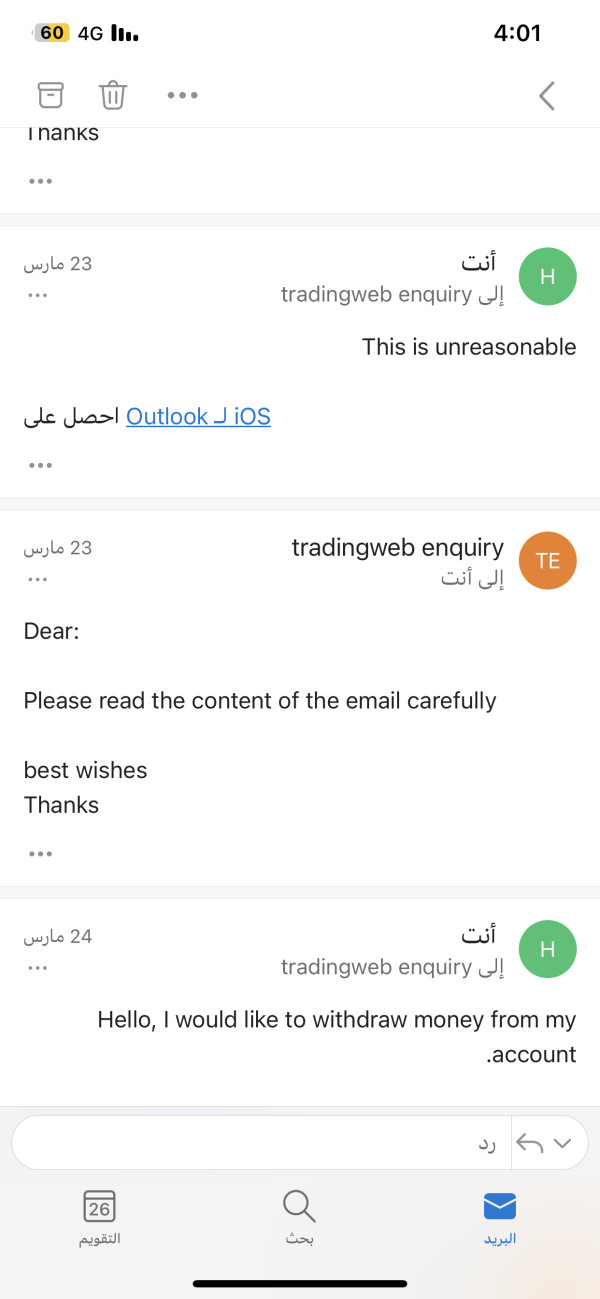

Trust and Security Analysis

The trust and security evaluation of TradingWeb reveals significant concerns based on available industry reports. Multiple sources have flagged the platform as operating without proper regulatory oversight, which fundamentally undermines trader protection mechanisms. Legitimate brokers usually maintain licenses from recognized financial authorities and implement complete security protocols to protect client funds and data.

Industry watchdogs have specifically warned about TradingWeb's anonymous nature and lack of checkable business premises. These factors represent substantial red flags in an industry where transparency and regulatory compliance are essential for trader protection. The absence of proper licensing means traders lack access to compensation schemes, regulatory dispute resolution, and other standard protections.

Security measures such as fund segregation, encryption protocols, and audit procedures are not clearly documented for TradingWeb. The platform's low trust rating reflects these basic concerns about operational legitimacy and trader protection. Reports suggesting potential fraudulent activity further compound security concerns for potential users.

User Experience Analysis

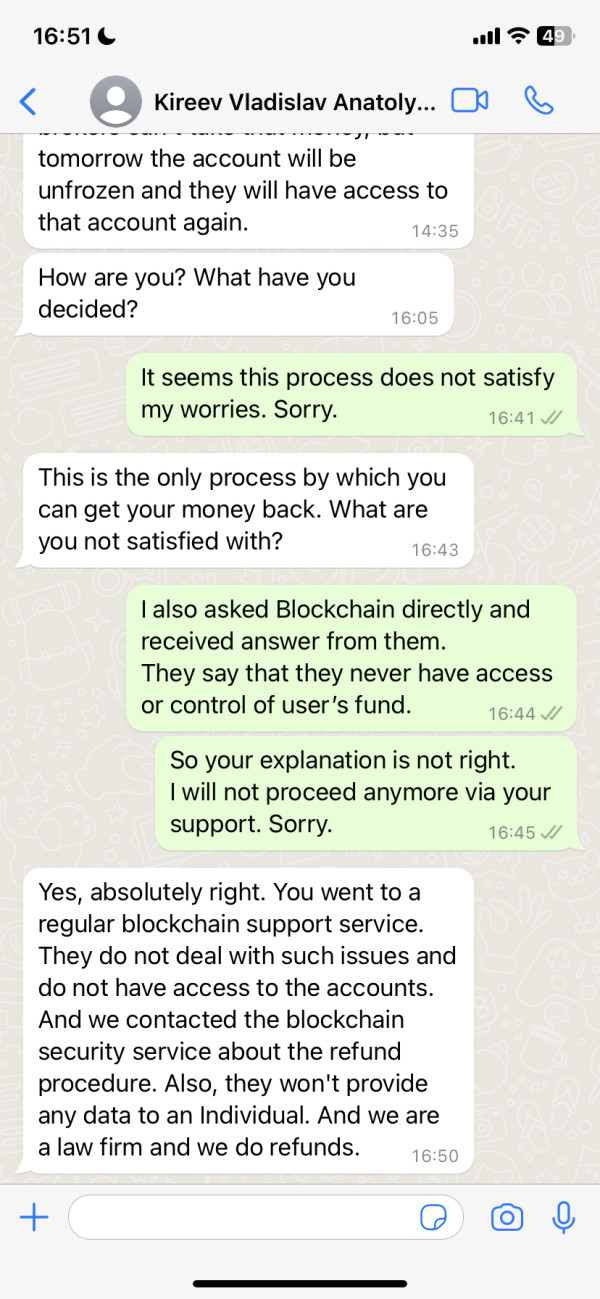

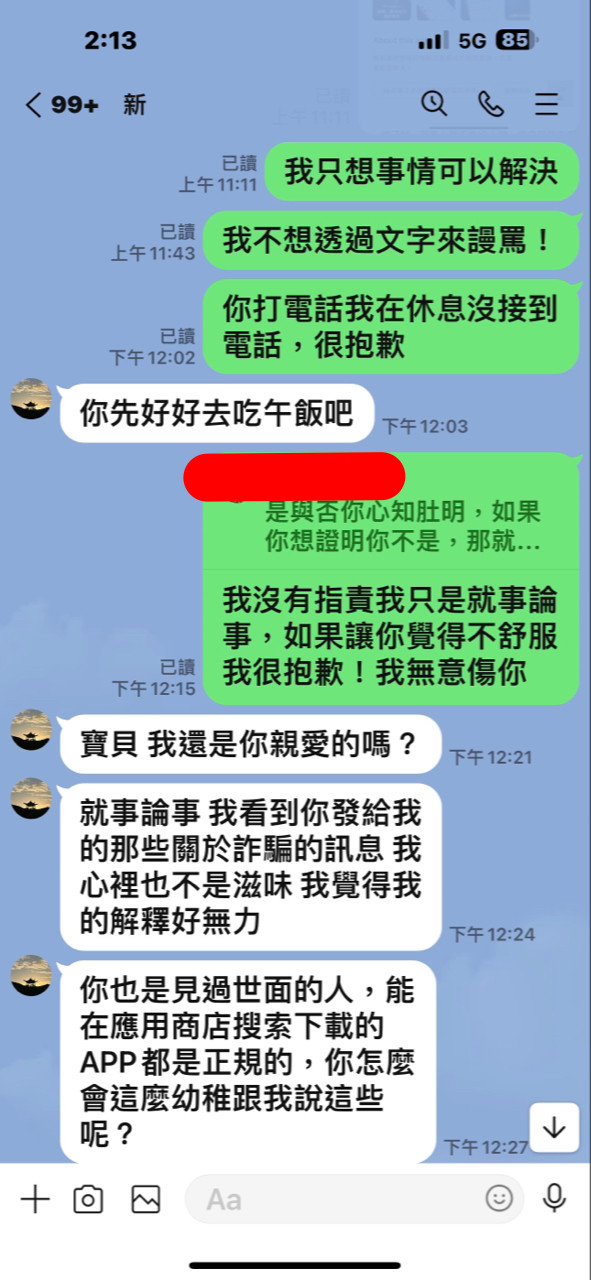

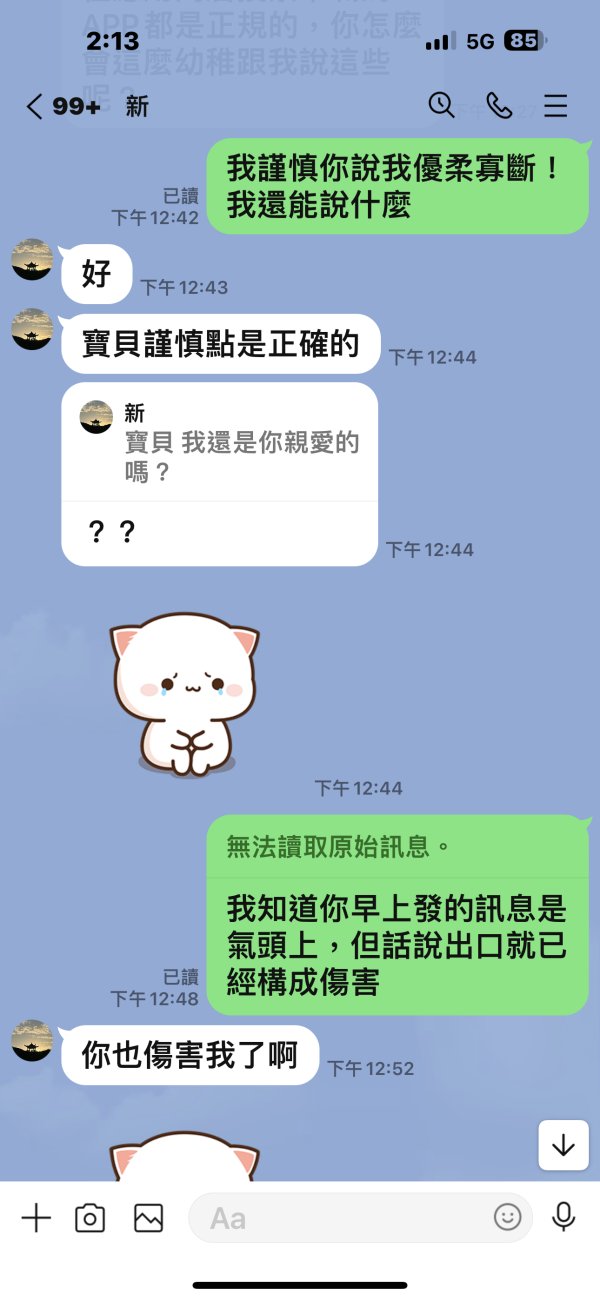

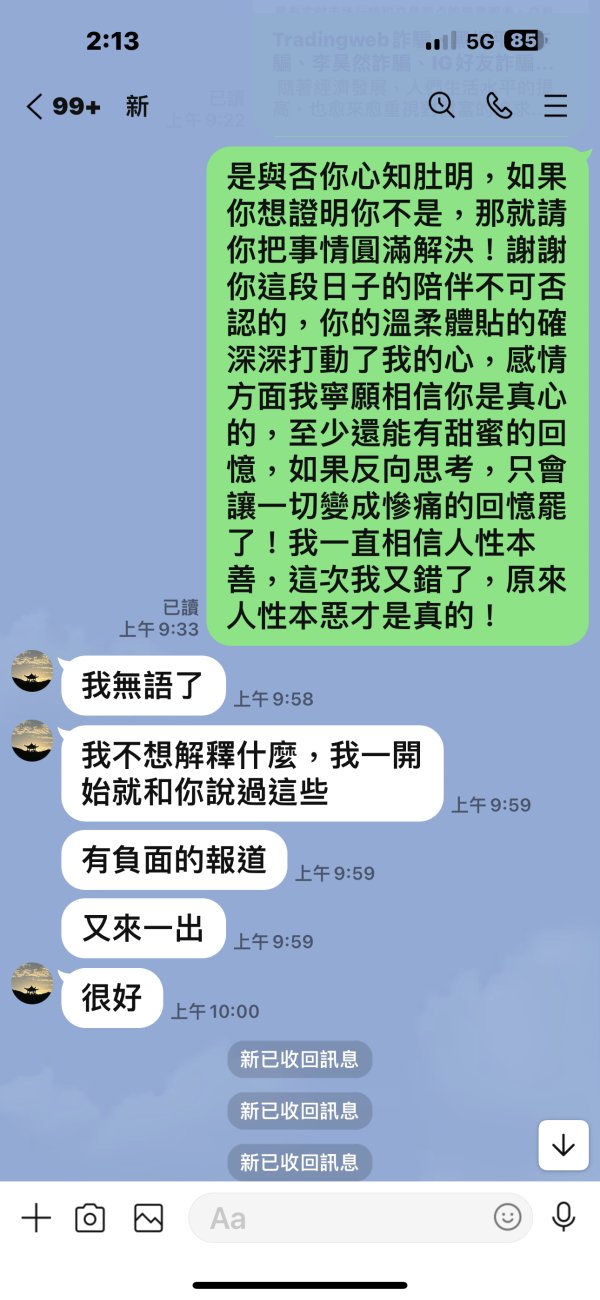

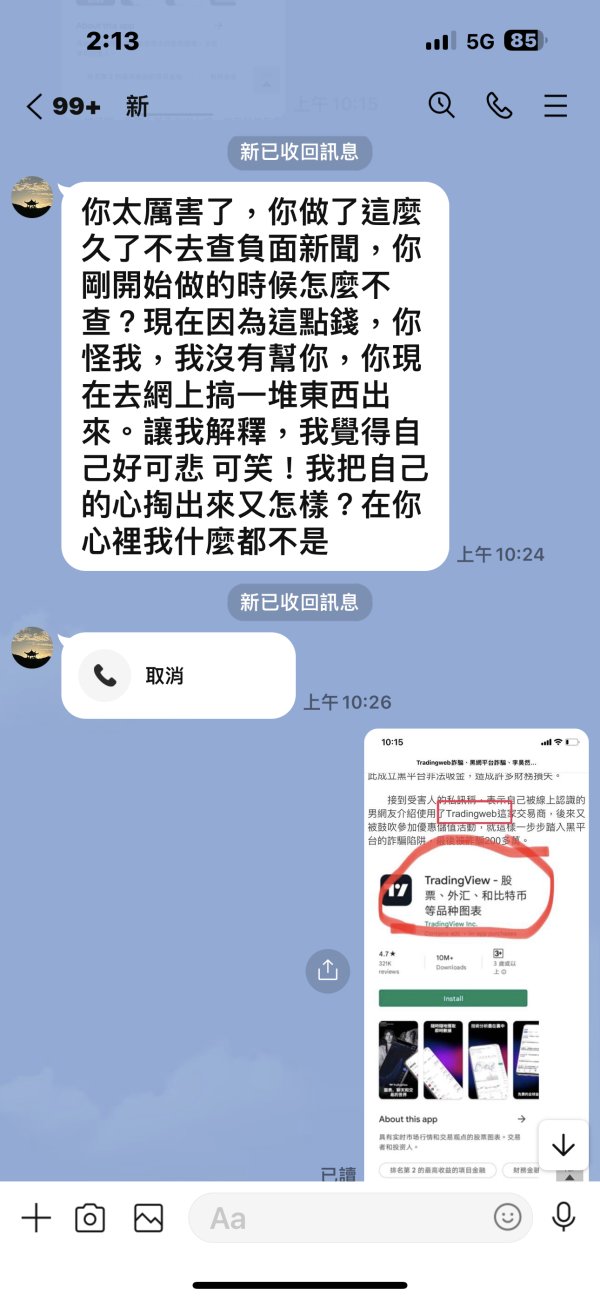

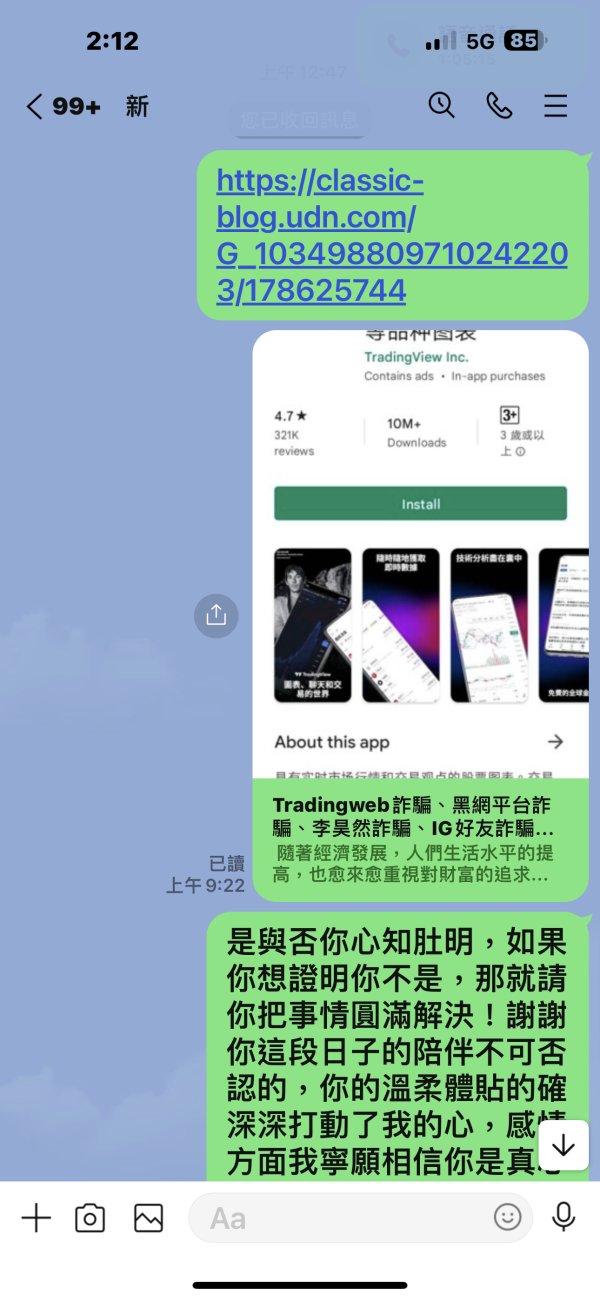

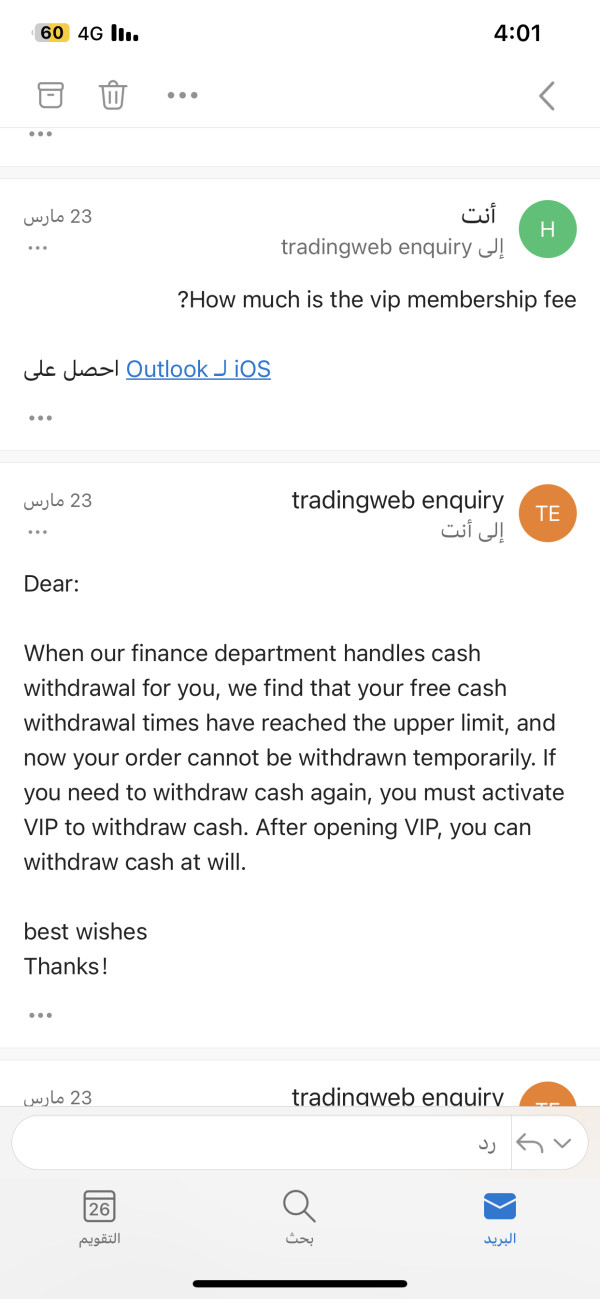

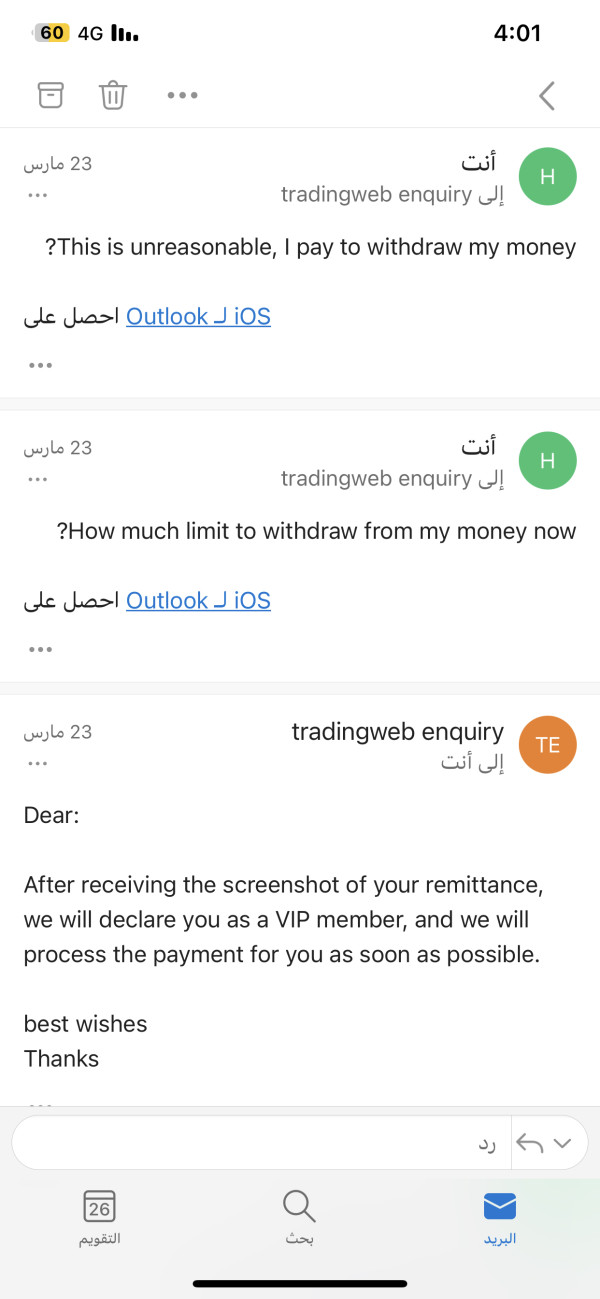

User feedback regarding TradingWeb presents a contradictory picture that requires careful analysis. While some sources indicate positive user ratings, industry reports simultaneously warn about potential fraudulent activity. This discrepancy raises questions about the authenticity and reliability of available user testimonials.

Legitimate user experience usually includes registration ease, platform navigation, account verification processes, and overall satisfaction with trading services. However, the conflicting nature of available feedback makes it difficult to establish reliable user experience benchmarks for TradingWeb. The platform's anonymous nature may contribute to this uncertainty, as verified user experiences become harder to authenticate.

The warning from industry sources about potential scam activity significantly impacts user experience considerations. Traders seeking reliable platforms usually prioritize verified user feedback from established review sources and regulatory databases. The mixed signals surrounding TradingWeb's user experience suggest potential risks that serious traders should carefully consider.

Conclusion

This tradingweb review concludes with significant concerns about the platform's suitability for serious traders. The combination of anonymous operations, lack of regulatory oversight, and industry warnings about potential fraudulent activity creates a risk profile that exceeds acceptable levels for most trading scenarios. While some user ratings appear positive, the basic absence of proper licensing and transparency raises questions about the platform's legitimacy.

Based on available evidence, we cannot recommend TradingWeb to any trader category. The platform's operational model lacks the regulatory protections and transparency standards that characterize legitimate trading environments. Traders seeking reliable forex trading services would benefit from choosing regulated alternatives with verified licensing and transparent business operations.

The primary disadvantage of TradingWeb lies in its regulatory status and anonymous nature, which eliminate standard trader protections. Any perceived advantages are overshadowed by these basic security and legitimacy concerns that could expose traders to significant risks.