Regarding the legitimacy of WINDSOR BROKERS forex brokers, it provides CYSEC, FSA and WikiBit, (also has a graphic survey regarding security).

Is WINDSOR BROKERS safe?

Pros

Cons

Is WINDSOR BROKERS markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 22

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

WB Trade EU Ltd

Effective Date:

2004-05-20Email Address of Licensed Institution:

compliance@wbtrade.euSharing Status:

No SharingWebsite of Licensed Institution:

www.wbtrade.euExpiration Time:

--Address of Licensed Institution:

53, Spyrou Kyprianou Ave, CY-4004 Mesa Yitonia, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 500 505Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Windsor Brokers International Ltd

Effective Date:

--Email Address of Licensed Institution:

SDRepresentative@windsorbrokers.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.windsorbrokers.comExpiration Time:

--Address of Licensed Institution:

Scenic Car Hire Building, No. G3, Ma Joie, Mahe, SeychellesPhone Number of Licensed Institution:

+248 432 11 48Licensed Institution Certified Documents:

Is Windsor Brokers A Scam?

Introduction

Windsor Brokers, established in 1988, positions itself as a reputable player in the forex and CFD trading market, catering to a global clientele. With over three decades of experience, Windsor Brokers claims to provide a secure and user-friendly trading environment. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The importance of evaluating a forex broker stems from the potential for financial loss, fraud, and the overall integrity of the trading environment. This article employs a comprehensive investigation framework to analyze Windsor Brokers, focusing on its regulatory standing, company background, trading conditions, customer experiences, and risk factors to determine whether it is a reliable broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is pivotal in assessing its legitimacy and safety. Windsor Brokers operates under multiple regulatory authorities, which adds a layer of oversight to its operations. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 030/04 | Cyprus | Verified |

| Financial Services Commission (FSC) | N/A | Belize | Verified |

| Financial Services Authority (FSA) | SD 072 | Seychelles | Verified |

| Jordan Securities Commission (JSC) | 1265 | Jordan | Verified |

| Capital Markets Authority (CMA) | 156 | Kenya | Verified |

Windsor Brokers is regulated by CySEC, which is known for its robust regulatory framework that mandates strict compliance with financial standards and investor protection measures. The broker also claims to be governed by the FSC in Belize, the FSA in Seychelles, and the JSC in Jordan, which, while providing some level of oversight, are often viewed as less stringent compared to tier-1 regulators like the FCA or ASIC. Notably, the CySEC regulation ensures that client funds are held in segregated accounts, providing an additional layer of security. However, reports of operational issues and withdrawal complaints raise questions about the broker's adherence to regulatory standards over time.

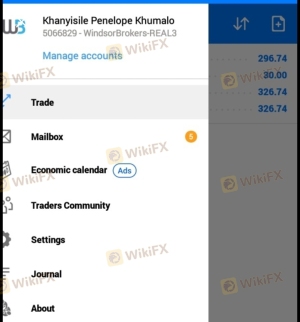

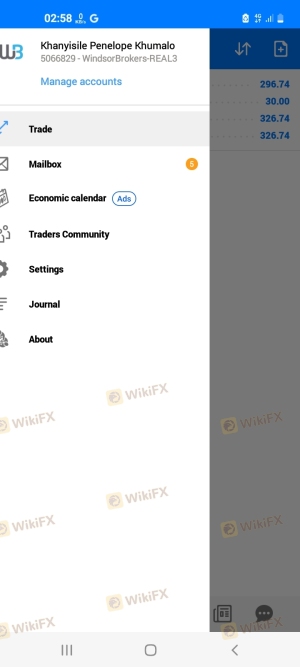

Company Background Investigation

Windsor Brokers has a long-standing history in the financial markets, having been founded in 1988. The company has evolved significantly since its inception, expanding its services to cover a wide range of financial instruments, including forex, CFDs, commodities, and indices. The ownership structure of Windsor Brokers is not publicly disclosed, which can be a concern for transparency. The management team is comprised of experienced professionals in finance and trading, contributing to the firm's credibility.

The company's transparency is further evaluated by its communication with clients and the availability of information on its website. While Windsor Brokers provides educational resources and market analysis, the lack of detailed information regarding its ownership and management can lead to skepticism among potential clients. A broker's transparency is crucial for building trust, and Windsor Brokers could improve in this regard by offering more insights into its corporate governance and management structure.

Trading Conditions Analysis

Windsor Brokers offers a variety of trading conditions, which are essential for traders to understand before opening an account. The broker's fee structure includes spreads, commissions, and overnight interest rates. Below is a comparison of the core trading costs associated with Windsor Brokers and the industry average:

| Fee Type | Windsor Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Structure | $8 per round trip for Zero account | $6 per round trip |

| Overnight Interest Range | Varies | Varies |

Windsor Brokers' spreads are competitive, particularly for its Zero account, which offers spreads starting at 0.0 pips. However, the commission of $8 per round trip may be higher than some competitors, which could deter cost-sensitive traders. Additionally, the broker's overnight interest rates vary, which can impact trading costs depending on the positions held. Overall, while Windsor Brokers provides reasonable trading conditions, potential clients should carefully evaluate their trading strategies and cost considerations.

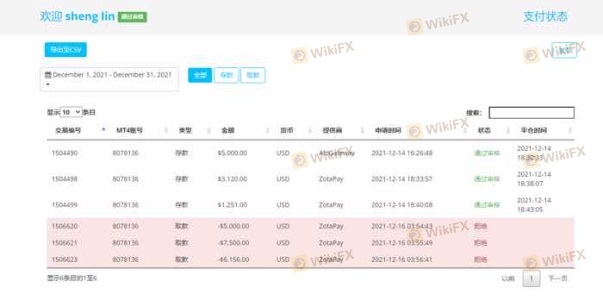

Client Funds Safety

The safety of client funds is a paramount concern for any trader. Windsor Brokers employs several measures to protect client funds, including the segregation of client accounts and participation in investor compensation schemes. The broker claims to hold client funds in top-tier banks, ensuring that they are not intermingled with the company's operational funds. Furthermore, Windsor Brokers offers negative balance protection, which prevents clients from losing more than their deposited amounts.

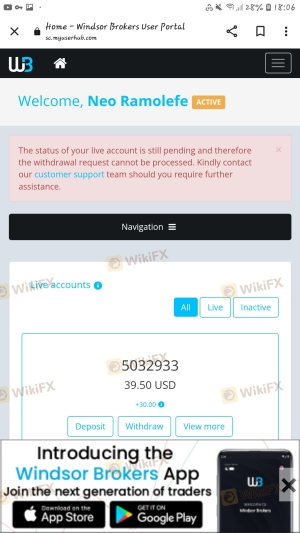

Despite these measures, there have been historical concerns regarding the safety of funds at Windsor Brokers, particularly relating to withdrawal issues reported by clients. Such issues can undermine trust and raise alarms about the broker's operational integrity. Therefore, it is essential for potential clients to be aware of these concerns and assess the broker's history in handling client funds.

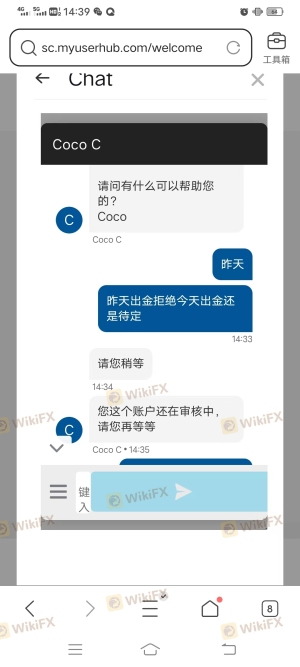

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of Windsor Brokers reveal a mixed bag of experiences among traders. While some clients praise the broker for its trading conditions and user-friendly platform, others have expressed frustration over withdrawal difficulties and customer service responsiveness. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response time |

| Customer Service | Medium | Mixed reviews |

| Platform Stability | Medium | Occasional glitches |

Typical case studies include reports of clients struggling to withdraw their funds, often citing delays and unresponsive customer service. These complaints highlight potential operational issues within the broker's support infrastructure. On the other hand, there are also positive testimonials regarding the broker's trading conditions and educational resources, indicating that experiences can vary widely based on individual circumstances.

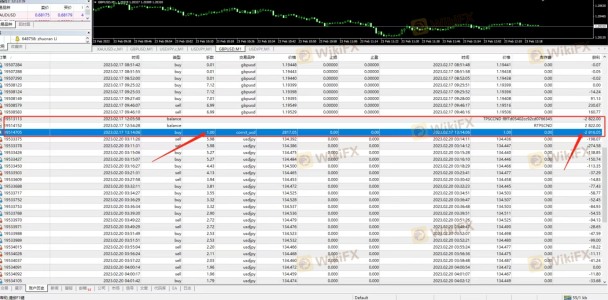

Platform and Trade Execution

Windsor Brokers utilizes the popular MetaTrader 4 (MT4) platform, known for its reliability and extensive features. The platform supports various trading strategies and offers advanced charting tools, making it suitable for both novice and experienced traders. However, some users have reported issues with order execution, including slippage and re-quotes during volatile market conditions.

The execution quality is a critical aspect of trading, as delays or failures can significantly impact a trader's profitability. While Windsor Brokers aims to provide a seamless trading experience, any signs of platform manipulation or execution issues should be taken seriously by potential clients.

Risk Assessment

Using Windsor Brokers carries a certain level of risk, as is common with all trading activities. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Multiple regulations, but not tier-1 |

| Operational Risk | High | Reports of withdrawal issues |

| Market Risk | High | Volatility inherent in forex trading |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts for practice, and maintain a disciplined trading strategy. It is also advisable to stay informed about the broker's operational status and any regulatory updates that may affect trading conditions.

Conclusion and Recommendations

In conclusion, Windsor Brokers presents a mixed profile. While the broker is regulated by multiple authorities and offers competitive trading conditions, the reported withdrawal issues and customer complaints raise red flags that potential traders should consider. There are no clear indications of fraudulent activity; however, the operational challenges suggest that caution is warranted.

For novice traders, it may be wise to explore other options with a stronger track record of customer service and operational integrity. Recommended alternatives include brokers with tier-1 regulation and a proven history of reliability. Overall, traders should weigh the pros and cons carefully before engaging with Windsor Brokers, ensuring they are comfortable with the associated risks.

Is WINDSOR BROKERS a scam, or is it legit?

The latest exposure and evaluation content of WINDSOR BROKERS brokers.

WINDSOR BROKERS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WINDSOR BROKERS latest industry rating score is 6.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.