Is LowCostForex safe?

Business

License

Is LowCostForex Safe or Scam?

Introduction

LowCostForex is a relatively new player in the forex market, established in 2018 and positioning itself as a cost-effective trading platform for retail traders. With the allure of low spreads and minimal trading costs, it has attracted attention from traders looking for budget-friendly options. However, the forex market is rife with potential pitfalls, and traders must exercise caution when selecting a broker. The importance of regulatory oversight, transparency, and customer feedback cannot be overstated, as these factors significantly impact the safety and reliability of a trading platform. In this article, we will explore the safety of LowCostForex by examining its regulatory status, company history, trading conditions, client fund security, and user experiences. Our research methodology involved a comprehensive analysis of online reviews, regulatory databases, and user feedback to provide an objective assessment of whether LowCostForex is truly safe or if it raises any red flags.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy and safety. LowCostForex claims to operate under certain regulatory frameworks, but a thorough investigation reveals that it lacks authorization from major financial regulatory bodies. Below is a summary of the core regulatory information for LowCostForex:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

LowCostForex does not have a valid license from any recognized financial authority, which is a significant concern for potential traders. The absence of regulation means that there are no safeguards in place to protect clients funds, and traders may have limited recourse in case of disputes or issues with withdrawals. This lack of regulatory oversight raises questions about the broker's operational integrity and the overall safety of trading with them.

Historically, unregulated brokers have been associated with higher risks, including fraudulent practices, lack of transparency, and potential insolvency. The absence of a regulatory framework means that LowCostForex is not held accountable to any financial authority, making it imperative for traders to proceed with caution. In summary, the lack of regulation is a critical factor in assessing whether LowCostForex is safe or a potential scam.

Company Background Investigation

LowCostForex is operated by PHP International Live Quiddity Ltd, a company incorporated in Anguilla, British West Indies. While the company has been in operation for a few years, its history and ownership structure remain somewhat obscure. There is limited information available regarding the management team and their professional backgrounds, which is concerning for potential investors. A transparent company should provide detailed information about its leadership and operational history, allowing traders to make informed decisions.

The lack of transparency in the company's information disclosure raises further questions about its credibility. A well-established broker typically offers insights into its founders, management team, and operational practices, which helps build trust with clients. In contrast, LowCostForex's vague background and limited public presence may indicate a lack of accountability, making it difficult for traders to ascertain the reliability of the platform.

Furthermore, the absence of a comprehensive history or a strong reputation in the forex industry is a significant red flag. Traders should be wary of engaging with brokers that do not provide adequate information about their operations, as this can be indicative of underlying issues. Overall, the company background investigation suggests that LowCostForex may not be as safe as it claims, warranting caution for potential traders.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its safety and reliability. LowCostForex advertises itself as a low-cost trading platform, claiming to offer competitive spreads and low commissions. However, an in-depth analysis of its fee structure reveals some concerning aspects. Below is a comparison of core trading costs:

| Fee Type | LowCostForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 1.0 pips |

| Commission Model | $2 - $5 per lot (depending on account type) | $3.50 per lot |

| Overnight Interest Range | Variable | Variable |

While LowCostForex offers attractive spreads that begin at 0.1 pips for major currency pairs, the reality may differ based on market conditions and liquidity. Additionally, the commission structure appears to be competitive; however, traders should be cautious of any hidden fees that may not be immediately apparent.

Moreover, the variability of overnight interest rates can impact trading costs significantly, especially for traders who hold positions overnight. The lack of clarity regarding withdrawal fees and deposit methods further complicates the understanding of the overall cost structure. Traders should carefully review the terms and conditions related to fees before committing to LowCostForex, as unexpected costs can erode potential profits.

In conclusion, while LowCostForex positions itself as a low-cost broker, the complexity of its fee structure and potential hidden costs raise concerns about its overall trading conditions. These factors contribute to the question of whether LowCostForex is truly safe for traders looking to minimize costs.

Client Fund Security

The safety of client funds is paramount when assessing the reliability of a forex broker. LowCostForex claims to implement various security measures for client funds, but the lack of regulatory oversight raises significant concerns. The company does not provide clear information about fund segregation, investor protection, or negative balance protection policies.

In regulated environments, brokers are typically required to segregate client funds from their operational funds, ensuring that traders' money is protected in case of insolvency. However, without regulatory oversight, there is no guarantee that LowCostForex adheres to such practices. The absence of transparency regarding these security measures further exacerbates the risks associated with trading on this platform.

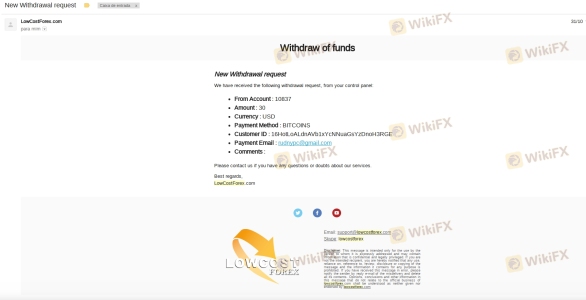

Additionally, there have been reports of clients experiencing difficulties with withdrawals and accessing their funds. Complaints about delayed withdrawals and unresponsive customer service are common, raising alarms about the broker's commitment to safeguarding client assets. Traders should be particularly cautious of brokers that do not provide adequate information about their fund security measures, as this can indicate potential risks.

In summary, the lack of clear information regarding client fund security at LowCostForex is a significant concern. Traders must weigh the risks involved and consider whether they are comfortable with the potential implications of trading with an unregulated broker that may not prioritize fund safety.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating the reliability of a forex broker. LowCostForex has garnered mixed reviews from users, with several complaints highlighting issues related to withdrawals and customer support. Below is a summary of the major complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow/No Response |

| Poor Customer Support | Medium | Unresponsive |

| Account Termination Issues | High | Inconsistent |

Many users have reported difficulties in withdrawing their funds, with some stating that their requests went unanswered for extended periods. This lack of responsiveness is alarming, as it raises concerns about the broker's commitment to customer service and its ability to address client issues promptly.

Furthermore, some traders have expressed frustration over account terminations without clear explanations, which can be indicative of underlying operational issues. These complaints highlight a pattern of behavior that suggests LowCostForex may not prioritize its clients' needs, raising further questions about its overall reliability.

In conclusion, the customer experience and feedback regarding LowCostForex paint a concerning picture. The prevalence of withdrawal issues and poor customer support raises significant red flags for potential traders, suggesting that caution is warranted when considering this broker.

Platform and Trade Execution

The performance of a trading platform is crucial for traders, as it directly impacts their ability to execute trades efficiently. LowCostForex utilizes the popular MetaTrader 4 platform, known for its user-friendly interface and robust features. However, user experiences indicate mixed results regarding platform stability and execution quality.

Many traders have reported instances of slippage and delays in order execution, particularly during periods of high market volatility. Such issues can significantly affect trading outcomes, especially for scalpers and day traders who rely on precise entry and exit points. Additionally, the absence of transparency regarding the broker's execution practices raises concerns about potential manipulation or unfair practices.

While the platform may offer a range of tools and features, the quality of execution is a critical factor that traders must consider. If a broker's platform is prone to delays and slippage, it can lead to frustration and financial losses for traders.

Overall, the platform and trade execution assessment of LowCostForex suggests that while it may provide access to a popular trading platform, the execution quality and reliability are areas of concern. Traders should carefully evaluate these factors before committing to this broker.

Risk Assessment

When evaluating the overall safety of a forex broker, it is essential to consider the associated risks. Below is a risk scorecard summarizing key risk areas for LowCostForex:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight from authorities |

| Fund Security Risk | High | Lack of transparency regarding fund safety |

| Customer Service Risk | Medium | Complaints about slow response times |

| Execution Risk | Medium | Reports of slippage and execution delays |

Overall, the risk assessment for LowCostForex indicates that potential traders face significant risks associated with regulatory oversight, fund security, and customer service. These factors should be carefully considered before engaging with this broker.

Conclusion and Recommendations

In conclusion, the evidence presented raises substantial concerns about the safety and reliability of LowCostForex. The lack of regulatory oversight, combined with customer complaints and issues related to fund security, suggests that traders should exercise extreme caution when considering this broker. While it may offer low trading costs, the associated risks may outweigh the potential benefits.

For traders seeking a reliable and safe trading environment, it is advisable to explore alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as Pepperstone, IC Markets, and FXTM are notable options that provide robust regulatory oversight and positive user experiences.

In summary, while LowCostForex may appear enticing at first glance, the potential risks and concerns surrounding its operations warrant careful consideration. Traders should prioritize safety and reliability when selecting a forex broker, ensuring they choose a platform that aligns with their trading goals and risk tolerance.

Is LowCostForex a scam, or is it legit?

The latest exposure and evaluation content of LowCostForex brokers.

LowCostForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LowCostForex latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.