CMSTrader 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

CMS Trader has emerged as a player in the forex and CFD market since its inception in 2013. This broker offers a diverse range of trading options, including over 35 forex pairs, commodities, and cryptocurrencies. While it presents an appealing platform for experienced traders, it raises significant concerns regarding fund safety and operational legitimacy, primarily due to its lack of regulatory oversight. Users have voiced numerous complaints about withdrawal difficulties and subpar customer service across various internet forums. With a high minimum deposit requirement of $500 and multiple warnings from regulatory bodies, the broker's operations should be approached with caution, especially by novice traders.

⚠️ Important Risk Advisory & Verification Steps

Trading with unregulated brokers can expose your investments to numerous risks. Therefore, it is crucial to conduct due diligence and verify broker legitimacy before engaging.

Risk Statement:

- Engaging with unregulated brokers like CMS Trader could jeopardize your funds due to potential fraud or mismanagement.

Potential Harms:

- Difficulty withdrawing funds.

- Poor customer service or nonexistent support systems.

- Lack of accountability and recourse in case of disputes.

Self-Verification Steps:

- Verify Company Details: Search for the broker on official financial regulator websites (e.g., FCA, ASIC) to confirm their licensing status.

- Check User Reviews: Consult trader forums such as Forex Peace Army for genuine user experiences and complaints.

- Assess Financial Claims: Look for any claims regarding asset trading, minimum deposit requirements, and potential conflicts of interest.

- Contact Customer Support: Reach out via the broker's listed contact methods to gauge response times and customer service quality.

- Monitor for Warnings: Regularly check the websites of financial regulatory authorities for any recent warnings or updates on the brokers status.

Broker Rating Framework

Broker Overview

Company Background and Positioning

Established in 2013, CMS Trader, operating under the name of Safe Side Trading Ltd, is positioned as a forex and CFD broker based in St. Vincent and the Grenadines. The broker claims to have operational offices in various regions, including the UK and Australia; however, there is significant evidence that it operates without adequate regulatory oversight. Companies like the FCA and the Ontario Securities Commission have issued warnings citing the firm's unlicensed activities in the UK and Canada, respectively.

Core Business Overview

CMS Trader provides a trading platform primarily focused on forex, CFDs, and a limited selection of cryptocurrencies. The broker touts its offerings of over 35 forex pairs, various indices, commodities, and a cryptocurrency option—Bitcoin. Despite its claims of providing a broad array of financial instruments, the credibility of these offerings is undermined by the lack of regulation and numerous negative reviews surrounding its trading practices.

Quick-Look Details Table

In-depth Analysis of Each Dimension

1. Trustworthiness Analysis

Regulatory Information Conflicts

CMS Trader provides conflicting information regarding its regulatory status, claiming certain licenses while being actively flagged as unauthorized by notable entities. The FCA explicitly identifies CMS Trader as operating in the UK without proper licensing, signaling a high-risk environment for traders.

User Self-Verification Guide

- Visit: FCA's Financial Services Register

- Search for CMS Trader or alternate trading names.

- Contact the FCAs consumer helpline at 0800 111 6768 if you find discrepancies.

- Use the NFA's BASIC database to verify additional operational rules.

- Document anything suspicious you find for further investigation.

“I wished I had known about the warnings.” - Anonymous Trader on Forex Peace Army.

Industry Reputation and Summary

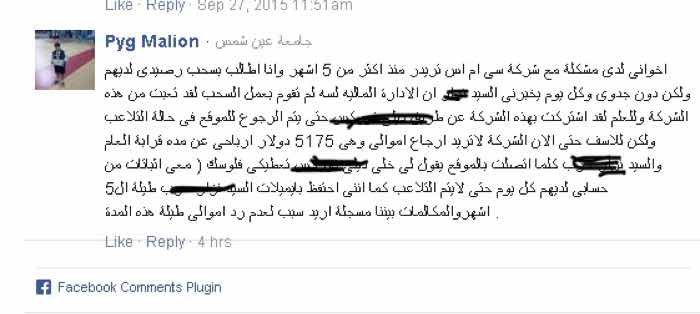

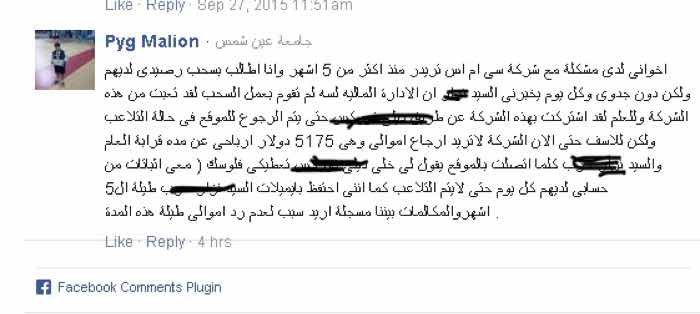

The collective user feedback highlights pronounced dissatisfaction, often reflecting delayed response to withdrawal requests and ineffective customer support. Such testimonies reinforce the vigilant need for self-verification before choosing to invest.

2. Trading Costs Analysis

Advantages in Commissions

CMS Trader advertises relatively low trading costs compared to major competitors, specifically with commission-free trading for its account types, an attractive proposition for volume traders who may wish to engage across various markets.

The "Traps" of Non-Trading Fees

While advertised as commission-free, users report high withdrawal fees of $20 alongside problematic withdrawal processes, as noted by countless complaints. There is a concern that these additional non-trading fees outweigh any perceived benefits of low trading commissions.

"I lost $30 trying to withdraw my funds, with no support available." - User Review.

Cost Structure Summary

Although CMS Trader executes competitive commissions, the overall cost structure loaded with hidden fees may deter numerous potential clients. Traders must assess their investment strategies relative to the potentially high non-trading fees.

Platform Diversity

CMS Trader operates using the Sirix and MT5 platforms, catering primarily to experienced traders. The available platforms are functional; however, they lack some advanced trading tools commonly found with regulated brokers, and the absence of MT4 could be a disadvantage for many traders.

Quality of Tools and Resources

Basic charting features and market analytical tools are present, yet the offerings do not meet the levels seen with more established platforms. The educational material appears limited and sometimes fails to address the advanced needs of serious traders.

Platform Experience Summary

User reviews suggest that navigating the Sirix platform can be cumbersome, with important features often reported to be hard to locate or utilize. The overall sentiment points toward a requirement for improvement in platform functionality.

4. User Experience Analysis

Onboarding Process

The account setup process for CMS Trader is straightforward; however, the required documentation and approval times can create frustrations, which some users have noted as excessive.

User Interface and Navigation

Although the Sirix platform is user-friendly, shifts in interface usability during trading sessions can result in disjointed experiences, with many traders experiencing delays in executing orders due to platform unresponsiveness.

Overall User Satisfaction

Customer feedback suggests a strong lack of satisfaction, primarily driven by withdrawal frustrations and ineffective customer support. This discord can lead to anxiety among traders about the safety of their investments and operational efficacy of the broker.

5. Customer Support Analysis

Availability of Support Channels

CMS Trader provides customer support mainly through email and live chat, yet there are reported deficiencies in these channels. The absence of phone support raises concerns about how promptly they can assist their traders.

Quality of Support

Numerous complaints have emerged regarding long response times. Traders often report waiting 1-3 days for simple inquiries and even longer for more complex issues, leading to heightened frustration for clients trying to access their funds.

User Experiences

“I reached out multiple times and never got a single reply to my concerns.” - Feedback from CMS Trader client.

6. Account Conditions Analysis

Account Types and Features

CMS Trader offers various account types (Mini, Silver, Gold), with entry-level accounts starting at $500, a higher threshold than most competitors, while additional account types provide features aimed at serious traders.

Deposit and Withdrawal Processes

The methods for funding and withdrawing funds remain basic, with the requirement that any withdrawal must mirror the initial deposit method. Those using wire transfers may find the processes cumbersome with certain fees applied.

Account Condition Summary

Starting with a high minimum deposit raises barriers for new or inexperienced traders, particularly when accessing a broker that lacks regulatory backing. The costs associated with managing accounts can also deter long-term engagement.

Conclusion

CMS Trader presents itself as an online trading platform with diverse offerings; however, its operational legitimacy is marred by the lack of regulatory oversight and numerous negative user experiences. Experienced traders considering a foray into CMS Trader should proceed with caution, weighing the risks against the potential rewards. For novice traders or those concerned about fund safety, it is advisable to seek alternatives with established regulatory protections.

Trading always involves inherent risks, and with unregulated brokers like CMS Trader, the possibility of compromised investments increases substantially. Always adhere to strict verification protocols and utilize regulated platforms where accountability and client protections are prioritized.