Go Markets 2025 Review: Everything You Need to Know

Summary

Go Markets is a trusted forex broker. This company has built a strong position in the competitive online trading world over many years. This complete Go Markets review shows a broker that offers good pricing and works under solid rules. Go Markets positions itself as a good choice for traders who want access to many different markets.

The broker's best features include access to thousands of CFD instruments you can trade across many asset types, plus advanced trading platforms made for both new and experienced traders. Go Markets does really well at giving complete market coverage. This lets investors trade forex, stocks, indices, and commodities through one platform.

User feedback data shows that Go Markets gets mixed reviews from its clients. TrustPilot ratings show a good score of 4.6 out of 5 stars based on 162 customer reviews. This means users generally have positive experiences. However, REVIEWS.io shows a different view with a 2.0 out of 5 rating from 139 reviews, where only 24% of reviewers recommend the broker.

This difference in ratings means user experiences vary, and potential clients should think about this carefully. The broker mainly targets investors who want to do different trading activities across forex, equity indices, individual stocks, and commodity markets. Go Markets seems good for traders who value platform quality and broad market access over very low costs.

Important Notice

This review uses publicly available information and user feedback from various review platforms and industry sources. The analysis shows data available when this was published and may change if the broker updates their terms, conditions, or services.

Potential traders should do their own research and check current information directly with Go Markets before making investment decisions. Trading CFDs and forex involves big risks, and past performance does not promise future results.

Rating Framework

Broker Overview

Go Markets works as an established online CFD trading provider with headquarters in Australia. The company serves the global trading community through its complete financial services platform. Go Markets has positioned itself as a full-service broker that offers access to international financial markets through contracts for difference, which lets clients trade various asset classes without owning the actual instruments.

The broker's business model focuses on giving retail and institutional clients access to forex markets, global equity indices, individual stock CFDs, and commodity markets. Go Markets emphasizes competitive pricing and aims to deliver professional-grade trading tools to its diverse client base. The company's approach combines technological innovation with broad market access.

Go Markets uses advanced trading platform technology to deliver its services, though specific platform names and technical details are not listed in available public information. The broker supports trading across major asset categories including foreign exchange pairs, stock indices from global markets, individual equity CFDs, and commodity instruments. This Go Markets review shows that while specific regulatory details need verification directly with the company, the broker maintains operational standards that match industry requirements for client fund protection and trading transparency.

Regulatory Framework: Available information does not specify the exact regulatory bodies that oversee Go Markets operations. The company maintains its primary headquarters in Australia, which suggests compliance with relevant Australian financial services regulations.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and fees is not detailed in available public sources and should be verified directly with the broker.

Minimum Deposit Requirements: Current minimum deposit amounts for different account types are not specified in available materials. You need to get direct confirmation from Go Markets.

Promotional Offerings: Information about current bonus structures, promotional campaigns, or new client incentives is not detailed in public sources.

Tradeable Assets: Go Markets provides access to foreign exchange markets, global stock indices, individual stock CFDs, and commodity markets. The broker offers thousands of tradeable instruments across these categories.

Cost Structure: The broker advertises competitive pricing with low spread offerings. However, specific commission structures, overnight financing rates, and additional fees need direct verification for accuracy.

Leverage Options: Specific leverage ratios available to different client categories and jurisdictions are not detailed in available information.

Platform Selection: Go Markets offers advanced trading platform technology. However, specific platform names, features, and compatibility details need direct confirmation.

Geographic Restrictions: Information about restricted jurisdictions or regional limitations is not specified in available sources.

Customer Support Languages: Available customer service languages and regional support options are not detailed in public information.

This Go Markets review shows that potential clients need to verify specific operational details directly with the broker to ensure accuracy and current relevance.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

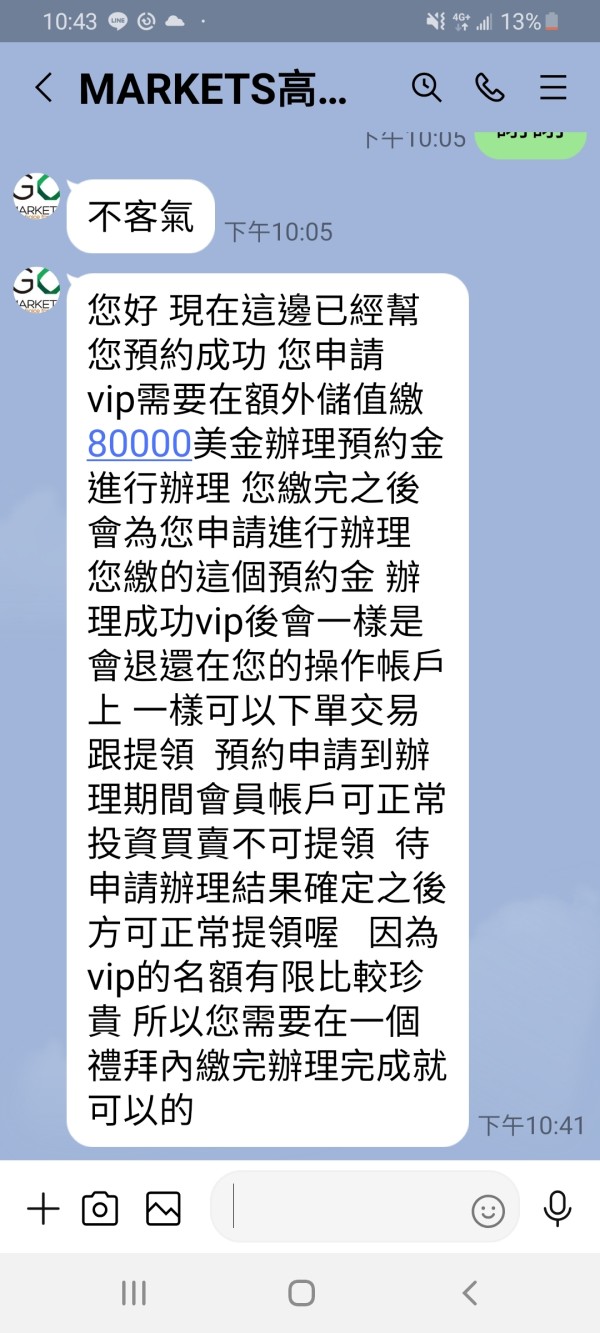

Go Markets' account conditions present a mixed picture for potential traders. This is mainly because there is limited publicly available information about specific terms and requirements. The broker's account structure details, including minimum deposit requirements, account tier benefits, and specific trading conditions, are not fully detailed in available public sources.

The lack of clear information about account opening procedures, verification requirements, and different account types represents a big limitation for traders trying to evaluate whether Go Markets fits their trading needs and financial capabilities. Without clear details on spreads, commissions, and account maintenance fees, potential clients cannot make informed comparisons with other brokers in the market.

Available information suggests that Go Markets offers standard CFD trading accounts. However, specific features such as Islamic account options, professional trader classifications, or institutional account benefits are not clearly outlined. The absence of detailed account condition information makes it challenging for traders to understand the full cost structure and trading environment they would encounter.

This Go Markets review reveals that while the broker may offer competitive account conditions, the lack of readily available detailed information creates uncertainty for potential clients who require transparency in their broker selection process.

Go Markets demonstrates strong performance in the tools and resources category. This is mainly through its extensive offering of tradeable CFD instruments spanning thousands of different markets and asset classes. The broker's platform technology is described as advanced, which suggests sophisticated trading tools and market access capabilities.

The breadth of available trading instruments represents a significant strength. This allows traders to diversify across forex markets, global equity indices, individual stocks, and commodity markets through a single broker relationship. This comprehensive market access eliminates the need for multiple broker accounts and simplifies portfolio management for active traders.

The advanced platform technology mentioned in available information suggests that Go Markets invests in providing professional-grade trading tools. However, specific details about charting capabilities, technical analysis tools, automated trading support, and research resources are not detailed in public sources.

While the broker appears to offer substantial trading resources, the lack of detailed information about educational materials, market analysis, economic calendars, and trading signals represents a gap in the available assessment data. The strong rating in this category reflects the confirmed breadth of tradeable instruments and platform advancement, though a complete evaluation would benefit from more detailed resource specifications.

Customer Service and Support Analysis (6/10)

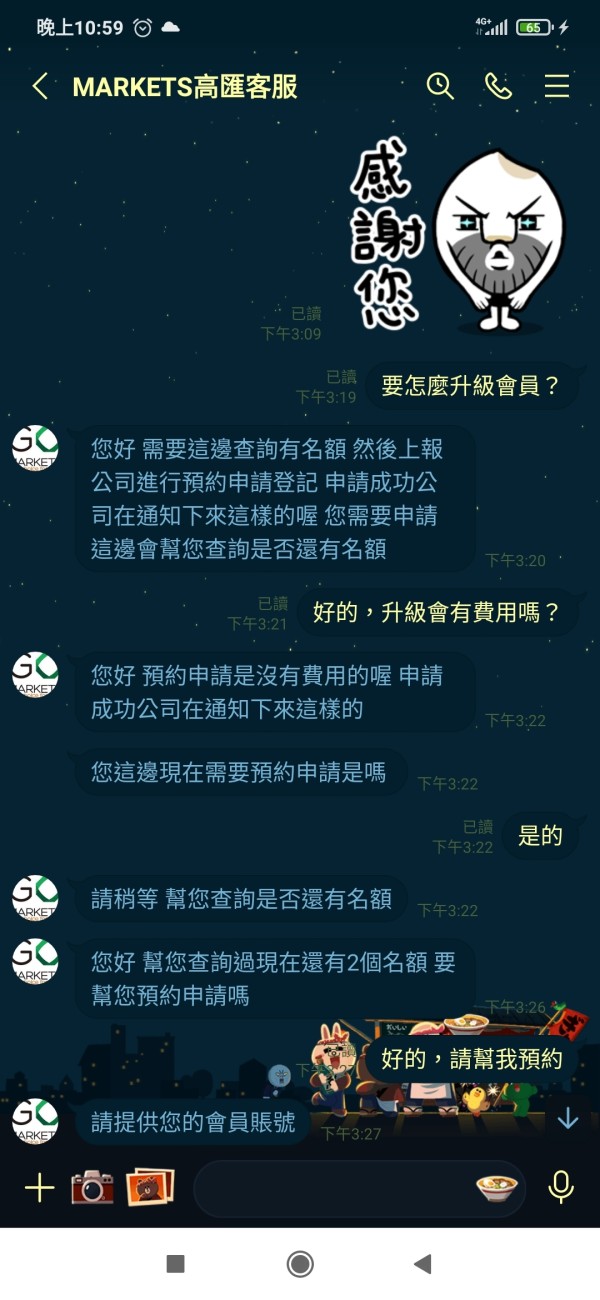

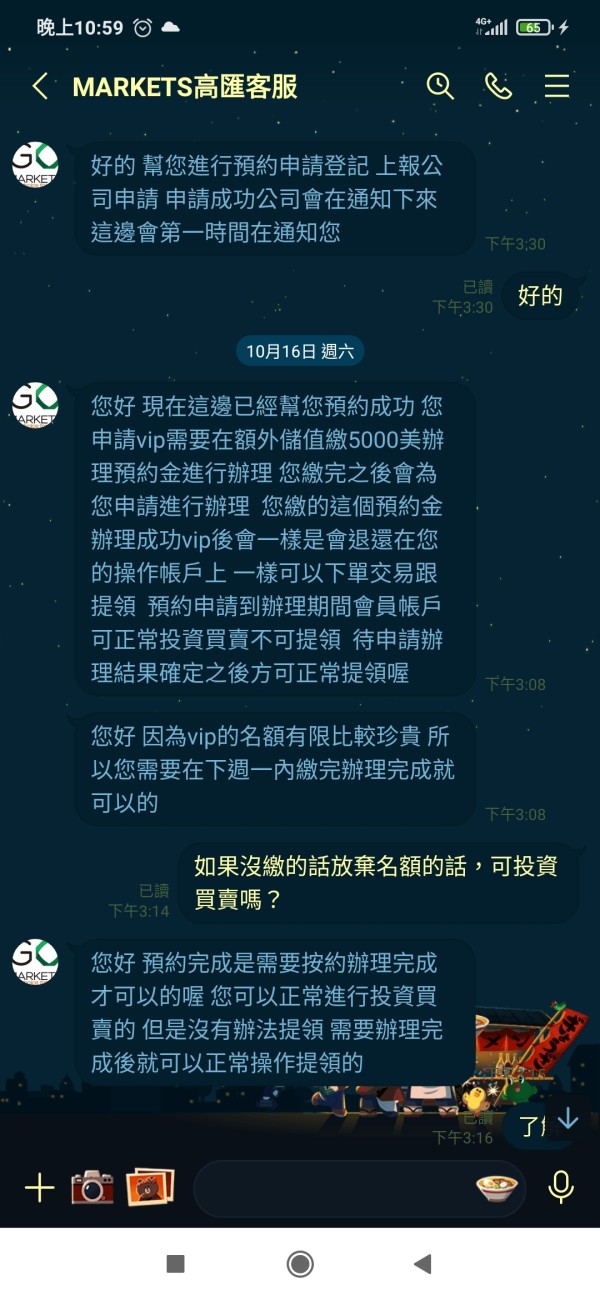

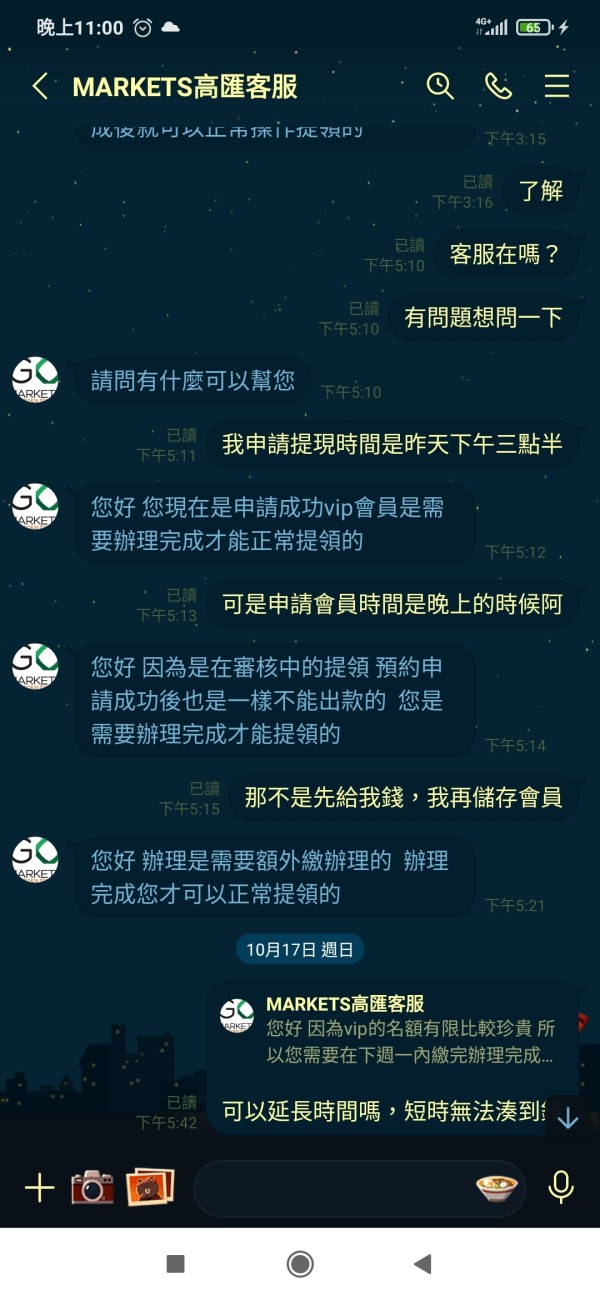

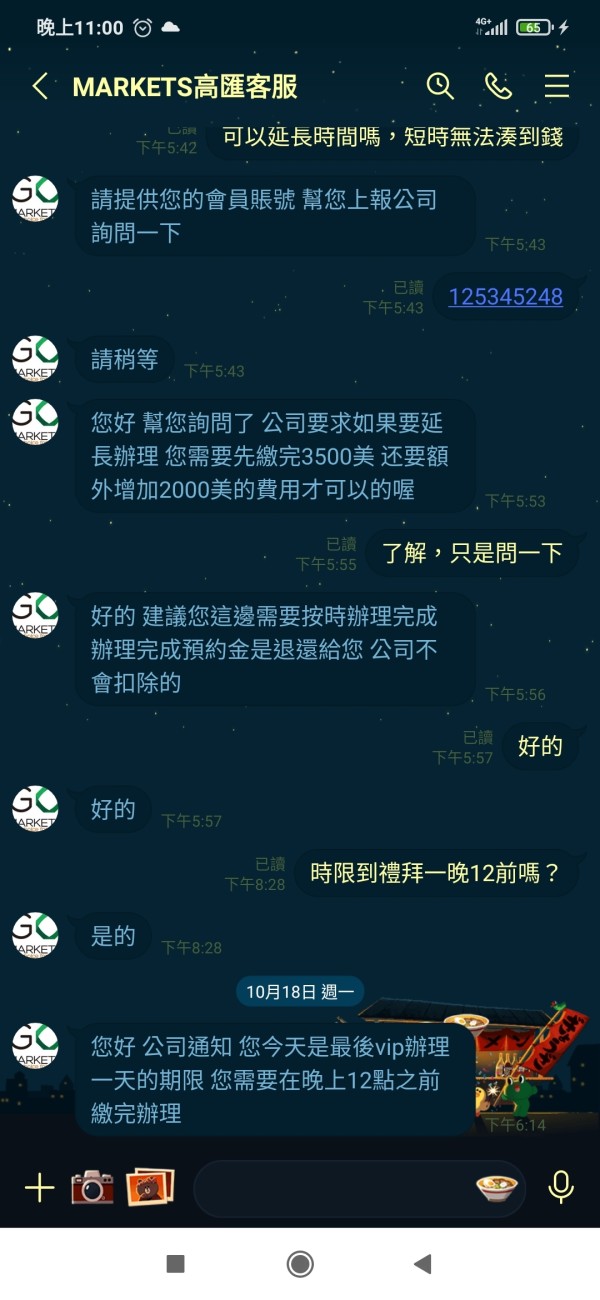

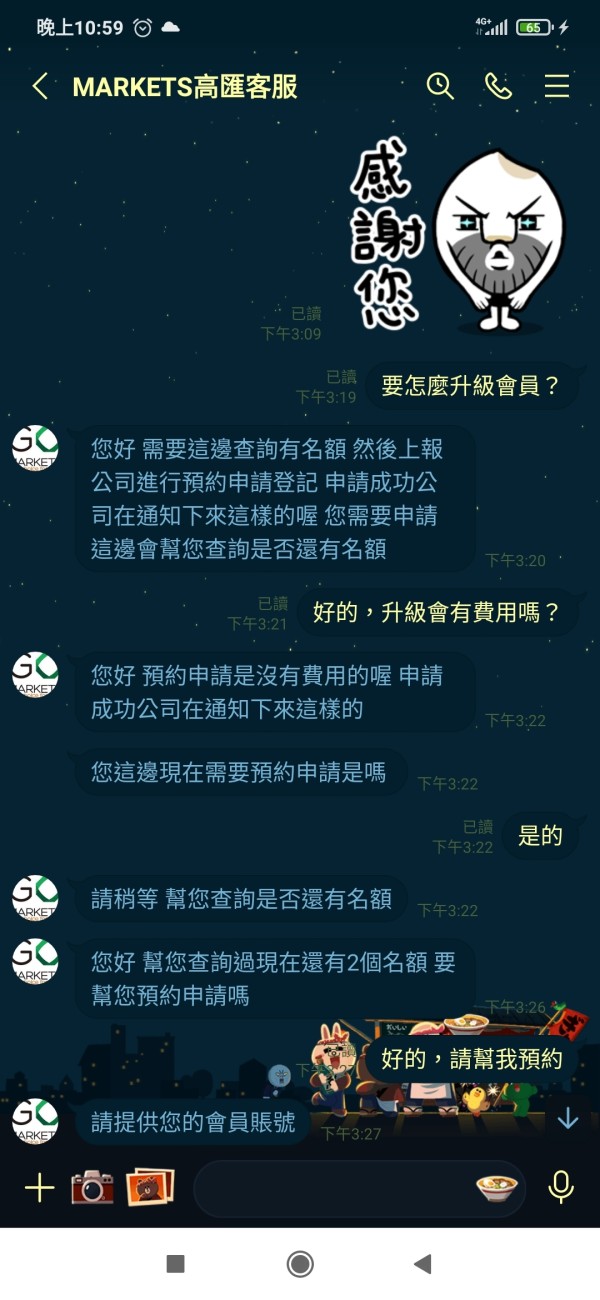

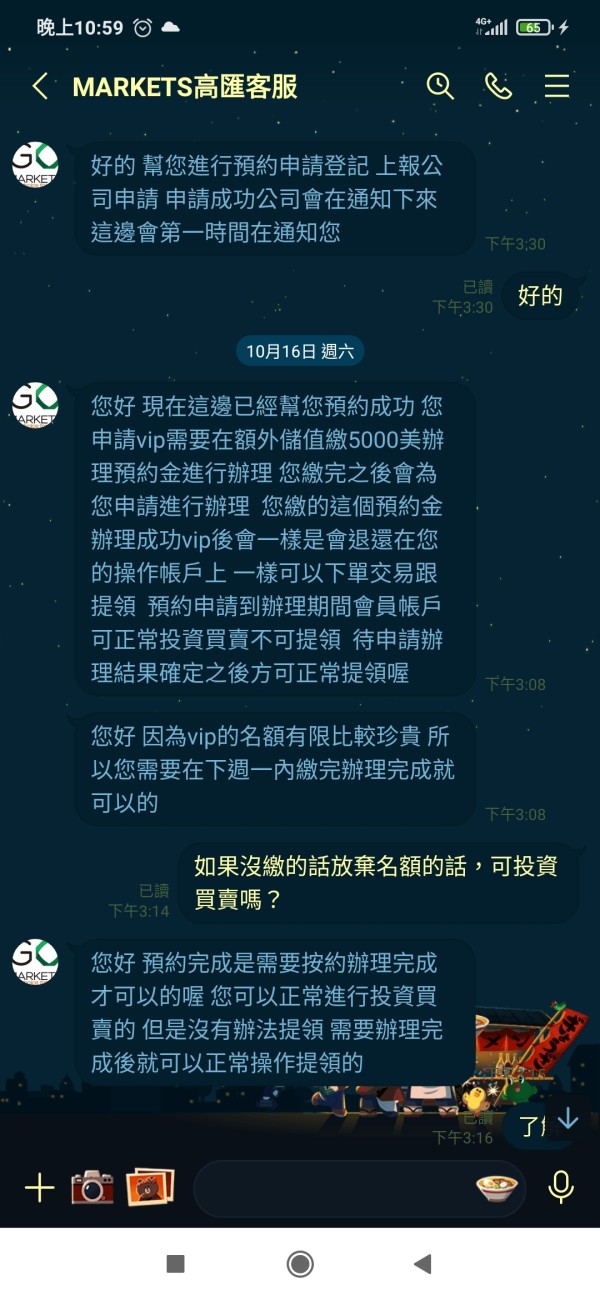

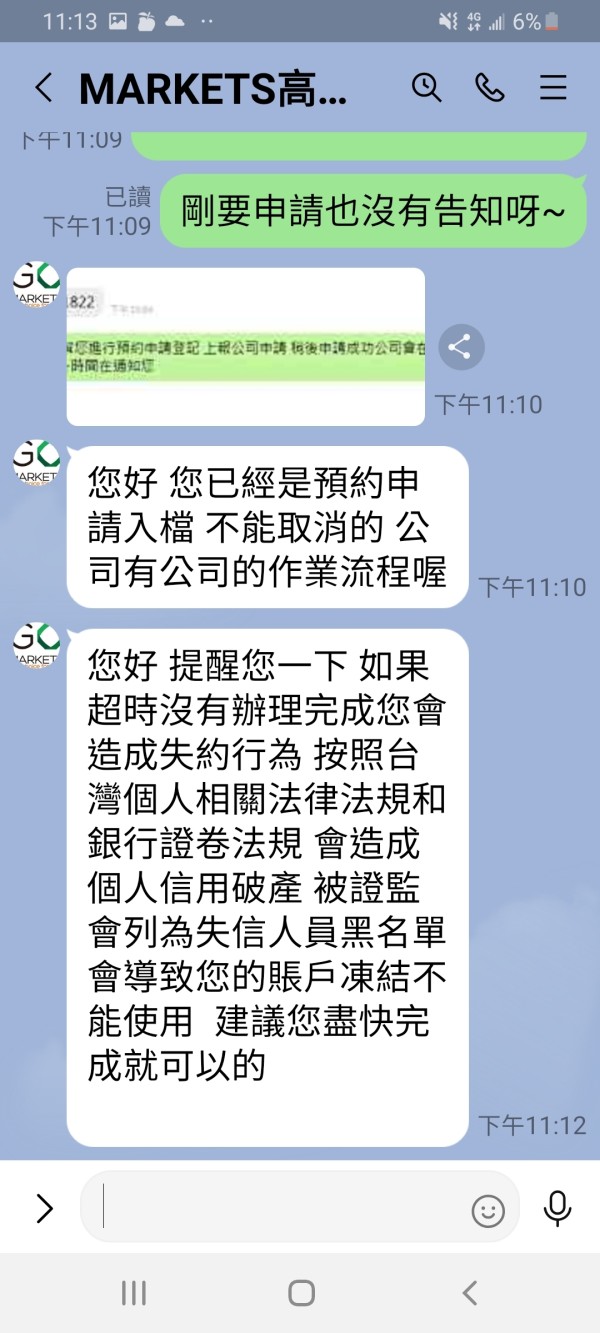

Customer service evaluation for Go Markets reveals significant differences in user experiences. This is evidenced by contrasting ratings across different review platforms. The substantial difference between TrustPilot's 4.6/5 rating and REVIEWS.io's 2.0/5 rating suggests inconsistent service delivery or varying user expectations.

The mixed feedback pattern indicates that while some clients receive satisfactory support experiences, others encounter significant service challenges. This inconsistency in customer satisfaction levels raises questions about service reliability, response times, and problem resolution effectiveness across different client segments or inquiry types.

Available information does not specify customer service channels, availability hours, response time commitments, or multilingual support options. The absence of detailed service level information makes it difficult for potential clients to set appropriate expectations regarding support accessibility and quality.

The moderate rating reflects the concerning disparity in user experiences while acknowledging that some clients do report positive interactions. Potential clients should consider this variability when evaluating Go Markets and may benefit from testing customer service responsiveness during the account evaluation process.

Trading Experience Analysis (7/10)

The trading experience with Go Markets appears to center around advanced platform technology and comprehensive market access. This provides traders with professional-grade tools for executing their strategies across diverse asset classes. The broker's emphasis on platform sophistication suggests a focus on delivering quality execution environments.

Available information indicates that Go Markets provides access to thousands of tradeable CFD instruments. This significantly enhances the trading experience by offering extensive diversification opportunities and the ability to capitalize on various market conditions across different sectors and regions.

The advanced platform technology mentioned suggests robust functionality for order management, market analysis, and trade execution. However, specific details about execution speeds, platform stability, mobile trading capabilities, and advanced order types are not detailed in available sources.

User feedback regarding actual trading experiences, platform performance under various market conditions, and execution quality is not comprehensively detailed in available information. The rating reflects the confirmed platform advancement and market access breadth while acknowledging the need for more specific performance data.

This Go Markets review indicates that the trading experience likely meets professional standards. However, traders should verify specific platform capabilities and performance metrics that align with their particular trading strategies and requirements.

Trust Factor Analysis (7/10)

Go Markets' trust factor assessment reflects generally positive industry recognition and user perception of the broker's credibility. The company is widely regarded as a reputable player in the online trading space. This positive reputation forms a solid foundation for client confidence in the broker's operational integrity.

The broker's Australian headquarters location suggests operation under established financial services regulatory frameworks. However, specific regulatory details, licensing numbers, and oversight mechanisms are not detailed in available public information. This regulatory context generally supports client confidence in operational standards and fund security measures.

The significant disparity between review platform ratings introduces some uncertainty regarding consistent service delivery and client satisfaction levels. While TrustPilot ratings suggest strong client approval, the contrasting REVIEWS.io feedback indicates potential areas of concern that affect overall trust assessment.

Available information does not specify client fund protection measures, segregated account policies, compensation schemes, or third-party auditing arrangements. These details are crucial for comprehensive trust evaluation and should be verified directly with the broker.

The trust factor rating acknowledges the broker's positive industry reputation while recognizing the need for more detailed information regarding regulatory compliance, client protection measures, and the resolution of mixed user feedback patterns.

User Experience Analysis (6/10)

User experience evaluation for Go Markets reveals a complex picture characterized by significant variations in client satisfaction levels across different review platforms and user segments. The substantial gap between positive TrustPilot ratings and negative REVIEWS.io feedback suggests that user experiences vary considerably based on individual circumstances or expectations.

The 24% recommendation rate on REVIEWS.io indicates that a majority of users on that platform would not recommend Go Markets to others. This raises concerns about overall satisfaction levels and service delivery consistency. This contrasts sharply with the 4.6/5 TrustPilot rating, suggesting either platform-specific bias or genuine variations in service experiences.

Available information does not provide detailed insights into user interface design, platform navigation ease, account management functionality, or mobile application performance. These factors significantly impact daily user experience but are not comprehensively addressed in available public sources.

The broker's focus on advanced platform technology suggests attention to user experience quality. However, specific usability features, customization options, and user-friendly design elements require direct verification. The breadth of available trading instruments may enhance user experience for traders seeking comprehensive market access through a single platform.

The moderate rating reflects the mixed user feedback while acknowledging that some clients do report positive experiences. Potential users should consider testing the platform and services during evaluation periods to assess personal compatibility with Go Markets' user experience delivery.

Conclusion

Go Markets presents itself as a competent forex and CFD broker offering competitive pricing structures and access to thousands of tradeable instruments across multiple asset classes. The broker's strength lies in its comprehensive market coverage and advanced platform technology. This makes it suitable for traders seeking diversified investment opportunities through a single broker relationship.

The broker appears well-suited for investors interested in forex, stock indices, individual equities, and commodity trading who value platform sophistication and broad market access. However, potential clients should carefully consider the mixed user feedback patterns and verify specific service details directly with the company.

Key advantages include the extensive range of tradeable CFD instruments, generally positive industry reputation, and advanced trading platform capabilities. Primary limitations center on limited publicly available information regarding specific account conditions, regulatory details, and the concerning disparity in user satisfaction ratings across different platforms.

Prospective traders should conduct thorough due diligence, including direct communication with Go Markets to clarify account terms, regulatory compliance, and service expectations before making investment decisions.