PSB Review 1

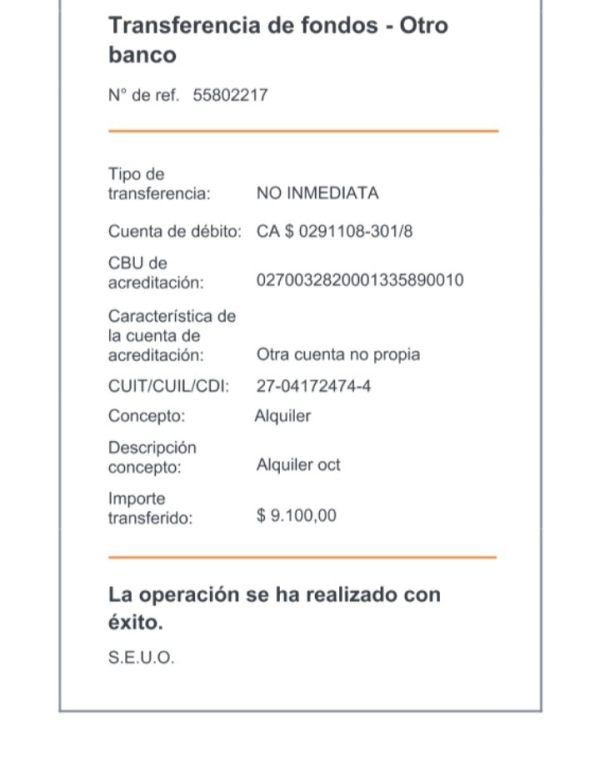

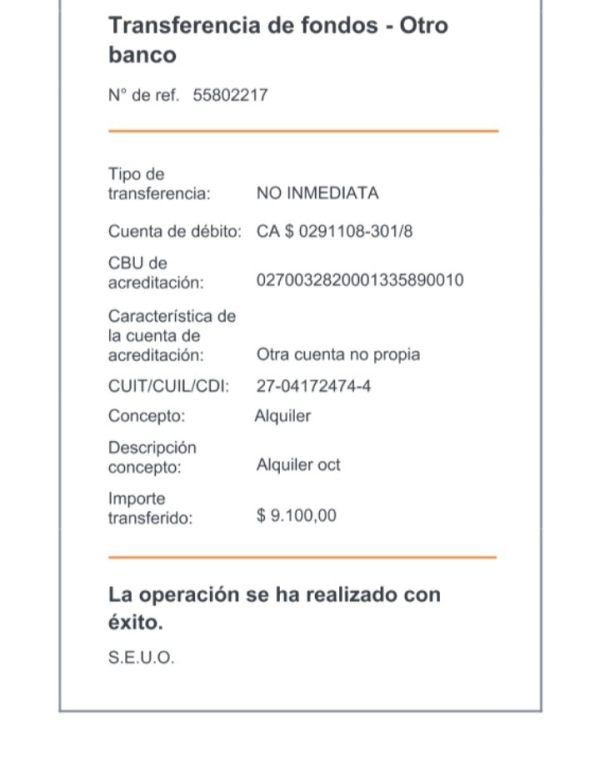

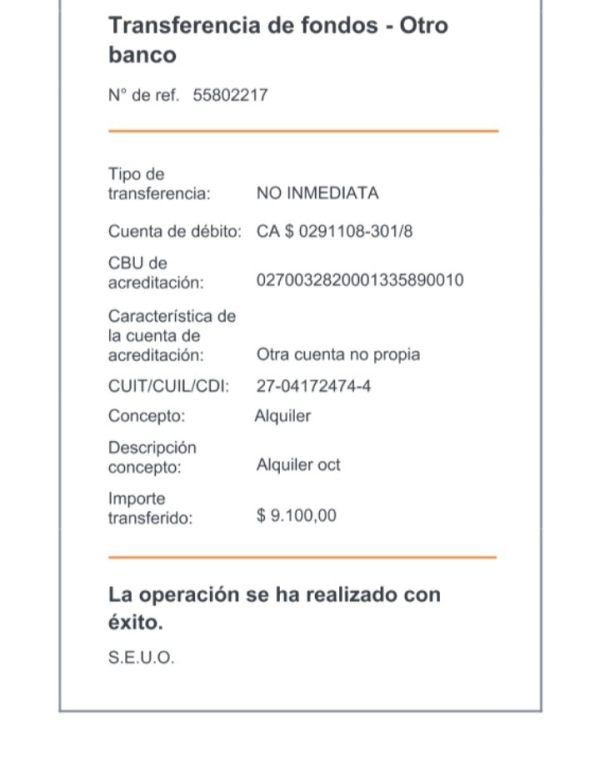

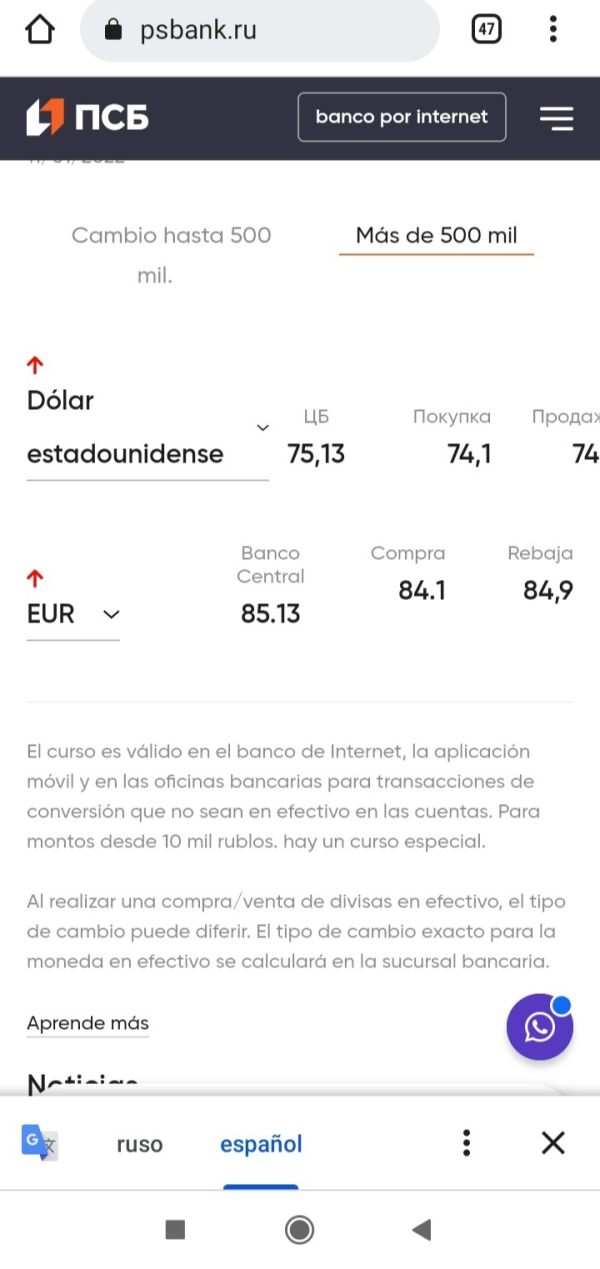

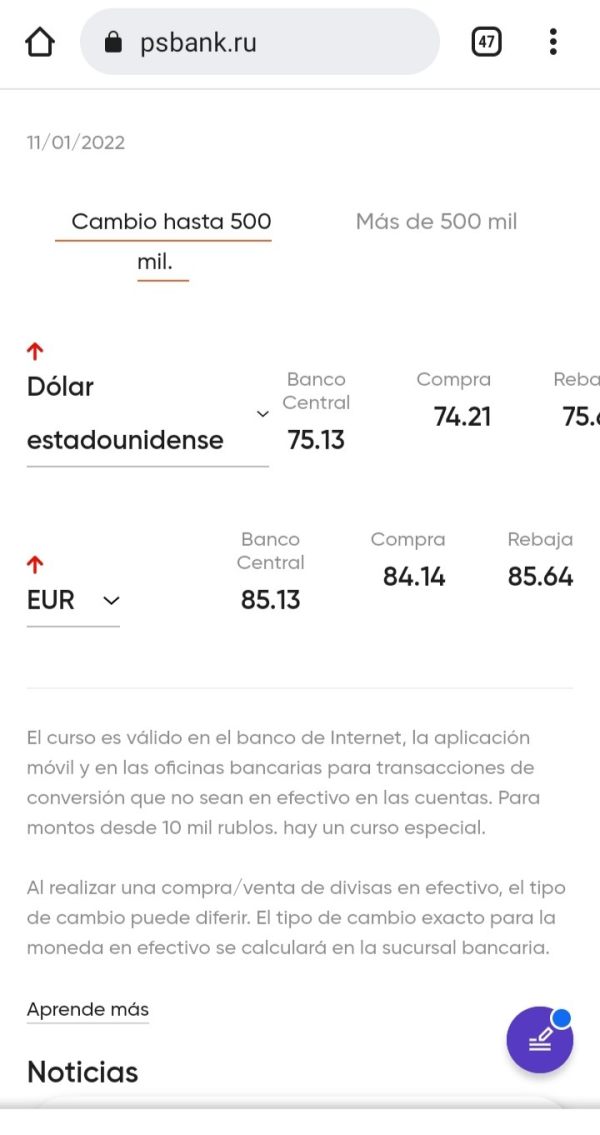

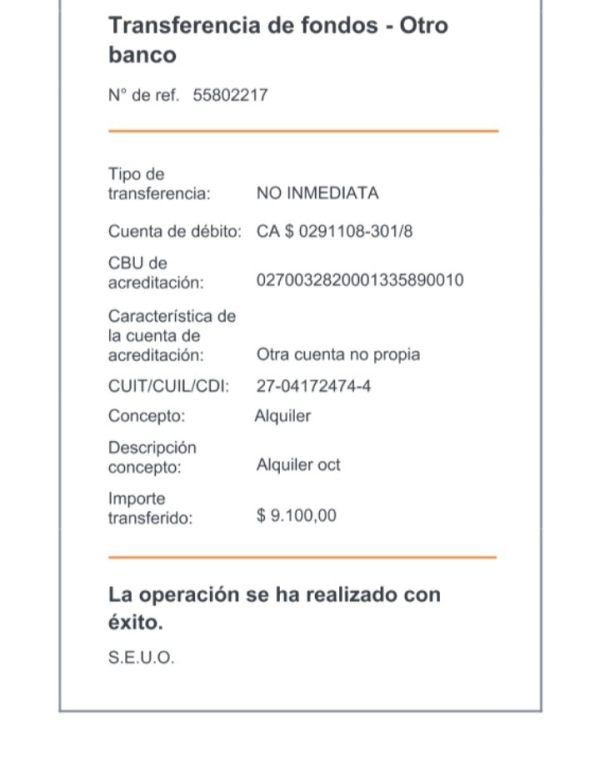

After I did most of my operations, they abandoned me without any capital, because they assumed that I would know the time they left, but they did not indicate it. Obviously, it was intentional. My investment was 9,100

PSB Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

After I did most of my operations, they abandoned me without any capital, because they assumed that I would know the time they left, but they did not indicate it. Obviously, it was intentional. My investment was 9,100

This psb review gives a neutral view of PSB Brokerage Inc. The company has been running for about six years with its main office in Stockton, California, United States. CarrierSource shows that PSB works as an insurance brokerage company under USDOT 3358087 and Docket MC1074877. Our review finds big gaps in information about important trading conditions and regulatory details.

The company's profile lacks transparency in key areas that traders need to make smart decisions. PSB has set up a real office in California and keeps proper DOT registration for its brokerage work. However, the missing details about trading platforms, account types, and regulatory compliance create doubt for potential clients. This psb review aims to give a complete analysis based on available information while pointing out areas where more clarity is needed.

Potential users should be careful when thinking about PSB Brokerage Inc services due to limited regulatory and trading information in our research. This review uses publicly available company registration data and limited user feedback sources. The missing detailed regulatory information makes it hard to give clear recommendations.

Our assessment uses available corporate background information and industry standard evaluation criteria. However, specific details about trading conditions remain unclear from current sources.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | Information Not Available/10 | Specific account types and conditions not detailed in available sources |

| Tools and Resources | Information Not Available/10 | Trading tools and educational resources not specified in current data |

| Customer Service | Information Not Available/10 | Customer support channels and quality metrics not documented |

| Trading Experience | Information Not Available/10 | Platform performance and execution details not available |

| Trust Factor | Information Not Available/10 | Regulatory compliance information insufficient for assessment |

| User Experience | Information Not Available/10 | User feedback and interface details not comprehensively available |

PSB Brokerage Inc started about six years ago. The company runs its main office at 4719 Quail Lakes Drive Pmb G502, Stockton, California, US 95207. CarrierSource data shows the company works as a registered brokerage entity under the Department of Transportation with USDOT number 3358087 and keeps Docket MC1074877. The company's registration shows it works in the insurance and brokerage sector, though specific details about financial services remain limited in available documents.

The corporate structure suggests PSB works as a specialized brokerage firm. However, the exact scope of trading services and platform offerings needs more clarification. Current available information does not specify the types of trading platforms used, the range of tradeable asset classes offered, or the primary regulatory frameworks governing their operations. This psb review notes that while the company keeps proper business registration, the missing detailed service information limits our ability to give complete analysis of their trading environment and client offerings.

Regulatory Oversight: Available sources do not specify the primary financial regulatory bodies overseeing PSB's operations beyond basic DOT registration requirements.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees is not detailed in current documents.

Minimum Deposit Requirements: Entry-level investment thresholds and account funding minimums are not specified in available materials.

Promotional Offers: Current bonus structures, welcome packages, or promotional incentives are not documented in accessible sources.

Tradeable Assets: The range of financial instruments, currency pairs, commodities, or other investment products available through PSB is not clearly outlined.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs requires additional clarification from the company.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in current documents.

Platform Selection: Specific trading platforms, mobile applications, and software options are not detailed in available sources.

Geographic Restrictions: Service availability by region and any territorial limitations are not clearly documented.

Customer Support Languages: Available communication languages and support channels require further specification.

This psb review highlights the need for more complete information disclosure to enable thorough evaluation of the company's services.

The evaluation of PSB's account conditions faces big limitations due to insufficient information in available sources. Traditional account assessment criteria include variety of account types, minimum deposit requirements, account opening procedures, and specialized features such as Islamic accounts or professional trader options. However, current documents do not give specific details about these essential elements.

Industry standards typically require brokers to offer multiple account tiers accommodating different trader experience levels and investment capacities. Professional evaluation also considers the account opening process complexity, verification requirements, and time-to-activation metrics. Without access to PSB's specific account structure information, this assessment cannot provide definitive scoring on these critical factors.

The missing detailed account condition information represents a significant transparency gap that potential clients should consider when evaluating PSB's services. Prospective traders typically require clear understanding of account minimums, fee structures, and available account features before making platform decisions.

Complete evaluation of trading tools and educational resources requires detailed information about platform capabilities, research offerings, and trader support materials. Standard industry assessment examines charting tools, technical analysis capabilities, fundamental analysis resources, and educational content quality. However, available sources do not give sufficient detail about PSB's specific tool offerings.

Professional trading environments typically include advanced charting packages, real-time market data, economic calendars, and automated trading support. Educational resources often include webinars, tutorials, market analysis, and trading guides designed to support trader development. The missing specific information about these resources limits our ability to give accurate assessment.

Modern traders increasingly rely on complete research platforms, mobile trading capabilities, and integration with third-party analysis tools. Without detailed information about PSB's technological infrastructure and resource offerings, this evaluation cannot provide definitive guidance on these crucial platform elements.

Customer service evaluation typically examines support channel availability, response time metrics, service quality standards, and multilingual support capabilities. Professional assessment also considers support hours, problem resolution efficiency, and staff expertise levels. However, current available information does not give specific details about PSB's customer service infrastructure.

Industry best practices include 24/7 support availability, multiple communication channels including live chat, phone, and email support, plus complete FAQ resources. Response time benchmarks and service quality metrics are essential for evaluating broker reliability and client satisfaction levels. The missing specific customer service information in available sources prevents detailed assessment of these critical factors.

Effective customer support often includes dedicated account management, technical assistance, and educational support services. Professional evaluation requires understanding of staff qualifications, training standards, and problem resolution procedures, none of which are detailed in current PSB documents.

Trading experience assessment includes platform stability, execution speed, order processing quality, mobile trading capabilities, and overall trading environment quality. Professional evaluation examines slippage rates, re-quote frequency, platform uptime statistics, and execution transparency. However, available sources do not give specific performance metrics or user experience data for PSB's trading platforms.

Modern trading platforms require robust infrastructure supporting high-frequency trading, multiple order types, advanced charting capabilities, and seamless mobile integration. User experience factors include interface design, navigation efficiency, and platform reliability during high-volatility periods. This psb review cannot give specific assessment of these factors due to limited available information.

Professional traders typically require detailed performance statistics, execution quality reports, and platform comparison data to make informed decisions. The missing specific trading experience information represents a significant evaluation gap for potential PSB clients.

Trust factor evaluation examines regulatory compliance, fund security measures, company transparency, industry reputation, and crisis management capabilities. Professional assessment requires verification of regulatory licenses, segregated account policies, insurance coverage, and compliance with international financial standards. However, available sources do not give complete regulatory information for PSB operations.

Financial industry trust assessment typically includes third-party audits, regulatory compliance reports, client fund protection measures, and transparent fee disclosure. Company history, management background, and regulatory standing are crucial factors in determining broker reliability and client fund security.

The limited availability of specific regulatory and compliance information in current sources prevents complete trust factor assessment. Potential clients should seek additional regulatory verification and compliance documents before making investment decisions.

User experience evaluation includes overall client satisfaction, interface design quality, registration process efficiency, funding operation smoothness, and common user concern resolution. Complete assessment requires user feedback analysis, satisfaction surveys, and platform usability testing results. However, current sources do not give detailed user experience information for PSB services.

Professional user experience assessment examines onboarding process quality, platform learning curve, customer journey optimization, and user interface design effectiveness. Mobile experience, cross-platform compatibility, and accessibility features are increasingly important factors in modern broker evaluation.

The missing specific user experience data and client feedback in available sources limits our ability to give definitive assessment of PSB's service quality and client satisfaction levels. Prospective users should seek additional user reviews and platform demonstrations before making service decisions.

This psb review concludes with a neutral assessment due to significant information gaps in essential areas including regulatory oversight, trading conditions, and user experience data. While PSB Brokerage Inc keeps proper business registration and has operated for about six years, the limited availability of detailed service information prevents complete evaluation.

The company appears suitable for clients specifically seeking insurance brokerage services, though potential trading service users should seek additional information verification. Primary concerns include the missing detailed regulatory compliance information and insufficient trading condition transparency. Prospective clients should conduct additional due diligence and request complete service documents before making platform decisions.

FX Broker Capital Trading Markets Review