Is GO MARKETS safe?

Business

License

Is Go Markets Safe or a Scam?

Introduction

Go Markets, established in 2006, has carved a niche for itself in the forex and CFD trading landscape. As one of Australia's pioneering brokers, it offers a range of trading instruments, including forex, indices, commodities, and cryptocurrencies. Given the competitive nature of the forex market, traders must exercise caution and thoroughly evaluate their brokers to ensure they are engaging with a legitimate and trustworthy platform. This article aims to provide an objective analysis of Go Markets by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. The investigation is based on a review of multiple credible sources, including regulatory filings, customer testimonials, and industry analyses.

Regulation and Legitimacy

Regulation plays a crucial role in determining the safety and legitimacy of a forex broker. Go Markets is regulated by several prominent authorities, which adds to its credibility.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 254963 | Australia | Verified |

| CySEC | 322/17 | Cyprus | Verified |

| FSC | GB19024896 | Mauritius | Verified |

| FSA | SD043 | Seychelles | Verified |

The Australian Securities and Investments Commission (ASIC) is recognized for its rigorous standards and operational oversight, making it a top-tier regulator. Go Markets' compliance with ASIC regulations indicates a commitment to maintaining high operational integrity. Additionally, the broker's CySEC license provides an extra layer of security, as it includes investor compensation schemes that protect clients in case of insolvency. Overall, Go Markets has a solid regulatory framework, which is a positive indicator when considering the question, "Is Go Markets safe?"

Company Background Investigation

Go Markets has a rich history that reflects its growth and adaptability within the trading industry. Founded in 2006 in Melbourne, Australia, it has expanded its operations internationally, establishing offices in key financial cities such as Cyprus, Mauritius, and Seychelles. The ownership structure of Go Markets is transparent, and it operates under the umbrella of a well-organized corporate entity. The management team comprises professionals with extensive backgrounds in finance, trading, and customer service, further enhancing the broker's reputation.

The company prioritizes transparency and information disclosure, providing clients with a wealth of resources to understand its operations better. This commitment to openness is essential in building trust with clients and addressing the question of whether Go Markets is a scam. Overall, the company's history and management team lend credibility to its operations.

Trading Conditions Analysis

Go Markets offers competitive trading conditions that cater to a wide range of traders. The broker provides two primary account types: the Standard account, which features spreads starting from 0.8 pips and no commissions, and the Go Plus+ account, which offers spreads from 0.0 pips but incurs a commission of $2.50 per side.

| Fee Type | Go Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.8 pips | 1.0 pips |

| Commission Model | $2.50 per side | $3.00 per side |

| Overnight Interest Range | Varies by asset | Varies by asset |

The fee structure is relatively competitive, particularly for active traders who benefit from lower spreads. However, potential clients should remain vigilant about any unusual fees, especially those related to overnight positions, which can significantly impact profitability. This analysis indicates that while Go Markets offers favorable trading conditions, traders should be aware of the associated costs to fully understand, "Is Go Markets safe?"

Customer Fund Safety

When assessing a broker's safety, it is essential to consider the measures in place to protect customer funds. Go Markets employs several robust safety protocols, including the segregation of client funds in separate accounts from its operational funds. This practice minimizes the risk of losing client deposits in the event of financial difficulties faced by the broker.

Moreover, Go Markets offers negative balance protection, ensuring that clients cannot lose more than their account balance, which is a critical risk management feature. Historically, there have been no significant issues reported regarding the safety of funds at Go Markets, reinforcing the notion that it is a secure trading environment. This commitment to fund safety is a crucial aspect of the overall evaluation of whether "Is Go Markets safe?"

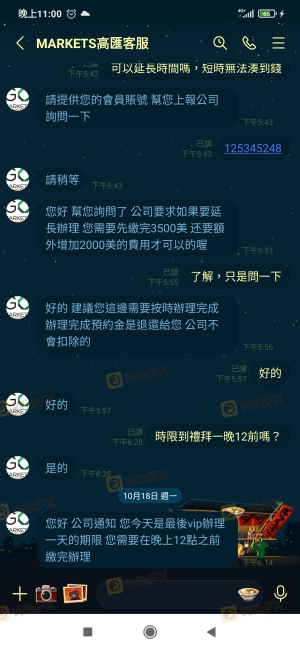

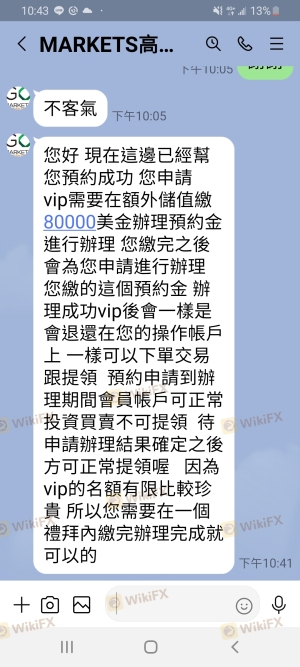

Customer Experience and Complaints

Customer feedback is a vital component in determining the reliability of a broker. Go Markets generally receives positive reviews for its user-friendly platform and responsive customer service. However, like any broker, it is not without its complaints. Common issues reported by users include delays in fund withdrawals and occasional platform stability problems during high market volatility.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Timely response, but issues persist |

| Platform Stability Issues | High | Ongoing improvements noted |

For instance, some traders have reported significant delays in processing withdrawals, particularly during busy trading periods. However, customer service has been responsive in addressing these concerns, indicating a commitment to resolving issues as they arise. Overall, while there are areas for improvement, the general sentiment among users leans towards a positive experience, suggesting that Go Markets can be considered safe.

Platform and Trade Execution

The trading platforms offered by Go Markets, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), are well-regarded in the industry for their reliability and functionality. Traders have access to advanced charting tools, technical indicators, and automated trading capabilities, making them suitable for both novice and experienced traders.

The execution quality is generally high, with minimal slippage reported during trades. However, some users have expressed concerns about order execution during high-impact news events, where they experienced delays or re-quotes. These issues need to be monitored closely, as they can affect trading outcomes. Overall, the platforms provide a solid trading experience, contributing to the assessment of whether "Is Go Markets safe?"

Risk Assessment

Engaging with any broker involves inherent risks. For Go Markets, the primary risks include market volatility, platform stability, and regulatory compliance.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Market Volatility | High | Potential for rapid price changes impacting trades. |

| Platform Stability | Medium | Occasional issues reported during peak trading times. |

| Regulatory Compliance | Low | Strong regulatory oversight from ASIC and CySEC. |

To mitigate these risks, traders are advised to employ sound risk management strategies, such as setting stop-loss orders and diversifying their portfolios. Additionally, maintaining awareness of market conditions and broker updates can help traders navigate potential challenges effectively.

Conclusion and Recommendations

In conclusion, the evidence suggests that Go Markets is a legitimate broker with a solid regulatory foundation and a commitment to customer safety. While there are some areas for improvement, particularly in customer service responsiveness and platform stability, the overall assessment leans towards a positive evaluation.

For traders considering Go Markets, it is important to remain informed about the potential risks and to utilize the broker's educational resources to enhance trading strategies. If you are a beginner or a trader seeking a reliable platform, Go Markets presents a viable option. However, if you prioritize lower minimum deposits or specific trading instruments not offered by this broker, exploring alternatives like IG Markets or Pepperstone may be beneficial.

Ultimately, the question "Is Go Markets safe?" can be answered affirmatively, as the broker demonstrates a commitment to regulatory compliance, customer fund safety, and overall user satisfaction.

Is GO MARKETS a scam, or is it legit?

The latest exposure and evaluation content of GO MARKETS brokers.

GO MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GO MARKETS latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.