LEOM 2025 Review: Everything You Need to Know

Executive Summary

LEOM is an unregulated offshore forex broker that raises serious concerns about its reliability and credibility in financial markets. Despite offering leverage up to 1:500 and a diverse range of trading assets, this leom review reveals mixed user feedback with moderate overall satisfaction ratings. The broker operates without proper regulatory oversight, which presents substantial risks for potential clients considering their services.

Key features include the use of the MT4 trading platform and provision of diversified trading assets including forex currency pairs, CFDs, precious metals, indices, ETFs, Bitcoin, and other cryptocurrencies. The platform targets investors seeking high-leverage trading opportunities and diverse asset selection. However, the lack of regulatory protection remains a critical concern.

According to available user feedback data, LEOM receives moderate ratings, with AmbitionBox scoring the company at 3.0 out of 5, reflecting mixed employee and user experiences. The broker's unregulated status significantly impacts its trustworthiness score. This makes it essential for potential clients to exercise extreme caution when considering their services for forex and CFD trading activities.

Important Notice

LEOM operates as an unregulated offshore broker, and its services may vary significantly across different geographical regions. Potential users should exercise extreme caution when considering this platform due to the absence of regulatory oversight from recognized financial authorities.

This evaluation is based on available user feedback, industry standards, and publicly accessible information to provide an objective assessment. The lack of proper regulation means client funds may not be protected under standard investor protection schemes, and dispute resolution mechanisms may be limited or non-existent.

Rating Framework

Broker Overview

LEOM presents itself as a newly established offshore broker, though specific founding details and headquarters information remain unclear in available documentation. The company operates in the competitive forex and CFD trading space, targeting retail traders seeking access to international financial markets.

However, the lack of transparency regarding company background and regulatory status raises immediate red flags for potential clients. The broker's primary business model centers around providing online trading services through the popular MetaTrader 4 platform.

LEOM offers access to multiple asset classes including forex currency pairs, contracts for difference, precious metals such as gold and silver, stock indices, exchange-traded funds, Bitcoin, and various other cryptocurrencies. This leom review indicates that while the broker attempts to provide comprehensive trading services, the absence of regulatory oversight significantly undermines its credibility in the competitive brokerage landscape.

Regulatory Status: Available information does not specify any regulatory jurisdiction or oversight body governing LEOM's operations, which represents a significant concern for potential clients seeking regulated trading environments.

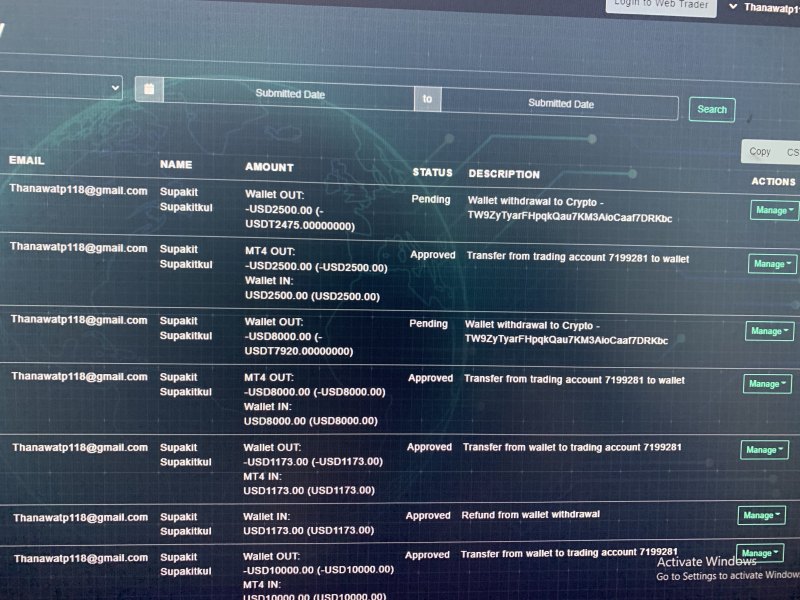

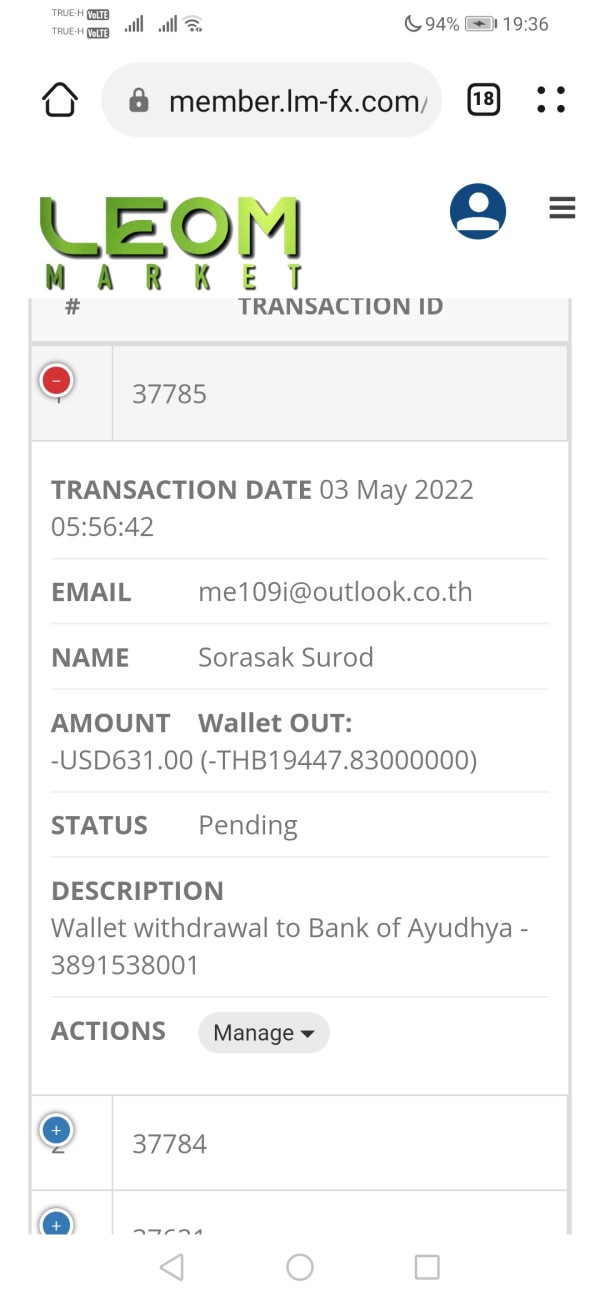

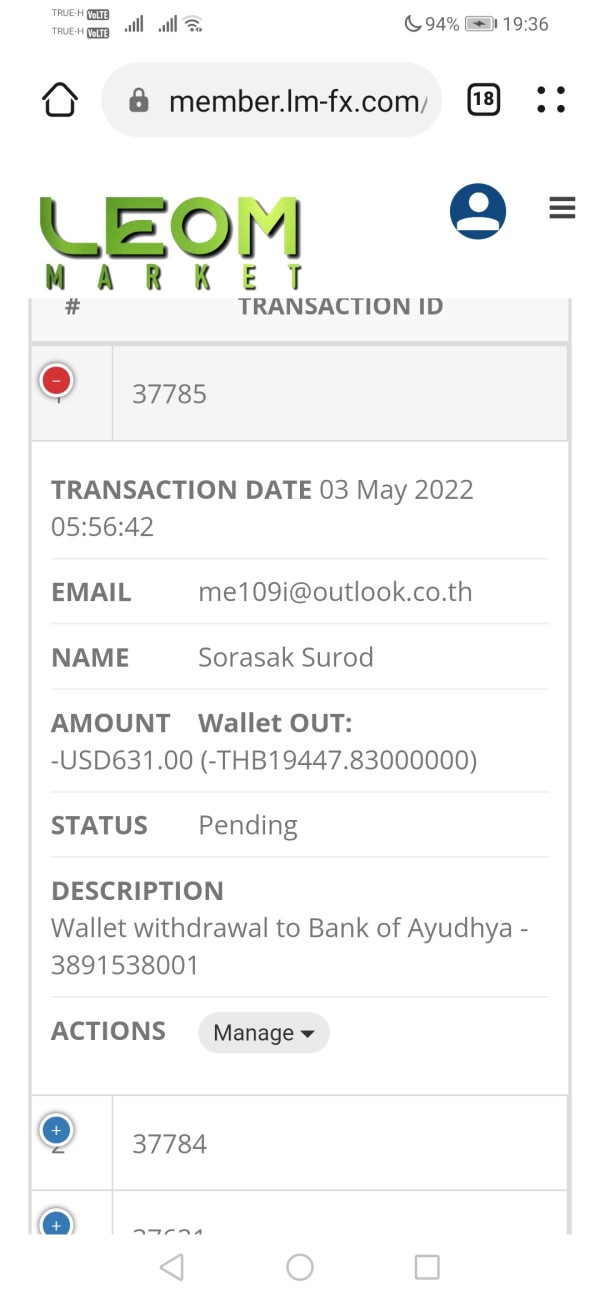

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing times, and associated fees is not detailed in available documentation, limiting transparency for potential clients. Minimum Deposit Requirements: The broker has not disclosed minimum deposit requirements in accessible materials, making it difficult for traders to assess entry barriers.

Bonus and Promotions: No specific information about promotional offers, welcome bonuses, or ongoing incentive programs is available in current documentation.

Tradeable Assets: LEOM provides access to forex currency pairs, CFDs, precious metals including gold and silver, stock indices, ETFs, Bitcoin, and other cryptocurrencies, offering reasonable asset diversity for traders. Cost Structure: Detailed information regarding spreads, commissions, overnight fees, and other trading costs is not clearly specified in available materials, hindering cost comparison analysis.

Leverage Options: The broker offers leverage up to 1:500, which is competitive in the retail forex market but comes with significant risk warnings.

Platform Selection: LEOM utilizes the MetaTrader 4 platform, a widely recognized and established trading software in the forex industry. Regional Restrictions: Specific information about geographical limitations or restricted jurisdictions is not detailed in available documentation.

Customer Support Languages: Available customer service languages are not specified in current materials, potentially limiting accessibility for international clients.

This leom review highlights the concerning lack of detailed information across multiple critical areas that potential clients typically require for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

LEOM's account conditions receive a below-average rating due to insufficient transparency and lack of detailed information. The broker has not provided clear specifications regarding account types, minimum deposit requirements, or account opening procedures in available documentation.

This opacity makes it extremely difficult for potential clients to understand what they can expect when opening an account with the platform. The absence of information about special account features, such as Islamic accounts for Muslim traders, demo account availability, or different tier structures, further diminishes the broker's appeal.

Professional traders typically require detailed account specifications to make informed decisions, and LEOM's failure to provide this information suggests either poor marketing practices or intentional obscurity. Without clear account terms and conditions, potential clients cannot adequately assess whether LEOM's offerings align with their trading needs and risk tolerance.

The lack of regulatory oversight compounds these concerns, as there are no standardized protections or guarantee schemes that would typically safeguard client deposits and trading activities. This leom review emphasizes that the insufficient account information transparency significantly impacts the broker's credibility and makes it challenging to recommend their services to serious traders seeking reliable and well-documented trading conditions.

LEOM receives an average rating for tools and resources, primarily based on their provision of the MetaTrader 4 platform, which is a well-established and feature-rich trading software widely accepted in the forex industry. MT4 offers comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and a user-friendly interface that appeals to both novice and experienced traders.

However, the broker's score is limited by the apparent lack of additional research and analysis resources. Professional forex brokers typically provide market analysis, economic calendars, trading signals, educational materials, and research reports to support their clients' trading decisions.

Available documentation does not indicate whether LEOM offers these supplementary services. Educational resources are particularly important for retail traders, and the absence of information about webinars, tutorials, market commentary, or trading guides suggests either limited offerings or poor communication of available resources.

Additionally, details about automated trading support, custom indicators, or advanced trading tools beyond the standard MT4 package are not specified. While the MT4 platform provides a solid foundation for trading activities, the lack of comprehensive additional tools and resources prevents LEOM from achieving a higher rating in this category, limiting its appeal to traders who value extensive broker-provided support and analysis.

Customer Service and Support Analysis (5/10)

Customer service and support receive an average rating due to the absence of detailed information about LEOM's support infrastructure and service quality. Available documentation does not specify customer service channels, such as live chat, telephone support, email assistance, or support ticket systems, making it impossible to assess accessibility and convenience for clients requiring assistance.

Response time expectations, service availability hours, and support quality standards are not disclosed in accessible materials. Professional forex brokers typically provide 24/5 or 24/7 customer support to accommodate global trading schedules, but LEOM's support availability remains unclear.

This uncertainty is particularly concerning for active traders who may require immediate assistance during volatile market conditions. Multi-language support capabilities are not specified, potentially limiting accessibility for international clients who prefer assistance in their native languages.

Additionally, the absence of user feedback specifically addressing customer service experiences makes it difficult to assess real-world support quality and problem resolution effectiveness. The lack of transparency regarding customer service infrastructure and the absence of user testimonials about support experiences contribute to the moderate rating.

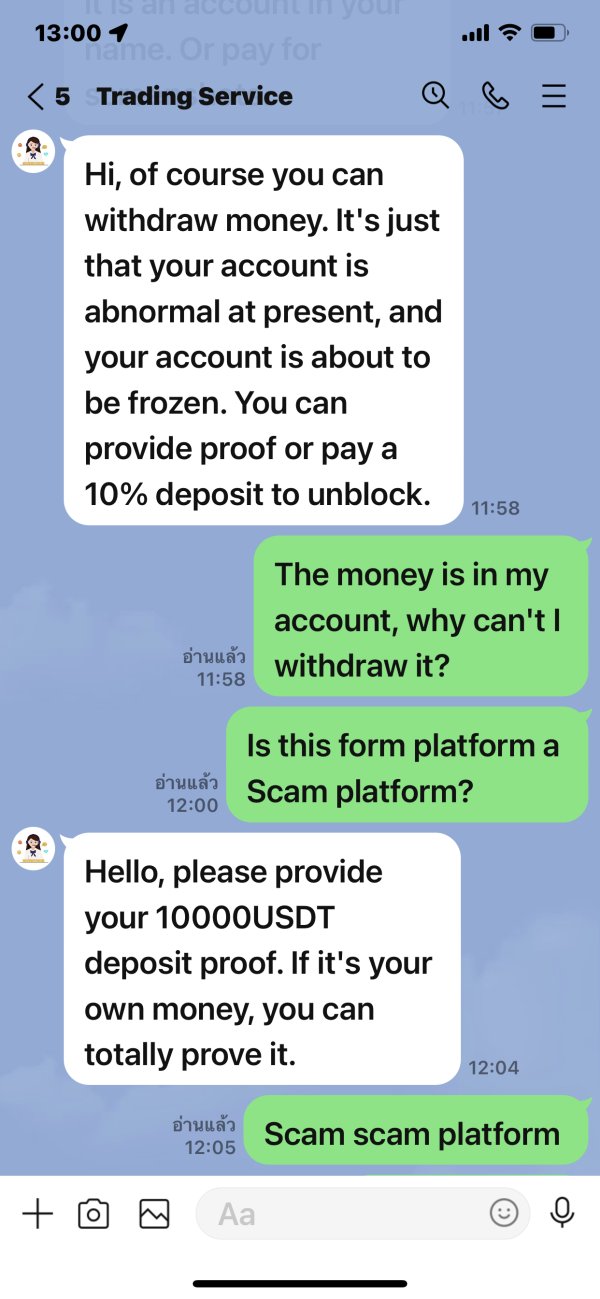

Without proper regulatory oversight, clients may have limited recourse if they encounter service issues or disputes that require resolution through customer support channels.

Trading Experience Analysis (5/10)

The trading experience receives an average rating based on limited available information about platform performance, execution quality, and overall user satisfaction. While LEOM utilizes the MetaTrader 4 platform, which generally provides reliable trading functionality, specific details about platform stability, execution speeds, and order processing quality are not documented in available materials.

Order execution quality is crucial for forex trading success, particularly during high-volatility periods when slippage and requotes can significantly impact trading results. However, information about LEOM's execution model, whether they operate as a market maker or STP broker, and their approach to order processing is not clearly specified.

Mobile trading experience details are absent from available documentation, despite mobile accessibility being essential for modern forex traders who require the ability to monitor and manage positions while away from desktop computers. The availability and functionality of mobile applications or mobile-optimized web platforms remain unclear.

User feedback regarding trading experience is limited, with the AmbitionBox rating of 3.0 providing only general insight into overall satisfaction levels. This leom review indicates that while the MT4 platform provides a functional trading environment, the lack of detailed performance metrics and user experience testimonials prevents a more favorable assessment of the broker's trading experience quality.

Trustworthiness Analysis (2/10)

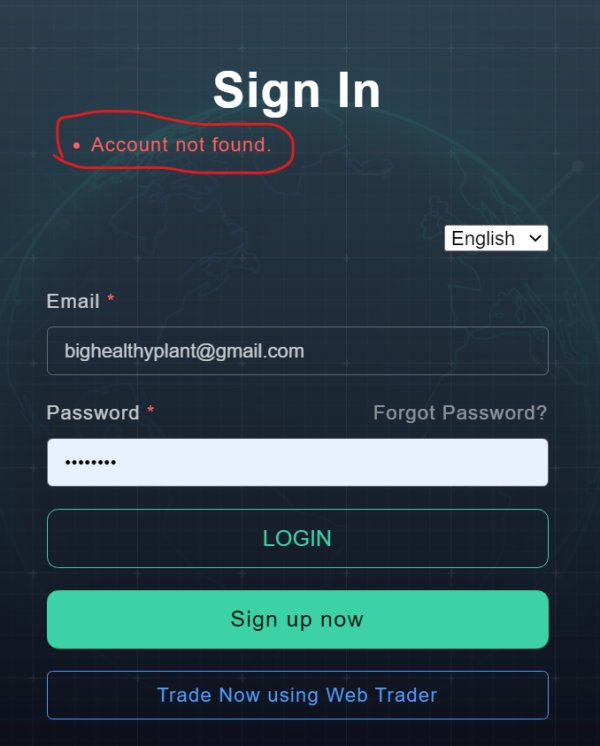

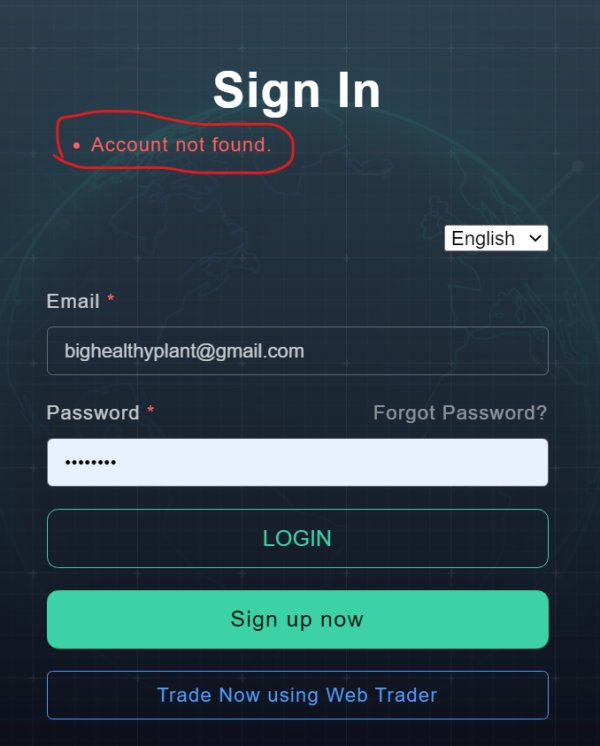

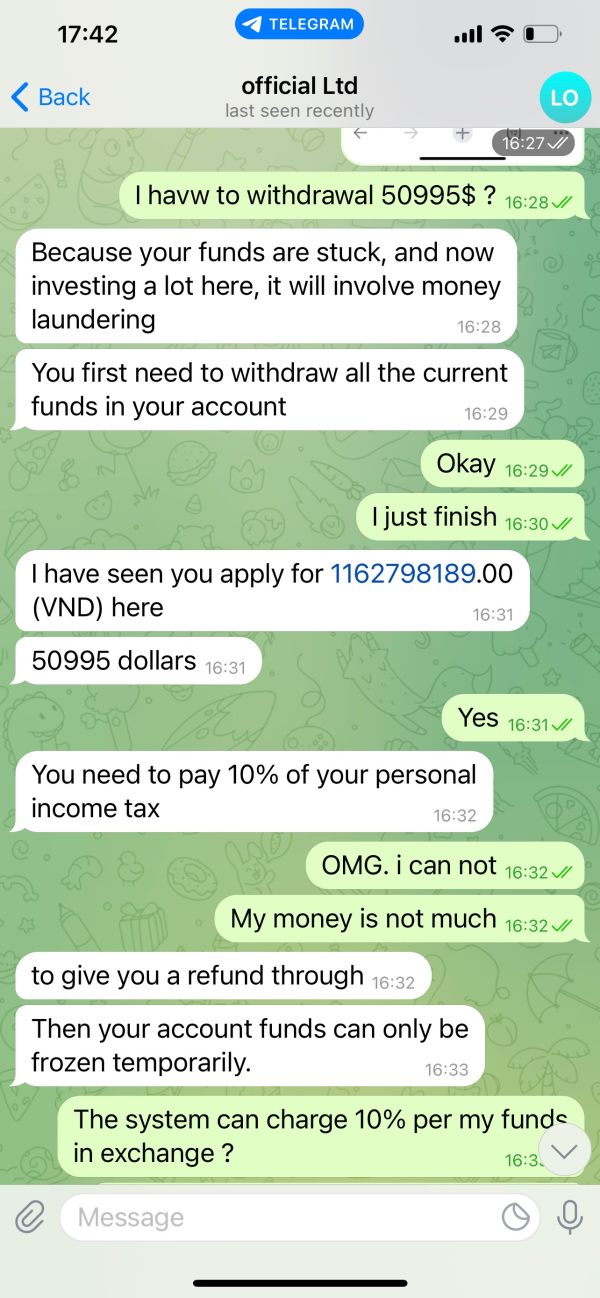

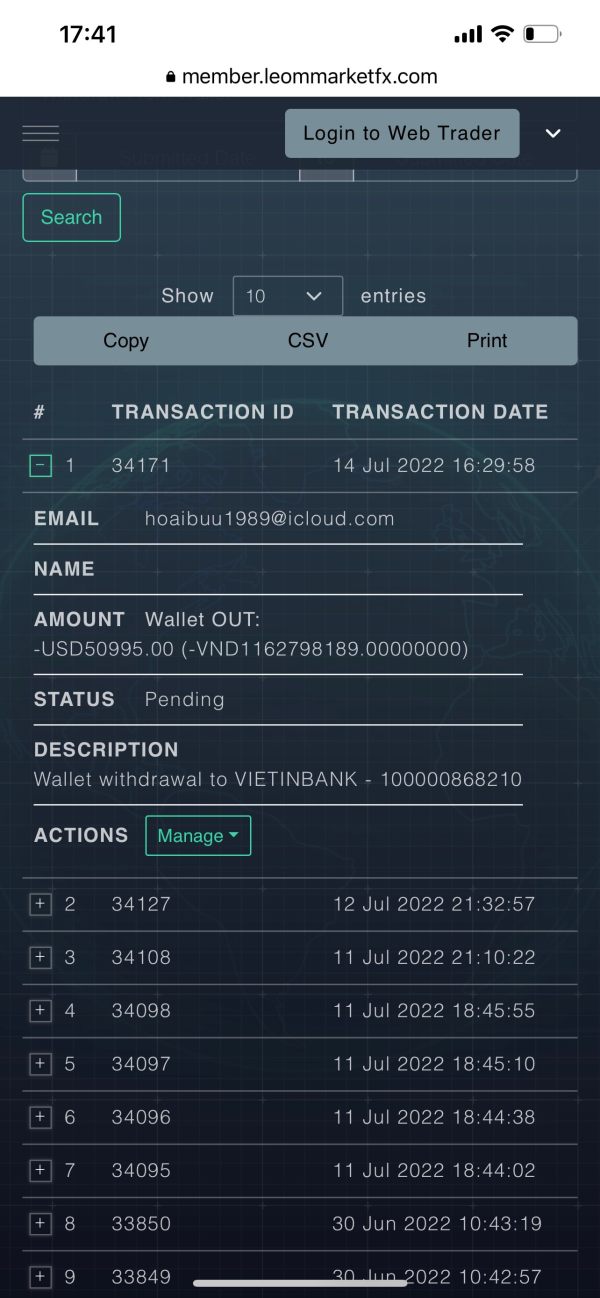

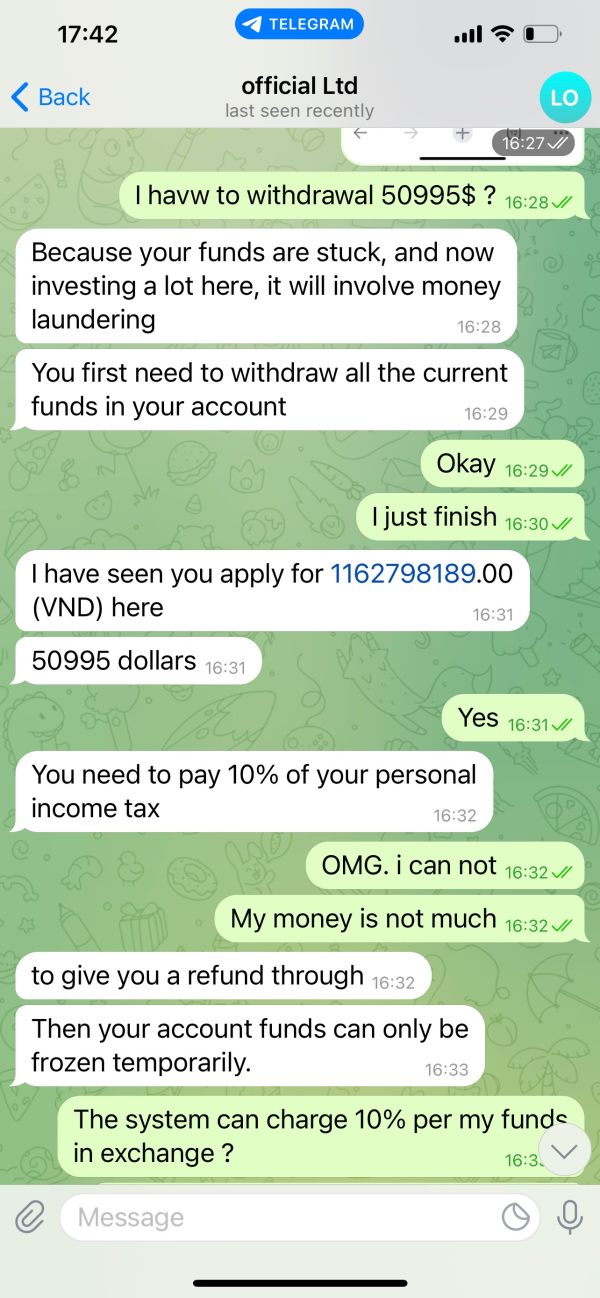

LEOM receives a poor trustworthiness rating primarily due to its unregulated status, which represents the most significant concern for potential clients. The absence of regulatory oversight from recognized financial authorities means that client funds lack standard protections typically provided by regulated brokers, such as segregated client accounts, compensation schemes, and dispute resolution mechanisms.

Regulatory compliance is fundamental to broker trustworthiness, as it ensures adherence to strict operational standards, financial reporting requirements, and client protection measures. Without regulatory supervision, clients have no guarantee that the broker maintains adequate capital reserves, follows proper fund handling procedures, or operates with transparency and integrity.

Company transparency is another area of concern, as detailed information about company ownership, management team, operational history, and financial stability is not readily available. Legitimate brokers typically provide comprehensive company information to build trust and demonstrate credibility with potential clients.

The absence of third-party audits, financial statements, or independent verification of business practices further undermines trustworthiness. Additionally, the lack of information about negative incident handling or dispute resolution procedures leaves clients uncertain about recourse options if problems arise.

These factors collectively contribute to the low trustworthiness rating and suggest that potential clients should exercise extreme caution when considering LEOM's services.

User Experience Analysis (5/10)

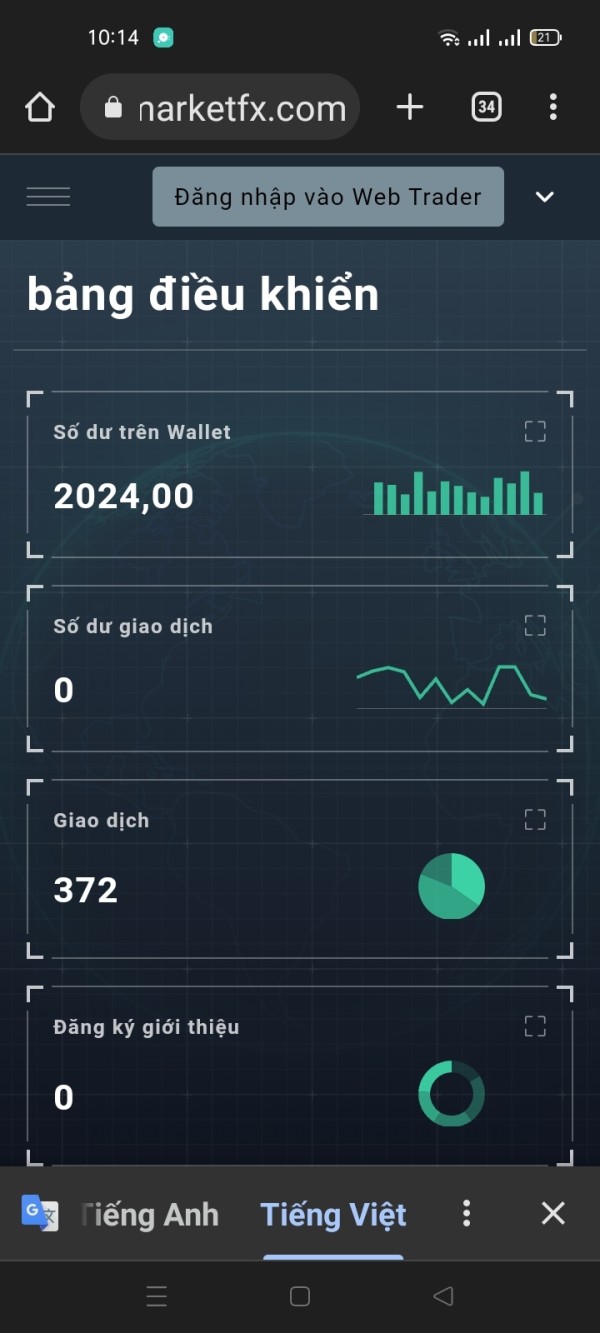

User experience receives an average rating based on the limited available feedback and the general functionality provided by the MT4 platform. The AmbitionBox rating of 3.0 reflects moderate satisfaction levels, though this data appears to relate more to employee experiences rather than client trading experiences, limiting its direct relevance to potential trading clients.

Interface design and ease of use information is not specifically detailed in available materials, though the MT4 platform generally provides a user-friendly environment for forex trading. However, the broker's website usability, account management interface, and overall user journey experience remain unclear due to insufficient documentation.

Registration and verification processes are not described in accessible materials, making it impossible to assess the efficiency and user-friendliness of the onboarding experience. Professional brokers typically streamline these processes while maintaining necessary compliance standards, but LEOM's approach remains undocumented.

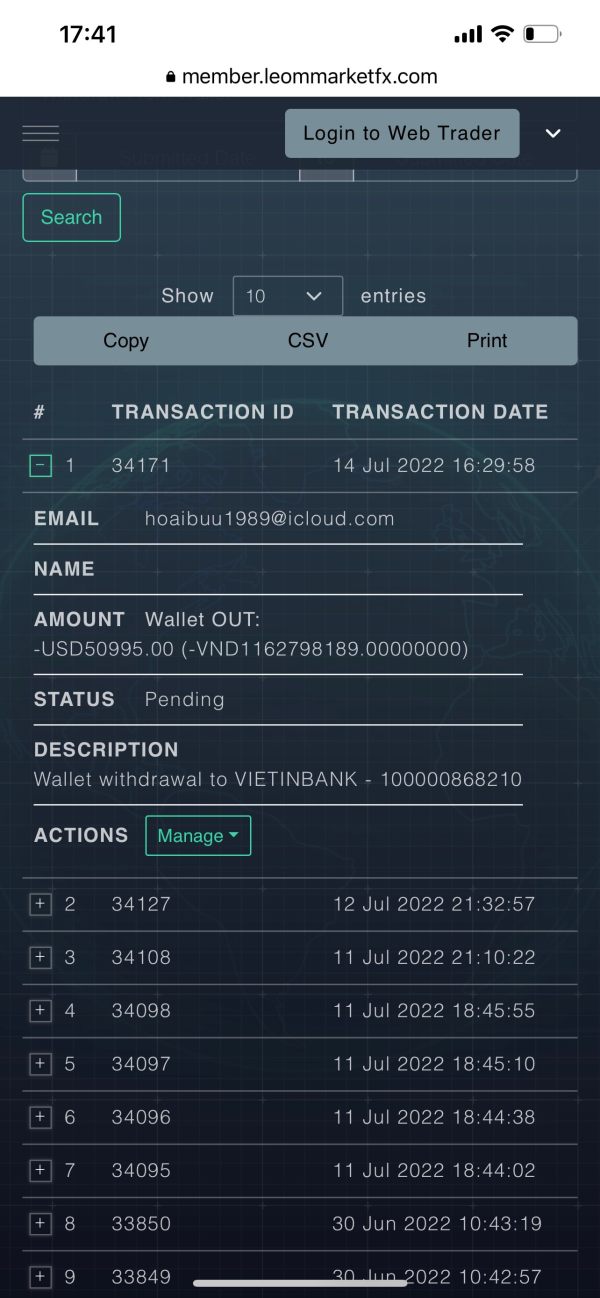

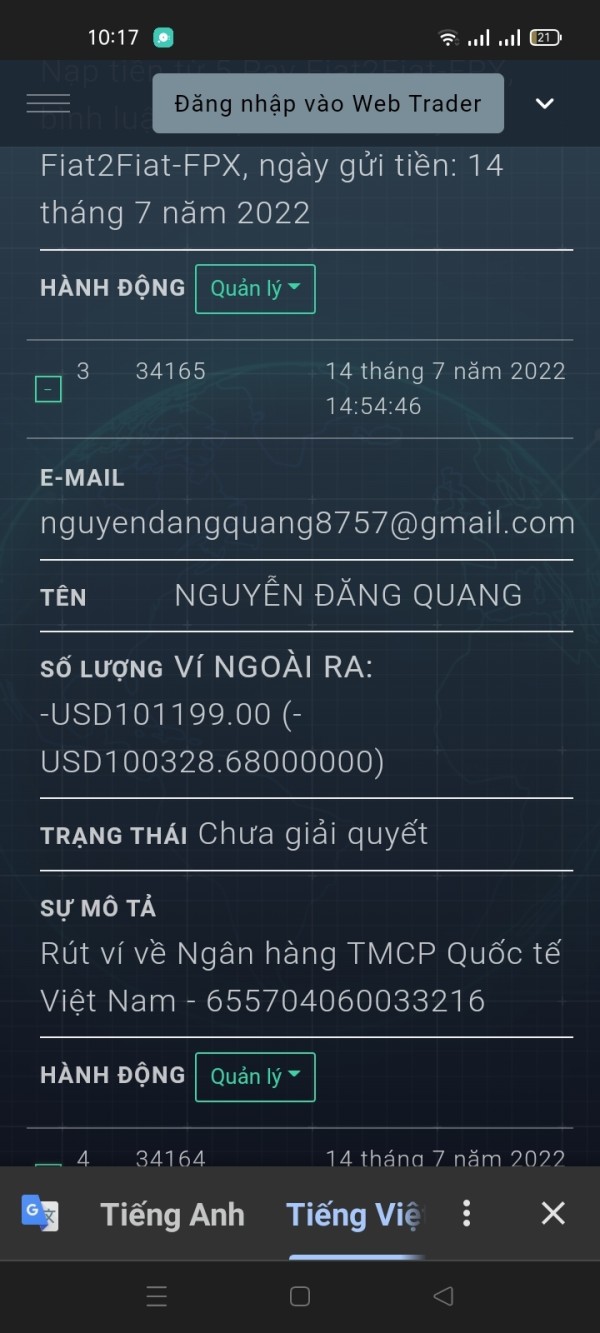

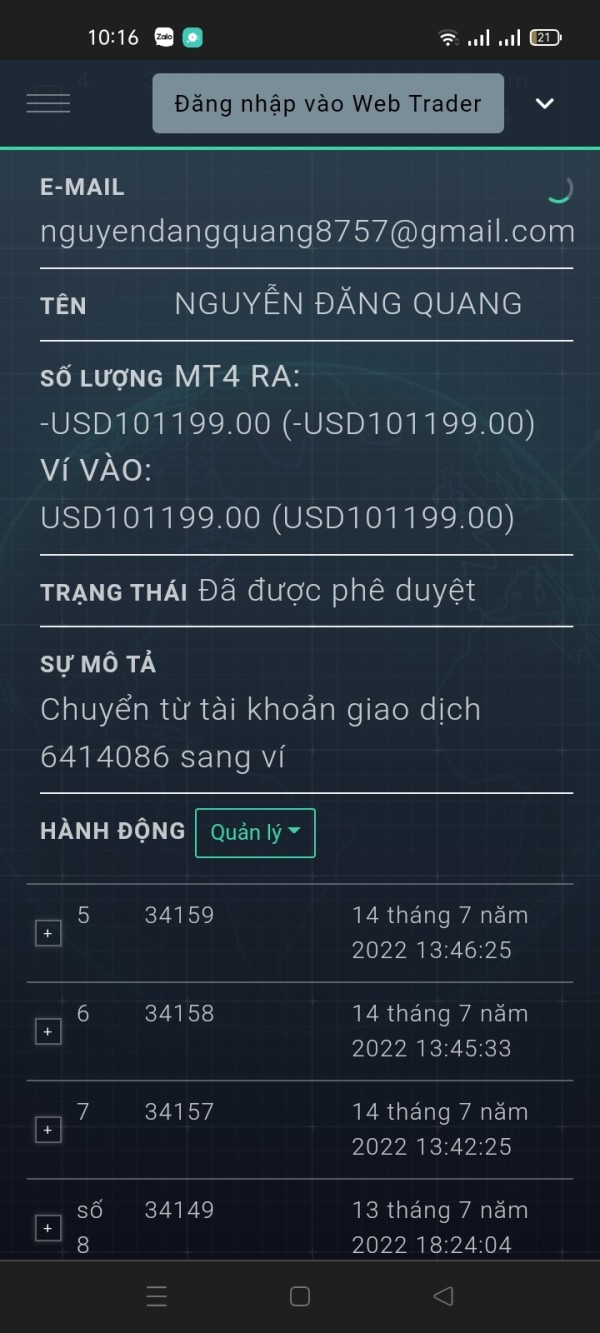

Fund operation experiences, including deposit and withdrawal processes, processing times, and associated difficulties, are not detailed in available information. These aspects significantly impact overall user satisfaction, as complicated or delayed fund operations often lead to client frustration and negative experiences.

The target user profile appears to be traders seeking high leverage and diverse asset options, though the lack of comprehensive user feedback and detailed experience reports prevents a more accurate assessment of whether LEOM successfully meets these user expectations and requirements.

Conclusion

This comprehensive leom review reveals that LEOM operates as an unregulated offshore broker with significant limitations in transparency and client protection. While the broker offers competitive leverage up to 1:500 and access to diverse trading assets through the MT4 platform, the absence of regulatory oversight presents substantial risks that potential clients must carefully consider.

The broker may appeal to traders specifically seeking high-leverage opportunities and diverse asset selection, but the lack of regulatory protection, insufficient transparency in operational details, and moderate user satisfaction ratings suggest that more established, regulated alternatives would provide superior security and service quality. Key advantages include competitive leverage ratios and asset diversity, while major disadvantages encompass the unregulated status, limited transparency, and insufficient information about critical operational aspects such as costs, customer service, and account conditions.