FXTime 2025 Review: Everything You Need to Know

Executive Summary

FXTime presents itself as an online forex and CFD broker. Our comprehensive analysis reveals significant concerns that potential traders should carefully consider before making any decisions about using their services. This fxtime review uncovers critical issues regarding the broker's regulatory status and overall trustworthiness in the trading community that could affect your money and trading experience.

The broker operates without proper regulatory oversight from major financial authorities. This immediately raises red flags for trader safety and fund security that every potential user should understand. According to multiple industry sources and user feedback platforms, FXTime has been flagged as a potentially high-risk broker with questionable business practices that could put your investment at serious risk.

Key characteristics that define FXTime include its unregulated status and consistently poor user reviews across various platforms. The broker appears to target traders seeking high-risk, high-reward opportunities, but the associated risks far outweigh any potential benefits that might seem attractive at first glance. Based on available data from industry watchdogs and user review platforms, FXTime has received notably low trust scores and has been subject to warnings from financial authorities.

The lack of transparent information about the company's operations, combined with negative user experiences, positions this broker as unsuitable for most retail traders. Our analysis indicates that FXTime primarily appeals to traders who may be unaware of the risks associated with unregulated brokers, making education and awareness crucial for the trading community to protect themselves from potential financial losses.

Important Notice

This review acknowledges that FXTime may operate under different legal frameworks across various jurisdictions. The lack of clear regulatory information makes it difficult to verify specific regional compliance that could affect your rights as a trader. Traders should be aware that the broker's status and available services may vary significantly depending on their location and local financial laws.

Our evaluation methodology incorporates comprehensive analysis of available regulatory information, user feedback from multiple platforms, industry warnings, and publicly available data about the broker's operations. This fxtime review is based on information available as of 2025 and reflects the current understanding of the broker's market position and regulatory standing that could change over time.

Rating Framework

Broker Overview

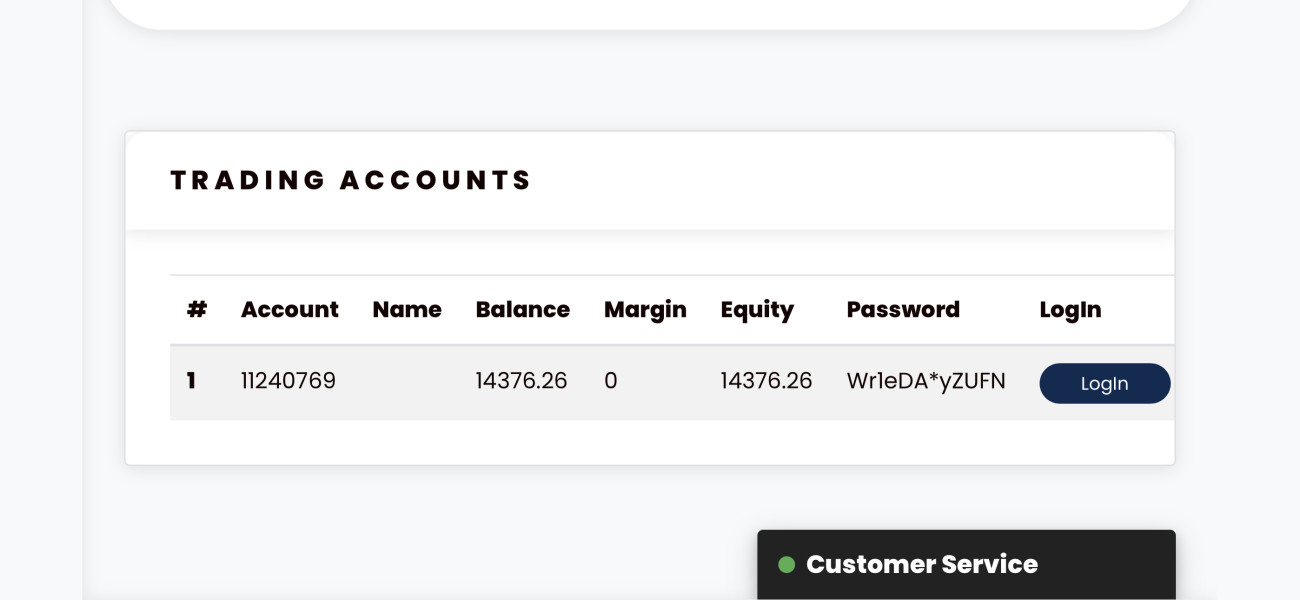

FXTime operates as an online trading platform offering forex and CFD services. Specific details about its establishment date and corporate background remain unclear from available sources, which raises immediate concerns about transparency. The broker markets itself as providing access to various financial instruments, but the lack of transparent company information raises immediate concerns about its legitimacy and operational standards that every potential trader should carefully consider.

The company's business model appears to focus on attracting retail traders through online marketing. The absence of clear regulatory oversight suggests potential risks in its operational approach that could affect your trading experience and fund safety. Industry sources indicate that FXTime has been flagged by various financial watchdogs as a broker requiring extreme caution from potential users who might be considering opening accounts.

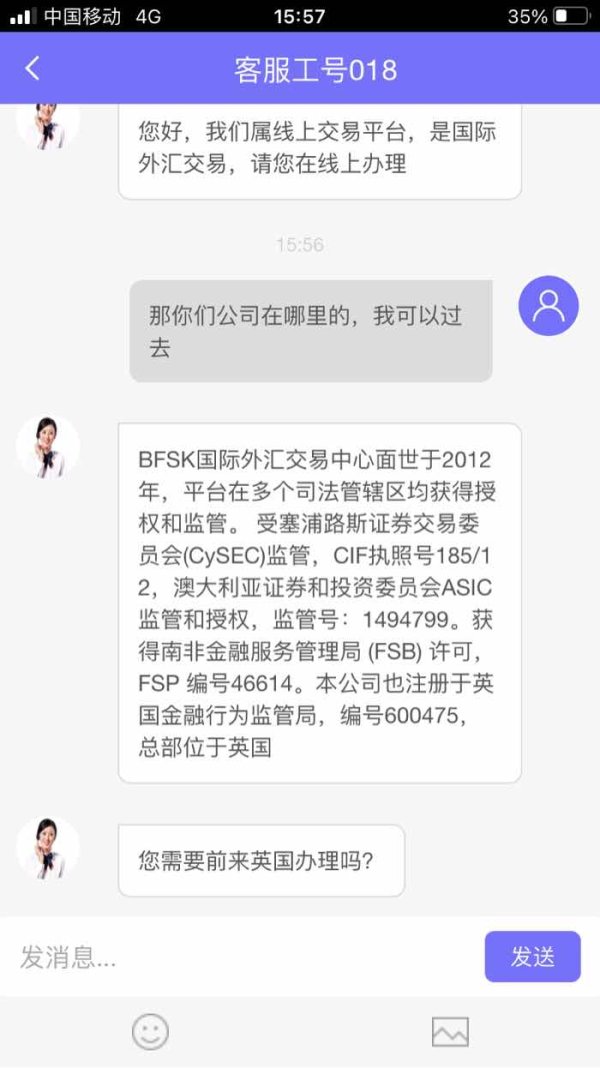

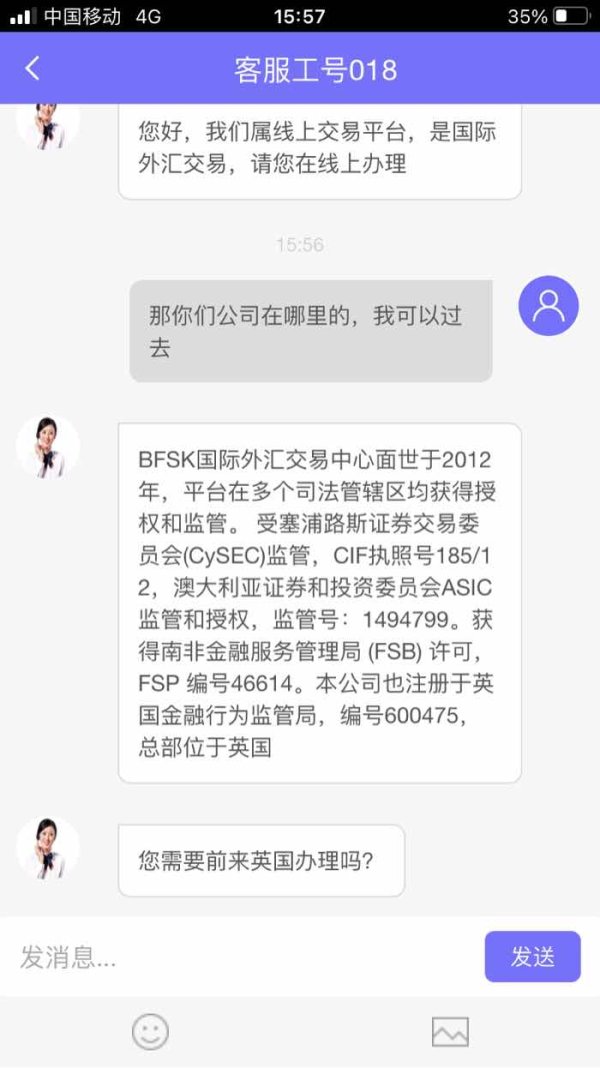

According to available information, FXTime offers trading services in forex markets and CFD instruments. Specific details about spreads, execution models, and trading conditions are not readily available through official channels, which makes it difficult to evaluate their competitiveness. The broker's lack of regulatory authorization from major financial authorities including the FCA, ASIC, CySEC, or other recognized regulators significantly impacts its credibility and trustworthiness in the global trading community.

The platform operates without oversight from established financial regulatory bodies. This means traders have limited recourse in case of disputes or issues that might arise during their trading experience. This unregulated status places FXTime outside the protection frameworks that legitimate brokers must adhere to, creating substantial risks for potential users who might lose their money without legal protection.

Regulatory Status: FXTime operates without authorization from major financial regulatory authorities. This unregulated status means the broker is not subject to the strict oversight and consumer protection measures required by legitimate financial regulators that protect trader interests and funds.

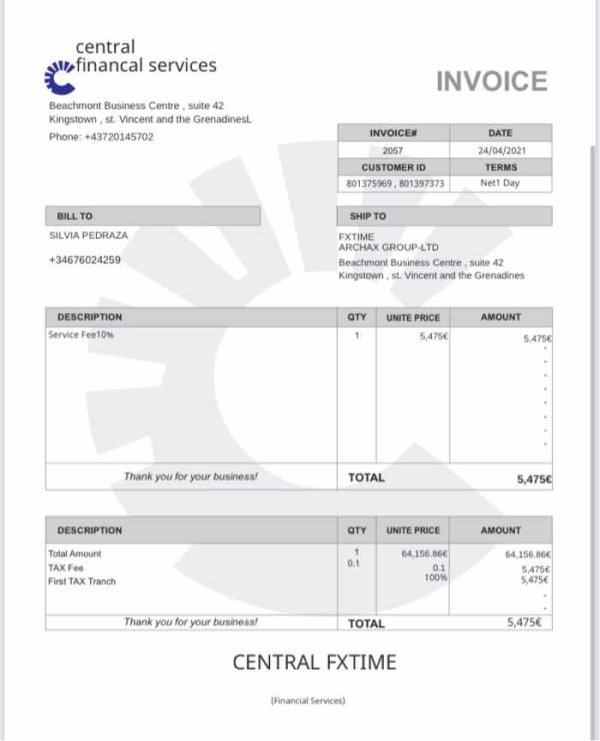

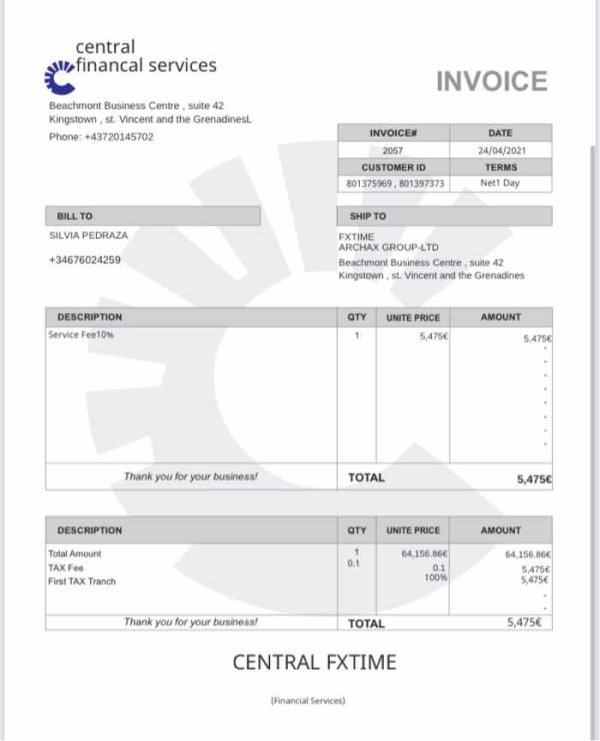

Deposit and Withdrawal Methods: Specific information about payment methods, processing times, and associated fees is not clearly documented in available sources. This raises concerns about transparency in financial operations that could affect your ability to access your money when needed.

Minimum Deposit Requirements: The broker's minimum deposit requirements are not clearly specified in available documentation. This makes it difficult for potential traders to understand the financial commitment required to start trading with their platform.

Bonus and Promotions: Information about promotional offers, welcome bonuses, or ongoing incentives is not readily available through official channels. Unregulated brokers often use aggressive promotional tactics that might seem attractive but could hide important terms and conditions.

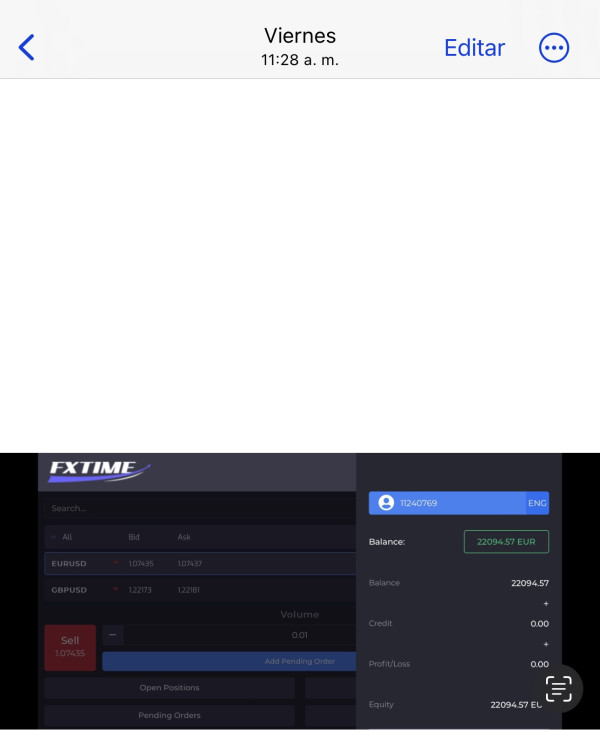

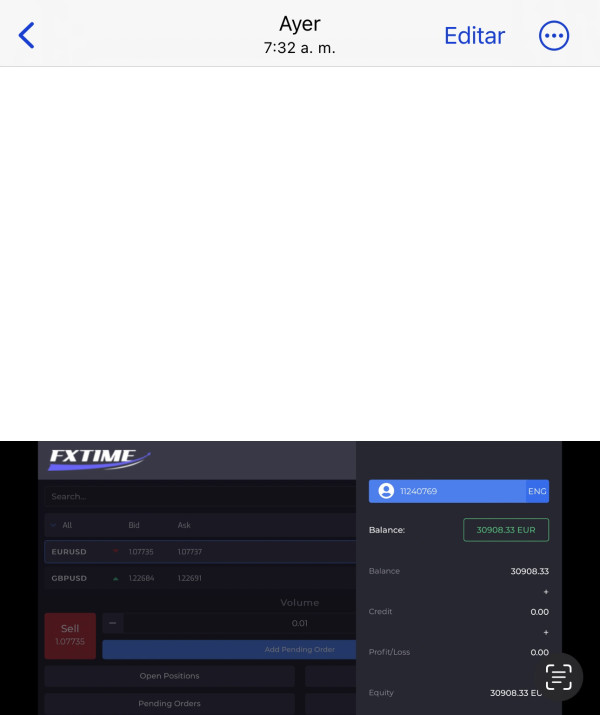

Tradeable Assets: FXTime claims to offer forex pairs and CFD instruments. The specific range of available assets, market coverage, and trading conditions remain unclear from available sources, making it hard to evaluate their market offerings.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not transparently provided. This makes it impossible for traders to accurately assess the true cost of trading with their platform. This fxtime review finds the lack of cost transparency concerning for potential users who need to understand all fees before trading.

Leverage Ratios: Specific leverage offerings and risk management measures are not clearly documented. This is problematic given the high-risk nature of leveraged trading that can lead to significant losses.

Platform Options: Details about trading platforms, mobile applications, and technical capabilities are not adequately documented in available sources. This makes it difficult to evaluate the quality and functionality of their trading technology.

Geographic Restrictions: Information about service availability in specific countries or regions is not clearly outlined. This could affect your ability to use their services depending on where you live.

Customer Support Languages: The range of supported languages for customer service is not specified in available documentation. This could create communication barriers for international traders who need help in their native language.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The evaluation of FXTime's account conditions reveals a significant lack of transparency and available information. Standard account types that legitimate brokers typically offer, such as standard, premium, or VIP accounts, are not clearly documented for FXTime, which makes it impossible for potential traders to understand what services they would receive. This absence of clear account structure information suggests poor operational transparency that could hide important limitations or restrictions.

Minimum deposit requirements, which are fundamental information for any trading platform, are not transparently disclosed. Legitimate brokers typically provide clear information about entry-level deposits, account upgrade requirements, and associated benefits that help traders make informed decisions. The lack of this basic information suggests poor operational transparency and could indicate hidden fees or requirements.

Account opening procedures and verification processes are not adequately explained. This raises questions about the broker's compliance with standard industry practices that protect both traders and the financial system. Legitimate brokers typically outline clear KYC procedures and documentation requirements that are transparent and easy to understand.

Special account features such as Islamic accounts for Muslim traders, demo accounts for practice trading, or managed account options are not mentioned in available sources. This fxtime review finds that the complete absence of detailed account information significantly undermines trader confidence and suggests inadequate service structure that could limit your trading options.

FXTime's offering of trading tools and educational resources appears severely limited based on available information. Professional trading platforms typically provide comprehensive charting tools, technical indicators, and analytical resources to support trader decision-making, but these essential features are not documented for FXTime. The absence of documented trading tools suggests a basic or inadequate platform offering that could limit your ability to analyze markets effectively.

Research and market analysis resources, which are standard features of legitimate brokers, are not evident in FXTime's service description. Professional brokers typically offer daily market analysis, economic calendars, expert commentary, and research reports to help traders make informed decisions about their investments. The lack of these resources could put you at a significant disadvantage when trying to make profitable trading decisions.

Educational materials such as trading guides, webinars, tutorials, and market education programs are not documented. These resources are crucial for trader development and are standard offerings from reputable brokers that want their clients to succeed. The absence suggests limited commitment to trader education and success, which could leave new traders without proper guidance.

Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, or copy trading services, is not mentioned in available information. Modern trading platforms typically support various automated trading options to meet diverse trader needs and help improve trading efficiency.

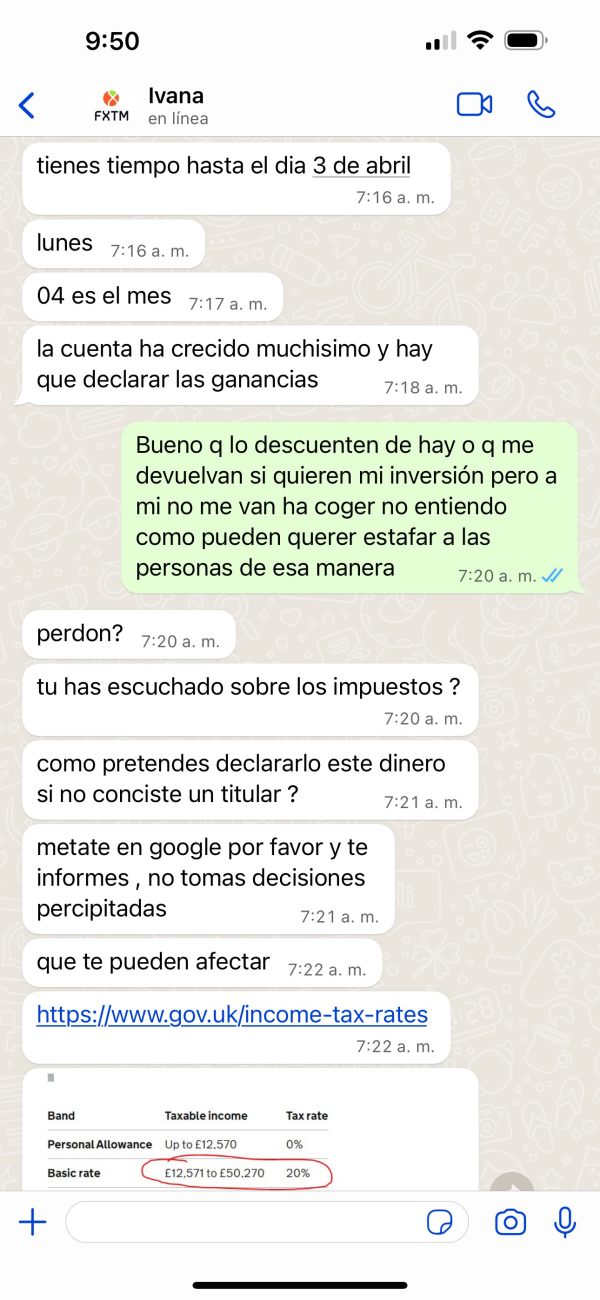

Customer Service and Support Analysis (Score: 1/10)

Information about FXTime's customer service capabilities is notably absent from available sources. This raises significant concerns about support quality and availability when you might need help with your account or trading issues. Legitimate brokers typically provide multiple contact channels including phone support, live chat, email assistance, and comprehensive FAQ sections that make it easy to get help when needed.

Response times and service quality metrics are not documented. This makes it impossible to assess the broker's commitment to customer support and whether you can expect timely help when problems arise. Professional brokers usually guarantee specific response times and maintain service quality standards that are transparently communicated to users so they know what to expect.

Multi-language support capabilities are not specified. This could limit accessibility for international traders who need help in their native language to understand complex trading issues. Reputable brokers typically offer support in multiple languages to serve their global client base effectively and ensure clear communication.

Operating hours for customer support are not clearly defined. This leaves potential traders uncertain about when assistance would be available if they encounter problems with their accounts or trading platform. This lack of transparency in support operations suggests inadequate customer service infrastructure and commitment that could leave you without help when you need it most.

Trading Experience Analysis (Score: 1/10)

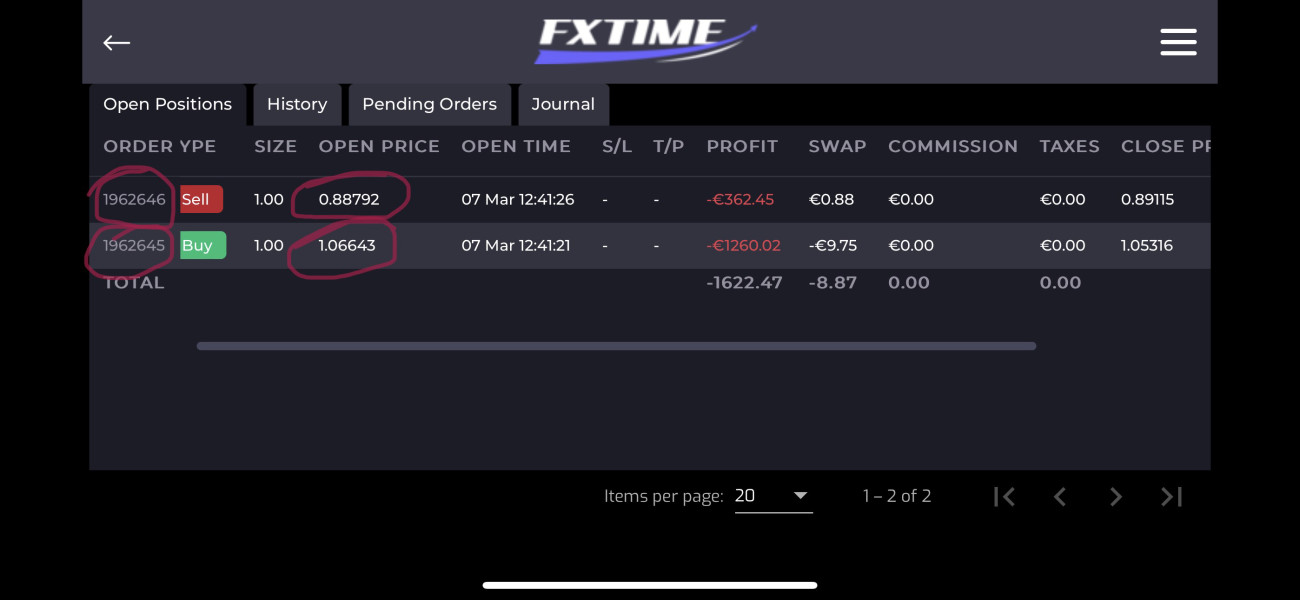

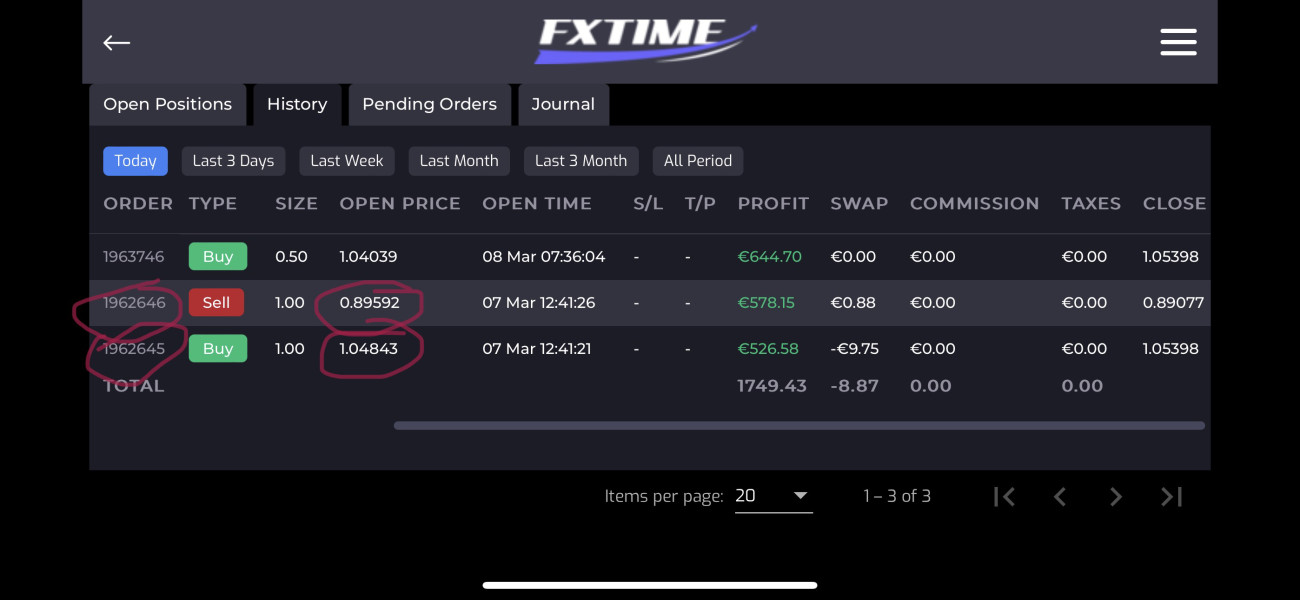

The trading experience offered by FXTime cannot be adequately assessed due to the lack of detailed platform information and user experience data. Platform stability, execution speed, and overall performance metrics are not documented in available sources, which are crucial factors for successful trading that could directly affect your profits and losses. Without this information, it's impossible to know if the platform will work reliably when you need to execute trades quickly.

Order execution quality, including fill rates, slippage statistics, and execution speed data, is not provided. These metrics are essential for traders to understand the quality of trade execution they can expect from the platform. Professional brokers typically publish execution statistics to demonstrate their platform performance and build trust with potential clients.

Platform functionality and feature completeness cannot be evaluated without access to detailed platform specifications. Modern trading platforms should offer comprehensive charting, multiple order types, risk management tools, and user-friendly interfaces that make trading efficient and effective. The lack of information about these basic features raises concerns about platform quality.

Mobile trading capabilities and cross-device synchronization features are not documented. In today's trading environment, mobile platform quality is crucial for traders who need access to markets while away from their computers to manage positions and respond to market changes. This fxtime review finds the lack of platform information concerning for potential users who need reliable mobile trading access.

Trust and Safety Analysis (Score: 2/10)

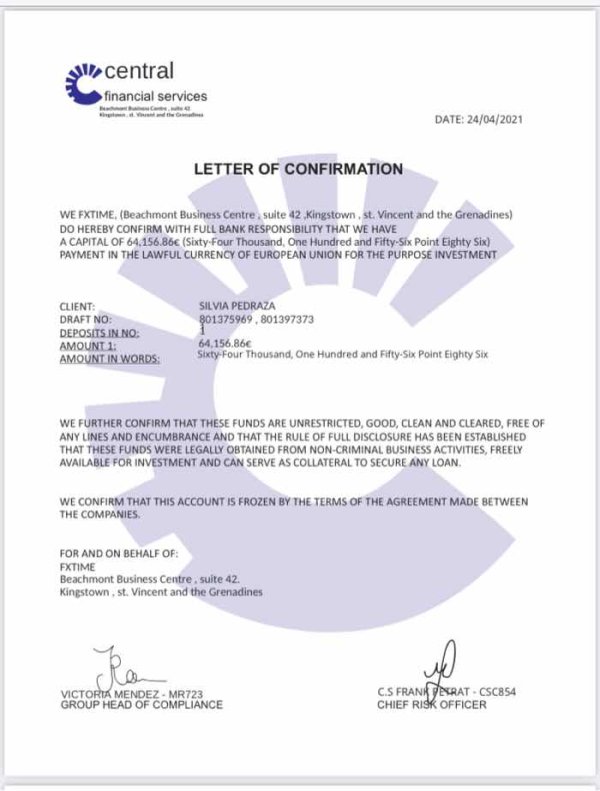

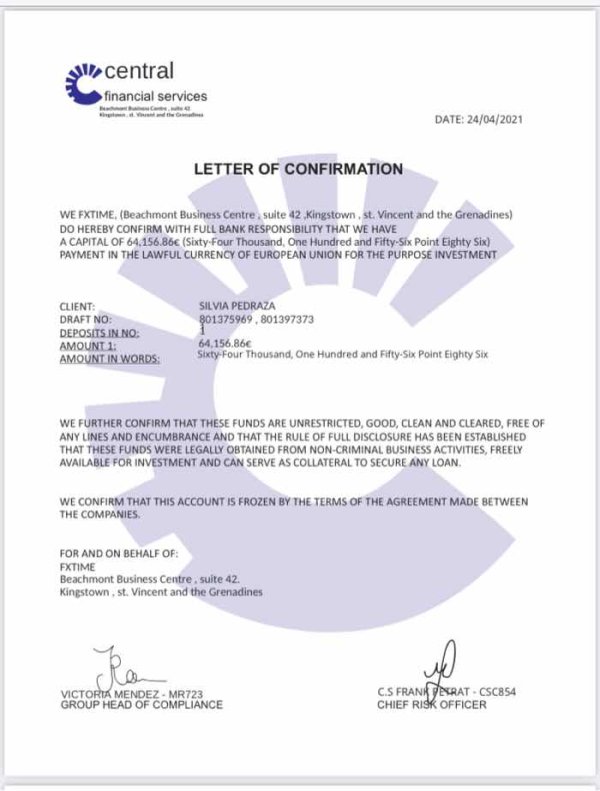

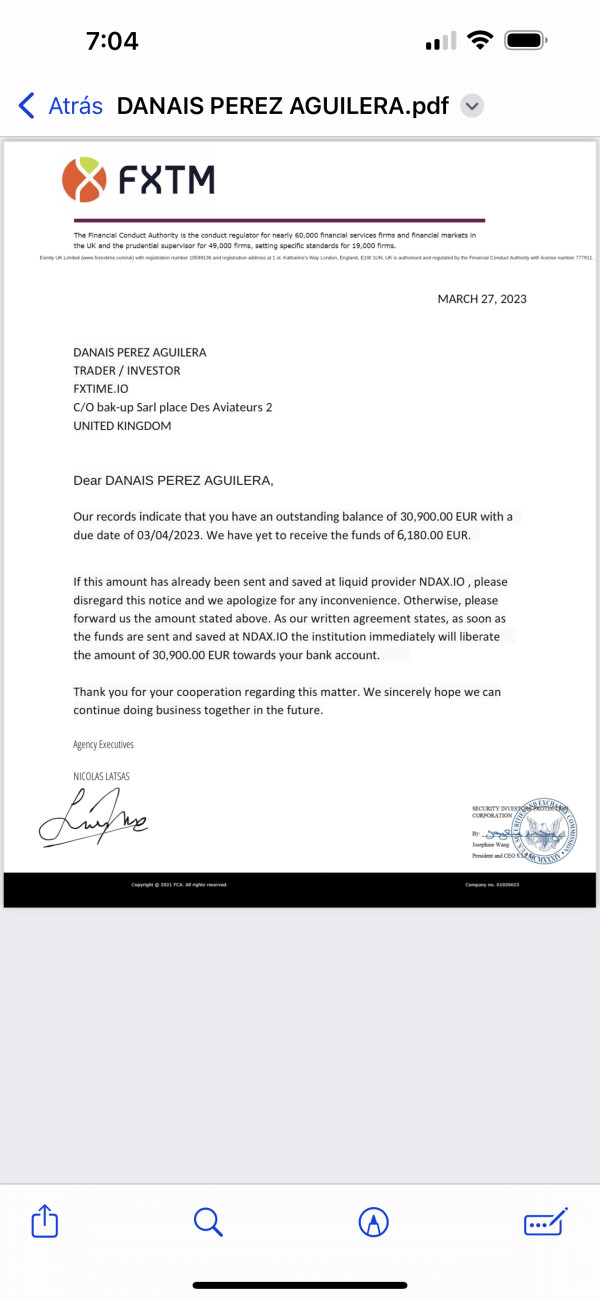

FXTime's trust and safety profile presents serious concerns primarily due to its unregulated status. Operating without oversight from recognized financial authorities means the broker is not subject to capital adequacy requirements, client fund segregation mandates, or operational standards that protect trader interests and ensure your money is safe. This lack of regulation creates significant risks for anyone considering trading with this broker.

Fund safety measures such as client money segregation, deposit insurance, or compensation schemes are not documented. Regulated brokers are typically required to maintain client funds in separate accounts and provide various forms of protection against broker insolvency that could protect your money if the company fails. Without these protections, your funds could be at serious risk.

Company transparency is severely lacking. Limited information is available about corporate structure, ownership, financial statements, or operational history that would help you understand who you're dealing with. Legitimate brokers typically provide comprehensive company information and maintain transparent business practices that build trust with their clients.

Industry reputation appears problematic based on available warnings and negative feedback. Financial authorities have issued alerts about FXTime, and user review platforms indicate significant trust issues among the trading community that suggest serious problems with their business practices.

User Experience Analysis (Score: 1/10)

User experience evaluation for FXTime is challenging due to limited available feedback and documentation. The overall user satisfaction appears low based on available review platform data, with users expressing concerns about various aspects of the service that could affect your trading experience. These negative reviews suggest systemic problems with how the broker treats its clients.

Interface design and platform usability cannot be properly assessed without access to detailed platform reviews or user interface documentation. Modern trading platforms should offer intuitive design, customizable layouts, and user-friendly navigation that makes trading efficient and enjoyable. The lack of information about these features raises concerns about platform quality.

Registration and account verification processes are not clearly documented. This suggests potential issues with user onboarding that could make it difficult to get started with trading. Legitimate brokers typically provide clear guidance through account setup and verification procedures that make the process smooth and transparent.

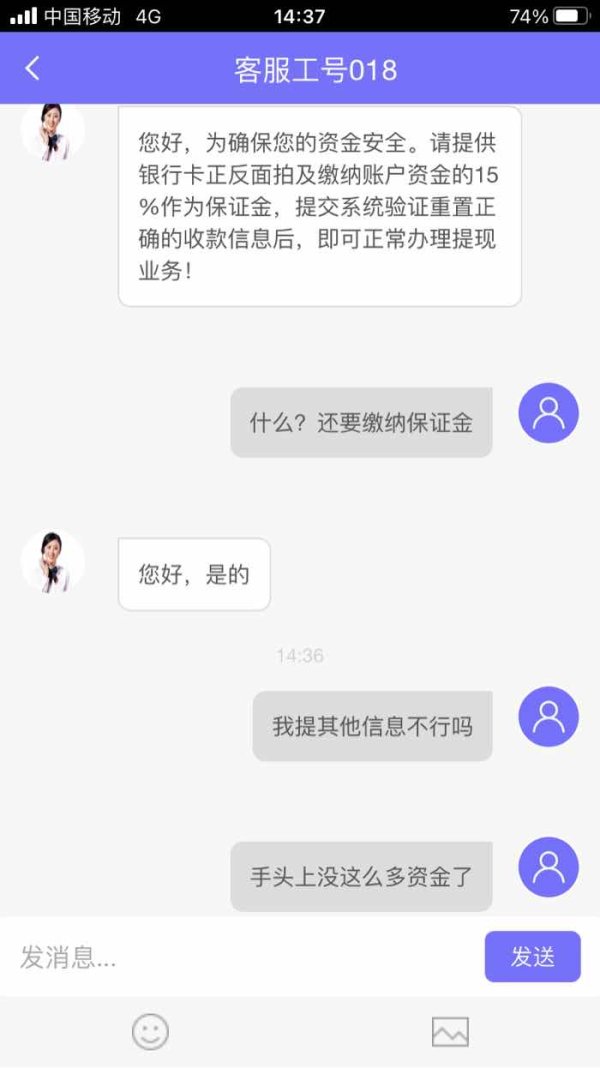

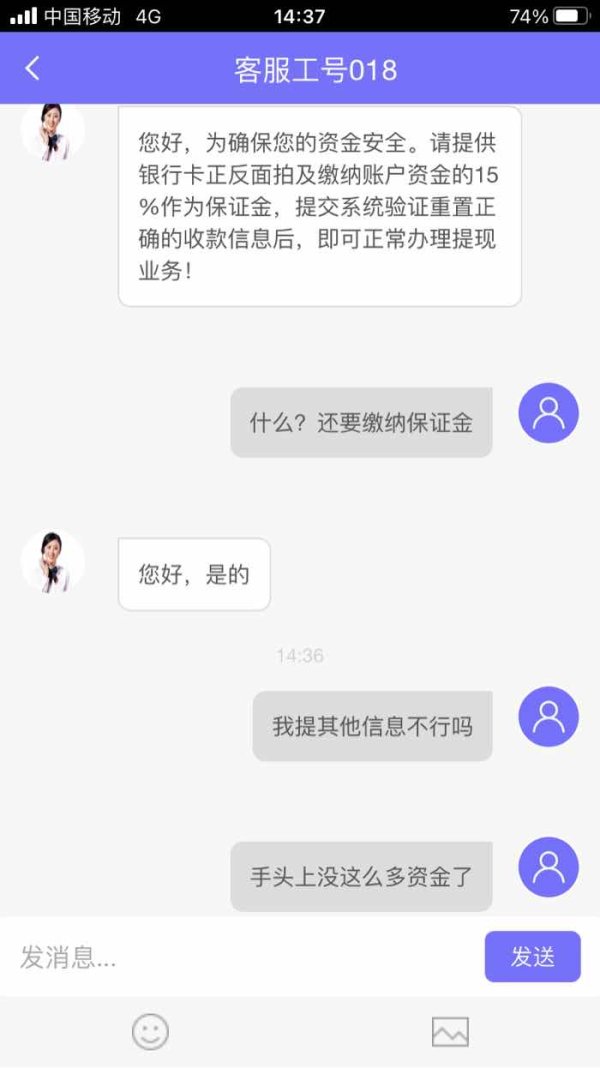

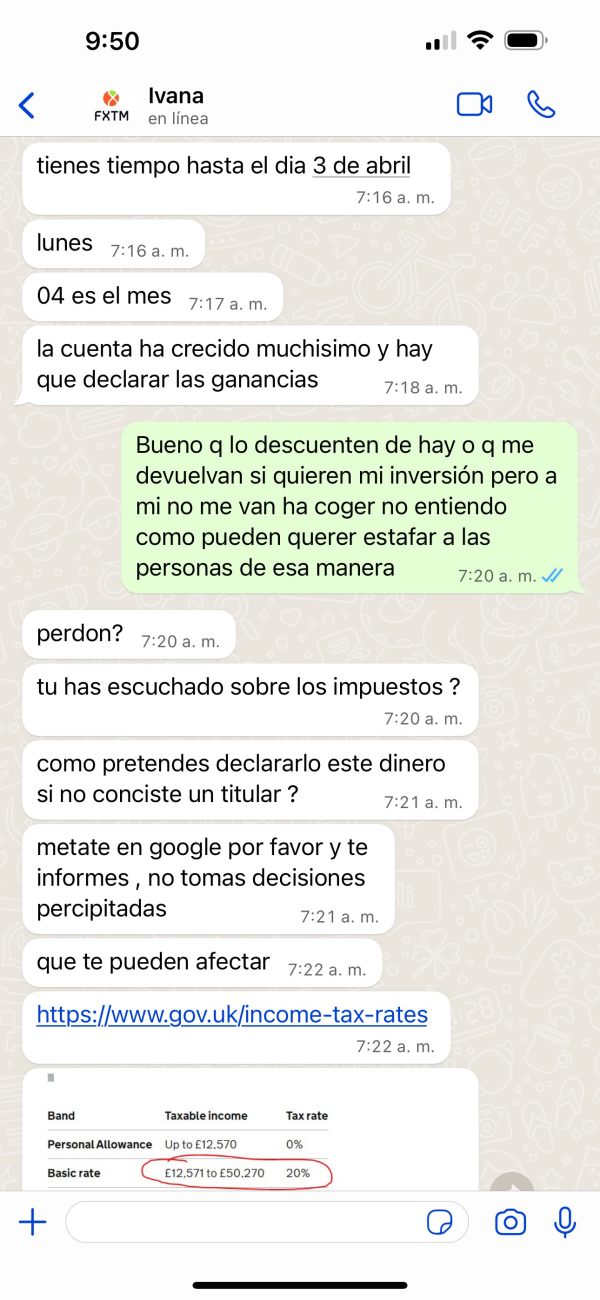

Common user complaints found in available sources include concerns about fund safety, withdrawal issues, and lack of responsive customer support. These recurring themes in user feedback indicate systemic problems with the broker's service delivery that could affect your ability to trade successfully and access your money when needed.

Conclusion

This comprehensive fxtime review reveals significant concerns about the broker's suitability for retail traders. FXTime operates without proper regulatory oversight, lacks transparency in its operations, and has received negative feedback from industry watchdogs and users alike, which creates substantial risks for anyone considering using their services. The combination of these factors makes this broker unsuitable for most traders who want to protect their money and have a positive trading experience.

The broker is not recommended for typical retail traders due to the substantial risks associated with its unregulated status and limited operational transparency. Only traders with extremely high risk tolerance and full understanding of potential losses should consider such platforms, and even then, better alternatives exist in the regulated broker space. Most traders would be better served by choosing a properly regulated broker that offers transparent operations and client protections.

The main disadvantages include the absence of regulatory protection, lack of transparent operational information, poor user reviews, and inadequate documentation of trading conditions. No significant advantages were identified that would justify the associated risks for most traders who want reliable service and fund safety. This fxtime review strongly recommends looking for alternative brokers that offer proper regulation, transparent operations, and positive user feedback to ensure a safe and successful trading experience.