Regarding the legitimacy of FXTIME forex brokers, it provides CYSEC, FCA, FSCA and WikiBit, (also has a graphic survey regarding security).

Is FXTIME safe?

Pros

Cons

Is FXTIME markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Forextime Ltd

Effective Date:

2012-12-13Email Address of Licensed Institution:

compliance@forextime.comSharing Status:

No SharingWebsite of Licensed Institution:

www.forextime.com/euExpiration Time:

--Address of Licensed Institution:

35, Lamprou Konstantara Street, FXTM Tower, Kato Polemidia, CY-4156 LimassolPhone Number of Licensed Institution:

+357 25 558 777Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Exinity UK Ltd

Effective Date:

2018-02-01Email Address of Licensed Institution:

info@forextime.co.uk, complaints@forextime.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.forextime.com/ukExpiration Time:

--Address of Licensed Institution:

8 - 10 Old Jewry London EC2R 8DN UNITED KINGDOMPhone Number of Licensed Institution:

+442035141251Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

FOREXTIME LTD

Effective Date: Change Record

2016-07-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2024-02-02Address of Licensed Institution:

FXTM TOWER 35 LAMPROU KONSTANTARA, KATO POLEMIDIA LIMASSOL, CYPRUSPhone Number of Licensed Institution:

00357 25558777Licensed Institution Certified Documents:

Is FxTime A Scam?

Introduction

FxTime positions itself as an online trading broker in the foreign exchange (forex) market, catering to traders seeking to engage in currency trading, commodities, cryptocurrencies, and more. However, the rise of online trading has brought about a surge of new brokers, making it crucial for traders to carefully assess the legitimacy and reliability of these platforms. With the potential for significant financial loss, it is essential to evaluate whether FxTime is a trustworthy broker or a potential scam. This article will investigate FxTime's regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and overall risks associated with trading on this platform.

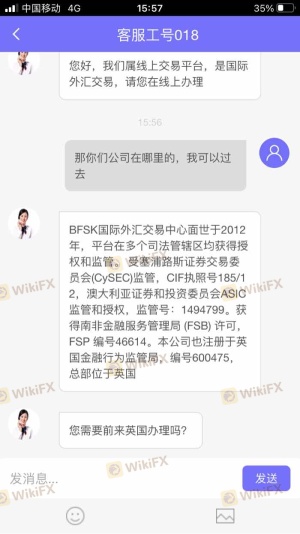

Regulatory and Legality

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A regulated broker is typically subject to oversight by financial authorities, which helps ensure that they adhere to ethical practices and maintain client fund security. In the case of FxTime, the broker claims to operate under various jurisdictions, yet it lacks a credible regulatory license from recognized authorities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation from reputable organizations such as the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC) raises significant concerns. Furthermore, multiple warnings have been issued against FxTime by financial regulators in countries such as Austria, Germany, and Canada, labeling it as a scam. Such warnings indicate that the broker has faced scrutiny regarding its operations, which is a major red flag for potential investors. The lack of a regulatory framework means that traders using FxTime have little to no protection in the event of disputes or financial issues.

Company Background Investigation

FxTime's company background reveals a concerning lack of transparency. The broker does not disclose its ownership structure, headquarters, or any relevant information about its management team. This anonymity is alarming, as legitimate brokers typically provide detailed information about their corporate structure to foster trust among clients.

The absence of a clear history or established track record further complicates matters. Traders are often advised to conduct thorough research on a broker's background, including the experience and qualifications of its management team. However, with FxTime, there is a notable absence of such information, leaving potential clients in the dark about who is managing their funds.

Moreover, the broker's claims of operating under various jurisdictions, including references to Estonian laws, do not hold up under scrutiny, as no official records confirm its legitimacy or presence in those regions. This lack of transparency raises questions about the broker's intentions and its overall reliability, making it difficult for traders to feel secure in their investments.

Trading Conditions Analysis

FxTime offers a variety of trading conditions, but these conditions raise several concerns. The broker provides three account types, with a minimum deposit starting at $250. However, the overall fee structure appears to be opaque and potentially misleading.

| Fee Type | FxTime | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | From 1.0 pips | 0.5 - 1.0 pips |

| Commission Model | Up to $50 per lot | $5 - $30 per lot |

| Overnight Interest Range | N/A | Varies |

The spreads offered by FxTime start from 1.0 pips, which is relatively high compared to industry standards, particularly given the competitive nature of the forex market. Additionally, the commission structure appears excessive, particularly for higher-tier accounts. Such high costs can significantly erode potential profits, making trading less viable for clients.

Furthermore, the lack of clarity regarding overnight interest rates and potential hidden fees raises additional red flags. Many users have reported difficulties when trying to withdraw their funds, often facing unexplained delays or additional charges. This lack of transparency in fee structures could indicate that FxTime employs tactics to maximize its profits at the expense of its clients.

Customer Fund Safety

The safety of customer funds is paramount when evaluating any broker. FxTime's lack of regulation and transparency raises significant concerns regarding the security of client funds. Regulated brokers are typically required to maintain segregated accounts, ensuring that client funds are kept separate from the broker's operational funds. This practice helps protect clients in the event of bankruptcy or financial mismanagement.

Unfortunately, FxTime does not provide any information regarding its fund security measures. There is no indication of whether client funds are held in segregated accounts or if the broker participates in any investor protection schemes. The absence of negative balance protection is another alarming factor, as it exposes traders to the risk of losing more than their initial investment.

Additionally, there have been reports of historical issues related to fund security and withdrawal difficulties. Clients have expressed frustration over their inability to access their funds, often citing excessive fees and bureaucratic hurdles. Such experiences highlight the potential risks associated with trading on unregulated platforms like FxTime, further emphasizing the need for caution.

Customer Experience and Complaints

Client feedback plays a crucial role in assessing the reliability of a broker. In the case of FxTime, numerous negative reviews and complaints have surfaced, painting a troubling picture of the broker's operations. Many clients report difficulties in withdrawing their funds, with some experiencing significant delays and unexplained fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Minimal |

| High Fees | High | Ignored |

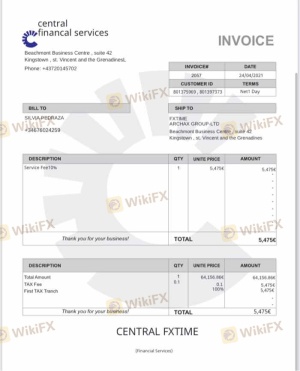

Common complaints revolve around withdrawal issues, where clients have reported being pressured to deposit more funds before being allowed to withdraw their initial investments. This pattern of behavior is characteristic of scam brokers, who often employ tactics to extract additional funds from clients.

One typical case involved a trader who deposited $5,000 but faced multiple hurdles when attempting to withdraw their profits. The broker claimed that additional deposits were necessary to process the withdrawal, leading to frustration and financial loss. Such experiences highlight the risks associated with trading with FxTime and underscore the importance of thorough research before engaging with any broker.

Platform and Trade Execution

The trading platform offered by FxTime is a web-based solution that lacks the sophistication and features found in industry-standard platforms like MetaTrader 4 or 5. Users have reported that the platform is basic, with limited functionality and a lack of advanced trading tools.

Moreover, the quality of order execution has come under scrutiny, with some traders experiencing significant slippage and rejected orders. These issues can severely impact trading performance and profitability, raising questions about the broker's ability to provide a reliable trading environment.

There are also concerns about potential platform manipulation, as some users have alleged that the broker may engage in practices that disadvantage clients. Such claims are serious and warrant further investigation, particularly given the broker's lack of transparency and regulatory oversight.

Risk Assessment

Using FxTime presents a range of risks that traders must consider before opening an account. The lack of regulation, transparency, and poor customer feedback contribute to an overall high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about legitimacy. |

| Fund Security | High | Lack of segregation and negative balance protection. |

| Withdrawal Issues | High | Numerous complaints about withdrawal difficulties. |

| Trading Conditions | Medium | High fees and poor execution can erode profits. |

To mitigate these risks, potential clients are advised to thoroughly research their options and consider using regulated brokers with established reputations. Engaging with a broker that offers clear fee structures, robust fund protection measures, and responsive customer service can significantly reduce the likelihood of negative experiences.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that FxTime is a high-risk broker that exhibits several characteristics commonly associated with scams. The lack of regulatory oversight, transparency issues, and numerous client complaints raise significant concerns about the safety of funds and the overall reliability of the platform.

For traders considering whether to engage with FxTime, it is advisable to exercise extreme caution. Those seeking to enter the forex market should prioritize brokers that are well-regulated, transparent, and have positive client feedback.

If you are looking for reliable alternatives, consider brokers that are regulated by reputable authorities such as the FCA or CySEC. These brokers are more likely to provide a secure trading environment and protect your investments effectively. Ultimately, conducting thorough research and choosing a trustworthy broker is essential for a successful trading experience.

In summary, is FxTime safe? The overwhelming evidence suggests otherwise. Proceed with caution and consider your options carefully.

Is FXTIME a scam, or is it legit?

The latest exposure and evaluation content of FXTIME brokers.

FXTIME Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXTIME latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.