Is FXCC Markets Ltd safe?

Pros

Cons

Is FXCC Markets Ltd Safe or a Scam?

Introduction

FXCC Markets Ltd has positioned itself as a notable player in the forex trading landscape since its inception in 2010. With a focus on providing a transparent and competitive trading environment, FXCC aims to cater to both retail and professional traders. However, as the forex market is rife with potential pitfalls, it is essential for traders to carefully assess the credibility of any broker before committing their funds. This article aims to provide an objective analysis of FXCC Markets Ltd, investigating its regulatory status, company background, trading conditions, customer experience, and overall safety. Our evaluation is based on a comprehensive review of available online resources, user feedback, and industry standards.

Regulation and Legitimacy

The regulatory landscape surrounding a forex broker is critical in determining its safety and reliability. FXCC Markets Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) and operates under the European Markets in Financial Instruments Directive (MiFID). This regulatory framework is designed to protect traders and ensure fair trading practices. Below is a summary of FXCC's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 121/10 | Cyprus | Verified |

The CySEC regulation is significant as it imposes strict requirements on brokers, including capital adequacy, segregation of client funds, and regular reporting. However, it is essential to note that FXCC also operates through offshore entities, which may not offer the same level of protection. The company's regulatory history appears to be clean, with no significant compliance issues reported. Nevertheless, potential clients should be cautious of the inherent risks associated with trading through offshore brokers, as these entities often lack stringent oversight.

Company Background Investigation

FXCC Markets Ltd was founded in 2010 by a team of forex professionals with extensive industry experience. The company has its headquarters in Limassol, Cyprus, and operates additional offices in Vanuatu. FXCC is owned by FX Central Clearing Ltd, which adds a layer of complexity to its ownership structure. The management team boasts a wealth of experience in the financial markets, which contributes to the company's operational integrity.

In terms of transparency, FXCC provides a wealth of information on its website, including details about its regulatory status, trading conditions, and the variety of services offered. However, while the company presents itself as a trustworthy broker, the presence of offshore entities raises questions about the level of transparency and accountability. Traders should consider the implications of dealing with a broker that operates in multiple jurisdictions, especially those with less stringent regulatory frameworks.

Trading Conditions Analysis

FXCC Markets Ltd offers competitive trading conditions, particularly through its ECN XL account, which is known for its low spreads and zero commission structure. The broker operates on a spread-only model, which can be appealing to cost-conscious traders. Below is a comparison of FXCC's core trading costs against industry averages:

| Fee Type | FXCC Markets Ltd | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.0 - 0.3 pips | 1.0 - 1.5 pips |

| Commission Model | No Commission | Varies (0.1 - 0.5%) |

| Overnight Interest Range | Varies (Swap Fees) | Varies (Swap Fees) |

While FXCC's trading conditions are generally favorable, it is essential for traders to be aware of any hidden fees or unusual policies. For example, the broker charges an inactivity fee of $5 per month after three months of no trading activity. This policy could be a concern for traders who may not be active all the time. Overall, FXCC's fee structure appears competitive, but potential clients should read the fine print to avoid unexpected costs.

Customer Fund Safety

The safety of client funds is a paramount concern for any trader. FXCC Markets Ltd employs several measures to ensure the security of its clients' investments. The broker segregates client funds from its operational funds, which is a standard practice among regulated brokers. Additionally, FXCC is a member of the Investor Compensation Fund (ICF), which provides an additional layer of protection for clients in the event of insolvency.

Despite these measures, the presence of offshore entities raises questions about the overall safety of client funds. Traders should be aware that while CySEC provides a robust regulatory framework, the same cannot be said for the Vanuatu Financial Services Commission (VFSC), which has less stringent oversight. Therefore, while FXCC appears to have strong safety measures in place, traders should conduct their due diligence and consider the risks associated with offshore operations.

Customer Experience and Complaints

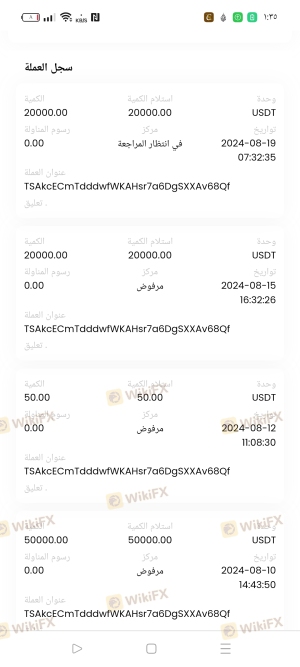

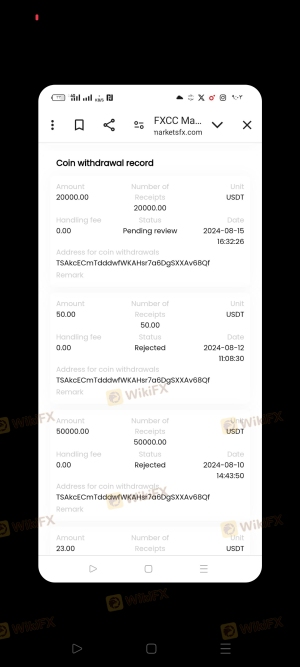

Customer feedback is an invaluable resource when assessing a broker's reliability. Overall, FXCC Markets Ltd has received mixed reviews from its clients. Many users praise the broker for its competitive trading conditions and fast execution speeds. However, there are also numerous complaints regarding withdrawal issues and customer service responsiveness. Below is a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed Responses |

| Poor Customer Service | Medium | Generally Slow |

| Misleading Promotions | High | Inconsistent |

One notable case involved a trader who reported difficulties withdrawing funds, claiming the broker requested additional documentation multiple times, leading to significant delays. Such experiences can undermine trust and raise concerns about the broker's operational practices. While FXCC has mechanisms in place for addressing complaints, the consistency and quality of their responses appear to vary.

Platform and Trade Execution

FXCC Markets Ltd utilizes the widely popular MetaTrader 4 (MT4) platform, known for its reliability and advanced trading features. The platform is user-friendly and supports various trading strategies, including scalping and automated trading. However, the absence of a web-based trading platform may limit accessibility for some traders.

In terms of order execution, FXCC claims to provide a no-dealing desk environment, which theoretically minimizes the risk of slippage and re-quotes. However, some users have reported instances of slippage, particularly during volatile market conditions. While the broker's execution model aims to enhance transparency, traders should remain vigilant and monitor their trades closely.

Risk Assessment

Using FXCC Markets Ltd comes with a set of inherent risks that traders should consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Presence of offshore entities could pose risks. |

| Withdrawal Issues | High | Numerous complaints about delays and complications. |

| Market Risk | High | High leverage can amplify losses. |

| Customer Support | Medium | Inconsistent response times reported. |

To mitigate these risks, traders should ensure they fully understand the terms and conditions of their accounts, maintain clear communication with customer service, and consider starting with smaller amounts to gauge the broker's reliability.

Conclusion and Recommendations

In conclusion, FXCC Markets Ltd presents a mixed picture when it comes to safety and reliability. While the broker is regulated by CySEC and offers competitive trading conditions, the presence of offshore operations and numerous customer complaints about withdrawals and service responsiveness warrant caution.

Traders should approach FXCC with a balanced perspective, weighing the benefits of low costs and favorable trading conditions against the potential risks associated with offshore regulation. For those looking for alternative options, brokers with strong regulatory oversight, such as IG or OANDA, may provide a more secure trading environment.

Ultimately, it is essential for traders to conduct thorough research and consider their own risk tolerance before engaging with FXCC Markets Ltd.

Is FXCC Markets Ltd a scam, or is it legit?

The latest exposure and evaluation content of FXCC Markets Ltd brokers.

FXCC Markets Ltd Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXCC Markets Ltd latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.