MGS Finance 2025 Review: Everything You Need to Know

Summary

MGS Finance presents a concerning case in the forex brokerage landscape. It earns an overall negative assessment due to its lack of legitimate regulatory authorization and consistently poor user feedback. This mgs finance review reveals that while the broker claims to offer diverse trading instruments including forex, stocks, indices, cryptocurrencies, and commodity CFDs, it fundamentally lacks the transparent trading conditions and regulatory compliance that serious traders require.

The broker primarily targets investors seeking diversified trading opportunities across multiple asset classes. However, potential clients must exercise extreme caution when considering MGS Finance. Multiple regulatory warnings and widespread negative user experiences raise significant red flags about the platform's legitimacy and operational integrity.

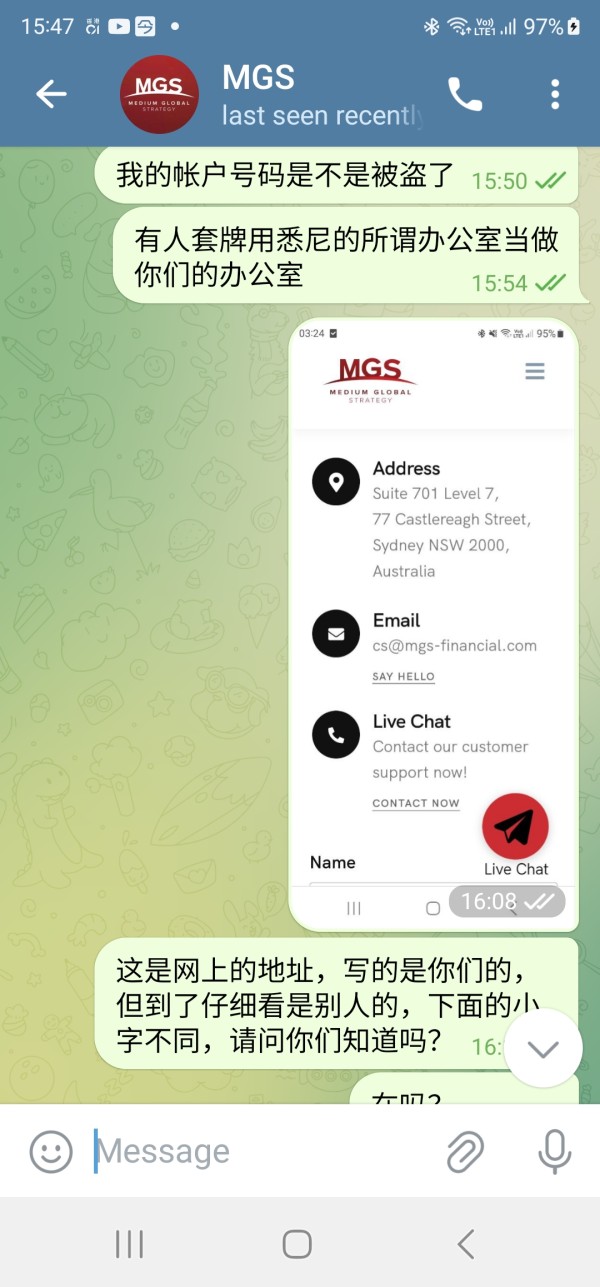

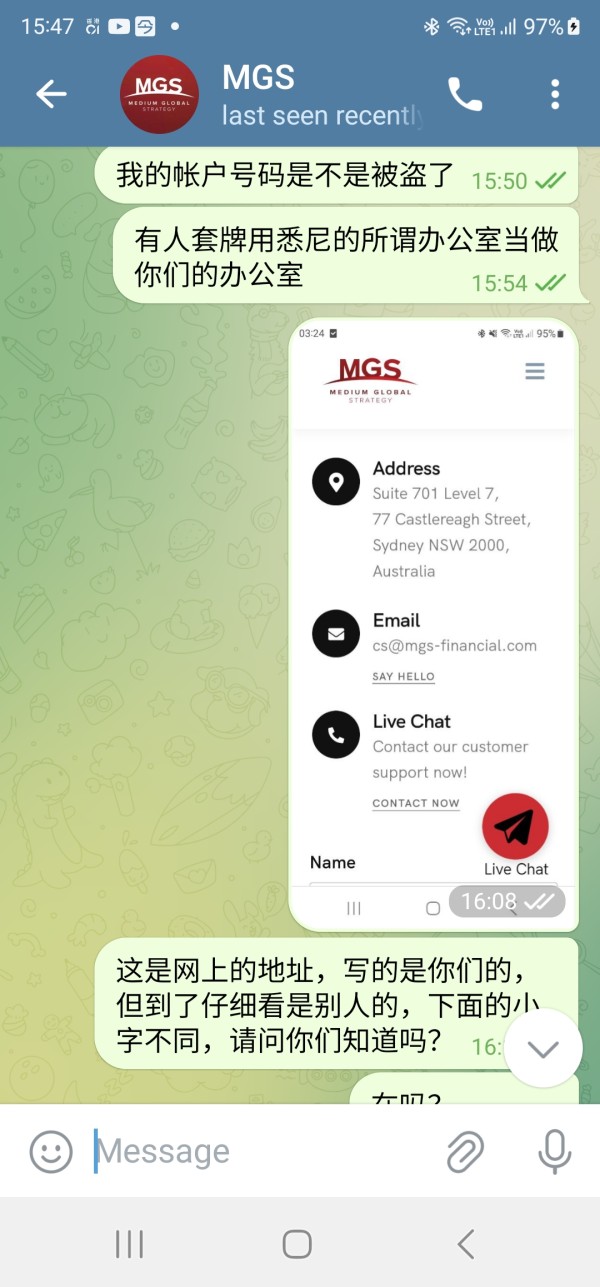

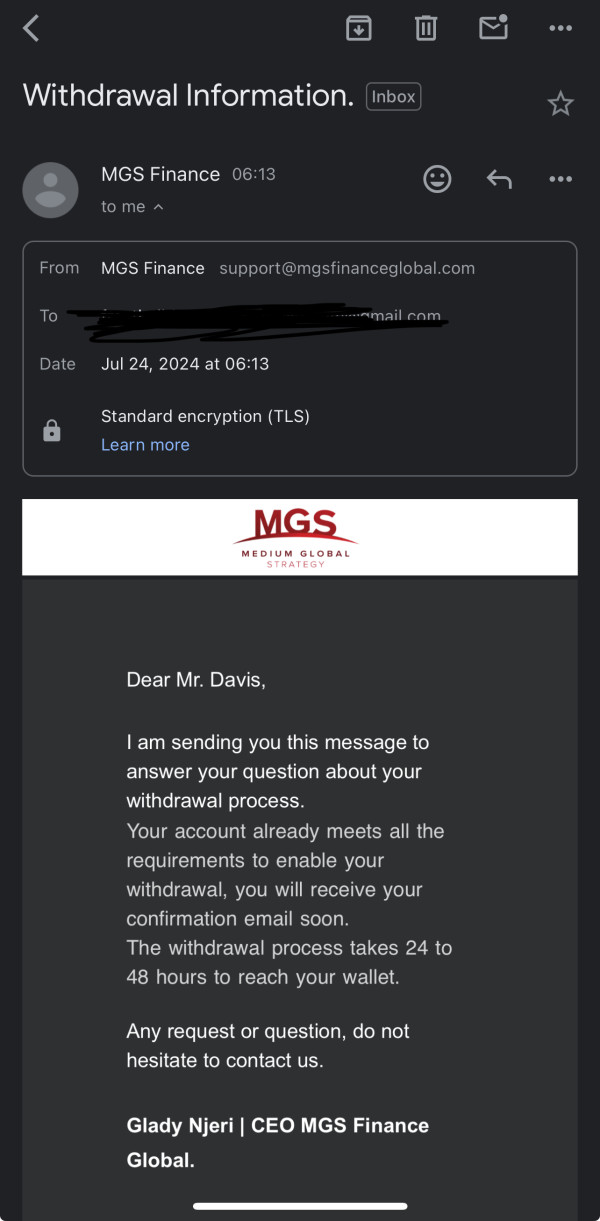

Our investigation reveals that MGS Finance operates as an offshore broker without proper licensing, despite claims of regulatory oversight. The Financial Markets Authority (FMA) has issued specific warnings regarding this broker's unauthorized operations, while user testimonials consistently highlight problems with customer service, platform reliability, and withdrawal processes. These factors combine to create a trading environment that poses substantial risks to investor capital and trading success.

Important Notice

Regional Entity Differences: MGS Finance claims to operate under Australian Securities and Investments Commission (ASIC) regulation. However, verification reveals that the company has not obtained the necessary licenses from this authority. Additionally, the Financial Markets Authority (FMA) has issued official warnings stating that MGS Finance is not registered and lacks legitimate authorization to provide financial services in their jurisdiction.

Review Methodology: This comprehensive evaluation is based on publicly available regulatory information, user feedback from multiple sources, and industry reports. Our analysis aims to provide objective insights while highlighting both potential benefits and significant risks associated with this broker.

Rating Framework

Broker Overview

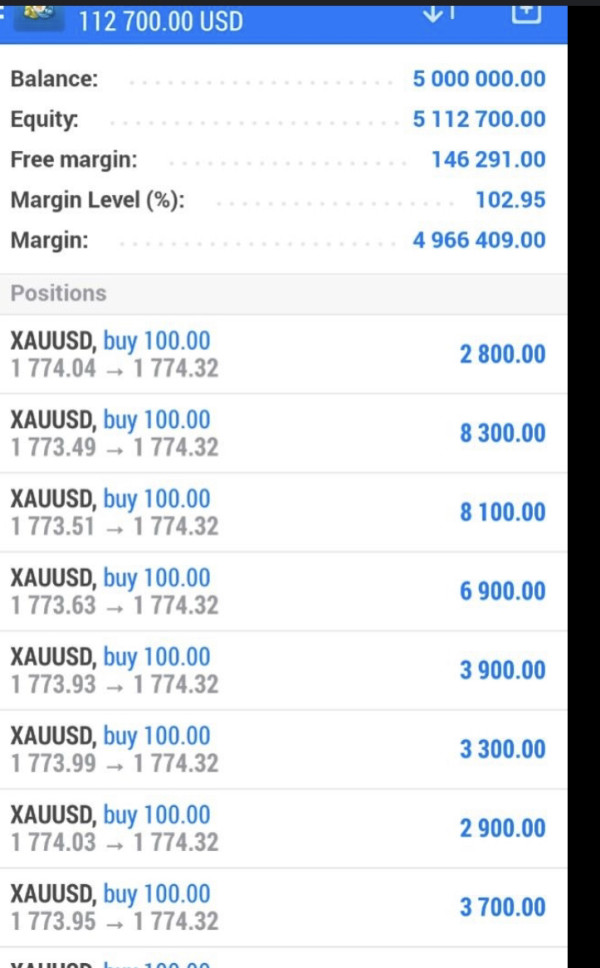

MGS Finance operates as an offshore brokerage firm. It has attracted attention primarily for regulatory concerns rather than trading excellence. While the establishment date remains unclear from available documentation, the broker positions itself as a provider of Contract for Difference (CFD) trading services across multiple asset classes. The company's business model focuses on offering leveraged trading opportunities in forex, equities, indices, cryptocurrencies, and commodities, though specific operational details remain largely unclear.

The broker's claimed regulatory status has become a major point of concern. Discrepancies exist between their marketing claims and actual regulatory verification. Multiple financial watchdog organizations have flagged MGS Finance for operating without proper authorization, creating a significant trust deficit that potential clients must carefully consider.

This mgs finance review indicates that while the broker attempts to present itself as a comprehensive trading solution, fundamental issues with transparency, regulatory compliance, and customer satisfaction create substantial barriers to recommendation. The platform's approach to client onboarding and service delivery has consistently failed to meet industry standards. This results in widespread negative feedback from the trading community.

Regulatory Status: MGS Finance claims ASIC regulation but lacks verified licensing. The FMA has specifically warned that this broker operates without registration and proper authorization, creating legal and financial risks for clients.

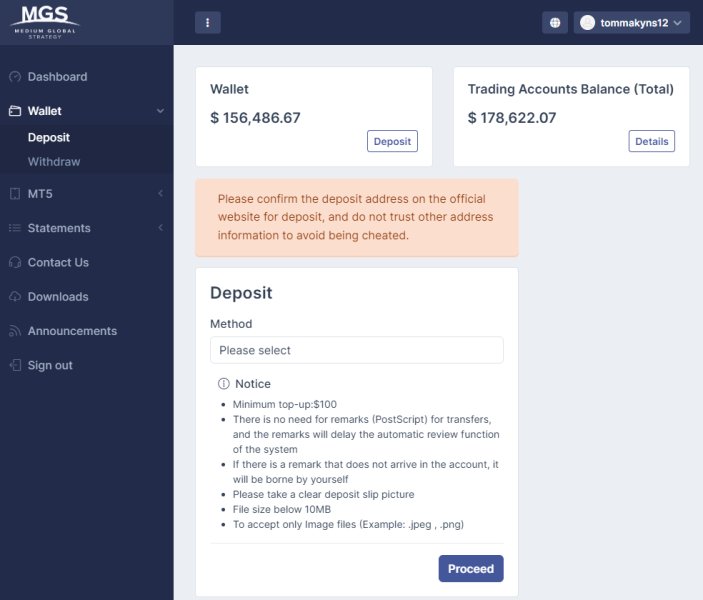

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available documentation. This raises transparency concerns about fund management procedures.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit requirements in accessible materials. This makes it difficult for potential clients to assess entry barriers.

Bonus and Promotional Offers: Available documentation does not mention specific bonus structures or promotional campaigns. This lack of information may indicate either absence of such programs or poor marketing transparency.

Tradeable Assets: The platform offers CFD trading across forex pairs, stock indices, individual equities, major cryptocurrencies, and commodity markets. This provides theoretical diversification opportunities despite regulatory concerns.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This creates uncertainty about the true cost of trading with this broker and makes cost comparison with legitimate alternatives impossible.

Leverage Ratios: Specific leverage offerings are not detailed in available materials. This prevents assessment of risk management parameters.

Platform Options: The trading platform technology and software solutions are not specifically identified in available documentation.

Geographic Restrictions: Information about regional trading restrictions and availability is not clearly specified.

Customer Service Languages: Available documentation does not specify supported languages for customer service interactions.

This mgs finance review highlights the concerning lack of transparency across multiple operational areas that typically require clear disclosure from legitimate brokers.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

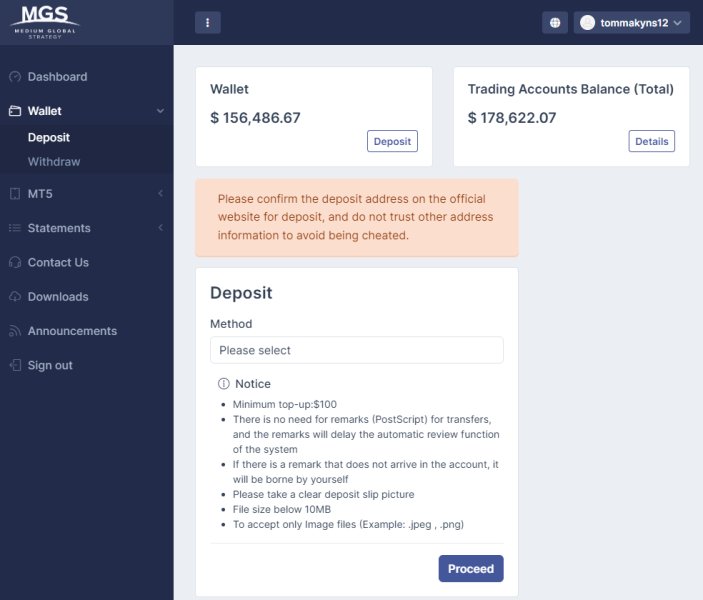

MGS Finance's account structure represents one of its most problematic areas. It earns a low score due to fundamental transparency issues. Available documentation fails to specify distinct account types, their respective features, or the requirements for accessing different service levels. This lack of clarity creates immediate concerns for potential clients who need clear information to make informed decisions about their trading arrangements.

The absence of disclosed minimum deposit requirements further complicates the evaluation process. Legitimate brokers typically provide transparent information about entry barriers, allowing traders to assess whether the platform suits their financial capacity. MGS Finance's failure to communicate these basic parameters suggests either poor operational organization or deliberate hiding of important terms.

User feedback consistently indicates dissatisfaction with the account opening process. Users describe it as unnecessarily complex and lacking proper documentation. Several reports suggest that clients encounter unexpected requirements or conditions that were not clearly communicated during initial marketing interactions. This mgs finance review finds that the broker's approach to account management falls significantly short of industry standards.

The platform's failure to mention specialized account options, such as Islamic trading accounts or professional trader classifications, further limits its appeal to diverse trading communities. Compared to established brokers that offer multiple account tiers with clearly defined benefits and requirements, MGS Finance's approach appears unprofessional and potentially problematic for serious traders seeking reliable trading relationships.

MGS Finance receives a moderate score for tools and resources primarily due to its claimed offering of multiple CFD trading categories. However, specific details about tool quality and functionality remain largely undisclosed. The broker advertises access to forex, stock, index, cryptocurrency, and commodity trading, suggesting a comprehensive asset selection that could appeal to diversification-focused traders.

However, the platform's failure to detail specific research capabilities, market analysis tools, or educational resources significantly undermines its value proposition. Professional traders typically require access to technical analysis software, economic calendars, market news feeds, and educational materials to support their trading decisions. The absence of clear information about these critical resources raises questions about the platform's commitment to trader success.

User feedback regarding available tools indicates mixed experiences. Some traders note access to basic charting capabilities while others report limitations in advanced analytical functions. The lack of detailed documentation about automated trading support, expert advisors, or algorithmic trading capabilities further restricts the platform's appeal to sophisticated trading strategies.

When compared to established brokers that provide comprehensive educational libraries, webinar series, and dedicated research teams, MGS Finance's resource offering appears inadequate. The platform's failure to highlight unique tools or proprietary research capabilities suggests limited investment in trader development and market analysis infrastructure.

Customer Service and Support Analysis (Score: 4/10)

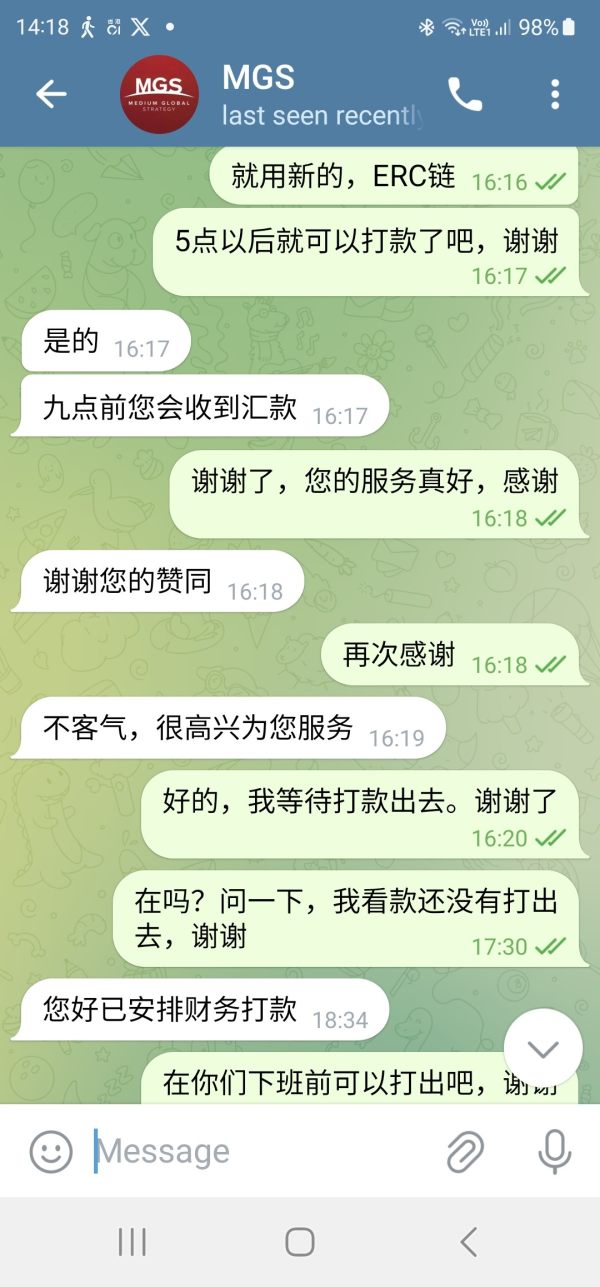

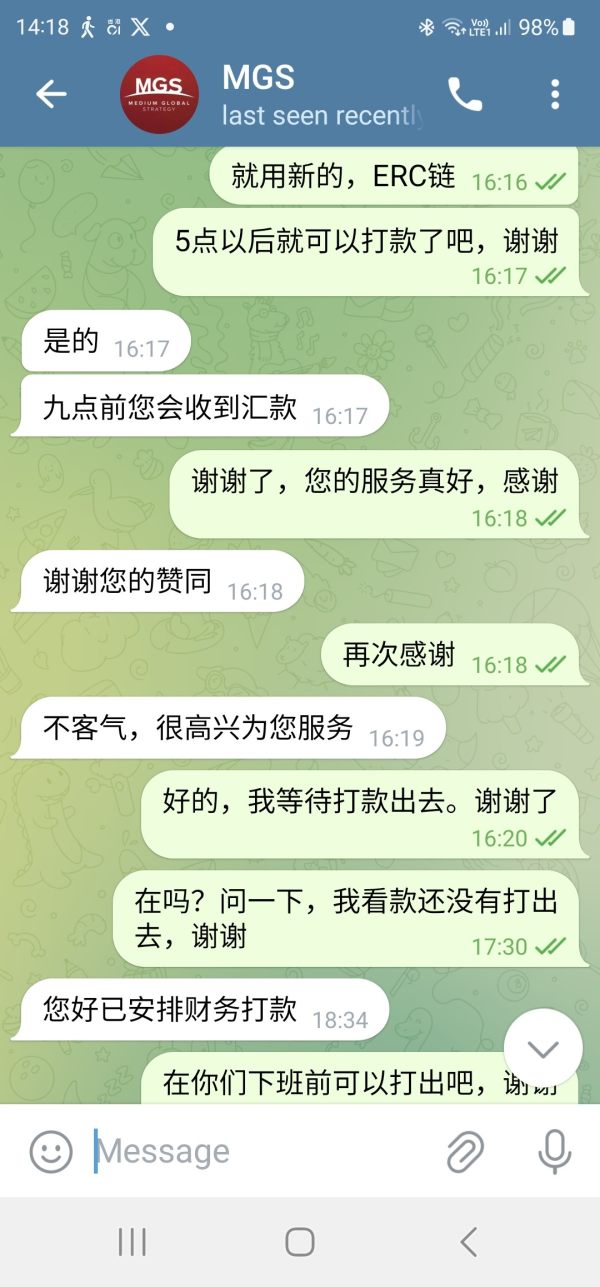

Customer service represents a critical weakness for MGS Finance. User feedback consistently highlights poor response times, limited problem-solving capabilities, and inadequate professional support. Available documentation fails to specify customer service channels, operating hours, or response time commitments, creating uncertainty about support availability when traders encounter issues.

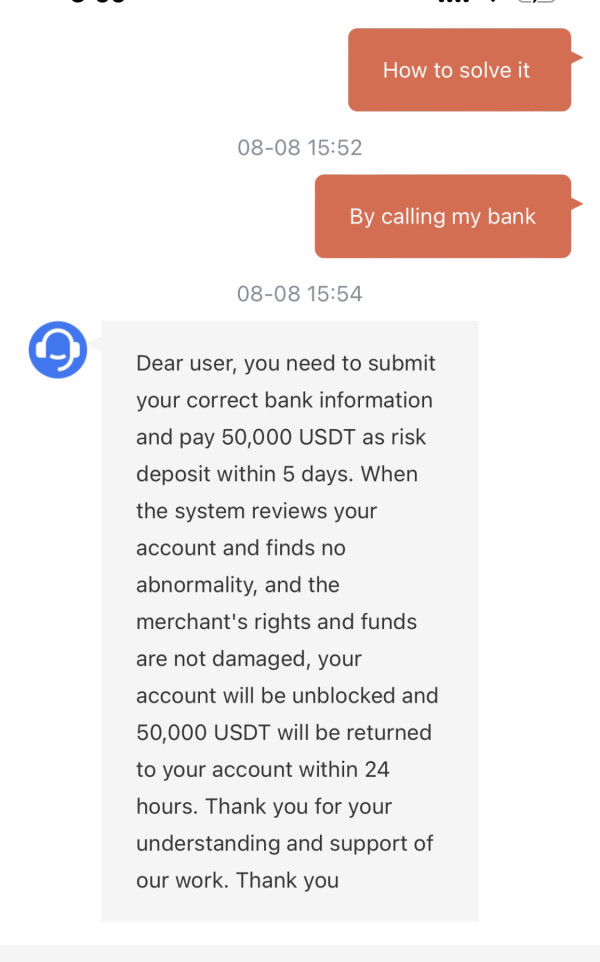

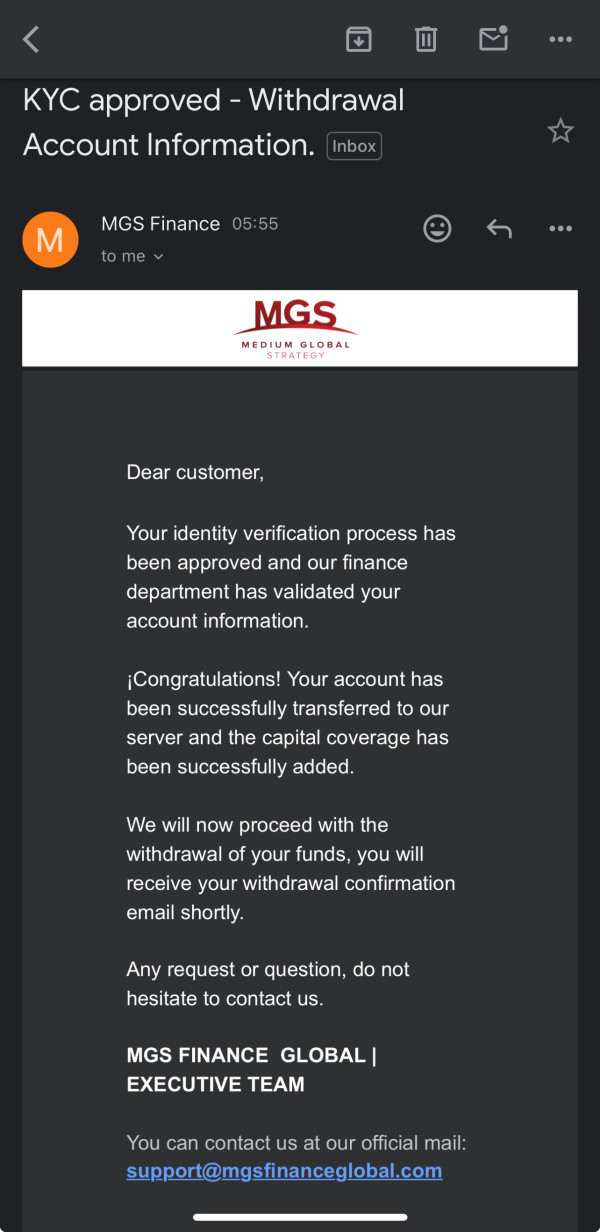

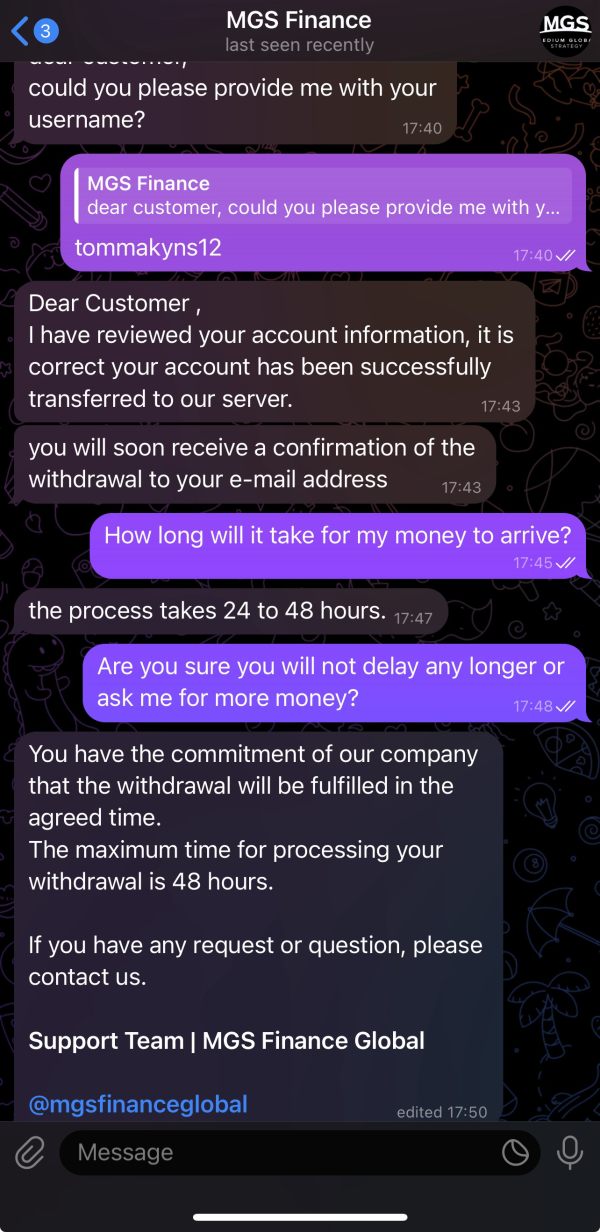

Multiple user reports describe frustrating experiences with customer service representatives who appear to lack adequate training or authority to resolve common trading problems. Complaints frequently mention lengthy delays in receiving responses to inquiries, particularly regarding account verification, withdrawal processing, and technical platform issues. These service deficiencies create additional stress for traders who require timely assistance.

The absence of clearly specified multilingual support capabilities further limits the broker's accessibility to international traders. Professional brokers typically provide customer service in multiple languages with native speakers who understand cultural nuances and can communicate complex financial concepts effectively. MGS Finance's failure to highlight these capabilities suggests limited international service infrastructure.

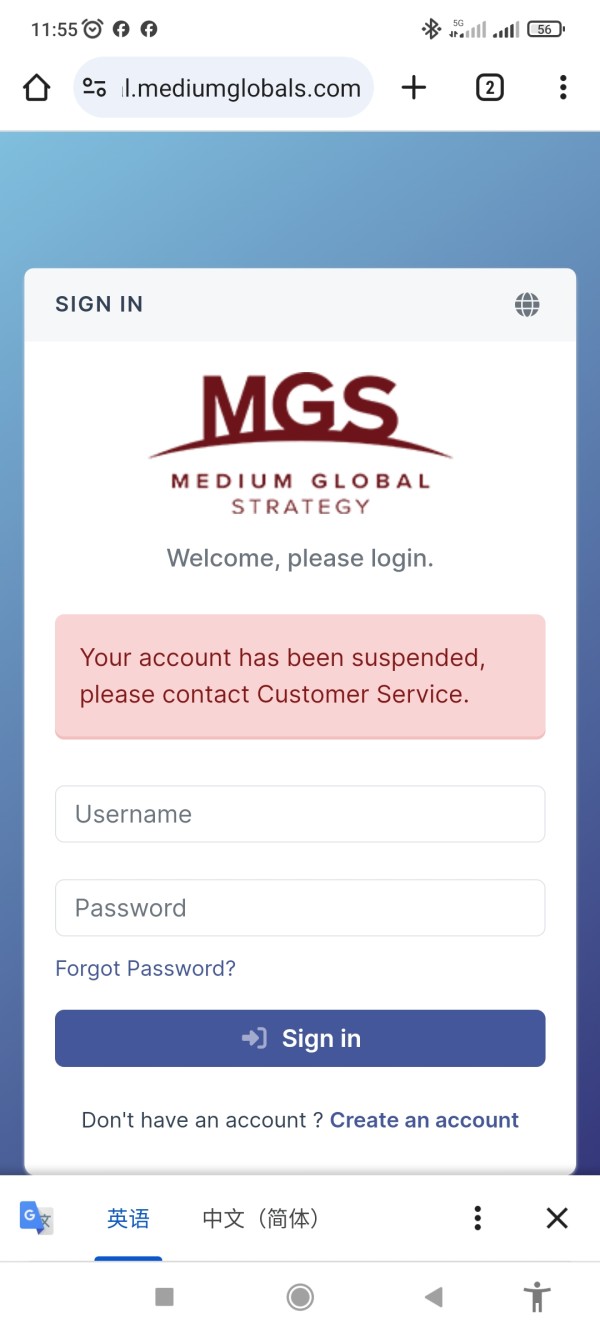

User testimonials consistently express disappointment with the overall customer service experience. They note that representatives often provide generic responses that fail to address specific concerns. The platform's apparent inability to resolve withdrawal issues and account access problems has generated significant negative feedback across multiple review platforms, indicating systematic customer service problems rather than isolated incidents.

Trading Experience Analysis (Score: 4/10)

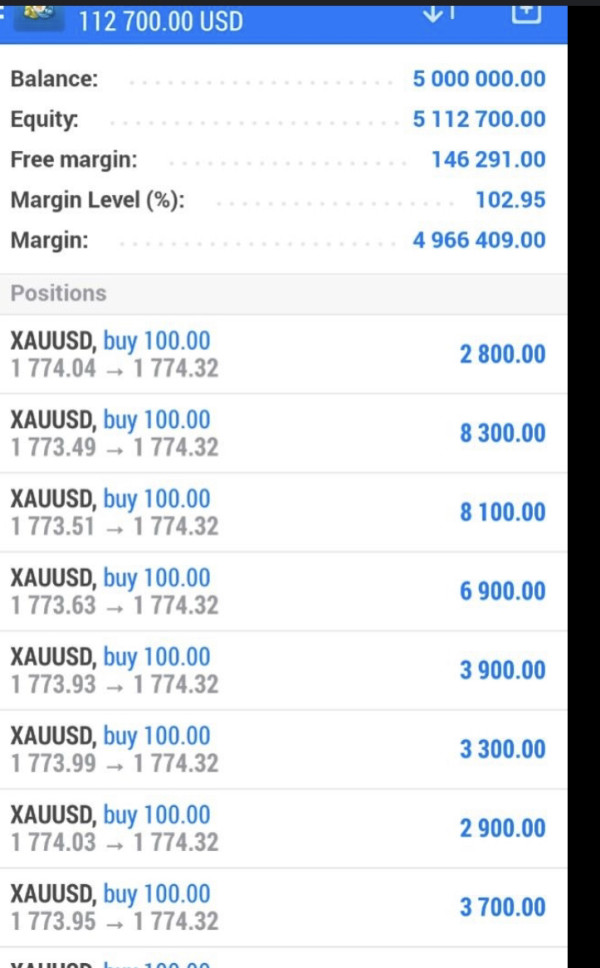

The trading experience with MGS Finance receives a below-average rating due to multiple user-reported issues with platform stability, order execution quality, and overall trading environment reliability. Traders have expressed concerns about platform performance during volatile market conditions. This suggests inadequate technical infrastructure to support consistent trading operations.

User feedback indicates problems with slippage and requotes, particularly during high-impact news events and market opening hours. These execution issues can significantly impact trading profitability and strategy effectiveness, creating frustration for traders who require reliable order processing. The absence of detailed execution statistics or transparency reports makes it difficult to assess the true quality of trade execution.

Platform functionality concerns include reports of limited charting tools, inadequate technical indicators, and poor mobile trading experiences. Modern traders expect sophisticated analytical capabilities and seamless cross-device functionality, areas where MGS Finance appears to fall short of contemporary standards. The lack of detailed platform specifications or feature demonstrations further complicates assessment of trading capabilities.

This mgs finance review reveals that trading environment concerns extend beyond technical issues to include questions about pricing transparency and spread competitiveness. Users report uncertainty about trading costs and hidden fees, while the absence of published spread comparisons or commission structures makes it impossible to evaluate cost-effectiveness against established alternatives.

Trust and Safety Analysis (Score: 2/10)

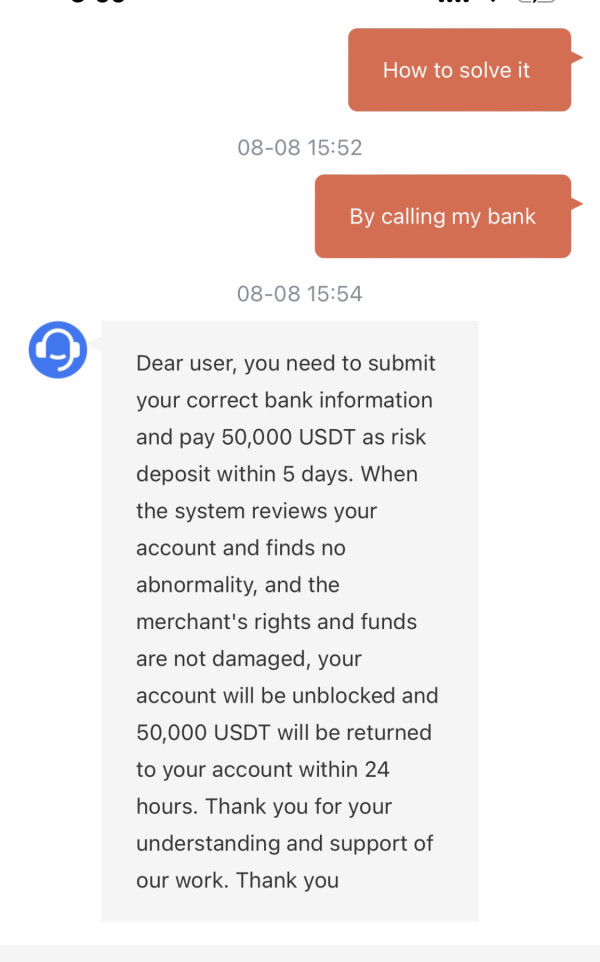

Trust and safety represent MGS Finance's most significant weakness. It earns the lowest score due to fundamental regulatory compliance failures and widespread industry warnings. The broker's lack of legitimate regulatory authorization creates immediate legal and financial risks for potential clients, as unregulated brokers offer no investor protection or recourse mechanisms.

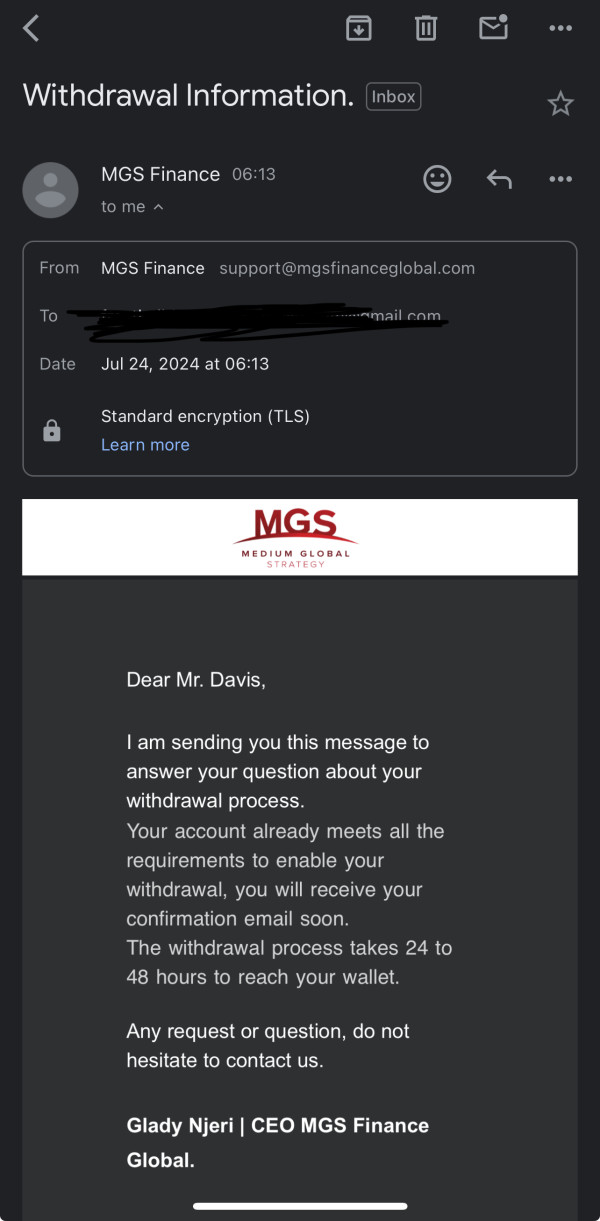

The Financial Markets Authority's specific warning about MGS Finance's unauthorized operations provides clear evidence of regulatory non-compliance. This official warning, combined with the broker's false claims about ASIC regulation, demonstrates a pattern of misleading marketing that undermines trust and suggests potential fraudulent intent. Legitimate brokers maintain transparent regulatory relationships and provide verifiable licensing information.

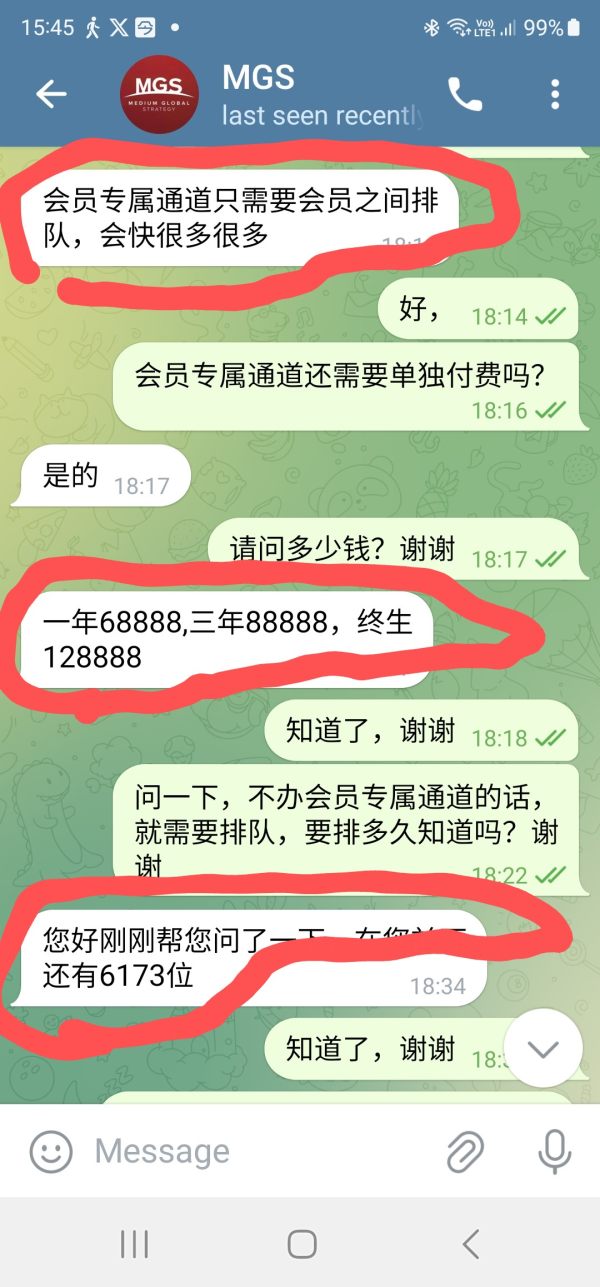

Multiple industry websites have classified MGS Finance as a potential scam broker. This reflects widespread concern about the platform's legitimacy and operational practices. These warnings typically result from investigations into regulatory status, user complaints, and business practice analysis, indicating serious red flags that extend beyond simple regulatory oversights.

The absence of disclosed fund safety measures, such as segregated client accounts, deposit insurance, or third-party auditing, further compromises client protection. Established brokers typically maintain transparent fund management practices and provide detailed information about client money protection, areas where MGS Finance offers no assurance or documentation.

User Experience Analysis (Score: 3/10)

Overall user experience with MGS Finance receives a poor rating based on consistently negative feedback across multiple evaluation criteria. Users report widespread dissatisfaction with platform usability. They describe interfaces as confusing and lacking intuitive navigation features that facilitate efficient trading operations.

The registration and account verification process has generated numerous complaints about complexity, unclear requirements, and excessive documentation demands. Several users report experiencing unexpected delays and additional verification steps that were not communicated during initial signup, creating frustration and suggesting poor process design or deliberate obstruction tactics.

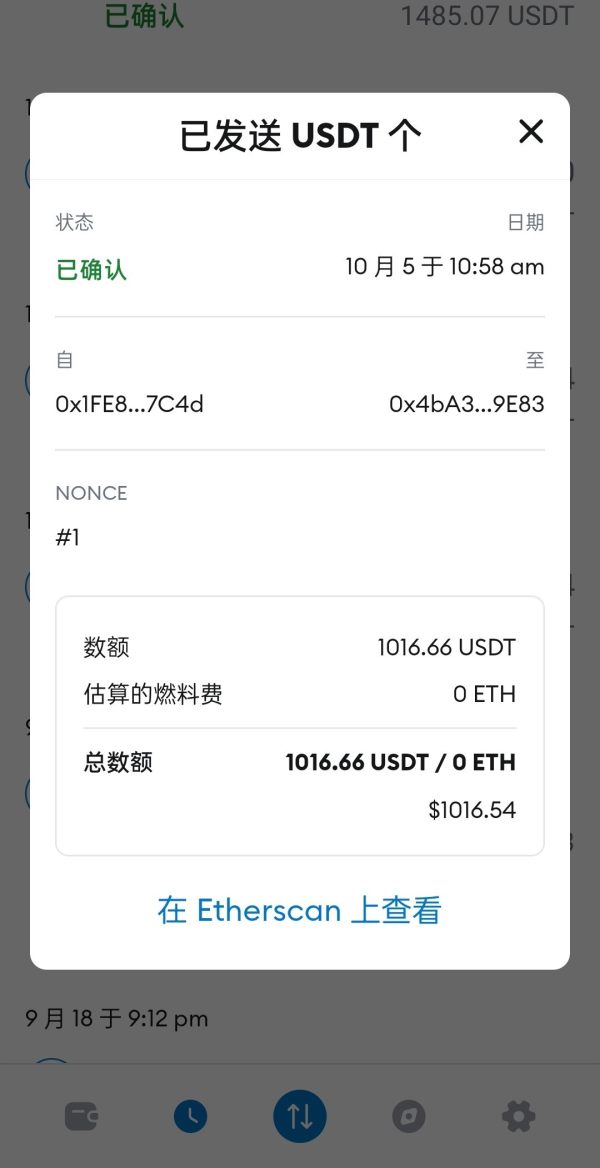

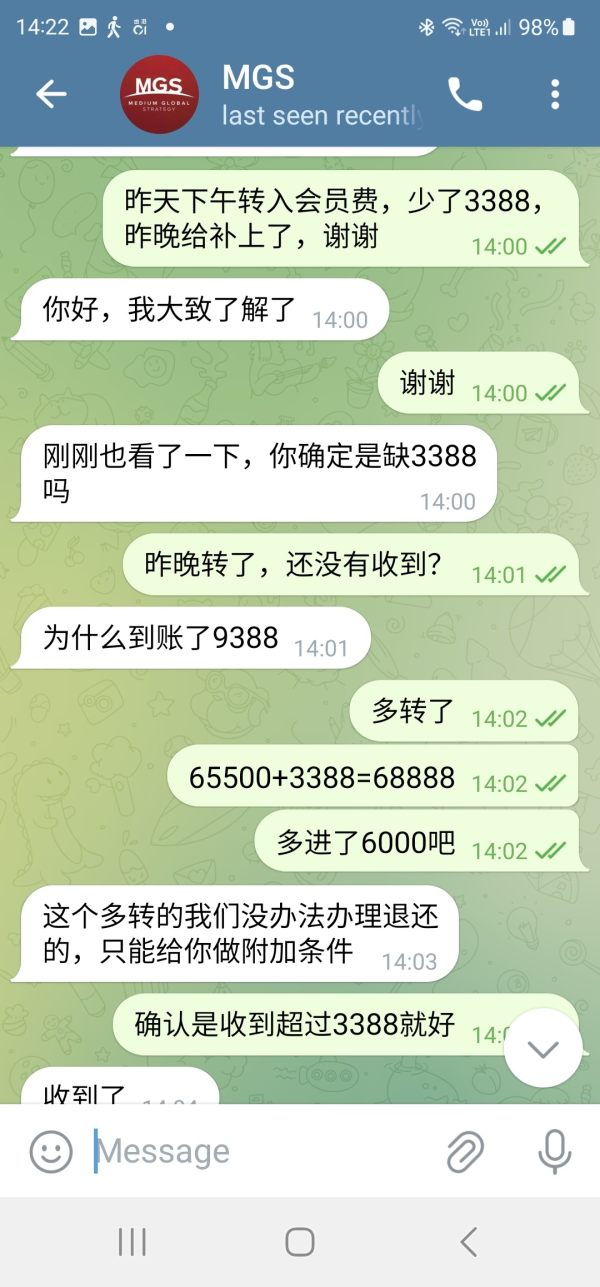

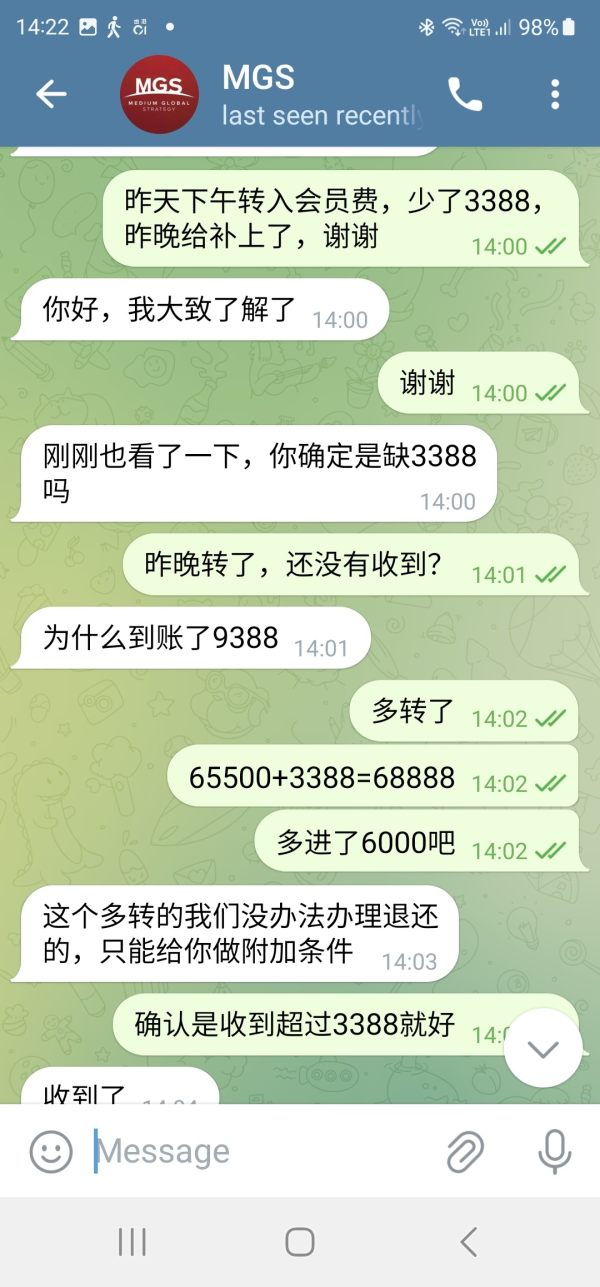

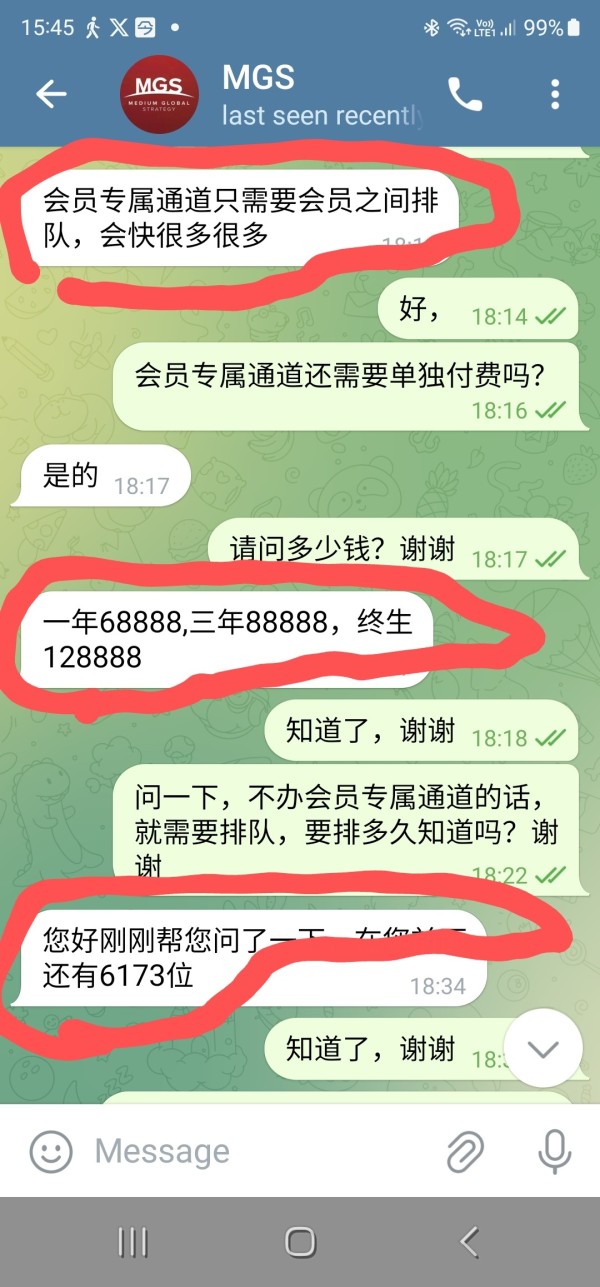

Fund management experiences represent a particular source of user dissatisfaction. Multiple reports describe complicated deposit procedures and significant withdrawal delays. These operational issues create stress and uncertainty for traders who require reliable access to their capital, while the absence of clear fund management policies compounds these concerns.

Common user complaints focus on the platform's legitimacy concerns and service quality issues. Many traders express regret about choosing MGS Finance over established alternatives. The concentration of negative feedback across multiple review platforms suggests systematic problems rather than isolated incidents, indicating fundamental operational and customer service deficiencies that affect the majority of users.

Conclusion

This comprehensive mgs finance review concludes with a strong negative recommendation. It cites fundamental regulatory compliance failures and widespread operational deficiencies. MGS Finance's lack of legitimate regulatory authorization, combined with official warnings from financial authorities, creates unacceptable risks for traders regardless of their experience level or risk tolerance.

While the broker claims to offer diversified trading opportunities across multiple asset classes, the absence of regulatory protection, transparent trading conditions, and reliable customer support far outweighs any potential benefits. The platform appears unsuitable for serious traders who prioritize capital safety, regulatory compliance, and professional service standards.

Traders seeking legitimate forex and CFD trading opportunities should consider established, properly regulated brokers that provide transparent operations, verified regulatory compliance, and positive user experiences. The risks associated with MGS Finance significantly exceed any potential advantages, making it an inappropriate choice for responsible trading activities.