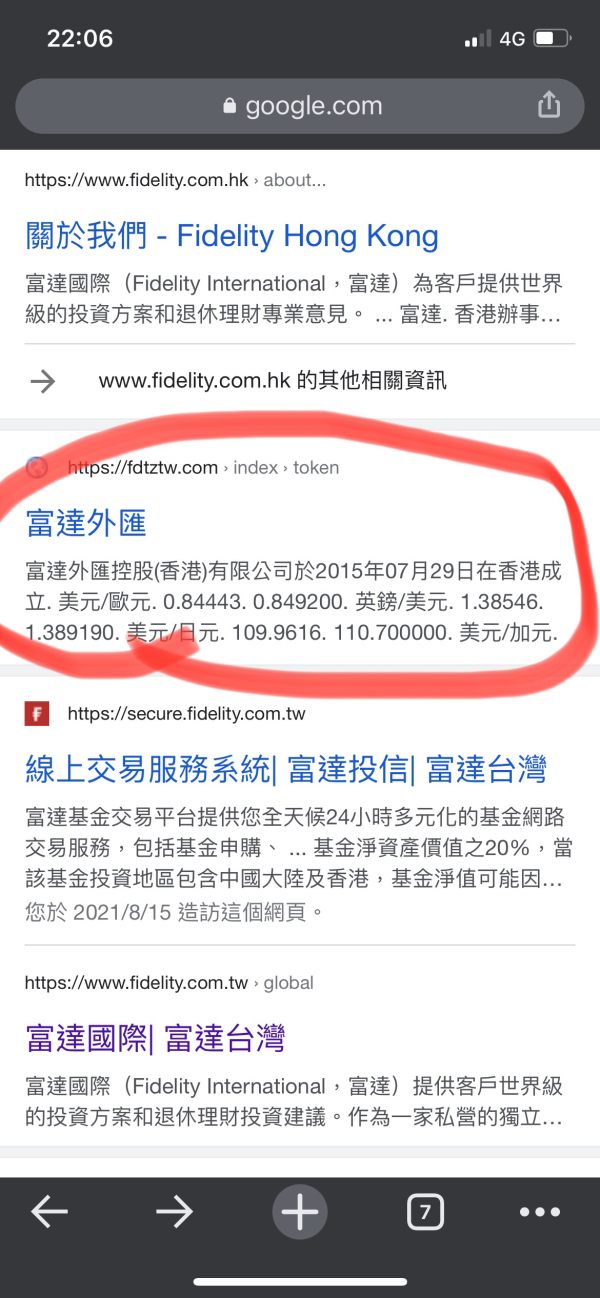

Fuda 2025 Review: Everything You Need to Know

Executive Summary

This fuda review looks at a broker with very little public information available. This makes it hard to give a complete review of their services. Based on what we can find, Fuda connects to Fuda Group USA Corp, which is a New York company that works with gold trading and collecting gold tailings. The company also runs smaller companies like Fuda Gold UK Limited and Marvel Investment Corporation Limited. These smaller companies trade fluorite, graphite, and granite.

The broker seems to focus mainly on precious metals and minerals trading, especially gold products. However, we don't know much about their forex trading abilities, whether they follow regulations, or what standard broker services they offer. The company says it focuses strongly on investor relations and has advantages in the precious metals and minerals business.

The target customers seem to be individual and business traders who want to trade gold and commodities. But since we don't have detailed service information, it's hard to know exactly who would use this broker. Since we don't have clear regulatory information or user reviews, potential clients should be very careful and do thorough research before working with this broker.

Important Notice

This review uses limited information about Fuda as a forex and trading broker. The company seems to have different parts operating in various countries, which may mean different rules and services depending on where you live. Fuda Group USA Corp works from New York, while smaller operations exist in the UK and other places.

Our review method uses public information, regulatory databases, and user feedback when we can find it. However, the limited data for this broker means this review may not cover all parts of the user experience or service quality that potential clients might see.

Rating Framework

Broker Overview

Fuda Group USA Corp is a specialized financial company based in New York that focuses mainly on gold trading and precious metals collection. According to the information we have, the company has built itself up in the precious metals and minerals industry with a special focus on gold tailings collection. The organization works through multiple smaller companies, including Fuda Gold UK Limited and Marvel Investment Corporation Limited, which helps it reach different geographical markets and commodity sectors.

The company's business model centers on trading activities with precious metals and minerals. It has documented involvement in fluorite, graphite, and granite trading through its smaller company operations. This varied approach to commodity trading suggests a broader scope than traditional forex brokers, though specific details about currency trading abilities remain unclear from available sources.

The operational structure shows a commitment to investor relations and keeping competitive advantages within the precious metals sector. However, standard forex brokerage services such as currency pairs, CFDs, or traditional retail trading platforms are not clearly detailed in the accessible information. This fuda review must therefore focus on the limited available data while acknowledging significant information gaps about conventional brokerage operations.

Regulatory Status: Available information does not specify particular regulatory authorities watching over Fuda's operations. The company operates from New York and has UK smaller companies that may fall under respective jurisdictional frameworks.

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and supported payment systems is not detailed in available sources.

Minimum Deposit Requirements: Current sources do not specify minimum account funding requirements or different account tier structures.

Bonuses and Promotions: No information about welcome bonuses, trading incentives, or promotional offers is available in accessible materials.

Tradeable Assets: Primary focus appears to be on gold and related precious metals. Smaller company involvement in fluorite, graphite, and granite trading exists, though specific instrument availability is not detailed.

Cost Structure: Spreads, commissions, overnight fees, and other trading costs are not specified in available information sources.

Leverage Ratios: Maximum leverage offerings and margin requirements are not documented in accessible materials.

Platform Options: Specific trading platforms, whether proprietary or third-party solutions, are not identified in current information sources.

Geographic Restrictions: Service availability and regional limitations are not clearly outlined in available data.

Customer Support Languages: Supported communication languages and regional support capabilities are not specified in accessible sources.

This fuda review highlights the significant information gaps that potential clients should be aware of when considering this broker.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for Fuda presents big challenges due to limited available information. Standard brokerage account types, such as demo accounts, standard accounts, premium accounts, or professional trader accounts, are not detailed in accessible sources. This lack of transparency about account structures makes it difficult for potential clients to understand what options might be available to them.

Minimum deposit requirements, which are crucial for trader decision-making, remain unspecified in available materials. Most reputable brokers clearly outline their account funding requirements, ranging from low-barrier entry accounts to high-minimum premium services. The absence of this information raises questions about the broker's transparency and client communication practices.

Account opening procedures, verification requirements, and onboarding processes are not documented in accessible sources. Modern brokers typically provide clear guidance on required documentation, verification timelines, and account activation procedures. The lack of such information may indicate either limited retail focus or insufficient public disclosure of operational procedures.

Special account features, such as Islamic swap-free accounts, managed accounts, or institutional trading arrangements, are not mentioned in available information. This gap makes it impossible to assess whether the broker accommodates diverse religious requirements or sophisticated trading needs.

The assessment of trading tools and resources available through Fuda remains largely unclear based on accessible information. Standard trading tools such as technical analysis indicators, charting packages, economic calendars, and market research are not specifically mentioned in available sources. This represents a significant information gap for traders who rely on comprehensive analytical resources.

Research and analysis capabilities, which form the backbone of informed trading decisions, are not detailed in current materials. Professional brokers typically offer market commentary, fundamental analysis, technical insights, and economic research to support client trading activities. The absence of such information makes it difficult to evaluate the broker's commitment to client education and market analysis.

Educational resources, including webinars, tutorials, trading guides, and market education materials, are not documented in accessible sources. These resources are increasingly important for both novice and experienced traders seeking to improve their market knowledge and trading skills.

Automated trading support, including Expert Advisor compatibility, API access, or algorithmic trading capabilities, is not addressed in available information. Modern traders often require sophisticated automation tools, making this information gap particularly relevant for technically-oriented clients.

Customer Service and Support Analysis

Customer service evaluation for Fuda faces substantial limitations due to insufficient available information about support structures and service quality. Standard support channels such as live chat, email support, telephone assistance, and help desk services are not detailed in accessible sources. This lack of transparency about client support mechanisms raises concerns about the broker's commitment to customer service.

Response time expectations and service level agreements are not documented in available materials. Professional brokers typically provide clear guidance on support availability, expected response times for different inquiry types, and escalation procedures for complex issues. The absence of such information makes it difficult for potential clients to set appropriate service expectations.

Service quality indicators, including customer satisfaction metrics, support team expertise levels, and problem resolution capabilities, are not available in current sources. These factors are crucial for understanding the actual client experience and support effectiveness.

Multilingual support capabilities and regional service teams are not specified in accessible information. Given the international nature of forex trading and the company's apparent multi-jurisdictional presence, language support and regional expertise become important considerations for diverse client bases.

Trading Experience Analysis

The evaluation of trading experience with Fuda encounters significant limitations due to insufficient information about platform performance and execution quality. Platform stability, which is crucial for consistent trading operations, cannot be assessed based on available sources. Traders require reliable platform uptime and consistent performance during various market conditions.

Order execution quality, including execution speed, slippage characteristics, and requote frequency, is not documented in accessible materials. These factors directly impact trading profitability and user satisfaction, making their absence particularly concerning for potential clients evaluating the broker.

Platform functionality and feature completeness cannot be properly assessed without specific information about the trading interface, available order types, risk management tools, and analytical capabilities. Modern traders expect comprehensive platform features that support various trading strategies and risk management approaches.

Mobile trading capabilities and application quality are not detailed in current sources. With increasing mobile trading adoption, the availability and quality of mobile platforms significantly impact user experience and trading flexibility.

Trust Factor Analysis

Trust assessment for Fuda faces substantial challenges due to limited regulatory and transparency information. Regulatory oversight, which forms the foundation of broker trustworthiness, is not clearly established in available sources. While the company operates from New York and has UK smaller companies, specific regulatory authorizations and compliance frameworks are not detailed.

Client fund protection measures, including segregated accounts, deposit insurance, and negative balance protection, are not documented in accessible materials. These protections are fundamental to client security and represent critical trust factors for potential users.

Company transparency regarding ownership structure, financial stability, and operational history is limited in available information. Established brokers typically provide comprehensive background information, regulatory disclosures, and corporate governance details to build client confidence.

Industry reputation and third-party recognition are not evident in current sources. Professional brokers often receive industry awards, regulatory recognition, or independent ratings that help establish credibility and market standing.

User Experience Analysis

User experience evaluation for Fuda remains largely impossible due to insufficient feedback and interface information in available sources. Overall user satisfaction metrics, which typically come from client surveys, review platforms, and feedback aggregation, are not accessible for this broker.

Interface design quality and usability cannot be assessed without specific information about platform layout, navigation structure, and user interface elements. Modern trading platforms require intuitive design and efficient workflow management to support effective trading operations.

Registration and verification processes are not detailed in available materials. Streamlined onboarding experiences with clear documentation requirements and reasonable verification timelines are important factors in overall user satisfaction.

Funding and withdrawal experiences, including processing efficiency and fee transparency, cannot be evaluated based on current information sources. These operational aspects significantly impact user satisfaction and broker relationships.

Conclusion

This fuda review reveals significant information limitations that make comprehensive broker evaluation challenging. Based on available data, Fuda appears to operate through Fuda Group USA Corp with a focus on precious metals and commodity trading, particularly gold-related activities. However, standard forex brokerage information including regulatory status, trading conditions, and client services remains largely undocumented in accessible sources.

Potential users interested in gold and commodity trading may find the broker's specialized focus relevant. But the lack of transparent information about regulatory oversight, trading conditions, and client protections presents considerable concerns. The absence of user feedback and detailed service information makes it difficult to recommend this broker without substantial additional due diligence.

The main advantage appears to be specialization in precious metals trading. Significant disadvantages include limited transparency, unclear regulatory status, and insufficient public information about standard brokerage services. Potential clients should exercise extreme caution and seek direct communication with the broker to obtain essential information before considering any trading relationship.