Is FUDA safe?

Business

License

Is Fuda Safe or a Scam?

Introduction

Fuda Capital, an online forex broker, has gained attention in the trading community for its offerings in the foreign exchange market. However, as with many brokers, potential investors must exercise caution and conduct thorough research before committing their funds. The forex market is rife with unregulated brokers, making it crucial for traders to assess the legitimacy and safety of their chosen platforms. In this article, we will investigate whether Fuda Capital is a safe option for traders or if it raises red flags that suggest it could be a scam. Our investigation will be based on a review of regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

One of the first indicators of a broker's reliability is its regulatory status. Regulatory bodies oversee trading practices to ensure that brokers adhere to industry standards and protect investors' interests. Unfortunately, Fuda Capital does not appear to be regulated by any major financial authority, which is a significant concern for potential clients.

Here is a summary of Fuda Capital's regulatory status:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight implies that Fuda Capital operates in an unregulated environment, posing potential risks to clients. Without a regulatory body to hold them accountable, traders may face difficulties in withdrawing funds or may encounter unfair trading practices. The lack of oversight raises questions about the broker's legitimacy and whether it is a safe option for traders.

Company Background Investigation

Fuda Capital's company background is another area of concern. The broker claims to operate from multiple locations, including Hong Kong and the UK, but lacks transparency regarding its ownership and management structure. This anonymity can be a red flag for potential investors, as it complicates the process of accountability.

The company's website provides limited information about its history, development, and key personnel. A reputable broker typically discloses details about its management team, including their professional backgrounds and experience in the financial sector. However, Fuda Capital's lack of transparency raises questions about its credibility and trustworthiness.

Furthermore, the absence of a clear ownership structure means that clients do not know who is responsible for their funds and trading activities. This lack of information is concerning and suggests that traders may be putting their capital at risk without adequate safeguards in place.

Trading Conditions Analysis

An essential aspect of evaluating any broker is its trading conditions, including fees and spreads. Fuda Capital advertises competitive trading conditions, but the lack of transparency regarding its fee structure raises concerns.

Here‘s a comparison of Fuda Capital’s trading costs:

| Fee Type | Fuda Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | Unknown | 0-10 USD |

| Overnight Interest Range | Unknown | 0.5%-2% |

While Fuda Capital promotes low spreads, the absence of clear information about commissions and overnight fees may indicate hidden costs that could affect profitability. Traders should be wary of brokers that do not provide transparent pricing structures, as this could lead to unexpected expenses and ultimately impact their trading experience.

Customer Funds Safety

The safety of customer funds is a critical factor when assessing a broker's reliability. Fuda Capital does not provide sufficient information about its fund security measures. Traders should look for brokers that employ strong client fund protection policies, such as segregated accounts, investor compensation schemes, and negative balance protection.

Unfortunately, Fuda Capital's lack of regulatory oversight means that it is not required to follow strict guidelines regarding fund security. This raises concerns about the potential for mismanagement or loss of client funds. Additionally, there have been reports of difficulties in withdrawing funds from unregulated brokers, further emphasizing the importance of ensuring that a broker is safe before investing.

Customer Experience and Complaints

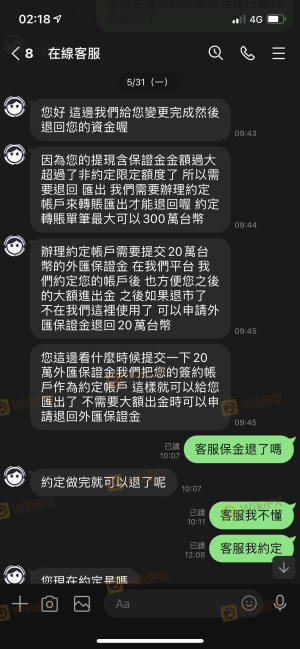

Analyzing customer feedback is vital for understanding a broker's reputation. Many reviews of Fuda Capital indicate a pattern of complaints regarding withdrawal issues and unresponsive customer service.

Here is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | Medium | Poor |

| Misleading Promotions | High | Poor |

Many users have reported difficulties in accessing their funds, with some claiming that their accounts were blocked without explanation. The company's response to these complaints has often been inadequate, leading to frustration and distrust among clients. Such patterns of behavior are concerning and suggest that Fuda Capital may not be a safe option for traders.

Platform and Execution

The trading platform is another critical aspect of the trading experience. Fuda Capital claims to offer a user-friendly trading environment, but there are concerns regarding the execution quality and potential for slippage. Traders have reported instances of delayed order execution and high slippage rates, which can significantly impact trading outcomes.

Moreover, the absence of a well-known trading platform, such as MetaTrader 4 or 5, raises questions about the reliability and functionality of Fuda Capital's trading interface. Traders should be cautious of platforms that do not provide robust execution capabilities, as this can lead to missed opportunities and increased trading costs.

Risk Assessment

Using Fuda Capital presents several risks that traders should be aware of. Here is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection. |

| Withdrawal Risk | High | Reports of difficulties in accessing funds. |

Given the high-risk levels associated with Fuda Capital, traders should approach this broker with caution. It is advisable to consider alternative options that offer better regulatory protection and client fund security.

Conclusion and Recommendations

In conclusion, the investigation into Fuda Capital raises significant concerns about its legitimacy and safety for traders. The lack of regulatory oversight, transparency regarding company operations, and numerous customer complaints suggest that Fuda Capital may not be a safe option for trading.

Traders are advised to exercise caution and consider reputable alternatives that provide robust regulatory protection and transparent trading conditions. It is essential to prioritize safety when selecting a forex broker, and based on the evidence presented, Fuda Capital does not appear to meet these standards. If you are considering trading in forex, it may be wise to explore brokers with established reputations and regulatory backing to ensure a safer trading experience.

In summary, is Fuda safe? The evidence suggests otherwise, and potential traders should remain vigilant and informed before making any commitments.

Is FUDA a scam, or is it legit?

The latest exposure and evaluation content of FUDA brokers.

FUDA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FUDA latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.