Is FRXE safe?

Pros

Cons

Is Frxe Safe or Scam?

Introduction

Frxe is an online forex broker that aims to provide trading services to retail investors. Operating since 2012, it positions itself in the competitive landscape of forex trading, offering a range of financial instruments including forex pairs, cryptocurrencies, and CFDs. However, the importance of conducting thorough due diligence when selecting a forex broker cannot be overstated. Traders must be vigilant about the legitimacy and reliability of their chosen platforms, especially given the prevalence of scams in the forex industry. This article investigates the safety and legitimacy of Frxe by analyzing its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its trustworthiness. Frxe claims to be registered in the Marshall Islands, an offshore jurisdiction often associated with lax regulatory oversight. Notably, there is no evidence of Frxe being licensed by any reputable financial authority, raising concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that traders' funds are not protected by any governing body, which is a significant red flag. Unregulated brokers often have the freedom to operate without adhering to strict compliance standards, making them a risky choice for traders. The lack of a valid license suggests that Frxe may not be a safe option for those looking to invest their money in forex trading.

Company Background Investigation

Frxe operates under the name Frxe Trading Limited, with claims of being based in Cyberjaya, Malaysia. However, the companys transparency is questionable, as it does not disclose key information about its ownership structure or management team. The lack of available data on the individuals running the company raises concerns about accountability and trust.

Furthermore, the companys history is not well-documented, making it difficult for potential clients to assess its credibility. A reputable broker should provide clear information about its founders and management team, ensuring that clients can verify their qualifications and experience in the financial industry. The opacity surrounding Frxe's management further contributes to the skepticism regarding its safety and reliability.

Trading Conditions Analysis

Frxe offers various trading accounts with different minimum deposit requirements, but the overall trading conditions raise some concerns. The broker advertises competitive spreads and leverage, but the lack of transparency regarding fees and commissions is alarming.

| Fee Type | Frxe | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of a clear commission structure and the vague description of overnight interest rates may lead to unexpected costs for traders. Such practices are often associated with less reputable brokers, making it essential for potential clients to proceed with caution. Understanding the fee structure is vital for traders to gauge the true cost of trading and to avoid hidden charges that could erode their profits.

Client Fund Safety

When assessing whether Frxe is safe, one must consider the measures in place to protect client funds. Unfortunately, the broker does not provide adequate information regarding fund segregation, investor protection, or negative balance protection policies. This lack of clarity poses a significant risk to traders, as funds deposited with Frxe may not be secure.

Historically, unregulated brokers have been known to mishandle client funds, leading to significant financial losses for traders. Without the assurance of fund protection, clients may find themselves vulnerable to potential fraud or mismanagement of their investments. Therefore, the absence of robust safety measures further supports the notion that Frxe may not be a safe option for forex trading.

Customer Experience and Complaints

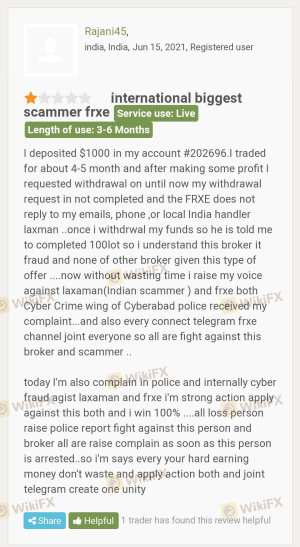

Client feedback is an essential aspect of evaluating a broker's reliability. Reviews of Frxe reveal a troubling pattern of complaints, primarily concerning withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds, with some claiming that withdrawal requests go unanswered for extended periods.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | High | Poor |

For instance, one trader reported that after making a profit, their withdrawal request was not processed, and communication with customer support was non-existent. Such experiences indicate a lack of responsiveness and accountability from Frxe, which is a significant concern for potential clients. The high severity of these complaints suggests that traders should be wary of engaging with this broker.

Platform and Trade Execution

Frxe utilizes the MetaTrader 5 platform, which is known for its advanced trading features. However, the performance and reliability of the platform can vary. Users have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

The quality of trade execution is crucial for traders, as delays or errors can lead to financial losses. If there are signs of platform manipulation or other irregularities, it raises further doubts about whether Frxe is a safe trading option.

Risk Assessment

Engaging with Frxe presents several risks that potential traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | High | Numerous complaints about withdrawal issues. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers that are regulated and have a proven track record of reliability. It is essential to prioritize safety and transparency in trading to protect investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Frxe may not be a safe trading option. The lack of regulation, transparency, and numerous complaints about withdrawal issues raise significant concerns about the broker's legitimacy. Traders should approach Frxe with caution and consider the potential risks involved in trading with an unregulated broker.

For those looking for safer alternatives, it is advisable to choose regulated brokers that provide clear information about their operations, offer robust fund protection measures, and have a positive reputation in the trading community. Prioritizing safety and due diligence is crucial for a successful trading experience.

Is FRXE a scam, or is it legit?

The latest exposure and evaluation content of FRXE brokers.

FRXE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FRXE latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.