forsterfof Review 1

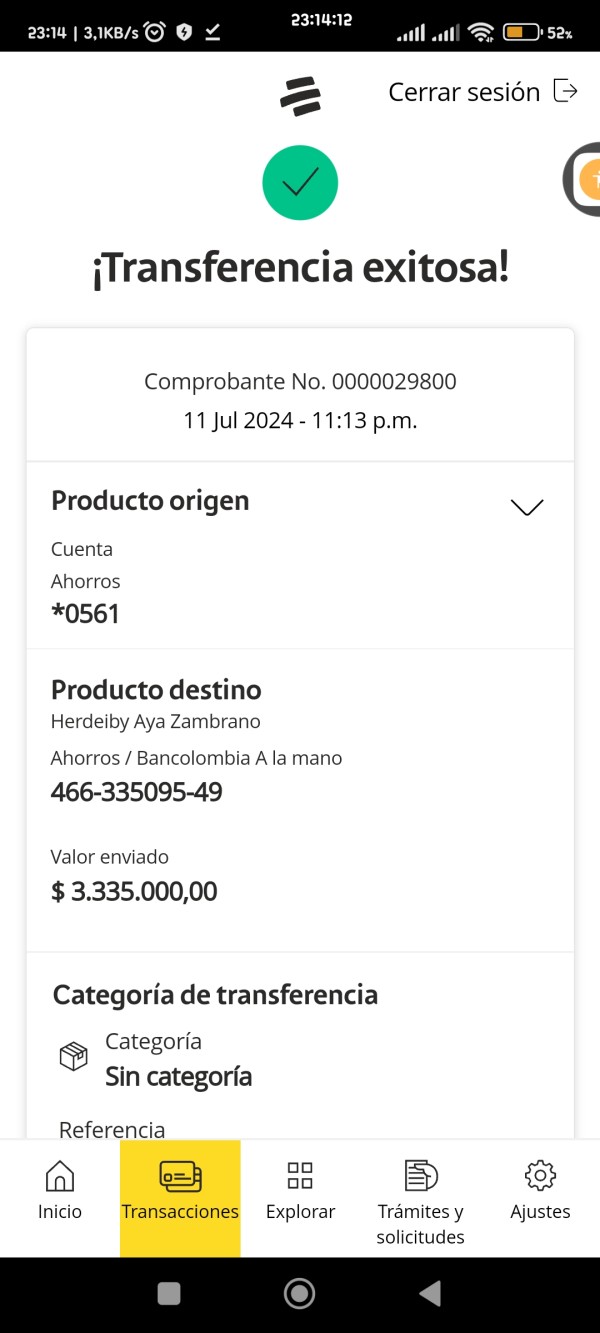

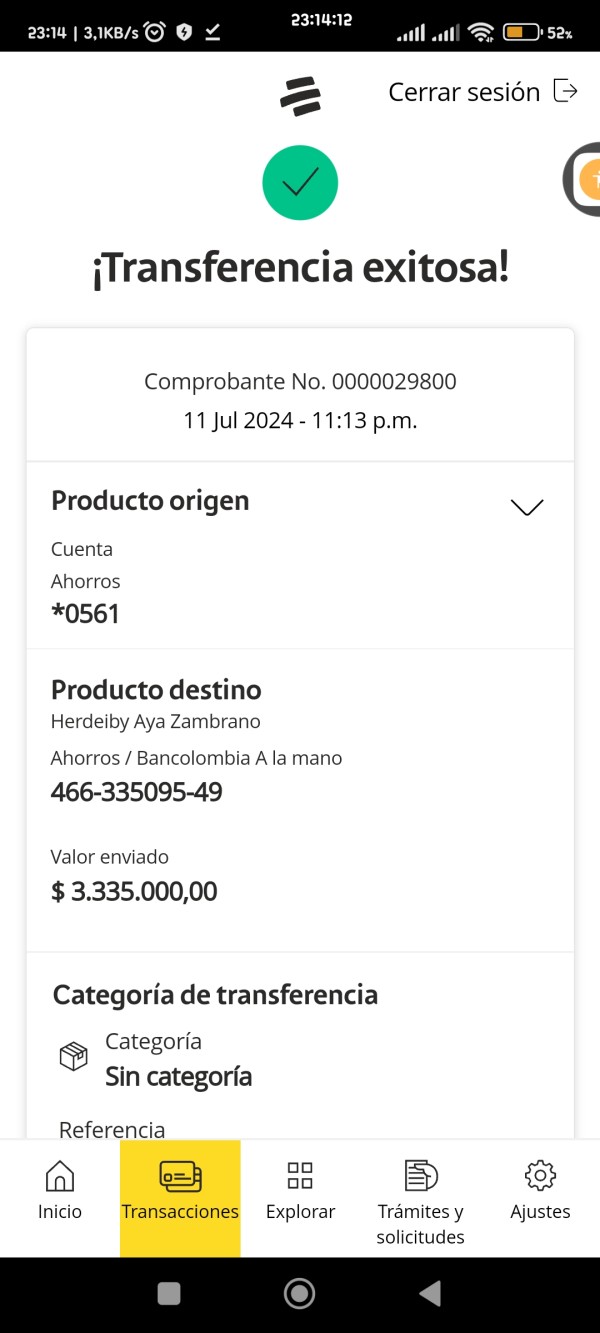

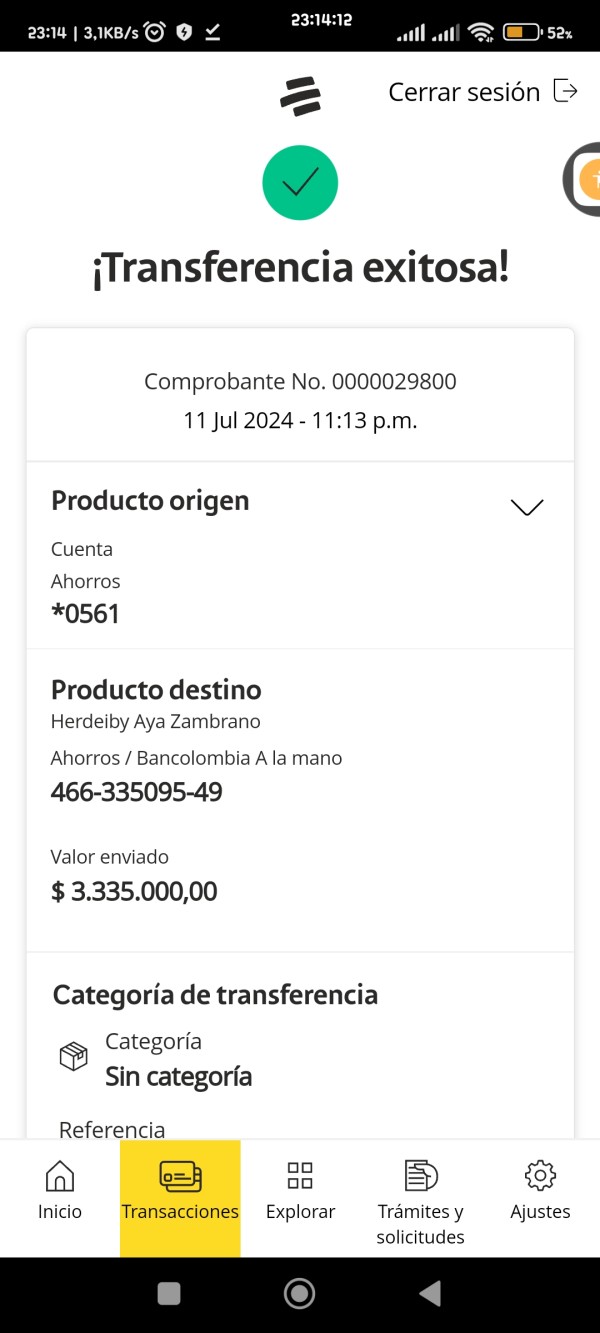

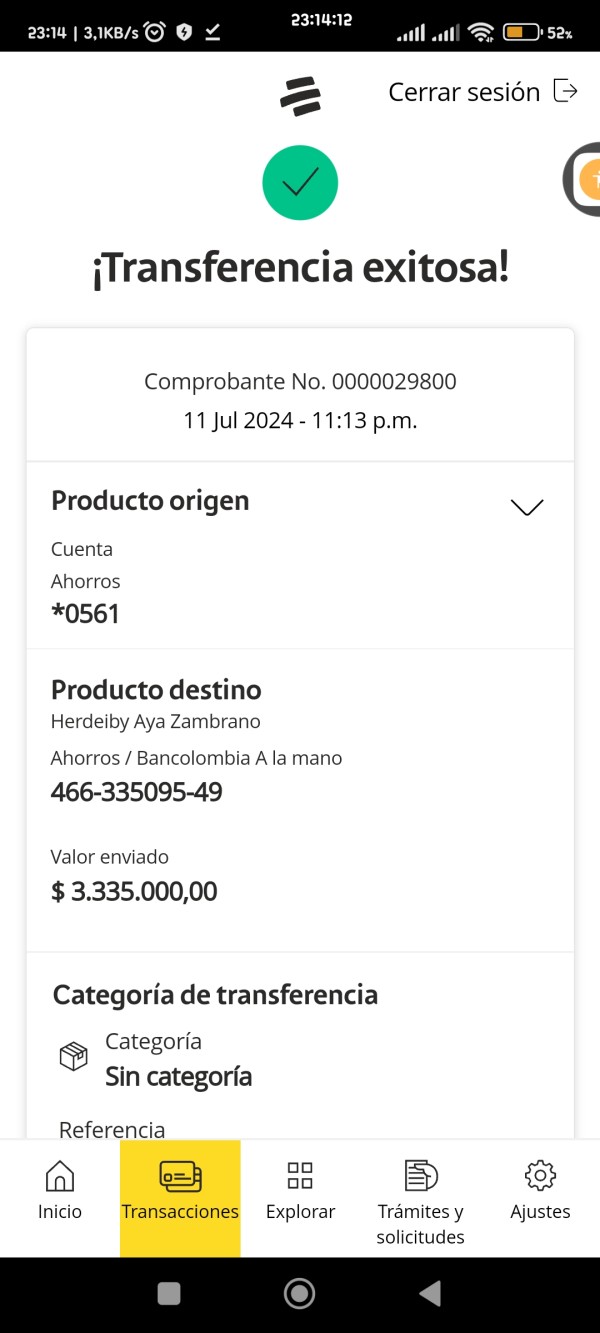

Be very careful ⚠️ the money did not reach the platform.

forsterfof Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Be very careful ⚠️ the money did not reach the platform.

This comprehensive forsterfof review reveals major concerns about this trading platform. The platform claims to offer services in stocks, cryptocurrencies, and indices, but our analysis from multiple sources shows forsterfof has been flagged as a high-risk platform with extremely low user trust scores. Scamadviser rates the platform at just 25%. Scamdoc assigns an even lower score of 16%, which indicates major safety concerns for potential traders.

Several reputable financial review websites have explicitly marked the platform as a scam. This makes it particularly dangerous for new traders who may be attracted by promises of trading opportunities in popular asset classes. Multiple sources have published warnings about forsterfof with detailed reports highlighting the platform's suspicious activities and lack of proper regulatory oversight. Given these red flags, traders should exercise extreme caution and consider alternative, properly regulated brokers for their trading activities.

This review is based on available information from multiple user evaluations, trust score assessments, and financial review platforms as of 2025. The information presented reflects what we currently understand about forsterfof's operations and reputation within the trading community. Our evaluation method uses user feedback, trust scores from established website verification services, and reports from financial industry watchdogs to provide a comprehensive assessment of this platform's legitimacy and safety for potential users.

| Category | Score | Rating Basis |

|---|---|---|

| Account Conditions | 1/10 | Lack of transparency regarding account types, minimum deposits, and terms |

| Tools and Resources | 4/10 | Limited information available about trading tools despite claims of multi-asset support |

| Customer Service | 2/10 | Predominantly negative user feedback regarding support quality and responsiveness |

| Trading Experience | 3/10 | User reports indicate poor trading conditions and platform reliability issues |

| Trust and Safety | 1/10 | Multiple scam warnings and extremely low trust scores from verification services |

| User Experience | 2/10 | Overwhelmingly negative user reviews and feedback across multiple platforms |

Forsterfof presents itself as a trading platform offering access to stocks, cryptocurrencies, and indices. The platform targets retail traders seeking diversified investment opportunities, but detailed information about the company's establishment date, corporate background, and operational history remains missing from available sources. This lack of transparency regarding basic company information raises immediate red flags about the platform's legitimacy and commitment to regulatory compliance.

The platform's business model appears to focus on attracting traders through promises of multi-asset trading capabilities. It particularly emphasizes popular markets like cryptocurrency and stock indices, but the absence of clear information about the company's operational structure, management team, or corporate governance suggests a potentially problematic foundation that serious traders should carefully consider before engaging with the platform.

Available information does not indicate proper licensing from recognized financial authorities regarding regulatory oversight and platform specifications. The trading platform type, specific asset offerings beyond the broad categories mentioned, and regulatory compliance status remain unclear in available documentation. This lack of transparency concerning essential operational details, combined with the platform's poor reputation scores, suggests that forsterfof may not meet the standards expected from legitimate financial service providers in today's regulated trading environment.

Regulatory Status: Available information does not specify any recognized financial regulatory authorities overseeing forsterfof's operations. This represents a significant concern for trader protection and fund security.

Deposit and Withdrawal Methods: Specific payment processing options, supported currencies, and transaction procedures are not detailed in available sources. This creates uncertainty about fund management processes.

Minimum Deposit Requirements: The platform's entry-level investment requirements are not specified in available documentation. This makes it difficult for potential traders to assess accessibility.

Promotional Offers: Information regarding welcome bonuses, trading incentives, or promotional campaigns is not available in current sources.

Available Trading Assets: The platform claims to offer stocks, cryptocurrencies, and indices, but detailed asset lists, market coverage, and specific instruments remain unspecified.

Cost Structure: Critical pricing information including spreads, commission rates, overnight fees, and other trading costs are not transparently disclosed in available materials.

Leverage Options: Maximum leverage ratios, margin requirements, and risk management tools are not specified in accessible information.

Platform Technology: Details about trading software, mobile applications, and technical infrastructure are not provided in current sources.

Geographic Restrictions: Service availability by region and any territorial limitations are not clearly outlined.

Customer Support Languages: Available communication languages and support channels are not specified in current documentation.

This forsterfof review highlights the concerning lack of transparency across fundamental operational aspects. Legitimate brokers typically disclose these details prominently.

The account conditions offered by forsterfof present significant transparency issues that should concern potential traders. Available information does not specify the types of accounts available, their respective features, or the requirements for accessing different service tiers, and this lack of clarity makes it impossible for traders to understand what they're signing up for or to compare offerings with legitimate competitors in the market.

The absence of clear minimum deposit information creates additional uncertainty for potential clients. Legitimate brokers typically provide transparent pricing structures and account requirements to help traders make informed decisions, so the fact that forsterfof does not clearly communicate these basic requirements suggests either poor business practices or intentional hiding of terms that might not be favorable to clients.

The account opening process and verification procedures are not detailed in available sources. Professional brokers usually outline their KYC (Know Your Customer) procedures and account verification timelines to set proper expectations, but the lack of such information from forsterfof raises questions about their compliance with standard financial industry practices and regulatory requirements.

Special account features such as Islamic accounts, professional trader classifications, or institutional services are also not mentioned in available materials. This forsterfof review finds that the overall lack of transparency regarding account conditions represents a major red flag for potential users.

Forsterfof claims to provide trading services across stocks, cryptocurrencies, and indices, but detailed information about the actual trading tools and resources available to users remains limited. The platform receives a modest score in this category primarily because it does offer access to multiple asset classes, which could theoretically provide diversification opportunities for traders.

The lack of specific information about research tools, market analysis resources, and educational materials significantly undermines the platform's value proposition. Professional trading platforms typically offer comprehensive market research, technical analysis tools, economic calendars, and educational resources to support trader success, so the absence of detailed information about such resources suggests that forsterfof may not provide the comprehensive support that serious traders require.

Automated trading capabilities, API access, and third-party tool integration are not mentioned in available sources. Modern traders often rely on algorithmic trading solutions and advanced technical analysis tools, making the absence of such information concerning for potential users seeking sophisticated trading environments.

The platform's research and analysis capabilities appear to be either non-existent or poorly communicated. This limits its appeal to informed traders who rely on quality market insights for their decision-making processes.

Customer service represents one of the most problematic aspects of the forsterfof platform based on available user feedback and industry reports. The predominantly negative user experiences suggest that the platform fails to meet basic customer support standards expected in the financial services industry.

Available information does not specify the customer service channels offered, such as phone support, live chat, email assistance, or support ticket systems. Professional brokers typically provide multiple contact methods and clearly communicate their availability hours, response time commitments, and escalation procedures, but the absence of such information from forsterfof suggests a lack of commitment to customer service excellence.

Response time data and service quality metrics are not available in current sources, but user feedback patterns indicate significant dissatisfaction with support experiences. This aligns with the platform's overall reputation issues and suggests that users may face difficulties when seeking assistance with account issues, technical problems, or dispute resolution.

Multi-language support capabilities and regional customer service availability are also not specified. This could create additional barriers for international users, and the overall customer service picture painted by available information suggests that forsterfof does not prioritize user support, which is particularly concerning given the platform's other reputation issues.

The trading experience offered by forsterfof appears to be substandard based on available user feedback and platform analysis. Specific technical performance data is not available, but user reports suggest significant issues with platform reliability, order execution quality, and overall trading conditions that impact user satisfaction.

Platform stability and execution speed are critical factors for successful trading, particularly in volatile markets like cryptocurrencies. The lack of detailed technical specifications and performance metrics from forsterfof suggests either poor platform performance or reluctance to share performance data that might not compare favorably with legitimate competitors.

Order execution quality, including fill rates, slippage statistics, and rejection rates, are not transparently reported by the platform. Professional brokers typically provide execution quality reports and maintain high standards for order processing to ensure fair trading conditions, so the absence of such transparency from forsterfof raises concerns about whether users receive fair execution on their trades.

Mobile trading capabilities and cross-platform synchronization are essential features for modern traders, but specific information about forsterfof's mobile offerings is not available in current sources. This forsterfof review finds that the overall trading environment appears to lack the professional standards and transparency expected from legitimate trading platforms.

Trust and safety represent the most critical concerns regarding forsterfof, with multiple sources explicitly identifying the platform as a scam operation. The extremely low trust scores from reputable verification services - 25% from Scamadviser and 16% from Scamdoc - indicate severe safety concerns that potential users should not ignore.

Regulatory compliance information is notably absent from available sources. This suggests that forsterfof may operate without proper financial authority oversight, and legitimate brokers typically prominently display their regulatory licenses and compliance information to build user confidence. The absence of such credentials from forsterfof represents a major red flag for potential users.

Fund security measures, including client money segregation, deposit protection schemes, and insurance coverage, are not detailed in available information. Professional brokers implement robust safeguards to protect client funds and typically communicate these protections clearly to build trust, but the lack of such information from forsterfof suggests inadequate protection for user deposits.

Third-party evaluations consistently warn against using forsterfof, with multiple financial review platforms publishing explicit scam warnings. These warnings, combined with the platform's poor trust scores, create a compelling case against engaging with this platform for trading activities.

User experience feedback for forsterfof is overwhelmingly negative, with multiple sources reporting poor satisfaction levels and warning potential users about the platform's problematic practices. The consistent pattern of negative reviews across different evaluation platforms suggests systemic issues with the platform's service delivery and user treatment.

Interface design and usability information is not available in current sources. This makes it difficult to assess the platform's technical user experience, but the broader pattern of user dissatisfaction suggests that even if the interface were well-designed, fundamental issues with the platform's operations create poor overall experiences for users.

The registration and account verification process is not detailed in available sources, but user feedback patterns suggest potential issues with account management and user onboarding procedures. Professional platforms typically streamline these processes while maintaining proper security standards.

Common user complaints appear to center around the platform's legitimacy and safety concerns rather than specific feature issues. This suggests that users' primary concerns relate to the fundamental trustworthiness of the platform rather than technical usability problems, and this pattern of feedback reinforces the serious reputation issues identified in other aspects of this evaluation.

This comprehensive forsterfof review reveals a platform that poses significant risks to potential traders and should be avoided by anyone seeking legitimate trading services. The overwhelming evidence from multiple verification sources, combined with explicit scam warnings from reputable financial review platforms, creates a clear picture of a high-risk operation that does not meet professional trading standards.

The platform is particularly unsuitable for novice traders who may be attracted by promises of multi-asset trading opportunities. These new traders lack the experience to identify the warning signs of potentially fraudulent operations, and even experienced traders should avoid forsterfof given the numerous red flags and lack of regulatory oversight that characterizes legitimate trading environments.

The platform claims to offer access to stocks, cryptocurrencies, and indices, but the significant disadvantages far outweigh any potential benefits. These disadvantages include extremely low trust scores, lack of regulatory compliance, poor user feedback, and explicit scam warnings, so traders seeking legitimate opportunities in these asset classes should consider properly regulated alternatives with transparent operations and positive user feedback.

FX Broker Capital Trading Markets Review