Roden 2025 Review: Everything You Need to Know

Executive Summary

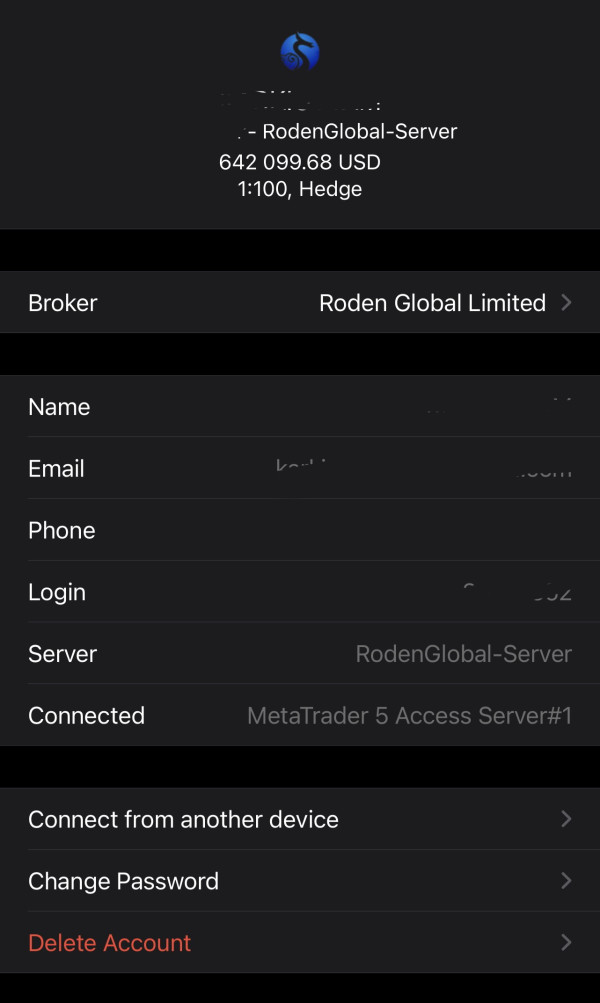

This roden review provides a comprehensive analysis of Roden Global Limited. It's a forex broker that has been operating since 1993. Based on available information and user feedback, Roden presents a mixed picture in the forex trading landscape. The broker offers multiple trading services including forex, futures, options, stocks, and CFDs. It positions itself as a multi-asset trading provider.

However, several concerning factors emerge from user reports. These particularly involve the broker's requirement for clients to pay 50% of taxes and commissions in advance. User evaluations show a divided sentiment, with some positive reviews balanced against neutral assessments and exposure complaints. The lack of clear regulatory information and transparency issues raise questions about the broker's overall reliability.

Roden appears to target investors interested in multi-market trading across forex, futures, and options. However, potential clients should exercise caution given the mixed user feedback and operational practices that deviate from industry standards.

Important Notice

This review is based on limited available information regarding Roden Global Limited. The information summary does not provide specific details about regulatory differences across regions. Readers should be aware that broker services and regulations may vary significantly by jurisdiction.

Our evaluation methodology relies primarily on user feedback, company background information, and publicly available business model details. Due to the limited scope of available data, some assessments may be incomplete. Prospective traders are advised to conduct additional due diligence before making any trading decisions.

Rating Framework

Based on the available information, here are our ratings for Roden across six key dimensions:

Broker Overview

Company Background and Establishment

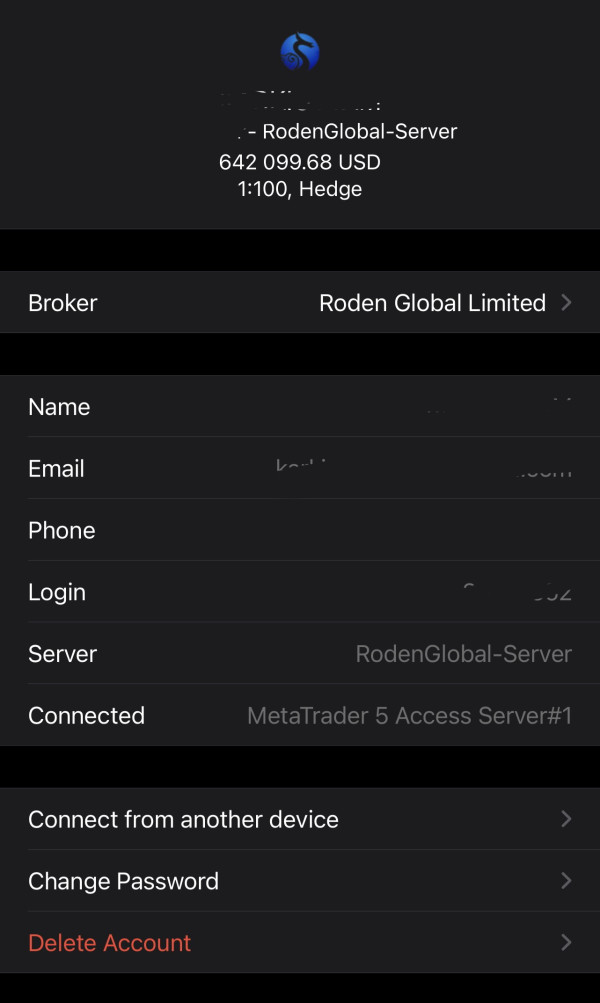

Roden Global Limited was established in 1993. This makes it one of the longer-standing entities in the online trading space. The company positions itself as a comprehensive online forex trading provider, offering services that extend beyond traditional currency trading. According to available information, Roden has maintained operations for over three decades. This suggests some level of operational continuity in the competitive forex market.

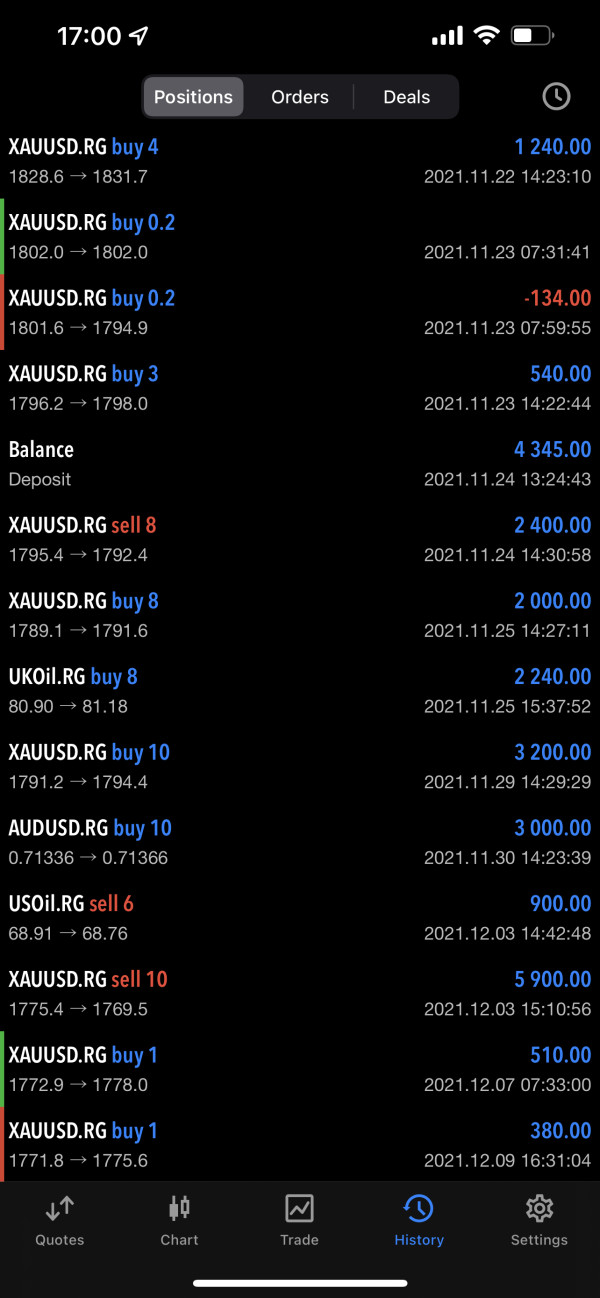

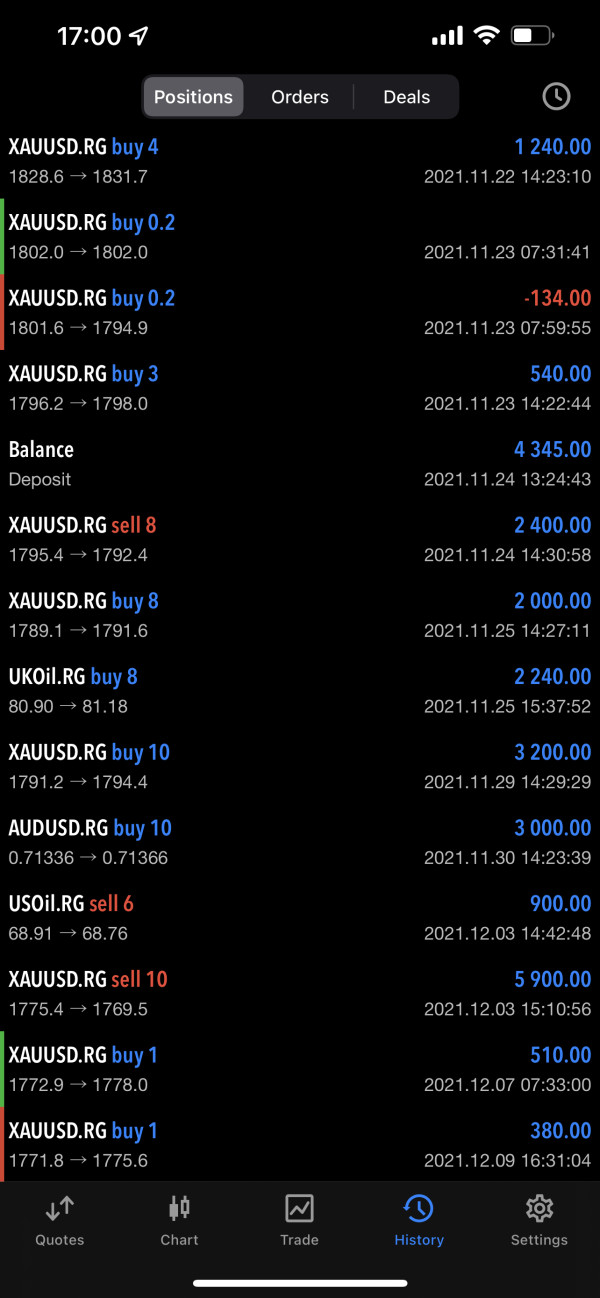

The broker's business model centers on providing multi-asset trading services. These include foreign exchange, futures trading, options, stock trading, and contracts for difference. This diversified approach indicates an attempt to cater to traders with varying investment preferences and risk appetites.

Service Portfolio and Market Position

Roden's service offering spans multiple asset classes. It positions the broker as a one-stop solution for diverse trading needs. The broker provides access to forex markets, futures contracts, options trading, equity markets, and CFD instruments. However, specific details about trading platform types and technological infrastructure are not clearly outlined in available materials.

The information summary does not specify particular regulatory oversight or licensing details. This represents a significant gap in understanding the broker's compliance framework. Additionally, details about the company's geographical reach, primary market focus, or specific regulatory jurisdictions remain unclear from the available documentation.

Regulatory Status: The information summary does not mention specific regulatory authorities or licensing jurisdictions under which Roden operates. This represents a significant transparency concern.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options is not provided in the available materials.

Minimum Deposit Requirements: The information summary does not specify minimum deposit requirements for account opening or maintenance.

Bonus and Promotional Offers: No information about promotional offers, welcome bonuses, or ongoing incentive programs is mentioned in the available materials.

Tradeable Assets: Roden offers access to multiple asset classes including foreign exchange pairs, futures contracts, options, stock trading, and contracts for difference. This provides diversification opportunities for traders.

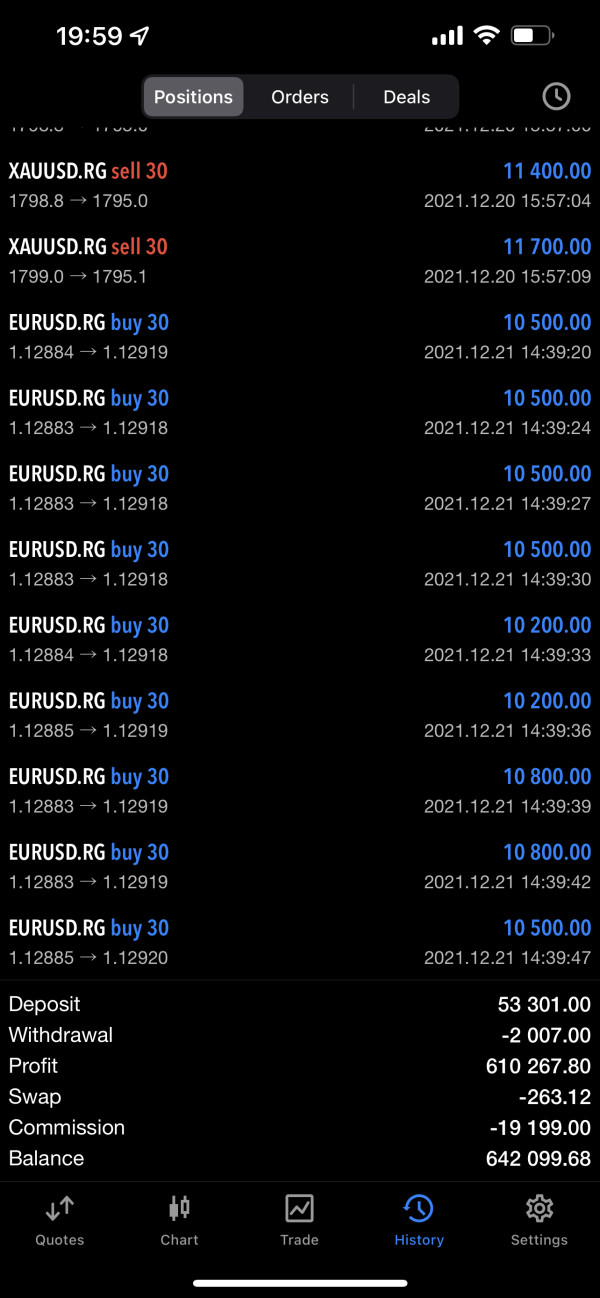

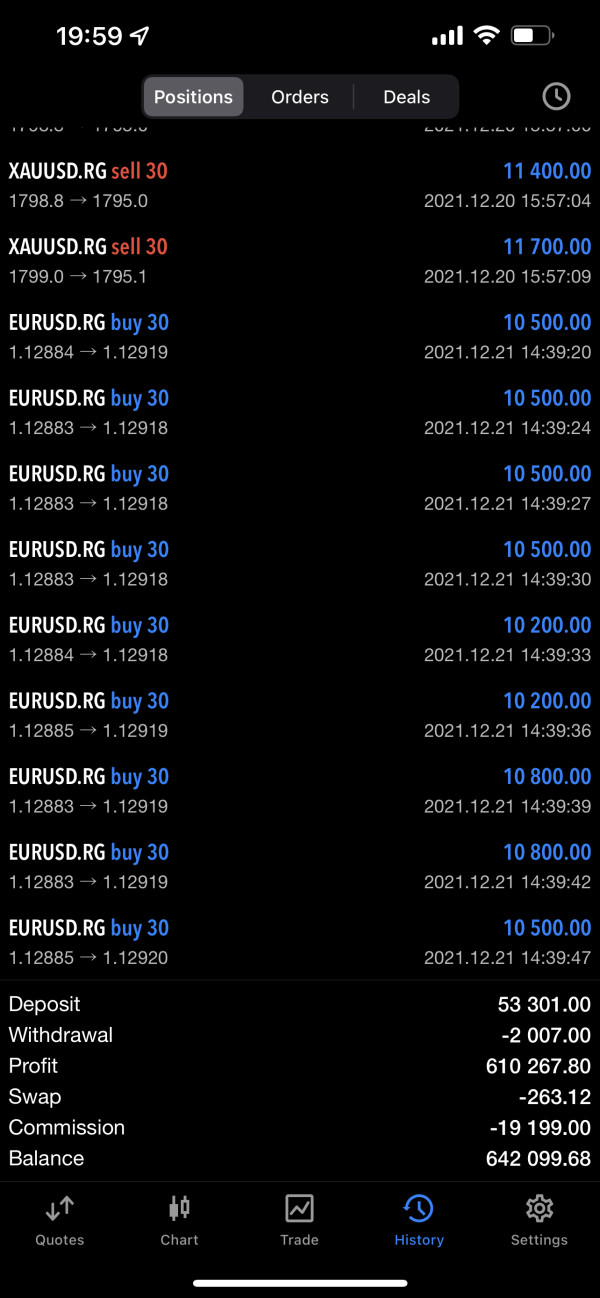

Cost Structure: A notable concern emerges regarding Roden's fee structure. User reports indicate the broker requires clients to pay 50% of taxes and commissions in advance. However, specific information about spreads, standard commission rates, or other trading costs is not detailed in the available materials.

Leverage Ratios: The information summary does not provide details about available leverage ratios or margin requirements.

Platform Options: Specific trading platform information is not mentioned in the available materials. This leaves questions about technological capabilities and user interface options.

Geographic Restrictions: The information summary does not specify which regions or countries may be restricted from accessing Roden's services.

Customer Support Languages: Information about supported languages for customer service is not provided in the available documentation.

This roden review highlights significant information gaps that potential clients should consider when evaluating the broker.

Detailed Rating Analysis

Account Conditions Analysis

Roden's account conditions present several areas of concern due to limited transparency in available information. The information summary does not provide specific details about different account types, tier structures, or the various features that might be available to different client segments. This lack of clarity makes it difficult for potential traders to understand what they can expect from their trading relationship with the broker.

The absence of information regarding minimum deposit requirements is particularly problematic. This is typically one of the first considerations for new traders when selecting a broker. Without clear guidance on initial funding requirements, traders cannot properly assess whether Roden's services align with their available capital and trading goals.

Account opening procedures and verification processes are not detailed in the available materials. This leaves potential clients uncertain about the onboarding experience. Additionally, there is no mention of specialized account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions. This is a standard offering among many established brokers.

The lack of comprehensive account information in this roden review reflects broader transparency issues. Potential clients should carefully consider these before proceeding with account opening.

The evaluation of Roden's trading tools and resources is severely limited by the lack of specific information in available materials. The information summary does not mention the types of trading tools, analytical resources, or technical analysis capabilities that the broker provides to its clients. This represents a significant gap in understanding the broker's technological offerings and support for informed trading decisions.

Research and analysis resources, which are crucial for effective trading, are not described in the available documentation. Professional traders typically rely on market research, economic calendars, technical analysis tools, and fundamental analysis resources to make informed decisions. The absence of information about these capabilities raises questions about the broker's commitment to supporting client success.

Educational resources, another critical component of a comprehensive trading environment, are not mentioned in the information summary. Many established brokers provide educational materials, webinars, tutorials, and market analysis to help traders improve their skills and understanding of market dynamics.

Automated trading support, including expert advisor compatibility and algorithmic trading capabilities, is not addressed in the available materials. This omission is particularly significant given the increasing importance of automated trading strategies in modern forex markets.

Customer Service and Support Analysis

Customer service evaluation for Roden is challenging due to limited specific information about support infrastructure and capabilities. The information summary indicates that user evaluations include both positive and neutral reviews. This suggests that client experiences with customer support vary significantly. However, without detailed information about support channels, response times, or service quality metrics, it's difficult to provide a comprehensive assessment.

The availability of customer service channels such as live chat, email support, phone assistance, or ticket systems is not specified in the available materials. This lack of clarity about communication options could be problematic for traders who require prompt assistance with account issues, technical problems, or trading inquiries.

Response time information, which is crucial for evaluating support effectiveness, is not provided in the information summary. Traders often need quick resolution of urgent issues, particularly during volatile market conditions. This makes response time a critical factor in broker selection.

Multi-language support capabilities are not mentioned in the available documentation. This could limit accessibility for international clients. Additionally, customer service hours and availability across different time zones are not specified. This leaves questions about support accessibility for global trading activities.

Trading Experience Analysis

The trading experience evaluation for Roden is significantly hampered by the lack of detailed information about platform functionality, execution quality, and overall trading environment. The information summary does not provide specific details about platform stability. This is crucial for consistent trading performance, particularly during high-volatility market periods.

Order execution quality, including execution speed, slippage rates, and fill rates, is not addressed in the available materials. These factors are fundamental to trading success and client satisfaction. Poor execution can significantly impact trading profitability and overall user experience.

Platform functionality and feature completeness remain unclear from the available information. Modern traders expect comprehensive charting tools, technical indicators, order management capabilities, and real-time market data. The absence of information about these features makes it difficult to assess whether Roden's platform meets contemporary trading standards.

Mobile trading experience, which has become increasingly important for active traders, is not mentioned in the information summary. Many traders require the ability to monitor positions, execute trades, and manage accounts from mobile devices. This makes mobile platform quality a significant consideration.

This roden review reveals substantial gaps in trading experience information. Potential clients should investigate further before committing to the platform.

Trust and Safety Analysis

Trust and safety represent perhaps the most concerning aspects of this Roden evaluation. This is primarily due to the absence of clear regulatory information and several operational practices that deviate from industry standards. The information summary does not mention specific regulatory authorities, licensing details, or compliance frameworks that govern Roden's operations. This is a significant red flag in the regulated forex industry.

The lack of regulatory oversight information raises serious questions about client fund protection, operational standards, and recourse mechanisms in case of disputes. Established brokers typically operate under strict regulatory supervision that includes requirements for segregated client funds, adequate capitalization, and transparent business practices.

Fund safety measures, including client money segregation, deposit insurance, and operational risk management, are not detailed in the available materials. These protections are standard expectations in the regulated forex industry. Their absence or unclear status represents a significant concern for potential clients.

A particularly troubling aspect mentioned in user feedback is the requirement for clients to pay 50% of taxes and commissions in advance. This practice is highly unusual in the forex industry. It raises questions about the broker's operational model and client fund handling procedures.

Company transparency issues are evident throughout this evaluation. There is limited information available about corporate structure, financial stability, regulatory compliance, and operational practices.

User Experience Analysis

User experience analysis for Roden reveals a mixed picture based on available feedback. Users provide positive, neutral, and negative evaluations of their experiences with the broker. This diversity in user sentiment suggests inconsistent service delivery and varying client satisfaction levels across different aspects of the trading relationship.

The information summary indicates that some users have had positive experiences with Roden. However, specific details about what aspects of the service generated satisfaction are not provided. Understanding the sources of positive feedback would be valuable for potential clients considering the broker.

However, the presence of neutral reviews and exposure complaints suggests that not all clients have been fully satisfied with their experience. The nature of these concerns is not detailed in the available information. The existence of exposure reviews typically indicates serious issues with broker practices or client treatment.

Interface design and platform usability are not addressed in the available materials. This makes it difficult to assess the user-friendliness of Roden's trading environment. Modern traders expect intuitive interfaces, efficient navigation, and comprehensive functionality that supports effective trading activities.

Registration and account verification processes are not described in the information summary. This leaves questions about the ease and efficiency of getting started with Roden. Additionally, the actual experience of funding accounts and withdrawing profits remains unclear from available information.

Conclusion

This comprehensive roden review reveals a broker with significant transparency and operational concerns that potential clients should carefully consider. While Roden Global Limited has maintained operations since 1993 and offers access to multiple asset classes including forex, futures, options, stocks, and CFDs, several factors raise serious questions about its suitability for most traders.

The most concerning aspects include the lack of clear regulatory information, unusual fee structures requiring advance payment of taxes and commissions, and limited transparency about operational practices. These factors, combined with mixed user feedback that includes exposure complaints, suggest that Roden may not meet the standards expected from modern forex brokers.

The broker might potentially appeal to traders specifically interested in multi-asset exposure across various financial markets. However, the significant information gaps and operational concerns make it difficult to recommend Roden to most retail traders. The advantages of diverse trading services are substantially outweighed by concerns about regulatory oversight, fee transparency, and overall operational reliability that emerge from this analysis.