EXCO 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

EXCO, a young forex broker established in 2018 and based in Saint Vincent and the Grenadines, positions itself as an attractive option for both novice and experienced traders. It offers competitive trading conditions, including a low minimum deposit of $50 and leverage up to 1:500, appealing particularly to those new to the forex market. The broker emphasizes a strong educational focus, boasting award-winning mentoring programs and resources to assist traders in improving their skills. However, significant concerns arise from its lack of regulation and numerous reports of withdrawal difficulties, which may deter risk-averse investors and those prioritizing fund safety. Consequently, while there are opportunities for traders willing to embrace higher risks, caution is advised for those seeking secure trading environments.

⚠️ Important Risk Advisory & Verification Steps

Risk of Trading with EXCO:

- No Regulatory Oversight: EXCO operates without the oversight of any significant regulatory body, which heightens the risk of fund mismanagement and withdrawal issues.

- Potential Harms: Traders may experience complications in accessing funds, which could lead to financial losses.

How to Self-Verify:

- Understand Broker Legitimacy:

- Research regulatory bodies (e.g., FCA, ASIC, CySEC).

- Check if the broker is registered with such authorities.

- Visit Regulatory Websites:

- Use authoritative databases such as NFA's BASIC or forex watchdog sites.

- Assess User Feedback:

- Look for verified reviews on platforms like Trustpilot or ForexPeaceArmy.

- Contact Customer Service:

- Engage with customer support to gauge responsiveness and reliability.

- Gather Documentation:

- Keep a folder of IDs, trades, and transactions to support any claims.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2018, EXCO is operated by RSG Finance Ltd., registered in Saint Vincent and the Grenadines. This offshore location raises questions about the broker's credibility and the safety of its operations, especially since the local financial authority does not regulate forex and CFD brokers. Despite being relatively new, EXCO has garnered attention through its educational initiatives and competitive trading environment, but the absence of a reputable regulatory framework poses a significant risk to traders.

Core Business Overview

EXCO primarily offers trading services in forex and CFDs across various assets including commodities, indices, and cryptocurrencies. The broker provides access to two trading platforms: the popular MetaTrader 4 (MT4) and its proprietary platform, EXCO Prime. Claims regarding its trading environment include negative balance protection and promises for educational support to new traders. However, the authenticity of these promises is questionable given its regulatory status.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

A thorough investigation into EXCO's regulatory posture reveals a significant lack of oversight, which turns it into a high-risk option for potential investors. The Financial Services Authority of Saint Vincent and the Grenadines clearly states that it does not regulate forex and CFD brokers, leading to serious concerns about fund mismanagement. The contradictory information surrounding the broker's legitimacy has manifested in numerous negative user reviews, indicating a pattern of withdrawal issues.

Regulatory Information Conflicts:

There is conflicting information regarding EXCOs legitimization, with some sources claiming a lack of oversight from any recognized regulatory body. This creates uncertainty regarding the safety of funds deposited with them, leading to skepticism from potential users.

User Self-Verification Guide:

- Research: Look up the broker on regulatory authority websites.

- Check Reviews: Sites like ForexPeaceArmy can provide real-user experiences.

- Engage with Support: Contact support directly to gauge professionalism.

- Verify Claims: Ensure operational claims about regulation and protection are substantiated.

- Industry Reputation and Summary:

Overall feedback tends to indicate a lack of trustworthiness. As one user remarked,

"I will make it quick and simple, I thought EXCO Trader had the cheapest commission... but they will keep 5% of your deposit. You can never get back all your money."

Trading Costs Analysis

EXCO markets itself as a cost-effective broker with competitive options, especially for those who are comfortable with taking risks.

Advantages in Commissions:

Traders can benefit from low commission rates, particularly on the ECN account where a $2 commission per side is charged, enabling traders to keep more of their profits compared to many other brokers.

The "Traps" of Non-Trading Fees:

However, users have reported high withdrawal fees that can significantly cut into profits. One complaint highlighted a withdrawal fee of up to 6%, which users found unacceptable.

"I had a terrible experience with them... their staff are unprofessionals... but when it comes to withdrawal, thats when you sweat like hell."

- Cost Structure Summary:

While low transaction costs might attract active traders, the hidden fees can lead to a false sense of savings for novice traders. Balancing costs with the broker's lack of security should cause potential users to re-evaluate their choice.

EXCO provides access to well-known trading platforms that help traders analyze market trends and execute trades efficiently.

Platform Diversity:

Both MT4 and EXCO Prime cater to a range of trading styles, from automated systems to manual trading setups. The platform allows for customization, supporting various trading strategies and tools.

Quality of Tools and Resources:

Charting features, indicators, and educational resources such as articles and videos contribute positively to the user experience by making information more accessible.

Platform Experience Summary:

User feedback indicates a mixture of positive and negative experiences.

"I thought their platform had everything I needed, but they failed to deliver on several promised features."

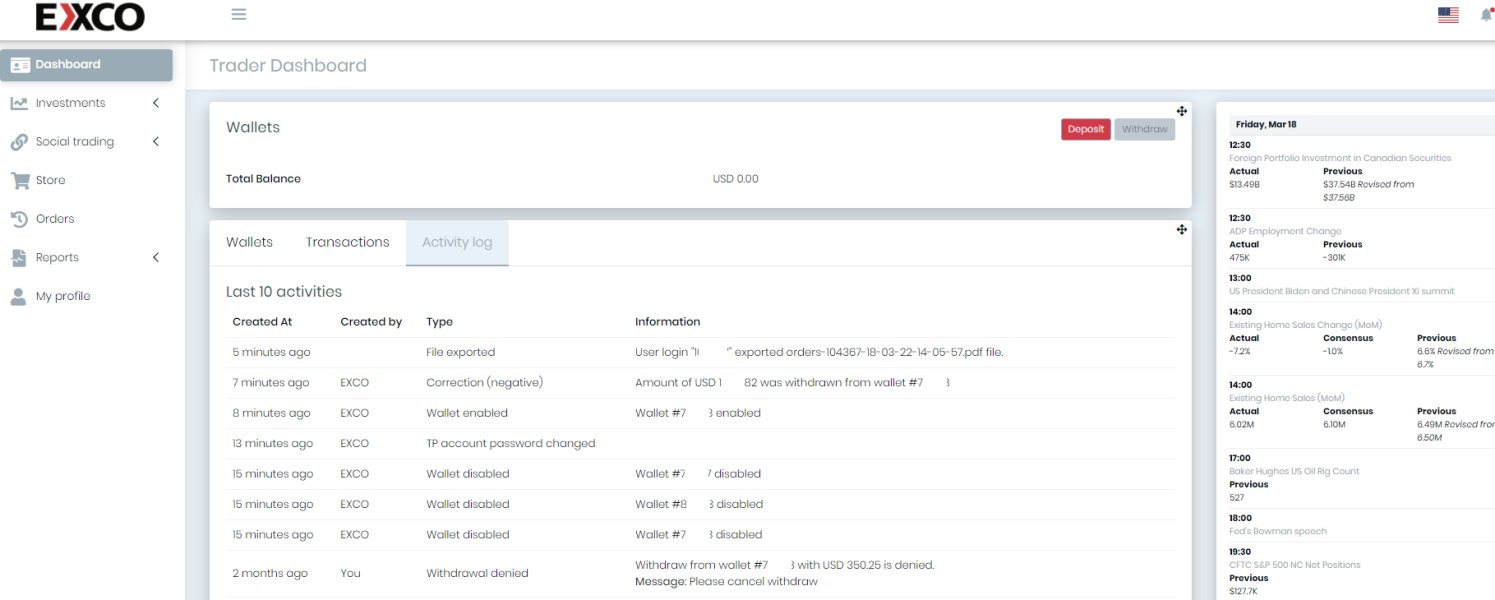

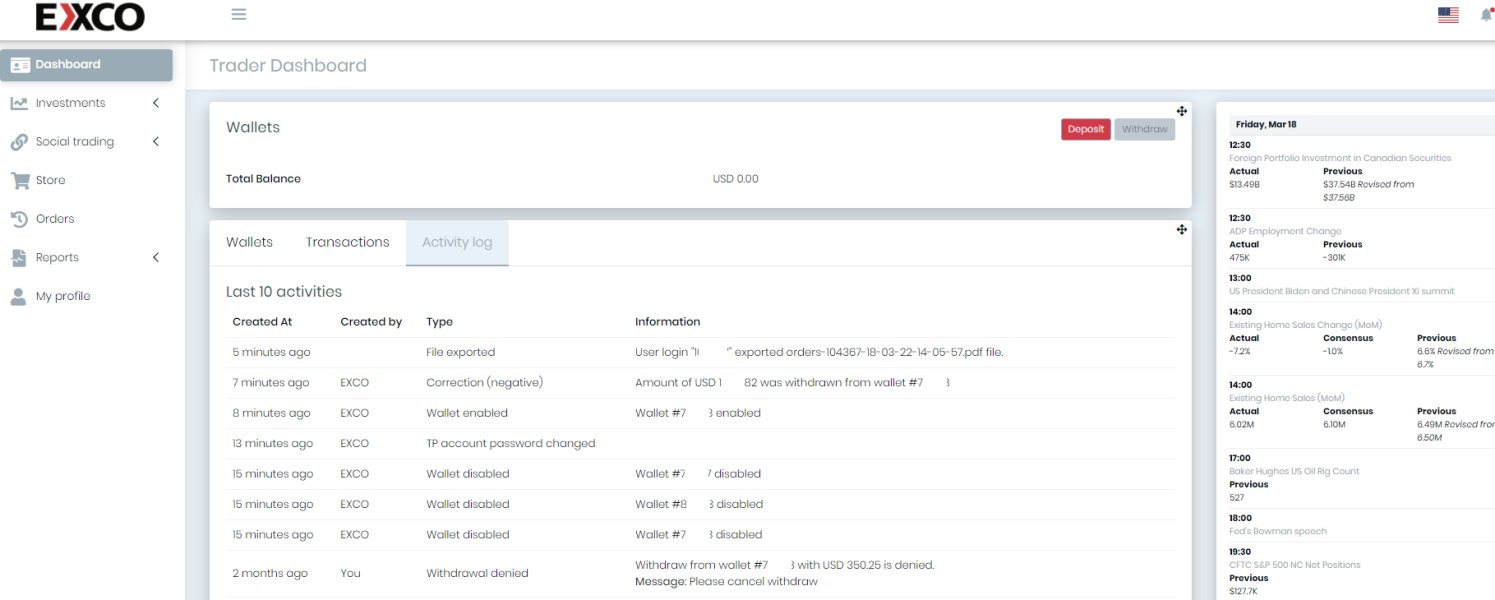

User Experience Analysis

The user journey with EXCO reveals a complicated landscape, particularly with regard to onboarding and withdrawal processes.

Onboarding Process:

Users have reported that signing up and initiating trading is straightforward; however, the eventual withdrawal process has been fraught with challenges.

Trading Experience:

Traders have noted a lack of transparency regarding spreads and commissions, leading to confusion and frustration during trading scenarios.

Withdrawal Experience:

Several users have also mentioned significant delays and difficulties in withdrawing funds, indicating a systemic issue within EXCO's operational framework.

"I thought the withdrawal would be straightforward... but it took ages and customer support was not helpful."

Customer Support Analysis

The level of customer support has been a common concern among users, contributing negatively to the overall reputation of the broker.

Availability and Responsiveness:

Reports indicate that while EXCO claims to offer 24/7 support, many users found response times lacking and representatives unhelpful when issues escalated.

Quality of Support:

Feedback reflects dissatisfaction regarding the teams lack of knowledge and the politicized nature of interactions with customers, leaving many frustrated.

Summary of Support Experience:

Overall interactions indicate a need for significant improvements. Users have voiced their discontent:

"Over time, EXCO Trader's customer service has significantly enhanced... they now promptly address concerns," although many challenges remain.

Account Conditions Analysis

Understanding the account types and conditions offered by EXCO is essential for prospective traders.

Account Types Overview:

EXCO provides two primary account types: ECN and STP, each designed for different trader profiles, yet both expose users to considerable operational risks due to the lack of regulation.

Minimum Deposit and Leverage:

The minimum deposit for an account starts as low as $10, appealing to novice traders, whereas high leverage allows experienced traders to manage larger positions.

Overall Account Conditions Summary:

While the conditions may be attractive, the inherent risks cannot be overlooked, particularly given allegations of withdrawal difficulties and insufficient regulatory oversight.

Conclusion

In summary, while EXCO presents itself as a promising option for both novice and experienced traders, significant risks associated with its unregulated status and frequent user complaints about withdrawal issues cast a long shadow over its potential benefits. For traders willing to embrace those risks in pursuit of competitive pricing and educational resources, EXCO may offer valuable opportunities. However, for risk-averse investors prioritizing fund safety and security, exploring alternatives with stronger regulatory backing is advisable.

This review serves as a comprehensive analysis of EXCO's offerings and risks. Potential traders are encouraged to proceed with caution and conduct thorough due diligence before engaging with this broker.