Pandora Finance 2025 Review: Everything You Need to Know

Summary

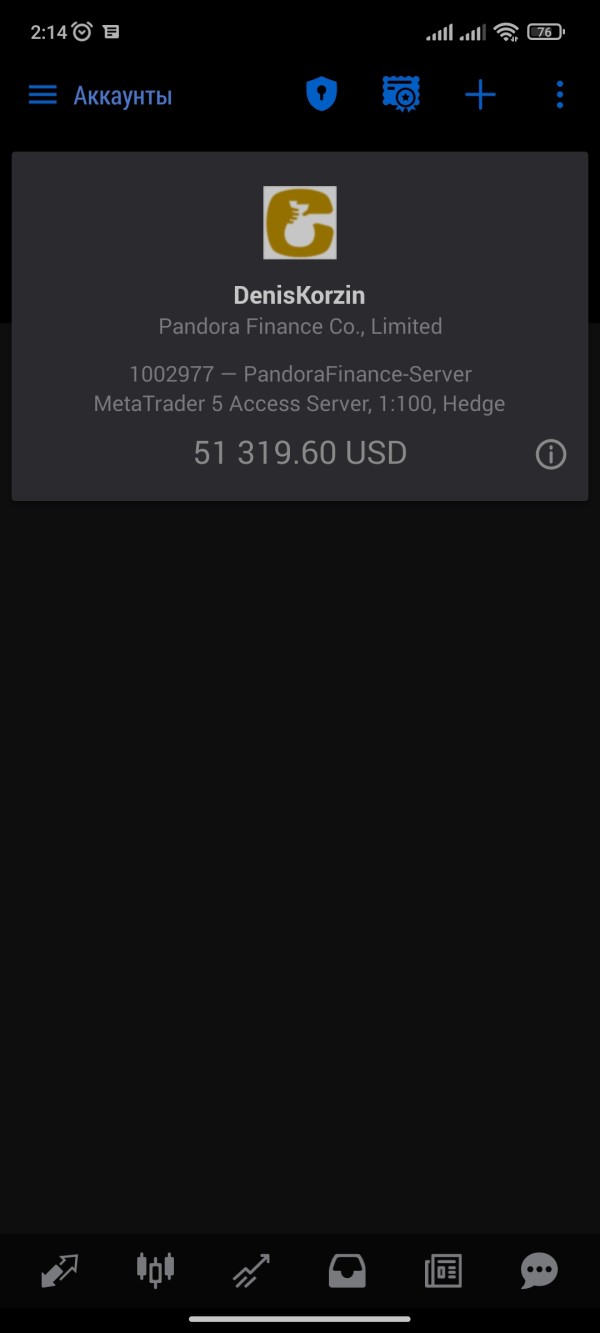

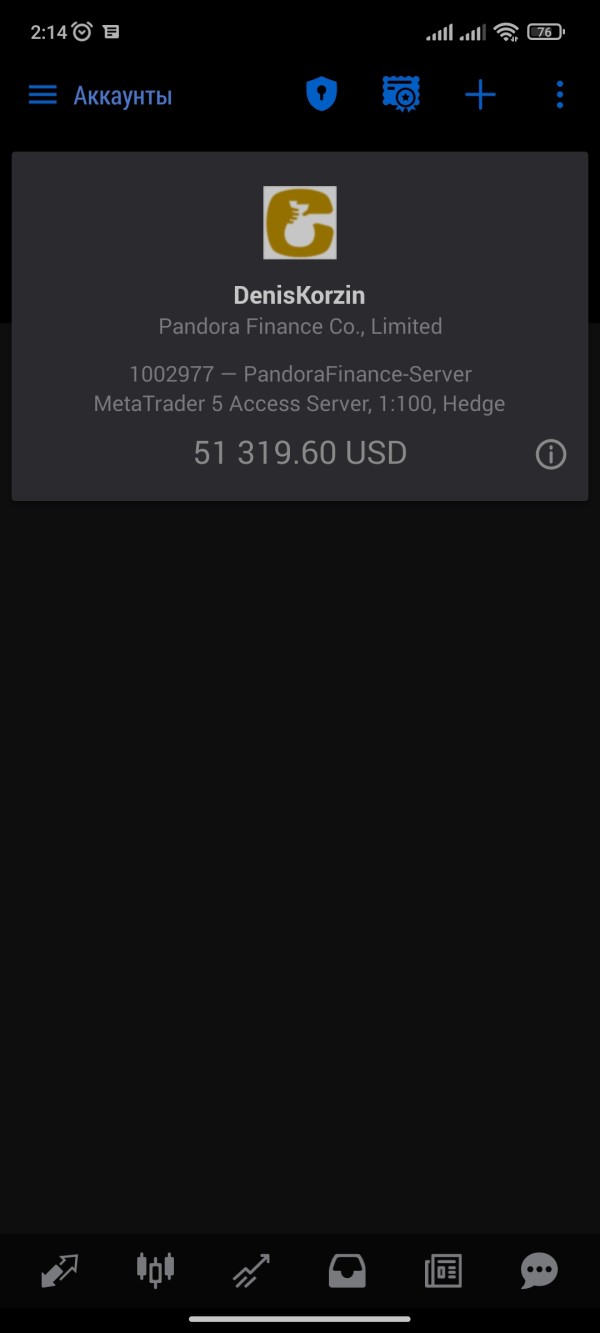

Pandora Finance works as a forex broker with a mixed reputation in the trading industry. According to information from WikiBit and various review platforms, this pandora finance review shows a company that places itself within the competitive forex brokerage landscape. The broker seems to offer standard trading services including forex and CFD trading. However, detailed information about their specific offerings stays limited in publicly available sources.

Based on the available data, Pandora Finance presents itself as a trading platform focused on providing access to global financial markets. Traders should note that comprehensive information about their regulatory status, trading conditions, and operational details is not extensively documented in major review platforms. The company's profile suggests they cater to retail traders seeking exposure to forex markets. The lack of detailed public information may concern some potential clients.

This review examines all available information about Pandora Finance to provide traders with a balanced assessment of what to expect from this broker. It includes both potential benefits and areas where information transparency could be improved.

Important Notice

This pandora finance review is based on publicly available information from various sources including WikiBit and other financial review platforms. Traders should be aware that information about Pandora Finance's regulatory status, specific trading conditions, and operational details may vary across different jurisdictions. This information is not comprehensively detailed in available sources.

The evaluation presented here reflects the current state of publicly accessible information. It should be supplemented with direct contact with the broker for the most up-to-date and detailed information about their services. Potential clients are advised to conduct their own due diligence and verify all trading conditions before opening an account.

Rating Framework

Broker Overview

Pandora Finance operates within the competitive forex brokerage sector. Specific details about the company's founding date and corporate background are not extensively documented in available public sources. According to WikiBit, the company maintains a presence in the forex trading space. It offers services to retail traders seeking access to currency markets and related financial instruments.

The broker's business model appears to focus on providing trading access to forex markets. Comprehensive details about their operational structure, corporate governance, and business history remain limited in publicly available documentation. This lack of detailed corporate information may be a consideration for traders who prioritize transparency in broker selection.

Regarding trading infrastructure, pandora finance review sources indicate that the company offers access to forex and CFD trading. Specific details about their trading platforms, technology partnerships, and execution methods are not comprehensively detailed in available materials. The broker appears to target retail traders. Their specific market positioning and competitive advantages are not extensively documented in major review platforms or regulatory databases.

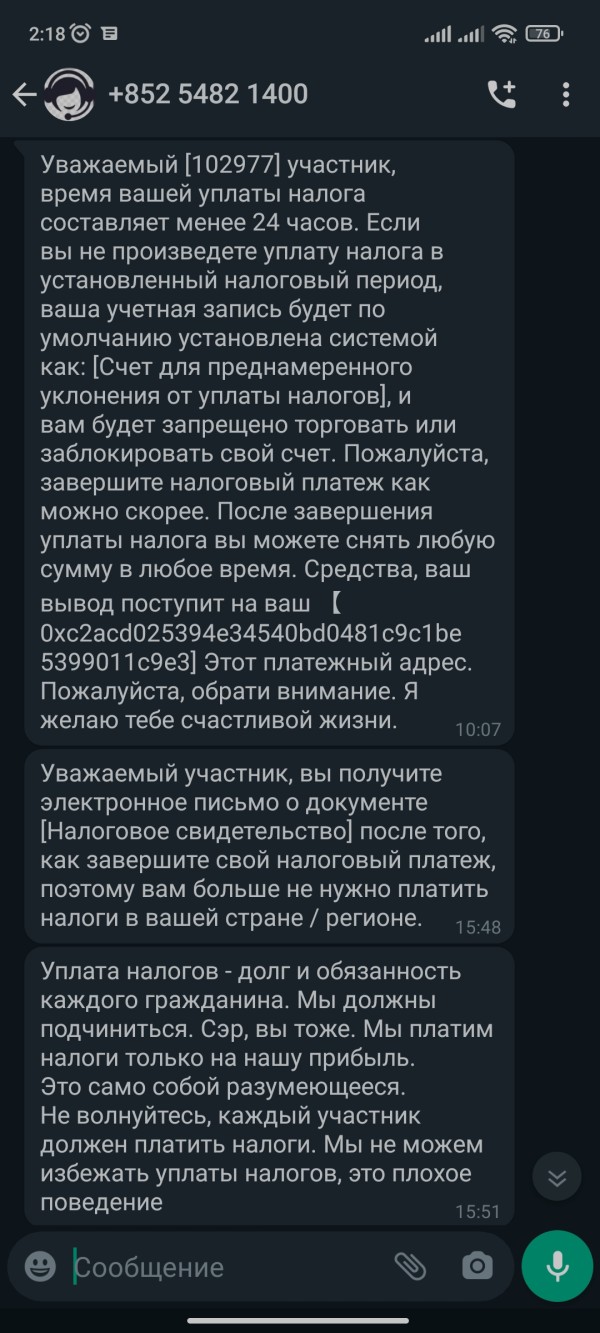

Regulatory Status: Available sources do not provide comprehensive information about Pandora Finance's regulatory oversight or licensing jurisdictions. This represents a significant information gap for potential clients.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees is not detailed in publicly available sources.

Minimum Deposit Requirements: The broker's account opening requirements and minimum funding levels are not specified in available documentation.

Promotions and Bonuses: No information about promotional offerings or bonus programs is available in current sources.

Trading Assets: The broker appears to offer forex and CFD trading. The complete range of available instruments is not comprehensively documented.

Cost Structure: Details about spreads, commissions, overnight fees, and other trading costs are not extensively available in public sources. This makes cost comparison difficult.

Leverage Options: Information about maximum leverage ratios and margin requirements is not detailed in available materials.

Platform Choices: Specific trading platform options and their features are not comprehensively documented in this pandora finance review.

Geographic Restrictions: Service availability by region is not clearly specified in available sources.

Customer Support Languages: Information about multilingual support options is not available in current documentation.

Account Conditions Analysis

The evaluation of Pandora Finance's account conditions faces significant limitations due to the lack of detailed publicly available information. Standard industry practice suggests that forex brokers typically offer multiple account types designed for different trader segments. These range from beginner-friendly accounts to advanced trading solutions for experienced clients. However, specific details about Pandora Finance's account structure, including the number of account types, their distinctive features, and target user segments, are not comprehensively documented in available sources.

Regarding minimum deposit requirements, which represent a crucial factor for many traders in broker selection, this pandora finance review finds no specific information about funding thresholds for different account types. Industry standards vary significantly. Some brokers require deposits as low as $10 while others target higher-net-worth clients with minimum requirements of $1,000 or more. Without clear documentation of Pandora Finance's requirements, potential clients cannot adequately assess accessibility.

The account opening process, verification procedures, and documentation requirements also lack detailed public information. Modern forex brokers typically implement KYC procedures that require identity verification, address confirmation, and sometimes income documentation. Pandora Finance's specific procedures are not outlined in available materials.

Assessment of Pandora Finance's trading tools and resources encounters substantial limitations due to insufficient publicly available information about their platform offerings and analytical capabilities. Modern forex brokers typically provide comprehensive trading tools including technical analysis indicators, charting packages, economic calendars, and market research. Specific details about Pandora Finance's tool suite are not extensively documented in available sources.

Educational resources represent another critical area where information about Pandora Finance remains limited. Industry-leading brokers often provide extensive educational materials including trading guides, webinars, market analysis, and tutorial content designed to support trader development. However, this review finds no comprehensive information about Pandora Finance's educational offerings or their approach to client education and market analysis support.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, represents an increasingly important consideration for many traders. The availability and sophistication of such features at Pandora Finance are not detailed in publicly accessible sources. This limits the ability to assess their suitability for traders requiring automated trading solutions.

Research and analysis resources, including market commentary, technical analysis, and fundamental research, are not comprehensively documented for Pandora Finance. This makes it difficult to evaluate the broker's analytical support capabilities.

Customer Service and Support Analysis

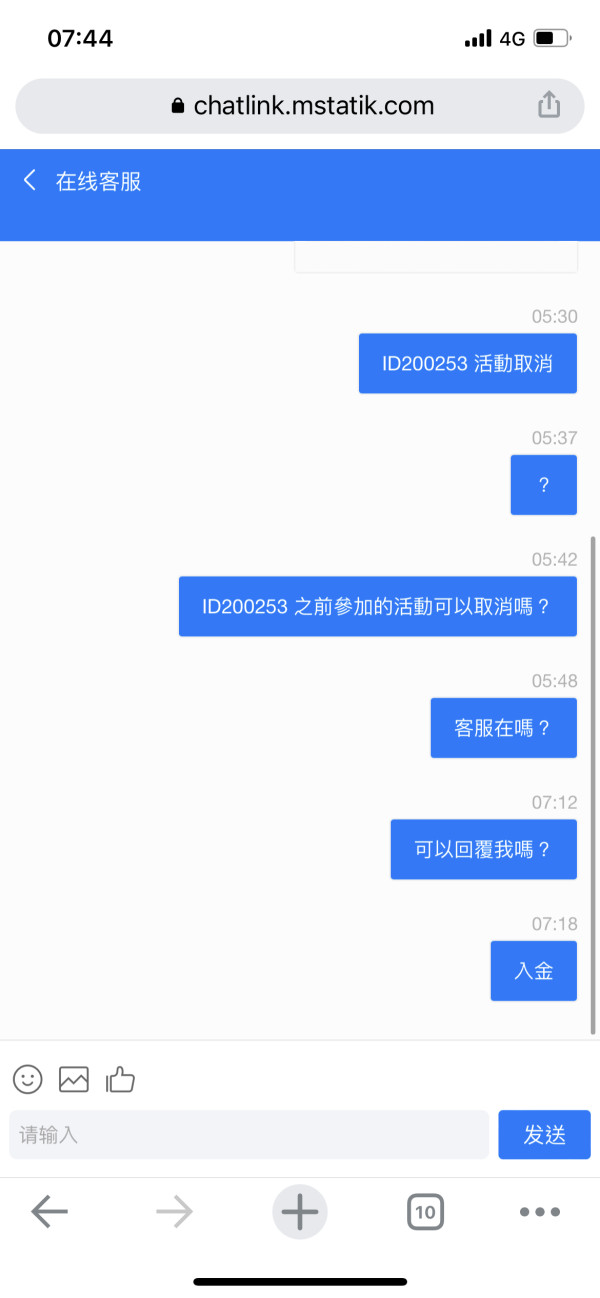

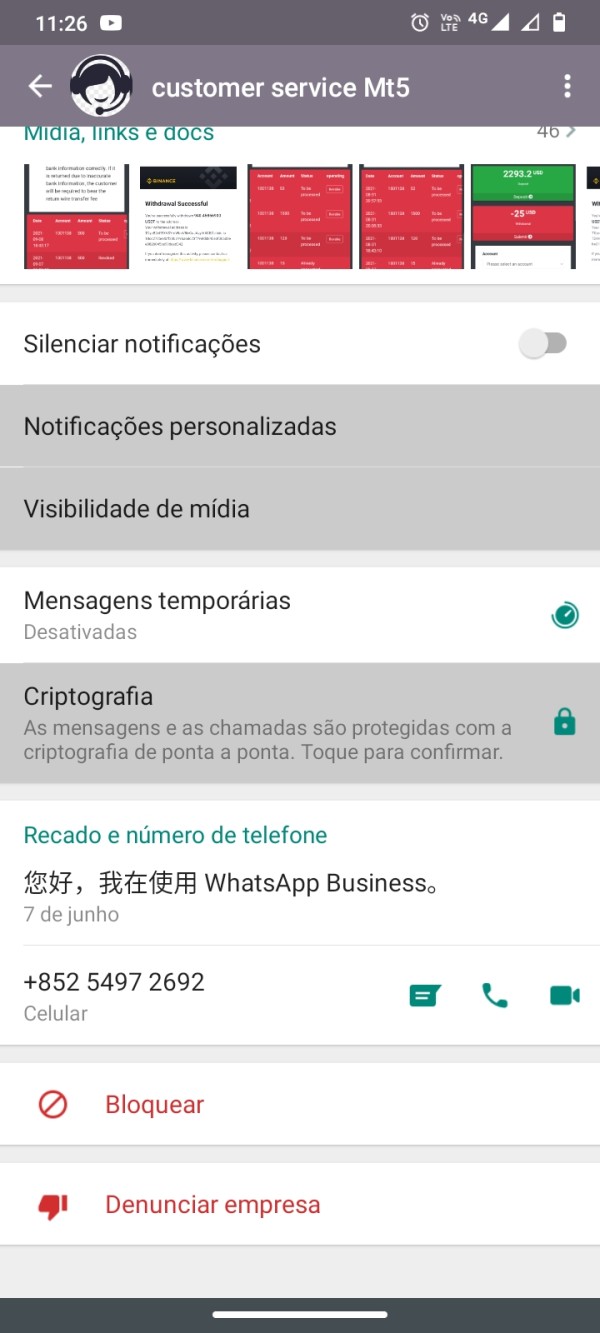

Evaluation of Pandora Finance's customer service capabilities faces significant challenges due to limited publicly available information about their support infrastructure and service quality. According to available sources, specific details about customer service channels, availability hours, and response times are not comprehensively documented. This makes it difficult to assess the broker's commitment to client support.

Modern forex brokers typically offer multiple communication channels including live chat, email support, telephone assistance, and sometimes social media engagement. However, information about Pandora Finance's specific support channels and their operational hours is not detailed in available sources. This lack of transparency about support accessibility may concern traders who prioritize responsive customer service.

Multilingual support capabilities, which are increasingly important in the global forex market, are not specified for Pandora Finance in available documentation. Many international brokers provide support in multiple languages to serve diverse client bases. This broker's language capabilities remain unclear based on publicly accessible information.

The quality and professionalism of customer service, typically reflected in user reviews and feedback, shows limited available data for Pandora Finance. Without comprehensive user feedback about support experiences, response quality, and problem resolution effectiveness, potential clients cannot adequately assess the broker's service standards.

Trading Experience Analysis

Assessment of the trading experience offered by Pandora Finance encounters substantial limitations due to insufficient publicly available information about platform performance, execution quality, and user interface design. Modern forex trading relies heavily on platform stability, fast execution speeds, and intuitive user interfaces. Specific details about Pandora Finance's platform capabilities are not extensively documented in available sources.

Platform stability and reliability represent critical factors for successful forex trading, as technical issues can result in missed opportunities or unwanted losses. However, this pandora finance review finds limited information about server uptime, platform performance during high-volatility periods, or technical infrastructure quality. User feedback about platform reliability is not comprehensively available in major review platforms.

Order execution quality, including fill rates, slippage levels, and rejection rates, represents another crucial aspect of trading experience that lacks detailed documentation for Pandora Finance. Professional traders typically evaluate brokers based on execution statistics and transparency about order handling. Such information is not readily available for this broker.

Mobile trading capabilities, which have become essential for modern traders, are not detailed in available sources. The quality of mobile applications, feature completeness compared to desktop platforms, and cross-device synchronization capabilities remain unclear based on publicly accessible information about Pandora Finance's offerings.

Trust Factor Analysis

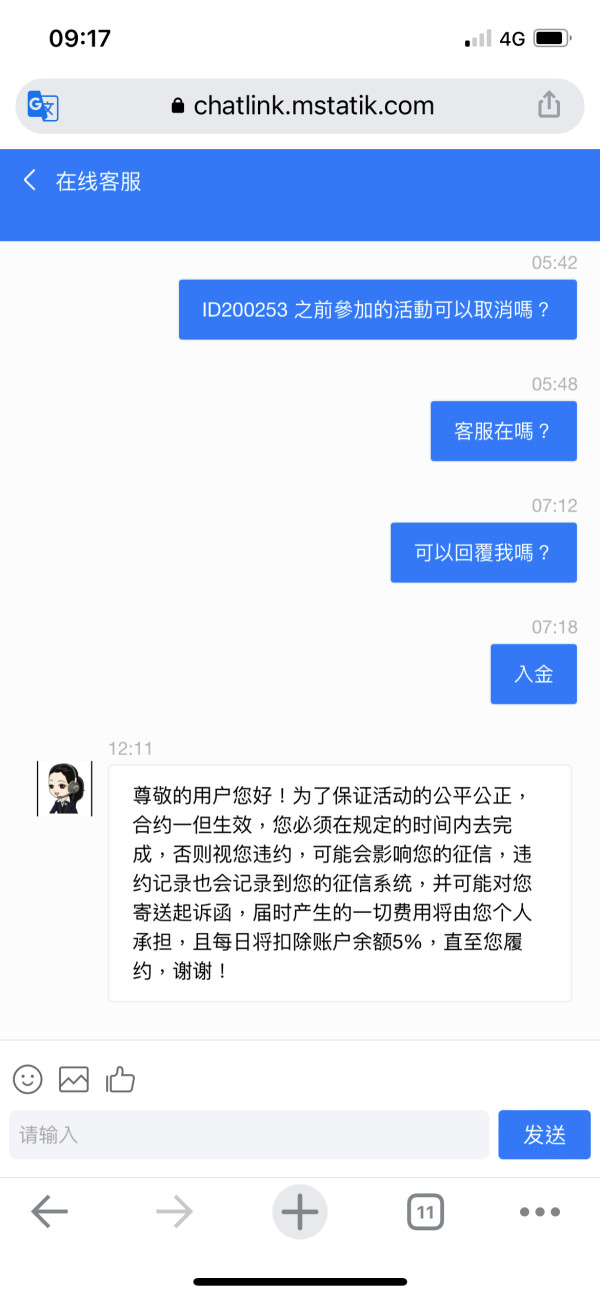

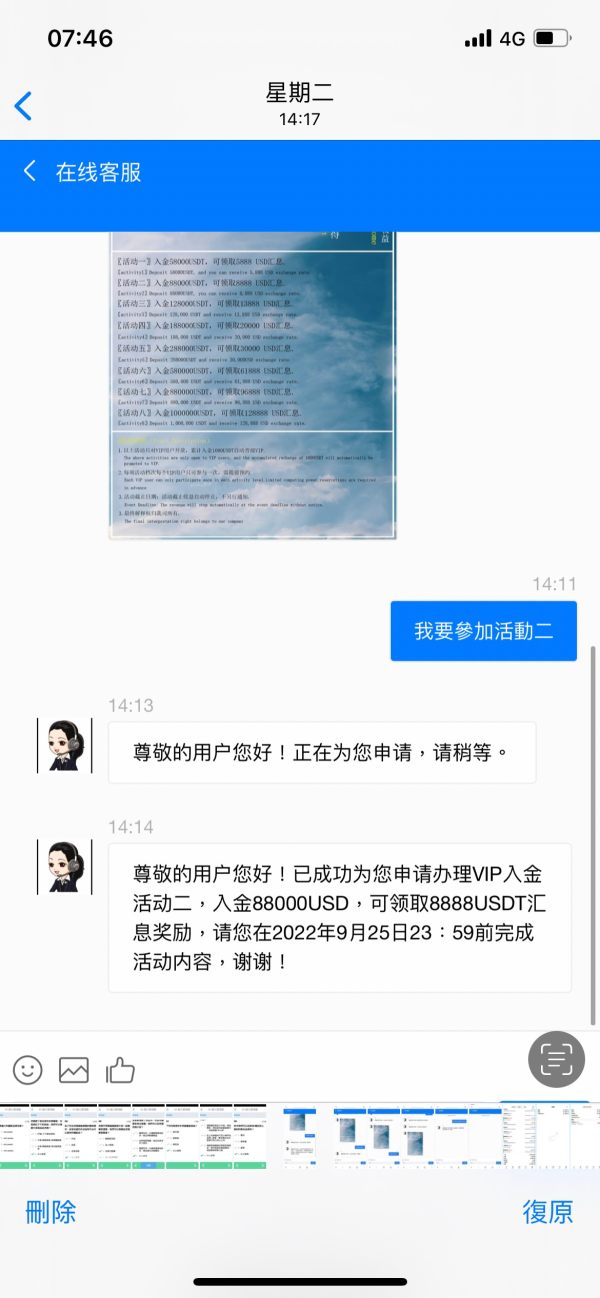

The trust factor evaluation for Pandora Finance reveals significant concerns regarding transparency and regulatory clarity. One of the most critical aspects of broker trustworthiness involves regulatory oversight and licensing. Comprehensive information about Pandora Finance's regulatory status is not readily available in major financial databases or review platforms. This lack of clear regulatory information represents a substantial concern for traders who prioritize regulated brokers for fund safety and legal protection.

Fund security measures, including client fund segregation, insurance coverage, and banking relationships, are not detailed in publicly available sources about Pandora Finance. Industry best practices typically involve segregating client funds from operational capital and maintaining relationships with tier-one banking institutions. This broker's specific fund protection measures are not documented in available materials.

Corporate transparency, reflected through detailed company information, management profiles, and operational disclosure, appears limited for Pandora Finance based on available sources. Reputable brokers typically provide comprehensive corporate information including company registration details, management team backgrounds, and operational transparency reports.

Industry reputation and third-party recognition, such as awards, certifications, or positive coverage in financial media, are not extensively documented for Pandora Finance in available sources. The absence of significant positive recognition or detailed reviews in major financial platforms may indicate limited market presence or transparency challenges.

User Experience Analysis

User experience evaluation for Pandora Finance faces substantial limitations due to limited available user feedback and detailed platform reviews. The overall user satisfaction assessment cannot be comprehensively determined due to insufficient user reviews and ratings on major review platforms. This makes it difficult to gauge general client satisfaction levels.

Interface design and platform usability represent critical factors in trading success. Specific information about Pandora Finance's platform design, navigation structure, and user interface quality is not extensively documented in available sources. Modern traders expect intuitive platforms with customizable layouts and efficient workflow design. Evaluation of these aspects remains limited for this broker.

The registration and account verification process, which significantly impacts initial user experience, lacks detailed documentation in publicly available sources. Streamlined onboarding processes with clear verification requirements and reasonable processing times are industry expectations. Specific details about Pandora Finance's procedures are not readily available.

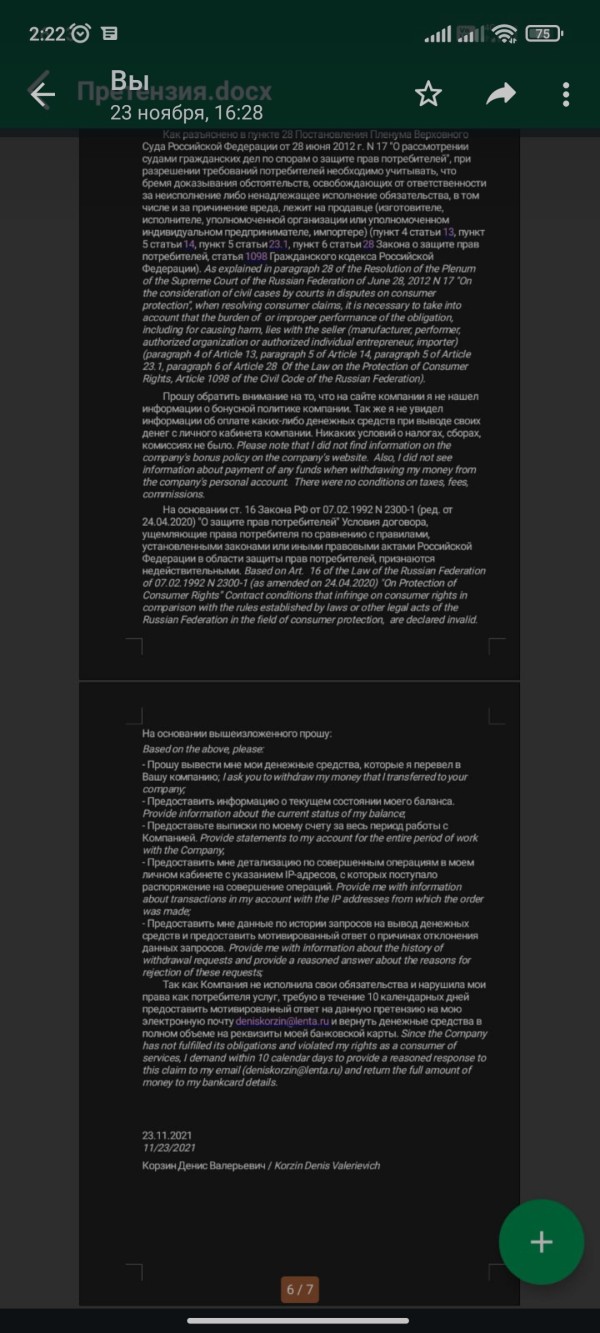

Funding and withdrawal experiences, including processing times, fee structures, and available payment methods, are not comprehensively detailed in available sources. User feedback about transaction experiences, which typically provide valuable insights into operational efficiency, is not extensively available for Pandora Finance in major review platforms.

Common user complaints and recurring issues, which typically emerge in detailed review platforms and forums, are not comprehensively documented for Pandora Finance. This limits the ability to identify potential service areas requiring improvement.

Conclusion

This comprehensive pandora finance review reveals a broker operating in the forex market with limited publicly available information about their services, regulatory status, and operational details. While the company appears to offer forex and CFD trading services, the lack of detailed information about trading conditions, regulatory oversight, and user experiences presents challenges for potential clients seeking comprehensive broker evaluation.

The broker may be suitable for traders who prioritize direct communication with brokers to obtain detailed information about services and conditions. However, traders who value extensive public information, clear regulatory status, and comprehensive online reviews may find the limited available documentation concerning.

The main advantages appear to include basic forex trading access. Significant disadvantages include limited transparency about regulatory status, trading conditions, and operational details that are typically expected in modern forex brokerage evaluation.