Financika 2025 Review: Everything You Need to Know

Summary

This financika review gives you a complete look at Sharp Trading Ltd, which runs the Financika brand from Vanuatu. Our review shows mixed results for this forex broker that mainly targets new traders who want to learn. Financika offers lots of educational materials and many different assets like forex, indices, stocks, commodities, and CFDs, but there are big problems with trading conditions and service quality.

The broker requires a minimum deposit of $250 and gives leverage up to 1:200, which makes it easy for new traders to start. User feedback always points out problem areas like high spreads starting from 3 pips, frequent slippage issues, and withdrawal problems. The company has a trust score of 64, which means moderate risk levels, and many user complaints suggest possible fraud. Financika offers its own platforms called WebPROfit and Mobil PRO fit, but it doesn't have the standard MetaTrader platforms that experienced traders prefer.

This review concludes that Financika might work for beginners who want educational content, but serious traders should be careful because of documented service and execution problems.

Important Notice

This evaluation looks at Financika, which Sharp Trading Ltd operates as a Vanuatu-registered company. Since this is an offshore regulatory environment, traders should know that protection levels may be very different from those in major financial centers. Vanuatu's regulatory framework usually provides less strict oversight compared to places like the UK's FCA or Australia's ASIC.

This assessment comes from available market data, user feedback, and regulatory information. Since offshore brokers often have limited transparency, traders should strongly consider doing additional research before using this platform.

Rating Framework

Broker Overview

Sharp Trading Ltd runs the Financika brand as a Vanuatu-based brokerage in the competitive online trading market. The company works as a B-book broker, which means it acts as a market maker instead of giving direct market access. This business model means the broker takes the opposite side of client trades, which can create conflicts of interest but also allows for fixed spreads and guaranteed execution in many cases.

The broker's regulatory status under Vanuatu puts it in the offshore financial services category. This allows more flexible operations and potentially higher leverage, but it also means client protections may be limited compared to brokers regulated by top-tier authorities. The company has built its presence in retail trading by focusing on educational content and beginner-friendly features, though this financika review shows significant concerns about execution quality and customer service standards.

Financika's platform system centers on proprietary trading software, specifically WebPROfit for desktop users and Mobil PRO fit for mobile trading. The lack of MetaTrader 4 or 5 platforms may be a limitation since these are industry standards that many retail traders prefer. The broker offers access to multiple asset classes including major and minor forex pairs, global indices, individual stocks, commodities like gold and oil, and various CFD instruments, giving a reasonably complete trading environment for retail clients.

Regulatory Jurisdiction: Financika operates under Sharp Trading Ltd, registered in Vanuatu. This offshore jurisdiction gives limited regulatory oversight compared to major financial centers, which traders should consider when looking at safety and protection levels.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available sources, which raises transparency concerns for potential clients seeking clarity on funding options.

Minimum Deposit Requirements: The broker sets a minimum deposit of $250, which is relatively accessible for beginning traders and matches industry standards for retail-focused brokers.

Promotional Offers: Details about bonus structures or promotional campaigns are not specified in available documentation, suggesting either limited promotional activity or lack of transparency in marketing materials.

Available Trading Assets: Financika provides access to forex pairs, global indices, individual stocks, commodities, and CFD instruments, offering a diverse range of trading opportunities across multiple markets and asset classes.

Cost Structure: The broker uses a spread-based pricing model with starting spreads of 3 pips. User feedback consistently shows higher-than-average spreads, which significantly impacts trading costs. Commission structures are not clearly specified in available materials.

Leverage Options: Maximum leverage is set at 1:200, which provides substantial buying power while staying within reasonable risk parameters for retail traders in offshore jurisdictions.

Platform Selection: Trading happens through proprietary platforms WebPROfit and Mobil PRO fit. The absence of MetaTrader platforms may limit appeal to traders familiar with industry-standard software.

Geographic Restrictions: Information about specific geographic restrictions or prohibited jurisdictions is not detailed in available sources.

Customer Support Languages: Specific language support options for customer service are not clearly documented in available materials.

This financika review notes that the limited availability of detailed operational information raises transparency concerns that potential clients should carefully consider.

Account Conditions Analysis

Financika's account structure appears relatively straightforward, though specific details about different account tiers remain unclear from available documentation. The $250 minimum deposit requirement positions the broker competitively within the retail market segment, making it accessible to traders with limited initial capital. This threshold is neither exceptionally low nor prohibitively high compared to industry standards.

However, the account opening process and verification requirements lack detailed public information, which may concern traders seeking transparency about onboarding procedures. The absence of clearly defined account types suggests either a simplified single-account structure or insufficient disclosure of available options. Most established brokers typically offer multiple account tiers with varying features, spreads, and minimum deposits.

The lack of information about Islamic accounts, professional trading accounts, or managed account services shows either limited product diversity or inadequate marketing transparency. Additionally, the absence of demo account details in available materials raises questions about whether prospective clients can test the platform before committing funds.

User feedback about account conditions primarily focuses on the problematic spread structure rather than account features themselves. The starting spread of 3 pips is significantly higher than competitive industry standards, where major currency pairs often trade with spreads below 1 pip at reputable brokers. This financika review emphasizes that while the minimum deposit may attract beginners, the high spread costs could quickly erode trading capital, particularly for active traders or those using scalping strategies.

Financika shows strength in educational content provision, offering comprehensive learning materials that include tutorials, webinars, and market analysis resources. This educational focus aligns well with the broker's apparent targeting of novice traders who require foundational knowledge before engaging in live trading activities.

The proprietary trading platforms WebPROfit and Mobil PRO fit represent the broker's technological infrastructure. While these platforms provide basic charting capabilities and order execution functionality, the absence of advanced analytical tools or third-party platform integration may limit their appeal to sophisticated traders. The platforms reportedly include standard features such as real-time quotes, basic technical indicators, and mobile accessibility.

However, the lack of MetaTrader 4 or 5 integration represents a significant limitation, as these platforms are industry standards offering extensive customization, expert advisor functionality, and comprehensive analytical tools. Many professional traders specifically seek brokers providing MetaTrader access due to its robust feature set and familiar interface.

Research and analysis resources appear limited based on available information, with no clear indication of daily market commentary, economic calendar integration, or professional analyst insights. Most competitive brokers provide regular market updates, trading signals, and economic event analysis to support client decision-making.

The educational materials receive positive feedback from users, suggesting quality content that serves its intended purpose of trader development. However, the overall technology package appears basic compared to industry leaders who offer advanced charting packages, automated trading capabilities, and comprehensive market research tools.

Customer Service and Support Analysis

Customer service represents a significant weakness in Financika's operational framework, with user feedback consistently highlighting responsiveness and quality issues. Available information does not specify customer support channels, operating hours, or language options, which immediately raises concerns about service accessibility and transparency.

User complaints frequently mention difficulties in reaching customer service representatives and unsatisfactory responses when contact is established. This pattern suggests either understaffing in the support department or inadequate training of customer service personnel. The lack of clearly published contact methods beyond basic email or phone numbers indicates limited commitment to customer accessibility.

Response times appear problematic based on user feedback, with traders reporting delays in addressing account issues, technical problems, and withdrawal requests. In the competitive forex industry, prompt customer service is essential for maintaining trader confidence, particularly when dealing with time-sensitive trading issues or account access problems.

The most concerning aspect involves user reports of unresolved withdrawal issues and account disputes. Multiple complaints suggest that customer service fails to adequately address client concerns regarding fund access, which represents a critical failure in broker-client relationships. Professional brokers typically maintain dedicated support teams for financial operations with clear escalation procedures.

The absence of live chat support, comprehensive FAQ sections, or self-service account management tools further limits the customer experience. Modern forex brokers generally provide multiple contact channels including phone, email, live chat, and social media support to ensure client accessibility across different time zones and communication preferences.

Trading Experience Analysis

The trading experience at Financika presents significant challenges that substantially impact client satisfaction and profitability. User feedback consistently reports frequent slippage issues, where executed prices differ from requested prices, particularly during volatile market conditions. This execution quality problem can severely impact trading performance and suggests either technological limitations or deliberate price manipulation.

Platform stability concerns emerge from user reports, though specific technical performance data is not available in public documentation. The proprietary platforms WebPROfit and Mobil PRO fit apparently lack the robustness and reliability that traders expect from professional trading software. Frequent disconnections or slow execution speeds can be particularly damaging for active traders or those using time-sensitive strategies.

The high spread environment, with starting spreads of 3 pips, creates a challenging trading environment where positions must move significantly in the trader's favor before achieving profitability. This spread structure is particularly problematic for scalping strategies or high-frequency trading approaches that rely on capturing small price movements.

Order execution quality receives negative feedback from users, with reports of requotes and rejection of profitable trades. These execution issues, combined with slippage problems, suggest systematic trading environment problems that favor the broker over clients. Professional brokers typically guarantee execution quality and maintain transparent execution statistics.

Mobile trading experience through Mobil PRO fit lacks detailed user feedback, though the absence of positive reviews suggests potential limitations in mobile functionality. Modern traders increasingly rely on mobile platforms for market monitoring and trade management, making robust mobile technology essential for competitive positioning. This financika review emphasizes that execution quality issues represent fundamental problems that impact overall trading viability.

Trust and Safety Analysis

Financika's trust profile presents significant concerns that potential clients must carefully evaluate. Operating under Sharp Trading Ltd with Vanuatu registration places the broker in an offshore regulatory environment that provides limited client protections compared to major financial jurisdictions. Vanuatu's regulatory framework typically lacks the stringent capital requirements, segregated account mandates, and compensation schemes found in tier-one regulatory jurisdictions.

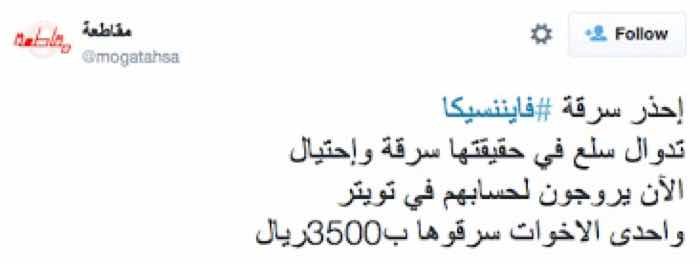

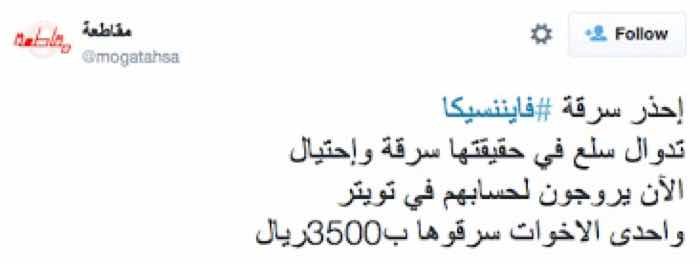

The trust score of 64 indicates moderate risk levels, though user feedback suggests higher actual risk based on operational experiences. Multiple user complaints alleging fraudulent practices, including withdrawal refusals and account manipulation, severely impact the broker's credibility. These allegations, while unverified through regulatory action, represent serious red flags for potential clients.

The company's transparency levels appear insufficient, with limited disclosure of operational details, financial statements, or regulatory compliance documentation. Reputable brokers typically provide comprehensive information about their regulatory status, capital adequacy, and client fund protection measures. The absence of such transparency raises questions about the broker's commitment to industry best practices.

Fund security measures are not clearly documented, leaving clients uncertain about segregated account arrangements, deposit insurance, or compensation schemes. Most regulated brokers maintain client funds in segregated accounts with tier-one banks and provide clear documentation of these protection measures.

The handling of negative events and user complaints appears inadequate based on available feedback, with users reporting unresolved disputes and limited recourse options. Professional brokers typically maintain formal complaint procedures and regulatory oversight that provides clients with dispute resolution mechanisms. The offshore regulatory environment may limit client recourse options in case of disputes or broker default.

User Experience Analysis

Overall user satisfaction with Financika appears significantly below industry standards, with negative feedback substantially outweighing positive reviews. The combination of high spreads, execution problems, and customer service issues creates a challenging environment for traders seeking reliable brokerage services.

Interface design and platform usability information is limited, though the absence of positive feedback regarding the proprietary platforms suggests potential usability issues. Modern traders expect intuitive, responsive trading interfaces with comprehensive functionality and customization options. The lack of detailed platform reviews indicates either limited user adoption or unsatisfactory user experiences.

The registration and verification process lacks documented user feedback, though the overall negative sentiment toward the broker suggests potential complications in account opening procedures. Streamlined onboarding processes are essential for positive initial user experiences and competitive positioning in the retail trading market.

Fund operation experiences represent a critical weakness, with multiple users reporting withdrawal difficulties and account access problems. These operational issues fundamentally undermine trader confidence and represent the most serious concerns in this financika review. Reliable deposit and withdrawal processing is essential for maintaining trader trust and regulatory compliance.

Common user complaints center on high trading costs, poor execution quality, unresponsive customer service, and withdrawal complications. This pattern of consistent negative feedback across multiple operational areas suggests systematic problems rather than isolated incidents. The broker appears better suited for traders primarily interested in educational content rather than active trading activities.

User demographic analysis suggests that while the broker may attract beginners through educational offerings and low minimum deposits, retention rates likely suffer due to poor trading conditions and service quality. Experienced traders would likely find the platform limitations and execution issues unacceptable for professional trading activities.

Conclusion

This comprehensive financika review reveals a broker with significant operational challenges that outweigh its limited strengths. While Financika offers valuable educational resources and maintains accessible minimum deposit requirements, the fundamental issues surrounding trading conditions, customer service, and execution quality create substantial barriers to successful trading experiences.

The broker may serve traders primarily seeking educational content and basic market exposure, particularly beginners who prioritize learning resources over advanced trading conditions. However, active traders or those seeking reliable execution quality should exercise extreme caution and consider alternative brokers with stronger regulatory oversight and better operational track records.

The combination of high spreads, frequent slippage, customer service problems, and withdrawal complications represents a pattern of service deficiencies that significantly impact trading viability and client satisfaction.