Is Financika safe?

Pros

Cons

Is Financika A Scam?

Introduction

Financika is a forex and CFD broker that has emerged in the trading landscape, offering a variety of financial instruments to traders worldwide. Established in 2014 and operating under the company name Sharp Trading Ltd., Financika presents itself as a viable option for both novice and experienced traders. However, the necessity for traders to thoroughly evaluate forex brokers cannot be overstated. The financial market is rife with risks, and choosing the wrong broker can lead to significant financial losses.

In this article, we will delve into whether Financika is safe or a potential scam. Our investigation is based on a comprehensive analysis of the broker's regulatory status, company background, trading conditions, customer safety measures, client feedback, and platform performance. We aim to provide a balanced view to help potential investors make informed decisions.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors for assessing its safety. A well-regulated broker is typically held to higher standards, ensuring that client funds are protected and that the broker operates transparently. In the case of Financika, it is registered with the Vanuatu Financial Services Commission (VFSC). However, this regulatory body is often criticized for its lax standards, making it easy for brokers to obtain licenses.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | N/A | Vanuatu | Registered |

While having a license from the VFSC provides some level of legitimacy, it does not equate to the stringent regulations imposed by more reputable authorities like the UK's Financial Conduct Authority (FCA) or Australia's Australian Securities and Investments Commission (ASIC). Moreover, Financika has been blacklisted by the French regulator Autorité des Marchés Financiers (AMF) in December 2016, which raises red flags regarding its operational practices.

The lack of robust regulatory oversight and the history of warnings from various financial authorities suggest that Financika is not safe for trading. Traders are advised to consider these factors carefully before engaging with the broker.

Company Background Investigation

Financika is operated by Sharp Trading Ltd., which is registered in Vanuatu. The company claims to have a customer support office in Bulgaria and processes payments through Cubbon Services Ltd. in Cyprus. However, the overall transparency regarding its ownership structure and operational history is limited.

The management team behind Financika is not well-documented, which raises concerns about their experience and qualifications in the financial trading sector. A lack of information about the team can lead to questions about the broker's credibility and the quality of service it provides.

In terms of transparency, Financika's website provides some basic information about its services, but it lacks comprehensive details about its operational practices, management team, and financial health. This opacity can be a significant drawback for potential clients who seek a trustworthy broker.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is crucial. These include spreads, commissions, and other associated costs. Financika offers a standard account with a minimum deposit requirement of $200. However, its trading costs appear to be higher than the industry average.

| Cost Type | Financika | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3.0 pips | 1.0-1.5 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | High | Moderate |

The spreads offered by Financika, starting at 3.0 pips for major currency pairs, are significantly higher than what many competitors provide. Additionally, there are reports of a $500 inactivity fee charged quarterly, which is unusually high and may deter traders from maintaining their accounts.

Such high fees and unfavorable trading conditions may indicate that Financika is not safe for traders seeking competitive pricing. It is essential for potential clients to weigh these costs against their trading strategies and financial objectives.

Customer Funds Safety

Ensuring the safety of customer funds is paramount in the trading industry. Financika claims to implement various safety measures, including segregating client funds from its operational funds. However, the effectiveness of these measures is questionable given the broker's regulatory status.

The lack of robust investor protection mechanisms, such as negative balance protection, further raises concerns. In the event of a broker's insolvency, clients may find themselves at risk of losing their investments without any recourse. Additionally, there have been no reported incidents of fund security breaches, but the absence of a credible regulatory framework leaves clients vulnerable.

Given these factors, it is crucial for traders to consider whether Financika is safe for their investments. Without solid financial safeguards, trading with this broker may pose significant risks.

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. A review of online sources reveals a mixed bag of experiences from Financika users. Many clients have reported issues related to withdrawal processes, citing delays and difficulties in accessing their funds.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| High Spreads | Medium | Average |

| Inactivity Fees | Medium | Average |

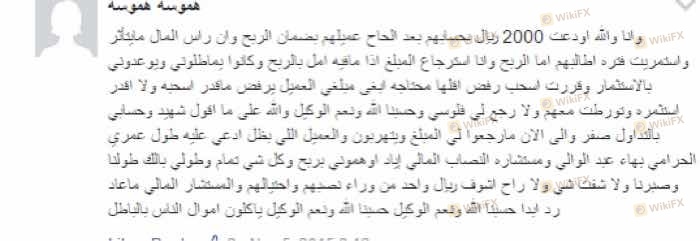

Common complaints include difficulties in withdrawing profits and high inactivity fees, which have led some users to label Financika as a scam. A notable case involved a trader who reported being unable to withdraw their profits after depositing a significant amount, ultimately leading to frustration and distrust.

These recurring issues suggest that Financika may not be safe, especially for traders who prioritize timely access to their funds. Potential clients should be cautious and consider these experiences before proceeding.

Platform and Trade Execution

The trading platform offered by Financika, known as Web Profit, is designed to cater to both novice and experienced traders. However, users have reported that the platform lacks the functionality and reliability of more established platforms like MetaTrader 4.

Concerns about order execution quality have also been raised, including instances of slippage and rejected orders. Such issues can significantly impact trading performance, particularly for those employing high-frequency trading strategies.

The absence of a demo account further complicates the situation, as prospective clients are unable to test the platform before committing their funds. This limitation makes it difficult for traders to assess whether Financika is safe for their trading needs.

Risk Assessment

Engaging with any forex broker involves inherent risks, and Financika is no exception. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of credible regulation raises concerns. |

| Financial Risk | High | High fees and poor withdrawal practices pose significant risks. |

| Operational Risk | Medium | Platform reliability issues could impact trading performance. |

To mitigate these risks, potential traders are advised to conduct thorough research, consider starting with a smaller investment, and explore alternative brokers with stronger regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Financika is not safe for trading. The broker's weak regulatory standing, high fees, and numerous client complaints paint a concerning picture. While it may offer certain educational resources, these do not compensate for the fundamental issues regarding safety and reliability.

For traders seeking a more secure trading environment, it is advisable to consider well-regulated alternatives such as brokers licensed by the FCA or ASIC. These brokers typically offer better trading conditions, stronger investor protection, and a more transparent operational framework.

In summary, potential clients should exercise caution when considering Financika as their trading partner and look for brokers that can provide a more trustworthy and secure trading experience.

Is Financika a scam, or is it legit?

The latest exposure and evaluation content of Financika brokers.

Financika Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Financika latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.